Resources

About Us

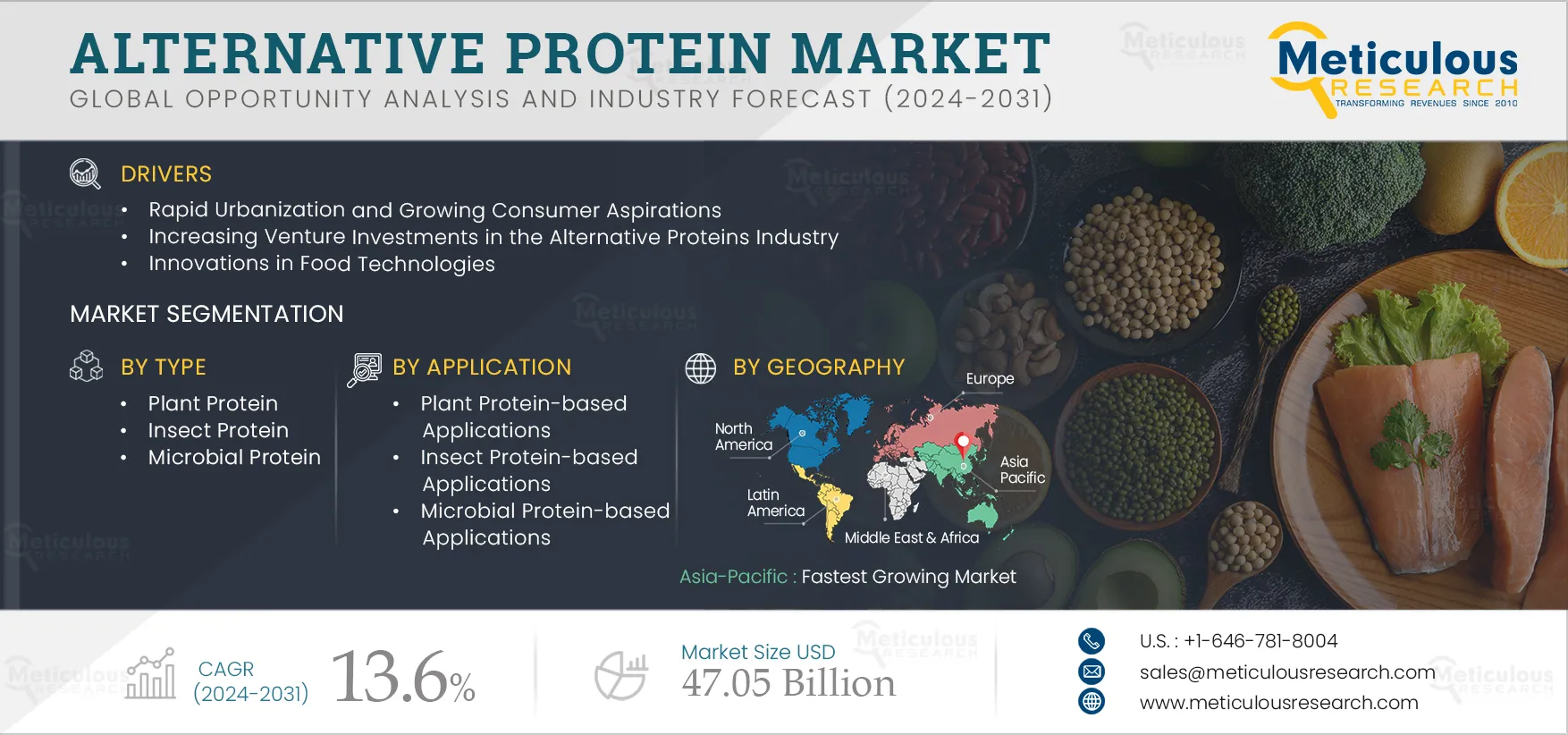

Alternative Protein Market Size, Share, Forecast, & Trends Analysis by Type (Plant Protein [Soy, Pea, Potato], Insect Protein [Crickets, BSF], Microbial [Algae Protein, Fungal Proteins]), Application (Food & Beverage, Alternative Proteins) - Global Forecast to 2031

Report ID: MRFB - 104269 Pages: 750 Jan-2024 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportIn terms of volume, the alternative protein market is projected to reach 13,536 thousand tons by 2031, at a CAGR of 9.3% during the forecast period of 2024–2031. The growth of this market can be attributed to several factors, including the rapid urbanization and growing consumer aspirations, increasing venture investments in the alternative protein industry, innovations in food technologies, the high nutritional value of edible insects, and the environmental sustainability of alternative protein production and consumption. However, the higher costs of alternative protein compared to conventional protein and consumers’ high preference for animal-based products restrain the growth of this market. Furthermore, consumers’ increasing inclination toward plant-based foods is expected to generate growth opportunities for the players operating in the alternative protein market.

Well-established meat and dairy product manufacturers are being targeted by civil society groups and new food businesses due to ethical and animal welfare concerns. Plant-based products, including protein, are animal cruelty-free and, therefore, ethical and more sustainable. Protein diversification has the potential to transform food companies’ core business and value proposition due to its higher profitability, lower risk exposure, and the ability to compete and innovate.

The growing trend of millennials adopting flexitarian and meat-free diets indicates a change in consumption habits, a significant shift from earlier generations. Companies across the food value chain, from producers to retailers, are already investing in these opportunities. Some companies are hedging against or preparing for a decline in the demand for animal products and investing in companies that produce plant-based alternatives. In the past few years, market players have received investments/funding from several high-profile individuals, financial investors, and companies. According to the Good Food Institute, In 2024, the alternative protein industry received USD 2.9 billion in disclosed investments. In the same year, plant-based meat, egg, and dairy companies received USD 1.9 billion in investments, a significant increase over USD 693 million raised in 2019. Plant-based meat, seafood, egg, and dairy companies have raised USD 6.3 billion in investments since 2010.

Some of the recent key developments in this market are as follows:

Thus, increasing venture capital investments supporting plant-based product manufacturers is driving the growth of the global alternative protein market.

Click here to: Get Free Sample Pages of this Report

Alternative protein are increasingly becoming a staple in modern-day diets. Consumer demand for ethical, sustainable, and healthy protein sources is driving investments and innovation in the meat and dairy substitutes industry. Innovative food is a category of agrifood tech encompassing novel food products and ingredients, such as alternative meat (plant-based and cell-culture-based), insect protein, alternative sugars, and flavor enhancers. According to the venture capital firm AgFunder, global investments in food tech and agtech start-ups reached USD 29.6 billion in 2022, wherein the food innovation sector accounted for a ~ 60% share. The category is dominated by animal-free alternative meat and dairy products and healthy ingredient alternatives.

Advances in alternative protein-based products are generating a great deal of interest among consumers and mainstream news. They are becoming increasingly common in retail outlets and foodservice menus. Animal agriculture is inherently inefficient, particularly in terms of feed conversion. According to the World Resources Institute (WRI), even the most efficient source of meat – chicken – converts only around 11% of gross feed energy into animal protein (WRI 2016). Innovations in food technologies have enabled the production of various alternative protein, ranging from advanced plant-based protein to cultured meat products without animals.

Thus, the food technology revolution is expected to fundamentally disrupt the current market and make protein more sustainable, supporting the growth of the alternative protein market.

In recent years, there has been a significant growth in vegetarianism and veganism globally due to increasing health and environmental awareness and compassion for animals. In 2021, ~8% of the world's population was vegetarian (Source: Heinrich Böll Stiftung). In the U.S., around 5–8% of people were vegan in 2022. Also, 31–42% of India's population is considered vegetarian. In Europe, vegans account for ~5% and vegetarians for ~10% of the total population. According to the Vegan Society, in 2022, ~10% of the U.K.’s population followed a vegan diet, and 9% of the population in Germany was vegetarian.

Veganism refers to the practice of refraining from using eggs, dairy, meat, and other animal-derived products. Vegans consume products that contain ingredients or components derived from plant sources. Increasing health concerns and allergic reactions to egg and dairy products have shifted consumers’ focus toward veganism. Additionally, consumers believe that veganism can help reduce the risk of chronic diseases such as heart disease and cancer. Increasing concerns regarding animal welfare and the environment have also encouraged many consumers to choose vegan foods. This growth in veganism has boosted the demand for plant-based products such as pea protein, soy protein, and flaxseeds.

According to the Academy of Nutrition and Dietetics, suitably planned vegetarian, including vegan diets, are healthful and nutritionally acceptable. They decrease the danger of certain ailments, including ischemic heart disease, Type 2 diabetes, hypertension, certain types of cancer, and obesity. These diets are suitable for all lifecycle stages, including pregnancy, lactation, infancy, childhood, adolescence, and older adulthood, as well as for athletes. Thus, increasing veganism is generating significant growth opportunities for the players operating in the alternative protein market.

Based on type, the alternative protein market is segmented into plant protein, insect protein, and microbial protein. In 2024, the plant protein segment is expected to account for the largest share of 82.8% of the alternative protein market. The large share of this market is mainly attributed to the growing demand from food & beverage manufacturers, huge availability of raw materials for processing, and lower cost than other alternative protein.

However, the insect protein segment is expected to grow at the highest CAGR of 29.0% during the forecast period of 2024–2031. The high growth rate of this segment is mainly driven by the growing demand for environmentally friendly protein-rich food and the rising investments in edible insect farming.

Based on type, the plant protein market is segmented into soy protein, wheat protein, pea protein, canola protein, potato protein, rice protein, corn protein, and other plant protein. In 2024, the soy protein segment is expected to account for the largest share of 54.9% of the plant protein market. The large share of this segment is attributed to its easy availability, lower price of soy protein, increased demand for meat protein alternatives, a wide range of applications in various products, and multiple health benefits.

Based on type, the insect protein market is segmented into crickets, black soldier fly (BSF), and other insect protein. In 2024, the crickets segment is expected to account for the largest share of 47.0% of the insect protein market. The large share of this segment is attributed to its high nutritional value, the ease of farming and processing of crickets, the incorporation of crickets into various food recipes and products, and the increasing demand for cricket-based products, such as protein powders, protein bars, and snacks. However, the black soldier fly segment is expected to register the highest CAGR during the forecast period.

Based on type, the microbial protein market is segmented into algae protein, fungal protein, and bacterial protein. In 2024, the algae protein segment is expected to account for the largest share of 70.0% of the microbial protein market. The large market share of this segment is mainly attributed to the growth of the dietary supplements industry, the rising preference for spirulina-sourced products, and the increasing number of products that include algae as ingredients.

Moreover, this segment is expected to grow at the fastest CAGR of 13.7% during the forecast period. The high growth rate of this segment is driven by factors such as the increasing vegetarian population, the rising incidences of diet-related diseases, such as malnutrition, the growth of the nutraceutical industry, and the increasing usage of chlorella in aquaculture diets.

Based on application, the global alternative protein market is mainly segmented into plant protein-based applications, insect protein-based applications, and microbial protein-based applications. In 2024, the plant protein-based applications segment is expected to account for the largest share of 82.8% of the alternative protein market. The large share of this segment is attributed to the growing vegetarian and vegan population, consumers' rising demand for clean-label products, and the increasing investments and expansions by plant-based product manufacturers. However, the insect protein-based applications segment is expected to record the highest CAGR during the forecast period.

Based on application, the plant protein market is segmented into food & beverage, animal feed, nutrition & health supplements, pharmaceuticals, and other plant protein-based applications. In 2024, the food & beverage segment is expected to account for the largest share of 60.6% of the global plant protein market. The large market share of this segment is mainly attributed to increasing consumer preference for plant-based foods and ingredients, the growing awareness and demand for protein-rich food products, the versatile functionality and compatibility of plant-based protein with vegetarian and vegan lifestyles, and the rise of clean-label trends.

However, the nutrition & health supplements segment is expected to record a CAGR of 11.8% during the forecast period. The growth of this segment is mainly attributed to changing lifestyles, growing health & wellness trends, and the increasing prevalence of diseases.

Based on application, the insect protein market is segmented into food & beverage and animal feed. In 2024, the food & beverage segment is expected to account for the largest share of the global insect protein market. The large share of this segment is driven by the growing food shortage worldwide, the increasing consumption of processed whole insects as food, and the rising demand for high-quality alternative protein and amino acid sources among end users.

Based on application, the microbial protein market is segmented into nutraceuticals, food & beverage, animal feed, cosmetics, and other microbial protein-based applications. In 2024, the nutraceuticals segment is expected to account for the largest share of 49.7% of the overall microbial protein market. The large share of this market is mainly attributed to the wide use of microbial protein in health supplements and the improved nutritional value of these products with the addition of microbial protein ingredients. This segment is expected to grow at the fastest CAGR during the forecast period.

Based on region, the alternative protein market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, North America is expected to account for the largest share of 38.3% of the global alternative protein market. North America alternative protein market is estimated to be worth USD 7.4 billion in 2024. The prominent position of North America in the alternative protein market is attributed to the increasing focus on producing protein using sustainable methods due to the rising environmental concerns and ethical aspects associated with animal protein, the increasing vegan population, the rising number of investments in alternative protein products, the increasing demand for healthy & nutritional products, and technological advancements in the food industry.

However, Asia-Pacific is expected to record the highest CAGR of 15.8% during the forecast period. The growth of this regional market is mainly attributed to the increasing awareness regarding the importance of protein-rich diets, the increasing technological advancements in the food & beverages industry, the fast-growing economy, and the wide availability of raw materials.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the global alternative protein market are Archer-Daniels-Midland Company (U.S.), Cargill, Incorporated (U.S.), Roquette Frères (France), Ingredion Incorporated (U.S.), Kerry Group plc (Ireland), International Flavors & Fragrances, Inc. (IFF) (U.S.), Now Health Group, Inc. (U.S.), Tate & Lyle Plc (U.K.), Axiom Foods Inc. (U.S.), Burcon NutraScience Corporation (Canada), BENEO GmbH (A Part of Südzucker AG) (Germany), Glanbia Plc (Ireland), Sotexpro (France), Farbest-Tallman Foods Corporation (U.S.), CHS Inc. (U.S.), Ÿnsect (SAS) (France), Enterra Feed Corporation (Canada), Protix B.V. (Netherlands), Entomo Farms (Canada), Global Bugs Asia Co., Ltd. (Thailand), Aspire Food Group (U.S.), EnviroFlight, LLC (U.S.), Haocheng Mealworm Inc. (China), JR Unique Foods Ltd. (Thailand), Armstrong Cricket Farm Georgia (U.S.), Rocky Mountain Micro Ranch (U.S.), Cricket Lab Limited (U.K.), DIC Corporation (Japan), Cellena Inc. (U.S.), Taiwan Chlorella Manufacturing Company (Taiwan), Cyanotech Corporation (U.S.), Bluebiotech International GmbH (Germany), Pond Technologies Holdings Inc. (Canada), E.I.D.-Parry (India) Limited (India), Tianjin Norland Biotech Co., Ltd. (China), MycoTechnology Inc. (U.S.), Enough. (U.K.), Corbion NV (Netherlands), Sun Chlorella Corporation (Japan), Plantible Foods, Inc. (U.S.), Parabel Nutritional, Inc. (U.S.), Far East Bio-Tec Co., Ltd. (Taiwan), Far East Microalgae Industries, Co. Ltd. (Taiwan), Roquette Klötze Gmbh & Co. Kg (Germany), Yaeyama Shokusan Co., Ltd. (Japan), Unibio Group (Denmark), String Bio (India), Calysta, Inc. (U.S.), Angel Yeast Co., Ltd (China), and Lesaffre (France).

In June 2023, BENEO GmbH (Germany), launched non-GMO vegetal protein, rice protein, vital wheat gluten, and faba bean protein concentrate for pet food.

In March 2023, Archer-Daniels-Midland Company (U.S.), signed a joint venture agreement with Marel hf. (Iceland), a provider of advanced food processing solutions, to start an alternative protein innovation center in the Netherlands.

|

Particulars |

Details |

|

Number of Pages |

750 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

13.6% |

|

Market Size (Value) |

USD 47.05 Billion by 2031 |

|

CAGR (Volume) |

9.3% |

|

Market Size (Volume) |

13,536 Thousand Tons by 2031 |

|

Segments Covered |

By Type

By Application

|

|

Countries Covered |

North America (U.S., Canada), Asia-Pacific (China, India, Japan, Australia, and Rest of Asia-Pacific), Europe (France, Germany, Italy, Spain, U.K., and Rest of Europe), Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, Ecuador, and Rest of Latin America), and the Middle East & Africa |

|

Key Companies |

Archer-Daniels-Midland Company (U.S.), Cargill, Incorporated (U.S.), Roquette Frères (France), Ingredion Incorporated (U.S.), Kerry Group plc (Ireland), International Flavors & Fragrances, Inc. (IFF) (U.S.), Now Health Group, Inc. (U.S.), Tate & Lyle Plc (U.K.), Axiom Foods Inc. (U.S.), Burcon NutraScience Corporation (Canada), BENEO GmbH (A Part of Südzucker AG) (Germany), Glanbia Plc (Ireland), Sotexpro (France), Farbest-Tallman Foods Corporation (U.S.), CHS Inc. (U.S.), Ÿnsect (SAS) (France), Enterra Feed Corporation (Canada), Protix B.V. (Netherlands), Entomo Farms (Canada), Global Bugs Asia Co., Ltd. (Thailand), Aspire Food Group (U.S.), EnviroFlight, LLC (U.S.), Haocheng Mealworm Inc. (China), JR Unique Foods Ltd. (Thailand), Armstrong Cricket Farm Georgia (U.S.), Rocky Mountain Micro Ranch (U.S.), Cricket Lab Limited (U.K.), DIC Corporation (Japan), Cellena Inc. (U.S.), Taiwan Chlorella Manufacturing Company (Taiwan), Cyanotech Corporation (U.S.), Bluebiotech International GmbH (Germany), Pond Technologies Holdings Inc. (Canada), E.I.D.-Parry (India) Limited (India), Tianjin Norland Biotech Co., Ltd. (China), MycoTechnology Inc. (U.S.), Enough. (U.K.), Corbion NV (Netherlands), Sun Chlorella Corporation (Japan), Plantible Foods, Inc. (U.S.), Parabel Nutritional, Inc. (U.S.), Far East Bio-Tec Co., Ltd. (Taiwan), Far East Microalgae Industries, Co. Ltd. (Taiwan), Roquette Klötze Gmbh & Co. Kg (Germany), Yaeyama Shokusan Co., Ltd. (Japan), Unibio Group (Denmark), String Bio (India), Calysta, Inc. (U.S.), Angel Yeast Co., Ltd (China), and Lesaffre (France). |

The report on the alternative protein market encompasses protein ingredients originating from a range of innovative sources as substitutes for traditional animal protein. These sources include plant-based, edible insect-based, and microbial-based protein ingredients.

This global alternative protein market report provides detailed market insights and market size & forecasts of alternative protein in terms of value (by type, application, and geography) & volume (by type and geography). Each segment provides the market size & forecast for five key geographies (North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa) along with the key countries.

The alternative protein market is projected to reach $47.05 billion by 2031, at a CAGR of 13.6% during the forecast period 2024–2031.

The plant protein segment is expected to hold the major share of the market in 2024.

The plant protein-based application segment is projected to record a higher growth rate during the forecast period 2024–2031.

The key players operating in the global alternative protein market are Archer-Daniels-Midland Company (U.S.), Cargill, Incorporated (U.S.), Roquette Frères (France), Ingredion Incorporated (U.S.), Kerry Group plc (Ireland), International Flavors & Fragrances, Inc. (IFF) (U.S.), Now Health Group, Inc. (U.S.), Tate & Lyle Plc (U.K.), Axiom Foods Inc. (U.S.), Burcon NutraScience Corporation (Canada), BENEO GmbH (A Part of Südzucker AG) (Germany), Glanbia Plc (Ireland), Sotexpro (France), Farbest-Tallman Foods Corporation (U.S.), CHS Inc. (U.S.), Ÿnsect (SAS) (France), Enterra Feed Corporation (Canada), Protix B.V. (Netherlands), Entomo Farms (Canada), Global Bugs Asia Co., Ltd. (Thailand), Aspire Food Group (U.S.), EnviroFlight, LLC (U.S.), Haocheng Mealworm Inc. (China), JR Unique Foods Ltd. (Thailand), Armstrong Cricket Farm Georgia (U.S.), Rocky Mountain Micro Ranch (U.S.), Cricket Lab Limited (U.K.), DIC Corporation (Japan), Cellena Inc. (U.S.), Taiwan Chlorella Manufacturing Company (Taiwan), Cyanotech Corporation (U.S.), Bluebiotech International GmbH (Germany), Pond Technologies Holdings Inc. (Canada), E.I.D.-Parry (India) Limited (India), Tianjin Norland Biotech Co., Ltd. (China), MycoTechnology Inc. (U.S.), Enough. (U.K.), Corbion NV (Netherlands), Sun Chlorella Corporation (Japan), Plantible Foods, Inc. (U.S.), Parabel Nutritional, Inc. (U.S.), Far East Bio-Tec Co., Ltd. (Taiwan), Far East Microalgae Industries, Co. Ltd. (Taiwan), Roquette Klötze Gmbh & Co. Kg (Germany), Yaeyama Shokusan Co., Ltd. (Japan), Unibio Group (Denmark), String Bio (India), Calysta, Inc. (U.S.), Angel Yeast Co., Ltd (China), and Lesaffre (France).

The emerging countries from the Asia-Pacific and Latin America region are expected to offer significant growth opportunities for vendors in the alternative protein market during the forecast period.

Published Date: Aug-2024

Published Date: Jul-2024

Published Date: Jun-2024

Published Date: May-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates