Resources

About Us

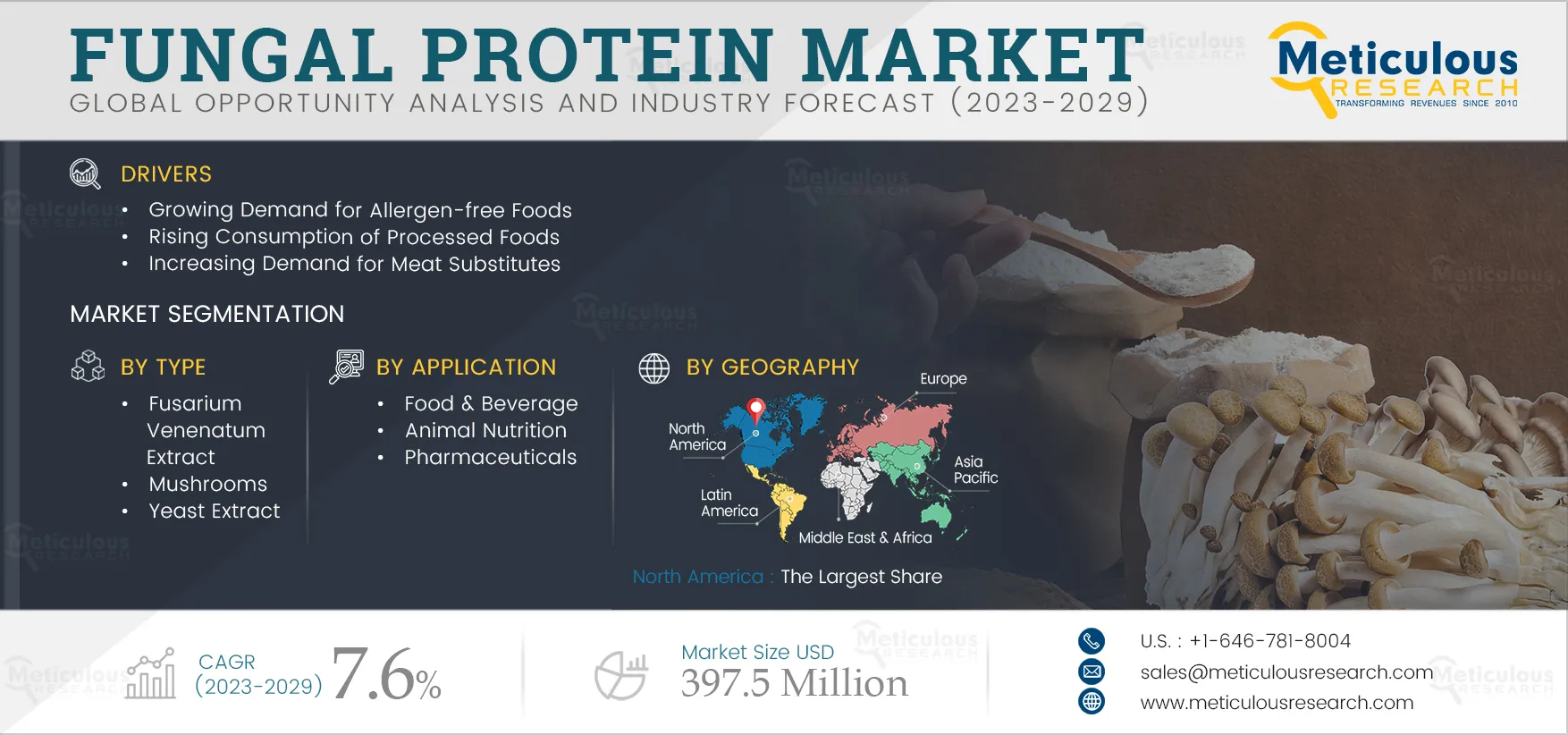

Fungal Protein Market by Type (Fusarium Venenatum Extract Protein, Mushroom Protein, Yeast Extract Protein), Application (Food & Beverages {Beverages, Bakery}, Animal Nutrition {Poultry, Aquafeed}, Pharmaceuticals, Other Applications), and Geography - Global Forecast to 2029

Report ID: MRFB - 104614 Pages: 176 May-2023 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportThe Fungal Protein Market is expected to reach $397.5 million by 2029, at a CAGR of 7.6% during the forecast period 2023–2029. Moreover, in terms of volume, the global fungal protein market is expected to reach 23,185 tons by 2029, at a CAGR of 6.2% during the forecast period. The growth of this market is expected to be driven by factors such as the rapidly growing demand for allergen-free foods, rising consumption of processed food, and growing demand for meat-substitute products. Moreover, the rising adoption of yeast extract in the processed food industry is expected to offer significant growth opportunities for players in the fungal protein market. However, factors such as undefined regulatory guidelines are expected to hinder market growth to a certain extent.

The fungal protein comprises fusarium venenatum extract, mushrooms, and yeast extract. Fusarium venenatum is a filamentous fungus used to produce mycoprotein on a commercial scale. Mycoprotein is one of the few solutions to meet the growing global protein demand, environmentally and economically sustainable. Mycoprotein offers the benefit of having a low environmental impact owing to its specific and perfectly mastered manufacturing process. As a result, it is considered a sustainable protein compared to other more resource-intensive and environmentally impactful sources.

Mycoprotein is witnessing demand from the meat substitute sector due to its unique nutritional characteristics. Unlike most plant-based proteins, mycoproteins are complete proteins containing all nine essential amino acids and compare well with other protein sources. The growing instances of soy allergies and wheat gluten intolerance across the globe are causing the mycoprotein-based meat substitutes market to grow as more consumers switch their preferences from soy and wheat to mycoprotein. Thus, the growing preference for mycoprotein-based meat substitutes and the increasing demand for soy-free products are driving the demand for mycoprotein and, thereby, the growth of the global fungal protein market.

Furthermore, some of the key future targets for mycoprotein production aim to turn the production process into a more cyclical one, utilizing wastewater and reusing some of the waste streams, including leftovers from fermentation. A few manufacturers are investing heavily in R&D for the future target of the cyclic process as well as in marketing and category management of the brand.

Click here to: Get a Free Sample Copy of this report

Rising Demand for Meat Alternative Products Propels the Growth of the Fungal Protein Market

The growing world population's increased demand for protein and meat substitutes or meat alternative products has led to the development of new food ingredients from alternative protein sources. Currently, protein manufacturers are finding innovative ways to meet the growing demand for alternative proteins. Over the past decade, there has been a growing interest in developing and producing plant, cell-based, and other protein sources-based alternatives to farmed meat. Meat alternatives include fungal protein-based products that look and taste like meat and could potentially play a key role in stimulating dietary change. Plant-based and fungal protein is of immense importance worldwide, leading to the growing interest in its ability to meet the rising demand for protein from non-meat sources, as high meat consumption levels are increasingly being criticized due to ethical and environmental issues.

Furthermore, several studies target processed meat to show the relationship between the consumption of these products and health concerns. The International Agency for Research on Cancer (IARC) has classified processed meat as a carcinogen that causes cancer and red meat as a probable carcinogen that probably causes cancer. As a result, the American Cancer Society has recommended a diet limiting processed and red meat. The American Cancer Society Guidelines on Nutrition and Physical Activity for Cancer Prevention recommend choosing beans instead of red and processed meat. Meat alternatives have lower saturated fat than meat (higher saturated fat intake is linked to an increased risk of heart disease). Fungal protein is derived from a fungi-based sustainable food source, has low total and saturated fat levels, and contains very low amounts of cholesterol.

Moreover, mycoprotein can be used to make a variety of substitute meat products, and its naturally meat-like structure gives a cost and texture advantage over plant-based proteins, which have to go through an additional process to reproduce the texture of meat.

Thus, fungal protein is a healthy source of protein compared to conventional meat and offers several social, environmental, and health benefits, driving the demand for fungal protein across the globe.

Key Findings in the Fungal Protein Market Study:

In 2022, the Fusarium Venenatum Extract Protein Segment is Expected to Generate the Largest Revenue in the Fungal Protein Market by Type

Based on type, the fungal protein market is segmented into fusarium venenatum, mushroom, and yeast extract. In 2022, the fusarium venenatum extract segment is estimated to account for the largest share of the global fungal protein market. The large share of this segment is attributed to the increasing consumer inclination to adopt a healthy diet. Moreover, its dynamic properties, such as being rich in fiber and protein and low and saturated fat content, further drive the demand for fusarium venenatum-based fungal protein in the food & beverage industries.

However, the yeast extract protein segment is projected to grow at the highest CAGR of 10.5% during the forecast period, owing to the growing adoption of yeast extract in animal and human nutrition, growing adoption in free-from products, and its cost-effectiveness.

In 2022, the Food & Beverage Segment is Expected to Dominate the Fungal Protein Market by Application

Based on application, the fungal protein market is segmented into food & beverage, animal nutrition, pharmaceuticals, and other applications. In 2022, the food & beverage segment is estimated to account for the largest share of the global fungal protein Market. The dominant position of this segment is attributed to the growing global food & beverage industry and the increasing adoption of mycoprotein in the food industry due to its cholesterol and satiety benefits and nutritional composition. Also, the increasing consumer preference for meat alternatives and the growing awareness and demand for protein-rich sustainable food products further boost the demand for fungal protein in the food & beverage industry.

However, the pharmaceutical application segment is projected to grow at the highest CAGR of 8.0% during the forecast period due to its eukaryotic and unicellular characteristics and post-translational modification ability.

Asia-Pacific: Fastest Growing Market

Based on geography, the global fungal protein market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2022, North America is estimated to account for the largest share of the global fungal protein market, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The large share of this market is attributed to the expanding vegan culture, the ongoing protests against animal cruelty, and an enormous number of health-conscious consumers. Moreover, increasing focus on producing protein using sustainable methods due to the rising environmental concerns and ethical aspects associated with animal protein and technological advancements in the food industry further boost the demand for fungal protein in the region.

However, Asia-Pacific is expected to record the highest CAGR of 8.4% during the forecast period 2023–2029. The rapid growth of the fungal protein market in Asia-Pacific is attributed to the rising awareness about health and wellness concerns among the population, growing demand for vegan food products, and increased demand for a protein-rich diet. Moreover, the growing government initiatives to increase the production of yeast and mushrooms in India and China are expected to provide opportunities for stakeholders operating in this market.

Report Summary:

|

Particular |

Details |

|

Page No. |

~176 |

|

Format |

|

|

Forecast Period |

2023-2029 |

|

Base Year |

2022 |

|

CAGR |

7.6% |

|

Market Size (Value) |

$397.5 Million |

|

Market Size (Volume) |

23,185 tons |

|

Segments Covered |

By Type

By Application

By Geography

|

|

Countries/Regions Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, Rest of Asia-Pacific), Latin America, and the Middle East & Africa |

|

Key Companies |

Koninklijke DSM N.V. (Netherlands), Associated British Foods plc (U.K.), Lesaffre Group (France), Kerry Group plc (Ireland), Lallemand Inc. (Canada), Oriental Yeast Co., Ltd. (Japan), Halcyon Proteins Pty. Ltd. (Australia), AngelYeast Co., Ltd. (China), Van Wankum Ingredients BV (Netherlands), and MYCORENA AB (Sweden). |

Major companies in the global fungal protein market have implemented various strategies over the years to expand their product offerings & global footprints and augment their market shares. The key strategies followed by the leading companies in this market were product launches, investments, agreements, collaborations, & partnerships, expansions, and acquisitions. The key players profiled in the global fungal protein market research report are Koninklijke DSM N.V. (Netherlands), Associated British Foods plc (U.K.), Lesaffre Group (France), Kerry Group plc (Ireland), Lallemand Inc. (Canada), Oriental Yeast Co., Ltd. (Japan), Halcyon Proteins Pty. Ltd. (Australia), AngelYeast Co., Ltd. (China), Van Wankum Ingredients BV (Netherlands), and MYCORENA AB (Sweden).

Key questions answered in the report:

In terms of value, the global fungal protein market is projected to reach $397.5 million by 2029, at a CAGR of 7.6% during the forecast period.

The yeast extract segment is slated to register the highest growth rate during the forecast period and provide significant opportunities for the players operating in this market.

The food and beverage segment is slated to register the highest growth rate during the forecast period and provide significant opportunities for the players operating in this market.

o Growing demand for allergen-free foods.

o Rising consumption of processed food.

o Growing demand for meat-substitute products.

Undefined regulatory guidelines.

o Rising adoption of yeast extract in the food industry.

o Emerging economies such as Asia-Pacific and the Middle East.

The key players profiled in the global fungal protein market research report are Koninklijke DSM N.V. (Netherlands), Associated British Foods plc (U.K.), Lesaffre Group (France), Kerry Group plc (Ireland), Lallemand Inc. (Canada), Oriental Yeast Co., Ltd. (Japan), Halcyon Proteins Pty. Ltd. (Australia), AngelYeast Co., Ltd. (China), Van Wankum Ingredients BV (Netherlands), and MYCORENA AB (Sweden).

The Asia-Pacific region is demonstrating signs of strong growth in the near future.

Published Date: May-2025

Published Date: Feb-2025

Published Date: Jan-2025

Published Date: Aug-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates