Resources

About Us

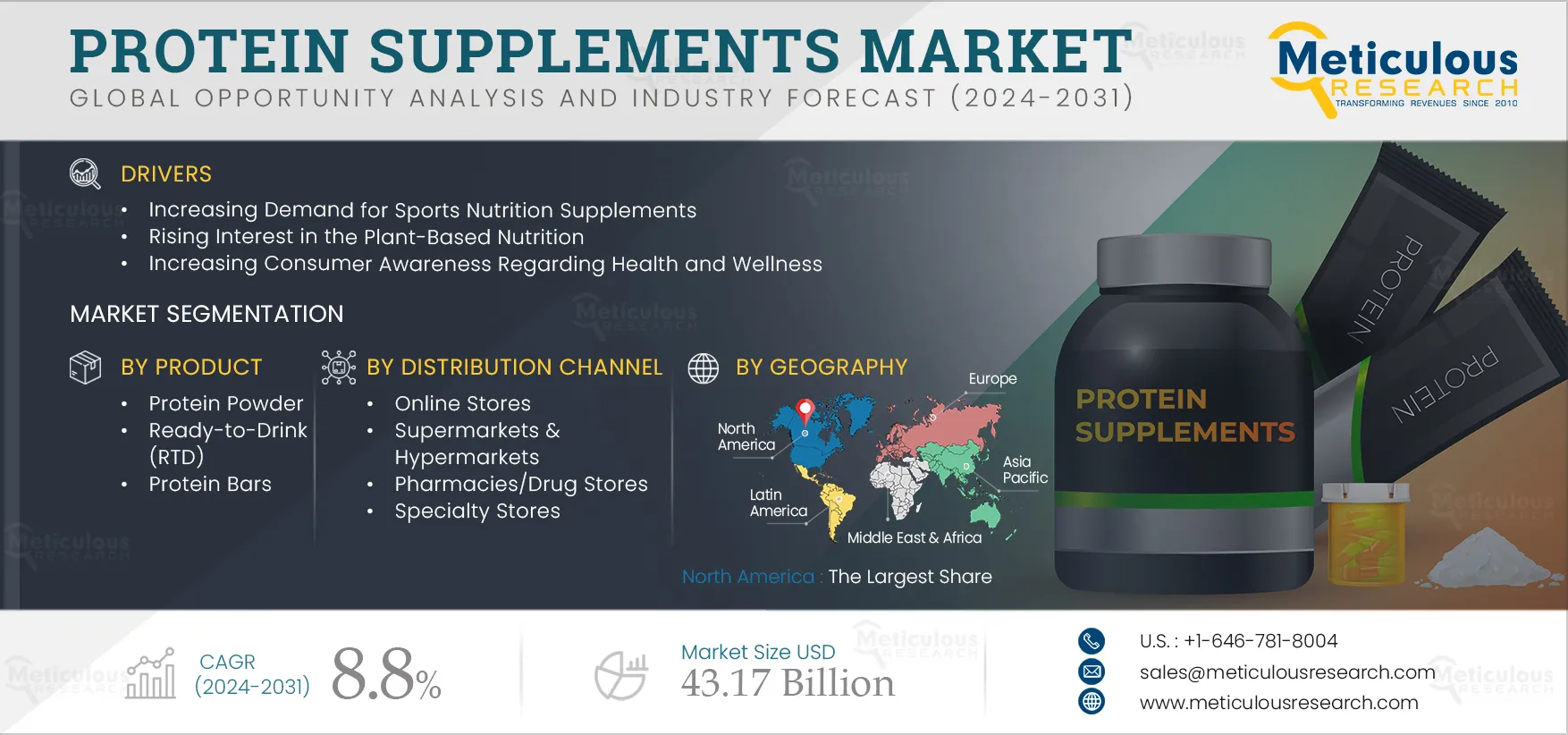

Protein Supplements Market Size, Share, Forecast, & Trends Analysis by Product (Powder, RTD, Bar), Source (Animal-based {Whey}, Plant-based {Soy}), Application (Sports Nutrition), Distribution Channel (Online, Specialty Stores) - Global Forecast to 2032

Report ID: MRFB - 1041168 Pages: 250 May-2024 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market can be attributed to several factors, including the increasing demand for sports nutrition supplements, rising interest in plant-based nutrition, increasing consumer awareness regarding health & wellness, and rising product innovations in protein supplements. Moreover, the increasing demand for personalized nutrition and expansion into emerging economies are expected to offer growth opportunities for the players operating in this market. Additionally, the growing preference for online purchases and the rising popularity of vegan protein supplements are major trends in the protein supplements market.

However, the threat of counterfeit products is expected to hinder the market growth to a certain extent. Furthermore, the misconception about consuming protein supplements poses a challenge to market expansion.

The integration of sports and fitness into daily lifestyles has sparked a surge in the demand for sports nutrition products. These products, rich in essential nutrients like proteins, vitamins, carbohydrates, and fats, cater to the training, muscle growth, and recovery needs of athletes and fitness enthusiasts alike. Protein supplements, in particular, offer a convenient solution for meeting daily protein requirements without the hassle of preparing extensive meals, ideal for those with busy schedules. Available in diverse forms such as powders, bars, and shakes, protein supplements seamlessly integrate into daily routines. As awareness grows regarding the role of nutrition in enhancing sports performance, more individuals are turning to protein supplements. With sports and fitness gaining traction across age groups, the demand for protein supplements is poised to escalate, solidifying their pivotal role in the thriving sports nutrition market.

Click here to: Get a Free Sample Copy of this Report

Click here to: Get a Free Sample Copy of this Report

In recent times, there has been a notable surge in health and wellness awareness, fostering increased consumer understanding of protein's benefits in promoting an active lifestyle. Recognized for its pivotal role in muscle growth, weight management, and satiety, protein has become a fundamental element of balanced nutrition. The rise in fitness activities like strength training and high-intensity interval training has further fueled the demand for protein supplements to aid performance and recovery. Consequently, consumers are gravitating towards high-quality options such as whey protein and plant-based alternatives to fulfill their nutritional requirements. Moreover, backed by scientific evidence advocating protein-rich diets for addressing health issues, protein supplements have gained widespread acceptance. With a growing emphasis on health-conscious choices, consumers are proactively incorporating adequate protein into their daily diets, driving the expansion of the protein supplements market to meet evolving preferences and needs.

The growing health consciousness and demand for supplements to support healthy lifestyles have significantly contributed to the increasing demand for protein supplements. Moreover, online purchases of protein supplements have witnessed a remarkable surge due to the convenience they offer compared to traditional retail channels. The rise of e-commerce has allowed consumers to purchase protein supplements from the comfort of their homes, saving time and effort.

Additionally, the emergence of direct-to-consumer (DTC) protein supplement brands has disrupted the market, offering personalized products, subscription-based services, and enhanced customer experiences. By bypassing intermediaries and connecting directly with consumers, DTC brands can better understand customer preferences, respond to market trends, and establish strong customer relationships. The continued growth of e-commerce and the rise of DTC brands are expected to play pivotal roles in shaping the protein supplements market. As more consumers prioritize convenience, personalization, and engaging experiences, these factors boost demand for protein supplements.

Consumers are becoming more aware of the health, environmental, and ethical benefits of plant-based diets, leading to a surge in demand for vegan protein supplements. Around 1.5 billion people are vegetarian globally (Source: Great Green Wall organization (U.S.)). Also, according to The World Animal Foundation (WAF), there are about 88 million vegans globally, and the European Vegetarian Union reports that the number of vegans in Europe has doubled from 1.3 million in 2016 to 2.6 million in 2020, representing 3.2% of the total European population. This shift towards plant-based diets has driven the demand for vegan protein supplements as consumers seek options that align with their dietary preferences and ethical choices. In response to this demand, the market has seen a rise in innovative vegan protein supplements derived from plant-based sources such as pea, hemp, brown rice, and soy, providing a diverse range of options for consumers.

For instance, in October 2024, Glanbia plc's (Ireland) brand Optimum Nutrition launched Clear Protein, a plant protein isolate containing 20g of high-quality protein, 3.6g of branched-chain amino acids (BCAAs), and zero sugar per serving to support muscle growth and repair. With such innovations, the rising popularity of vegan protein supplements is expected to contribute significantly to the growth of the protein supplements market.

In recent years, health-conscious consumers have driven a significant shift towards personalized nutrition. As people become more aware of the impact of their dietary choices on overall health and wellbeing, they are increasingly seeking tailored solutions that cater to their unique needs, preferences, and fitness goals. The rising disposable income and growing consumer awareness regarding health and wellness are driving demand for personalized nutrition. Consumers are paying closer attention to their health and recognizing that individual nutritional requirements vary based on factors like age, lifestyle, fitness goals, and dietary preferences. Personalized nutrition offers numerous benefits, including better health outcomes, effective muscle growth, and recovery. As consumers shift towards personalized nutrition, the protein supplements market will likely experience a transformation towards more customized products and services, with companies leveraging technology to provide tailored solutions that meet individual consumer needs.

Based on product, the protein supplements market is segmented into protein powder, ready-to-drink, protein bar, and others. In 2025, the protein powder segment is expected to account for the largest share of 63.8% of the protein supplements market. The large market share of this segment can be attributed to the higher adoption of protein powder supplements with ease in handling, cost efficiency, comparatively lower additional ingredients like sugar, additives, and preservatives; and competence to maintain the stability of the ingredient. Further, the growing consumer demand for plant-based protein powders is expected to boost demand for protein powder.

However, the ready-to-drink segment is projected to witness the highest growth rate of 9.3% during the forecast period of 2025–2032. This growth is driven by factors such as growing consumer preferences for convenience, the rising popularity of plant-based protein beverages, and changing consumer preferences & lifestyles. Ready-to-drink (RTD) protein beverages offer a quick, on-the-go solution for consumers seeking to meet their daily protein needs without the hassle of preparation.

Based on source, the protein supplements market is segmented into animal-based, plant-based, spirulina protein, and others. In 2025, the animal-based segment is expected to account for the largest share of the protein supplements market. The large market share can be attributed to the increasing demand for whey protein powder, rising demand for high-value proteins, nutritional benefits of animal protein, and increasing demand for sports nutrition. Further, animal-based proteins, such as whey and casein, are known for their high biological value and essential amino acid profiles, making them popular among consumers seeking muscle growth, athletic performance, and overall health benefits.

However, the plant-based segment is projected to witness the highest growth rate during the forecast period of 2025–2032. This growth is driven by the growing consumer interest in plant-based nutrition, increasing vegan and vegetarian population, rising prevalence of lactose intolerant consumers, and product innovations.

Based on application, the protein supplements market is segmented into sports nutrition and additional nutrition. In 2025, the sports nutrition segment is expected to account for the larger share of the protein supplements market. The large market share of this segment can be attributed to the growing demand from athletes, bodybuilders, and fitness enthusiasts seeking to enhance athletic performance, build muscle, and support muscle recovery. Furthermore, this segment is slated to register a higher CAGR during the forecast period due to the increasing consciousness regarding the benefits of a balanced and nutrient-rich diet, as well as the role protein supplements play in weight management and lean muscle growth. As more individuals prioritize their health and fitness goals, the demand for protein supplements within the sports nutrition segment is expected to grow.

Based on distribution channel, the protein supplements market is segmented into supermarkets & hypermarkets, online stores, pharmacies/drug stores, and specialty stores. In 2025, the online stores segment is expected to account for the largest share of the protein supplements market. The large market share of this segment can be attributed to the increasing preference for online shopping among consumers, the convenience offered by online platforms, the growing preference for personalization, contactless shopping, consumer convenience, easy price comparisons between brands, availability of different brands, and the advantage of greater discounts compared to offline stores. Additionally, this segment is projected to register the highest CAGR during the forecast period due to the increasing consumer demand for direct-to-consumer protein supplement brands, and new product innovations with new flavors and ingredients.

Based on geography, the protein supplements market is divided into five major regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is expected to account for the largest share of 50.5% of the protein supplements market, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The large share of this market is mainly attributed to the growing number of fitness activities, higher adoption of nutritional supplements, increased health consciousness among consumers, easy availability of protein supplement products, and increasing prevalence of health concerns. Furthermore, the increasing adoption of plant-based protein supplements is expected to drive the demand for protein supplements in the U.S.

However, the Asia-Pacific region is projected to register the highest CAGR of 9.4% during the forecast period due to the growing population and urbanization, rising disposable income, and the growing popularity of fitness and sports activities. Additionally, the growing consumer awareness regarding the health benefits of high-protein-rich diets and the increasing number of health-conscious consumers are further expected to support the growth of this region.

Furthermore, in major countries like China and India, the market is further bolstered by changing dietary patterns and the increasing accessibility of protein supplements through e-commerce platforms.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the protein supplements market are Glanbia plc (Ireland), The Simply Good Foods Company (U.S.), Iovate Health Sciences International Inc. (Canada), Amway Corporation (U.S.), PepsiCo, Inc. (U.S.), THG PLC (U.K.), Mondelēz International, Inc. (U.S.), Herbalife Ltd. (U.S.), NOW Health Group, Inc. (U.S.), Meiji Holdings Co., Ltd. (Japan), Woodbolt Distribution, LLC (U.S.), FitLife Brands, Inc. (U.S.), Orgain, Inc. (U.S.), and Post Holdings, Inc. (U.S.).

In December 2024, THG plc’s (U.K.) brand MyProtein launched a new flavor of its clear whey protein, Iron Brute, described as 'undeniably Scottish’. The new flavor contains 20g of hydrolyzed protein with zero sugar and 81 kcal per serving. The clear whey range by MyProtein aims to offer a refreshing alternative to conventional protein shakes, providing consumers with a variety of flavors to support their training and macronutrient goals.

In November 2022, Glanbia plc (Ireland) brand Optimum Nutrition launched Gold Standard 100% Plant Protein powder. This plant-protein powder is a blend of pea, rice, and fava bean protein and contains 24g of protein per serving, nine essential amino acids, and a blend of vitamins and minerals. It is available in two flavors: rich chocolate fudge and creamy vanilla.

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

8.8% |

|

Market Size (Value) |

USD 43.17 Billion by 2032 |

|

Segments Covered |

By Product

By Source

By Application

By Distribution Channel

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Russia, Netherlands, Poland, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (United Arab Emirates, South Africa, Saudi Arabia, and Rest of Middle East & Africa). |

|

Key Companies |

Glanbia plc (Ireland), The Simply Good Foods Company (U.S.), Iovate Health Sciences International Inc. (Canada), Amway Corporation (U.S.), PepsiCo, Inc. (U.S.), THG PLC (U.K.), Mondelēz International, Inc. (U.S.), Herbalife Ltd. (U.S.), NOW Health Group, Inc. (U.S.), Meiji Holdings Co., Ltd. (Japan), Woodbolt Distribution, LLC (U.S.), FitLife Brands, Inc. (U.S.), Orgain, Inc. (U.S.), and Post Holdings, Inc. (U.S.). |

The Protein Supplements Market includes products like protein powders, bars, and shakes that support fitness, health, and protein intake needs for diverse consumer segments.

The Protein Supplements Market was valued at $22.02 Billion in 2024. It is projected to grow to $43.17 Billion by 2032, showing strong expansion in the coming years.

The market is forecasted to grow at an 8.8% CAGR from 2025 to 2032, driven by increasing consumer health awareness and ongoing product innovations.

The Protein Supplements Market size is expected to grow from $23.86 Billion in 2025 to $43.17 billion by 2032, reflecting substantial market growth.

Major players include Glanbia plc, The Simply Good Foods Company, Iovate Health Sciences, Amway, PepsiCo, THG PLC, Mondel?z, Herbalife, NOW Health Group, and Meiji Holdings.

Key trends include increasing online sales, rising vegan protein demand, and a growing interest in personalized nutrition solutions tailored to individual health needs.

Drivers include rising demand for sports nutrition, greater health awareness, increasing interest in plant-based options, and ongoing innovations in protein supplement products.

The market is segmented by product type (powders, bars), source (animal-based, plant-based), application (sports, additional nutrition), and distribution channel (online, retail).

The global outlook is positive, with expected growth driven by health trends, increasing demand for personalized nutrition, and expanding e-commerce channels.

The market is set to grow from $23.86 billion in 2025 to $43.17 billion by 2032, reflecting robust growth driven by rising consumer interest and innovative products.

The Protein Supplements Market is projected to grow at an 8.8% CAGR from 2025 to 2032, indicating strong growth and increasing consumer engagement.

North America holds the highest market share at 50.5% in 2025 due to high fitness activity, health consciousness, and widespread availability of protein supplements.

Published Date: Feb-2025

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Nov-2024

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates