Resources

About Us

AI Video Generation & Editing Software Market Size, Share, & Forecast by AI Function (Text-to-Video, Image-to-Video, Script-to-Video, Auto-Editing), Output Quality, and Target User (Prosumer, Enterprise) - Global Forecast to 2036

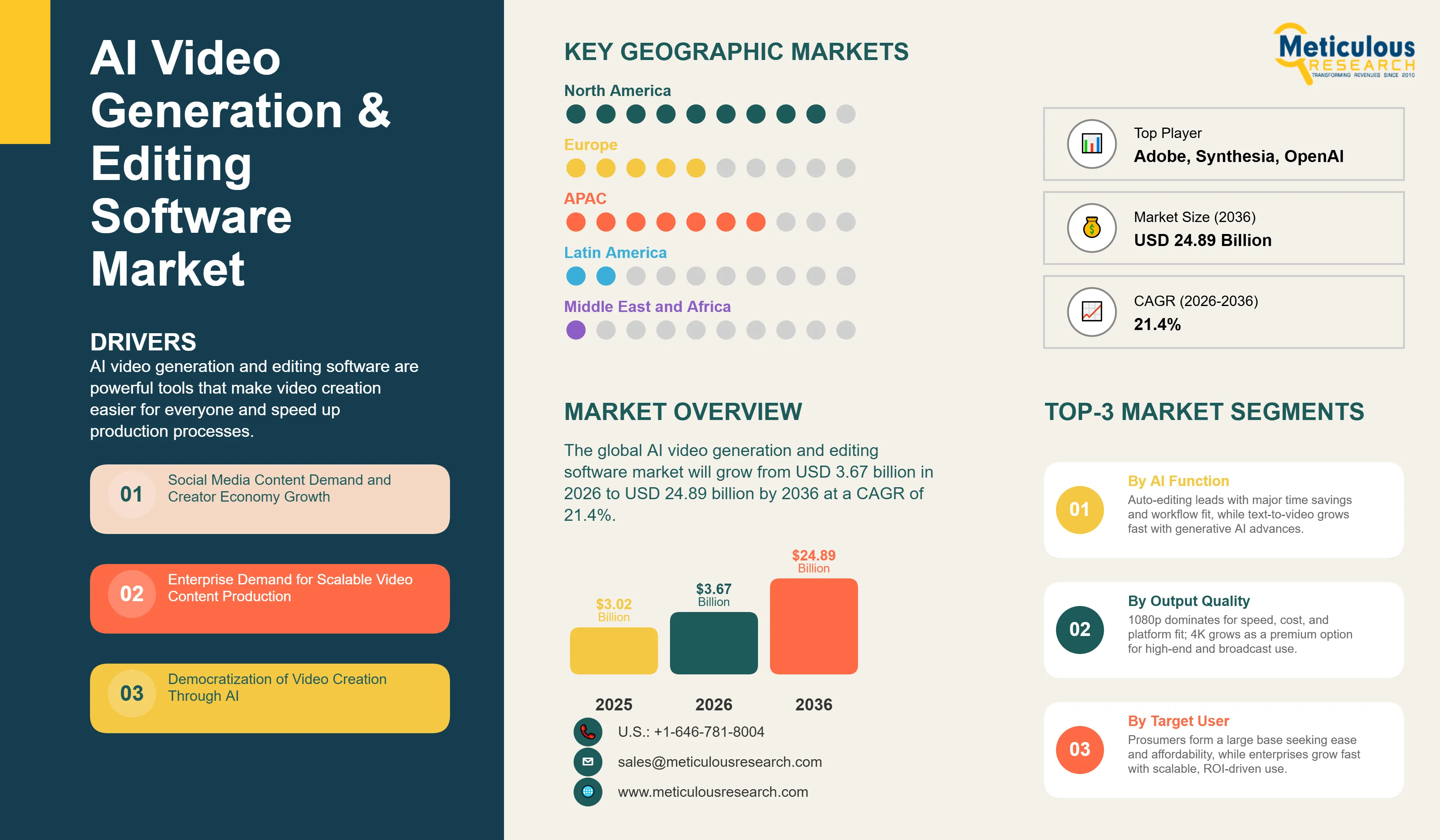

Report ID: MRICT - 1041676 Pages: 265 Jan-2026 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global AI video generation & editing software market is expected to reach USD 24.89 billion by 2036 from USD 3.67 billion in 2026, at a CAGR of 21.4% from 2026 to 2036.

AI video generation and editing software are powerful tools that make video creation easier for everyone and speed up production processes. They allow creators, marketers, businesses, and individuals to make high-quality videos using artificial intelligence. This technology removes technical challenges and shortens the time it takes to release content. The aim is to help users without technical skills create engaging videos, lower production costs through automation, quickly iterate and personalize content, and expand video marketing across different platforms and languages.

These systems employ advanced technologies such as generative AI models that create videos from text prompts, computer vision algorithms that help understand scenes and recognize objects, natural language processing for script analysis and voice generation, deep learning networks for style transfer and visual improvement, automated editing algorithms that follow cinematographic guidelines, and neural rendering methods for producing realistic synthetic content. Text-to-video systems read written descriptions and create matching visual scenes, while auto-editing features look at raw footage and apply cuts, transitions, color adjustments, and effects based on patterns learned from professional videos.

These systems let creators make videos 10 to 100 times faster than traditional methods and cut production expenses by reducing the need for extensive manual editing. They enable the creation of personalized video content at scale for targeted marketing and automatically produce multilingual versions through AI dubbing and subtitles. Additionally, they allow rapid testing of various creative options for better results. These tools also support the growth of the creator economy by providing accessible resources for individual creators, assisting marketing teams in large businesses with their content campaigns, helping small businesses achieve professional video quality, and making it easier to produce educational content by simplifying technical requirements.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

AI video generation and editing software is changing content creation by removing technical hurdles and reducing production times from weeks to minutes. Previously, video production required specific skills, such as cinematography, proficiency in editing software, color correction expertise, and access to costly equipment and software licenses. Professional editors spent hours reviewing footage, selecting clips, applying transitions, correcting colors, and adding effects to produce polished content. This method cannot meet the modern demands of content driven by social media, which requires daily posts, personalized marketing that needs thousands of video variations, rapid news cycles that call for immediate video responses, and the expansion of the creator economy that sees millions wanting video production options. AI video generation and editing tools let anyone create professional-quality content using simple text inputs or automated processing. Text-to-video models can generate complete videos from written descriptions, auto-editing systems turn raw footage into polished content automatically, and AI enhancement features improve visual quality, remove backgrounds, and add effects with a single click. These technologies together pave the way for democratized video creation, where engaging visual storytelling is available to everyone, regardless of their technical skills or budget.

Several trends are reshaping the AI video generation and editing market. These include the advancement of foundation models like Sora, Runway Gen-2, and Pika, which produce increasingly realistic videos; the integration of multimodal AI that combines text, image, audio, and video understanding; real-time rendering that allows interactive guidance during video generation; personalization engines that create custom video content for each viewer; and synthetic human avatars that deliver presentations and tutorials that are hard to tell apart from real people. The combination of breakthroughs in generative AI, the power of cloud computing for scalable processing, growth in the creator economy driving demand for content tools, and social media preferences favoring video content has sped up adoption. What began as experimental AI features in professional software is now evolving into complete, end-to-end AI-first creation platforms.

The AI video generation and editing market is moving towards full creative production platforms that manage everything from ideas to distribution. Modern implementations go beyond simple editing features. They offer complete workflows, including AI-powered script generation from brief prompts or brand guidelines, storyboard visualization that shows previews shot by shot before production, automated asset selection that pulls in stock footage and images matching content needs, voice synthesis that generates natural narration in multiple languages and styles, music generation that creates copyright-free soundtracks fitting video moods, automated editing that applies professional pacing and transitions, and one-click adaptation that reformats content for different platforms and aspect ratios. The shift from editing assistance tools to full creative production ecosystems marks a key change in how video content is created and produced.

Generative AI model capabilities are advancing quickly with each research breakthrough and model release. Leading systems now provide features like photorealistic rendering that produces video indistinguishable from actual camera footage in many cases, temporal consistency keeping objects and characters stable across frames, physics simulation ensuring realistic motion and interactions, style control allowing for precise artistic input through text, long-form generation creating coherent sequences lasting several minutes instead of just short clips, and camera control that specifies exact movements, angles, and focal lengths. Companies like Runway, Pika Labs, Stability AI, and OpenAI compete by rapidly innovating, with each model release showing significant quality enhancements. This direction suggests that AI systems will produce broadcast-quality content within two to three years, fundamentally changing traditional production economics.

The merging of AI video generation with synthetic media and virtual production is creating new content possibilities. Virtual influencers and AI avatars become content creators, digital humans deliver corporate training and customer service via video, product demonstrations are made entirely through synthetic means without physical prototypes, and virtual production settings replace costly physical sets. These features enable new strategies that were previously impossible, including hyper-personalized videos with individual messages for every viewer, real-time video content responding to events within minutes, endless creative variations testing hundreds of methods to maximize engagement, and multilingual content where synthetic avatars speak many languages with perfect lip-syncing. The technological shift from editing assistance to complete synthetic content generation represents a significant change in media production.

|

Parameter |

Details |

|

Market Size Value in 2026 |

USD 3.67 Billion |

|

Revenue Forecast in 2036 |

USD 24.89 Billion |

|

Growth Rate |

CAGR of 21.4% from 2026 to 2036 |

|

Base Year for Estimation |

2025 |

|

Historical Data |

2021-2025 |

|

Forecast Period |

2026-2036 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2026 to 2036 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

AI Function, Output Quality, Target User, Deployment Mode, Video Length, Application, Industry Vertical, Region |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Countries Covered |

U.S., Canada, U.K., Germany, France, Spain, Italy, Netherlands, China, Japan, South Korea, India, Australia, Singapore, Brazil, Mexico, UAE, Saudi Arabia |

|

Key Companies Profiled |

Adobe Inc., Runway AI Inc., Synthesia Ltd., Descript Inc., Pika Labs, Stability AI, OpenAI (Sora), Google (Veo), Pictory AI, InVideo, Veed.io, Lumen5, Fliki, HeyGen, Kapwing, Animoto Inc., Magisto (Vimeo), Peech AI, Opus Clip, Vidyo.ai |

Driver: Social Media Content Demand and Creator Economy Growth

The rapid growth of video-focused social media platforms creates an extraordinary demand for tools that support quick and large-scale content production. Platforms like TikTok, Instagram Reels, YouTube Shorts, and others vie for user attention with short videos. Algorithms tend to favor video over static content, resulting in video posts getting 5-10 times the engagement of images or text on most platforms. This preference leads creators, brands, and marketers to focus on video strategies. However, traditional video production cannot keep up with the speed needed for daily or multiple posts. Making a single polished 60-second video often takes hours, including reviewing footage, cutting, color correcting, mixing audio, and adding effects. AI video generation and editing software helps meet this speed challenge by automating many time-consuming tasks. Auto-editing features analyze raw footage to create finished videos within minutes. Template systems allow for quick customization to maintain brand consistency, and generative AI produces entirely new content from text descriptions. The growth of the creator economy, with over 50 million people worldwide identifying as content creators, fuels the demand for accessible tools. Professional YouTubers, Instagram personalities, TikTok creators, and rising influencers need efficient production workflows, which AI automation provides. Brand marketing teams face similar pressures to create video content for various platforms, campaigns, and audiences. AI tools enable individual marketers to produce video content that used to require entire production teams. The rise of social commerce, where products sell directly through video content, increases these demands. E-commerce platforms leverage AI to automatically generate product demonstrations from images and descriptions. The overall shift toward video consumption, along with the need for speed, creates ongoing demand for AI automation tools.

Driver: Enterprise Demand for Scalable Video Content Production

Companies across different industries are facing increasing needs for video content that traditional methods cannot feasibly meet. Training and development teams require video for onboarding, skills training, compliance education, and ongoing learning programs. Large organizations with thousands of employees require extensive training libraries that would cost millions to produce through traditional video production. AI video generation allows training teams to create professional quality content from text-based materials, generate scenarios with synthetic actors, and automatically translate content for global workers. Marketing and communications departments also need video content for product launches, feature explanations, customer testimonials, social media campaigns, and sales support. The explosion of digital marketing channels means content must be produced simultaneously for websites, email campaigns, LinkedIn, Twitter, YouTube, and new platforms. AI editing tools help marketing teams automatically create platform-specific versions from master content. Customer success and support teams are increasingly using video for onboarding guides, troubleshooting tutorials, and feature explanations. AI systems can automatically create these videos from product documentation and screen recordings. Internal communications teams develop video content for executive messages, company announcements, and cultural initiatives to boost engagement. AI avatar systems allow executives to deliver personalized video messages on a large scale without the need for extensive filming. Sales teams use AI-generated personalized videos that include specific company information and pain points. E-learning companies produce course content using AI-generated instructional videos and animations. The return on investment for enterprises adopting AI is clear, as costs for AI video software subscriptions are thousands of dollars annually, compared to the hundreds of thousands needed for traditional production to achieve similar volumes. Companies also enjoy rapid adjustments based on feedback, easy updates when products or policies change, and centralized brand consistency through templates.

Opportunity: Personalized Video Marketing at Scale

AI video generation technology allows for unprecedented personalization in video marketing by creating tailored content for each prospect or customer. Traditional video marketing typically produces one generic video for all audiences. Some segmentation may create different versions for certain customer segments, but true individualization—where each recipient gets a video tailored to their circumstances, company, interests, and buyer journey—was previously not feasible with traditional methods. AI video generation changes that significantly. Systems can now automatically create thousands or millions of unique video variations with personalized elements, including the recipient's name and company displayed, specific product recommendations based on browsing or purchase history, industry-specific examples, regional customization featuring local landmarks, language and cultural adaptation, and dynamic calls to action based on individual profiles. Implementation includes data integration that pulls customer information from CRM systems, template frameworks that define video structure while allowing for variable elements, generative AI producing visuals tailored to each recipient, voice synthesis for personalized narration, and automated rendering to create unique videos at scale. Results show marked improvements in engagement, with personalized videos achieving 3-5 times higher view-through rates, 2-3 times higher click-through rates, and significantly higher conversion rates compared to generic videos. Applications range from welcome videos for new customers featuring their purchase details to abandoned cart recovery videos showing specific products left behind, account review videos for B2B customers highlighting their usage data and recommendations, real estate videos matching properties to buyer preferences, and job recruitment videos that address candidates by name while focusing on relevant role aspects. The benefit of personalized video marketing provides strong motivation for enterprises to adopt this approach, as early adopters show better campaign results. AI video generation makes personalization affordable on a large scale, opening up marketing strategies that were previously unattainable.

Opportunity: Multilingual and Cross-Cultural Content Expansion

AI video generation and editing software significantly lowers the barriers to creating multilingual content, allowing for global expansion for creators and businesses. Traditional video localization for international markets involved costly processes like professional script translations, hiring native-speaking voice talent, adjusting lip-sync for on-camera speakers, adapting visuals and examples culturally, and full separate production for each language. This expensive model meant only large companies with significant budgets could afford multilingual video content, leaving individuals and small businesses restricted to single-language audiences. Now, AI systems automate multilingual video production through various integrated features, such as neural machine translation that converts scripts while keeping their meaning and tone, voice cloning that generates narration in target languages using the original speaker’s voice attributes, automatic lip-sync adjustment that makes speakers appear to naturally speak the target languages, cultural localization that recommends suitable visual changes, and subtitle generation with proper timing. Leading platforms support 50-100+ languages, allowing for genuine global reach. This implementation enables entirely new strategies for content. YouTube creators can automatically produce versions of their videos in Spanish, Hindi, Portuguese, and other major languages, reaching billions of potential viewers. Company training content created in English can be deployed globally in employees’ native languages. E-learning platforms can offer courses in preferred languages automatically. Marketing campaigns can modify their messaging for regional markets. The economic transformation is significant, as AI-driven multilingual production could cost just 5-10% of traditional localization while maintaining similar quality. Market expansion opportunities now include diversifying creator revenue by monetizing international audiences, speeding up enterprise global strategies with localized training and marketing content, democratizing education through language-accessible learning materials, and promoting cultural exchange through simpler cross-language content sharing. Government and NGO efforts can include public health information in community languages and education materials for language minorities. The ability to affordably produce high-quality multilingual video content presents a major market opportunity as content creators and organizations see new growth possibilities.

By AI Function:

The auto-editing segment is expected to have the largest share of the market in 2026. This is due to its immediate applicability to existing video production workflows and proven time savings. Auto-editing systems analyze raw video footage and automatically perform editing tasks that typically required skilled editors. These tasks include identifying and removing pauses, filler words, and mistakes from recordings. They also select the best shots from multiple takes based on audio quality and visual composition. The systems apply cuts and transitions at natural points following cinematographic principles. They add titles, captions, and lower-thirds automatically. They also provide color correction and grading for a consistent professional look, enhance audio by removing background noise and balancing levels, and optimize pacing for an engaging rhythm and flow. Modern implementations use deep learning models trained on thousands of professionally edited videos to learn editing patterns and principles. Computer vision analyzes visual content to identify faces, objects, actions, and scene changes. Speech recognition and natural language processing analyze audio content to identify key points, questions, and emphasis. The systems understand the video's context, such as whether it is an interview, tutorial, vlog, or presentation, and apply the appropriate editing styles. Implementation scenarios include YouTube creators uploading raw recordings and receiving polished videos ready for publication. Corporate training departments can convert presentation recordings into professional learning content. Podcast creators can automatically generate video versions with dynamic camera angles and captions. News organizations can rapidly produce video stories from raw footage. Auto-editing can save 60-90% of editing time compared to manual processes. Platforms like Descript, Opus Clip, and Vidyo.ai target auto-editing workflows with editor-like interfaces powered by AI automation. The segment's immediate value and compatibility with existing production workflows drive adoption.

The text-to-video segment is growing rapidly as generative AI capabilities advance. These advancements allow for the creation of complete video content from written descriptions. Text-to-video systems interpret natural language prompts and generate corresponding visual sequences, including scenes, actions, objects, and effects described in text. Leading models such as OpenAI's Sora, Google's Veo, Runway Gen-2, and Pika demonstrate impressive capabilities in generating coherent video clips from prompts. This technology enables entirely new creative workflows where creators describe desired video content in text, and AI generates it. This eliminates the need for filming, stock footage, or traditional animation. Applications include creating social media content, where creators can generate engaging videos that match trending topics without shooting any footage. Additionally, it can be used to generate marketing content, product demonstrations, and explainer videos from descriptions, as well as concept visualizations for filmmakers and advertisers who want to create storyboard previews before production. Educational content can be generated for scientific visualizations and historical recreations. In the entertainment space, AI can produce shorts and creative experiments. Current limitations include video lengths that are typically limited to 10-60 seconds for the best quality, occasional inconsistencies in physics and temporal artifacts, significant processing times, and uncertainties around copyright in the training data. However, the rapid improvement of this technology suggests that many limitations will be addressed within 2-3 years. The potential of text-to-video technology to change content creation economics drives significant research investment and startup activity.

By Output Quality:

The HD 1080p segment is expected to lead the market in 2026. It offers an optimal balance of quality, rendering speed, and platform requirements for most use cases. 1080p resolution at 1920x1080 pixels provides enough quality for social media platforms, websites, mobile viewing, and most professional applications while keeping file sizes and processing times reasonable. Most content is consumed on mobile devices, where 1080p exceeds screen resolution capabilities, making higher resolutions unnecessary for the viewer experience. AI video processing requires significantly more computing power at higher resolutions. Processing 4K requires four times the resources compared to 1080p for equivalent tasks. This leads to longer rendering times, as complex AI effects take minutes at 1080p but hours at 4K. Storage and bandwidth costs also increase with resolution. 4K files use four times the storage and transmission bandwidth. For workflows that require rapid iteration and frequent revisions, 1080p enables faster turnaround times. Platform requirements reinforce this balance. Instagram, TikTok, Twitter, and LinkedIn optimize for 1080p or lower. YouTube supports 4K, but most views are at 1080p or lower. Web embedding typically delivers 1080p for better performance. Enterprise applications like training videos, marketing content, and internal communications rarely require 4K. This segment serves diverse users, from individual creators optimizing for social platforms to enterprises producing corporate content at scale.

The 4K Ultra HD segment is growing as a premium option for specific high-value applications. 4K resolution at 3840x2160 pixels provides exceptional detail suitable for large-screen displays, broadcast television, cinema, and future-proof content archives. Applications justifying 4K include professional filmmaking and broadcast production, high-end brand marketing and advertising, product videography for e-commerce requiring zoom capability, real estate visualization, and content intended for editing and post-production, where quality preservation is critical. AI video tools offering 4K output target professional users willing to accept longer processing times and higher costs for better quality. Cloud computing infrastructure for 4K processing requires significant GPU resources, driving up subscription prices. The segment has a smaller volume but offers higher value per user compared to the HD segment.

By Target User:

The prosumer segment is expected to account for substantial market share, encompassing individual content creators, social media influencers, small marketing teams, and freelance video producers. Prosumers require professional-quality output but lack budgets for enterprise software or extensive training time for complex professional tools. They prioritize ease of use, rapid results, and affordable pricing with typical budgets of $10-100 per month for software subscriptions. Use cases include YouTube creators producing regular content on consistent schedules, Instagram and TikTok influencers creating daily posts, small business owners producing marketing videos, freelance videographers offering services to local clients, and hobbyist creators pursuing passion projects. AI video software serves this segment through intuitive interfaces requiring minimal training, template libraries enabling quick customization without starting from scratch, one-click effects and enhancements automating technical processes, mobile apps allowing content creation on smartphones, and tiered pricing with free or low-cost entry levels. Platforms like InVideo, Pictory, Lumen5, and Veed.io specifically target prosumer users with simplified workflows and affordable pricing. The segment's massive size with tens of millions of potential users and continuous content production needs create substantial recurring revenue opportunities. Creator economy growth and platform algorithm preferences for video content drive sustained demand as more individuals pursue content creation professionally or semi-professionally.

The enterprise segment is growing rapidly as corporations recognize ROI from AI video production tools for marketing, training, and communications. Enterprise users require features including team collaboration with multiple users editing and reviewing content, brand consistency through template systems and asset libraries, integration with existing tools including CRM, marketing automation, and content management systems, security and compliance meeting corporate data governance requirements, and analytics measuring video performance and engagement. Use cases span marketing teams producing product videos, social content, and campaigns at scale, training and development departments creating employee learning content, sales teams generating personalized outreach videos, customer success teams producing onboarding and tutorial content, and internal communications delivering executive messages and company announcements. Enterprise platforms including Synthesia, HeyGen, Descript Enterprise, and Adobe's offerings provide features meeting corporate requirements with SSO authentication, advanced permissions and approval workflows, usage analytics and reporting, dedicated support and onboarding assistance, and custom branding and white-labeling. Pricing models reflect enterprise budgets with annual contracts ranging from thousands to tens of thousands of dollars based on seats and usage. The value proposition centers on cost savings compared to traditional video production, operational efficiency from reduced production time, and scale enabling video content strategies previously impossible. Enterprise segment growth is accelerating as early adopters demonstrate ROI and case studies emerge across industries.

By Application:

The social media content creation segment is experiencing explosive growth driven by platform algorithm preferences for video and creator economy expansion. Social media applications require specific characteristics including vertical or square aspect ratios for mobile-first platforms, short durations typically 15-60 seconds matching platform preferences and audience attention spans, attention-grabbing openings with hooks within first 2-3 seconds, captions and text overlays for sound-off viewing, trending audio and effects matching platform culture, and platform-specific optimization for Instagram Reels, TikTok, YouTube Shorts, and others. AI video tools address these requirements through automatic reformatting creating platform-specific versions from single source content, trending effect libraries incorporating popular visual styles, auto-captioning with stylized text animations, music libraries with trending and copyright-free audio, and viral content analysis suggesting topics and formats. Users include individual creators building audiences and monetizing content, brands and marketers reaching consumers on social platforms, agencies managing social presence for multiple clients, and influencer marketing campaigns. The segment benefits from network effects where successful AI-generated content inspires additional creators to adopt tools, viral trends demonstrate capabilities to broad audiences, and platform features enabling content discovery reward consistent high-volume posting that AI tools enable. Challenges include platform policy uncertainties around AI-generated content, authenticity concerns from audiences preferring human-created content, and rapid trend cycles requiring constant tool updates. Nevertheless, the fundamental economics favoring AI-augmented creation for sustainable content velocity drive continued growth.

The marketing and advertising segment represents substantial enterprise opportunity as brands recognize video content effectiveness across digital channels. Marketing applications span product demonstration videos explaining features and benefits, explainer videos simplifying complex offerings, testimonial and case study videos building credibility, brand story content communicating values and mission, campaign content for product launches and promotions, and retargeting videos for potential customers who showed interest. AI tools enable marketing teams to produce video content at unprecedented scale and personalization. Generative AI creates product videos from text descriptions and product images, auto-editing transforms customer interview recordings into polished testimonials, personalization engines produce individualized videos incorporating prospect information, A/B testing tools generate multiple creative variations for optimization, and multilingual generation expands campaign reach globally. Implementation delivers measurable marketing performance improvements with video content consistently demonstrating higher engagement than static alternatives, personalized videos showing superior conversion rates, and video landing pages reducing bounce rates. Marketing technology integration with CRM systems, marketing automation platforms, and analytics tools enables data-driven video strategies. The segment growth is reinforced by shifting advertising budgets toward digital video, social media platform video ad formats, and marketing attribution data demonstrating video ROI.

In 2026, North America is expected to have the largest share of the global AI video generation and editing software market. This leadership comes from several factors. First, many top AI companies and creative software providers, like Adobe, Runway, Synthesia, and Descript, are based in the United States. Second, Silicon Valley drives technical innovation in AI research. Third, the creator economy in the U.S. has millions of professional and semi-professional content creators. There is also early adoption of AI technologies by forward-thinking companies. Additionally, strong venture capital funding supports AI video startups. American cultural influence shapes global social media trends, with content creation patterns often starting in the U.S. and spreading internationally. The Hollywood entertainment industry is increasingly using AI production tools for tasks like previsualization, synthetic background actors, and speeding up visual effects. Industries in marketing and advertising, especially in New York and major cities, also boost demand from businesses. Educational institutions and e-learning companies are using AI video tools to create course content. Government and military training programs create further specialized demand. Regional traits include a willingness to pay premium prices, a preference for advanced features rather than simplicity, a need for compatibility with existing creative and marketing tools, and attention to disclosure and copyright issues related to AI-generated content. North America's technology leadership and large potential market make it the main revenue source for AI video software companies.

Asia-Pacific is projected to grow at the fastest rate during this period, driven by a surge in short-form video consumption and a large number of creators. Chinese platforms like Douyin (the domestic version of TikTok) and Kuaishou host hundreds of millions of active content creators who need production tools. The integration of e-commerce on platforms such as Taobao and Tmall increases demand for product video creation. Domestic AI companies like ByteDance, Alibaba, Tencent, and Baidu are developing competitive AI video technologies tailored for Chinese language and cultural contexts. Government initiatives for AI development provide funding and support for the growth of the industry. Southeast Asian markets, including Indonesia, Vietnam, the Philippines, and Thailand, are experiencing fast growth in the creator economy and mobile-first video consumption. India holds significant potential with its large English and Hindi-speaking populations, a booming creator economy monetizing through YouTube and Instagram, and increasing startup activities in creative AI tools. The Japanese market shows interest in virtual influencers and synthetic human applications. The South Korean market benefits from strong creative industries and high demand for K-pop content production. Regional traits include a focus on mobile-first design to optimize for smartphone creation and consumption, price sensitivity that favors freemium models and lower subscription costs, local language support for various Asian languages, and differences in platform ecosystems that require adjustments for regional platforms. Cultural preferences also shape content styles and editing conventions, which call for localized features. The combination of a large population, widespread mobile access, growth in the creator economy, and local AI industry development positions Asia-Pacific for the highest growth rates.

Europe represents a substantial market with strong creative industries and growing enterprise adoption. United Kingdom maintains significant market presence with London advertising and media industries, thriving YouTube and social media creator communities, and BBC and media organizations exploring AI production tools. Germany shows enterprise demand from automotive and industrial companies using video for training and marketing, startup activity in AI video space, and cultural appreciation for engineering quality in software tools. France contributes through fashion and luxury brand marketing applications, government AI research initiatives, and Francophone content creation. Netherlands benefits from Amsterdam creative tech cluster and international corporate headquarters. Scandinavian countries show high technology adoption rates and English-language content creation. Southern European markets including Spain and Italy demonstrate growing creator economies and small business adoption. Regional characteristics include GDPR and data privacy compliance requirements, multilingual content needs across European languages, artistic and creative quality expectations, and sustainability concerns about AI computational energy consumption. Regulatory attention on AI-generated content transparency and potential misinformation presents both challenges and opportunities as clear frameworks may accelerate enterprise adoption by reducing legal uncertainty.

The major players in the AI video generation & editing software market include Adobe Inc. (U.S.), Runway AI Inc. (U.S.), Synthesia Ltd. (U.K.), Descript Inc. (U.S.), Pika Labs (U.S.), Stability AI (U.K.), OpenAI (Sora) (U.S.), Google (Veo) (U.S.), Pictory AI (U.S.), InVideo (U.S.), Veed.io (U.K.), Lumen5 (Canada), Fliki (India), HeyGen (U.S.), Kapwing (U.S.), Animoto Inc. (U.S.), Magisto (Vimeo) (U.S.), Peech AI (Israel), Opus Clip (U.S.), and Vidyo.ai (U.S.), among others.

The AI video generation & editing software market is expected to grow from USD 3.67 billion in 2026 to USD 24.89 billion by 2036.

The AI video generation & editing software market is expected to grow at a CAGR of 21.4% from 2026 to 2036.

The major players include Adobe Inc., Runway AI Inc., Synthesia Ltd., Descript Inc., Pika Labs, Stability AI, OpenAI (Sora), Google (Veo), Pictory AI, InVideo, Veed.io, Lumen5, Fliki, HeyGen, Kapwing, Animoto Inc., Magisto (Vimeo), Peech AI, Opus Clip, and Vidyo.ai, among others.

The main factors include social media content demand and creator economy growth requiring rapid production tools, enterprise demand for scalable video content across training and marketing, democratization of video creation through accessible AI tools, personalized video marketing enabling individualized content at scale, multilingual content expansion through automated translation and dubbing, advancement of generative video foundation models improving output quality, and integration of multimodal AI combining text, image, audio, and video capabilities.

North America region will lead the global AI video generation & editing software market in 2026 due to AI technology leadership and massive creator economy, while Asia-Pacific region is expected to register the highest growth rate during the forecast period 2026 to 2036 driven by exploding short-form video consumption and rapid creator economy expansion.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, by AI Function

3.3. Market Analysis, by Output Quality

3.4. Market Analysis, by Target User

3.5. Market Analysis, by Deployment Mode

3.6. Market Analysis, by Video Length

3.7. Market Analysis, by Application

3.8. Market Analysis, by Industry Vertical

3.9. Market Analysis, by Geography

3.10. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global AI Video Generation & Editing Software Market: Impact Analysis of Market Drivers (2026-2036)

4.2.1. Social Media Content Demand and Creator Economy Growth

4.2.2. Enterprise Demand for Scalable Video Content Production

4.2.3. Democratization of Video Creation Through AI

4.3. Global AI Video Generation & Editing Software Market: Impact Analysis of Market Restraints (2026-2036)

4.3.1. Computational Resource Requirements and Processing Costs

4.3.2. Quality Inconsistencies and Generative Artifacts

4.4. Global AI Video Generation & Editing Software Market: Impact Analysis of Market Opportunities (2026-2036)

4.4.1. Personalized Video Marketing at Scale

4.4.2. Multilingual and Cross-Cultural Content Expansion

4.5. Global AI Video Generation & Editing Software Market: Impact Analysis of Market Challenges (2026-2036)

4.5.1. Copyright and Intellectual Property Uncertainties

4.5.2. Platform Policies on AI-Generated Content

4.6. Global AI Video Generation & Editing Software Market: Impact Analysis of Market Trends (2026-2036)

4.6.1. Advancement of Generative Video Foundation Models

4.6.2. Integration of Multimodal AI Capabilities

4.7. Porter’s Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. AI Video Technologies and Generation Architectures

5.1. Introduction to Generative AI for Video

5.2. Text-to-Video Generation Models and Architectures

5.3. Diffusion Models and Neural Rendering

5.4. Computer Vision for Scene Understanding

5.5. Natural Language Processing for Script Analysis

5.6. Voice Synthesis and Audio Generation

5.7. Automated Editing Algorithms and Cinematography AI

5.8. Synthetic Human Generation and Avatar Systems

5.9. Impact on Market Growth and Technology Adoption

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Share / Ranking by Key Players

7. Global AI Video Generation & Editing Software Market, by AI Function

7.1. Introduction

7.2. Text-to-Video Generation

7.2.1. Prompt-Based Generation

7.2.2. Script-to-Video Conversion

7.2.3. Blog-to-Video Transformation

7.3. Image-to-Video Generation

7.3.1. Still Image Animation

7.3.2. Photo Sequence Video Creation

7.3.3. Product Image Video Generation

7.4. Auto-Editing

7.4.1. Intelligent Cutting and Assembly

7.4.2. Remove Silences and Filler Words

7.4.3. Multi-Camera Angle Selection

7.5. AI Enhancement

7.5.1. Upscaling and Resolution Enhancement

7.5.2. Color Grading and Correction

7.5.3. Stabilization and Noise Reduction

7.6. Voice and Audio AI

7.6.1. Voice Cloning and Synthesis

7.6.2. Auto-Dubbing and Translation

7.6.3. Music Generation

7.7. Visual Effects and Graphics

7.7.1. Background Removal and Replacement

7.7.2. Object Insertion and Manipulation

7.7.3. Style Transfer

8. Global AI Video Generation & Editing Software Market, by Output Quality

8.1. Introduction

8.2. Standard Definition (SD)

8.3. High Definition (HD 720p)

8.4. Full HD (1080p)

8.5. 4K Ultra HD

8.6. 8K (Future/Emerging)

9. Global AI Video Generation & Editing Software Market, by Target User

9.1. Introduction

9.2. Individual Creators

9.2.1. YouTube Creators

9.2.2. Social Media Influencers

9.2.3. Hobbyists

9.3. Prosumer

9.3.1. Semi-Professional Creators

9.3.2. Freelance Videographers

9.3.3. Small Business Owners

9.4. Small and Medium Businesses (SMB)

9.4.1. Marketing Teams

9.4.2. E-commerce Businesses

9.4.3. Local Service Providers

9.5. Enterprise

9.5.1. Large Corporations

9.5.2. Marketing Agencies

9.5.3. Media and Entertainment Companies

9.6. Educational Institutions

9.7. Government and Non-Profit Organizations

10. Global AI Video Generation & Editing Software Market, by Deployment Mode

10.1. Introduction

10.2. Cloud-Based

10.2.1. SaaS (Software as a Service)

10.2.2. Browser-Based Applications

10.2.3. Mobile Cloud Apps

10.3. On-Premises

10.4. Hybrid Deployment

11. Global AI Video Generation & Editing Software Market, by Video Length

11.1. Introduction

11.2. Short-Form Video (< 3 minutes)

11.2.1. Social Media Clips (15-60 seconds)

11.2.2. Advertisements (30-90 seconds)

11.2.3. Product Demos (1-3 minutes)

11.3. Medium-Form Video (3-20 minutes)

11.3.1. YouTube Videos

11.3.2. Tutorials and How-To Content

11.3.3. Webinar Clips

11.4. Long-Form Video (> 20 minutes)

11.4.1. Training and Educational Content

11.4.2. Webinars and Presentations

11.4.3. Documentary Content

12. Global AI Video Generation & Editing Software Market, by Application

12.1. Introduction

12.2. Social Media Content Creation

12.2.1. Instagram Reels and Stories

12.2.2. TikTok Videos

12.2.3. YouTube Shorts

12.2.4. LinkedIn Video Posts

12.3. Marketing and Advertising

12.3.1. Product Videos

12.3.2. Explainer Videos

12.3.3. Brand Content

12.3.4. Video Advertisements

12.4. Corporate Training and L&D

12.4.1. Employee Onboarding

12.4.2. Skills Training

12.4.3. Compliance Training

12.5. E-Commerce

12.5.1. Product Demonstrations

12.5.2. Testimonial Videos

12.5.3. Live Shopping Content

12.6. Education and E-Learning

12.6.1. Course Content

12.6.2. Lecture Videos

12.6.3. Educational Animations

12.7. Entertainment and Media

12.7.1. Short Films

12.7.2. Music Videos

12.7.3. Previsualization

12.8. News and Journalism

12.9. Internal Communications

13. Global AI Video Generation & Editing Software Market, by Industry Vertical

13.1. Introduction

13.2. Media and Entertainment

13.3. Advertising and Marketing

13.4. E-Commerce and Retail

13.5. Education and E-Learning

13.6. Corporate and Enterprise

13.7. Technology and Software

13.8. Healthcare and Pharmaceuticals

13.9. Financial Services

13.10. Real Estate

13.11. Travel and Hospitality

13.12. Others

14. AI Video Generation & Editing Software Market, by Geography

14.1. Introduction

14.2. North America

14.2.1. U.S.

14.2.2. Canada

14.2.3. Mexico

14.3. Europe

14.3.1. U.K.

14.3.2. Germany

14.3.3. France

14.3.4. Spain

14.3.5. Italy

14.3.6. Netherlands

14.3.7. Rest of Europe

14.4. Asia-Pacific

14.4.1. China

14.4.2. Japan

14.4.3. South Korea

14.4.4. India

14.4.5. Australia

14.4.6. Singapore

14.4.7. Southeast Asia

14.4.8. Rest of Asia-Pacific

14.5. Latin America

14.5.1. Brazil

14.5.2. Mexico

14.5.3. Argentina

14.5.4. Rest of Latin America

14.6. Middle East & Africa

14.6.1. UAE

14.6.2. Saudi Arabia

14.6.3. South Africa

14.6.4. Rest of Middle East & Africa

15. Company Profiles

(Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

15.1. Adobe Inc.

15.2. Runway AI Inc.

15.3. Synthesia Ltd.

15.4. Descript Inc.

15.5. Pika Labs

15.6. Stability AI

15.7. OpenAI (Sora)

15.8. Google (Veo)

15.9. Pictory AI

15.10. InVideo

15.11. Veed.io

15.12. Lumen5

15.13. Fliki

15.14. HeyGen

15.15. Kapwing

15.16. Animoto Inc.

15.17. Magisto (Vimeo)

15.18. Peech AI

15.19. Opus Clip

15.20. Vidyo.ai

15.21. Others

16. Appendix

16.1. Questionnaire

16.2. Available Customization

Published Date: Aug-2025

Published Date: Oct-2024

Published Date: Sep-2024

Published Date: Jul-2024

Published Date: Oct-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates