Resources

About Us

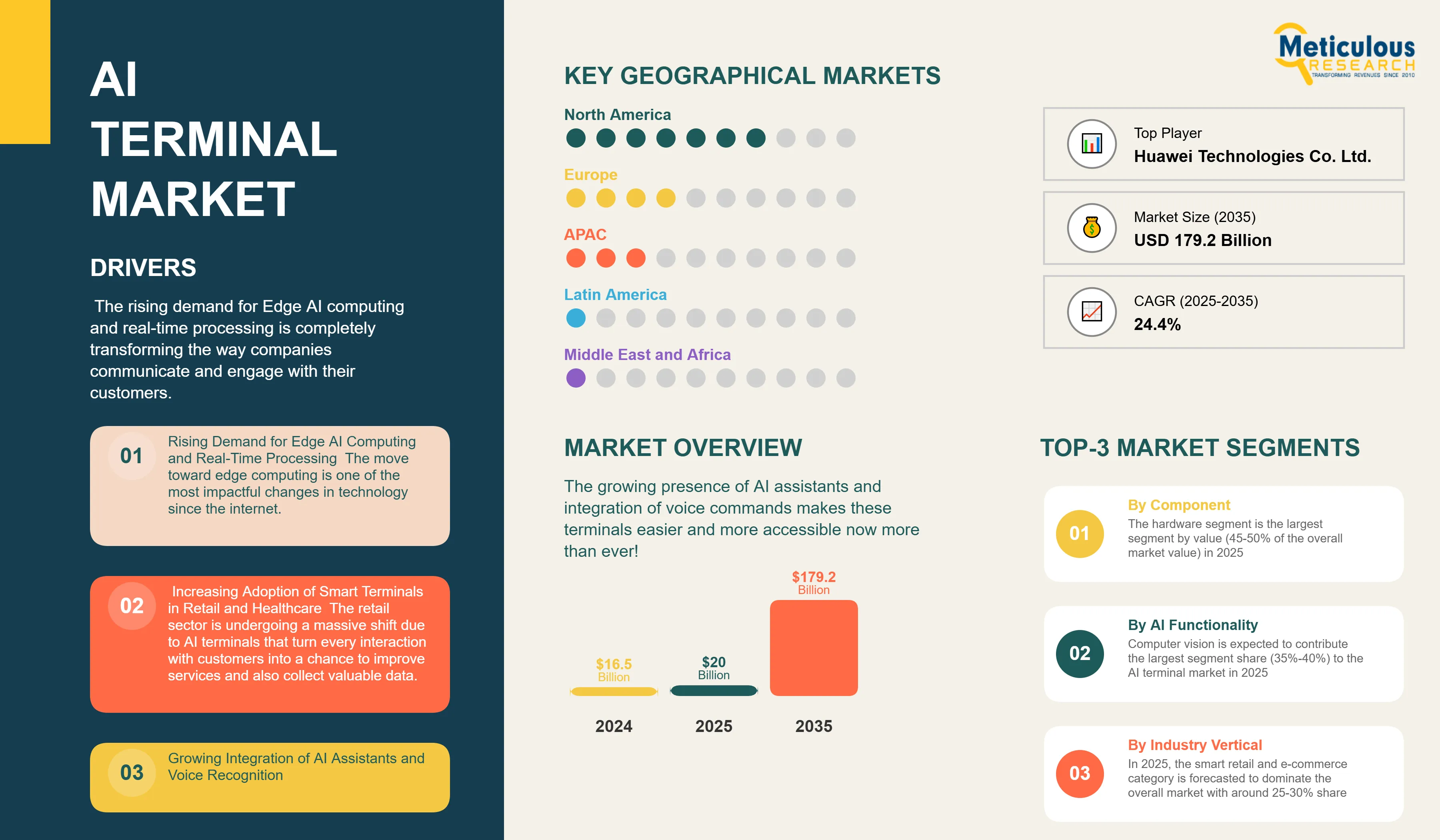

AI Terminal Market Size, Share, Forecast, & Trends Analysis by Component (Hardware, Software, Services) Functionality (Computer Vision, Voice Processing, Multi-Modal AI) Deployment (Fixed, Mobile, Hybrid) Industry (Retail, Healthcare, Banking, Smart Cities) - Global Forecast to 2035

Report ID: MRICT - 1041537 Pages: 190 Jul-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe rising demand for Edge AI computing and real-time processing is completely transforming the way companies communicate and engage with their customers. Companies across a multitude of industries are quickly deploying smart terminals in retail environments and health care facilities in order to create enhanced customer experiences and lower operating costs. The growing presence of AI assistants and integration of voice commands makes these terminals easier and more accessible now more than ever!

Digital transformation and smart city building are being driven by global government initiatives, as well as a continuing development of IoT infrastructures and ecosystems of connected devices that are creating unique opportunities for AI terminals to develop intelligent gateways between the digital and physical experiences. AI terminals will serve as focal points in highly visible public services, transportation hubs and local urban infrastructure initiatives.

The market faces considerable challenges that organizations need to navigate carefully. Smaller companies and developing markets find it cumbersome to sustain enough called-up cash and invest in developing AI terminal solutions. The implications of data security and the considerations of privacy in respect of AI-enabled terminal applications are complex and require advanced protection features and compliance policies and processes. Technical limitations like processing power, battery life and usability will constantly be a relief for engineers and system designers. The complications of merging AI models and optimizing system performance require specialized knowledge and skills that most markets are still lacking.

Despite the challenges, the market presents the most exciting and untapped potential. The rollout of 5G networks has enabled a new generation of AI terminals that provide improved connectivity and real-time processing capabilities. The increase in autonomous mobility solutions and smart transport systems has highlighted a need for more advanced in-vehicle AI terminals. The adoption of AI-powered kiosks and self-service solutions are transforming customer service operations in multiple industries.

Combining computer vision and sensor technologies is expanding the ability of terminals to read and respond to human activity in increasingly complicated ways. New applications in industrial automation and intelligent manufacturing are creating new market niches where AI terminals are becoming decision-making hubs in production workflows.

Transformational tech trends are altering the competitive landscape in dramatic ways. As AI capability moves into smaller form factors due to advances in power-efficient AI chips, AI application is set to explode. The combination of AI with augmented reality, virtual reality, and mixed-reality technologies has opened up user experience creation possibilities that do not resemble the user experience of only three years ago. The use of federated learning and distributed processing of AI is making terminals intelligent while protecting user privacy and minimizing the use of bandwidth resources.

Market Drivers

Rising Demand for Edge AI Computing and Real-Time Processing

The move toward edge computing is one of the most impactful changes in technology since the internet. According to Gartner's 2024 Strategic Technology Trends report, by 2025, approximately 75% of enterprise-created data will be processed at or near the edge, up from about 10% in 2018. This rapid shift has created an increased demand for AI terminals that can run sophisticated AI algorithms on-site, and that don't deplete bandwidth through connections to the cloud.

Local edge AI processing saves 85% to 95% on latency compared to cloud-only solutions. Edge AI processing enables real-time decision making in mission-critical applications where every millisecond matters. For example, retail environments will be able to use AI terminals to provide real-time analytics on how customers move through physical spaces, assess inventory levels per store with accuracy, and personalize shopping experiences instantly. Similarly, healthcare facilities will be able to use AI terminals as patient monitors, as well as diagnostic assistants—applications where time is of the essence and can save lives.

This shift highlights the emergence of customer-facing AI terminals as important foundational technologies in edge computing that empower enterprises to realize low-latency, effective, and dependable AI-centric businesses.

The economic advantages of adopting edge AI terminals are significant. Many organizations report reduced bandwidth expenses and greater system reliability based on diminished dependence on cloud-connected journeys, with many real-world examples demonstrating double-digit percentage reductions in costs and resilience from local processing. Manufacturing companies that use AI terminals for quality control and predictive maintenance often see significant reductions in downtime – usually 20-30% – and significant improvements in product quality. The COVID-19 pandemic accelerated adoption as businesses focused on contactless and autonomous solutions that can operate under unstable network connections, which are continuing to this day, due to the operational benefits of edge AI in mission-critical contexts.

Increasing Adoption of Smart Terminals in Retail and Healthcare

The retail sector is undergoing a massive shift due to AI terminals that turn every interaction with customers into a chance to improve services and also collect valuable data. Retailers today are increasing the use of AI terminals for not just automated checkout but even personalized recommendations to be made to customers. Recent surveys from the National Retail Federation among several other retail analyst firms report that about 65-70% of retailers now are committing considerable funds towards customer-facing AI powered interface technologies.

Smart terminals in retail have proven their worth in some measurable way through better customer engagement and operational efficiency. Individual examples can demonstrate customer engagement time increases of 30-45%, as well as common improvements in conversion rates anywhere between 15-30%. These AI powered terminals are usually multi-lingual, quickly adapt to customer preferences and are able to provide the service 24/7, which can lessen dependance on other staffing models.

There has also been an acceleration of AI terminal adoption in healthcare, which are changing the way patient care is delivered and implementing front-office workflows. Hospitals and clinics are starting to implement AI terminals to check-in patients, do preliminary symptom assessments, and give ongoing treatment plans. These AI terminal systems can also do initial health screening, vital signs collection and sync up with electronic health records (EHR), thus increasing efficiency of care administration and access.

The advantages of AI terminals in healthcare settings extend beyond efficiencies. These terminals promote better accuracy in diagnosis. As a result, patients could end up with improved diagnosis with consistent assessments, and standardized assessments reduce human error. Additionally, they promote better access by providing additional languages and accommodation for patients with disabilities. Many healthcare organizations have reported data showing implementations of AI terminals have reduced patient wait times by as much as 25% to 40% and increased patient satisfaction scores by 30% to 50%. Although the results may vary by use case and use of the AI terminal, the potential is still tremendous!

Table: Key Factors Impacting Global AI Terminal Market (2025–2035)

Base CAGR: 24.4%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

||||

|

1. |

Rising Demand for Edge AI Computing and Real-Time Processing |

Strong adoption in retail and healthcare |

Universal deployment across all industries |

▲ +2.2% |

|

2. |

Increasing Adoption of Smart Terminals in Retail and Healthcare |

Rapid deployment in urban markets |

Expansion to rural and emerging markets |

▲ +1.6% |

|

3. |

Growing Integration of AI Assistants and Voice Recognition |

Premium segment adoption |

Standard feature across all price points |

▲ +1.1% |

|

Restraints |

||||

|

1. |

High Initial Investment and Development Costs |

Limits adoption in SME segment |

Economies of scale reduce impact |

▼ −0.8% |

|

2. |

Data Privacy and Security Concerns |

Regulatory compliance costs |

Standardized security frameworks emerge |

▼ −0.6% |

|

Opportunities |

||||

|

1. |

Development of 5G-Enabled AI Terminals |

Premium applications in major cities |

Widespread 5G coverage enables mass adoption |

▲ +2.4% |

|

2. |

Growth in Autonomous Vehicles and Smart Transportation |

Pilot programs and early adopters |

Full autonomous vehicle ecosystem |

▲ +2.1% |

|

Trends |

||||

|

1. |

Miniaturization and Energy-Efficient AI Chip Development |

Premium device differentiation |

Standard across all product categories |

▲ +0.6% |

|

2. |

Convergence of AI, AR/VR, and Mixed Reality Technologies |

Early adoption in gaming and education |

Mainstream business applications |

▲ +0.8% |

|

Challenges |

||||

|

1. |

Standardization Issues Across Different Platforms |

Fragmented market with compatibility issues |

Industry standards emerge |

▼ −0.3% |

|

2. |

Interoperability with Legacy Systems |

Integration complexity slows adoption |

Middleware solutions simplify integration |

▼ −0.2% |

Market Segmentation Analysis

By Component

The AI terminal market is segmented by component: hardware, software, and services. The hardware segment is the largest segment by value (45-50% of the overall market value) in 2025. Hardware has the largest market share because it requires such a large investment in advanced processors, sensors, displays, and other physical components that provide the foundation for terminal AI functionality.

The software segment is expected to grow at the highest compound annual growth rate (CAGR) during the projected period from 2025 to 2035. This growth is due to the greater sophistication of algorithms, the criticality of differentiating software in crowded markets, the shifting to software as a service or product as a service (e.g., terminal operating and value-added services), and ongoing digital updates and feature enhancements over the life of the terminal.

While the services segment has a comparatively small market share in terms of overall value, it constitutes a meaningful component of the overall AI terminal ecosystem (i.e., installation, maintenance, training, continuous support services) and ensures that terminals perform optimally and users derive satisfaction from the terminal use.

By AI Functionality

Considering the functionality of the AI, the AI terminal market segments include computer vision, voice and natural language processing, predictive analytics and fore-casting, multi-modal AI, and decision making and edge inference execution. Computer vision is expected to contribute the largest segment share (35%-40%) to the AI terminal market in 2025. This expected share illustrates the strong, growing demand to integrate facial recognition, object detection, and various visual analytics capabilities across ubiquitous applications such as retail, security, and even some healthcare solutions.

On the other hand, the multi-modal AI segment is expected to grow at the fastest CAGR throughout the forecast period. The increased demand for multi-modal AI terminals drives this increase in market growth and represents the industry's current focus on terminal developments that can consume visual, auditory, and sensory data inputs and synthesize a more complete and precise response. Multi-modal AI terminals represent the future of human-machine interaction, allowing terminals to understand context and intent across multiple channels of input, ultimately providing users a more natural and effective experience.

By Deployment Model

As per deployment model, the market for AI terminals is divided into fixed AI terminals, mobile/portable AI terminals, on-premise vs edge-native terminals, and hybrid AI terminal solutions. By 2025, the fixed AI terminals segment will have a share of around 40-45%, as AI terminals will be deployed commonly across retail stores, healthcare facilities, and other public spaces, which provides the operational performance of having a permanent installation for functionality and security.

However, the hybrid AI terminal solutions segment, which is clearly identified on the basis of organizational need for both flexibility to change application both in deployment and operation, is expected to realize the highest CAGR during the forecast period. Hybrid solutions allow customers to enjoy both fixed AI terminals, providing the stability of permanence, and the flexibility of mobile deployment, which is highly attractive to those businesses who wish to deploy both permanent and temporary AI terminal capability.

By Industry Vertical

The AI terminal market is categorized by industry verticals into smart retail and e-commerce, healthcare and medical diagnostics, banking and financial services, public safety and smart cities, transportation and automotive, manufacturing and industrial automation, education and digital learning, and hospitality and customer experience centers. In 2025, the smart retail and e-commerce category is forecasted to dominate the overall market with around 25-30% share due to retailers' urgent need to enhance their customer's experience and keep pace with the convenience of shopping online.

Alternatively, the healthcare and medical diagnostics category is anticipated to achieve the highest CAGR in the five-year forecast period of 2025-2035 as a result of the following: (i) continued emphasis on patient-centered care; (ii) improved systems of health care delivery; (iii) the integration of AI diagnostics into mainstream medical practice; and (iv) expanding use of technology-based health and wellness services by both medical professionals and patients.

Regional Analysis

From a geography perspective, the AI terminal market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America market is expected to hold 40-45% share of the global AI terminal market in 2025. North America replicates its leadership across many categories, driven by highest AI adoption rates globally, extensive levels of venture capital investment into AI startups, early enterprise adoption of highly technical products, leading AI companies like NVIDIA, Google, and Microsoft fostering innovating in AI terminal technologies.

North America is well-positioned due to its mature digital infrastructure, high purchasing power enabling higher-end AI terminals, and to high regulation institutions that need compliant solutions. North America leads multiple sectors, such as healthcare and financial services, where AI terminal usage and potential is growing dramatically. North America is also the largest pilot in new AI terminal application development before rolling out globally.

Nonetheless, the Asia-Pacific region will exhibit the highest CAGR during the forecast period of 2025-2035, primarily due to massive public-sector investment in smart city programs, growing middle class populations with more digital adoption, the largest manufacturing deep pool of AI terminal hardware, and strong digital transformation agendas in countries such as China, India, and South Korea. The sheer sizes of the populations and the rapid urbanization of the region are resulting in unprecedented market demand for AI terminal deployments in retail, public transport, and public services.

Competitive Landscape

The AI terminal market is highly competitive, with technology companies, AI companies, and hardware vendors all competing for the same market share. The competitive landscape consists of leading technology companies and wholesale hardware vendors who are adapting their business models to the AI revolution along with AI companies.

Key players in the global AI terminal market are Huawei Technologies Co, Ltd.; ZTE Corporation; SenseTime Group Inc.; Megvii Technology Limited; Horizon Robotics Inc.; YITU Technology; Terminus Technologies; Unisound AI Technology Co, Ltd.; iFlytek Co. Ltd.; Cambricon Technologies Corp., Ltd.; Rockchip Electronics Co., Ltd.; MediaTek Inc.; Advantech Co, Ltd.; ADLINK Technology Inc.; Axiomtek Co., Ltd.; Lenovo Group Ltd.; NVIDIA Corporation (Jetson Platforms); Neousys Technology Inc.; and IEI Integration Corp.

Each of these companies are pursuing various strategies to enhance their competitive positioning. Chinese manufacturers such as Huawei and SenseTime are taking advantage of their sizeable and dominant domestic market positions, together with political backing from national governments, to make their mark on international markets. Some chip makers, like NVIDIA and MediaTek, have focused on ensuring their powerful, compatible yet energy-efficient processing platforms enable more advanced artificial intelligence capabilities. For those companies who focus on industrial computing, like Advantech and ADLINK, their approach has been to utilize their existing knowledge and development capabilities to take former platforms and develop artificial intelligence terminals suited for the stringent demands of difficult operating environments.

|

Particulars |

Details |

|

Number of Pages |

190 |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

24.4% |

|

Market Size 2024 |

USD 16.5 billion |

|

Market Size 2025 |

USD 20 billion |

|

Market Size 2035 |

USD 179.2 billion |

|

Segments Covered |

By Component, AI Functionality, Deployment Model, and Industry Vertical |

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA) |

The AI terminal market is projected to reach USD 179.2 billion by 2035 from USD 20 billion in 2025, at a CAGR of 24.4% during the forecast period.

In 2025, the hardware segment is projected to hold the major share of the AI terminal market, while the software segment is slated to record the highest growth rate due to increasing AI algorithm sophistication and software-as-a-service model adoption.

Key factors driving growth include rising demand for edge AI computing and real-time processing, increasing adoption of smart terminals in retail and healthcare, growing integration of AI assistants and voice recognition technology, expansion of IoT infrastructure and connected device ecosystems, and government initiatives promoting digital transformation and smart cities.

Key opportunities include developing 5G-enabled AI terminals for new connectivity options, developing autonomous vehicles and smart transportation systems, developing AI-powered kiosks and self-service solutions, applying computer vision and advanced sensors, and developing new applications in industrial automation and smart manufacturing.

Key trends include miniaturization and energy-efficient AI chip development, convergence of AI with AR/VR and mixed reality technologies, implementation of federated learning and distributed AI processing, and integration of quantum computing elements in AI terminal architecture.

The multi-modal AI segment is expected to grow at the highest rate throughout the projected period as demand for terminals that can process visual, auditory and sensor data simultaneously to provide more natural and complete user interactions increases.

The healthcare and medical diagnostics segment is positioned to exhibit the strong growth due to increasingly important focus on patient-centered care, more efficient healthcare delivery systems, and growing acceptance of technology-assisted healthcare in the medical community and among patients.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currencies

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research / Interviews with Key Opinion Leaders

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Methodology

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. AI Terminal Market, by Component

3.2.2. AI Terminal Market, by AI Functionality

3.2.3. AI Terminal Market, by Deployment Model

3.2.4. AI Terminal Market, by Industry Vertical

3.2.5. AI Terminal Market, by Region

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Trends

4.2.5. Challenges

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Competitive Rivalry

4.4. Technology Impact on AI Terminal Market

4.4.1. AI Chipsets and Inference Engines

4.4.2. Embedded Systems and Edge Computing

4.4.3. Connectivity and Smart Sensor Integration

5. AI Terminal Market Assessment — By Component

5.1. Overview

5.2. Hardware

5.3. Software

5.4. Services

6. AI Terminal Market Assessment — By AI Functionality

6.1. Overview

6.2. Computer Vision (eg, facial/object recognition)

6.3. Voice and Natural Language Processing

6.4. Predictive Analytics and Forecasting

6.5. Multi-Modal AI (vision + voice + sensor fusion)

6.6. Decision-Making and Edge Inference Execution

7. AI Terminal Market Assessment — By Deployment Model

7.1. Overview

7.2. Fixed AI Terminals

7.3. Mobile/Portable AI Terminals

7.4. On-Premise vs. Edge-Native Terminals

7.5. Hybrid AI Terminal Solutions

8. AI Terminal Market Assessment — By Industry Vertical

8.1. Overview

8.2. Smart Retail and E-commerce

8.3. Healthcare and Medical Diagnostics

8.4. Banking and Financial Services

8.5. Public Safety and Smart Cities

8.6. Transportation and Automotive

8.7. Manufacturing and Industrial Automation

8.8. Education and Digital Learning

8.9. Hospitality and Customer Experience Centers

9. AI Terminal Market Assessment — By Region

9.1. Overview

9.2. North America

9.2.1. US

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. UK

9.3.3. France

9.3.4. Rest of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. South Korea

9.4.5. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America

9.6. Middle East & Africa

9.6.1. UAE

9.6.2. Saudi Arabia

9.6.3. South Africa

9.6.4. Rest of MEA

10. Competitive Landscape

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Contemporary Stalwarts

10.5. Market Share/Ranking Analysis (2024)

11. Company Profiles

11.1. Huawei Technologies Co. Ltd.

11.2. ZTE Corporation

11.3. SenseTime Group Inc.

11.4. Megvii Technology Limited

11.5. Horizon Robotics Inc.

11.6. YITU Technology

11.7. Terminus Technologies

11.8. Unisound AI Technology Co. Ltd.

11.9. iFlytek Co. Ltd.

11.10. Cambricon Technologies Corp. Ltd.

11.11. Rockchip Electronics Co. Ltd.

11.12. MediaTek Inc.

11.13. Advantech Co. Ltd.

11.14. ADLINK Technology Inc.

11.15. Axiomtek Co. Ltd.

11.16. Lenovo Group Ltd.

11.17. NVIDIA Corporation (Jetson Platforms)

11.18. Neousys Technology Inc.

11.19. IEI Integration Corp.

11.20. Others

12. Appendix

12.1. Available Customization

12.2. Related Reports

LIST OF TABLES

Table 1. Global AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 2. Global AI Terminal Hardware Market, by Country/Region, 2025–2035 (USD Million)

Table 3. Global AI Terminal Software Market, by Country/Region, 2025–2035 (USD Million)

Table 4. Global AI Terminal Services Market, by Country/Region, 2025–2035 (USD Million)

Table 5. Global AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 6. Global AI Terminal Market for Computer Vision, by Country/Region, 2025–2035 (USD Million)

Table 7. Global AI Terminal Market for Voice and Natural Language Processing, by Country/Region, 2025–2035 (USD Million)

Table 8. Global AI Terminal Market for Predictive Analytics and Forecasting, by Country/Region, 2025–2035 (USD Million)

Table 9. Global AI Terminal Market for Multi-Modal AI, by Country/Region, 2025–2035 (USD Million)

Table 10. Global AI Terminal Market for Decision-Making and Edge Inference Execution, by Country/Region, 2025–2035 (USD Million)

Table 11. Global AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 12. Global Fixed AI Terminals Market, by Country/Region, 2025–2035 (USD Million)

Table 13. Global Mobile/Portable AI Terminals Market, by Country/Region, 2025–2035 (USD Million)

Table 14. Global On-Premise vs. Edge-Native Terminals Market, by Country/Region, 2025–2035 (USD Million)

Table 15. Global Hybrid AI Terminal Solutions Market, by Country/Region, 2025–2035 (USD Million)

Table 16. Global AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 17. Global AI Terminal Market for Smart Retail and E-commerce, by Country/Region, 2025–2035 (USD Million)

Table 18. Global AI Terminal Market for Healthcare and Medical Diagnostics, by Country/Region, 2025–2035 (USD Million)

Table 19. Global AI Terminal Market for Banking and Financial Services, by Country/Region, 2025–2035 (USD Million)

Table 20. Global AI Terminal Market for Public Safety and Smart Cities, by Country/Region, 2025–2035 (USD Million)

Table 21. Global AI Terminal Market for Transportation and Automotive, by Country/Region, 2025–2035 (USD Million)

Table 22. Global AI Terminal Market for Manufacturing and Industrial Automation, by Country/Region, 2025–2035 (USD Million)

Table 23. Global AI Terminal Market for Education and Digital Learning, by Country/Region, 2025–2035 (USD Million)

Table 24. Global AI Terminal Market for Hospitality and Customer Experience Centers, by Country/Region, 2025–2035 (USD Million)

Table 25. North America: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 26. North America: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 27. North America: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 28. North America: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 29. U.S.: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 30. U.S.: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 31. U.S.: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 32. U.S.: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 33. Canada: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 34. Canada: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 35. Canada: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 36. Canada: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 37. Europe: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 38. Europe: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 39. Europe: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 40. Europe: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 41. Germany: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 42. Germany: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 43. Germany: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 44. Germany: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 45. U.K.: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 46. U.K.: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 47. U.K.: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 48. U.K.: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 49. France: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 50. France: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 51. France: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 52. France: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 53. Rest of Europe: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 54. Rest of Europe: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 55. Rest of Europe: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 56. Rest of Europe: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 57. Asia-Pacific: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 58. Asia-Pacific: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 59. Asia-Pacific: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 60. Asia-Pacific: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 61. China: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 62. China: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 63. China: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 64. China: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 65. Japan: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 66. Japan: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 67. Japan: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 68. Japan: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 69. India: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 70. India: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 71. India: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 72. India: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 73. South Korea: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 74. South Korea: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 75. South Korea: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 76. South Korea: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 77. Rest of Asia-Pacific: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 78. Rest of Asia-Pacific: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 79. Rest of Asia-Pacific: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 80. Rest of Asia-Pacific: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 81. Latin America: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 82. Latin America: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 83. Latin America: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 84. Latin America: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 85. Brazil: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 86. Brazil: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 87. Brazil: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 88. Brazil: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 89. Mexico: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 90. Mexico: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 91. Mexico: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 92. Mexico: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 93. Rest of Latin America: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 94. Rest of Latin America: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 95. Rest of Latin America: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 96. Rest of Latin America: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 97. Middle East & Africa: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 98. Middle East & Africa: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 99. Middle East & Africa: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 100. Middle East & Africa: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 101. UAE: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 102. UAE: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 103. UAE: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 104. UAE: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 105. Saudi Arabia: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 106. Saudi Arabia: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 107. Saudi Arabia: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 108. Saudi Arabia: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 109. South Africa: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 110. South Africa: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 111. South Africa: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 112. South Africa: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

Table 113. Rest of MEA: AI Terminal Market, by Component, 2025–2035 (USD Million)

Table 114. Rest of MEA: AI Terminal Market, by AI Functionality, 2025–2035 (USD Million)

Table 115. Rest of MEA: AI Terminal Market, by Deployment Model, 2025–2035 (USD Million)

Table 116. Rest of MEA: AI Terminal Market, by Industry Vertical, 2025–2035 (USD Million)

LIST OF FIGURES

Figure 1. Research Process

Figure 2. Secondary Sources Referenced for This Study

Figure 3. Primary Research Techniques

Figure 4. Key Executives Interviewed

Figure 5. Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6. Market Sizing and Growth Forecast Approach

Figure 7. In 2025, the Hardware segment to Account for the Largest Share

Figure 8. In 2025, the Computer Vision to Account for the Largest Share

Figure 9. In 2025, the Fixed AI Terminals to Account for the Largest Share

Figure 10. In 2025, the Smart Retail and E-commerce to Account for the Largest Share

Figure 11. Asia-Pacific to be the Fastest-growing Regional Market

Figure 12. Impact Analysis of Market Dynamics

Figure 13. Global AI Terminal Market: Porter's Five Forces Analysis

Figure 14. Global AI Terminal Market, by Component, 2025 Vs. 2035 (USD Million)

Figure 15. Global AI Terminal Market, by AI Functionality, 2025 Vs. 2035 (USD Million)

Figure 16. Global AI Terminal Market, by Deployment Model, 2025 Vs. 2035 (USD Million)

Figure 17. Global AI Terminal Market, by Industry Vertical, 2025 Vs. 2035 (USD Million)

Figure 18. Global AI Terminal Market, by Region, 2025 Vs. 2035 (USD Million)

Figure 19. North America: AI Terminal Market Snapshot (2025)

Figure 20. Europe: AI Terminal Market Snapshot (2025)

Figure 21. Asia-Pacific: AI Terminal Market Snapshot (2025)

Figure 22. Latin America: AI Terminal Market Snapshot (2025)

Figure 23. Middle East & Africa: AI Terminal Market Snapshot (2025)

Figure 24. Key Growth Strategies Adopted by Leading Players (2022–2025)

Figure 25. Global AI Terminal Market Competitive Benchmarking, by Component

Figure 26. Competitive Dashboard: Global AI Terminal Market

Figure 27. Global AI Terminal Market Share/Ranking, by Key Player, 2024 (%)

Published Date: Aug-2025

Published Date: Aug-2025

Published Date: Oct-2024

Published Date: Sep-2024

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates