1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

2. Research Methodology

2.1. Research Process

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.1.3. Growth Forecast

2.3.2. Market Share Analysis

2.4. Assumptions for the Study

2.5. Limitations for the Study

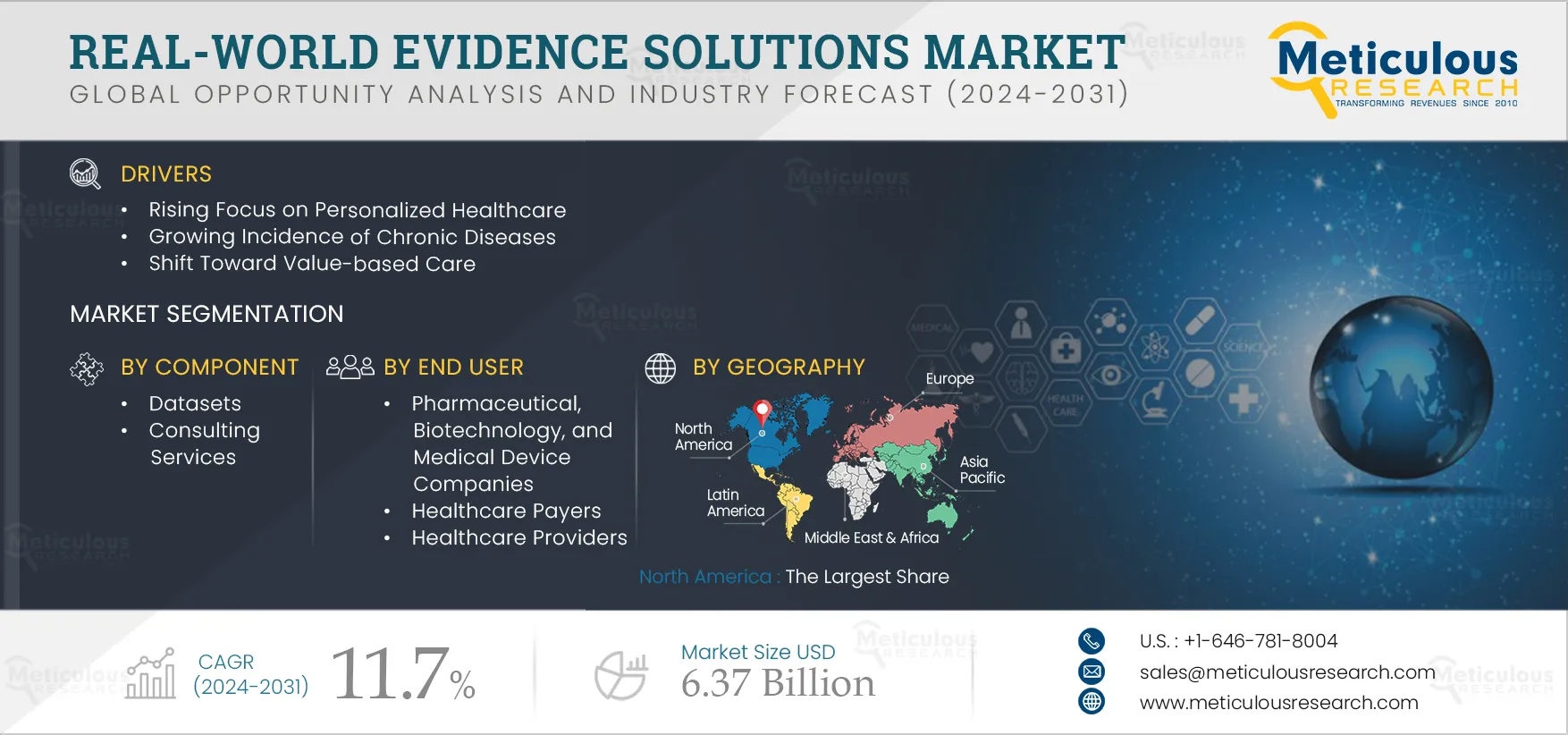

3. Executive Summary

4. Market Insights

4.1. Market Overview

4.2. Drivers

4.2.1. Rising Focus on Personalized Healthcare

4.2.2. Delays in Drug Development and the Consequent Increase in Development Costs

4.2.3. Growing Incidence of Chronic Diseases

4.2.4. Shift Toward Value-based Care

4.2.5. Rapidly Growing Big Data in the Healthcare Sector

4.3. Restraints

4.3.1. Reluctance to Rely on Real-World Studies

4.4. Opportunities

4.4.1. Emerging Economies

4.4.2. Rising Focus on end-to-end RWE Services

4.5. Challenges

4.5.1. Lack of Standardized Methodologies for Developing RWE

4.6. Key Market Trends

4.6.1. The Incorporation of Artificial Intelligence (AI) in the RWE Industry

4.6.1.1. The Adoption of AI Technologies is Growing in the Following Areas:

4.6.1.1.1. Clinical Trials Design

4.6.1.1.2. Modeling and Forecasting Patient Enrichment & Recruitment

4.6.1.1.3. Selecting Investigator Site

4.6.1.1.4. Patient Monitoring & Managing and Medication Adherence & Retention

4.6.1.1.5. AI-enabled Clinical Trial Analytics

4.6.1.1.6. Outsourcing Essential AI Solutions Via Strategic Partnerships & Collaborations

4.6.1.1.7. Market Access Using AI Solutions

4.6.1.1.8. Post-market Surveillance Using AI Solutions

4.6.1.2. Case Studies for AI-based RWE Solutions

4.6.1.2.1. AI-based RWE Solutions for Medical Device Post-market Studies - Huma.AI (U.S.)

4.6.1.2.2. AI-enabled RWE Solutions to Support Clinical Decision-making in Drug Research and Development - Owkin, Inc. (France)

4.6.1.2.3. AI-integrated RWE Solutions for Market Access - Medaffcon Oy (Finland)

4.6.1.2.4. Leveraging Real-world Data Insights Using AI and Machine Learning Algorithms – Aetion, Inc. (U.S.) & Quinten Health (France)

4.6.1.2.5. AI-powered Real-world Medical Imaging – Life Image Inc. (U.S.)

4.6.1.2.6. AI-powered RWE Platform to Track Adverse Events - Data2life (Israel)

4.6.1.2.7. AI-powered RWE Solutions to Predict Patients' Health at Critical Care Units - Phastar (U.K.)

4.6.2. Growing Adoption of RWE in Drug Development and Commercialization

4.6.3. Rising Number of Consolidations

4.6.4. Improved Patient Outcomes and Value Creation From Real-world Evidence

4.7. The Impact of COVID-19

5. Real-world Evidence (RWE) Solutions Market: Regulatory Analysis

5.1. Introduction

5.2. North America

5.3. Europe

5.4. Asia-Pacific

5.5. Rest of the World

6. Pricing Models (Emr/Genomic/Integrated Datasets)

6.1. Introduction

6.2. Pay Per Patient Record (Volume-based Pricing)

6.3. Pay Per Usage (Value-based Pricing)

6.4. Annual Subscription

7. Real-world Evidence Solutions Market, by Component

7.1. Introduction

7.2. Datasets

7.2.1. Disparate Datasets

7.2.1.1. EMR/EHR/Clinical Data

7.2.1.2. Claims & Billing Data

7.2.1.3. Pharmacy Data

7.2.1.4. Product/Disease Registries Data

7.2.1.5. Other Disparate Datasets

7.2.2. Integrated Datasets

7.3. Consulting & Analytics

8. Real-world Evidence Solutions Market, by Application

8.1. Introduction

8.2. Market Access & Reimbursement/Coverage Decisions

8.3. Drug Development & Approvals

8.3.1. Oncology

8.3.2. Neurology

8.3.3. Immunology

8.3.4. Cardiovascular Diseases

8.3.5. Other Therapeutic Areas

8.4. Medical Device Development & Approvals

8.5. Post-market Surveillance

8.6. Clinical & Regulatory Decision-making

9. Real-world Evidence Solutions Market, by End User

9.1. Introduction

9.2. Pharmaceutical, Biotechnology, and Medical Device Companies

9.3. Healthcare Payers

9.4. Healthcare Providers

9.5. Other End Users

10. Real-world Evidence Solutions Market, by Geography

10.1. Introduction

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.3. Europe

10.3.1. U.K.

10.3.2. Germany

10.3.3. France

10.3.4. Italy

10.3.5. Spain

10.3.6. Rest of Europe

10.4. Asia-Pacific

10.4.1. Japan

10.4.2. China

10.4.3. India

10.4.4. South Korea

10.4.5. Taiwan

10.4.6. Singapore

10.4.7. Rest of Asia-Pacific

10.5. Latin America

10.6. Middle East & Africa

11. Competitive Landscape

11.1. Introduction

11.2. Key Growth Strategies

11.3. Competitive Benchmarking

11.4. Market Share Analysis (2021)

11.4.1. IQVIA Holdings, Inc. (U.S.)

11.4.2. ICON Plc (Ireland)

11.4.3. PPD Inc. (U.S.)

12. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments)

12.1. IQVIA Holdings Inc.

12.2. PPD Inc.

12.3. ICON Plc

12.4. Parexel International Corporation

12.5. UnitedHealth Group Incorporated

12.6. Flatiron Health, Inc.

12.7. Oracle Corporation

12.8. SAS Institute, Inc.

12.9. Anthem, Inc.

12.10. Clinigen Group Plc

12.11. Cognizant Technology Solutions Corporation

12.12. PerkinElmer, Inc.

13. Appendix

13.1. Questionnaire

13.2. Available Customization

List of Tables

Table 1 Global Real-world Evidence Solutions Market Drivers: Impact Analysis, (2022–2029)

Table 2 Total Cost Per Study, by Phase and Therapeutic Area (USD Million)

Table 3 Number of Persons Aged 65 Years or Above, by Region (2019 VS. 2050)

Table 4 Sources of Healthcare Data

Table 5 Global Real-world Evidence Solutions Market Restraints: Impact Analysis (2022–2029)

Table 6 Strategic Developments of Key Players Related to the Integration of AI Into RWE Solutions

Table 7 RWE in Latin American Countries

Table 8 Observed Indicative Prices of Real-world Data by Type (USD Per Patient Record)

Table 9 Global Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 10 Global Real-world Evidence Solutions Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 11 Real-world Evidence Solutions Datasets Market Size, by Country/Region, 2020–2029 (USD Million)

Table 12 Global RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 13 RWE Disparate Datasets Market Size, by Country/Region, 2020–2029 (USD Million)

Table 14 RWE EMR/EHR/Clinical Data Market Size, by Country/Region, 2020–2029 (USD Million)

Table 15 RWE Claims & Billing Data Market Size, by Country/Region, 2020–2029 (USD Million)

Table 16 RWE Pharmacy Data Market Size, by Country/Region, 2020–2029 (USD Million)

Table 17 RWE Product/Disease Registries Data Market Size, by Country/Region, 2020–2029 (USD Million)

Table 18 Other RWE Disparate Datasets Market Size, by Country/Region, 2020–2029 (USD Million)

Table 19 RWE Integrated Datasets Market Size, by Country/Region, 2020–2029 (USD Million)

Table 20 RWE Consulting & Analytics Market Size, by Country/Region, 2020–2029 (USD Million)

Table 21 Global Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 22 Global RWE Solutions Market Size for Market Access & Reimbursement/Coverage Decisions, by Country/Region, 2020–2029 (USD Million)

Table 23 Global RWE Solutions Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 24 Global RWE Solutions Market Size for Drug Development & Approvals, by Country/Region, 2020–2029 (USD Million)

Table 25 Oncology: Drugs in the R&D Pipeline

Table 26 Global RWE Solutions Market Size for Oncology, by Country/Region, 2020–2029 (USD Million)

Table 27 Neurology: Drugs in the R&D Pipeline

Table 28 Global RWE Solutions Market Size for Neurology, by Country/Region, 2020–2029 (USD Million)

Table 29 Immunology: Drugs in the R&D Pipeline

Table 30 Global RWE Solutions Market Size for Immunology, by Country/Region, 2020–2029 (USD Million)

Table 31 Medical Costs Associated With Cardiovascular Diseases (2010–2030) ( USD Billion)

Table 32 Cardiovascular Diseases: Drugs in the R&D Pipeline

Table 33 Global RWE Solutions Market Size for Cardiovascular Diseases, by Country/Region, 2020–2029 (USD Million)

Table 34 Other Therapeutic Areas: Drugs in the R&D Pipeline

Table 35 Global RWE Solutions Market Size for Other Therapeutic Areas, by Country/Region, 2020–2029 (USD Million)

Table 36 Global RWE Solutions Market Size for Medical Device Development & Approvals, by Country/Region, 2020–2029 (USD Million)

Table 37 Global RWE Solutions Market Size for Post-market Surveillance, by Country/ Region, 2020–2029 (USD Million)

Table 38 Global RWE Solutions Market Size for Clinical & Regulatory Decision-Making, by Country/Region, 2020–2029 (USD Million)

Table 39 Global RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 40 Global RWE Solutions Market Size for Pharmaceutical, Biotechnology, and Medical Device Companies, by Country/Region, 2020–2029 (USD Million)

Table 41 Global RWE Solutions Market Size for Healthcare Payers, by Country/Region, 2020–2029 (USD Million)

Table 42 Global RWE Solutions Market Size for Healthcare Providers, by Country/Region, 2020–2029 (USD Million)

Table 43 Global RWE Solutions Market Size for Other End Users, by Country/Region, 2020–2029 (USD Million)

Table 44 Global Real-world Evidence Solutions Market, by Country/Region, 2020–2029 (USD Million)

Table 45 North America: Real-world Evidence Solutions Market Size, by Country, 2020–2029 (USD Million)

Table 46 North America: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 47 North America: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 48 North America: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 49 North America: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 50 North America: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 51 North America: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 52 U.S.: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 53 U.S.: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 54 U.S.: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 55 U.S.: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 56 U.S.: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 57 U.S.: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 58 Number of Active Clinical Trials in Canada, by Condition, 2020

Table 59 Canada: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 60 Canada: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 61 Canada: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 62 Canada: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 63 Canada: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 64 Canada: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 65 Europe: Real-world Evidence Solutions Market Size, by Country/Region, 2020–2029 (USD Million)

Table 66 Europe: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 67 Europe: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 68 Europe: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 69 Europe: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 70 Europe: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 71 Europe: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 72 U.K.: Conferences and Workshops on Real-world Evidence Solutions

Table 73 U.K.: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 74 U.K.: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 75 U.K.: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 76 U.K.: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 77 U.K.: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 78 U.K.: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 79 Conferences, Symposia, and Workshops in Germany

Table 80 Germany: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 81 Germany: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 82 Germany: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 83 Germany: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 84 Germany: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 85 Germany: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 86 France: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 87 France: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 88 France: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 89 France: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 90 France: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 91 France: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 92 Italy: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 93 Italy: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 94 Italy: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 95 Italy: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 96 Italy: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 97 Italy: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 98 Spain: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 99 Spain: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 100 Spain: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 101 Spain: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 102 Spain: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 103 Spain: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 104 Rest of Europe: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 105 Rest of Europe: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 106 Rest of Europe: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 107 Rest of Europe: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 108 Rest of Europe: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 109 Rest of Europe: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 110 Asia-Pacific: Real-world Evidence Solutions Market Size, by Country/Region, 2020–2029 (USD Million)

Table 111 Asia-Pacific: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 112 Asia-Pacific: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 113 Asia-Pacific: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 114 Asia-Pacific: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 115 Asia-Pacific: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 116 Asia-Pacific: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 117 Japan: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 118 Japan: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 119 Japan: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 120 Japan: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 121 Japan: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 122 Japan: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 123 Diversified Real-World Data Sources in China

Table 124 China: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 125 China: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 126 China: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 127 China: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 128 China: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 129 China: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 130 India: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 131 India: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 132 India: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 133 India: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 134 India: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 135 India: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 136 South Korea: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 137 South Korea: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 138 South Korea: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 139 South Korea: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 140 South Korea: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 141 South Korea: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 142 RWE Sources in Taiwan

Table 143 Taiwan: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 144 Taiwan: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 145 Taiwan: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 146 Taiwan: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 147 Taiwan: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 148 Taiwan: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 149 Singapore: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 150 Singapore: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 151 Singapore: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 152 Singapore: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 153 Singapore: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 154 Singapore: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 155 Estimated Number of New Cancer Cases From 2020 to 2030

Table 156 ROAPAC: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 157 RoAPAC: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 158 RoAPAC: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 159 RoAPAC: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 160 RoAPAC: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 161 RoAPAC: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 162 Latin America: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 163 Latin America: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 164 Latin America: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 165 Latin America: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 166 Latin America: RWE Market Size for Drug Development & Approvals, by Therapeutic Area, 2020–2029 (USD Million)

Table 167 Latin America: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 168 Middle East & Africa: Real-world Evidence Solutions Market Size, by Component, 2020–2029 (USD Million)

Table 169 Middle East & Africa: RWE Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 170 Middle East & Africa: RWE Disparate Datasets Market Size, by Type, 2020–2029 (USD Million)

Table 171 Middle East & Africa: Real-world Evidence Solutions Market Size, by Application, 2020–2029 (USD Million)

Table 172 Middle East & Africa: RWE Market Size for Drug Development & Approvals, byTherapeutic Area, 2020–2029 (USD Million)

Table 173 Middle East & Africa: RWE Solutions Market Size, by End User, 2020–2029 (USD Million)

Table 174 Recent Developments, by Company, 2018–2022

List of Figures

Figure 1 Key Stakeholders

Figure 2 Research Process

Figure 3 Key Secondary Sources

Figure 4 Primary Research Techniques

Figure 5 Key Executives Interviewed

Figure 6 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 7 Market Size Estimation

Figure 8 Global Real-world Evidence Solutions Market, by Component, 2022 Vs. 2029 (USD Million)

Figure 9 Global Real-world Evidence Solutions Market, by Application, 2022 Vs. 2029 (USD Million)

Figure 10 Global Real-world Evidence Solutions Market, by End User, 2022 Vs. 2029 (USD Million)

Figure 11 Global Real-world Evidence Solutions Market, by Geography

Figure 12 Market Dynamics

Figure 13 Percentage of Personalized Medicines Approved (2015–2020)

Figure 14 U.S.: Number of People With Chronic Conditions (2000–2030)

Figure 15 Asia-Pacific: Percent Share of Global Clinical Trial Activities (2012–2020)

Figure 16 Global Real-world Evidence Solutions Market Size, by Component, 2022 Vs. 2029 (USD Million)

Figure 17 U.S.: Number of E-Prescriptions, 2013–2020 (Billions)

Figure 18 Global Real-world Evidence Solutions Market Size, by Application, 2022–2029 (USD Million)

Figure 19 Estimated Number of New Cancer Cases, by Region, 2020–2040 (In Millions)

Figure 20 Global Real-world Evidence Solutions Market Size, by End User, 2022 Vs. 2029 (USD Million)

Figure 21 Pharmaceutical R&D Spending, 2012–2026 ( USD Billion)

Figure 22 Global Real-world Evidence Solutions Market, by Region, 2022–2029 (USD Million)

Figure 23 North America: Real-world Evidence Solutions Market Snapshot

Figure 24 Number of Novel Drug Approvals by Cder From 2010 To 2020

Figure 25 Europe: Real-world Evidence Solutions Market Snapshot

Figure 26 Pharmaceutical Industry R&D Expenditure in Germany, 2016–2019 (USD Million)

Figure 27 France: Share of Population Aged 65 & Above, 2010–2020

Figure 28 Italy: Share of Population Aged 65 Years and Above, 2015–2020

Figure 29 Pharmaceutical R&D Expenditure in Spain, 2016–2019 (USD Million)

Figure 30 Pharmaceutical R&D Expenditure in European Countries, 2016–2019 (USD Million)

Figure 31 Asia-Pacific: Real-world Evidence Solutions Market Snapshot

Figure 32 Number of People >65 Years of Age in Japan, 2000–2050

Figure 33 Key Growth Strategies Adopted by Leading Players (2018–2022)

Figure 34 Real-world Evidence Solutions: Competitive Benchmarking

Figure 35 Market Share Analysis: Real-world Evidence Solutions Industry (2021)

Figure 36 Financial Overview (2019–2021): IQVIA Holdings Inc.

Figure 37 Financial Overview (2018–2020): PPD Inc.

Figure 38 Financial Overview (2019–2021): ICON Plc

Figure 39 Financial Overview (2019–2021): UnitedHealth Group Incorporated

Figure 40 Financial Overview (2019–2021): Oracle Corporation

Figure 41 Financial Overview (2020–2021): SAS Institute Inc.

Figure 42 Financial Overview (2019–2021): Anthem, Inc.

Figure 43 Financial Overview (2019–2021): Clinigen Group Plc

Figure 44 Financial Overview (2019–2021): Cognizant Technology Solutions Corporation

Figure 45 Financial Overview (2019–2022): PerkinElmer, Inc.