Resources

About Us

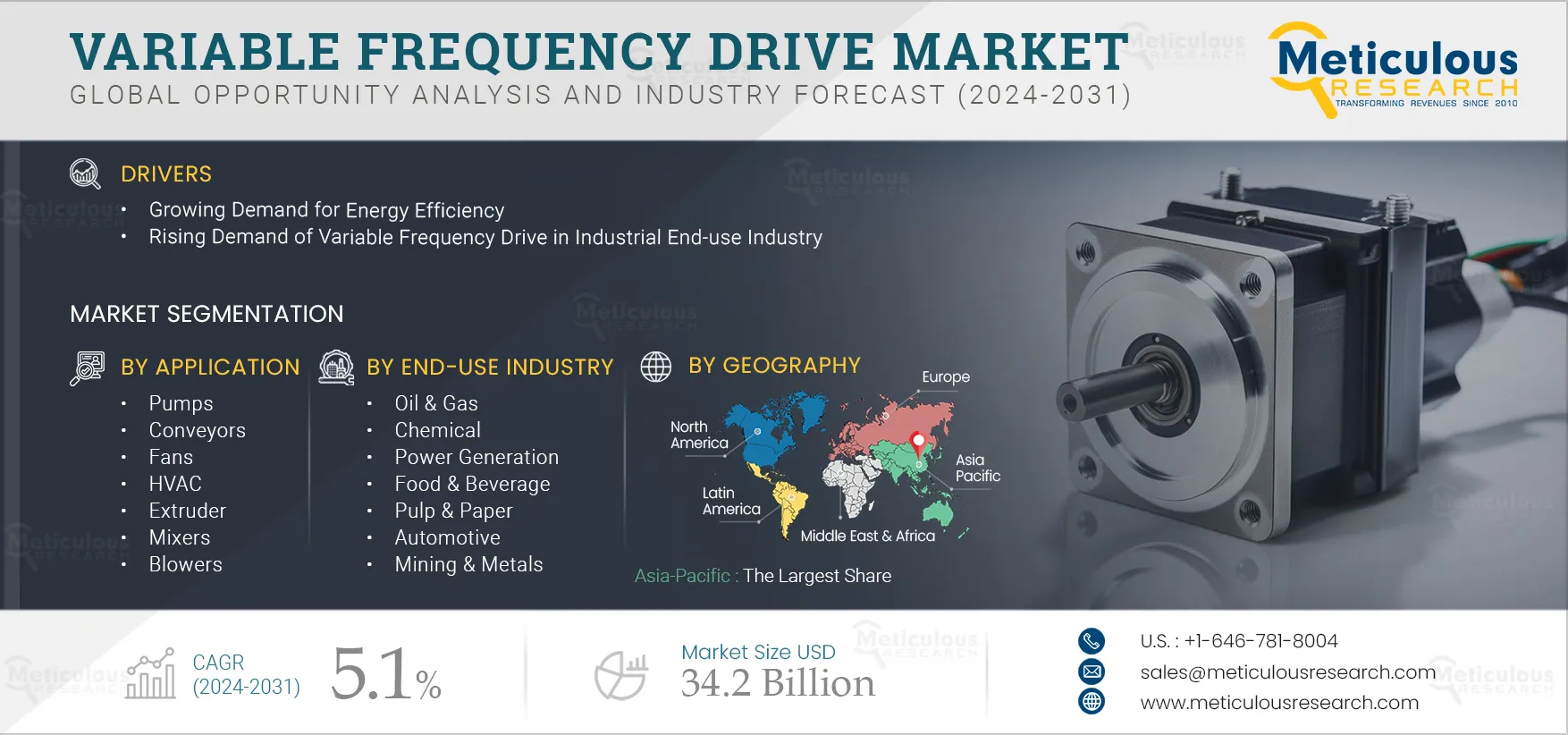

Variable Frequency Drive Market by Phase Type, Drive Type (AC Drive, DC Drive), Voltage Rating (Low-voltage Drive), Application (HAVAC, Conveyors), End-use Industry (Oil & Gas, Power Generation) and Geography - Global Forecast to 2032

Report ID: MRSE - 1041306 Pages: 250 Aug-2024 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of the variable frequency drive market is primarily driven by the growing demand for energy efficiency and rising demand for variable frequency drive in the industrial sector. Moreover, the modernization of power infrastructure is expected to generate growth opportunities for the players operating in this market.

Economic, technological, environmental, and operational concerns all play a part in the growing demand for VFDs in the industrial sector. VFDs are becoming increasingly recognized as a crucial part of contemporary industrial processes as firms strive to achieve sustainability targets, cut costs, and increase efficiency. Electric motor speed and torque can be optimized with the use of VFDs, directly resulting in lower energy usage. VFDs save a significant amount of energy by modifying the motor speed to fit the demands of the load. This is especially advantageous for high-power consumption. In the industrial sector, variable frequency drives can provide a host of advantages that boost overall system performance, lower operating costs, and increase energy efficiency. Variable-frequency drive provides precise control, extends equipment life, and contributes to environmental goals, all contributing to the market's growth.

Click here to: Get Free Sample Pages of this Report

VFDs are commonly used to control the speed and torque of electric motors by altering the frequency and voltage of the power source. Through the process of matching motor speed to actual demand, VFDs effectively minimize energy use. This has a particularly substantial effect on applications where energy savings are significant, like fans and pumps. Modern, high-efficiency motors have a versatile and dependable design, which makes variable-speed drives ideal for HVAC systems in buildings with advanced energy-saving features. Moreover, VFDs assist enterprises in adhering to energy efficiency norms and laws, which frequently call for the use of energy-saving and greenhouse gas-emitting technology.

Thus, the growing demand for energy efficiency in various applications is driving the growth of the variable frequency drive market.

The energy efficiency of modern electrical infrastructure is becoming progressively more important. Electric motor speed and torque are adjusted by VFDs to match load needs, resulting in significant energy savings. The goal of contemporary infrastructure is to increase power systems' dependability and efficiency. By precisely adjusting motor operations, lowering mechanical stress, and averting potential failures, VFDs improve system control. Increased system reliability and lower maintenance costs are the results of this. Additionally, VFDs include sophisticated features like connecting choices, diagnostic tools, and digital controls. These functions complement data analytics, predictive maintenance, and remote monitoring and control, all of which are part of the wider trend of digitization in the power infrastructure.

Therefore, by increasing energy efficiency, integrating with smart and renewable technologies, boosting system dependability, and assisting with regulatory compliance, the modernization of power infrastructure is propelling the variable frequency drive market.

Based on phase type, the variable frequency drive market is segmented into single-phase VFDs and three-phase VFDs. In 2025, the three-phase VFDs segment is expected to account for the largest share of the variable frequency drive market. The increased use of three-phase VFDs in HVAC and extruder applications and the growing requirement for three-phase VFDs to reduce energy consumption are all factors contributing to this segment's significant market share. The growing demand for precise control in high-power applications and the increasing deployment of three-phase VFDs in water and wastewater treatment and the oil and gas industries are driving this segment’s growth.

Moreover, this segment is also expected to record a higher CAGR during the forecast period.

Based on drive type, the variable frequency drive market is segmented into AC drives, DC drives, and servo drives. In 2025, the AC drive segment is expected to account for the largest share of over 83.0% of the variable frequency drive market. This segment’s large market share is attributed to the increasing demand for energy-efficient solutions across various industries, rising industrial automation and smart manufacturing, and increasing adoption of AC drives in fans and pumps, conveyors, mixers, and crushers applications. In addition, the benefits offered by the AC drive segment, such as reduced power consumption, cost savings, precise speed control, enhanced performance, and improved operational efficiency, contribute to this segment's growth. Moreover, this segment is also estimated to record a higher CAGR during the forecast period.

Based on voltage rating, the variable frequency drive market is segmented into low-voltage drive, medium-voltage drive, and high-voltage drive. In 2025, the low voltage drive segment is expected to account for the largest share of over 71.0% of the variable frequency drive market. The growing requirement for low-temperature, low-voltage, variable frequency drive that are compact in size, increased investment in research and development, and the need to improve performance are all factors driving this segment's substantial market share. The growing need for low-voltage drives in power generation, as well as the growing use of low-voltage drives in fans, compressors, and pump applications, contribute to the segment's growth. Additionally, players in the market are collaborating to create cutting-edge products, which is assisting in this segment's expansion.

For instance, in September 2024, Rockwell Automation, Inc. (U.S.) agreed with Infinitum (U.S.) to develop high-efficiency, low-voltage drives and motors available for energy-intensive industrial applications.

However, the medium voltage drive segment is expected to register the highest CAGR during the forecast period. The increasing need for heightened energy efficiency, medium voltage drives to reduce operational costs, and for medium voltage drives in the oil and gas and mining industries are expected to support the growth of this segment.

Based on application, the variable frequency drive market is segmented into pumps, conveyors, fans, HVAC, extruders, mixers, blowers, chillers, and other applications. In 2025, the pumps segment is expected to account for the largest share of over 39.0% of the variable frequency drive market. This segment’s large market share is attributed to the increasing need for variable frequency drive to improve efficiency and throttle flow rate from the oil and gas, water treatment plant, etc. industries and the rising demand for accurate flow and pressure control.

However, the HVAC segment is expected to register the highest CAGR during the forecast period. The increasing need for effective climate management, increased use of energy-efficient technologies, and better temperature regulation and air quality are all anticipated to fuel this segment's expansion.

Furthermore, key market players are focused on introducing new solutions to improve business performance. For instance, in February 2025, ABB India introduced its next-generation compact drive specialized for HVACR systems. This new drive controls high-efficiency motors, empowering businesses to reach the highest IE5 efficiency standard.

Based on end-use industry, the variable frequency drive market is segmented into oil & gas, power generation, food & beverage, pulp & paper, automotive, mining & metals, marine & offshore, chemical, water and wastewater treatment, and other end-use industries. In 2025, the oil & gas segment is expected to account for the larger share of over 28.0% of the variable frequency drive market. This segment's large market share is attributed to the rising need to minimize energy waste and improve overall system efficiency, the rising demand for three-phase voltage drive in the oil & gas industry, and rising investment in modernizing infrastructure and improving operational efficiency. Moreover, this segment is also anticipated to register the highest CAGR during the forecast period.

Based on geography, the variable frequency drive market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Asia-Pacific is expected to account for the largest share of over 43.0% of the variable frequency drive market. The significant revenue share of this region is attributed to the presence of major variable frequency drive players. Variable frequency drives are also in high demand in the region due to increased smart building and infrastructure projects, heightened energy efficiency requirements, and rapid industrialization. Market participants are also concentrating on broadening their product offerings in order to bolster the expansion of this region.

For instance, in May 2024, ABB India expanded its manufacturing footprint with a new line for variable speed drive modules at the Peenya factory in Bengaluru. The new line will produce drives ranging from 75 kW to 250 kW and will cater to all major industrial segments.

Moreover, Asia-Pacific is expected to register the highest CAGR of 6.5% during the forecast period. This region's rapid growth is due to factors including the expanding demand for automation systems and smart building technologies, the growing use of variable frequency drives in the industrial sector, and the growing emphasis on energy management.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the variable frequency drive market are ABB Ltd. (Switzerland), Siemens AG (Germany), Danfoss (Denmark), Schneider Electric SE (France), Rockwell Automation, Inc. (U.S.), Fuji Electric Co., Ltd. (Japan), TMEIC (Japan), Delta Electronics, Inc. (Taiwan), Parker Hannifin Corporation (U.S.), General Electric (U.S.), Eaton Corporation plc (Ireland), Honeywell International, Inc. (U.S.), Yaskawa Electric Corporation (Japan), Nidec Motor Corporation (Japan), and Anaheim Automation, Inc. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR |

5.1% |

|

Market Size |

$34.2 Billion by 2032 |

|

Segments Covered |

By Phase Type

By Drive Type

By Voltage Rating

By Application

By End-use Industry

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, U.K., France, Italy, Spain, Switzerland, Poland, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Singapore, South Korea, Australia & New Zealand, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America) and the Middle East & Africa (UAE, Israel, Rest of Middle East & Africa) |

|

Key Companies |

ABB Ltd. (Switzerland), Siemens AG (Germany), Danfoss (Denmark), Schneider Electric SE (France), Rockwell Automation, Inc. (U.S.), Fuji Electric Co., Ltd. (Japan), TMEIC (Japan), Delta Electronics, Inc. (Taiwan), Parker Hannifin Corporation (U.S.), General Electric (U.S.), Eaton Corporation plc (Ireland), Honeywell International, Inc. (U.S.), Yaskawa Electric Corporation (Japan), Nidec Motor Corporation (Japan), and Anaheim Automation, Inc. (U.S.) |

The variable frequency drive market study focuses on market assessment and opportunity analysis based on the sales of variable frequency drive products across various countries, regions, and market segments. The study includes a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years.

The variable frequency drive market is estimated to reach $34.2 billion by 2032, at a CAGR of 5.1% from 2025 to 2032.

In 2025, the pumps segment is expected to account for the largest share of over 39.0% of the variable frequency drive market. The segment’s large share is attributed to the rising need for precise flow and pressure control and the increasing demand for variable frequency drive from the water treatment plant industry, oil & gas, etc., to throttle the flow rate and enhance efficiency.

The growth of the variable frequency drive market is primarily driven by the growing demand for energy efficiency and rising demand for variable frequency drive in the industrial sector. Moreover, the modernization of power infrastructure is expected to generate growth opportunities for the players operating in this market.

The key players operating in the variable frequency drive market are ABB Ltd. (Switzerland), Siemens AG (Germany), Danfoss (Denmark), Schneider Electric SE (France), Rockwell Automation, Inc. (U.S.), Fuji Electric Co., Ltd. (Japan), TMEIC (Japan), Delta Electronics, Inc. (Taiwan), Parker Hannifin Corporation (U.S.), General Electric (U.S.), Eaton Corporation plc (Ireland), Honeywell International, Inc. (U.S.), Yaskawa Electric Corporation (Japan), Nidec Motor Corporation (Japan), and Anaheim Automation, Inc. (U.S.).

At present, Asia-Pacific dominates the variable frequency drive market. Moreover, Japan, China, India, and South Korea are expected to witness strong growth in the demand for variable frequency drive in the coming years.

Published Date: Sep-2020

Published Date: Nov-2022

Published Date: Sep-2024

Published Date: Jan-2025

Published Date: Dec-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates