Resources

About Us

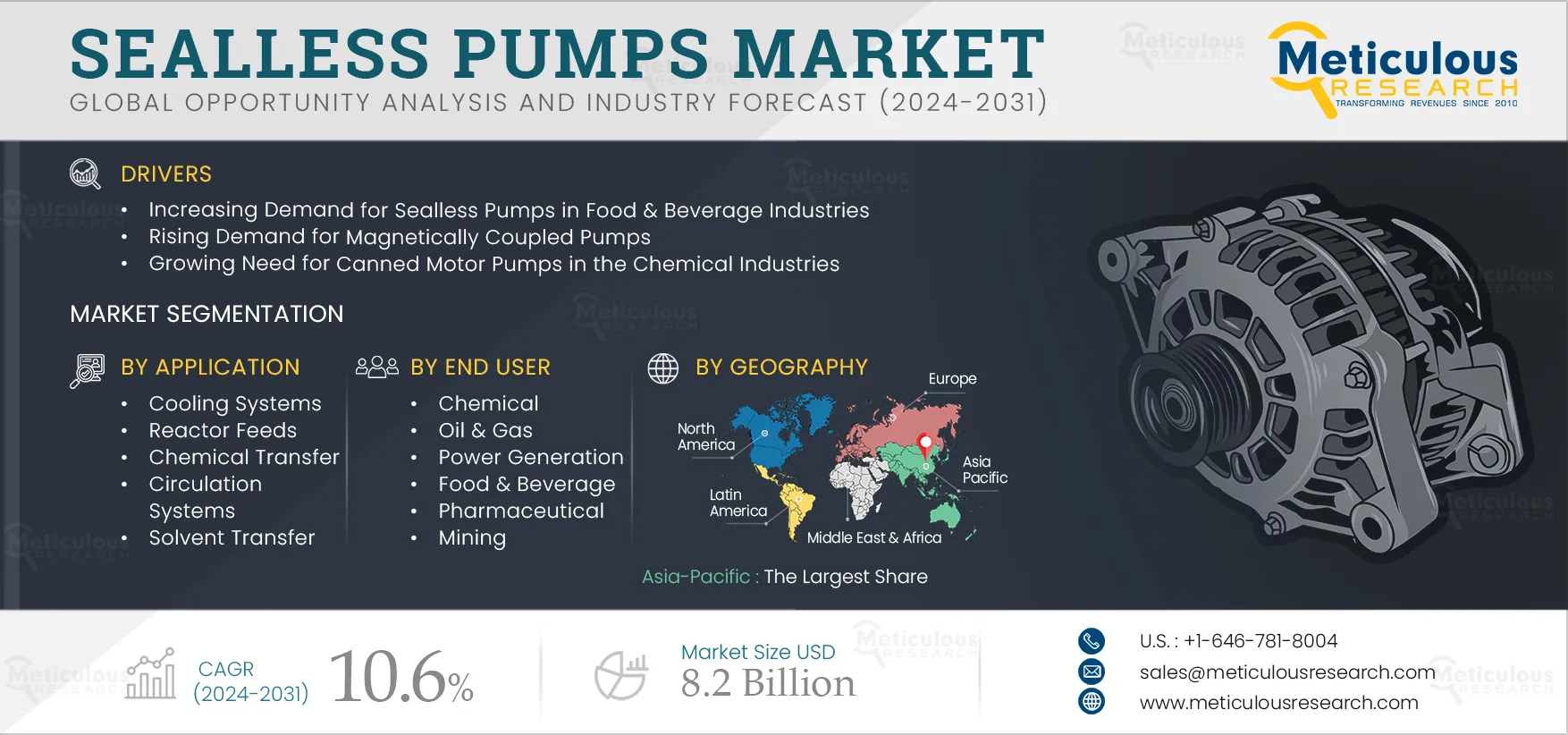

Sealless pumps Market Size, Share, Forecast, & Trends Analysis by Product (Magnetic-Driven Pumps, Canned Motor Pumps), Flow Rate, Application (Chemical Transfer, Cooling Systems), End User (Chemical, Pharmaceutical, and Power Generation) and Geography - Global Forecast to 2032

Report ID: MRSE - 104330 Pages: 350 Jan-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of the sealless pumps market is primarily driven by the increasing demand for sealless pumps in the food and beverage industries, rising demand for magnetically coupled pumps, and the growing need for canned motor pumps in the chemical industries. Moreover, the rising adoption of sealless pumps in pharmaceutical industries and the increasing popularity of sealless pumps in the power generation industry are expected to generate growth opportunities for the players operating in the market.

Sealless pumps are becoming increasingly popular in the food and beverage industry due to their ability to handle liquids without the risk of contamination. Sealless pumps meet hygiene and safety standards more efficiently as they eliminate the risk of leaks and contamination associated with traditional seals. This makes them ideal for processes where hygiene is critical, such as in the production of beverages and food products. Additionally, in the food and beverage industry, products often require careful handling to maintain their quality and integrity. Sealless pumps are particularly well-suited for transferring delicate, shear-sensitive, or high-viscosity fluids without damaging or altering the product. This capability makes them an ideal option for processes involving high-value or sensitive ingredients.

Moreover, regulations and industry standards for food safety and quality are becoming increasingly stringent. Sealless pumps offer a reliable solution for meeting these requirements. Thus, the growing need for sealless pumps in the food and beverage industry is driven by their ability to enhance hygiene, improve operational efficiency, and handle challenging fluids.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

In the chemical industry, the use of canned motor pumps is essential due to the rigorous and hazardous nature of chemical processing. These pumps feature a distinctive design where the motor and pump are enclosed within a single, sealed unit, eliminating the need for a shaft seal—a common failure point in conventional pumps. This design is particularly critical in chemical processing, where leakage of hazardous substances can result in dangerous situations, environmental damage, or regulatory breaches. The increasing demand for canned motor pumps in the chemical industry is thus fueled by their superior safety, reliability, and reduced maintenance requirements. Their capability to handle hazardous chemicals, along with the industry's growing emphasis on regulatory compliance and sustainability, further drives the demand for these pumps in modern chemical operations.

Based on product, the sealless pumps market is segmented into magnetic-driven pumps and canned motor pumps. In 2025, the magnetic-driven pumps segment is expected to account for the larger share of over 64.0% of the sealless pumps market. This segment’s large share is attributed to the rising demand for efficient and environment-friendly fluid handling solutions, magnetically coupled pumps, and the growing adoption of magnetic-driven pumps in various industrial applications.

However, the canned motor pumps segment is expected to register the highest CAGR during the forecast period. The increasing need for energy-efficient pumping solutions and growing demand for API 585 canned motor pumps in the chemical and pharmaceutical industries are expected to support this segment's growth.

Based on flow rate, the sealless pumps market is segmented into up to 80 m3/hr, 81 to 150 m3/hr, 150 to 250 m3/hr,250 to 350 m3/hr, and above 351 m3/hr. In 2025, the 150 to 250 m3/hr segment is expected to account for the largest share of over 28.0% of the sealless pumps market. The substantial market share of this segment can be attributed to the growing demand for dependable and efficient sealless pumps, particularly those with medium flow rates, in both renewable energy and food & beverage applications. Additionally, the segment's expansion is driven by the advantages provided by pumps within the 150 to 250 m³/hr range, including reliable performance, durability, flow stability, energy efficiency, and precise flow control. Moreover, this segment is expected to register the highest CAGR during the forecast period.

Based on application, the sealless pumps market is segmented into cooling systems, reactor feeds, chemical transfer, circulation systems, solvent transfer, and other applications. In 2025, the chemical transfer segment is expected to account for the largest share of over 32.0% of the sealless pumps market. The significant market share of this segment is driven by the growing demand for the safe and efficient management of hazardous, corrosive, and high-value fluids, the increasing requirements for high-purity chemical applications, and the heightened need for effective leak prevention and containment solutions. Moreover, this segment is expected to witness the highest CAGR during the forecast period.

Based on end user, the sealless pumps market is segmented into chemical, oil & gas, power generation, food & beverage, pharmaceutical, mining, petrochemical refineries, and other end users. In 2025, the chemical segment is expected to account for the largest share of over 34.0% of the sealless pumps market. The substantial market share of this segment is attributed to the heightened emphasis on sustainability and energy efficiency within the chemical industry, stringent environmental regulations concerning chemical handling and waste management, rising demand for canned motor pumps, and the growing adoption of magnetic-driven pumps in applications such as chemical synthesis, filtration, and recirculation.

However, the pharmaceutical segment is expected to register the highest CAGR during the forecast period. This segment's rapid growth is supported by the increasing demand for sealless pumps in the production of vaccines, therapeutics, and other pharmaceutical products, the rising need for high-purity and sterile processing in pharmaceutical manufacturing, and the advancement of smart sealless pumps within the pharmaceutical industry.

Based on geography, the sealless pumps market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Asia-Pacific is expected to account for the largest share of over 45.0% of the sealless pumps market. The high revenue share of this region is anticipated to be bolstered by the presence of leading market players. Additionally, factors such as the growing demand for energy-efficient and environmentally friendly pumps across various industries, the rising adoption of sealless magnetic drive pumps in the pharmaceutical sector, advancements in smart sealless pump technology, and the increasing use of sealless pumps in the power generation industry are driving demand in the region.

Moreover, Asia-Pacific is poised to register the highest CAGR of 11.5% during the forecast period. The rapid expansion of regional economies, particularly in China, South Korea, Japan, and India, along with infrastructural advancements in the APAC region, increased industrialization, and the development of smart sealless pumps, are driving the rapid growth of this market. Additionally, the growing investment by market players in the advancement of smart sealless pump technology further supports this regional market's growth.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the sealless pumps market are IDEX Corporation (U.S.), Flowserve Corporation (U.S.), KSB SE & Co. KGaA (Germany), IWAKI Co., Ltd. (Japan), ITT Goulds Pumps (U.S.), Kirloskar Brothers Limited (India), Teikoku Electric Mfg. Co„ Ltd. (Japan), Nikkiso Co., Ltd. (Japan), Klaus Union (U.S.), Sundyne (U.S.), CP Pumpen AG (Switzerland), HERMETIC-Pumpen GmbH (Germany), March Manufacturing Inc. (U.S.), OPTIMEX (France), Dandong Colossus CQ Ltd (China), Dickow Pumpen GmbH & Co. KG (Germany), and Richter Chemie-Technik GmbH (Germany).

|

Particulars |

Details |

|

Number of Pages |

350 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

10.6% |

|

Market Size (Value) |

$8.2 Billion by 2032 |

|

Segments Covered |

By Product

By Flow Rate

By Application

By End User

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, U.K., France, Italy, Spain, Switzerland, Poland, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Singapore, South Korea, Australia & New Zealand, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America) and the Middle East & Africa (UAE, Israel, Rest of Middle East & Africa) |

|

Key Companies |

IDEX Corporation (U.S.), Flowserve Corporation (U.S.), KSB SE & Co. KGaA (Germany), IWAKI Co., Ltd. (Japan), ITT Goulds Pumps (U.S.), Kirloskar Brothers Limited (India), Teikoku Electric Mfg. Co„ Ltd. (Japan), Nikkiso Co., Ltd. (Japan), Klaus Union (U.S.), Sundyne (U.S.), CP Pumpen AG (Switzerland), HERMETIC-Pumpen GmbH (Germany), March Manufacturing Inc. (U.S.), OPTIMEX (France), Dandong Colossus CQ Ltd (China), Dickow Pumpen GmbH & Co. KG (Germany), and Richter Chemie-Technik GmbH (Germany). |

The sealless pumps market study focuses on market assessment and opportunity analysis based on the sales of sealless pumps products across various countries, regions, and market segments. The study includes a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years.

The sealless pumps market is projected to reach $8.2 billion by 2032, at a CAGR of 10.6% from 2025 to 2032.

In 2025, the magnetic-driven pumps segment is expected to account for the largest share, over 64.0% of the sealless pumps market. The segment’s large share is attributed to the rising demand for efficient and environmentally friendly fluid handling solutions, the rising demand for magnetic-driven centrifugal pumps, and the growing adoption of magnetic-driven pumps in the chemical industry.

The growth of the sealless pumps market is primarily driven by the increasing demand for sealless pumps in the food and beverage industries, rising demand for magnetically coupled pumps, and the growing need for canned motor pumps in the chemical industries. Moreover, the rising adoption of sealless pumps in pharmaceutical industries and the increasing popularity of sealless pumps in the power generation industry are expected to generate growth opportunities for the players operating in this market.

The key players operating in the sealless pumps market are IDEX Corporation (U.S.), Flowserve Corporation (U.S.), KSB SE & Co. KGaA (Germany), IWAKI Co., Ltd. (Japan), ITT Goulds Pumps (U.S.), Kirloskar Brothers Limited (India), Teikoku Electric Mfg. Co„ Ltd. (Japan), Nikkiso Co., Ltd. (Japan), Klaus Union (U.S.), Sundyne (U.S.), CP Pumpen AG (Switzerland), HERMETIC-Pumpen GmbH (Germany), March Manufacturing Inc. (U.S.), OPTIMEX (France), Dandong Colossus CQ Ltd (China), Dickow Pumpen GmbH & Co. KG (Germany), and Richter Chemie-Technik GmbH (Germany).

At present, Asia-Pacific dominates the sealless pumps market. Moreover, India, South Korea, and Singapore are expected to witness strong growth in the demand for sealless pumps in the coming years.

Published Date: Jul-2024

Published Date: Apr-2023

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates