1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Process

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.1.1.Bottom-Up Approach

2.3.1.2.Top-Down Approach

2.3.1.3.Growth Forecast

2.3.2. Market Share Analysis

2.4. Assumptions for the Study

2.5. Limitations for the Study

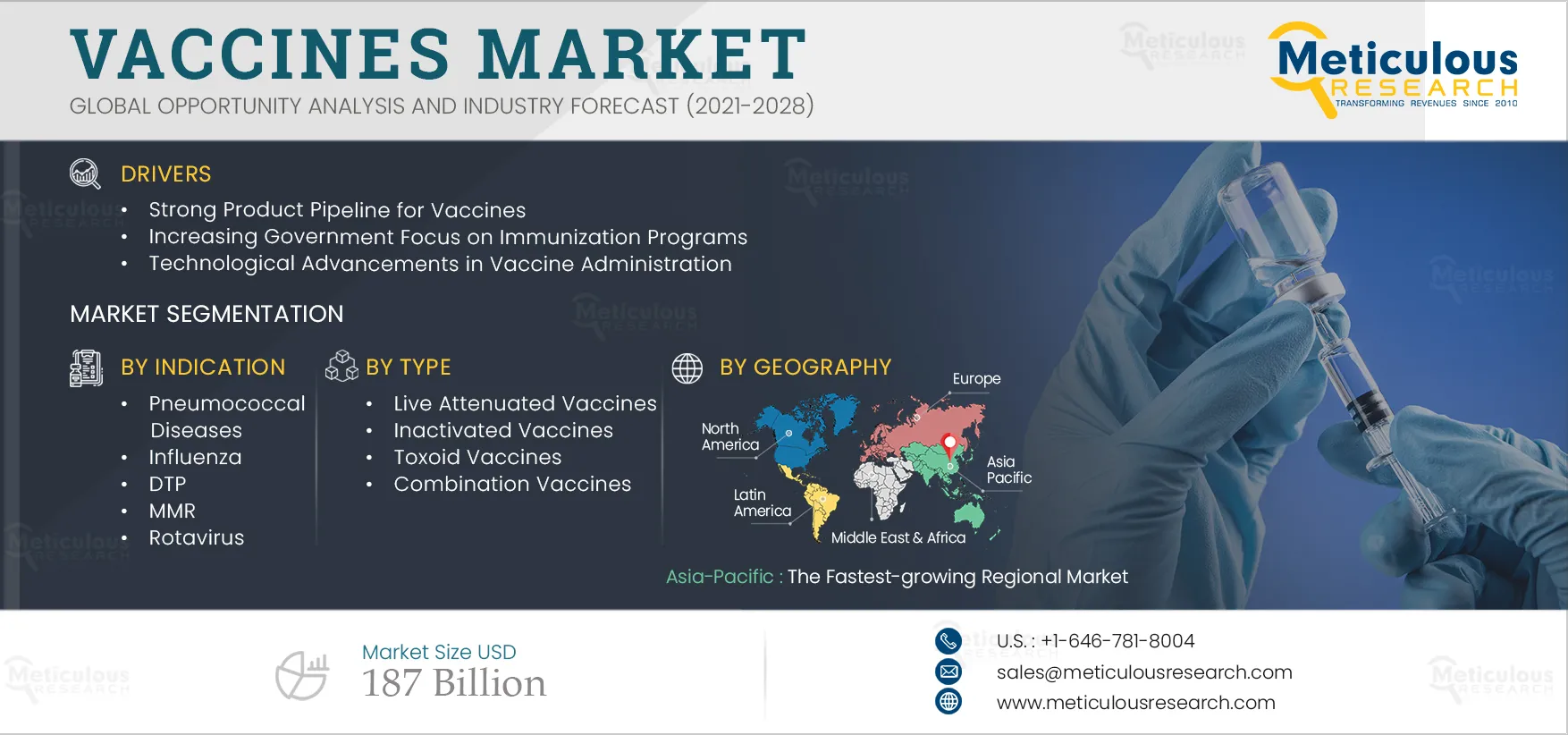

3. Executive Summary

4. Market Insights

4.1. Market Overview

4.2. Market Dynamics

4.2.1. Drivers

4.2.1.1. Strong Product Pipeline for Vaccines

4.2.1.2. Increasing Government Focus on Immunization Programs

4.2.1.3. Technological Advancements in Vaccine Administration

4.2.2. Restraints

4.2.2.1. High Costs Involved in Vaccine Development

4.2.2.2. Long Timelines of Vaccine Manufacturing

4.2.3. Opportunities

4.2.3.1. Rising Prevalence of Diseases

4.2.3.2. Growing Focus on Therapeutic Vaccines

4.2.3.3. Growth Prospects in Emerging Markets

4.2.3.4. Increasing Use of Adjuvants in Vaccines

4.2.4. Challenges

4.2.4.1. Product Recalls

4.2.4.2. Inadequate Access to Vaccines

5. Industry Analysis

5.1. Regulatory Analysis

5.2. Pipeline Analysis

5.3. Unmet Needs Analysis

5.4. Pricing Analysis, by Region

6. Global Vaccines Market, by Indication

6.1. Introduction

6.2. Pneumococcal Disease

6.3. Influenza

6.4. Human Papillomavirus (HPV)

6.5. Diphtheria, Tetanus, and Pertussis (DTP)

6.6. Meningococcal Disease

6.7. Measles, Mumps, and Rubella (MMR)

6.8. Rotavirus

6.9. Poliomyelitis (Polio)

6.10. Hepatitis

6.11. Other Indications

7. Global Vaccines Market, by Route of Administration

7.1. Introduction

7.2. Intramuscular (IM)

7.3. Subcutaneous (SC)

7.4. Oral

7.5. Other Routes of Administration

8. Global Vaccines Market, by Type

8.1. Introduction

8.2. Subunit & Conjugate Vaccines

8.3. Inactivated Vaccines

8.4. Live-Attenuated Vaccines

8.5. Toxoid Vaccines

8.6. Combination Vaccines

9. Global Vaccines Market, by Valence

9.1. Introduction

9.2. Multivalent Vaccines

9.3. Monovalent Vaccines

10. Global COVID-19 Vaccines Market

10.1. Introduction

10.2. Prevalence

10.3. COVID-19 Market Size & Forecast

10.4. Initiatives for Coronavirus Vaccine Development

10.5. Authorized Vaccines & Phase 3 Vaccine Candidates

10.6. COVID-19 Vaccine Pipeline Analysis

10.7. Purchase Data for COVID-19 Vaccines

10.8. Vaccination Coverage

11. Vaccines Market, by Geography

11.1. Introduction

11.2. North America

11.2.1. U.S.

11.2.2. Canada

11.3. Europe

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe (RoE)

11.4. Asia-Pacific

11.4.1. Japan

11.4.2. China

11.4.3. India

11.4.4. Rest of Asia-Pacific (RoAPAC)

11.5. Latin America

11.6. Middle East & Africa (MEA)

12. Competitive Landscape

12.1. Introduction

12.2. Key Growth Strategies

12.3. Competitive Benchmarking

12.4. Market Share Analysis

13. Company Profiles

13.1. Sanofi

13.1.1. Business Overview

13.1.2. Financial Overview

13.1.3. Product Portfolio

13.1.4. Product Pipeline

13.1.5. Strategic Developments

13.2. Merck & Co., Inc.

13.2.1. Business Overview

13.2.2. Financial Overview

13.2.3. Product Portfolio

13.2.4. Product Pipeline

13.2.5. Strategic Developments

13.3. GlaxoSmithKline plc.

13.3.1. Business Overview

13.3.2. Financial Overview

13.3.3. Product Portfolio

13.3.4. Product Pipeline

13.3.5. Strategic Developments

13.4. Pfizer, Inc.

13.4.1. Business Overview

13.4.2. Financial Overview

13.4.3. Product Portfolio

13.4.4. Product Pipeline

13.4.5. Strategic Developments

13.5. Johnson & Johnson

13.5.1. Business Overview

13.5.2. Financial Overview

13.5.3. Product Portfolio

13.5.4. Product Pipeline

13.5.5. Strategic Developments

13.6. Daiichi Sankyo Co., Ltd.

13.6.1. Business Overview

13.6.2. Financial Overview

13.6.3. Product Portfolio

13.6.4. Product Pipeline

13.6.5. Strategic Developments

13.7. Takeda Pharmaceutical Company Limited

13.7.1. Business Overview

13.7.2. Financial Overview

13.7.3. Product Portfolio

13.7.4. Product Pipeline

13.7.5. Strategic Developments

13.8. CSL Limited

13.8.1. Business Overview

13.8.2. Financial Overview

13.8.3. Product Portfolio

13.8.4. Product Pipeline

13.8.5. Strategic Developments

13.9. Emergent BioSolutions Inc.

13.9.1. Business Overview

13.9.2. Financial Overview

13.9.3. Product Portfolio

13.9.4. Product Pipeline

13.9.5. Strategic Developments

13.10. AstraZeneca PLC

13.10.1. Business Overview

13.10.2. Financial Overview

13.10.3. Product Portfolio

13.10.4. Strategic Developments

14. Appendix

14.1. Questionnaire

14.2. Available Customization

List of Tables

Table 1 Global Vaccines Market Drivers: Impact Analysis (2021–2028)

Table 2 Global Vaccines Market Restraints: Impact Analysis (2021–2028)

Table 3 Key Government Regulatory Agencies

Table 4 List of Some of the Promising Vaccines in the Pipeline

Table 5 Average Selling Price (ASP) of Key Vaccines, by Region (USD/Unit)

Table 6 Global Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 7 Overview: Pneumococcal Disease

Table 8 Pneumococcal Diseases: Vaccines in the Pipeline

Table 9 Key Companies Offering Pneumococcal Vaccines

Table 10 Vaccines Market Size for Pneumococcal Disease, by Country/Region, 2019–2028 (USD Million)

Table 11 Overview: Influenza

Table 12 Influenza: Vaccines in the Pipeline

Table 13 Key Companies Offering Influenza Vaccines

Table 14 Vaccines Market Size for Influenza, by Country/Region, 2019–2028 (USD Million)

Table 15 Overview: HPV

Table 16 HPV Vaccine Prices (As of November 2020)

Table 17 Vaccines Market Size for Human Papillomavirus (HPV), by Country/Region,

2019–2028 (USD Million)

Table 18 Overview: Diphtheria, Tetanus, and Pertussis (DTP)

Table 19 Key Companies Offering DTP Vaccines

Table 20 Vaccines Market Size for Diphtheria, Tetanus, and Pertussis (DTP),

by Country/Region, 2019–2028 (USD Million)

Table 21 Overview: Meningococcal Disease

Table 22 Marketed Meningococcal Vaccine Combinations

Table 23 Key Companies Offering Meningococcal Vaccines

Table 24 Vaccines Market Size for Meningococcal Disease, by Country/Region, 2019–2028 (USD Million)

Table 25 Overview: Measles, Mumps, and Rubella

Table 26 Key Companies Offering MMR Vaccines

Table 27 Vaccines Market Size for Measles, Mumps, and Rubella (MMR), by Country/Region, 2019–2028 (USD Million)

Table 28 Overview: Rotavirus Disease

Table 29 Key Companies Offering Rotavirus Vaccines

Table 30 Vaccines Market Size for Rotavirus, by Country/Region, 2019–2028 (USD Million)

Table 31 Overview: Poliomyelitis (Polio)

Table 32 Polio Cases and Endemic Countries

Table 33 Key Companies Offering Polio Vaccines

Table 34 Vaccines Market Size for Polio, by Country/Region, 2019–2028 (USD Million)

Table 35 Overview: Hepatitis A

Table 36 Overview: Hepatitis B

Table 37 Key Companies Offering Hepatitis Vaccines

Table 38 Vaccines Market Size for Hepatitis, by Country/Region, 2019–2028 (USD Million)

Table 39 Vaccines Market Size for Other Indications, by Country/Region, 2019–2028

(USD Million)

Table 40 Global Vaccines Market Size, by Route of Administration, 2019–2028

(USD Million)

Table 41 Intramuscular Sites of Vaccine Administration, by Age Group

Table 42 Vaccines for Intramuscular Administration

Table 43 Key Companies Offering Intramuscular Vaccines

Table 44 Intramuscular Vaccines Market Size, by Country/Region, 2019–2028

(USD Million)

Table 45 Administration Sites for Subcutaneous Vaccines, by Age Group

Table 46 Vaccines for Subcutaneous Administration

Table 47 Key Companies Offering Subcutaneous Vaccines

Table 48 Subcutaneous Vaccines Market Size, by Country/Region, 2019–2028 (USD Million)

Table 49 Key Companies Offering Oral Vaccines

Table 50 Oral Vaccines Market Size, by Country/Region, 2019–2028 (USD Million)

Table 51 Vaccines Market Size for Other Routes of Administration, by Country/Region, 2019–2028 (USD Million)

Table 52 Types of Vaccines, by Antigen

Table 53 Global Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 54 Companies Offering Subunit and Conjugate Vaccines

Table 55 Subunit & Conjugate Vaccines Market Size, by Country/Region, 2019–2028

(USD Million)

Table 56 Approved Inactivated Coronavirus Vaccines (As of 23/07/2021)

Table 57 Inactivated Coronavirus Vaccines in Development (As of 23/07/2021)

Table 58 Companies Offering Inactivated Vaccines

Table 59 Inactivated Vaccines Market Size, by Country/Region, 2019–2028 (USD Million)

Table 60 Live-Attenuated COVID-19 Candidate Vaccines

Table 61 Companies Offering Live-Attenuated Vaccines

Table 62 Live-Attenuated Vaccines Market Size, by Country/Region, 2019–2028

(USD Million)

Table 63 Toxoid Vaccines Used in the Vaccination Schedule

Table 64 Companies Offering Toxoid Vaccines

Table 65 Toxoid Vaccines Market Size, by Country/Region, 2019–2028 (USD Million)

Table 66 Companies Offering Combination Vaccines

Table 67 Combination Vaccines Market Size, by Country/Region, 2019–2028 (USD Million)

Table 68 Global Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 69 Multivalent Vaccines for Children (Available)

Table 70 Companies Offering Multivalent Vaccines

Table 71 Multivalent Vaccines Market Size, by Country/Region, 2019–2028 (USD Million)

Table 72 Malaria, Ebola, Dengue, and Coronavirus Vaccines in the Pipeline

Table 73 Companies Offering Monovalent Vaccines

Table 74 Monovalent Vaccines Market Size, by Country/Region, 2019–2028 (USD Million)

Table 75 Overview: Coronavirus Disease (COVID-19)

Table 76 Coronavirus Confirmed Cases (As of 29/07/2021)

Table 77 Vaccines Market Size for Coronavirus Disease, by Country/Region, 2020–2028

(USD Million)

Table 78 Authorized/Approved Coronavirus Vaccines

Table 79 Some of the Vaccine Candidates in Phase 3 Development

Table 80 Coronavirus Vaccine Confirmed and Projected Dose Purchases, by Country (As of December 2020)

Table 81 Global Vaccines Market Size (Excluding COVID-19), by Country/Region, 2019– 2028 (USD Million)

Table 82 North America: Vaccines Market Size, by Country, 2019–2028 (USD Million)

Table 83 North America: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 84 North America: Vaccines Market Size, by Route Of Administration, 2019–2028 (USD Million)

Table 85 North America: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 86 North America: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 87 Influenza Burden in the U.S., 2010–2020

Table 88 Some of the Coronavirus Vaccines in Development in the U.S. (As of 24/06/2021)

Table 89 U.S.: Macro Indicators

Table 90 U.S.: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 91 U.S.: Vaccines Market Size, by Route of Administration, 2019–2028 (USD Million)

Table 92 U.S.: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 93 U.S.: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 94 Canada: Macro Indicators

Table 95 Canada: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 96 Canada: Vaccines Market Size, by Route Of Administration, 2019–2028 (USD Million)

Table 97 Canada: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 98 Canada: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 99 Europe: Vaccines Market Size, by Country/Region, 2019–2028 (USD Million)

Table 100 Europe: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 101 Europe: Vaccines Market Size, by Route of Administration, 2019–2028

(USD Million)

Table 102 Europe: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 103 Europe: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 104 Germany: Macro Indicators

Table 105 Germany: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 106 Germany: Vaccines Market Size, by Route of Administration, 2019–2028

(USD Million)

Table 107 Germany: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 108 Germany: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 109 U.K.: Macro Indicators

Table 110 U.K.: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 111 U.K.: Vaccines Market Size, by Route of Administration, 2019–2028 (USD Million)

Table 112 U.K.: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 113 U.K.: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 114 France: Macro Indicators

Table 115 France: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 116 France: Vaccines Market Size, by Route of Administration, 2019–2028

(USD Million)

Table 117 France: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 118 France: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 119 Italy: Macro Indicators

Table 120 Italy: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 121 Italy: Vaccines Market Size, by Route of Administration, 2019–2028

(USD Million)

Table 122 Italy: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 123 Italy: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 124 Spain: Macro Indicators

Table 125 Spain: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 126 Spain: Vaccines Market Size, by Route of Administration, 2019–2028

(USD Million)

Table 127 Spain: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 128 Spain: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 129 RoE: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 130 RoE: Vaccines Market Size, by Route of Administration, 2019–2028 (USD Million)

Table 131 RoE: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 132 RoE: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 133 Asia-Pacific: Vaccines Market Size, by Country/Region, 2019–2028 (USD Million)

Table 134 Asia-Pacific: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 135 Asia-Pacific: Vaccines Market Size, by Route of Administration, 2019–2028

(USD Million)

Table 136 Asia-Pacific: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 137 Asia-Pacific: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 138 Japan: Macro Indicators

Table 139 Japan: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 140 Japan: Vaccines Market Size, by Route of Administration, 2019–2028

(USD Million)

Table 141 Japan: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 142 Japan: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 143 Coronavirus Vaccines Approved/In Development in China (As of 03/01/2021)

Table 144 China: Macro Indicators

Table 145 China: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 146 China: Vaccines Market Size, by Route of Administration, 2019–2028

(USD Million)

Table 147 China: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 148 China: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 149 Vaccine Prices in India

Table 150 India: Macro Indicators

Table 151 India: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 152 India: Vaccines Market Size, by Route of Administration, 2019–2028

(USD Million)

Table 153 India: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 154 India: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 155 RoAPAC: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 156 RoAPAC: Vaccines Market Size, by Route of Administration, 2019–2028

(USD Million)

Table 157 RoAPAC: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 158 RoAPAC: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 159 Latin America: Vaccines Market Size, by Indication, 2019–2028 (USD Million)

Table 160 Latin America: Vaccines Market Size, by Route of Administration, 2019–2028

(USD Million)

Table 161 Latin America: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 162 Latin America: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 163 Middle East & Africa: Vaccines Market Size, by Indication, 2019–2028

(USD Million)

Table 164 Middle East & Africa: Vaccines Market Size, by Route of Administration,

2019–2028 (USD Million)

Table 165 Middle East & Africa: Vaccines Market Size, by Type, 2019–2028 (USD Million)

Table 166 Middle East & Africa: Vaccines Market Size, by Valence, 2019–2028 (USD Million)

Table 167 Number of Developments by Major Players, 2018–2021

Table 168 Vaccines Market: Competitive Benchmarking, by Product

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 6 Market Size Estimation

Figure 7 Global Vaccines Market Size, by Indication, 2021–2028 (USD Million)

Figure 8 COVID-19 Vaccines Market 2021 Vs 2028 (USD Million)

Figure 9 Global Vaccines Market Size, by Route of Administration, 2021–2028

(USD Million)

Figure 10 Global Vaccines Market Size, by Type, 2021–2028 (USD Million)

Figure 11 Global Vaccines Market Size, by Valence, 2021–2028 (USD Million)

Figure 12 Vaccines Market Overview, by Region

Figure 13 Number of Health Products in the Pipeline: July 2021

Figure 14 Vaccine Projects in the Pipeline: 2020

Figure 15 Therapeutic Vaccines Being Developed for Cancer: 2011 and 2018

Figure 16 New Cancer Cases in Asia, Latin America, and the Caribbean: 2020–2040

Figure 17 Global Vaccines Market Size, by Indication, 2021–2028 (USD Million)

Figure 18 Influenza Vaccines Distribution: 2016–2021

Figure 19 Forecasted Global Demand for DTwP Vaccines: 2018–2032

Figure 20 MMR Vaccines Supply: 2016–2019

Figure 21 Global Vaccination Coverage Against Rotavirus: 2010–2020

Figure 22 U.S. Funding for Polio: 2015–2020

Figure 23 Routes of Vaccine Administration

Figure 24 Global Vaccines Market Size, by Route of Administration, 2021–2028

(USD Million)

Figure 25 Global Vaccines Market Size, by Type, 2021–2028 (USD Million)

Figure 26 Global Vaccines Market Size, by Valence, 2021–2028 (USD Million)

Figure 27 Coronavirus Vaccines in Development, by Phase

Figure 28 COVID-19 Vaccination Among Populations (As of 29/07/2021)

Figure 29 Global Vaccines Market Size, by Region, 2021–2028 (USD Million)

Figure 30 Geographic Snapshot: Vaccines Market, North America (Excluding COVID-19)

Figure 31 U.S. Funding for Global Polio: 2013–2020

Figure 32 Geographic Snapshot: Vaccines Market, Europe (Excluding COVID-19)

Figure 33 Increase in Immunization After Mandatory Vaccination

Figure 34 Increase in the Number of Registered Influenza Cases (2015–2019)

Figure 35 Spain: Increase in the Number of Biotechnology Companies (2010–2018)

Figure 36 Geographic Snapshot: Vaccines Market, Asia-Pacific (Excluding COVID-19)

Figure 37 India: Increase in Health Expenditure (2010–2020)

Figure 38 Cancer Incidence in the Middle East & Africa: 2020 and 2030

Figure 39 Key Growth Strategies Adopted by Leading Players, 2018–2021

Figure 40 Vaccines Market: Competitive Benchmarking, by Geography

Figure 41 Global Vaccines Market (Including COVID-19) Share, by Key Player, 2020 (%)

Figure 42 Sanofi: Financial Overview (2020)

Figure 43 Merck & Co., Inc.: Financial Overview (2020)

Figure 44 GlaxoSmithKline plc (GSK): Financial Overview (2020)

Figure 45 Pfizer, Inc.: Financial Overview (2020)

Figure 46 Johnson & Johnson (J&J): Financial Overview (2020)

Figure 47 Daichi Sankyo Co., Ltd.: Financial Overview (2020)

Figure 48 Takeda Pharmaceutical: Financial Overview (2020)

Figure 49 CSL Limited: Financial Overview (2020)

Figure 50 Emergent BioSolutions Inc.: Financial Overview (2020)

Figure 51 AstraZeneca PLC: Financial Overview (2020)