Resources

About Us

Urine Test Strips Market by Product Type (Reagent Strips, Dipsticks), Test Type (Single Parameter, Multi-Parameter), Application (Urinary Tract Infections, Diabetes, Kidney Disease, Pregnancy & Fertility, Liver Disease), End User, and Geography – Global Forecast to 2035

Report ID: MRHC - 1041619 Pages: 230 Oct-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Urine Test Strips Market Size?

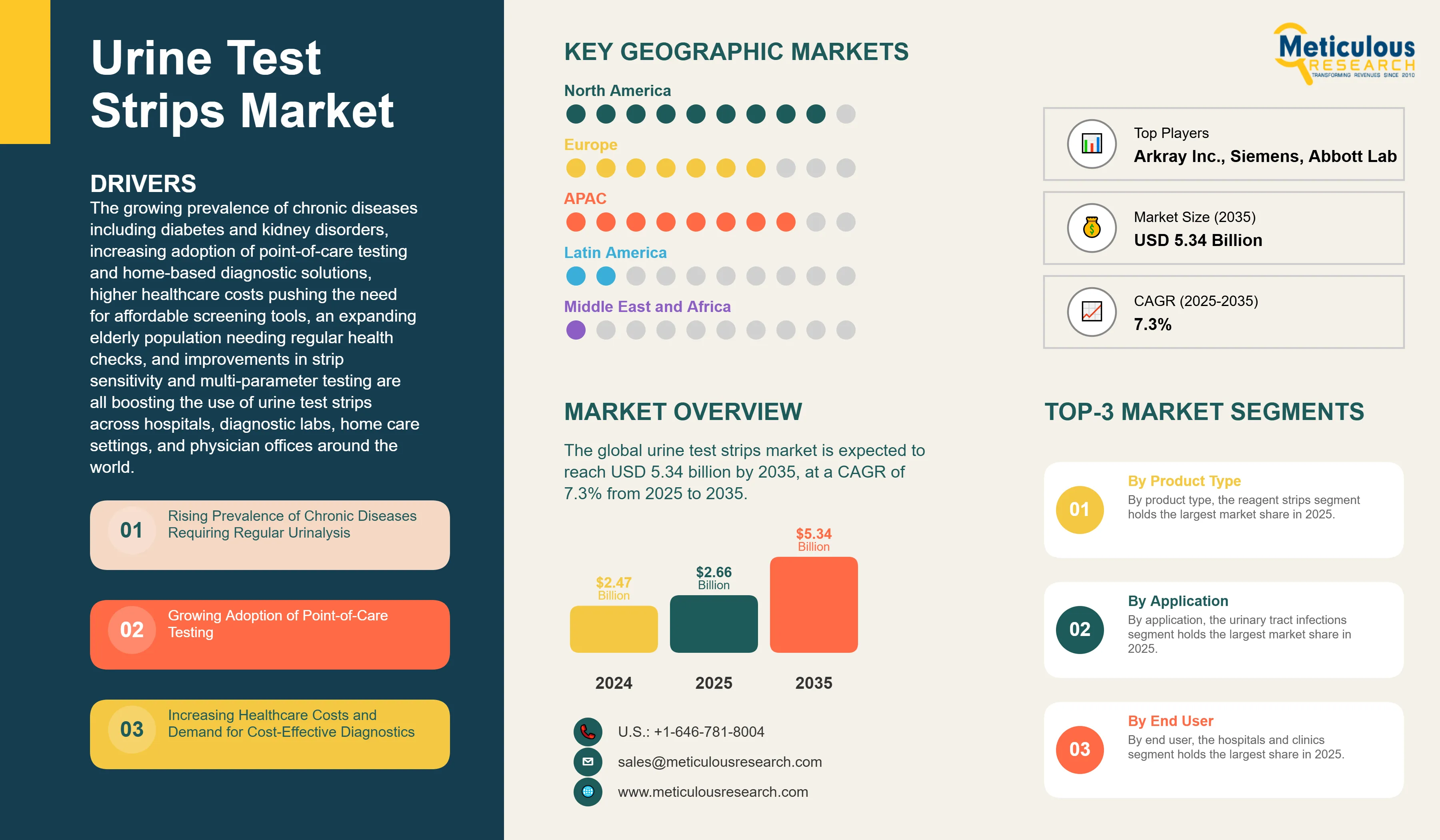

The global urine test strips market was valued at USD 2.47 billion in 2024. This market is expected to reach USD 5.34 billion by 2035 from USD 2.66 billion in 2025, at a CAGR of 7.3% from 2025 to 2035. The growing prevalence of chronic diseases including diabetes and kidney disorders, increasing adoption of point-of-care testing and home-based diagnostic solutions, higher healthcare costs pushing the need for affordable screening tools, an expanding elderly population needing regular health checks, and improvements in strip sensitivity and multi-parameter testing are all boosting the use of urine test strips across hospitals, diagnostic labs, home care settings, and physician offices around the world.

Market Highlights: Urine Test Strips

Click here to: Get Free Sample Pages of this Report

The urine test strips market includes the manufacturing, distribution, and use of diagnostic strips designed for qualitative and semi-quantitative analysis of urine samples. These strips help detect various health issues and metabolic problems. Urine test strips, also called urinalysis strips or dipsticks, are small plastic strips with several chemical reagent pads. These pads change color when they come into contact with certain substances in urine, like glucose, protein, blood, ketones, bilirubin, urobilinogen, pH, specific gravity, leukocytes, and nitrites. These tools are non-invasive and provide quick results in 60 to 120 seconds. They allow healthcare professionals and individuals to screen for urinary tract infections, diabetes, kidney disease, liver disorders, and other metabolic conditions without needing lab equipment or specialized training.

The market includes single-parameter strips that test for one specific substance, as well as multi-parameter strips that can detect 2 to 14 different parameters at once. These are available in various formats, such as individual strips, vials with multiple strips, and strips compatible with automated readers for digital results. The market is growing due to the increasing global burden of chronic diseases that need regular monitoring. There is also a rising preference for point-of-care testing, which cuts down lab turnaround times and boosts clinical decision making. The factors such as rising healthcare spending in emerging economies that improve access to diagnostic tools, aging populations with more metabolic disorders and infections, advancements in technology that enhance strip accuracy and shelf life, and a trend towards home healthcare that supports self-monitoring and proactive health management for a wide range of patients further drive the growth of this market.

What are the Key Trends in the Urine Test Strips Market?

Home-based health monitoring adoption: A major trend in the urine test strips market is the rapid growth of consumer use of home health monitoring. This shift is driven by rising health awareness, a preference for convenience, and the desire for proactive disease management without frequent visits to clinics. The easy availability of urine test strips for diabetes monitoring, urinary tract infection detection, pregnancy testing, and general wellness checks allows individuals to perform regular self-assessments and seek medical help when they notice unusual results. The COVID-19 pandemic sped up this trend by showing the benefits of remote health monitoring and decreasing unnecessary visits to healthcare facilities. Manufacturers are creating user-friendly products with simple instructions, clear color charts, and smartphone compatibility, making home testing easy for those without medical backgrounds. This trend is especially strong among diabetics who need to check their ketone and glucose levels often, women monitoring pregnancy and fertility, and older adults managing chronic conditions. Telehealth allows healthcare providers to guide home testing methods and interpret results from afar, broadening clinical care outside of traditional settings. This approach also reduces healthcare costs and encourages patients to take an active role in managing their health.

Multi-parameter testing expansion: Another key trend driving market growth is the move toward multi-parameter urine test strips. These strips provide more diagnostic information from a single test. This improves clinical efficiency and diagnostic accuracy while lowering per-test costs. Healthcare providers are increasingly choosing 10-14 parameter strips that can screen for multiple conditions at once. This approach replaces the need for separate single-parameter tests. It allows for a thorough metabolic assessment during routine check-ups, pre-surgical screenings, and chronic disease monitoring.

These advanced multi-parameter strips can detect traditional markers like glucose, protein, and blood. They also include specialized parameters such as microalbumin for early detection of diabetic nephropathy, creatinine for kidney function assessment, and specific gravity for evaluating hydration status. This trend supports preventive care and early disease detection by spotting subtle abnormalities that limited testing might miss. The cost-effectiveness of comprehensive screening compared to selective testing, along with the quick availability of results, helps healthcare facilities make immediate clinical decisions. This drives the standardization of multi-parameter strips for routine urinalysis and increases market value, even if it means lower unit volumes compared to basic testing methods.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 5.34 Billion |

|

Market Size in 2025 |

USD 2.66 Billion |

|

Market Size in 2024 |

USD 2.47 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 7.3% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Product Type, Test Type, Application, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Chronic Diseases Requiring Regular Urinalysis

A key factor driving the growth of the urine test strips market is the rising global burden of chronic diseases, including diabetes, chronic kidney disease, urinary tract infections, and liver disorders. These conditions require frequent urine testing for disease management and preventing complications. The International Diabetes Federation reports that around 537 million adults worldwide live with diabetes. This number is expected to reach 783 million by 2045, creating ongoing demand for urine glucose and ketone monitoring. These tests help detect diabetic ketoacidosis and assess glycemic control.

Chronic kidney disease affects about 10% of the global population. Early detection through urinary protein and albumin testing is vital. It helps slow disease progression and prevents end-stage renal failure that necessitates dialysis. Urinary tract infections are among the most common bacterial infections, impacting millions every year. These infections require quick diagnosis through leukocyte and nitrite detection to start appropriate antibiotic therapy.

The aging global population sees a higher incidence of these conditions. Elderly individuals often manage multiple health issues that need regular monitoring. Healthcare systems are placing greater focus on preventive care and early intervention strategies. These strategies rely on accessible, cost-effective screening tools like urine test strips to identify disease markers before symptoms worsen. The ability to conduct routine screenings in various settings, such as primary care offices, pharmacies, nursing homes, and home environments, makes urine test strips essential for managing the growing burden of chronic diseases and lowering healthcare costs linked to delayed diagnosis and disease complications.

Opportunity

Expanding Point-of-Care Testing in Emerging Markets

The rapid growth of point-of-care testing infrastructure in emerging markets across Asia-Pacific, Latin America, and Africa offers significant opportunities for the urine test strips market. Developing regions face many healthcare access challenges. These include limited lab infrastructure, a lack of trained personnel, long distances between rural populations and diagnostic facilities, and tight healthcare budgets that limit investments in expensive lab equipment.

Urine test strips help meet these challenges by offering affordable, equipment-free diagnostic options. They can be used in primary health centers, mobile clinics, pharmacies, and community health worker programs, reaching underserved populations. Economic development and a growing middle class in countries such as India, China, Brazil, Indonesia, and Nigeria are increasing spending on healthcare and expanding insurance coverage that includes basic diagnostic tests.

Government programs promoting universal healthcare and non-communicable disease screening create favorable conditions for adopting point-of-care diagnostics. The rising rates of diabetes, kidney disease, and infectious diseases in these areas, along with limited access to traditional lab services, make urine test strips essential for disease surveillance, screening programs, and chronic disease management at the community level. Manufacturers are creating cost-effective products suited for resource-limited settings, building local distribution networks, and partnering with government and non-government health organizations to increase market reach in fast-growing emerging economies, where much of the global population growth and disease burden is occurring.

Product Type Insights

Why Do Reagent Strips Dominate the Market?

The reagent strips segment holds the largest share of around 70-75% of the overall urine test strips market in 2025. This dominance is mainly due to their versatility, cost-effectiveness, and suitability for both manual visual reading and automated analyzer use in various healthcare settings.

The reagent strips come in various configurations, ranging from basic 2-parameter strips to detailed 14-parameter panels. This variety enables healthcare facilities to choose the right level of testing complexity based on their clinical needs and budget. The segment also gains from extensive clinical validation, regulatory approvals, and established reimbursement pathways in most healthcare systems.

Major manufacturers provide reagent strips in different packaging options, including single strips for point-of-care use and bulk containers for labs, catering to various end-user needs. The reliability, maturity, and cost-efficiency compared to other urinalysis methods maintain the dominance of reagent strips in global markets.

However, the dipsticks segment continues to grow steadily during the forecast period, with the rising over-the-counter market for home health testing, where simple single-purpose or basic multi-parameter strips attract non-professional users looking for easy health monitoring tools without needing to interpret complicated multi-parameter results.

Test Type Insights

How Do Multi-Parameter Strips Lead the Market?

The multi-parameter strips segment holds the largest share of the overall urine test strips market in 2025 and is also expected to grow the fastest through 2035. This growth is mainly due to their wide diagnostic ability, clinical efficiency, and cost-effectiveness when compared to performing several single-parameter tests.

These strips can test for 10 to 14 parameters at once, including glucose, protein, pH, specific gravity, blood, ketones, bilirubin, urobilinogen, nitrites, and leukocytes. They offer extensive metabolic and infection screening from a single urine sample and test. Healthcare providers prefer multi-parameter testing for routine health checks, pre-surgical assessments, emergency department evaluations, and chronic disease monitoring.

Technological advances have improved reagent stability, reduced cross-reactivity between adjacent pads, and enhanced color differentiation, making these strips more reliable for clinical decisions. The growth of this segment is further driven by increasing use in chronic disease management programs, especially for diabetes and kidney disease patients who need regular monitoring of multiple parameters to evaluate disease progression and treatment effectiveness.

Application Insights

How Do Urinary Tract Infections Drive Market Demand?

Based on application, the urinary tract infections segment holds the largest market share in 2025. UTI detection is the most common use for urine test strips due to the high rate of urinary tract infections in all age groups. This affects an estimated 150 million people worldwide each year, with women facing a significantly higher risk and recurrence.

The application includes children, pregnant women who need regular UTI screenings, older adults at greater risk of infections, catheterized patients, and otherwise healthy adults who have sudden symptoms. People with recurrent UTIs often use home test strips to tell the difference between infection recurrence and other causes of urinary symptoms. This helps them decide whether to manage their care at home or seek medical help. The segment benefits from clear clinical use, strong evidence for the accuracy of strip-based screening, and established clinical protocols that include urine strip testing in UTI diagnosis across healthcare settings globally.

The diabetes monitoring segment, however, is expected to grow at the fastest CAGR during the forecast period. Diabetes applications are growing rapidly due to the global diabetes epidemic. The prevalence is increasing rapidly in both developed and developing countries because of aging populations, obesity, inactive lifestyles, and changes in diet.

End User Insights

Why Do Hospitals and Clinics Lead the Market?

The hospitals and clinics segment holds the largest share of about 40-45% in 2025. These settings lead the market because of their high patient volumes, regular use of urinalysis in standard care, and various needs across emergency departments, inpatient wards, outpatient clinics, surgical assessments, and specialist practices. Hospitals perform millions of urinalyses each year for admission screenings, infection diagnosis, chronic disease monitoring, medication side effect checks, and pre-procedural clearances, creating a strong and steady demand for urine test strips.

The homecare settings segment is expected to grow at the fastest CAGR through 2035, mainly due to trends in consumer empowerment, preferences for convenience, cost factors, and an increasing number of chronic disease patients needing frequent monitoring that isn’t practical in clinics.

U.S. Urine Test Strips Market Size and Growth 2025 to 2035

The U.S. urine test strips market is projected to grow at a CAGR of 6.9% from 2025 to 2035.

How is North America Maintaining Dominance in the Urine Test Strips Market?

North America holds the largest share of 35-40% of the global urine test strips market in 2025. This is mainly due to its strong healthcare infrastructure, high spending on healthcare, widespread use of point-of-care testing, supportive reimbursement policies, and a significant burden of chronic diseases driving continuous demand for testing. The U.S. is home to the biggest market for urine test strips. It has extensive networks of hospitals, physician offices, urgent care facilities, and diagnostic labs conducting millions of urinalyses each year for various clinical reasons. The high rates of diabetes and obesity in North America create a strong need for metabolic screening and monitoring.

Which Factors Support the Asia Pacific Urine Test Strips Market Growth?

Asia Pacific is expected to witness the fastest growth from 2025 to 2035. This growth is mainly attributed to the increasing burden of chronic diseases, especially diabetes and kidney disease, in heavily populated countries like China, India, Indonesia, and other Southeast Asian nations moving toward non-communicable diseases. Economic development and a growing middle class in the region are improving access to healthcare, insurance coverage, and the ability to afford diagnostic services, including routine urinalysis. Government health programs in countries such as China and India are promoting diabetes screening, kidney disease detection, and infectious disease surveillance, which increases the demand for cost-effective diagnostic tools.

The large and aging population in the region drives the need for managing chronic diseases and regular health monitoring. Limited laboratory infrastructure in rural and remote areas makes urine test strips a practical diagnostic solutions that need minimal equipment and training. Rising health awareness and growing patient empowerment further boost consumer demand for home testing products. Expanding pharmacy networks and e-commerce platforms make these strips more accessible in urban and semi-urban areas.

Additionally, the growth of medical tourism in countries like Thailand, Singapore, and India also increases the utilization of healthcare facilities and the volume of diagnostic testing. Additionally, the lower baseline penetration compared to developed markets shows significant potential for growth as awareness, affordability, and access continue to improve.

Recent Developments

Segments Covered in the Report

By Product Type

By Test Type

By Application

By End User

By Region

The urine test strips market is expected to grow from USD 2.66 billion in 2025 to USD 5.34 billion by 2035.

The urine test strips market is expected to grow at a CAGR of 7.3% from 2025 to 2035.

The major players in the urine test strips market include Siemens Healthineers AG, Roche Diagnostics (F. Hoffmann-La Roche Ltd.), Abbott Laboratories, Arkray Inc., Sysmex Corporation, Quidel Corporation (QuidelOrtho Corporation), Sekisui Medical Co. Ltd., 77 Elektronika Kft., ACON Laboratories Inc., URIT Medical Electronic Co. Ltd., Changchun Dirui Medical Technology Co. Ltd., EKF Diagnostics Holdings plc, Bio-Rad Laboratories Inc., Cardinal Health Inc., YD Diagnostics Corporation, ERBA Diagnostics Inc., Helena Laboratories Corporation, Trinity Biotech plc, Teco Diagnostics, and Analyticon Biotechnologies AG among others.

The main factors driving the urine test strips market include rising prevalence of chronic diseases requiring regular urinalysis, growing adoption of point-of-care testing, increasing healthcare costs driving demand for cost-effective diagnostic tools, expanding geriatric population, technological advancements in strip sensitivity and digital integration, and growing home healthcare and self-monitoring trends.

North America region will lead the global urine test strips market during the forecast period 2025 to 2035.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, By Product Type

3.3. Market Analysis, By Test Type

3.4. Market Analysis, By Application

3.5. Market Analysis, By End User

3.6. Market Analysis, By Geography

3.7. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global Urine Test Strips Market: Impact Analysis of Market Drivers (2025–2035)

4.2.1. Rising Prevalence of Chronic Diseases Requiring Regular Urinalysis

4.2.2. Growing Adoption of Point-of-Care Testing

4.2.3. Increasing Healthcare Costs and Demand for Cost-Effective Diagnostics

4.3. Global Urine Test Strips Market: Impact Analysis of Market Restraints (2025–2035)

4.3.1. Accuracy Limitations and False Positive/Negative Results

4.3.2. Competition from Advanced Laboratory Methods

4.4. Global Urine Test Strips Market: Impact Analysis of Market Opportunities (2025–2035)

4.4.1. Expanding Point-of-Care Testing in Emerging Markets

4.4.2. Home Healthcare and Self-Monitoring Growth

4.5. Global Urine Test Strips Market: Impact Analysis of Market Challenges (2025–2035)

4.5.1. Regulatory Compliance and Quality Control Requirements

4.5.2. Price Pressure and Reimbursement Challenges

4.6. Global Urine Test Strips Market: Impact Analysis of Market Trends (2025–2035)

4.6.1. Digital Integration and Smartphone-Based Strip Readers

4.6.2. Multi-Parameter Testing Expansion

4.7. Porter's Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. The Impact of Digital Health on the Global Urine Test Strips Market

5.1. Introduction to Digital Health and Connected Diagnostics

5.2. Smartphone-Based Strip Readers and AI Analysis

5.3. Cloud-Based Data Management and Remote Monitoring

5.4. Integration with Electronic Health Records

5.5. Telemedicine and Remote Patient Monitoring Applications

5.6. Automated Urine Analyzers and Laboratory Workflow Integration

5.7. Patient Engagement and Self-Management Platforms

5.8. Impact on Market Growth and Technology Adoption

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Share/Ranking by Key Players

7. Global Urine Test Strips Market, By Product Type

7.1. Introduction

7.2. Reagent Strips

7.2.1. Automated Analyzer-Compatible Strips

7.2.2. Manual Reading Strips

7.3. Dipsticks

7.3.1. Single-Use Dipsticks

7.3.2. Multi-Use Dipsticks

8. Global Urine Test Strips Market, By Test Type

8.1. Introduction

8.2. Single Parameter Strips

8.2.1. Glucose

8.2.2. Protein

8.2.3. pH

8.2.4. Ketones

8.2.5. Blood

8.2.6. Others

8.3. Multi-Parameter Strips

9. Global Urine Test Strips Market, By Application

9.1. Introduction

9.2. Urinary Tract Infections

9.3. Diabetes Monitoring

9.4. Kidney Disease

9.5. Pregnancy and Fertility

9.6. Liver Disease

9.7. General Health Screening

9.8. Other Applications

10. Global Urine Test Strips Market, By End User

10.1. Introduction

10.2. Hospitals and Clinics

10.3. Diagnostic Laboratories

10.4. Homecare Settings

10.5. Physician Offices

10.6. Long-Term Care Facilities

10.7. Research and Academic Institutes

10.8. Others

11. Urine Test Strips Market, By Geography

11.1. Introduction

11.2. North America

11.2.1. U.S.

11.2.2. Canada

11.3. Europe

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Switzerland

11.3.7. Rest of Europe

11.4. Asia-Pacific

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. South Korea

11.4.5. Australia

11.4.6. Southeast Asia

11.4.7. Rest of Asia-Pacific

11.5. Latin America

11.5.1. Brazil

11.5.2. Mexico

11.5.3. Argentina

11.5.4. Rest of Latin America

11.6. Middle East & Africa

11.6.1. Saudi Arabia

11.6.2. UAE

11.6.3. South Africa

11.6.4. Rest of Middle East & Africa

12. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

12.1. Siemens Healthineers AG

12.2. Roche Diagnostics (F. Hoffmann-La Roche Ltd.)

12.3. Abbott Laboratories

12.4. Arkray Inc.

12.5. Sysmex Corporation

12.6. Quidel Corporation (QuidelOrtho Corporation)

12.7. Sekisui Medical Co. Ltd.

12.8. 77 Elektronika Kft.

12.9. ACON Laboratories Inc.

12.10. URIT Medical Electronic Co. Ltd.

12.11. Changchun Dirui Medical Technology Co. Ltd.

12.12. EKF Diagnostics Holdings plc

12.13. Bio-Rad Laboratories Inc.

12.14. YD Diagnostics Corporation

12.15. ERBA Diagnostics Inc.

12.16. Helena Laboratories Corporation

12.17. Trinity Biotech plc

12.18. Teco Diagnostics

12.19. Analyticon Biotechnologies AG

12.20. Others

13. Appendix

13.1. Questionnaire

13.2. Available Customization

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates