Resources

About Us

Transcriptome Sequencing Market by Product & Service (Consumables, Instruments, Software & Services), Technology (Bulk RNA-seq, Single-cell RNA-seq, Spatial Transcriptomics, Long-read RNA Sequencing), Application, and End User - Global Forecast to 2035

Report ID: MRHC - 1041675 Pages: 311 Jan-2026 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportTranscriptome Sequencing Market Size & Forecast

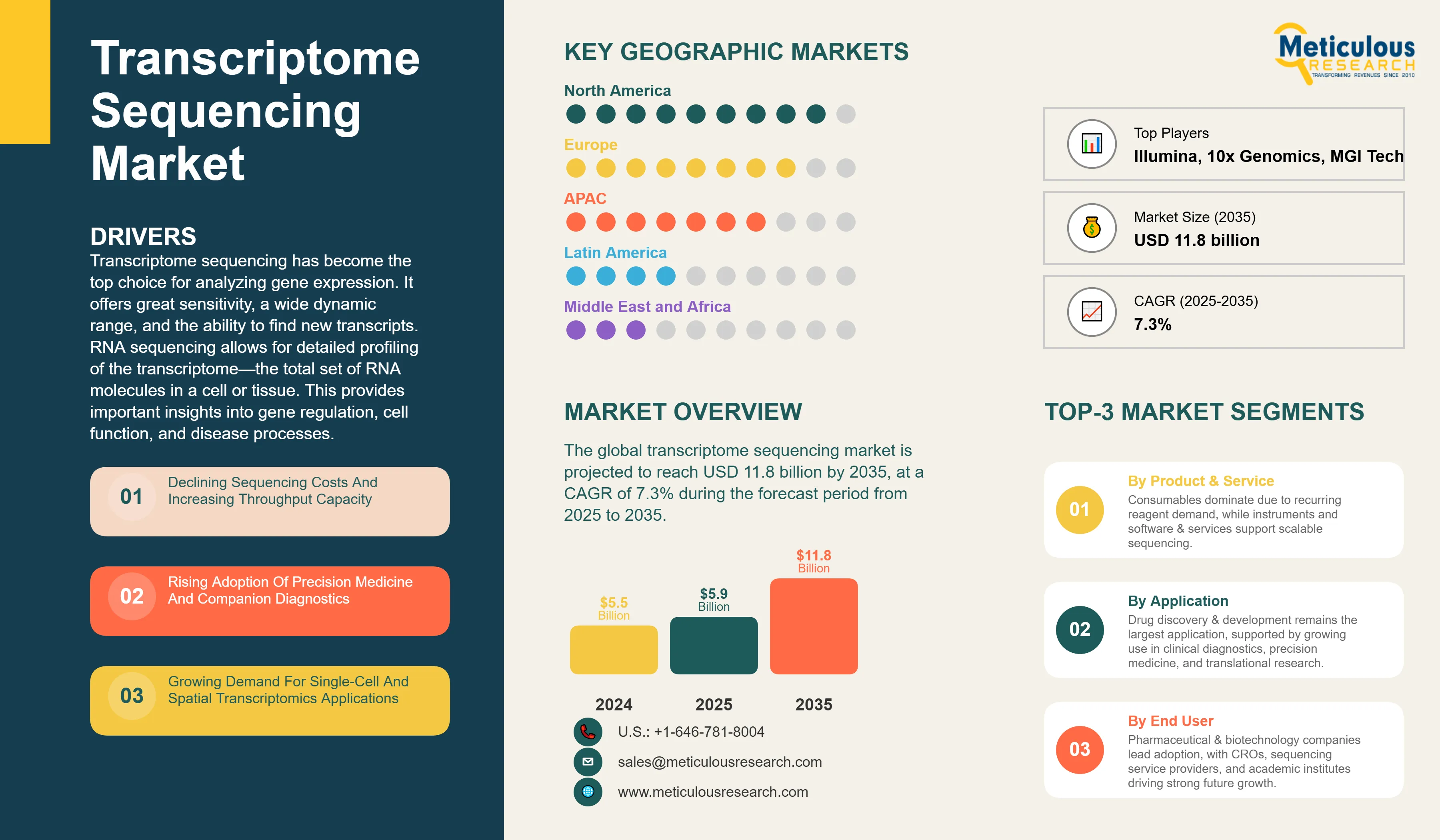

The global transcriptome sequencing market is projected to reach USD 11.8 billion by 2035 from an estimated USD 5.9 billion in 2025, at a CAGR of 7.3% during the forecast period from 2025 to 2035.

Transcriptome sequencing has become the top choice for analyzing gene expression. It offers great sensitivity, a wide dynamic range, and the ability to find new transcripts. RNA sequencing allows for detailed profiling of the transcriptome—the total set of RNA molecules in a cell or tissue. This provides important insights into gene regulation, cell function, and disease processes. Unlike older microarray technologies, modern transcriptome sequencing platforms provide whole-genome coverage, find splice variants and fusion genes, and uncover previously unknown transcripts. The technology includes various methods such as bulk RNA sequencing for looking at population-level gene expression, single-cell RNA sequencing for studying cell diversity, spatial transcriptomics for mapping gene expression in tissues, and long-read sequencing for characterizing full-length transcripts.

Key factors driving this market include falling sequencing costs and higher throughput capacity. There is a rising interest in precision medicine and companion diagnostics, along with growing demand for single-cell and spatial transcriptomics. Investment in drug discovery and biomarker development is also increasing. Sequencing costs have dropped significantly since 2008, far exceeding Moore's Law. Illumina's NovaSeq X Series targets a $200 genome, while Ultima Genomics' UG 100 Solaris, announced in February 2025, offers prices as low as $0.24 per million reads. Throughput has increased as well; Illumina reports up to 16 Tb per run on the NovaSeq X Plus and up to 26 billion single reads per flow cell. This allows for large population projects to be completed in shorter timeframes.

In August 2024, the FDA approved Illumina's TruSight Oncology Comprehensive (TSO) test. This test can profile over 500 genes, including RNA fusions like NTRK and RET. It serves as a companion diagnostic for targeted therapies, highlighting RNA sequencing's expanding role in clinical oncology. Large initiatives, like the NIH's All of Us Research Program, which has enrolled over 633,000 participants and sequenced more than 414,000 whole genomes, show how personalized medicine is progressing. In February 2025, the Chan Zuckerberg Initiative started the Billion Cells Project with 10x Genomics and Ultima Genomics. This project aims to analyze over one billion cells to develop advanced AI models for disease research.

With the rise of long-read sequencing technologies for full-length transcript analysis, the integration of AI and machine learning in transcriptome data analysis, and increasing use in clinical diagnostics and liquid biopsy, the transcriptome sequencing market is set to grow significantly. However, challenges remain. High capital investments are needed for sequencing infrastructure. The complexity of bioinformatics data analysis and interpretation, along with a shortage of skilled bioinformatics professionals and issues with standardization across sequencing platforms and workflows, could slow market growth.

Click here to: Get Free Sample Pages of this Report

Declining Sequencing Costs and Increasing Throughput Capacity

The sharp drop in sequencing costs is a major factor boosting the transcriptome sequencing market. Since 2008, sequencing costs have decreased much more quickly than Moore's Law predicted. NHGRI has tracked a steady reduction in the cost per genome across its funded centers. Illumina's NovaSeq X Series aims for a $200 genome at list price on its 25B flow cell and can process over 20,000 genomes per year on NovaSeq X Plus. Meanwhile, Ultima Genomics introduced UG 100 Solaris in February 2025. This platform offers 10 to 12 billion reads per wafer, with prices as low as $0.24 per million reads (about $80 per genome at 30×) and the capacity for over 30,000 genomes per year.

On the ultra-high-throughput side, Complete Genomics' DNBSEQ T20×2 claims it can process around 50,000 genomes per year and offers a path to reagent costs under $100 through dip immersion biochemistry and reagent reuse. Throughput has also increased, with Illumina reporting up to 16 Tb per run on NovaSeq X Plus (dual flow cell) and up to 26B single reads per flow cell. This allows for population-scale projects to be completed more quickly. Long-read platforms are also closing the price gap. PacBio Revio with SPRQ chemistry can report about 2,500 human genomes per year at just under $500 per genome. It also reduces DNA input to 500 ng while enhancing methylation calling for multiomic insights in every run. Together, these factors are speeding up transcriptome and genome programs from discovery to clinical application.

Rising Adoption of Precision Medicine and Companion Diagnostics

Precision medicine is quickly becoming essential in modern healthcare, with transcriptome sequencing playing a vital role in this change. By examining gene expression patterns, doctors can better understand disease mechanisms and choose treatments tailored to individual patients. Large initiatives such as the NIH's All of Us Research Program have already enrolled over 633,000 participants and sequenced more than 414,000 whole genomes, highlighting the rapid progress in personalized medicine.

Companion diagnostics are crucial to this shift. These tests help determine treatment options by matching patients with targeted therapies based on their molecular profiles. A significant milestone was reached in August 2024 when the FDA approved Illumina's TruSight Oncology Comprehensive (TSO) test. This panel can analyze over 500 genes, including RNA fusions like NTRK and RET, and acts as a companion diagnostic for treatments like VITRAKVI and RETEVMO. This illustrates the increasing importance of RNA sequencing in clinical oncology. Pharmaceutical companies are also incorporating companion diagnostics into their drug development processes. In 2024, QIAGEN expanded its partnership with AstraZeneca to create rapid diagnostic tools for chronic diseases using the QIAstat-Dx platform, which provides results during regular clinical visits.

Growing Demand for Single-Cell and Spatial Transcriptomics Applications

Single-cell RNA sequencing is transforming research by allowing scientists to study individual cells rather than averaging signals across thousands. This capability is critical for understanding cancer, immune disorders, and neurological diseases, where cell-to-cell differences drive treatment outcomes. In February 2025, the Chan Zuckerberg Initiative launched the Billion Cells Project with 10x Genomics and Ultima Genomics, aiming to analyze over one billion cells to build advanced AI models for disease research. New platforms like Parse Biosciences' GigaLab, which can process up to 10 million cells in a single run and scale to 2.5 billion cells annually, and CS Genetics' SimpleCell kit, enabling same-day analysis of 96 samples, are making single-cell studies faster and more accessible.

Spatial transcriptomics is gaining momentum as well. Unlike traditional sequencing, it preserves tissue architecture, showing not only which genes are active but where they are active. This is crucial for mapping tumor microenvironments, brain regions, and developmental processes. Leading platforms such as 10x Genomics' Visium HD, launched in 2024, deliver whole-transcriptome spatial analysis at near single-cell resolution, while Bruker's CosMx and GeoMx systems expanded in 2025 to include whole-transcriptome panels and 1,000-plex protein assays, pushing the boundaries of multi-modal tissue profiling.

Transcriptome Sequencing Market Opportunity

Integration of AI and Machine Learning in Transcriptome Data Analytics

Artificial intelligence is changing how we analyze transcriptome data. It makes the process faster and provides deeper insights. AI-driven tools now support every part of the workflow, from experimental design and automation to understanding complex sequencing data. Deep learning models help researchers tackle challenges in single-cell and spatial transcriptomics. They address issues like sparse data and batch effects by combining multiple data types for richer insights.

New developments are making analysis easier to access. In 2025, Nature Biotechnology featured CellWhisperer. This tool uses multimodal learning and natural language interfaces to allow scientists to query single-cell RNA sequencing data in a conversational way. This represents a significant step towards making data exploration more available to everyone. AI is also speeding up drug discovery by identifying biomarkers and predicting treatment responses. A notable example is the Illumina-NVIDIA partnership announced in May 2025. This collaboration combines Illumina's DRAGEN platform with NVIDIA's BioNeMo AI framework. It increases multiomics data processing speeds by 5 to 10 times, which greatly reduces time-to-insight for researchers and clinicians.

Transcriptome Sequencing Market Analysis: Top Market Opportunities

By Product & Service: The Consumables Segment Dominated the Transcriptome Sequencing Market in 2025

Based on product & service, the transcriptome sequencing market is segmented into consumables, instruments, and software & services. In 2025, the consumables segment accounted for the largest share of 51.4% of the transcriptome sequencing market with the fastest CAGR of 8.1% during the forecast period. The recurring nature of reagent and kit purchases required for ongoing sequencing operations, repeated usage of high-quality reagents in transcriptome studies, and expansion of sequencing applications across pharmaceutical, biotechnology, and academic research sectors contribute to the segment's large share. Key players are introducing advanced consumables to fulfill researchers' requirements. For instance, in May 2024, QIAGEN launched its QIAseq Multimodal DNA/RNA Library Kit, enabling researchers to prepare DNA and RNA libraries from a single sample.

However, the software & services segment is projected to register significant growth during the forecast period. The segment's growth is driven by increasing demand for bioinformatics expertise, AI-powered data analysis tools, and outsourced sequencing services that enable organizations without in-house capabilities to access advanced transcriptome analysis.

By Technology: The Bulk RNA-seq Segment Dominated the Transcriptome Sequencing Market in 2025

Based on technology, the transcriptome sequencing market is segmented into bulk RNA-seq, single-cell RNA-seq, spatial transcriptomics, long-read RNA sequencing, and small RNA sequencing. In 2025, the bulk RNA-seq segment accounted for the largest share of the transcriptome sequencing market. Bulk RNA-seq represents the most mature, standardized, and cost-effective transcriptomic technology available today. It has been widely adopted across academic research, pharmaceutical R&D, and clinical translational studies due to its robust workflows, reproducibility, and relatively straightforward data analysis. It enables high-throughput gene expression profiling across large sample cohorts, making it well suited for population-level studies, biomarker discovery, toxicology, and drug response analysis.

However, the spatial transcriptomics segment is the fastest-growing segment during the forecast period. The segment's fast growth is due to its ability to overcome the key limitation of traditional RNA-seq methods—loss of spatial context. Spatial transcriptomics enables researchers to measure gene expression while preserving the physical location of cells within tissues, providing critical insights into tissue heterogeneity, tumor microenvironments, neurobiology, and developmental biology.

By Application: The Drug Discovery & Development Segment Dominated the Transcriptome Sequencing Market in 2025

Based on application, the transcriptome sequencing market is segmented into drug discovery & development, clinical diagnostics, personalized medicine & companion diagnostics, basic & translational research, agricultural & veterinary research, and other applications. In 2025, the drug discovery & development segment accounted for the largest share of the transcriptome sequencing market. Pharmaceutical and biotechnology companies leverage RNA sequencing technologies extensively for target identification and validation, biomarker discovery, and toxicogenomics studies. The technology enables more precise gene expression profiling, facilitating the development of targeted therapies, particularly in oncology, neurology, and immunology.

However, the basic & translational research segment is projected to register the highest CAGR during the forecast period. This growth is driven by the rapid expansion of academic, government-funded, and collaborative research initiatives aimed at understanding disease biology at a molecular level.

By End User: The Pharmaceutical & Biotechnology Companies Segment Dominated the Transcriptome Sequencing Market in 2025

Based on end user, the transcriptome sequencing market is segmented into pharmaceutical & biotechnology companies, academic & research institutes, clinical diagnostic laboratories, contract research organizations (CROs) & sequencing service providers, and other end users. In 2025, the pharmaceutical & biotechnology companies segment accounted for the largest share of 34% of the transcriptome sequencing market. Transcriptomic data has become a strategic asset across the entire drug development lifecycle. These companies use RNA sequencing extensively for target discovery, biomarker identification, patient stratification, mechanism-of-action studies, toxicity profiling, and response monitoring.

However, the contract research organizations (CROs) & sequencing service providers segment is projected to register the highest CAGR of 8.9% during the forecast period due to the industry-wide shift toward outsourcing and flexible R&D models.

North America Dominated the Transcriptome Sequencing Market in 2025

Based on geography, the transcriptome sequencing market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America accounted for the largest share of 40% of the transcriptome sequencing market. North America's large share is attributed to its early adoption of advanced genomic technologies, strong life sciences ecosystem, and sustained investment in biomedical research. The region is home to a high concentration of pharmaceutical and biotechnology companies, leading academic institutions, and major sequencing technology providers, which collectively drive large-scale and continuous demand for transcriptome sequencing. Robust public and private research funding, particularly in the U.S., supports extensive use of RNA sequencing across drug discovery, clinical research, and translational studies.

However, the Asia-Pacific region is projected to register the highest CAGR during the forecast period. This growth is driven by rapid expansion of genomics infrastructure, research capacity, and healthcare investment across countries such as China, India, Japan, South Korea, and Australia. Governments in the region are increasingly funding national genomics initiatives, precision medicine programs, and population-scale research projects, which are significantly boosting adoption of transcriptome sequencing technologies.

Key Companies

Some of the prominent players operating in the transcriptome sequencing market are Illumina, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Pacific Biosciences of California, Inc. (U.S.), Oxford Nanopore Technologies plc (U.K.), 10x Genomics, Inc. (U.S.), QIAGEN N.V. (Netherlands), Agilent Technologies, Inc. (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Bio-Rad Laboratories, Inc. (U.S.), Takara Bio Inc. (Japan), Becton, Dickinson and Company (U.S.), Standard BioTools Inc. (U.S.), Element Biosciences, Inc. (U.S.), MGI Tech Co., Ltd. (China), and Singular Genomics Systems, Inc. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

311 |

|

Format |

|

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

7.3% |

|

Market Size (Value) in 2025 |

USD 5.9 Billion |

|

Market Size (Value) in 2035 |

USD 11.8 Billion |

|

Segments Covered |

By Product & Service

By Technology

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa |

|

Key Companies |

Illumina, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Pacific Biosciences of California, Inc. (U.S.), Oxford Nanopore Technologies plc (U.K.), 10x Genomics, Inc. (U.S.), QIAGEN N.V. (Netherlands), Agilent Technologies, Inc. (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Bio-Rad Laboratories, Inc. (U.S.), Takara Bio Inc. (Japan), Becton, Dickinson and Company (U.S.), Standard BioTools Inc. (U.S.), Element Biosciences, Inc. (U.S.), MGI Tech Co., Ltd. (China), and Singular Genomics Systems, Inc. (U.S.) |

The global transcriptome sequencing market size is projected to reach USD 5.9 billion in 2025.

The market is projected to grow from USD 5.9 billion in 2025 to USD 11.8 billion by 2035, at a CAGR of 7.3%.

The transcriptome sequencing market analysis indicates substantial growth, with projections indicating the market will reach USD 11.8 million by 2035, at a compound annual growth rate (CAGR) of 7.3% from 2025 to 2035.

The key companies operating in this market include Illumina, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Pacific Biosciences of California, Inc. (U.S.), Oxford Nanopore Technologies plc (U.K.), 10x Genomics, Inc. (U.S.), QIAGEN N.V. (Netherlands), Agilent Technologies, Inc. (U.S.), and others.

Single-cell RNA sequencing revolutionizing cellular heterogeneity research, spatial transcriptomics enabling tissue-level gene expression mapping, and multi-omics integration combining transcriptomics with proteomics and metabolomics are prominent trends in the transcriptome sequencing market.

By product & service, the consumables segment is forecasted to hold the largest market share during 2025-2035; by technology, the bulk RNA-seq segment is expected to dominate; by application, the drug discovery & development segment is expected to hold the largest share; by end user, the pharmaceutical & biotechnology companies segment is expected to dominate; and by geography, North America is expected to hold the largest share of the market during 2025-2035.

By region, North America held the largest share of the transcriptome sequencing market in 2025. The large share is attributed to early adoption of advanced genomic technologies, strong life sciences ecosystem, and sustained investment in biomedical research. However, Asia-Pacific is expected to register the highest growth rate during the forecast period, driven by rapid expansion of genomics infrastructure and increasing government funding for precision medicine programs.

Key drivers include declining sequencing costs and increasing throughput capacity, rising adoption of precision medicine and companion diagnostics, growing demand for single-cell and spatial transcriptomics applications, and increasing investment in drug discovery and biomarker development programs. These factors are collectively driving the adoption of transcriptome sequencing across applications.

1. Introduction

1.1. Market Definition

1.2. Currency & Limitations

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions For The Study

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Drivers

4.2.1. Declining Sequencing Costs And Increasing Throughput Capacity

4.2.2. Rising Adoption Of Precision Medicine And Companion Diagnostics

4.2.3. Growing Demand For Single-Cell And Spatial Transcriptomics Applications

4.2.4. Increasing Investment In Drug Discovery And Biomarker Development Programs

4.3. Restraints

4.3.1. High Capital Investment For Sequencing Infrastructure

4.3.2. Complexity Of Bioinformatics Data Analysis And Interpretation

4.4. Opportunities

4.4.1. Expansion Of Long-Read Sequencing Technologies For Full-Length Transcript Analysis

4.4.2. Integration Of Ai And Machine Learning In Transcriptome Data Analytics

4.4.3. Growing Application In Clinical Diagnostics And Liquid Biopsy

4.5. Challenges

4.5.1. Shortage Of Skilled Bioinformatics Professionals

4.5.2. Standardization Issues Across Sequencing Platforms And Workflows

4.6. Trends

4.6.1. Single-Cell Rna Sequencing Revolutionizing Cellular Heterogeneity Research

4.6.2. Spatial Transcriptomics Enabling Tissue-Level Gene Expression Mapping

4.6.3. Multi-Omics Integration Combining Transcriptomics With Proteomics And Metabolomics

4.7. Supply Chain Analysis

5. Global Transcriptome Sequencing Market, By Product & Service

5.1. Overview

5.2. Consumables

5.2.1. Library Preparation Kits

5.2.2. Sequencing Reagents & Flow Cells

5.2.3. Sample Preparation Kits (Rna Extraction & Purification)

5.2.4. Other Consumables

5.3. Instruments

5.3.1. Short-Read Sequencing Platforms

5.3.2. Long-Read Sequencing Platforms

5.3.3. Single-Cell Sequencing Systems

5.4. Software & Services

5.4.1. Bioinformatics Software & Data Analysis Tools

5.4.2. Sequencing Services

6. Global Transcriptome Sequencing Market, By Technology

6.1. Overview

6.2. Bulk Rna-Seq

6.3. Single-Cell Rna-Seq

6.3.1. Droplet-Based Microfluidics

6.3.2. Plate-Based Methods

6.3.3. Combinatorial Indexing

6.4. Spatial Transcriptomics

6.5. Long-Read Rna Sequencing

6.5.1. Single-Molecule Real-Time (Smrt) Sequencing

6.5.2. Nanopore Sequencing

6.6. Small Rna Sequencing

7. Global Transcriptome Sequencing Market, By Application

7.1. Overview

7.2. Drug Discovery & Development

7.2.1. Target Identification & Validation

7.2.2. Biomarker Discovery

7.2.3. Toxicogenomics

7.3. Clinical Diagnostics

7.3.1. Oncology (Tumor Profiling & Liquid Biopsy)

7.3.2. Rare & Genetic Diseases

7.3.3. Infectious Diseases

7.4. Personalized Medicine & Companion Diagnostics

7.5. Basic & Translational Research

7.6. Agricultural & Veterinary Research

7.7. Other Applications

8. Global Transcriptome Sequencing Market, By End User

8.1. Overview

8.2. Pharmaceutical & Biotechnology Companies

8.3. Academic & Research Institutes

8.4. Clinical Diagnostic Laboratories

8.5. Contract Research Organizations (Cros) & Sequencing Service Providers

8.6. Other End Users

9. Transcriptome Sequencing Market Assessment, By Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Italy

9.3.5. Switzerland

9.3.6. Spain

9.3.7. Belgium

9.3.8. Rest Of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. Australia

9.4.5. Rest Of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest Of Latin America

9.6. Middle East & Africa

9.6.1. Saudi Arabia

9.6.2. UAE

9.6.3. South Africa

9.6.4. Rest Of Middle East & Africa

10. Competitive Landscape

10.1. Introduction

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

11. Company Profiles

11.1. Illumina, Inc. (U.S.)

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Product Portfolio

11.1.4. Strategic Developments

11.2. Thermo Fisher Scientific, Inc.

11.2.1. Company Overview

11.2.2. Financial Overview

11.2.3. Product Portfolio

11.2.4. Strategic Developments

11.3. Pacific Biosciences Of California, Inc.

11.3.1. Company Overview

11.3.2. Financial Overview

11.3.3. Product Portfolio

11.3.4. Strategic Developments

11.4. Oxford Nanopore Technologies Ltd.

11.4.1. Company Overview

11.4.2. Product Portfolio

11.4.3. Strategic Developments

11.5. 10x Genomics, Inc.

11.5.1. Company Overview

11.5.2. Financial Overview

11.5.3. Product Portfolio

11.5.4. Strategic Developments

11.6. Qiagen N.V.

11.6.1. Company Overview

11.6.2. Financial Overview

11.6.3. Product Portfolio

11.6.4. Strategic Developments

11.7. Agilent Technologies, Inc.

11.7.1. Company Overview

11.7.2. Financial Overview

11.7.3. Product Portfolio

11.7.4. Strategic Developments

11.8. F. Hoffmann-La Roche Ltd. (U.S.)

11.8.1. Company Overview

11.8.2. Financial Overview

11.8.3. Product Portfolio

11.8.4. Strategic Developments

11.9. Bio-Rad Laboratories, Inc.

11.9.1. Company Overview

11.9.2. Financial Overview

11.9.3. Product Portfolio

11.9.4. Strategic Developments

11.10. Takara Bio Inc. (U.S.)

11.10.1. Company Overview

11.10.2. Product Portfolio

11.10.3. Strategic Developments

11.11. Becton, Dickinson And Company (U.S.)

11.11.1. Company Overview

11.11.2. Financial Overview

11.11.3. Product Portfolio

11.11.4. Strategic Developments

11.12. Standard Biotools Inc. (U.S.)

11.12.1. Company Overview

11.12.2. Financial Overview

11.12.3. Product Portfolio

11.12.4. Strategic Developments

11.13. Element Biosciences, Inc. (U.S.)

11.13.1. Company Overview

11.13.2. Product Portfolio

11.13.3. Strategic Developments

11.14. Mgi Tech Co., Ltd. (China)

11.14.1. Company Overview

11.14.2. Financial Overview

11.14.3. Product Portfolio

11.14.4. Strategic Developments

11.15. Singular Genomics Systems, Inc. (U.S.)

11.15.1. Company Overview

11.15.2. Product Portfolio

11.15.3. Strategic Developments

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Table

Table 1 Global Transcriptome Sequencing Market, By Product & Service, 2025-2035 (USD Million)

Table 2 Global Transcriptome Sequencing Consumables Market, By Type, 2025–2035 (USD Million)

Table 3 Global Transcriptome Sequencing Consumables Market, By Country/Region, 2023-2035 (USD Million)

Table 4 Global Transcriptome Sequencing Library Preparation Kits Market, By Country/Region, 2023-2035 (USD Million)

Table 5 Global Transcriptome Sequencing Sequencing Reagents and Flow Cells Market, By Country/Region, 2023-2035 (USD Million)

Table 6 Global Transcriptome Sequencing Sample Preparation Kits Market, By Country/Region, 2023-2035 (USD Million)

Table 7 Global Transcriptome Sequencing Other Consumables Market, By Country/Region, 2023-2035 (USD Million)

Table 8 Global Transcriptome Sequencing Instruments Market, By Type, 2025–2035 (USD Million)

Table 9 Global Transcriptome Sequencing Instruments Market, By Country/Region, 2023-2035 (USD Million)

Table 10 Global Transcriptome Short-Read Sequencing Platforms Market, By Country/Region, 2023-2035 (USD Million)

Table 11 Global Transcriptome Long-Read Sequencing Platforms Market, By Country/Region, 2023-2035 (USD Million)

Table 12 Global Transcriptome Single-Cell Sequencing Platforms Market, By Country/Region, 2023-2035 (USD Million)

Table 13 Global Transcriptome Sequencing Software & Services Market, By Type, 2025–2035 (USD Million)

Table 14 Global Transcriptome Sequencing Software & Services Market, By Country/Region, 2023-2035 (USD Million)

Table 15 Global Transcriptome Bioinformatics Software & Data Analysis Tools Market, By Country/Region, 2023-2035 (USD Million)

Table 16 Global Transcriptome Sequencing Services Market, By Country/Region, 2023-2035 (USD Million)

Table 17 Global Transcriptome Sequencing Market, By Technology, 2025-2035 (USD Million)

Table 18 Global Transcriptome Rna-Seq Market, By Country/Region, 2023-2035 (USD Million)

Table 19 Global Transcriptome Single-Cell Rna-Seq Market, By Type, 2025-2035 (USD Million)

Table 20 Global Transcriptome Single-Cell Rna-Seq Market, By Country/Region, 2023-2035 (USD Million)

Table 21 Global Transcriptome Droplet-Based Microfluidics Market, By Country/Region, 2023-2035 (USD Million)

Table 22 Global Transcriptome Plate-Based Methods Market, By Country/Region, 2023-2035 (USD Million)

Table 23 Global Transcriptome Combinatorial Indexing Market, By Country/Region, 2023-2035 (USD Million)

Table 24 Global Transcriptome Spatial Transcriptomics Market, By Country/Region, 2023-2035 (USD Million)

Table 25 Global Transcriptome Long-Read Rna Sequencing Market, By Type, 2025-2035 (USD Million)

Table 26 Global Transcriptome Long-Read Rna Sequencing Market, By Country/Region, 2023-2035 (USD Million)

Table 27 Global Transcriptome Smrt Sequencing Market, By Country/Region, 2023-2035 (USD Million)

Table 28 Global Transcriptome Nanopore Sequencing Market, By Country/Region, 2023-2035 (USD Million)

Table 29 Global Transcriptome Small Rna Sequencing Market, By Country/Region, 2023-2035 (USD Million)

Table 30 Global Transcriptome Sequencing Market, By Application, 2025–2035 (USD Million)

Table 31 Global Transcriptome Sequencing Market for Drug Discovery and Development, By Type, 2025-2035 (USD Million)

Table 32 Global Transcriptome Sequencing Market for Drug Discovery and Development, By Country/Region, 2023-2035 (USD Million)

Table 33 Global Transcriptome Sequencing Market for Target Identification & Validation, By Country/Region, 2023-2035 (USD Million)

Table 34 Global Transcriptome Sequencing Market for Biomarker Discovery, By Country/Region, 2023-2035 (USD Million)

Table 35 Global Transcriptome Sequencing Market for Toxicogenomics, By Country/Region, 2023-2035 (USD Million)

Table 36 Global Transcriptome Sequencing Market for Clinical Diagnostics, By Country/Region, 2023-2035 (USD Million)

Table 37 Global Transcriptome Sequencing Market for Oncology, By Country/Region, 2023-2035 (USD Million)

Table 38 Global Transcriptome Sequencing Market for Rare & Genetic Diseases T, By Country/Region, 2023-2035 (USD Million)

Table 39 Global Transcriptome Sequencing Market for Infectious Diseases, By Country/Region, 2023-2035 (USD Million)

Table 40 Global Transcriptome Sequencing Market for Personalized Medicine and Companion Diagnostics, By Country/Region, 2023-2035 (USD Million)

Table 41 Global Transcriptome Sequencing Market for Basic and Translational Research, By Country/Region, 2023-2035 (USD Million)

Table 42 Global Transcriptome Sequencing Market for Agricultural and Veterinary Research, By Country/Region, 2023-2035 (USD Million)

Table 43 Global Transcriptome Sequencing Market for Other Applications, By Country/Region, 2023-2035 (USD Million)

Table 44 Global Transcriptome Sequencing Market, By End User, 2025–2035 (USD Million)

Table 45 Global Transcriptome Sequencing Market for Pharmaceutical and Biotechnology Companies, By Country/Region, 2023-2035 (USD Million)

Table 46 Global Transcriptome Sequencing Market for Academic and Research Institutes, By Country/Region, 2023-2035 (USD Million)

Table 47 Global Transcriptome Sequencing Market for Clinical Diagnostic Laboratories, By Country/Region, 2023-2035 (USD Million)

Table 48 Global Transcriptome Sequencing Market for Contract Research Organizations (Cros) And Sequencing Service Providers, By Country/Region, 2023-2035 (USD Million)

Table 49 Global Transcriptome Sequencing Market for Other End Users, By Country/Region, 2023-2035 (USD Million)

Table 50 North America: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 51 North America: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 52 North America: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 53 North America: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 54 North America: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 55 North America: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 56 North America: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 57 North America: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 58 North America: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 59 North America: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 60 North America: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 61 North America: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 62 U.S.: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 63 U.S.: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 64 U.S.: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 65 U.S.: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 66 U.S.: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 67 U.S.: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 68 U.S.: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million

Table 69 U.S.: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 70 U.S.: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 71 U.S.: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 72 U.S.: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 73 Canada: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 74 Canada: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 75 Canada: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 76 Canada: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 77 Canada: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 78 Canada: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 79 Canada: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 80 Canada: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 81 Canada: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 82 Canada: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 83 Canada: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 84 Europe: Transcriptome Sequencing Market, By Country, 2023–2035 (USD Million)

Table 85 Europe: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 86 Europe: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 87 Europe: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 88 Europe: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 89 Europe: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 90 Europe: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 91 Europe: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 92 Europe: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 93 Europe: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 94 Europe: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 95 Europe: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 96 Germany: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 97 Germany: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 98 Germany: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 99 Germany: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 100 Germany: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 101 Germany: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 102 Germany: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 103 Germany: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 104 Germany: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 105 Germany: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 106 Germany: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 107 U.K.: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 108 U.K.: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 109 U.K.: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 110 U.K.: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 111 U.K.: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 112 U.K.: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 113 U.K.: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 114 U.K.: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 115 U.K.: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 116 U.K.: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 117 U.K.: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 118 France: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 119 France: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 120 France: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 121 France: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 122 France: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 123 France: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 124 France: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 125 France: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 126 France: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 127 France: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 128 France: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 129 Italy: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 130 Italy: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 131 Italy: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 132 Italy: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 133 Italy: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 134 Italy: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 135 Italy: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 136 Italy: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 137 Italy: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 138 Italy: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 139 Italy: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 140 Switzerland: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 141 Switzerland: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 142 Switzerland: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 143 Switzerland: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 144 Switzerland: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 145 Switzerland: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 146 Switzerland: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 147 Switzerland: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 148 Switzerland: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 149 Switzerland: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 150 Switzerland: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 151 Spain: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 152 Spain: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 153 Spain: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 154 Spain: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 155 Spain: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 156 Spain: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 157 Spain: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 158 Spain: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 159 Spain: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 160 Spain: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 161 Spain: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 162 Belgium: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 163 Belgium: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 164 Belgium: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 165 Belgium: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 166 Belgium: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 167 Belgium: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 168 Belgium: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 169 Belgium: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 170 Belgium: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 171 Belgium: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 172 Belgium: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 173 Rest of Europe: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 174 Rest of Europe: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 175 Rest of Europe: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 176 Rest of Europe: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 177 Rest of Europe: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 178 Rest of Europe: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 179 Rest of Europe: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 180 Rest of Europe: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 181 Rest of Europe: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 182 Rest of Europe: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 183 Rest of Europe: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 184 Asia-Pacific: Transcriptome Sequencing Market, By Country, 2023–2035 (USD Million)

Table 185 Asia-Pacific: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 186 Asia-Pacific: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 187 Asia-Pacific: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 188 Asia-Pacific: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 189 Asia-Pacific: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 190 Asia-Pacific: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 191 Asia-Pacific: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 192 Asia-Pacific: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 193 Asia-Pacific: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 194 Asia-Pacific: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 195 Asia-Pacific: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 196 China: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 197 China: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 198 China: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 199 China: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 200 China: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 201 China: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 202 China: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 203 China: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 204 China: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 205 China: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 206 China: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 207 Japan: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 208 Japan: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 209 Japan: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 210 Japan: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 211 Japan: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 212 Japan: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 213 Japan: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 214 Japan: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 215 Japan: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 216 Japan: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 217 Japan: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 218 India: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 219 India: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 220 India: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 221 India: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 222 India: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 223 India: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 224 India: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 225 India: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 226 India: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 227 India: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 228 India: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 229 Australia: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 230 Australia: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 231 Australia: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 232 Australia: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 233 Australia: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 234 Australia: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 235 Australia: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 236 Australia: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 237 Australia: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 238 Australia: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 239 Australia: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 240 Rest Of Asia-Pacific: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 241 Rest of Asia-Pacific: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 242 Rest of Asia-Pacific: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 243 Rest of Asia-Pacific: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 244 Rest of Asia-Pacific: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 245 Rest of Asia-Pacific: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 246 Rest of Asia-Pacific: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 247 Rest of Asia-Pacific: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 248 Rest of Asia-Pacific: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 249 Rest of Asia-Pacific: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 250 Rest of Asia-Pacific: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 251 Latin America: Transcriptome Sequencing Market, By Country, 2023–2035 (USD Million)

Table 252 Latin America: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 253 Latin America: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 254 Latin America: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 255 Latin America: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 256 Latin America: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 257 Latin America: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 258 Latin America: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 259 Latin America: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 260 Latin America: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 261 Latin America: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 262 Latin America: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 263 Brazil: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 264 Brazil: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 265 Brazil: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 266 Brazil: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 267 Brazil: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 268 Brazil: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 269 Brazil: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 270 Brazil: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 271 Brazil: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 272 Brazil: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 273 Brazil: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 274 Mexico: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 275 Mexico: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 276 Mexico: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 277 Mexico: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 278 Mexico: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 279 Mexico: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 280 Mexico: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 281 Mexico: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 282 Mexico: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 283 Mexico: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 284 Mexico: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 285 Rest of Latin America: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 286 Rest of Latin America: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 287 Rest of Latin America: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 288 Rest of Latin America: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 289 Rest of Latin America: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 290 Rest of Latin America: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 291 Rest of Latin America: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 292 Rest of Latin America: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 293 Rest of Latin America: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 294 Rest of Latin America: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 295 Rest of Latin America: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 296 Middle East & Africa: Transcriptome Sequencing Market, By Country, 2023–2035 (USD Million)

Table 297 Middle East & Africa: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 298 Middle East & Africa: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 299 Middle East & Africa: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 300 Middle East & Africa: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 301 Middle East & Africa: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 302 Middle East & Africa: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 303 Middle East & Africa: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 304 Middle East & Africa: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 305 Middle East & Africa: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 306 Middle East & Africa: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 307 Middle East & Africa: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 308 Saudi Arabia: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 309 Saudi Arabia: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 310 Saudi Arabia: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 311 Saudi Arabia: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 312 Saudi Arabia: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 313 Saudi Arabia: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 314 Saudi Arabia: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 315 Saudi Arabia: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 316 Saudi Arabia: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 317 Saudi Arabia: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 318 Saudi Arabia: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 319 UAE: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 320 UAE: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 321 UAE: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 322 UAE: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 323 UAE: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 324 UAE: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 325 UAE: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 326 UAE: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 327 UAE: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 328 UAE: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 329 UAE: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 330 South Africa: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 331 South Africa: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 332 South Africa: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 333 South Africa: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 334 South Africa: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 335 South Africa: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 336 South Africa: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 337 South Africa: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 338 South Africa: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 339 South Africa: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 340 South Africa: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 341 Rest of Middle East & Africa: Transcriptome Sequencing Market, By Product and Services, 2023-2035 (USD Million)

Table 342 Rest of Middle East & Africa: Transcriptome Sequencing Consumables Market, By Type, 2023-2035 (USD Million)

Table 343 Rest of Middle East & Africa: Transcriptome Sequencing Software and Services Market, By Type, 2023-2035 (USD Million)

Table 344 Rest of Middle East & Africa: Transcriptome Sequencing Instruments Market, By Type, 2023-2035 (USD Million)

Table 345 Rest of Middle East & Africa: Transcriptome Sequencing Market, By Technology, 2023-2035 (USD Million)

Table 346 Rest of Middle East & Africa: Single-Cell Rna-Seq Technology Market, By Type, 2023-2035 (USD Million)

Table 347 Rest of Middle East & Africa: Long-Read Rna Sequencing Technology Market, By Type, 2023-2035 (USD Million)

Table 348 Rest of Middle East & Africa: Transcriptome Sequencing Market, By Application, 2023-2035 (USD Million)

Table 349 Rest of Middle East & Africa: Transcriptome Sequencing Market for Drug Discovery & Development, By Type, 2023-2035 (USD Million)

Table 350 Rest of Middle East & Africa: Transcriptome Sequencing Market for Clinical Diagnostics Application, By Type, 2023-2035 (USD Million)

Table 351 Rest of Middle East & Africa: Transcriptomics Market, By End User, 2023-2035 (USD Million)

Table 352 Recent Developments, By Company, 2023-2025

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 Global Transcriptome Sequencing Market, By Product and Service, 2025 Vs. 2035 (USD Million)

Figure 8 Global Transcriptome Sequencing Market, By Technology 2025 Vs. 2035 (USD Million)

Figure 9 Global Transcriptome Sequencing Market, By Application, 2025 Vs. 2035 (USD Million)

Figure 10 Global Transcriptome Sequencing Market, By End User, 2025 Vs. 2035 (USD Million)

Figure 11 Transcriptome Sequencing Market, By Geography, 2025 Vs. 2035 (USD Million)

Figure 12 Factors Affecting Market Growth

Figure 13 Global Transcriptome Sequencing Market, By Product & Service, 2025 Vs. 2035 (USD Million)

Figure 14 Global Transcriptome Sequencing Market, By Technology, 2025 Vs. 2035 (USD Million)

Figure 15 Global Transcriptome Sequencing Market, By Application, 2025 Vs. 2035 (USD Million)

Figure 16 Global Transcriptome Sequencing Market, By End User, 2025 Vs. 2035 (USD Million)

Figure 17 Global Transcriptome Sequencing Market, By Region, 2025 Vs. 2035 (USD Million)

Figure 18 North America: Transcripgtome Sequencing Market Snapshot

Figure 19 Europe: Transcriptome Sequencing Market Snapshot

Figure 20 Asia-Pacific: Transcripgtome Sequencing Market Snapshot

Figure 21 Latin America: Transcripgtome Sequencing Market Snapshot

Figure 22 Middle East & Africa: Transcripgtome Sequencing Market Snapshot

Figure 23 Key Growth Strategies Adopted by Leading Players, 2023-2025

Figure 24 Transcriptomics Sequncing: Competitive Benchmarking, By Region

Figure 25 Competitive Dashboard: Transcriptome Sequencing Market

Figure 26 Illumina Inc.: Financial Overview (2024)

Figure 27 Thermo Fisher Scientific, Inc.: Financial Overview (2024)

Figure 28 Pacific Biosciences of California, Inc.: Financial Overview (2024)

Figure 29 Oxford Nanopore Technologies Ltd.: Financial Overview (2024)

Figure 30 10x Genomics, Inc: Financial Overview (2024)

Figure 31 Qiagen N.V.: Financial Overview (2024)

Figure 32 Agilent Technologies Inc.: Financial Overview (2024)

Figure 33 F. Hoffmann-La Roche Ltd.: Financial Overview (2024)

Figure 34 Bio-Rad Laboratories Inc.: Financial Overview (2024)

Figure 35 Takara Bio Inc.: Financial Overview (2024)

Figure 36 Becton, Dickinson and Company: Financial Overview (2024)

Figure 37 Standard Biotools Inc: Financial Overview (2024)

Figure 38 Mgi Tech Co., Ltd.: Financial Overview (2024)

Published Date: Jun-2025

Published Date: Aug-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates