Resources

About Us

Sunscreen Market by Product Type (Chemical, Physical/Mineral, Hybrid), SPF Range (Low, Medium, High, Very High), Form (Creams & Lotions, Sprays, Gels, Sticks, Powders), Distribution Channel, End User & Geography – Global Forecast to 2035

Report ID: MRCHM - 1041490 Pages: 212 May-2025 Formats*: PDF Category: Chemicals and Materials Delivery: 24 to 72 Hours Download Free Sample ReportThis report analyzes the global sunscreen market dynamics, evaluating how manufacturers are addressing evolving consumer preferences, skin health concerns, and sustainability requirements across diverse regions. The report provides a strategic analysis of market dynamics, growth projections until 2035, and competitive positioning across global and regional/country-level markets, with special emphasis on technological innovations, formulation advancements, and changing distribution models. The study offers deep insights into emerging market opportunities, regulatory landscapes, consumer demographics, and product segmentation across major geographic regions.

Key Market Drivers & Trends and Insights

Click here to: Get Free Sample Pages of this Report

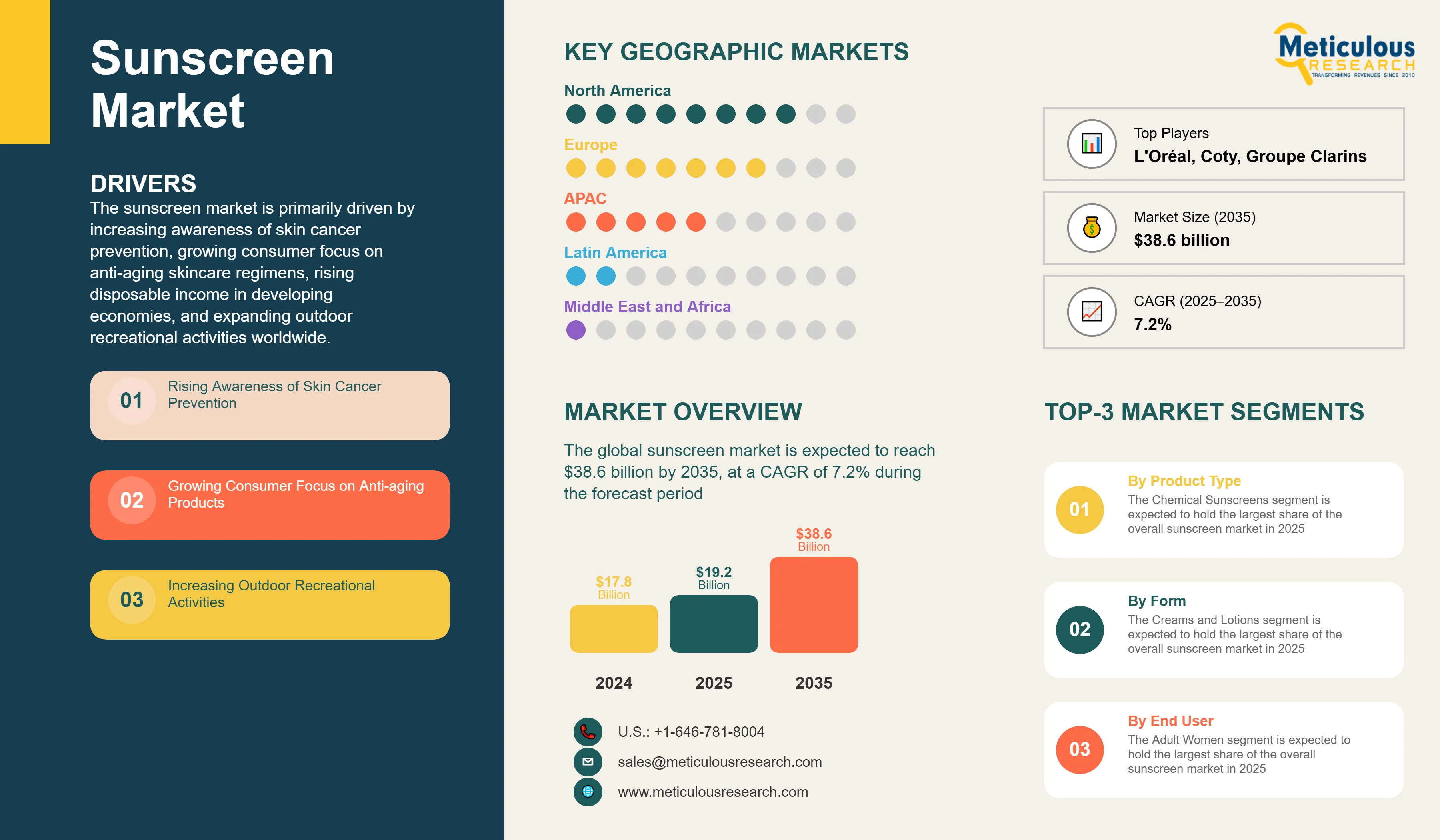

The sunscreen market is primarily driven by increasing awareness of skin cancer prevention, growing consumer focus on anti-aging skincare regimens, rising disposable income in developing economies, and expanding outdoor recreational activities worldwide. Significant shifts toward clean beauty and mineral-based formulations are reshaping industry standards, while multi-functional sun protection products that combine SPF with skincare benefits are gaining substantial traction. Additionally, integration of sunscreen into daily skincare routines, advancements in reef-safe and eco-friendly formulations, and innovations in texture and application methods are further accelerating market growth, especially in North America and Asia-Pacific regions where skin health consciousness is rapidly increasing.

Key Challenges

While the sunscreen market demonstrates robust growth potential, it faces several critical challenges including health concerns over traditional chemical ingredients, particularly as consumer awareness of ingredient safety increases. Stringent and varying regulatory standards across regions create significant compliance hurdles for global manufacturers. Premium pricing of high-quality products limits market penetration in price-sensitive regions, while sustainability challenges in packaging and formulation require substantial R&D investment. Additionally, persistent consumer confusion over SPF ratings and proper application techniques, limited product options addressing diverse skin types and tones, and fragmented distribution networks in emerging economies potentially impede market growth and create adoption barriers across different demographics.

Growth Opportunities

The sunscreen market presents numerous high-growth opportunities across multiple segments. The rapidly expanding demand for natural and organic formulations is driving significant innovation in plant-based UV filters and eco-certified ingredients. Another major opportunity lies in the development of multi-functional sun protection products that combine UV protection with anti-aging, pollution defense, and blue light protection benefits. Additionally, targeted products for specific demographics (men's sunscreen, products for melanin-rich skin) and expansion in emerging markets with rising skin health awareness are creating new revenue streams. The growing e-commerce channel presents opportunities for direct-to-consumer brands with personalized offerings, while advancements in delivery systems (microencapsulation, nanoparticle technology) are enabling development of next-generation products with enhanced efficacy and sensory profiles.

Market Segmentation Highlights

By Product Type

The Chemical Sunscreens segment is expected to hold the largest share of the overall sunscreen market in 2025, due to its widespread availability, established consumer familiarity, and cost-effective formulation advantages. However, the Physical/Mineral Sunscreens segment is projected to grow at the highest CAGR during the forecast period, driven by increasing consumer preference for "clean beauty" products, growing concerns about chemical absorption, and advancements in mineral formulation technology that have improved aesthetic qualities and eliminated the traditional white cast associated with these products.

By SPF Range

The Medium SPF (SPF 30-49) segment is expected to dominate the overall sunscreen market in 2025, primarily due to dermatologist recommendations for daily use and optimal balance between protection and wearability. However, the High SPF (SPF 50-69) segment is expected to grow at the fastest CAGR through the forecast period, driven by increasing consumer awareness of skin cancer prevention, rising outdoor recreational activities, and growing concerns about long-term UV-induced skin damage, particularly in regions with intense sun exposure.

By Form

The Creams and Lotions segment is expected to hold the largest share of the overall sunscreen market in 2025, due to its established market presence, comprehensive coverage capabilities, and versatility across various skin types and conditions. However, the Sticks segment is anticipated to experience the fastest growth rate during the forecast period, driven by their portability, precision application, travel-friendly nature, and minimal waste packaging that aligns with growing sustainability concerns.

By Distribution Channel

The Pharmacies and Drugstores segment is expected to hold the largest share of the overall sunscreen market in 2025, due to the perception of reliability, professional guidance availability, and the therapeutic positioning of sun protection products. However, the Online Retail segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing digital adoption, expanded product selection, competitive pricing, detailed product information availability, and the convenience of subscription models that encourage regular repurchasing of essential sun protection products.

By End User

The Adult Women segment is expected to hold the largest share of the overall sunscreen market in 2025, due to higher awareness of skin aging concerns, established skincare routines that include sun protection, and targeted marketing strategies from major brands. However, the Men's segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing male grooming trends, development of male-specific formulations, growing awareness of skin cancer risks, and expanding distribution through male-oriented retail channels and professional services.

By Geography

North America is projected to maintain the largest share of the global sunscreen market in 2025, supported by high consumer awareness of skin cancer prevention, widespread adoption of premium sun care products, a robust regulatory environment, and strong dermatological recommendations for daily sunscreen use. Europe ranks as the second-largest market, mainly due to stringent safety regulations, high brand loyalty, and a strong focus on skin health. Asia-Pacific, while currently the third-largest region by market value, is experiencing the fastest growth, fueled by a rising middle-class population, increasing beauty consciousness, and cultural preferences for brighter skin tones. Both Asia-Pacific and Latin America are expected to see rapid expansion during the forecast period, driven by growing disposable incomes, heightened awareness of skin health, increased tourism in tropical regions, and the introduction of innovative formulations by international brands tailored to local preferences and skin types.

Competitive Landscape

The global sunscreen market features a diverse competitive landscape with established multinational beauty conglomerates, specialized dermatological brands, clean beauty innovators, and emerging direct-to-consumer disruptors pursuing varied approaches to product development, formulation innovation, and market penetration strategies.

The broader solution provider landscape is categorized into industry leaders, market differentiators, vanguards, and contemporary stalwarts, with each group employing distinctive strategies to maintain competitive advantage. Leading providers are focusing on integrated sun protection solutions that combine advanced UV filters with anti-aging technology, while addressing region-specific skin concerns and sustainability requirements through tailored formulations and packaging innovations.

The key players operating in the global sunscreen market are L'Oréal S.A. (La Roche-Posay, Garnier, L'Oréal Paris), Johnson & Johnson (Neutrogena, Aveeno), Beiersdorf AG (Nivea, Eucerin), The Estée Lauder Companies Inc., Shiseido Company, Limited, Edgewell Personal Care (Banana Boat, Hawaiian Tropic), Groupe Clarins, Coty Inc., Unilever PLC, Procter & Gamble Co., Bayer AG (Coppertone), Sun Pharmaceuticals Industries Ltd., Kao Corporation, Bioderma Laboratories, and EltaMD, Inc. among others.

|

Particulars |

Details |

|

Number of Pages |

212 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

7.2% |

|

Market Size (Value) in 2025 |

USD 19.2 Billion |

|

Market Size (Value) in 2035 |

USD 38.6 Billion |

|

Segments Covered |

By Product Type

By SPF Range

By Form

By Distribution Channel

By End User

|

|

Countries Covered |

North America (U.S., Canada, Mexico), Europe (Germany, France, U.K., Italy, Spain, Nordics, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Thailand, Indonesia, Rest of Asia-Pacific), Latin America (Brazil, Argentina, Colombia, Rest of Latin America), Middle East & Africa (UAE, Saudi Arabia, South Africa, Israel, Egypt, Rest of Middle East & Africa) |

|

Key Companies |

L'Oréal S.A. (La Roche-Posay, Garnier, L'Oréal Paris), Johnson & Johnson (Neutrogena, Aveeno), Beiersdorf AG (Nivea, Eucerin), The Estée Lauder Companies Inc., Shiseido Company, Limited, Edgewell Personal Care (Banana Boat, Hawaiian Tropic), Groupe Clarins, Coty Inc., Unilever PLC, Procter & Gamble Co., Bayer AG (Coppertone), Sun Pharmaceuticals Industries Ltd., Kao Corporation, Bioderma Laboratories, EltaMD, Inc. |

The global sunscreen market was valued at $17.8 billion in 2024. This market is expected to reach approximately $38.6 billion by 2035, growing from an estimated $19.2 billion in 2025, at a CAGR of 7.2% during the forecast period of 2025–2035.

The global sunscreen market is expected to grow at a CAGR of 7.2% during the forecast period of 2025–2035.

The global sunscreen market is expected to reach approximately $38.6 billion by 2035, growing from an estimated $19.2 billion in 2025, at a CAGR of 7.2% during the forecast period of 2025–2035.

The key companies operating in this market include L'Oréal S.A. (La Roche-Posay, Garnier, L'Oréal Paris), Johnson & Johnson (Neutrogena, Aveeno), Beiersdorf AG (Nivea, Eucerin), The Estée Lauder Companies Inc., Shiseido Company, Limited, Edgewell Personal Care (Banana Boat, Hawaiian Tropic), Groupe Clarins, Coty Inc., Unilever PLC, Procter & Gamble Co., and others.

Major trends shaping the market include integration of sunscreen in daily skincare routines, reef-safe and eco-friendly formulations, innovations in texture and application methods, personalized sunscreen products, and multi-functional sun protection products combining SPF with skincare benefits.

• In 2025, the Chemical Sunscreens segment is expected to dominate the overall sunscreen market by product type

• Based on SPF range, the Medium SPF (SPF 30-49) segment is expected to hold the largest share of the overall sunscreen market in 2025

• Based on form, the Creams and Lotions segment is expected to hold the largest share of the global sunscreen market in 2025

• Based on distribution channel, the Pharmacies and Drugstores segment is expected to hold the largest share in 2025

North America is expected to hold the largest share of the global sunscreen market in 2025, driven by high consumer awareness of skin cancer prevention, premium product adoption, and established dermatological recommendations for daily sunscreen use. Latin America and Asia-Pacific are witnessing faster growth rates during the forecast period, driven by rising disposable incomes and expanding skin health awareness.

The growth of this market is driven by increasing awareness of skin cancer prevention, growing consumer focus on anti-aging skincare regimens, rising disposable income in developing economies, expanding outdoor recreational activities worldwide, and significant shifts toward clean beauty and mineral-based formulations.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research / Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Bottom-up Approach

2.3.3. Top-down Approach

2.3.4. Growth Forecast Approach

2.3.5. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Sunscreen Market, by Product Type

3.2.2. Sunscreen Market, by SPF Range

3.2.3. Sunscreen Market, by Form

3.2.4. Sunscreen Market, by Active Ingredients

3.2.5. Sunscreen Market, by Distribution Channel

3.2.6. Sunscreen Market, by End User

3.2.7. Sunscreen Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Rising Awareness of Skin Cancer Prevention

4.2.1.2. Growing Consumer Focus on Anti-aging Products

4.2.1.3. Increasing Outdoor Recreational Activities

4.2.1.4. Rising Disposable Income in Developing Regions

4.2.2. Restraints

4.2.2.1. Health Concerns Over Chemical Ingredients

4.2.2.2. Premium Pricing of High-quality Products

4.2.2.3. Regulatory Challenges for New Formulations

4.2.3. Opportunities

4.2.3.1. Demand for Natural and Organic Sunscreen Formulations

4.2.3.2. Growing Market for Multi-functional Sun Protection Products

4.2.3.3. Expansion in Emerging Markets

4.2.3.4. E-commerce as a Growing Distribution Channel

4.2.4. Trends

4.2.4.1. Integration of Sunscreen in Daily Skincare Routines

4.2.4.2. Reef-safe and Eco-friendly Formulations

4.2.4.3. Innovations in Texture and Application Methods

4.2.4.4. Personalized Sunscreen Products

4.2.5. Challenges

4.2.5.1. Varying Regulatory Standards Across Regions

4.2.5.2. Consumer Confusion Over SPF Ratings and Application

4.2.5.3. Sustainability in Packaging and Formulation

4.2.5.4. Addressing Different Skin Types and Tones

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Competitive Rivalry

4.4. Impact of Sustainability on Sunscreen Market

4.4.1. Eco-friendly Ingredients and Marine Life Protection

4.4.2. Sustainable Packaging Initiatives

4.4.3. Regulatory Developments for Reef-safe Sunscreens

4.4.4. Consumer Preferences for Sustainable Products

4.4.5. Corporate Responsibility and Sustainability Goals

4.4.6. Innovations in Biodegradable Formulations

4.4.7. Supply Chain Sustainability Practices

4.4.8. Future Trends in Sustainable Sunscreen Development

5. Sunscreen Market Assessment—by Product Type

5.1. Chemical Sunscreens

5.2. Physical/Mineral Sunscreens

5.3. Hybrid Sunscreens

6. Sunscreen Market Assessment—by SPF Range

6.1. Low SPF (Up to SPF 29)

6.2. Medium SPF (SPF 30-49)

6.3. High SPF (SPF 50-69)

6.4. Very High SPF (SPF 70+)

7. Sunscreen Market Assessment—by Form

7.1. Creams and Lotions

7.2. Sprays

7.3. Gels

7.4. Sticks

7.5. Powders

7.6. Other Forms (Oils, Wipes, etc.)

8. Sunscreen Market Assessment—by Distribution Channel

8.1. Supermarkets and Hypermarkets

8.2. Specialty Retail Stores

8.3. Pharmacies and Drugstores

8.4. Department Stores

8.5. Online Retail

8.6. Others (Direct Selling, etc.)

9. Sunscreen Market Assessment—by End User

9.1. Adult Sunscreen

9.1.1. Men

9.1.2. Women

9.2. Children Sunscreen

9.3. Baby Sunscreen

9.4. Professional/Occupational Use

10. Sunscreen Market Assessment—by Geography

10.1. North America

10.1.1. U.S.

10.1.2. Canada

10.1.3. Mexico

10.2. Europe

10.2.1. Germany

10.2.2. France

10.2.3. U.K.

10.2.4. Italy

10.2.5. Spain

10.2.6. Nordics (Sweden, Norway, Denmark, Finland)

10.2.7. Rest of Europe (RoE)

10.3. Asia-Pacific

10.3.1. China

10.3.2. Japan

10.3.3. India

10.3.4. Australia

10.3.5. South Korea

10.3.6. Thailand

10.3.7. Indonesia

10.3.8. Rest of Asia-Pacific (RoAPAC)

10.4. Latin America

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Colombia

10.4.4. Rest of Latin America (RoLATAM)

10.5. Middle East & Africa

10.5.1. UAE

10.5.2. Saudi Arabia

10.5.3. South Africa

10.5.4. Israel

10.5.5. Egypt

10.5.6. Rest of Middle East & Africa (RoMEA)

11. Competitive Landscape

11.1. Overview

11.2. Key Growth Strategies

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Industry Leaders

11.4.2. Market Differentiators

11.4.3. Vanguards

11.4.4. Contemporary Stalwarts

11.5. Market Share & Ranking Analysis, by Key Players, 2025

12. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

12.1. L'Oréal S.A. (La Roche-Posay, Garnier, L'Oréal Paris)

12.2. Johnson & Johnson (Neutrogena, Aveeno)

12.3. Beiersdorf AG (Nivea, Eucerin)

12.4. The Estée Lauder Companies Inc.

12.5. Shiseido Company, Limited

12.6. Edgewell Personal Care (Banana Boat, Hawaiian Tropic)

12.7. Groupe Clarins

12.8. Coty Inc.

12.9. Unilever PLC

12.10. Procter & Gamble Co.

12.11. Bayer AG (Coppertone)

12.12. Sun Pharmaceuticals Industries Ltd.

12.13. Kao Corporation

12.14. Bioderma Laboratories

12.15. EltaMD, Inc.

13. Appendix

13.1. Available Customization

13.2. Related Reports

List of Tables

Table 1. Global Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 2. Global Chemical Sunscreens Market, by Country/Region, 2023–2035 (USD Million)

Table 3. Global Physical/Mineral Sunscreens Market, by Country/Region, 2023–2035 (USD Million)

Table 4. Global Hybrid Sunscreens Market, by Country/Region, 2023–2035 (USD Million)

Table 5. Global Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 6. Global Low SPF (Up to SPF 29) Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 7. Global Medium SPF (SPF 30-49) Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 8. Global High SPF (SPF 50-69) Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 9. Global Very High SPF (SPF 70+) Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 10. Global Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 11. Global Creams and Lotions Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 12. Global Sprays Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 13. Global Gels Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 14. Global Sticks Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 15. Global Powders Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 16. Global Other Forms Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 17. Global Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 18. Global Sunscreen Market for Supermarkets and Hypermarkets, by Country/Region, 2023–2035 (USD Million)

Table 19. Global Sunscreen Market for Specialty Retail Stores, by Country/Region, 2023–2035 (USD Million)

Table 20. Global Sunscreen Market for Pharmacies and Drugstores, by Country/Region, 2023–2035 (USD Million)

Table 21. Global Sunscreen Market for Department Stores, by Country/Region, 2023–2035 (USD Million)

Table 22. Global Sunscreen Market for Online Retail, by Country/Region, 2023–2035 (USD Million)

Table 23. Global Sunscreen Market for Other Distribution Channels, by Country/Region, 2023–2035 (USD Million)

Table 24. Global Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 25. Global Adult Sunscreen Market, by Type, 2023–2035 (USD Million)

Table 26. Global Men Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 27. Global Women Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 28. Global Children Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 29. Global Baby Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 30. Global Professional/Occupational Use Sunscreen Market, by Country/Region, 2023–2035 (USD Million)

Table 31. North America: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 32. North America: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 33. North America: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 34. North America: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 35. North America: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 36. U.S.: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 37. U.S.: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 38. U.S.: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 39. U.S.: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 40. U.S.: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 41. Canada: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 42. Canada: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 43. Canada: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 44. Canada: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 45. Canada: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 46. Mexico: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 47. Mexico: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 48. Mexico: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 49. Mexico: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 50. Mexico: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 51. Europe: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 52. Europe: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 53. Europe: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 54. Europe: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 55. Europe: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 56. Germany: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 57. Germany: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 58. Germany: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 59. Germany: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 60. Germany: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 61. France: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 62. France: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 63. France: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 64. France: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 65. France: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 66. U.K.: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 67. U.K.: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 68. U.K.: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 69. U.K.: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 70. U.K.: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 71. Italy: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 72. Italy: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 73. Italy: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 74. Italy: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 75. Italy: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 76. Spain: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 77. Spain: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 78. Spain: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 79. Spain: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 80. Spain: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 81. Nordics: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 82. Nordics: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 83. Nordics: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 84. Nordics: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 85. Nordics: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 86. Rest of Europe: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 87. Rest of Europe: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 88. Rest of Europe: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 89. Rest of Europe: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 90. Rest of Europe: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 91. Asia-Pacific: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 92. Asia-Pacific: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 93. Asia-Pacific: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 94. Asia-Pacific: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 95. Asia-Pacific: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 96. China: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 97. China: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 98. China: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 99. China: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 100. China: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 101. Japan: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 102. Japan: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 103. Japan: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 104. Japan: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 105. Japan: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 106. India: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 107. India: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 108. India: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 109. India: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 110. India: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 111. Australia: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 112. Australia: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 113. Australia: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 114. Australia: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 115. Australia: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 116. South Korea: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 117. South Korea: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 118. South Korea: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 119. South Korea: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 120. South Korea: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 121. Thailand: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 122. Thailand: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 123. Thailand: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 124. Thailand: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 125. Thailand: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 126. Indonesia: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 127. Indonesia: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 128. Indonesia: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 129. Indonesia: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 130. Indonesia: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 131. Rest of Asia-Pacific: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 132. Rest of Asia-Pacific: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 133. Rest of Asia-Pacific: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 134. Rest of Asia-Pacific: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 135. Rest of Asia-Pacific: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 136. Latin America: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 137. Latin America: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 138. Latin America: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 139. Latin America: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 140. Latin America: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 141. Brazil: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 142. Brazil: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 143. Brazil: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 144. Brazil: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 145. Brazil: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 146. Argentina: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 147. Argentina: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 148. Argentina: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 149. Argentina: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 150. Argentina: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 151. Colombia: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 152. Colombia: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 153. Colombia: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 154. Colombia: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 155. Colombia: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 156. Rest of Latin America: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 157. Rest of Latin America: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 158. Rest of Latin America: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 159. Rest of Latin America: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 160. Rest of Latin America: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 161. Middle East & Africa: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 162. Middle East & Africa: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 163. Middle East & Africa: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 164. Middle East & Africa: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 165. Middle East & Africa: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 166. UAE: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 167. UAE: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 168. UAE: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 169. UAE: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 170. UAE: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 171. Saudi Arabia: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 172. Saudi Arabia: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 173. Saudi Arabia: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 174. Saudi Arabia: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 175. Saudi Arabia: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 176. South Africa: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 177. South Africa: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 178. South Africa: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 179. South Africa: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 180. South Africa: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 181. Israel: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 182. Israel: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 183. Israel: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 184. Israel: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 185. Israel: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 186. Egypt: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 187. Egypt: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 188. Egypt: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 189. Egypt: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 190. Egypt: Sunscreen Market, by End User, 2023–2035 (USD Million)

Table 191. Rest of Middle East & Africa: Sunscreen Market, by Product Type, 2023–2035 (USD Million)

Table 192. Rest of Middle East & Africa: Sunscreen Market, by SPF Range, 2023–2035 (USD Million)

Table 193. Rest of Middle East & Africa: Sunscreen Market, by Form, 2023–2035 (USD Million)

Table 194. Rest of Middle East & Africa: Sunscreen Market, by Distribution Channel, 2023–2035 (USD Million)

Table 195. Rest of Middle East & Africa: Sunscreen Market, by End User, 2023–2035 (USD Million)

List of Figures

Figure 1. Research Process

Figure 2. Secondary Components Referenced for This Study

Figure 3. Primary Research Techniques

Figure 4. Key Executives Interviewed

Figure 5. Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6. Market Sizing and Growth Forecast Approach

Figure 7. In 2025, the Chemical Sunscreens Product Type to Account for the Largest Share

Figure 8. In 2025, the Medium SPF (SPF 30-49) Range to Account for the Largest Share

Figure 9. In 2025, the Creams and Lotions Form to Account for the Largest Share

Figure 10. In 2025, the Pharmacies and Drugstores Distribution Channel to Account for the Largest Share

Figure 11. In 2025, the Adult Users End User Segment to Account for the Largest Share

Figure 12. North America to be the Largest Regional Market

Figure 13. Impact Analysis of Market Dynamics

Figure 14. Global Sunscreen Market: Porter's Five Forces Analysis

Figure 15. Global Sunscreen Market, by Product Type, 2025 Vs. 2032 (USD Million)

Figure 16. Global Sunscreen Market, by SPF Range, 2025 Vs. 2032 (USD Million)

Figure 17. Global Sunscreen Market, by Form, 2025 Vs. 2032 (USD Million)

Figure 18. Global Sunscreen Market, by Distribution Channel, 2025 Vs. 2032 (USD Million)

Figure 19. Global Sunscreen Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 20. Global Sunscreen Market, by Region, 2025 Vs. 2032 (USD Million)

Figure 21. North America: Sunscreen Market Snapshot (2025)

Figure 22. Europe: Sunscreen Market Snapshot (2025)

Figure 23. Asia-Pacific: Sunscreen Market Snapshot (2025)

Figure 24. Latin America: Sunscreen Market Snapshot (2025)

Figure 25. Middle East & Africa: Sunscreen Market Snapshot (2025)

Figure 26. Key Growth Strategies Adopted by Leading Players (2022–2025)

Figure 27. Global Sunscreen Market Competitive Benchmarking, by Product Type

Figure 28. Competitive Dashboard: Global Sunscreen Market

Figure 29. Global Sunscreen Market Share/Ranking, by Key Player, 2024 (%)

Figure 30. L'Oréal S.A.: Financial Overview (2024)

Figure 31. Johnson & Johnson: Financial Overview (2024)

Figure 32. Beiersdorf AG: Financial Overview (2024)

Figure 33. The Estée Lauder Companies Inc.: Financial Overview (2024)

Figure 34. Shiseido Company, Limited: Financial Overview (2024)

Figure 35. Edgewell Personal Care: Financial Overview (2024)

Figure 36. Groupe Clarins: Financial Overview (2024)

Figure 37. Coty Inc.: Financial Overview (2024)

Figure 38. Unilever PLC: Financial Overview (2024)

Figure 39. Procter & Gamble Co.: Financial Overview (2024)

Figure 40. Bayer AG: Financial Overview (2024)

Figure 41. Sun Pharmaceuticals Industries Ltd.: Financial Overview (2024)

Figure 42. Kao Corporation: Financial Overview (2024)

Figure 43. Bioderma Laboratories: Financial Overview (2024)

Figure 44. EltaMD, Inc.: Financial Overview (2024)

Published Date: Feb-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates