What is the Rare Earth Metals Market Size?

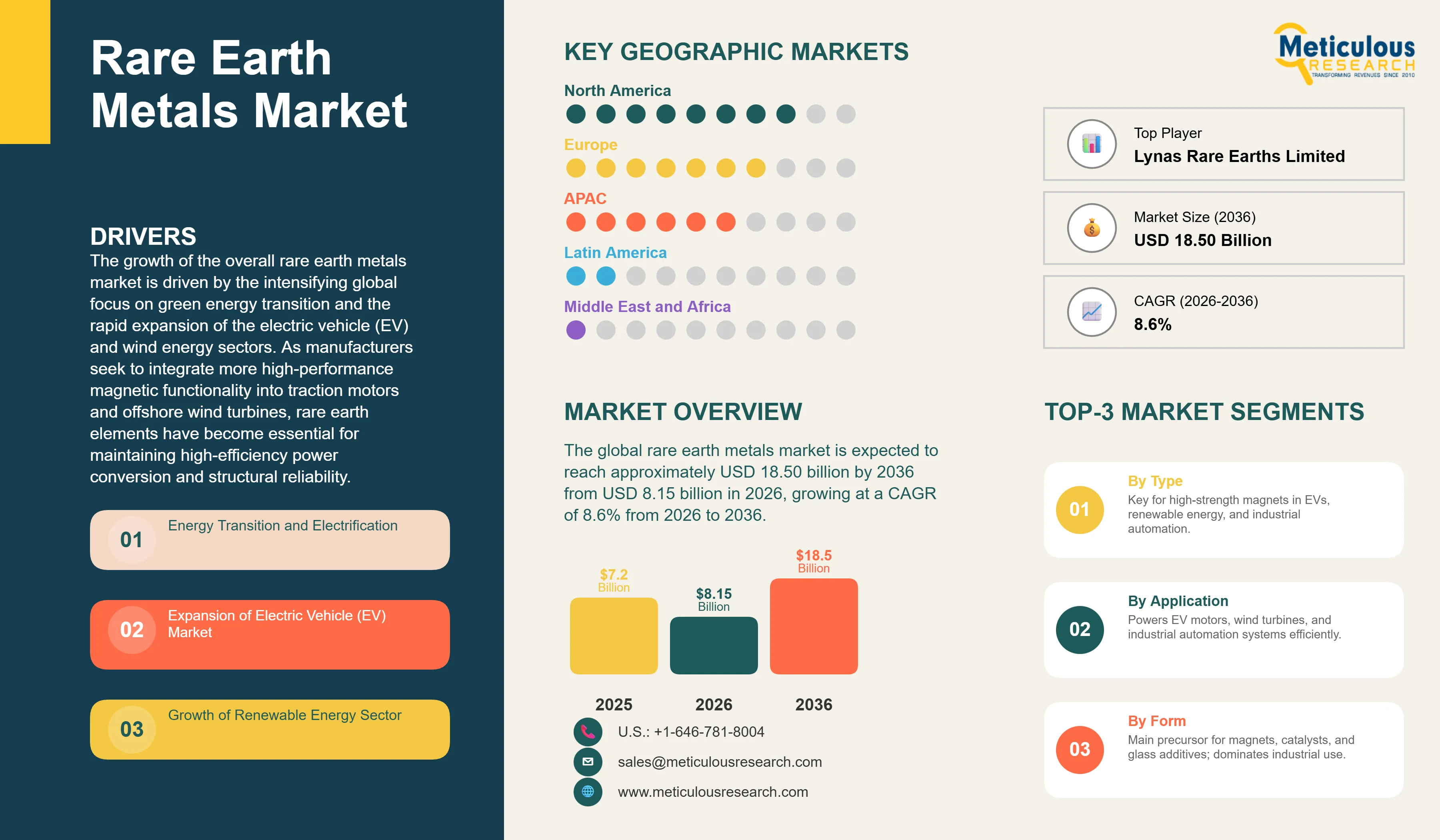

The global rare earth metals market was valued at USD 7.20 billion in 2025. The market is expected to reach approximately USD 18.50 billion by 2036 from USD 8.15 billion in 2026, growing at a CAGR of 8.6% from 2026 to 2036. The growth of the overall rare earth metals market is driven by the intensifying global focus on green energy transition and the rapid expansion of the electric vehicle (EV) and wind energy sectors. As manufacturers seek to integrate more high-performance magnetic functionality into traction motors and offshore wind turbines, rare earth elements have become essential for maintaining high-efficiency power conversion and structural reliability. The rapid expansion of consumer electronics and the increasing need for high-precision optical glass and advanced catalysts continue to fuel significant growth of this market across all major geographic regions.

Market Highlights: Global Rare Earth Metals Market

- In terms of revenue, the global rare earth metals market is projected to reach USD 18.50 billion by 2036.

- The market is expected to grow at a CAGR of 8.6% from 2026 to 2036.

- Asia-Pacific dominates the global rare earth metals market with the largest market share in 2026, driven by advanced mining infrastructure and the presence of leading refining innovators in China and Australia.

- North America is expected to witness steady growth during the forecast period, supported by massive investments in domestic supply chain security and the rapid adoption of clean energy solutions in the U.S. and Canada.

- By type, the Neodymium segment holds the largest market share in 2026, particularly in supporting high-strength permanent magnets for automotive and industrial applications.

- By application, the permanent magnets segment holds the largest market share in 2026, due to the rising demand for high-torque motors and the increasing prevalence of automation in manufacturing.

- By form, the oxides segment holds the largest share of the overall market in 2026.

Market Overview and Insights

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Rare earth metals are critical mineral resources that leverage unique magnetic, luminescent, and electrochemical properties to provide optimized industrial processes and improved product performance through a diverse range of high-tech applications. These materials include specialized oxides, pure metals, and alloys designed to enhance energy efficiency and enable miniaturization across the technology spectrum. The market is defined by high-purity extraction technologies such as solvent extraction and ion exchange, which significantly enhance material precision and resource utilization in high-pressure industrial environments. These materials are indispensable for manufacturing administrators seeking to optimize their internal product lines and meet aggressive sustainability and performance targets.

The market includes a diverse range of elements, ranging from light rare earth elements (LREEs) like Cerium and Lanthanum for basic polishing and catalysts to heavy rare earth elements (HREEs) like Dysprosium and Terbium for high-temperature magnetic stability. These systems are increasingly integrated with advanced supply chain components such as closed-loop recycling and sustainable mining practices to provide materials such as high-coercivity magnets and predictive maintenance of refinery equipment. The ability to provide stable, high-performance chemical data while minimizing environmental impact has made rare earth technology the choice for industries where material accuracy and supply chain reliability are paramount.

The global industrial sector is pushing hard to modernize production capabilities, aiming to meet carbon-neutral manufacturing targets and energy-efficient product goals. This drive has increased the adoption of high-performance magnetic solutions, with advanced neodymium-iron-boron (NdFeB) magnets helping to stabilize power output for ultra-high-efficiency electric motors. At the same time, the rapid growth in the hydrogen fuel cell and aerospace markets is increasing the need for high-reliability, lightweight metallurgical solutions.

What are the Key Trends in the Rare Earth Metals Market?

Proliferation of High-Coercivity Magnets and Heavy Rare Earth Optimization

Manufacturers across the industry are rapidly shifting to magnetic-optimized designs, moving well beyond traditional ferrite setups toward high-coercivity and dysprosium-lean architectures. MP Materials’ latest processing platforms deliver significantly higher recovery rates, while Lynas Rare Earths’ recent refinery upgrades have slashed lead times for high-purity oxides. The real game-changer comes with “grain boundary diffusion” technology featuring integrated heavy rare earth optimization that maintains peak magnetic performance even in high-temperature automotive environments. These advancements make high-efficiency traction motors practical and cost-effective for everyone from luxury EV startups to global automotive giants chasing excellence in vehicle range and lower total cost of ownership (TCO).

Innovation in Sustainable Refining and Closed-Loop Recycling

Innovation in sustainable refining and closed-loop recycling is rapidly driving the rare earth metals market, as mining operations become more circular and supply chains more localized. Equipment suppliers are now designing units that combine the efficiency of hydrometallurgy with the environmental safety of dry stack tailings in a single platform, saving valuable processing time and simplifying refinery logistics. These systems often involve advanced bio-leaching and electrochemical recovery capable of handling complex mineral ores without compromising environmental safety or chemical reliability.

At the same time, growing focus on resource security is pushing manufacturers to develop rare earth solutions tailored to end-of-life magnet recovery and urban mining principles. These systems help reduce environmental impact through modular recycling plants and the use of bio-based extraction agents. By combining high-density material recovery with robust environmental performance, these new designs support both technological advancement and corporate sustainability, strengthening the resilience of the broader industrial value chain.

Market Summary Table

|

Parameter

|

Details

|

|

Market Size by 2036

|

USD 18.50 Billion

|

|

Market Size in 2026

|

USD 8.15 Billion

|

|

Market Size in 2025

|

USD 7.20 Billion

|

|

Market Growth Rate (2026-2036)

|

CAGR of 8.6%

|

|

Dominating Region

|

Asia-Pacific

|

|

Fastest Growing Region

|

Asia-Pacific

|

|

Base Year

|

2025

|

|

Forecast Period

|

2026 to 2036

|

|

Segments Covered

|

Type, Form, Application, and Region

|

|

Regions Covered

|

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

|

Market Dynamics

Drivers: Energy Transition and the Rise of Electric Mobility

A key driver of the rare earth metals market is the rapid movement of the global industrial sector toward electrified, carbon-neutral mobility models. Global demand for high-efficiency electric motors, high-torque wind turbines, and lightweight aerospace components has created significant incentives for the adoption of rare earth-based materials. The trend toward “electrification-of-everything” and the integration of high-performance magnets into unified propulsion platforms drive manufacturers toward scalable solutions that rare earth metals can uniquely provide. It is estimated that as global adoption of EVs rises and renewable energy grids become more decentralized through 2036, the need for robust, high-performance materials increases significantly; therefore, neodymium-based magnets and high-purity oxides, with their ability to ensure high-density power conversion, are considered a crucial enabler of modern industrial strategies.

Opportunity: Strategic Stockpiling and Expansion of Domestic Supply Chains

The rapid growth of the strategic mineral market and domestic supply chain initiatives provides great opportunities for the rare earth metals market. Indeed, the global surge in resource nationalism has created a compelling demand for systems that can handle localized processing and provide supply chain transparency. These applications require high reliability, material traceability, and the ability to handle varied ore grades, all attributes that are met with advanced rare earth solutions. The recycling and secondary recovery market is set to expand significantly through 2036, with rare earth metals poised for an expanding share as nations seek to maximize resource independence and minimize supply disruptions. Furthermore, the increasing demand for high-precision polishing and advanced catalysts is stimulating demand for modular chemical solutions that provide high-speed material processing and operational flexibility.

Type Insights

Why Does the Neodymium Segment Lead the Market?

The Neodymium segment accounts for a significant portion of the overall rare earth metals market in 2026. This is mainly attributed to the versatile use of this element in supporting high-strength permanent magnets, high-torque electric motors, and complex industrial automation systems within modern manufacturing environments. These materials offer the most comprehensive way to ensure power density across diverse high-tech applications. The automotive and renewable energy sectors alone consume a large share of Neodymium, with major projects in China and Europe demonstrating the material’s capability to handle high-performance requirements. However, the Praseodymium and Dysprosium segments are expected to grow at a rapid CAGR during the forecast period, driven by the growing need for thermal stability and high-coercivity in complex magnetic transformations.

Application Insights

How Does the Permanent Magnets Segment Dominate?

Based on application, the permanent magnets segment holds the largest share of the overall market in 2026. This is primarily due to the massive volume of high-performance motors and the rigorous efficiency standards required for modern transportation and energy generation. Current large-scale industrial systems are increasingly specifying high-density magnetic platforms to ensure compliance with global energy standards and consumer expectations for high-performance electric vehicles.

The catalysts and polishing segment is expected to witness steady growth during the forecast period. The shift toward advanced automotive emission control and the complexity of multi-modal optical manufacturing are pushing the requirement for advanced rare earth systems that can handle varied chemical reactions and high-resolution surfaces while ensuring absolute reliability for safety-critical industrial decisions.

Form Insights

Why Does the Oxides Form Lead the Market?

The oxides segment commands the largest share of the global rare earth metals market in 2026. This dominance stems from its superior ability to serve as the primary precursor for almost all rare earth applications, including magnets, catalysts, and glass additives, making it the form of choice for high-volume industrial processing. Large-scale operations in chemical refining, glass manufacturing, and metallurgy drive demand, with advanced refining from providers like China Rare Earth Group and Lynas enabling reliable performance in complex industrial environments.

However, the metals and alloys segment is poised for rapid growth through 2036, fueled by expanding applications in high-performance magnets and specialized structural materials. Manufacturers face mounting pressure to optimize costs for high-performance, high-value applications, where metals provide a direct path to high-density magnetic and structural properties.

Regional Insights

How is Asia-Pacific Maintaining Dominance in the Global Rare Earth Metals Market?

Asia-Pacific holds the largest share of the global rare earth metals market in 2026. The largest share of this region is primarily attributed to the advanced mining infrastructure and the presence of the world’s leading refining innovators, particularly in China. China alone accounts for a significant portion of global rare earth investment, with its position as a leading producer of both LREEs and HREEs driving sustained growth. The presence of leading manufacturers like China Rare Earth Group and a well-developed downstream magnetic supply chain provides a robust market for both standard and high-purity rare earth solutions.

Which Factors Support North America and Europe Market Growth?

North America and Europe together account for a substantial share of the global rare earth metals market. The growth of these markets is mainly driven by the need for technological modernization in the defense and clean energy sectors. The demand for advanced rare earth systems in North America is mainly due to its large-scale resource security projects and the presence of innovators like MP Materials in the U.S.

In Europe, the leadership in automotive engineering and the push for green energy innovation are driving the adoption of high-reliability rare earth solutions. Countries like Germany, France, and the UK are at the forefront, with significant focus on integrating sustainable material solutions into industrial workflows and advanced manufacturing systems to ensure the highest levels of performance and reliability.

Key Players

The companies such as China Rare Earth Group Co., Ltd., Lynas Rare Earths Limited, MP Materials Corp., and Shenghe Resources Holding Co., Ltd. lead the global rare earth metals market with a comprehensive range of mining and refining solutions, particularly for large-scale magnetic applications and high-purity oxides. Meanwhile, players including Arafura Rare Earths Limited, Ucore Rare Metals Inc., USA Rare Earth, LLC, and Rainbow Rare Earths Limited focus on specialized extraction technologies, supply chain development, and localized processing platforms targeting the resource security and industrial sectors. Emerging manufacturers and integrated players such as Energy Fuels Inc., Iluka Resources Limited, and Hastings Technology Metals Limited are strengthening the market through innovations in byproduct recovery and modular refining platforms.

Key Questions Answered in the Report: