Resources

About Us

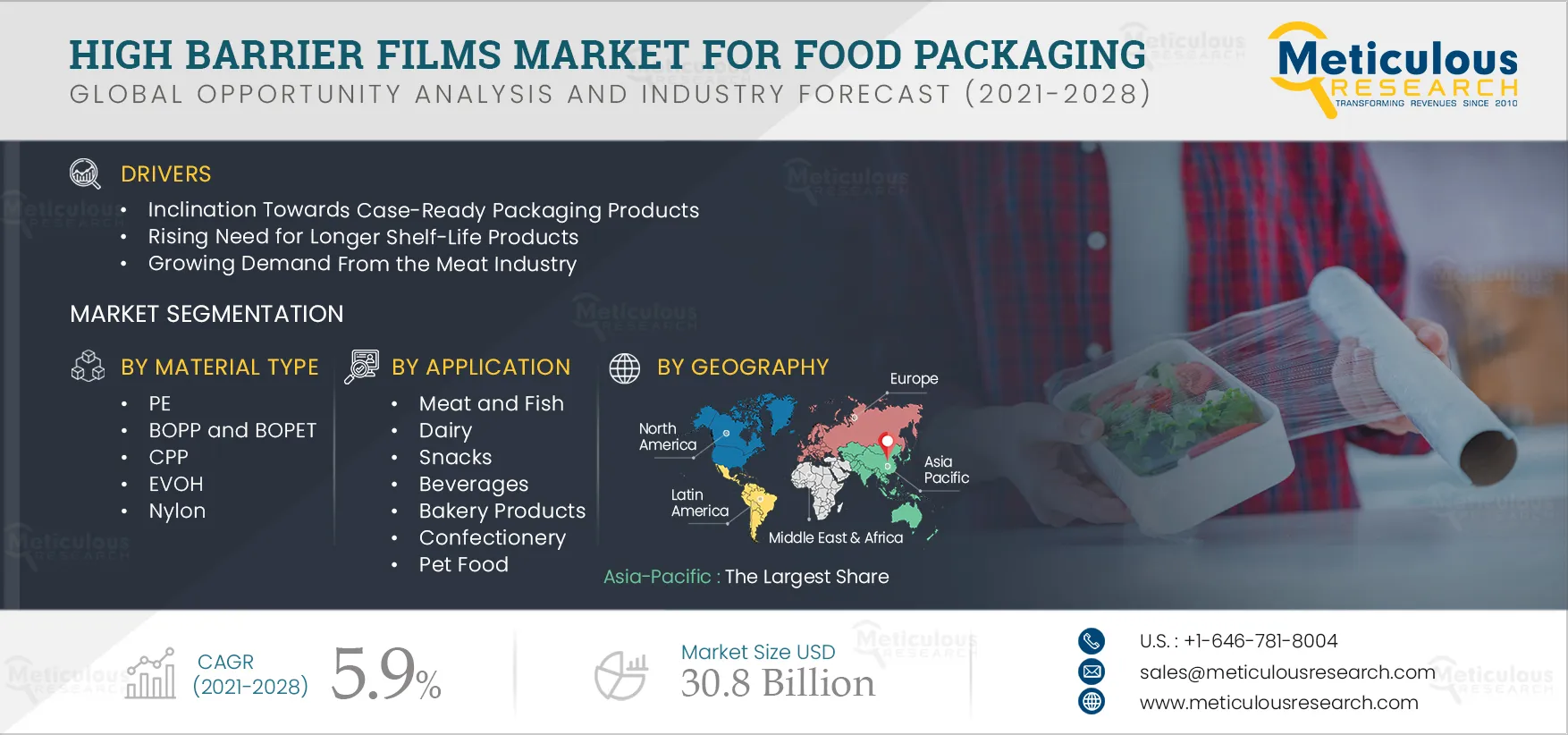

High Barrier Films Market for Food Packaging by Material Type (PE, BOPP & BOPET, CPP, EVOH, Nylon), Technology, Application (Meat and Fish, Dairy, Snacks, Confectionery, Bakery Products, Pet Food), End User, and Geography - Global Forecast to 2028

Report ID: MRCHM - 104402 Pages: 166 Jul-2021 Formats*: PDF Category: Chemicals and Materials Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of this market is mainly attributed to the growing inclination towards case-ready packaging products, rising need for high barrier packaging films for longer shelf-life products, growing consumer concerns for food wastage reduction, and growing demand from the meat industry. Moreover, the growing demand for biodegradable high barrier packaging films is expected to create lucrative opportunities for high barrier film manufacturers in this market. However, susceptibility to degradation is expected to hinder the growth of the high barrier films market for food packaging to some extent.

The COVID-19 pandemic has disrupted all sectors, including the packaging industry. It has a negative impact on the packaging barrier films market, as the supply chain is disrupted and production has taken a hit with less workforce. Usually, stay-at-home directives in many countries have resulted in no production and have restrained demand for packaging as the sale of consumer goods has dipped. In addition, the fluctuating economic conditions and exchange rates also are affecting the cost of raw materials. Thus, the high impact of coronavirus on the food and beverage industry and food packaging industry somehow limits high barrier films demand.

However, with many people buying groceries online amid the pandemic, new habits could also form, with COVID-19 accelerating the take-up of food e-commerce. As a result, e-commerce is expected to continue expanding its share over traditional retail channels. This results in rising demand for smart packaging, including high barrier films, and further accelerated by the COVID-19 pandemic. For instance, in August 2020, Carlsberg Brewery Malaysia is pinning its hopes on digital marketing and E-commerce to recover from huge revenue, and profit drops during the COVID-19 pandemic outbreak. In 2021, the demand for packaging barrier films is expected to gain momentum as the demand for frozen food and other food items with a longer shelf life is expected. In addition, the growing demand for food safety will drive a significant chunk of sales of packaging barrier films in 2021.

Sales of processed, canned, and frozen foods are rising as many consumers move away from fresh foods to favor stockpiling foods with a longer shelf life. Usually, the increasingly busy lifestyle of consumers and the consequent demand for convenient food packaging is driving the demand for barrier films. These high barrier films help to increase the product life and reduce the usage of preservatives. Barrier films also act as a printing substrate, which further provides aesthetic appeal to the product. As consumers become more aware of the impact their behavior has on the environment, they are increasingly interested in concrete ways to reduce their footprint. Now more than ever, consumers seek to purchase products that reflect their values and are sourced, produced, and packaged as sustainably as possible. Shelf-life longevity is the key factor consumers are considering in recent years.

COVID-19 has also escalated the demand for longer shelf-life products. UAE-headquartered fast-moving consumer goods (FMCG) firm Truebell has seen demand for long shelf-life products go up three folds due to the pandemic. According to Truebell, the company has seen an increase in the popularity of long-shelf-life food products and baking ingredients, increased consumption of home-cooked meals, more residents shopping locally, and rising interest in online food tutorials. In March 2020, Truebell witnessed a 300% increase in the demand for long shelf-life products. Consumers concerned about sustainable consumption welcome opportunities to purchase foods that offer a longer shelf life, and retailers are well-positioned to play a role in offering more sustainable solutions.

Nowadays, the food & beverage industry is transferring from traditional packaging formats to lightweight and easy-to-transport packaging. Barrier films help cater to this demand as they are lightweight compared to rigid packaging and eliminate the use of glass and cans, which increase the weight of the packaging. In addition, the barrier film works to efficiently block oxygen transmission and water vapor from contacting sensitive foods. All these factors are expected to drive the growth of the high barrier films market for food packaging across the globe.

Based on material type, the global high barrier films market for food packaging is segmented into PE, BOPP and BOPET, CPP, EVOH, nylon, and other materials. In 2021, the polyethylene (PE) segment is estimated to account for the largest share of the market. Moreover, this segment is also expected to witness rapid growth during the forecast period. The large share is mainly attributed to the rising need to replace glass and metal with polyethylene films and increased demand for hygienic and durable food packaging materials combined with consumer environmental concerns.

Based on technology, the global high barrier films market for food packaging is segmented into plasma-enhanced chemical vapor deposition (PECVD) and other technologies. The PECVD segment is expected to grow at the highest CAGR during the forecast period due to low operation temperature, lower chances of cracking deposited layer, good dielectric properties of the deposited layer, decent step coverage, less temperature-dependency, and rising demand for packaged foods.

Based on application, the global high barrier films market for food packaging is segmented into meat and fish, dairy, snacks, beverages, dehydrated foods & cereals, bakery products, confectionery, pet food, and other applications. In 2021, the meat and fish segment is expected to account for the largest share of the global high barrier films market for food packaging. Moreover, this segment is also expected to witness rapid growth during the forecast period. The large share of this segment is mainly attributed to the rising consumption of processed meat products, growing global consumption of fish, and increasing consumer preference for protein-rich food products.

Based on the end user, the high barrier films market for food packaging is segmented into processed food manufacturers and suppliers, packaging service providers, and other end users. In 2021, the processed food manufacturers and suppliers segment is expected to account for the largest share of the global high barrier film market for food packaging. Moreover, this segment is also expected to witness rapid growth during the forecast period. This segment's large share is mainly attributed to the growing demand for processed food products and the increasing number of food processing units.

In 2021, Asia-Pacific is estimated to account for the largest share of the overall high barrier films market for food packaging, followed by North America and Europe. The large share of this region is mainly attributed to the increasing demand for processed food products; strong growth in the food & beverage industry due to increasing urbanization, growing health awareness, and rising disposable income levels; development of the cold chain systems; government support for food processing sector; and growing demand for pet food.

Key Players

Some of the prominent players operating in the high barrier films market for food packaging are Amcor plc (Switzerland), Mondi plc (U.K.), Huhtamaki Group (Finland), Sealed Air Corporation (U.S.), Jindal Poly Films Limited (India), Toppan Printing Co., Ltd. (Japan), Kureha Corporation (Japan), HPM Global, Inc. (South Korea), Flair Flexible Packaging Corporation (U.S.), Constantia Flexibles Group GmbH (Austria), MULTIVAC (Germany), DuPont Teijin Films (U.S.), Wihuri Group (Finland), BERNHARDT Packaging & Process (France), Borealis AG (Austria), and Uflex Limited (India) among others.

High Barrier Films Market for Food Packaging, by Material Type

High Barrier Films Market for Food Packaging, by Technology

High Barrier Films Market for Food Packaging, by Application

High Barrier Films Market for Food Packaging, by End User

High Barrier Films Market for Food Packaging, by Geography

Key Questions Answered in the Report-

Published Date: Sep-2024

Published Date: May-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates