1 Introduction

1.1. Market Definition

1.2. Currency

1.3. Key Stakeholders

2 Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.1.1. Bottom-Up Approach

2.3.1.2. Top-Down Approach

2.3.1.3. Growth Forecast

2.4. Assumptions for the Study

2.5. Limitations for the Study

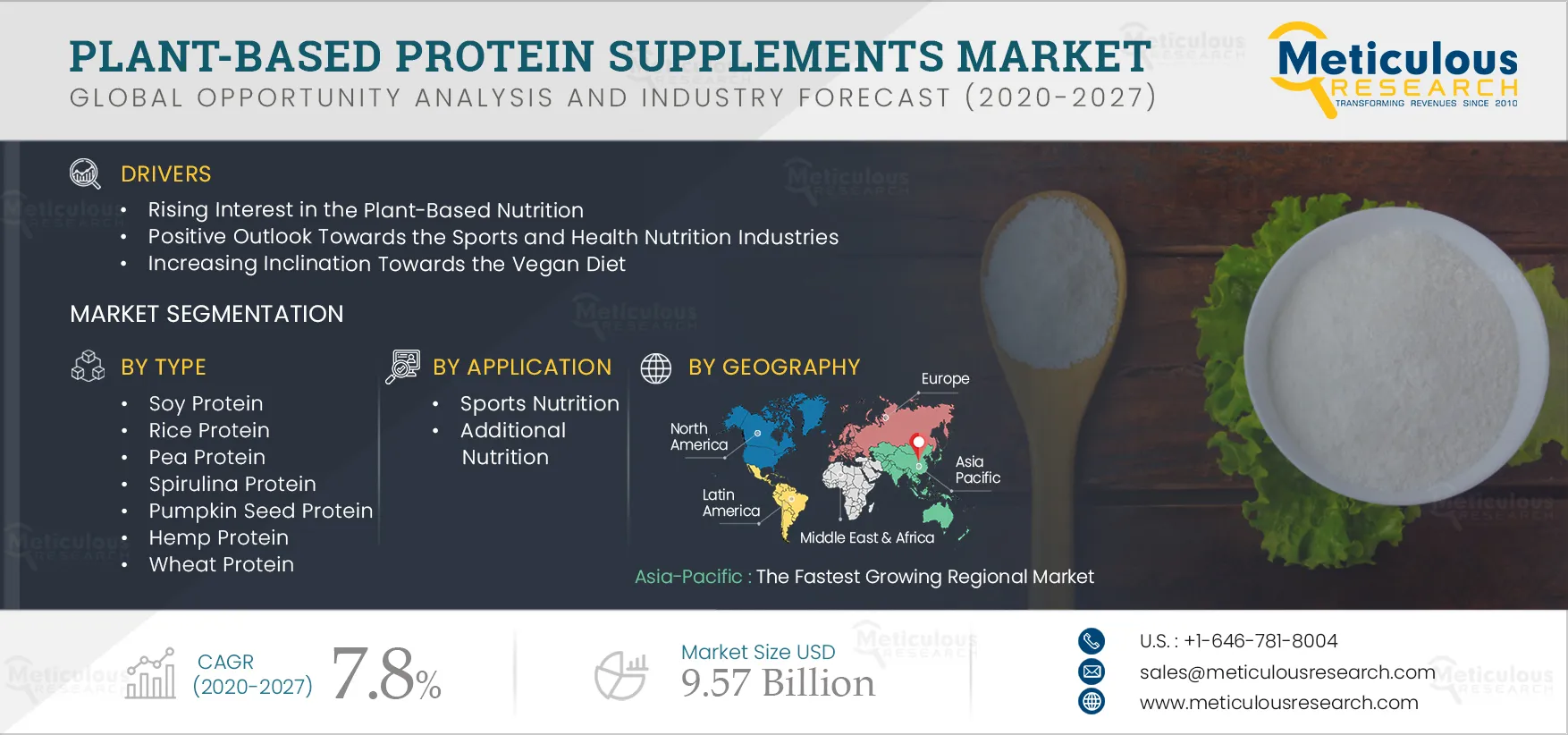

3 Executive Summary

3.1. Introduction

3.2. Segment Analysis

3.2.1. Plant Based Protein Supplements Market, by Type

3.2.2. Plant-Based Protein Supplements Market, by Form

3.2.3. Plant-Based Protein Supplements Market, by Application

3.2.4. Plant-Based Protein Supplements Market, by Distribution Channel

3.3. Plant-Based Protein Supplements Market: Regional Analysis

3.3.1. Competitive Landscape & Market Competitors

4 Market Insights

4.1. Introduction

4.2. Drivers

4.2.1. Rising Interest in the Plant-Based Nutrition

4.2.2. Positive Outlook Towards the Sports and Health Nutrition Industries

4.2.3. Increasing Inclination Towards the Vegan Diet

4.2.4. Increasing Demand for Personalized Nutrition

4.3. Restraints

4.3.1. Preference for Whey-Based Protein Supplements

4.3.2. Growing Preference for Soy- and Gluten-Free Products

4.4. Opportunities

4.4.1. Emerging Economies in Asia-Pacific, Latin America, and the Middle East & Africa

4.4.2. Increased New Product Launches of Plant-Based Protein Supplements

4.5. Trends

4.5.1. Growing Preference for Online Purchases

5 The Impact of Covid-19 on the Plant-Based Protein Supplements Market

6 Global Plant-Based Protein Supplements Market, by Type

6.1. Introduction

6.2. Soy Protein

6.3. Rice Protein

6.4. Pea Protein

6.5. Spirulina Protein

6.6. Pumpkin Seed Protein

6.7. Hemp Protein

6.8. Wheat Protein

6.9. Other Plant-Based Proteins

7 Global Plant-Based Protein Supplements Market, by Form

7.1. Introduction

7.2. Protein Powders

7.3. Ready-To-Drink Protein Beverages

7.4. Protein Bars

7.5. Other Forms

8 Global Plant-Based Protein Supplements Market, by Application

8.1. Introduction

8.2. Sports Nutrition

8.3. Additional Nutrition

9 Global Plant-Based Protein Supplements Market, by Distribution Channel

9.1. Introduction

9.2. Modern Groceries

9.3. Natural and Specialty Retail

9.4. Online Retail

9.5. Health Food Stores

9.6. Pharmacies and Drug Stores

9.7. Convenience Stores

9.8. Other Distribution Channels

10 Plant-Based Protein Supplements Market, by Geography

10.1. Introduction

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. U.K.

10.3.4. Italy

10.3.5. Spain

10.3.6. Rest of Europe (RoE)

10.4. Asia-Pacific

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. Rest of Asia-Pacific (RoAPAC)

10.5. Latin America

10.6. Middle East & Africa

11 Competitive Landscape

11.1. Introduction

11.2. Key Growth Strategies

11.3. Competitive Benchmarking

12 Company Profiles (Business Overview, Financial Overview, Product Portfolio, and Strategic Developments)

12.1. Glanbia Plc.

12.2. Now Health Group, Inc.

12.3. Nutiva Inc.

12.4. The Simply Good Foods Company

12.5. Iovate Health Sciences International Inc.

12.6. MusclePharm Corporation

12.7. Kerry Group Plc

12.8. Cytosport, Inc.

12.9. The Nature's Bounty Co.

12.10. Reliance Vitamin Company, Inc. (Reliance Private Label Supplements)

12.11. Herbalife Nutrition, Inc.

12.12. Danone SA

12.13. GNC Holdings, Inc.

12.14. Orgain Inc.

12.15. True Nutrition

13 Appendix

13.1. Questionnaire

13.2. Available Customization

List of Tables

Table 1 Global Plant-Based Protein Supplements Market Drivers: Impact Analysis (2020–2027)

Table 2 Global Plant-Based Protein Supplements Market Restraints: Impact Analysis (2020–2027)

Table 3 Global Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 4 Soy-Based Protein Supplements Market Size, by Country/Region, 2018–2027 (USD Million)

Table 5 Rice-Based Protein Supplements Market Size, by Country/Region, 2018–2027 (USD Million)

Table 6 Pea-Based Protein Supplements Market Size, by Country/Region, 2018–2027 (USD Million)

Table 7 Spirulina-Based Protein Supplements Market Size, by Country/Region, 2018–2027 (USD Million)

Table 8 Pumpkin Seed-Based Protein Supplements Market Size, by Country/Region, 2018–2027 (USD Million)

Table 9 Hemp-Based Protein Supplements Market Size, by Country/Region, 2018–2027 (USD Million)

Table 10 Wheat-Based Protein Supplements Market Size, by Country/Region, 2018–2027 (USD Million)

Table 11 Other Plant-Based Protein Supplements Market Size, by Country/Region, 2018–2027 (USD Million)

Table 12 Global Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 13 Plant-Based Protein Powders Market Size, by Country/Region, 2018–2027 (USD Million)

Table 14 Plant-Based Ready-To-Drink Protein Beverages Market Size, by Country/Region, 2018–2027 (USD Million)

Table 15 Plant-Based Protein Bars Market Size, by Country/Region, 2018–2027 (USD Million)

Table 16 Other Forms of Plant-Based Protein Supplements, Market Size, By Country/Region, 2018–2027 (USD Million)

Table 17 Global Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 18 Plant-Based Protein Supplements Market Size for Sport Nutrition, By Country/Region, 2018–2027 (USD Million)

Table 19 Plant-Based Protein Supplements Market Size for Additional Nutrition, By Country/Region, 2018–2027 (USD Million)

Table 20 Global Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 21 Plant-Based Protein Supplements Market Size for Modern Groceries, By Country/Region, 2018–2027 (USD Million)

Table 22 Plant-Based Protein Supplements Market Size for Natural and Specialty Retail, by Country/Region, 2018–2027 (USD Million)

Table 23 Plant-Based Protein Supplements Market Size for Online Retail, By Country/Region, 2018–2027 (USD Million)

Table 24 Plant-Based Protein Supplements Market Size for Health Food Stores, By Country/Region, 2018–2027 (USD Million)

Table 25 Plant-Based Protein Supplements Market Size for Pharmacies and Drug Stores, by Country/Region, 2018–2027 (USD Million)

Table 26 Plant-Based Protein Supplements Market Size for Convenience Stores, By Country/Region, 2018–2027 (USD Million)

Table 27 Plant-Based Protein Supplements Market Size for Other Distribution Channels, by Country/Region, 2018–2027 (USD Million)

Table 28 Global Plant-Based Protein Supplements Market Size, by Country/Region, 2018–2027 (USD Million)

Table 29 North America: Plant-Based Protein Supplements Market Size, by Country, 2018–2027 (USD Million)

Table 30 North America: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 31 North America: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 32 North America: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 33 North America: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 34 U.S.: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 35 U.S.: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 36 U.S.: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 37 U.S.: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 38 Canada: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 39 Canada: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 40 Canada: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 41 Canada: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 42 Europe: Plant-Based Protein Supplements Market Size, by Country/Region, 2018–2027 (USD Million)

Table 43 Europe: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 44 Europe: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 45 Europe: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 46 Europe: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 47 Germany: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 48 Germany: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 49 Germany: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 50 Germany: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 51 France: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 52 France: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 53 France: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 54 France: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 55 U.K.: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 56 U.K.: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 57 U.K.: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 58 U.K.: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 59 Italy: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 60 Italy: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 61 Italy: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 62 Italy: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 63 Spain: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 64 Spain: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 65 Spain: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 66 Spain: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 67 Rest of Europe: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 68 Rest of Europe: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 69 Rest of Europe: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 70 Rest of Europe: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 71 Asia-Pacific: Plant-Based Protein Supplements Market Size, by Country/Region, 2018–2027 (USD Million)

Table 72 Asia-Pacific: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 73 Asia-Pacific: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 74 Asia-Pacific: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 75 Asia-Pacific: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 76 China: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 77 China: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 78 China: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 79 China: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 80 Japan.: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 81 Japan.: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 82 Japan.: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 83 Japan.: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 84 India: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 85 India: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 86 India: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 87 India: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 88 Rest of Asia-Pacific: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 89 Rest of Asia-Pacific: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 90 Rest of Asia-Pacific: Plant-Based Protein Supplements Market Size, By Application, 2018–2027 (USD Million)

Table 91 Rest of Asia-Pacific: Plant-Based Protein Supplements Market Size, By Distribution Channel, 2018–2027 (USD Million)

Table 92 Latin America: Plant-Based Protein Supplements Market Size, by Type, 2018–2027 (USD Million)

Table 93 Latin America: Plant-Based Protein Supplements Market Size, by Form, 2018–2027 (USD Million)

Table 94 Latin America: Plant-Based Protein Supplements Market Size, by Application, 2018–2027 (USD Million)

Table 95 Latin America: Plant-Based Protein Supplements Market Size, by Distribution Channel, 2018–2027 (USD Million)

Table 96 Middle East & Africa: Plant-Based Protein Supplements Market Size, By Type, 2018–2027 (USD Million)

Table 97 Middle East & Africa: Plant-Based Protein Supplements Market Size, By Form, 2018–2027 (USD Million)

Table 98 Middle East & Africa: Plant-Based Protein Supplements Market Size, By Application, 2018–2027 (USD Million)

Table 99 Middle East & Africa: Plant-Based Protein Supplements Market Size, By Distribution Channel, 2018–2027 (USD Million)

Table 100 Total Number of Recent Developments, by Key Player, 2018–2021

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 The Soy Protein Segment Dominated the Market in 2020

Figure 8 The Ready-To-Drink Protein Beverages Segment to Witness the Highest Growth During the Forecast Period

Figure 9 The Sports Nutrition Segment Accounted for the Largest Market Share in 2020

Figure 10 The Online Retail Segment to Witness Significant Growth During the Forecast Period

Figure 11 Global Plant-Based Protein Supplements Market Scenario, by Geography, 2020

Figure 12 Market Dynamics

Figure 13 Preferred Channels for the Purchase of Nutritional Supplements, by Consumer Segment, 2018

Figure 14 Global Plant-Based Protein Supplements Market Size, by Type, 2020–2027

(USD Million)

Figure 15 Global Plant-Based Protein Supplements Market Size, by Form, 2020–2027

(USD Million)

Figure 16 Global Plant-Based Protein Supplements Market Size, by Application,

2020–2027 (USD Million)

Figure 17 Global Plant-Based Protein Supplements Market Size, by Distribution Channel, 2020–2027 (USD Million)

Figure 18 Global Plant-Based Protein Supplements Market Size, by Region, 2020–2027 (USD Million)

Figure 19 North America: Plant-Based Protein Supplements Market Snapshot

Figure 20 Europe: Plant-Based Protein Supplements Market Snapshot

Figure 21 Asia-Pacific: Plant-Based Protein Supplements Market Snapshot

Figure 22 Key Growth Strategies Adopted by Leading Players, 2018–2021

Figure 23 Plant-Based Protein Supplements Market: Competitive Benchmarking, by Form

Figure 24 Glanbia Plc: Financial Overview, 2020

Figure 25 The Simply Good Foods Company: Financial Overview, 2020

Figure 26 MusclePharm Corporation: Financial Overview, 2020

Figure 27 Kerry Group Plc: Financial Overview, 2020

Figure 28 PepsiCo Inc.: Financial Overview, 2020

Figure 29 Herbalife Nutrition, Inc.: Financial Overview, 2020

Figure 30 Danone Sa: Financial Overview, 2019

Figure 31 GNC Holdings, Inc.: Financial Overview, 2019