Resources

About Us

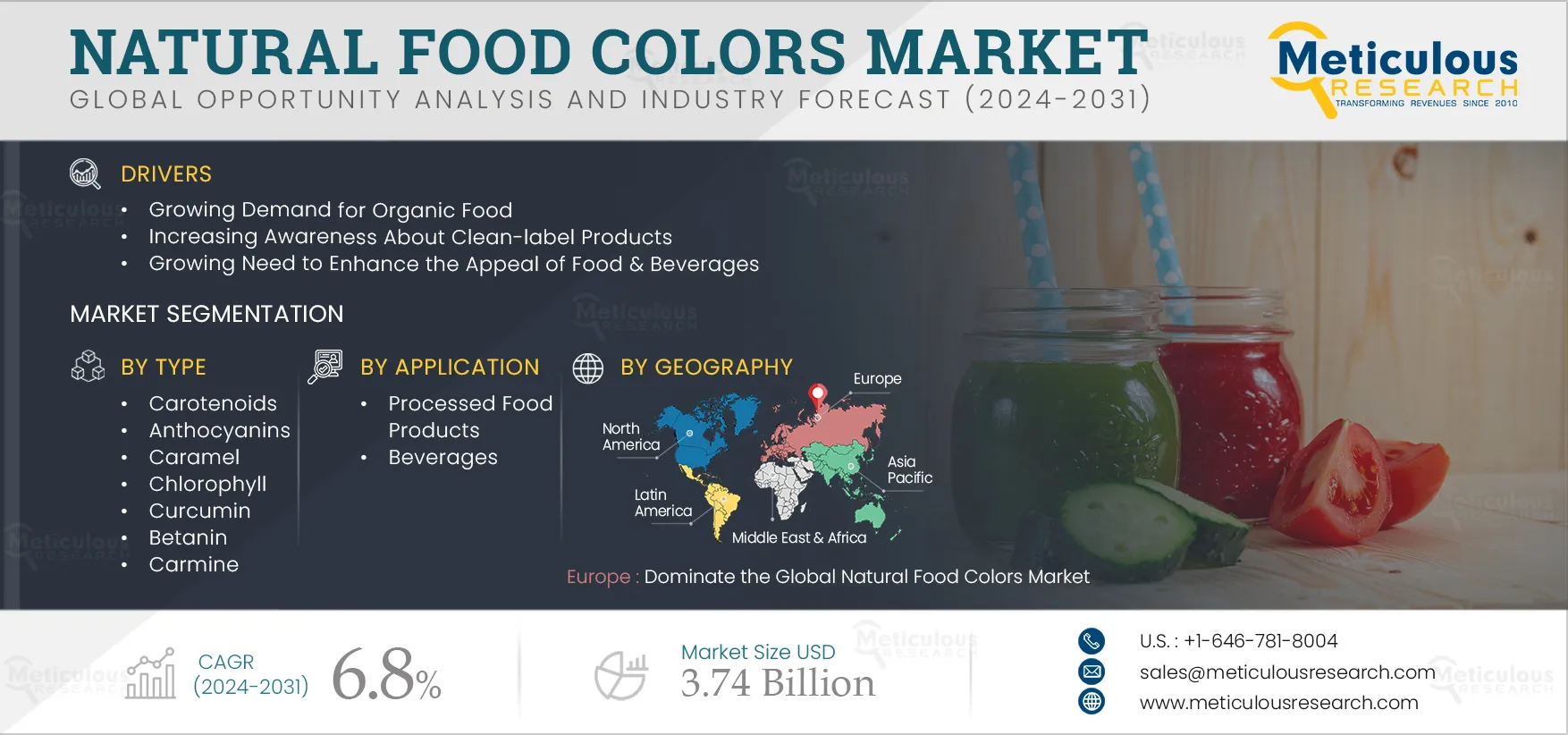

Natural Food Colors Market by Type (Carotenoids {Beta Carotene, Lycopene}, Anthocyanins, Betanin, Carmine), Source (Plants, Animal), Form (Liquid), Solubility (Water, Oil), Application (Processed Food Products, Beverages), and Geography - Global Forecast to 2031

Report ID: MRFB - 104389 Pages: 362 Aug-2024 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportKey factors driving the growth of this market include the rising demand for organic food products, increasing preference for clean-label food products, the need to boost the appeal of food & beverages, and advances in microencapsulation technology for natural colors. However, the high cost associated with natural food colors and stringent regulations pertaining to their use is expected to restrain the market’s growth.

Additionally, growing interest in alternative raw materials, the shift toward plant-based diets, and economic growth in emerging countries are expected to present growth opportunities for market participants.

Natural food colors or dyes are mainly obtained from plants, animals, fruits, insects, and minerals, which makes them safe to use as a food additive as they are free of harmful side effects. Furthermore, governments of various countries are supporting the use of natural food colors as they are biodegradable and do not cause pollution after disposal. Moreover, several regulations have been passed in many countries to promote the use of natural colors instead of synthetic food colors, which is further driving the demand for natural food colors globally.

The demand for natural food colors over synthetic food colors is increasing due to the growing consumer awareness of organic products, the health hazards associated with synthetic colors, and the health benefits of natural food colors. The use of artificial sources such as chemicals and artificial food additives to increase food production has led to adverse effects on health. At present, the rising health consciousness and shift towards environment-friendly products has increased the demand for naturally grown food products across the globe. Thus, to cater to this growing demand, food manufacturers are using natural food colors to enhance the appeal of food and beverage products after processing.

The rising demand for organic products is largely due to their perceived health benefits. According to FiBL, organic food sales reached USD 142.3 billion (EUR 135 billion) in 2022. Organic foods are produced without synthetic fertilizers, pesticides, growth hormones, or antibiotics and are free from GMOs. Natural food colors are extensively used in organic foods to further enhance their appeal. Therefore, the growing demand for organic foods is driving the demand for natural food colors.

Click here to: Get Free Sample Pages of this Report

Color is added to food & beverages to enhance their visual appeal, compensate for color loss due to processing, extreme temperatures, light, air, moisture, and storage conditions, and improve overall quality and make them more appealing to consumers. Suitable food colors are crucial for making prepared foods attractive and consumer-friendly, as the visual appearance of food significantly impacts the perception of taste. Thus, natural food colors contribute to making food more appealing and healthy. The rising demand for natural food colors by food companies to create visually appealing and healthy products is expected to drive the growth of this market.

With the increasing population and growing health consciousness among consumers, the demand for synthetic food coloring is declining. Moreover, global demand for raw materials is expected to rise as resources and land become scarcer. Natural food color sources, primarily botanicals, typically contain less than 2% pigment in the raw material, necessitating a large volume of botanical material to produce a small amount of color.

Advancements are being made in the development of natural food colorings, including improvements in extraction processes, purification, stability, identification of new sources, and formulation techniques. However, there remains a need for new natural colorants that offer high stability, strong coloring strength, and wide industrial applications.

Currently, natural colorant production does not meet the food industry’s demand. In order to address this issue, significant investment in research and development is necessary to identify abundant sources of natural colorants, making their application both technically and economically viable. Due to concerns about the adverse effects of synthetic colors on human health, food manufacturers are exploring innovative extraction methods from alternative natural sources. For instance, in 2021, MICHROMA S.A.U., an Argentinian start-up, developed a novel food colorant from fungi using synthetic biology and fermentation technology. Additionally, untapped raw materials like cabbage and algal species, which comply with regulatory standards, present significant opportunities for players operating in the natural food colors market.

Consumers are becoming more aware of the environmental and health consequences of their food choices, and they are increasingly opting for plant-based diets. The increasing intolerance for animal protein amongst consumers, the growing vegan population, and the rising number of venture investments in plant-based food companies are some of the factors driving the growth of the plant-based food market. This shift in consumer behavior is propelling the growth of plant-based foods. According to the Plant Based Foods Industry Association, the global sales of plant-based food are expected to reach around USD 162 billion by 2030.

Natural food colors, derived from a variety of sources such as fruits, vegetables, spices, and algae, are used to impart color to plant-based food and beverages. Plant-based foods are often chosen for their sustainability benefits, and using natural food colors aligns with this concern for the environment. Some synthetic food colors have been linked to health concerns such as allergies or hyperactivity in children.

Consumers who choose plant-based diets prioritize clean labels and transparency in food ingredients. Natural food colors, which are perceived as safer and healthier compared to synthetic alternatives, align with these preferences. This shift encourages food manufacturers to adopt natural colors to meet consumer expectations.

Based on type, the global natural food colors market is segmented into carotenoids, anthocyanins, caramel, chlorophyll, curcumin, betanin, carmine, phycocyanin, and other natural food colors. In 2024, the carotenoids segment is projected to dominate the natural food colors market with a share of 40.7%. This significant share can be attributed to their health benefits and growing demand across various sectors, such as dairy, beverages, and confectionery. Moreover, the increasing consumer preference for clean-label products, as well as advancements in extraction & production technologies that enhance carotenoid applications, contribute to the segment’s growth.

However, the phycocyanin segment is slated to record the highest compound annual growth rate of 12.3% during the forecast period of 2024–2031. This growth is driven by the rising focus on health and wellness, a shift towards natural ingredients over synthetic dyes, and a growing preference for natural blue pigments in beverages & confectionery. Furthermore, the growing use of spirulina-based colors like phycocyanin in response to safety concerns about synthetic additives is expected to propel the segment's growth throughout the forecast period.

Based on source, the global natural food colors market is segmented into plants, minerals, microorganisms, and animals. In 2024, the plants segment is projected to dominate the natural food colors market with a share of 76.4%. This significant share is attributed to the rising trend towards clean-label products and the increasing preference for plant-derived food colors, which are seen as a healthier and more natural option compared to synthetic alternatives.

However, the microorganisms segment is slated to record the highest compound annual growth rate of 8.2% during the forecast period of 2024–2031. This growth is driven by the rising consumer interest in natural and eco-friendly food ingredients, influenced by health and environmental considerations. Microorganisms, including algae, fungi, and bacteria, offer a variety of pigments used in natural food coloring. Their associated health benefits, such as antioxidant, anti-inflammatory, and antimicrobial properties, also contribute to the increased demand for these natural colorants.

Based on form, the global natural food colors market is segmented into liquid, powder, and other forms. In 2024, the liquid segment is projected to dominate the natural food colors market with a share of 70.7%. This significant share can be attributed to the advantages that liquid food colors provide, such as improved viscosity, enhanced mouthfeel, greater product stability, better texture, extended shelf life, and better visual appeal. These benefits drive the adoption of liquid colors in the food & beverage sector.

Moreover, the liquid segment is slated to record the highest compound annual growth rate of 7.0% during the forecast period of 2024–2031. This growth is driven by the increasing preference for liquid natural food colors, which offer high microbial stability, ease of use, and affordability.

Based on solubility, the global natural food colors market is segmented into water-soluble and oil-soluble. In 2024, the water-soluble segment is projected to dominate the natural food colors market with a share of 61.4%. This significant share can be attributed to the high preference for water-soluble food colors, which offer benefits such as concentrated color and high stability when mixed with water.

Moreover, the water-soluble segment is slated to record the highest compound annual growth rate of 7.8% during the forecast period of 2024–2031. This growth is driven by the increasing utilization of water-soluble natural colors in beverages, including soft drinks, juices, and sports drinks, and ongoing innovations in natural colorant technology.

Based on application, the global natural food colors market is segmented into processed food products and beverages. In 2024, the processed food products segment is projected to dominate the natural food colors market with a share of 62.2%. This significant share can be attributed to the growing demand for processed food, increasing consumer preference for natural colors over synthetic options due to health concerns, and ongoing innovations in food products. Furthermore, the processed food products segment is categorized into bakery & confectionery, dairy, snacks and cereals, meat, poultry, and seafood, oils and fats, and other processed food products. In 2024, the bakery & confectionery segment is projected to hold the major share of the global natural food colors market for processed food products. This significant share can be attributed to evolving consumer eating habits, population growth, the increasing demand for convenience foods, rising disposable incomes, and the proliferation of specialized e-commerce platforms for bakery and confectionery products.

However, the beverages segment is slated to record the highest compound annual growth rate during the forecast period of 2024–2031. This growth is driven by the increasing demand for clean-label ingredients in the functional and wellness beverage sector, leading to increased adoption of natural food colors by beverage manufacturers.

Based on geography, the global natural food colors market is divided into five major regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Europe is projected to dominate the natural food colors market with a share of 34.5%. The natural food colors market in Europe is estimated to be worth USD 817.6 million in 2024. Europe’s dominant market position can be attributed to the high demand for clean-label, natural products, stringent regulations governing the use of synthetic food colors, the presence of leading industry players, high investments in research & development, and a strong focus on sustainability.

However, the market in Asia-Pacific is slated to record the highest compound annual growth rate of 9.0% during the forecast period of 2024–2031. This growth is driven by the rising consumer inclination towards natural ingredients, increasing health concerns over synthetic colorants, and the growing demand for clean-label products and healthier, minimally processed food options.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios and geographic presence and key growth strategies adopted over the past 3–4 years. Some of the prominent companies in the natural food colors market are Oterra A/S (Denmark), Givaudan SA (Switzerland), Sensient Technologies Corporation (U.S.), Archer-Daniels-Midland Company (U.S.), DSM-Firmenich AG (Switzerland), BASF SE (Germany), Lycored, Ltd (A Part of ADAMA Agricultural Solutions Ltd.) (Israel), Döhler Group (Germany), GNT Group B.V. (Netherlands), San-Ei Gen F.F.I., Inc. (Japan), Kalsec, Inc. (U.S.), Innovation Colour Technology S.L. (Spain), IFC Solutions (U.S.), Mane Kancor Ingredients Private Limited (India), and Kolorjet Chemicals Pvt Ltd. (India).

|

Particulars |

Details |

|

Number of Pages |

362 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

6.8% |

|

Estimated Market Size (Value) |

$3.74 Billion by 2031 |

|

CAGR (Volume) |

5.3% |

|

Estimated Market Size (Volume) |

194,988 Tons by 2031 |

|

Segments Covered |

By Type

By Source

By Form

By Solubility

By Application

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa |

|

Key Companies |

Oterra A/S (Denmark), Givaudan SA (Switzerland), Sensient Technologies Corporation (U.S.), Archer-Daniels-Midland Company (U.S.), DSM-Firmenich AG (Switzerland), BASF SE (Germany), Lycored, Ltd (A Part of ADAMA Agricultural Solutions Ltd.) (Israel), Döhler Group (Germany), GNT Group B.V. (Netherlands), San-Ei Gen F.F.I., Inc. (Japan), Kalsec, Inc. (U.S.), Innovation Colour Technology S.L. (Spain), IFC Solutions (U.S.), Mane Kancor Ingredients Private Limited (India), and Kolorjet Chemicals Pvt Ltd. (India). |

The natural food colors market study provides comprehensive insights, market sizes, and forecasts in terms of both value and volume for the type and geography market segments. However, it focuses solely on value-based insights, market sizes, and forecasts for the form, solubility, source, and application segments.

Natural food colors are derived from fruits, vegetables, minerals, spices, animals, and microorganisms for coloring food and beverage applications. However, there is no formal definition for “natural colors” from the food authorities, the Food and Drug Administration (FDA) in the U.S., or the European Food Safety Authority (EFSA) in Europe. According to the Natural Food Colours Association (NATCOL), natural food colors originate from a wide range of sources like vegetables, fruits, plants, minerals, and other edible natural sources. They offer a wide spectrum of colors and impart color when added to food or drink. There are different types of colors, like carotenoids, lutein, anthocyanins, chlorophyll, turmeric, carmine, spirulina, and betanin, among others.

In terms of value, the natural food colors market is projected to reach $3.74 billion by 2031, at a CAGR of 6.8% during the forecast period 2024–2031.

The beverages segment is slated to record the highest compound annual growth rate during the forecast period of 2024–2031.

Some of the prominent companies in the natural food colors market are Oterra A/S (Denmark), Givaudan SA (Switzerland), Sensient Technologies Corporation (U.S.), Archer-Daniels-Midland Company (U.S.), DSM-Firmenich AG (Switzerland), BASF SE (Germany), Lycored, Ltd (A Part of ADAMA Agricultural Solutions Ltd.) (Israel), Döhler Group (Germany), GNT Group B.V. (Netherlands), San-Ei Gen F.F.I., Inc. (Japan), Kalsec, Inc. (U.S.), Innovation Colour Technology S.L. (Spain), IFC Solutions (U.S.), Mane Kancor Ingredients Private Limited (India), and Kolorjet Chemicals Pvt Ltd. (India).

The market in Asia-Pacific is slated to record the highest compound annual growth rate during the forecast period of 2024–2031. This growth is driven by the rising consumer inclination towards natural ingredients, increasing health concerns over synthetic colorants, and the growing demand for clean-label products and healthier, minimally processed food options.

Published Date: May-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates