Resources

About Us

Personalized Nutrition Market Size, Share, & Forecast by Product Type (Supplements, Functional Foods, Meal Plans), Delivery Model (Direct-to-Consumer, Clinical, Corporate Wellness), Technology (Genetic Testing, Microbiome Analysis, AI-Powered Platforms), and Application - Global Forecast (2026-2036)

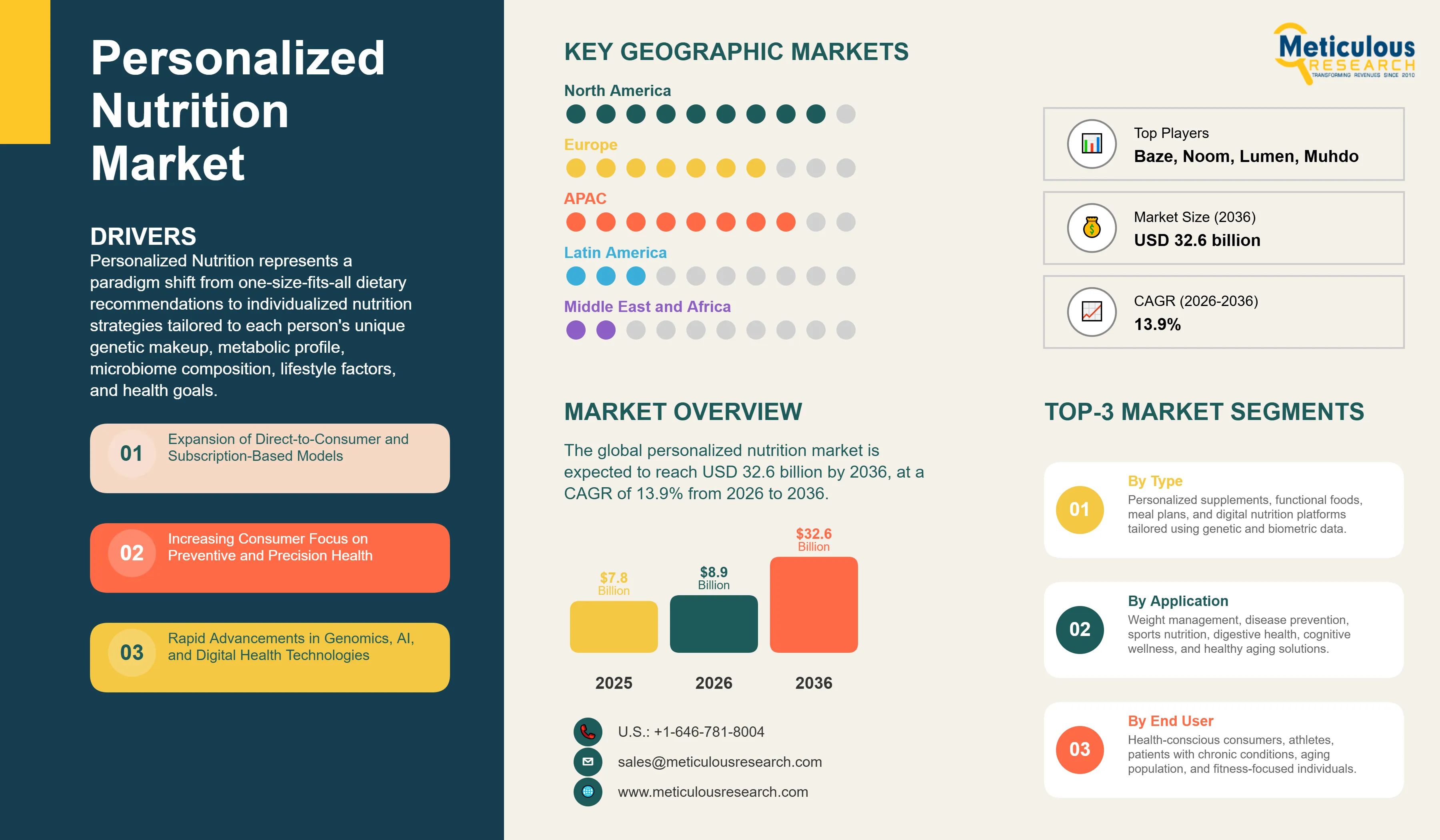

Report ID: MRFB - 1041700 Pages: 278 Feb-2026 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe global personalized nutrition market is expected to reach USD 32.6 billion by 2036 from USD 8.9 billion in 2026, at a CAGR of 13.9% from 2026 to 2036.

Personalized Nutrition represents a paradigm shift from one-size-fits-all dietary recommendations to individualized nutrition strategies tailored to each person's unique genetic makeup, metabolic profile, microbiome composition, lifestyle factors, and health goals. This precision approach leverages advanced technologies including DNA testing analyzing genetic variants (SNPs) affecting nutrient metabolism, vitamin absorption, and food sensitivities, gut microbiome sequencing identifying beneficial and harmful bacteria influencing digestion, immunity, and mental health, continuous glucose monitors (CGMs) tracking real-time blood sugar responses to different foods, wearable devices and health trackers monitoring activity levels, sleep quality, and physiological markers, artificial intelligence and machine learning algorithms analyzing millions of data points to generate customized recommendations, and blood biomarker testing measuring nutrient deficiencies, inflammatory markers, and metabolic health indicators. These technologies enable the creation of highly specific interventions including personalized supplement formulations addressing individual nutrient gaps and genetic predispositions, customized meal plans optimized for metabolic type, food preferences, and health conditions, targeted probiotic recommendations based on microbiome analysis, precision dosing of vitamins and minerals according to genetic variants affecting absorption and utilization, and dynamic dietary adjustments responding to real-time health data from wearables and continuous monitors. Personalized nutrition offers significant advantages over generic dietary advice, including improved health outcomes through targeted interventions addressing root causes rather than symptoms, enhanced compliance as recommendations align with individual preferences and lifestyle constraints, prevention of chronic diseases by identifying genetic risks and providing proactive nutritional strategies, optimization of athletic performance through nutrition timing and macronutrient ratios matched to training demands, weight management success rates 2-3 times higher than standard diets according to clinical studies, and reduction of adverse food reactions by identifying sensitivities and intolerances through genetic and antibody testing. The market serves diverse applications from disease prevention and management for conditions like diabetes, cardiovascular disease, and obesity, to performance optimization for athletes and fitness enthusiasts, healthy aging and longevity enhancement, cognitive function and mental health support, digestive health improvement, and beauty and skin health optimization through nutricosmetics.

1. In 2026, North America is estimated to account for the largest share of the global personalized nutrition market, driven by high consumer health awareness, widespread adoption of DNA testing and wearable devices, presence of leading personalized nutrition companies including 23andMe, Habit, and InsideTracker, strong preventive healthcare culture, and high disposable income supporting premium pricing.

2. Asia-Pacific is projected to register the highest CAGR during the forecast period, fueled by rising chronic disease prevalence, growing middle class with increasing health spending, smartphone and internet penetration enabling digital health platforms, government wellness initiatives, and cultural emphasis on preventive medicine and traditional personalized approaches like Ayurveda and Traditional Chinese Medicine.

3. Based on product type, the personalized supplements segment is estimated to hold the largest share of the market in 2026, driven by customized vitamin and mineral formulations, DNA-based supplement recommendations, subscription-based delivery models, and direct-to-consumer brands like Care/of, Persona Nutrition, and Baze offering tailored supplement packs.

4. Based on delivery model, the direct-to-consumer (DTC) segment is expected to witness the highest growth during the forecast period, driven by at-home testing kit convenience, subscription-based business models, mobile app integration, social media marketing effectiveness, and elimination of healthcare provider gatekeepers enabling broader market access.

5. Based on technology, the genetic testing segment dominates the market in 2026, representing the most established and scientifically validated approach with over 10 million consumers having used DNA-based nutrition services, providing actionable insights on nutrient metabolism, food sensitivities, and optimal macronutrient ratios based on genetic variants.

6. The AI-powered nutrition platforms segment is expected to grow at a significant CAGR during the forecast period, driven by machine learning algorithms improving recommendation accuracy, integration of multiple data sources including wearables and food logs, real-time personalization based on biometric feedback, and chatbot interfaces providing accessible nutrition coaching.

7. The weight management application segment accounts for the largest share, driven by obesity epidemic affecting 40% of adults in developed markets, proven effectiveness of personalized approaches achieving 2-3x better outcomes than generic diets, integration with continuous glucose monitoring for metabolic optimization, and consumer willingness to pay premium for successful weight loss solutions.

8. The U.S. personalized nutrition market is projected to grow at a CAGR of around 12% during the forecast period 2026 to 2036, driven by FDA regulation of genetic testing, insurance coverage expansion for preventive nutrition, employer wellness program adoption, influencer and celebrity endorsements, and consumer data privacy frameworks enabling trusted data sharing.

9. China is expected to lead the Asia-Pacific personalized nutrition market, driven by government Healthy China 2030 initiative, rapid digital health adoption, growing chronic disease burden, large-scale genomic databases, domestic companies like WeGene and 23Mofang offering localized genetic testing, and integration with Traditional Chinese Medicine principles.

10. In 2026, the U.K. is projected to account for significant share of the European personalized nutrition market, driven by National Health Service (NHS) pilot programs, strong nutrigenomics research from institutions like King's College London, data privacy protections under GDPR building consumer trust, and companies like Zoe offering microbiome-based personalized nutrition at scale.

Click here to: Get Free Sample Pages of this Report

Personalized Nutrition represents a fundamental transformation in how individuals approach diet, health, and wellness, moving from population-based dietary guidelines to precision recommendations tailored to unique biological characteristics. Traditional nutrition advice, based on averages across large populations, fails to account for enormous individual variation in how people metabolize nutrients, respond to different foods, and achieve health outcomes. Research demonstrates that identical meals can produce vastly different blood sugar responses in different individuals, that genetic variants affect vitamin D absorption by up to 300%, that microbiome composition influences calorie extraction from food by 150-200 calories daily, and that optimal macronutrient ratios for weight loss vary dramatically based on insulin sensitivity and metabolic type. This biological individuality creates a compelling case for personalized approaches that can address the 60% failure rate of traditional one-size-fits-all diets, reduce the $147 billion annual cost of obesity-related healthcare in the U.S. alone, prevent chronic diseases affecting 60% of adults globally, and optimize human performance and longevity. The personalized nutrition market has emerged as technologies enabling individual assessment have become accessible and affordable, with direct-to-consumer genetic testing declining from $1,000 in 2007 to under $100 today, microbiome sequencing becoming available for $99-299, continuous glucose monitors expanding beyond diabetes management to wellness applications, and artificial intelligence platforms analyzing millions of individual data points to generate increasingly accurate recommendations. This technological democratization has created a market opportunity serving early adopters including health-conscious millennials and Gen Z consumers willing to invest in preventive health, individuals with chronic conditions seeking alternative management approaches, athletes and fitness enthusiasts optimizing performance, parents concerned about children's nutrition and development, and aging populations focused on longevity and cognitive health.

Several key trends are reshaping the personalized nutrition market. These include convergence of multiple data sources with platforms integrating genetic, microbiome, blood biomarker, wearable device, and lifestyle data for comprehensive personalization, shift from static recommendations to dynamic adjustment with continuous monitoring enabling real-time dietary optimization, expansion beyond supplements to personalized foods with companies creating custom functional foods, meal kits, and beverages, clinical validation increasing with randomized controlled trials demonstrating superior outcomes versus standard approaches, integration with telehealth allowing remote nutrition counseling and physician oversight, and blockchain and privacy technologies addressing consumer data security concerns. The convergence of scientific advancement proving nutrigenomics efficacy, technology maturation making assessment tools affordable and user-friendly, consumer demand for health optimization and disease prevention, chronic disease epidemic creating urgency for effective interventions, and investment influx with over $2 billion in venture capital flowing to personalized nutrition startups 2020-2025 has accelerated market growth beyond initial predictions. Major food and supplement companies including Nestlé, Unilever, DSM, and Amway have launched personalized nutrition divisions or acquired startups, healthcare providers including CVS Health and Kaiser Permanente are piloting personalized nutrition programs, and technology giants including Amazon and Apple are exploring nutrition personalization features for their health platforms. This transformation has attracted attention from regulators ensuring consumer protection while fostering innovation, created new career opportunities in nutrigenomics and precision nutrition counseling, and established personalized nutrition as a multi-billion dollar market expected to reach mainstream adoption by the early 2030s.

The personalized nutrition market is transitioning from niche wellness offering to mainstream healthcare intervention, with increasing clinical validation, insurance reimbursement, and integration into standard medical practice. Leading platforms are demonstrating increasingly sophisticated capabilities, including multi-omic analysis combining genomics, proteomics, metabolomics, and microbiomics for comprehensive health assessment, predictive modeling using machine learning to forecast individual responses to dietary interventions before implementation, continuous optimization through closed-loop systems adjusting recommendations based on measured outcomes, precision supplementation dosing nutrients to optimal blood levels rather than generic recommended daily allowances, and personalized chronobiology timing nutrient intake to circadian rhythms and metabolic patterns. This technological sophistication is driving innovation as companies compete to offer the most accurate, comprehensive, and actionable personalization.

Genetic testing for personalized nutrition represents the most established technology, analyzing single nucleotide polymorphisms (SNPs) - variations in DNA affecting how individuals metabolize and respond to nutrients. Key genetic variants tested include MTHFR affecting folate metabolism and homocysteine levels, FTO and MC4R influencing obesity risk and response to different diet types, APOE determining cardiovascular disease risk and optimal fat intake, VDR affecting vitamin D metabolism and calcium absorption, COMT influencing caffeine metabolism and stress response, and lactase persistence determining dairy tolerance. Companies like 23andMe, AncestryDNA, and specialized nutrigenomics providers including Nutrigenomix, DNAfit, and Genova Diagnostics offer consumer tests analyzing 50-150 nutrition-relevant genetic variants for $99-399. These tests provide actionable recommendations including optimal macronutrient ratios (low-carb versus low-fat for weight loss based on genetic predisposition), vitamin and mineral requirements (individuals with certain variants need 2-5x normal vitamin D intake), food sensitivities (genetic lactose and gluten intolerance), eating behavior traits (genetic predisposition to overeating, snacking, or satiety responsiveness), and exercise response (optimal exercise type and intensity for weight loss based on genetic fitness markers). Clinical studies validate genetic testing utility, with research showing individuals following genetically-matched diets lose 2-3x more weight than those on mismatched diets, achieve better long-term adherence, and demonstrate improved biomarkers including cholesterol, blood sugar, and inflammatory markers. Limitations include that genetics explains only 20-40% of nutrition response variance (environment, microbiome, and lifestyle contribute significantly), genetic testing provides static information requiring complementary dynamic monitoring, and consumer genetic literacy affects recommendation interpretation and compliance.

Microbiome analysis has emerged as a powerful personalization tool, with gut bacteria composition influencing nutrient extraction, immune function, mental health, and chronic disease risk. The human gut contains 100 trillion bacteria from 1,000+ species, with composition varying dramatically between individuals based on diet, medications (especially antibiotics), stress, and early-life exposures. Microbiome testing companies including Viome, DayTwo, Ombre, and Thorne analyze stool samples using DNA sequencing to identify bacterial species present, their relative abundances, and functional capabilities (which metabolic pathways they express). These analyses provide insights including digestive efficiency (ability to break down proteins, fats, and carbohydrates), food recommendations (foods feeding beneficial bacteria versus harmful species), probiotic selection (specific strains addressing individual imbalances), disease risk (microbiome patterns associated with obesity, diabetes, inflammatory bowel disease), and supplement needs (bacterial production of vitamins like B12 and K affecting requirements). The Israeli company DayTwo has pioneered microbiome-based blood sugar prediction, demonstrating in a 1,000-person study published in Cell that microbiome analysis predicts post-meal glucose responses more accurately than traditional methods, enabling personalized diet recommendations that reduce glucose spikes by 40% compared to standard diabetic diets. The British company Zoe, co-founded by King's College London researchers, combines microbiome testing with continuous glucose monitoring and blood fat testing to create personalized nutrition scores for 100,000+ foods, showing in a 1,100-person trial that participants following Zoe recommendations lost average 9.4 pounds in 3 months and improved metabolic health markers. However, microbiome science faces challenges including that associations between bacteria and health outcomes don't always prove causation, microbiome composition changes over weeks to months requiring repeat testing, and interpretation complexity as the field is still establishing which bacterial patterns definitively predict health outcomes.

Market Dynamics:

Rising Chronic Disease Prevalence and Healthcare Costs: Chronic diseases including obesity, diabetes, cardiovascular disease, and metabolic syndrome affect 60% of adults globally and account for 70% of healthcare spending. In the United States, obesity affects 42% of adults costing $173 billion annually, diabetes affects 37 million people costing $327 billion, and cardiovascular disease affects 127 million costing $219 billion. Traditional dietary interventions show limited long-term success with 80-95% of dieters regaining weight within 5 years. Personalized nutrition demonstrates superior outcomes, with studies showing 2-3x better weight loss, 40% better blood sugar control, and improved adherence rates compared to generic approaches. This effectiveness in preventing and managing chronic conditions creates demand from individuals seeking alternatives to medication, employers aiming to reduce healthcare costs, and insurers recognizing potential savings from preventive interventions.

Consumer Shift Toward Preventive Health and Wellness: Modern consumers increasingly prioritize prevention over treatment, with 73% of millennials willing to pay premium for products and services supporting health goals. The COVID-19 pandemic accelerated this trend, highlighting immune health importance and personal responsibility for wellness. Consumers seek data-driven approaches to optimize health, with wearable device adoption reaching 320 million users globally, health app downloads exceeding 500 million annually, and 87% of consumers interested in using genetic information for health decisions. Personalized nutrition aligns with consumer desires for control, customization, and scientific validation of health choices. Social media influencers and celebrities promoting personalized nutrition amplify awareness and desirability, creating aspirational wellness brands that command premium pricing and strong customer loyalty.

Technology Advancement Making Personalization Accessible and Affordable: Dramatic cost reductions in genomic sequencing (from $100 million for first human genome in 2001 to under $100 for consumer genetic tests today), microbiome analysis (from research-only to $99-299 consumer tests), continuous glucose monitoring (from $300-400/month for diabetics to $70-150/month for wellness users), and artificial intelligence computing power have democratized personalized nutrition. Smartphone ubiquity enables easy data collection through food logging, activity tracking, and biometric monitoring. Cloud computing allows processing millions of individual data points to generate personalized recommendations at scale. These technological advances have transformed personalized nutrition from expensive concierge service available only to wealthy individuals into accessible consumer products serving mass markets through direct-to-consumer models, subscription services, and mobile apps.

Limited Clinical Validation and Regulatory Uncertainty: While nutrigenomics and personalized nutrition show promise, clinical evidence remains limited for many applications. Most genetic variants affect nutrition responses modestly (5-15% variance explained), and gene-diet interactions are complex with multiple genes influencing single outcomes. Many personalized nutrition companies base recommendations on preliminary research not validated in randomized controlled trials. Regulatory frameworks lag technology development, with FDA providing limited guidance on direct-to-consumer genetic testing claims, no standardized validation requirements for personalized nutrition algorithms, and ongoing debate about whether personalized nutrition constitutes medical advice requiring practitioner oversight. This regulatory uncertainty creates compliance risks, limits healthcare provider adoption, and reduces consumer confidence in unvalidated claims.

Data Privacy and Security Concerns: Personalized nutrition requires collecting sensitive health information including genetic data, biometric measurements, dietary habits, and health conditions. Consumers express concerns about data breaches exposing personal health information, insurance discrimination based on genetic predispositions, unauthorized data sharing with third parties, and lack of control over data use. High-profile data breaches affecting healthcare companies and 23andMe's 2023 breach compromising data of 6.9 million customers heighten privacy concerns. Regulations including GDPR in Europe and various U.S. state privacy laws create compliance complexity for companies operating across jurisdictions. Privacy concerns particularly affect older demographics and certain cultural groups, limiting market penetration and requiring substantial investment in data security infrastructure and transparent privacy policies.

High Costs and Limited Insurance Coverage: Personalized nutrition services typically cost $100-500 for initial testing plus $50-200 monthly for ongoing products and services, pricing out mass-market consumers. Comprehensive programs combining genetic testing, microbiome analysis, continuous glucose monitoring, and personalized supplements can exceed $2,000 annually. Insurance coverage remains limited, with most plans not reimbursing nutrigenomics testing or personalized nutrition counseling unless medically necessary for specific conditions. This out-of-pocket expense model limits market to affluent consumers and creates socioeconomic disparities in access. Price sensitivity varies by region and demographic, with lower adoption in price-conscious markets and among older consumers on fixed incomes compared to younger, higher-income segments willing to invest in preventive health.

Integration with Digital Health Ecosystems and Wearable Devices: The convergence of personalized nutrition with digital health platforms creates opportunities for comprehensive wellness solutions. Wearable device users (320 million globally) generate continuous health data including activity, sleep, heart rate variability, and stress markers that can inform nutrition recommendations. Continuous glucose monitors adopted by 2 million non-diabetic wellness users provide real-time feedback on food choices. Integration with electronic health records enables coordination between personalized nutrition and medical care. Apple Health, Google Fit, and Amazon Halo provide platforms connecting multiple health data sources. Companies creating seamless integration across genetic testing, biometric monitoring, food tracking, and personalized recommendations can offer superior value propositions and capture larger customer lifetime value through subscription models and ecosystem lock-in.

Corporate Wellness Program Adoption and Employer Health Benefits: Employers facing rising healthcare costs increasingly invest in preventive wellness programs, with 84% of large employers offering wellness benefits. Corporate wellness market valued at $61 billion globally provides channel for personalized nutrition adoption at scale. Employers benefit from reduced healthcare claims, improved productivity (poor nutrition costs employers $530 billion annually in lost productivity), and talent attraction and retention. Personalized nutrition programs demonstrate ROI through measurable health improvements and engagement rates 3-5x higher than generic wellness programs. Companies like Zipongo (acquired by Foodsmart) and Wellthy provide white-label personalized nutrition platforms for employers. Opportunities exist for B2B2C models serving millions of employees through employer-sponsored programs, leveraging group pricing to improve affordability and demonstrating population health outcomes to expand employer adoption.

Expansion into Emerging Markets with Rising Health Consciousness: Developing markets in Asia-Pacific, Latin America, and Middle East present substantial growth opportunities as rising incomes, increasing chronic disease burden, and smartphone penetration create conditions for personalized nutrition adoption. China's wellness market growing at 15% annually, India's middle class expanding to 600 million by 2030, and Southeast Asian digital health adoption accelerating post-pandemic provide favorable demographics. Cultural traditions including Ayurveda in India and Traditional Chinese Medicine in China align with personalization principles, easing consumer acceptance. Local companies adapting personalized nutrition to regional dietary patterns, genetic backgrounds, and cultural preferences can capture early-mover advantages. Opportunities include partnerships with regional healthcare providers, adaptation of testing to local genetic populations, and pricing strategies accommodating lower income levels while achieving profitability through volume.

The personalized nutrition market is expected to grow from USD 8.9 billion in 2026 to USD 32.6 billion by 2036.

The personalized nutrition market is expected to grow at a CAGR of 13.9% from 2026 to 2036.

Major players include Nestlé Health Science, DSM-Firmenich, Viome Life Sciences, DayTwo, Zoe, Habit, InsideTracker, Persona Nutrition, Care/of, Rootine, DNAfit, Nutrigenomix, Baze, Thorne HealthTech, 23andMe, Noom, and Levels Health, among others.

Main factors include rising chronic disease prevalence and healthcare costs, consumer shift toward preventive health and wellness, technology advancement making genetic and microbiome testing affordable, proven superior outcomes versus generic diets, wearable device integration, and corporate wellness program adoption.

North America is estimated to account for the largest share in 2026 due to high consumer health awareness and technology adoption, while Asia-Pacific is expected to register the highest growth rate during 2026-2036 driven by rising chronic disease burden and expanding middle class.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

4. Market Insights

4.1. Introduction

4.2. Drivers

4.3. Restraints

4.4. Opportunities

4.5. Challenges

4.6. Trends

4.7. Pricing Analysis

4.8. Value Chain Analysis

4.9. Porter's Five Forces Analysis

5. Global Personalized Nutrition Market, by Product Type

5.1. Introduction

5.2. Personalized Supplements

5.2.1. Custom Vitamin and Mineral Formulations

5.2.2. Personalized Probiotics

5.2.3. Targeted Functional Ingredients

5.3. Personalized Meal Plans and Food

5.3.1. Customized Meal Kits

5.3.2. Personalized Functional Foods

5.3.3. Custom Beverages and Shakes

5.4. Personalized Diet Plans and Coaching

5.5. Genetic and Diagnostic Testing Kits

6. Global Personalized Nutrition Market, by Delivery Model

6.1. Introduction

6.2. Direct-to-Consumer (DTC)

6.2.1. At-Home Testing and Subscriptions

6.2.2. Mobile App-Based Platforms

6.3. Clinical and Healthcare Provider-Led

6.3.1. Physician-Prescribed Programs

6.3.2. Registered Dietitian Services

6.4. Corporate Wellness Programs

6.5. Retail and Pharmacy Channels

7. Global Personalized Nutrition Market, by Technology

7.1. Introduction

7.2. Genetic Testing (Nutrigenomics)

7.2.1. SNP Analysis

7.2.2. Whole Genome Sequencing

7.3. Microbiome Analysis

7.3.1. 16S rRNA Sequencing

7.3.2. Metagenomic Sequencing

7.4. Blood Biomarker Testing

7.5. Continuous Glucose Monitoring (CGM)

7.6. AI-Powered Nutrition Platforms

7.7. Wearable Devices and Biosensors

8. Global Personalized Nutrition Market, by Application

8.1. Introduction

8.2. Weight Management and Obesity

8.3. Disease Prevention and Management

8.3.1. Diabetes Management

8.3.2. Cardiovascular Health

8.3.3. Digestive Health

8.4. Sports Nutrition and Performance

8.5. Healthy Aging and Longevity

8.6. Mental Health and Cognitive Function

8.7. Beauty and Skin Health (Nutricosmetics)

8.8. Prenatal and Maternal Nutrition

9. Global Personalized Nutrition Market, by End-User

9.1. Introduction

9.2. Individual Consumers

9.2.1. Health-Conscious Millennials and Gen Z

9.2.2. Chronic Disease Patients

9.2.3. Athletes and Fitness Enthusiasts

9.3. Healthcare Providers and Clinics

9.4. Corporate Wellness Programs

9.5. Fitness Centers and Gyms

9.6. Research Institutions

10. Personalized Nutrition Market, by Geography

10.1. Introduction

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.3. Europe

10.3.1. U.K.

10.3.2. Germany

10.3.3. France

10.3.4. Italy

10.3.5. Spain

10.3.6. Rest of Europe

10.4. Asia-Pacific

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. Australia

10.4.5. South Korea

10.4.6. Rest of Asia-Pacific

10.5. Latin America

10.5.1. Brazil

10.5.2. Mexico

10.5.3. Rest of Latin America

10.6. Middle East & Africa

10.6.1. UAE

10.6.2. Saudi Arabia

10.6.3. South Africa

10.6.4. Rest of Middle East & Africa

11. Competitive Landscape

11.1. Introduction

11.2. Market Share Analysis

11.3. Competitive Benchmarking

11.4. Key Strategic Developments

11.5. Competitive Dashboard

12. Company Profiles

(Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

12.1. Nestlé Health Science (Persona Nutrition acquired)

12.2. DSM-Firmenich

12.3. Viome Life Sciences

12.4. DayTwo Ltd.

12.5. Zoe Limited

12.6. Habit (Viome acquired)

12.7. InsideTracker

12.8. Persona Nutrition

12.9. Care/of (Bayer acquired)

12.10. Rootine

12.11. DNAfit (Prenetics acquired)

12.12. Nutrigenomix Inc.

12.13. Baze

12.14. Thorne HealthTech

12.15. Genova Diagnostics

12.16. 23andMe Inc.

12.17. Noom Inc.

12.18. Levels Health

12.19. Lumen

12.20. Muhdo

12.21. Others

13. Appendix

13.1. Questionnaire

13.2. Available Customization

Published Date: Oct-2024

Published Date: Jul-2024

Published Date: Jun-2023

Published Date: Jun-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates