Resources

About Us

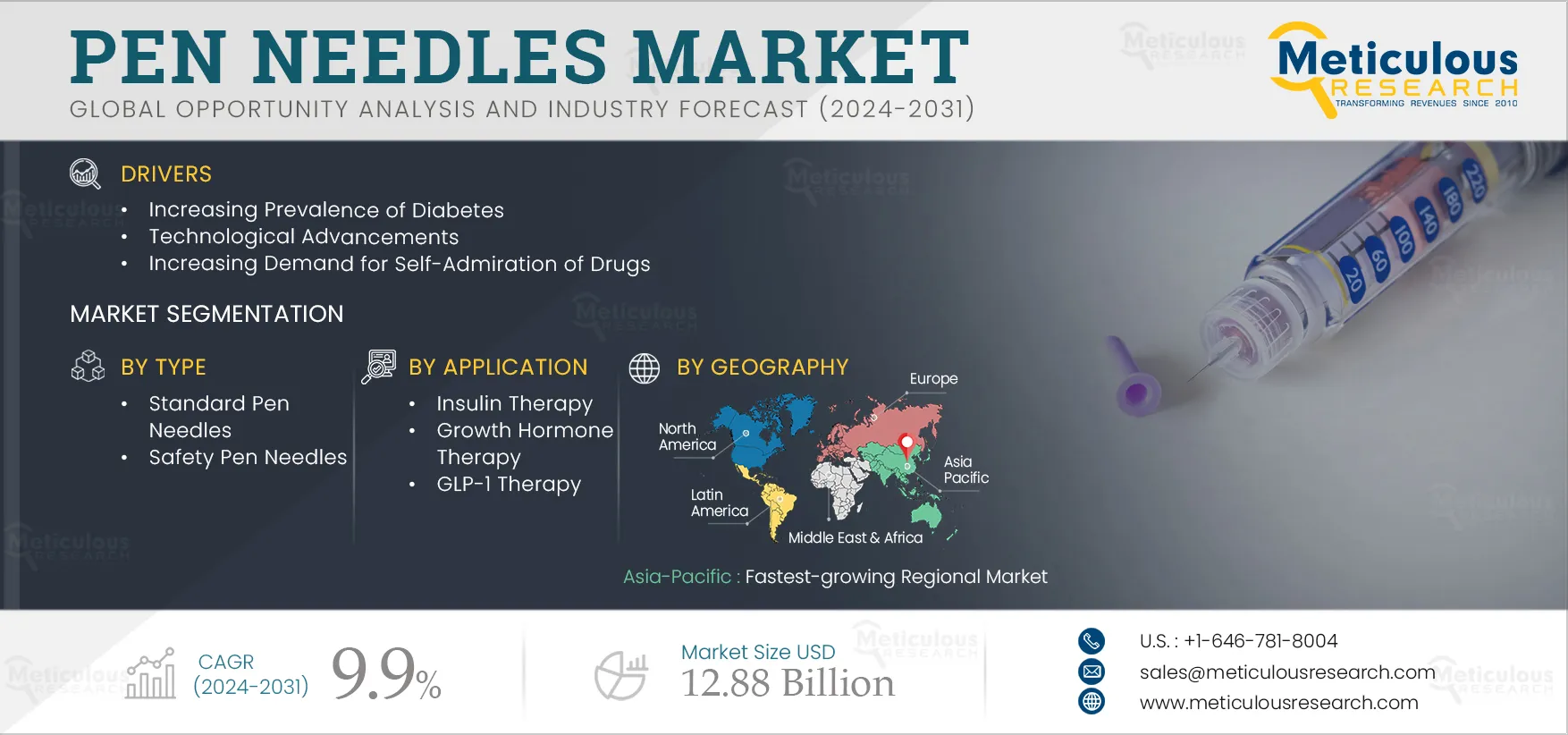

Pen Needles Market by Type (Standard, Safety), Needle Length, Usability (Disposable, Reuse), Application (Insulin, Growth Hormone, GLP-1), Distribution Channel (Hospital Pharmacy, Retail, Online), Setting (Home Care, Hospital) - Global Forecast to 2032

Report ID: MRHC - 1041113 Pages: 270 Aug-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportPen needles are sterile devices utilized with pen injectors to administer injectable drugs into the patient's body. Pen needles consist of needles implanted in a plastic body that is attached to an injection pen. Pen needles are offered in a variety of gauge sizes and lengths. People with diabetes typically use pen needles as they require several insulin injections each day. Technological advancements in pen needles prevent needle stick injuries and reduce pain and discomfort during injection, which improves the entire user experience.

The growth of this market is driven by factors such as the rising prevalence of diabetes, growing demand for self-administration of drugs, advancements in technology, and rising healthcare expenditure. Moreover, the preference for pen needles over vials and syringes, favorable reimbursement policies, and emerging economies are expected to offer significant market growth opportunities.

However, concerns regarding needlestick injuries restrain the market’s growth. Additionally, the reuse of pen needles, limited access to healthcare in developing nations, and lack of awareness about proper usage of pen needles pose challenges to the market’s growth.

Diabetes stands as one of the foremost global health challenges in the 21st century, with its prevalence increasing annually and posing significant risks of life-altering complications. According to the International Diabetes Federation, in 2021, 537 million people were diagnosed with diabetes worldwide. Among these, the Western Pacific region accounted for 206 million cases, Southeast Asia for 90 million, the Middle East and North Africa for 73 million, Europe for 61 million, North America and the Caribbean for 51 million, South and Central America for 32 million, and Africa for 24 million. This number is projected to reach 643 million by 2032 and 783 million by 2045.

Moreover, the Centers for Disease Control and Prevention reported that in 2022, 38 million individuals were diagnosed with diabetes in the U.S. Furthermore, Type 2 diabetes is increasingly prevalent among adults aged 45 and above, while its occurrence is also rising among teenagers, children, and adults overall. Thus, the rising prevalence of diabetes is driving the growth of the pen needles market.

Click here to: Get Free Sample Pages of this Report

In recent years, pen needles have gained popularity over traditional vials and syringes for certain medical purposes, specifically for insulin administration. Pen needles have various advantages, making them an increasingly common option among patients and healthcare practitioners.

Pen needles are engineered for user convenience, featuring clear labeling, customizable dosing, and straightforward injection mechanisms. Many models incorporate safety enhancements like automated needle retraction or shields to minimize the risk of accidental needlestick injuries. Compared to traditional syringes, pen needles typically have shorter and thinner needles, thereby reducing injection-related pain and discomfort thus enhancing the overall user experience. Additionally, pen needles come pre-filled with medication, eliminating the need to draw doses from vials using a separate syringe. These advantages contribute to the growing preference for pen needles over vials and syringes.

Among the types covered in this report, in 2025, the safety pen needles segment is expected to account for the larger share of the pen needles market. Safety pen needles are increasingly preferred over standard pen needles as they reduce the risk of needlestick injuries. Moreover, companies in the pen needles market are actively enhancing their product portfolios through the introduction of new products and obtaining regulatory approvals. For instance, in February 2024, Montmed, Inc. (Canada) secured a patent from the United States Patent and Trademark Office (USPTO) for its Sitesmart Pen Needles, designed to facilitate easy and seamless insulin administration for diabetic individuals, thereby promoting healthier injection practices. Similarly, in February 2021, UltiMed, Inc. (U.S.) launched the UltiCare safety pen needle, protecting against accidental needlestick injuries. These initiatives contribute to the growing demand for safety pen needles.

Among the needle lengths covered in this report, in 2025, the 4 mm segment is expected to account for the largest share of the pen needles market. The large market share of this segment can be attributed to the benefits offered by these needles, such as less pain and a higher level of comfort during injections compared to longer needles. Their shorter length allows for easy access to the patient's subcutaneous tissue, reducing the chances of needlestick injuries and minimizing the risk of adverse effects associated with intramuscular injections. Additionally, 4 mm needles help to ensure more consistent dosing, contributing to their widespread adoption.

Based on usability, in 2025, the single-use/disposable segment is expected to account for the largest share of the pen needles market. Insulin pen needles are intended for single use only, offering several advantages over traditional syringes. Single-use pen needles provide improved dosing accuracy, ease of use, and reduced pain during injections. Additionally, they help to minimize the risk of infections due to their pre-sterilized nature, eliminating the need for cleaning or sterilization before each use. This convenience is particularly beneficial for patients requiring frequent injections, as it saves them time and effort, thereby contributing to the increased adoption of single-use/disposable pen needles.

Among the applications covered in this report, in 2025, the insulin therapy segment is expected to account for the largest share of the pen needles market. Insulin therapy is the most commonly utilized approach for managing diabetes, aiding in the regulation of blood sugar levels and the prevention of associated complications. The large market share of this segment can be attributed to increasing awareness about the benefits of insulin therapy and the implementation of diabetes management and awareness initiatives. For instance, in December 2024, the government of Goa partnered with Sanofi S.A. (France) to accelerate diabetes awareness programs and facilitate early detection of diabetes in schools. Additionally, in November 2024, the American Diabetes Association (ADA) (U.S.) launched the "We Fight" campaign aimed at curing and preventing diabetes while improving the lives of individuals affected by the condition.

Among the distribution channels covered in this report, in 2025, the retail pharmacies segment is expected to account for the largest share of the pen needles market. The large market share of this segment can be attributed to the increasing consumer demand for pen needles and the opportunity for customers to inspect the product before making a purchase.

Among the healthcare settings covered in this report, in 2025, the home care segment is expected to account for the largest share of the pen needles market. The large market share of this segment can be attributed to the increasing development and adoption of home care devices due to their convenience, precision, and accuracy. Additionally, there has been a growing focus among companies to raise awareness about diabetes, which has led to increased adoption of pen needles in home care settings. Furthermore, home care allows patients to receive the necessary care for managing their conditions in the comfort of their own homes. Pen needles play a crucial role in enabling patients to self-administer injectable medications, further driving the shift toward home care.

The market in Asia-Pacific is projected to register the highest growth rate during the forecast period. The growth of this regional market can be attributed to the rising prevalence of diabetes in the region, the presence of major pen needle manufacturers in countries such as China, India, Singapore, and Japan, and technological advancements related to pen needles. These advancements include features such as compatibility with various insulin pens, adjustable needle lengths, and safety applications aimed at reducing needle stick injuries.

The report offers a competitive landscape based on an extensive assessment of the product offerings and geographic presence of leading market players and the key growth strategies adopted by them over the past three to four years. The key players profiled in the pen needles market report are Becton, Dickinson and Company (U.S.), Novo Nordisk A/S (Denmark), Ypsomed AG (Switzerland), Owen Mumford Limited (U.K.), B. Braun Melsungen AG (Germany), Terumo Group (Japan), Allison Medical, Inc. (U.S.), Cardinal Health, Inc. (U.S.), Trividia Health, Inc. (U.S.), UltiMed, Inc. (U.S.), Hindustan Syringes & Medical Devices Ltd (India), and Nanchang YiLi Medical Instrument Co.,LTD (China).

|

Particulars |

Details |

|

Number of Pages |

~270 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

9.9% |

|

Estimated Market Size (Value) |

$12.88 million by 2032 |

|

Segments Covered |

By Type

By Needles Length

By Usability

By Application

By Distribution Channel

By Healthcare Setting

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, Italy, U.K., Spain, Austria, Netherlands, Rest of Europe) Asia–Pacific (India, China, Japan, South Korea, Australia, Rest of Asia–Pacific), Latin America (Brazil, Mexico, Rest of Latin America), Middle East & Africa. |

|

Key Companies |

Becton, Dickinson and Company (U.S.), Novo Nordisk A/S (Denmark), Ypsomed AG (Switzerland), Owen Mumford Limited (U.K.), B. Braun Melsungen AG (Germany), Terumo Group (Japan), Allison Medical, Inc. (U.S.), Cardinal Health, Inc. (U.S.), UltiMed, Inc. (U.S.), Hindustan Syringes & Medical Devices Ltd (India), and Nanchang YiLi Medical Instrument Co.,LTD (China). |

This study offers a detailed assessment of the pen needles market and analyzes the market sizes & forecasts based on type, needle length, usability, application, distribution channel, and healthcare setting. This report also involves the value analysis of various segments and subsegments of the pen needles market at the regional and country levels.

The pen needles market is projected to reach $12.88 billion by 2032, at a CAGR of 9.9% during the forecast period.

Among the types covered in this report, in 2025, the safety pen needles segment is expected to account for the largest share of the market. The large market share of this segment is attributed to the benefits offered by safety pen needles over standard needles and technological advancements in safety pen needles.

The growth of this market is driven by factors such as the rising prevalence of diabetes, growing demand for self-administration of drugs, advancements in technology, and rising healthcare expenditure. Moreover, the preference for pen needles over vials and syringes, favorable reimbursement policies, and emerging economies are expected to offer significant market growth opportunities.

The key players profiled in the pen needles market report are Becton, Dickinson and Company (U.S.), Novo Nordisk A/S (Denmark), Ypsomed AG (Switzerland), Owen Mumford Limited (U.K.), B. Braun Melsungen AG (Germany), Terumo Group (Japan), Allison Medical, Inc. (U.S.), Cardinal Health, Inc. (U.S.), UltiMed, Inc. (U.S.), Hindustan Syringes & Medical Devices Ltd (India), and Nanchang YiLi Medical Instrument Co.,LTD (China).

Emerging economies, such as China and India, are expected to provide significant growth opportunities for market players due to the increasing healthcare expenditures in these countries.

1. Introduction

1.1. Market Definition and Scope

1.2. Market Ecosystem

1.3. Currency and Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecasting

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Drivers

4.2.1. Increasing Prevalence of Diabetes

4.2.2. Technological Advancements

4.2.3. Increasing Demand for Self-Admiration of Drugs

4.2.4. Rising Healthcare Expenditure

4.3. Restraints

4.3.1. Needlestick Injury Concerns

4.4. Opportunities

4.4.1. Rising Preference for Pen Needles over Vials and Syringes

4.4.2. Emerging Economies

4.4.3. Favourable Reimbursement Scenario

4.4.4. Implementation of AI in Pen Injectors

4.5. Challenges

4.5.1. Reuse of Pen Needles

4.5.2. Limited Access to Healthcare in Developing Countries

4.5.3. Lack of Awareness and Knowledge of Pen Needles

4.6. Factor Analysis

4.7. Industry Trends

4.8. Pricing Analysis

4.9. Regulatory Analysis

4.10. Porter’s Five Forces Analysis

4.11. Parent/Adjacent Market Analysis

5. Pen Needles Market Assessment—by Type

5.1. Overview

5.2. Standard Needles

5.3. Safety Needles

6. Pen Needles Market Assessment—by Needle Length

6.1. Overview

6.2. 4 mm

6.3. 5 mm

6.4. 6 mm

6.5. 8 mm

6.6. 10 mm

6.7. 12 mm & Above

7. Pen Needles Market Assessment—by Usability

7.1. Overview

7.2. Single-use/Disposable Needles

7.3. Reusable Needles

8. Pen Needles Market Assessment—by Application

8.1. Overview

8.2. Insulin Therapy

8.3. Growth Hormone Therapy

8.4. GLP-1 Therapy

8.5. Other Applications

9. Pen Needles Market Assessment—by Distribution Channel

9.1. Overview

9.2. Hospital Pharmacies

9.3. Retail Pharmacies

9.4. Online Channels

10. Pen Needles Market Assessment—by Healthcare Setting

10.1. Overview

10.2. Home Care

10.3. Hospitals and Clinics

10.4. Other Healthcare Settings

11. Pen Needles Market Assessment—by Geography

11.1. Overview

11.2. North America

11.2.1. U.S.

11.2.2. Canada

11.3. Europe

11.3.1. Germany

11.3.2. France

11.3.3. U.K.

11.3.4. Italy

11.3.5. Spain

11.3.6. Austria

11.3.7. Netherlands

11.3.8. Rest of Europe

11.4. Asia-Pacific

11.4.1. Japan

11.4.2. China

11.4.3. India

11.4.4. South Korea

11.4.5. Australia

11.4.6. Rest of Asia-Pacific

11.5. Latin America

11.5.1. Brazil

11.5.2. Mexico

11.5.3. Rest of Latin America

11.6. Middle East & Africa

12. Competition Analysis

12.1. Overview

12.2. Key Growth Strategies

12.3. Competitive Benchmarking

12.4. Competitive Dashboard

12.4.1. Industry Leaders

12.4.2. Market Differentiators

12.4.3. Vanguards

12.4.4. Emerging Companies

12.5. Market Share Analysis/Market Rankings, by Key Players (2024)

13. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis*)

13.1. Becton, Dickinson and Company

13.2. Novo Nordisk A/S

13.3. Ypsomed AG

13.4. Owen Mumford Limited

13.5. B. Braun Melsungen AG

13.6. Terumo Group

13.7. Allison Medical, Inc.

13.8. Cardinal Health, Inc.

13.9. Trividia Health, Inc.

13.10. UltiMed, Inc.

13.11. Hindustan Syringes & Medical Devices Ltd

13.12. Nanchang YiLi Medical Instrument Co.,LTD

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

14. Appendix

14.1. Available Customization

14.2. Related Reports

List of Tables

Table 1 Global Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 2 Global Standard Pen Needles Market, by Country/Region, 2022–2032 (USD Million)

Table 3 Global Safety Pen Needles Market, by Country/Region, 2022–2032 (USD Million)

Table 4 Global Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 5 Global 4mm Pen Needles Market, by Country/Region, 2022–2032 (USD Million)

Table 6 Global 5 mm Pen Needles Market, by Country/Region, 2022–2032 (USD Million)

Table 7 Global 6 mm Pen Needles Market, by Country/Region, 2022–2032 (USD Million)

Table 8 Global 8 mm Pen Needles Market, by Country/Region, 2022–2032 (USD Million)

Table 9 Global 10 mm Pen Needles Market, by Country/Region, 2022–2032 (USD Million)

Table 10 Global 12 mm & Above Pen Needles Market, by Country/Region, 2022–2032 (USD Million)

Table 11 Global Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 12 Global Single-use/Disposable Pen Needles Market, by Country/Region, 2022–2032 (USD Million)

Table 13 Global Reusable Pen Needles Market, by Country/Region, 2022–2032 (USD Million)

Table 14 Global Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 15 Global Pen Needles Market for Insulin Therapy, by Country/Region, 2022–2032 (USD Million)

Table 16 Global Pen Needles Market for Growth Hormone Therapy, by Country/Region, 2022–2032 (USD Million)

Table 17 Global Pen Needles Market for GLP-1 Therapy, by Country/Region, 2022–2032 (USD Million)

Table 18 Global Pen Needles Market for Other Applications, by Country/Region, 2022–2032 (USD Million)

Table 19 Global Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 20 Global Pen Needles Market for Hospital Pharmacies, by Country/Region, 2022–2032 (USD Million)

Table 21 Global Pen Needles Market for Retail Pharmacies, by Country/Region, 2022–2032 (USD Million)

Table 22 Global Pen Needles Market for Online Channels, by Country/Region, 2022–2032 (USD Million)

Table 23 Global Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 24 Global Pen Needles Market for Home Care, by Country/Region, 2022–2032 (USD Million)

Table 25 Global Pen Needles Market for Hospitals & Clinics, by Country/Region, 2022–2032 (USD Million)

Table 26 Global Pen Needles Market for Other Healthcare Settings, by Country/Region, 2022–2032 (USD Million)

Table 27 Global Pen Needles Market, by Country/Region, 2022–2032 (USD Million)

Table 28 North America: Pen Needles Market, by Country, 2022–2032 (USD Million)

Table 29 North America: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 30 North America: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 31 North America: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 32 North America: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 33 North America: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 34 North America: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 35 U.S.: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 36 U.S.: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 37 U.S.: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 38 U.S.: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 39 U.S.: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 40 U.S.: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 41 Canada: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 42 Canada: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 43 Canada: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 44 Canada: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 45 Canada: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 46 Canada: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 47 Europe: Pen Needles Market, by Country/Region, 2022–2032 (USD Million)

Table 48 Europe: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 49 Europe: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 50 Europe: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 51 Europe: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 52 Europe: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 53 Europe: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 54 Germany: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 55 Germany: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 56 Germany: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 57 Germany: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 58 Germany: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 59 Germany: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 60 France: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 61 France: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 62 France: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 63 France: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 64 France: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 65 France: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 66 U.K.: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 67 U.K.: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 68 U.K.: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 69 U.K.: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 70 U.K.: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 71 U.K.: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 72 Italy: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 73 Italy: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 74 Italy: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 75 Italy: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 76 Italy: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 77 Italy: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 78 Spain: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 79 Spain: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 80 Spain: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 81 Spain: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 82 Spain: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million

Table 83 Spain: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 84 Austria: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 85 Austria: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 86 Austria: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 87 Austria: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 88 Austria: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 89 Austria: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 90 Netherlands: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 91 Netherlands: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 92 Netherlands: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 93 Netherlands: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 94 Netherlands: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 95 Netherlands: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 96 Rest of Europe: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 97 Rest of Europe: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 98 Rest of Europe: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 99 Rest of Europe: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 100 Rest of Europe: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 101 Rest of Europe: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 102 Asia-Pacific: Pen Needles Market, by Country/Region, 2022–2032 (USD Million)

Table 103 Asia-Pacific: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 104 Asia-Pacific: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 105 Asia-Pacific: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 106 Asia-Pacific: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 107 Asia-Pacific: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million

Table 108 Asia-Pacific: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 109 Japan: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 110 Japan: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 111 Japan: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 112 Japan: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 113 Japan: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 114 Japan: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 115 China: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 116 China: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 117 China: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 118 China: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 119 China: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 120 China: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 121 India: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 122 India: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 123 India: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 124 India: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 125 India: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 126 India: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 127 South Korea: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 128 South Korea: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 129 South Korea: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 130 South Korea: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 131 South Korea: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 132 South Korea: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 133 Australia: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 134 Australia: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 135 Australia: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 136 Australia: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 137 Australia: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 138 Australia: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 139 Rest of Asia–Pacific: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 140 Rest of Asia–Pacific: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 141 Rest of Asia–Pacific: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 142 Rest of Asia–Pacific: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 143 Rest of Asia–Pacific: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 144 Rest of Asia–Pacific: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 145 Latin America: Pen Needles Market, by Country/Region, 2022–2032 (USD Million)

Table 146 Latin America: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 147 Latin America: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 148 Latin America: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 149 Latin America: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 150 Latin America: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 151 Latin America: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 152 Brazil: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 153 Brazil: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 154 Brazil: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 155 Brazil: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 156 Brazil: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 157 Brazil: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 158 Mexico: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 159 Mexico: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 160 Mexico: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 161 Mexico: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 162 Mexico: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 163 Mexico: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 164 Rest of Latin America: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 165 Rest of Latin America: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 166 Rest of Latin America: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 167 Rest of Latin America: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 168 Rest of Latin America: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 169 Rest of Latin America: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 170 Middle East & Africa: Pen Needles Market, by Type, 2022–2032 (USD Million)

Table 171 Middle East & Africa: Pen Needles Market, by Needle Length, 2022–2032 (USD Million)

Table 172 Middle East & Africa: Pen Needles Market, by Usability, 2022–2032 (USD Million)

Table 173 Middle East & Africa: Pen Needles Market, by Application, 2022–2032 (USD Million)

Table 174 Middle East & Africa: Pen Needles Market, by Distribution Channel, 2022–2032 (USD Million)

Table 175 Middle East & Africa: Pen Needles Market, by Healthcare Setting, 2022–2032 (USD Million)

Table 176 Recent Developments, by Company, 2020–2024

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Size Estimation

Figure 7 Global Pen Needles Market, by Type, 2025 VS. 2032 (USD Million)

Figure 8 Global Pen Needles Market, by Needle Length, 2025 VS. 2032 (USD Million)

Figure 9 Global Pen Needles Market, by Usability, 2025 VS. 2032 (USD Million)

Figure 10 Global Pen Needles Market, by Application, 2025 VS. 2032 (USD Million)

Figure 11 Global Pen Needles Market, by Distribution Channel, 2025 VS. 2032 (USD Million)

Figure 12 Global Pen Needles Market, by Healthcare Setting, 2025 VS. 2032 (USD Million)

Figure 13 Global Pen Needles Market, by Geography

Figure 14 Impact Analysis: Pen Needles Market

Figure 15 Global Pen Needles Market, by Type, 2025 VS. 2032 (USD Million)

Figure 16 Global Pen Needles Market, by Needle Length, 2025 VS. 2032 (USD Million)

Figure 17 Global Pen Needles Market, by Usability, 2025 VS. 2032 (USD Million)

Figure 18 Global Pen Needles Market, by Application, 2025 VS. 2032 (USD Million)

Figure 19 Global Pen Needles Market, by Distribution Channel, 2025 VS. 2032 (USD Million)

Figure 20 Global Pen Needles Market, by Healthcare Setting, 2025 VS. 2032 (USD Million)

Figure 21 Global Pen Needles Market, by Geography, 2025 VS. 2032 (USD Million)

Figure 22 North America: Pen Needles Market Snapshot

Figure 23 Europe: Pen Needles Market Snapshot

Figure 24 Asia-Pacific: Pen Needles Market Snapshot

Figure 25 Latin America: Pen Needles Market Snapshot

Figure 26 Key Growth Strategies Adopted by Leading Players, 2020–2025

Figure 27 Global Pen Needles Market: Competitive Benchmarking, by Type

Figure 28 Global Pen Needles Market: Competitive Benchmarking, by Geography

Figure 29 Global Pen Needles Market: Vendor Dashboard

Figure 30 Market Share Analysis: Global Pen Needles Market, 2024

Figure 31 Becton, Dickinson and Company: Financial Overview (2024)

Figure 32 Novo Nordisk A/S: Financial Overview (2024)

Figure 33 Ypsomed AG: Financial Overview (2024)

Figure 34 B. Braun Melsungen AG: Financial Overview (2024)

Figure 35 B Terumo Group: Financial Overview (2024)

Figure 36 Cardinal Health, Inc.: Financial Overview (2024)

Published Date: Feb-2025

Published Date: Jan-2025

Published Date: Aug-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates