Resources

About Us

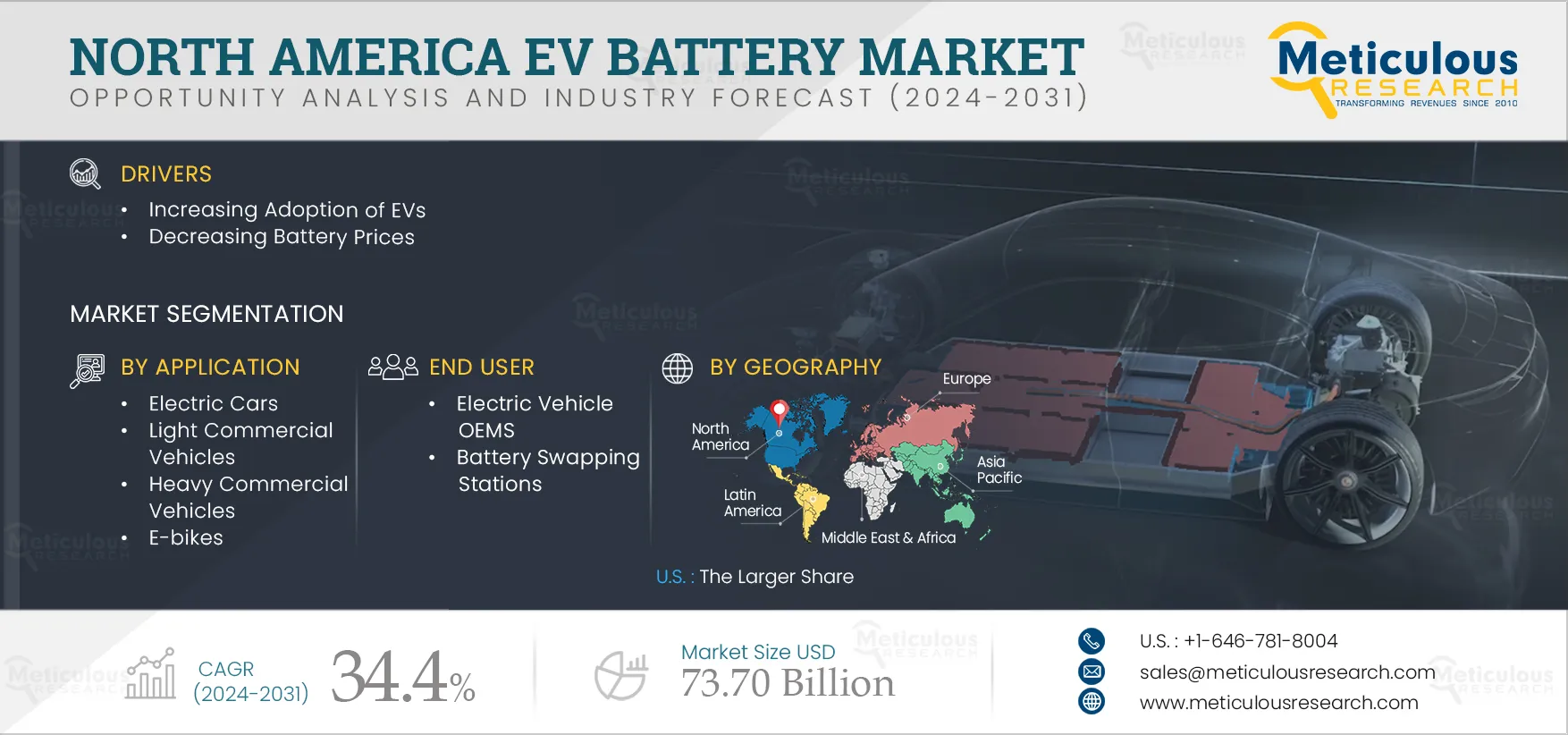

North America EV Battery Market by Type (Li-ion, Ni-MH, SLA, Ultracapacitor, Solid-state Batteries), Capacity (<50 kWh, 51-100 kWh, 101-300 kWh, >300 kWh), Bonding Type (Wire, Laser), Form, Application, End User, and Country - Forecast to 2031

Report ID: MRAUTO - 104531 Pages: 150 Jun-2024 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 48 Hours Download Free Sample ReportThe growth of North America’s EV battery market is driven by increasing investments by leading automotive OEMs in setting up battery manufacturing facilities in the region, increasing adoption of EVs, and decreasing battery prices. Furthermore, the increasing investments in alternative battery technology are expected to generate growth opportunities for the stakeholders in this market. However, the high import cost of raw materials for battery manufacturing and the low energy density of batteries are major challenges impacting market growth.

Several industry leaders are actively investing in the research & development of EV battery technology in North America. The growing number of pilot projects for the installation of charging infrastructures at various public places, an increasing number of buyers adopting EVs, growing government incentive programs and subsidies on purchasing EVs, and increasing competition among industry leaders to launch new models are some of the key factors driving the growth of this market in this region. Major key players in the market are investing in EV battery development to support the increasing demand for EV batteries. Also, in May 2021, Martinrea, an auto car manufacturer, and NanoXplore, a graphene producer, established a joint venture called VoltaXplore in Canada to manufacture EV batteries. The plant capacity is up to 1,000 batteries per day. Such advancements and developments in the EV battery industry are expected to grow the demand for batteries in the forecast period.

Click here to: Get a Free Sample Copy of this report

Click here to: Get a Free Sample Copy of this report

The growing number of pilot projects for the installation of charging infrastructures at various public places, an increasing number of EVs, growing government incentive programs and subsidies on purchasing EVs, and increasing competition among industry leaders to launch new models are some of the key factors driving the growth of this market in this region. The state and local governments are supporting the growth of the EV market by introducing numerous policies, infrastructure development, incentives, and awareness campaigns. States adopting zero-emission vehicles (ZEV) regulations further trigger the adoption of EVs by expanding model availability and providing assurance for charging infrastructure investments. Moreover, states such as California, Colorado, New Jersey, and Washington State are at the forefront of adopting these regulations. Thus, government support is one of the key factors driving the EV market growth. Such government support is boosting the adoption of EVs in North America. This is expected to boost the adoption of EV batteries in the forecast period.

The U.S. imports lithium-ion batteries from Asia, especially China, for electric vehicles and consumer electronics. The biggest challenge looming is the supply chain of raw materials to produce the batteries themselves. North America has long relied on imports to supply the components of technologies such as batteries. This includes nickel, lithium, graphite, cobalt, and many more. China has the upper hand in raw material resources. In addition to manufacturing a majority of the world’s batteries, its land is also an abundant source of many of the minerals and other materials required in the battery process. This shows that North American companies import most raw materials for battery manufacturing from other regions, making the cost of EV battery manufacturing in North America very high. This factor directly impacts the growth of the North America EV battery market during the forecast period.

EV batteries are witnessing advancement in battery composition, battery optimization, and battery charging rate. A researcher developed a solid-state battery for electric vehicles, ensuring better energy efficiency, size compactness, lightweight, and increased running range than lithium-ion batteries. Research has also been done on the chemical compositions of EV batteries. Instead of lithium-ion batteries, sodium-ion can also be used in EV batteries to make them inexpensive and non-inflammable. Solid Power (U.S.), a solid-state battery developer, uses sulfide-based cells. Its solid electrolyte is not flammable, so it delivers more than 50% more energy density than lithium-ion batteries. Solid-state batteries use solid compounds instead of liquid electrodes, which reduces the chances of battery inflammation. These batteries exhibit a high power-to-weight ratio, which improves the vehicle's driving range. Such advancements in the battery composition, battery optimization, and battery charging rate are poised to grow the demand for EV batteries in the forecasted years.

Based on type, the North America EV battery market is segmented into lithium-ion batteries, sealed lead acid batteries, nickel-metal hydride batteries, ultracapacitors, solid-state batteries, and other battery types. In 2024, the lithium-ion batteries segment is expected to account for the largest share of above 87.0% of the North America EV battery market. The segment’s large market share is mainly attributed to lithium-ion battery's higher energy density, compactness, durability, and lightweight, and increased adoption of lithium-ion batteries in electric vehicles.

Moreover, the lithium-ion batteries segment is expected to record the highest CAGR during the forecast period. This segment's growth is mainly driven by OEMs' increasing focus on partnerships to develop lithium-ion batteries, secure the battery supply chain for their existing and upcoming electric vehicles, and achieve technology leadership in EV batteries.

Based on capacity, the North America EV battery market is segmented into less than 50 kWh, 51 kWh to 100 kWh, 101 kWh to 300 kWh, and more than 300 kWh. In 2024, the 51kWh to 100kWh segment is expected to account for the largest share of above 91.0% of the North America EV battery market. The segment’s large share is mainly attributed to factor such as e increasing initiatives by leading automotive OEMs to launch long-range and more powerful electric cars and targets set by governments across the region to phase out internal combustion engine vehicles by 2030.

However, the 101kWh to 300kWh segment is expected to record the highest CAGR during the forecast period. This segment's growth is mainly driven by the growing initiatives by governments worldwide for fleet electrification, new vehicle launches by automotive OEMs for logistics and transportation applications, and the increasing adoption of EVs by e-commerce companies.

Based on bonding type, the North America EV battery market is segmented into wire bonding and laser bonding. In 2024, the wire bonding segment is expected to account for the larger share of above 79.0% of the North America EV battery market. The segment’s large share is mainly attributed to factors such as the high reliability of wire bonding technology, low production cost, better thermal relief properties, lesser scrap production, and easy replaceability of faulty wire bonds.

However, the laser bonding segment is expected to record the highest CAGR during the forecast period. This segment's growth is mainly driven by the advantages of laser bonding, such as narrow welds, high welding speed, and low heat level, which enable fast, automated, precise production of battery pack conductive joints.

Based on form, the North America EV battery market is segmented into prismatic, cylindrical, and pouch. In 2024, the pouch segment is expected to account for the largest share of above 41.0% of the North America EV battery market. The segment’s large share is mainly attributed to the benefits of pouch battery form, such as higher energy density, more safety performance, and lower internal resistance.

Moreover, the pouch segment is expected to record the highest CAGR during the forecast period. This segment's growth is mainly driven by increasing initiatives by automotive OEMs and battery OEMs to increase the use of pouch cells due to their high energy density.

Based on application, the North America EV battery market is segmented into electric cars, light commercial vehicles, heavy commercial vehicles, e-scooters & motorcycles, and e-bikes. In 2024, the electric cars segment is expected to account for the largest share of above 90.0% of the North America EV battery market. The segment’s large share is mainly attributed to the growing concerns regarding the negative environmental effects of vehicular emissions, supportive government initiatives to decarbonize transportation, and increasing efforts by major automotive OEMs to reduce greenhouse gas emissions and transform their products line-ups into green, clean, and environment-friendly vehicles.

However, the light commercial vehicles segment is expected to record the highest CAGR during the forecast period. The segment’s growth is mainly driven by the increasing focus of transport fleet operators on shifting to light commercial vehicles and the growing focus of EV manufacturers on expanding their light commercial vehicle lineup.

Based on end user, the North America EV battery market is segmented into electric vehicle OEMs and battery swapping stations. In 2024, the electric vehicle OEMs segment is expected to account for the larger share of above 74.0% of the North America EV battery market. The segment’s large share is mainly attributed to the increasing consumer adoption of EVs for personal use, increasing investment by automotive OEMs in EV battery manufacturing capacities to create a secure supply chain for their future electric vehicles, and increasing launch of new EV models by automotive OEMs.

However, the battery swapping stations segment is expected to record the highest CAGR during the forecast period. This segment's growth is mainly driven by growing battery-swapping services in the region and the expansion of battery-swapping stations across the major cities.

In 2024, the U.S. is expected to account for the larger share of above 98.0% of the North America EV battery market. The large market share of this country is attributed to the growing investment of companies in the research & development of EV battery technology and growing government initiatives in developing charging infrastructures.

Moreover, the U.S. is projected to register the highest CAGR of above 31.0% during the forecast period. This region's growth is attributed to the growing government incentive programs and subsidies for purchasing EVs and increasing competition among industry leaders to launch new models.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the North America EV battery market are NOHMs Technologies, Inc. (U.S.), QuantumScape Corporation (U.S.), American Battery Solutions, Inc. (U.S.), Clarios (U.S.), Romeo Power, Inc. (U.S.), and Electrovaya Inc. (Canada).

|

Particulars |

Details |

|

Number of Pages |

150 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

34.4% |

|

Market Size (Value) |

USD 73.70 Billion by 2031 |

|

Segments Covered |

By Type

By Capacity

By Bonding Type

By Form

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada) |

|

Key Companies |

NOHMs Technologies, Inc. (U.S.), QuantumScape Corporation (U.S.), American Battery Solutions, Inc. (U.S.), Clarios (U.S.), Romeo Power, Inc. (U.S.), and Electrovaya Inc. (Canada) |

The North America EV battery market study focuses on market assessment and opportunity analysis through the sales of EV batteries across North America. This study is also focused on competitive analysis for EV batteries in North America based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The North America EV Battery Market is expected to reach $73.70 billion by 2031, at a CAGR of 34.4% from 2024 to 2031.

In 2024, the lithium-ion batteries segment is expected to hold the largest share of the North America EV battery market.

The light commercial vehicles segment is expected to register the highest CAGR during the forecast period.

The growth of the North America EV battery market is driven by increasing investments by leading automotive OEMs to set up battery manufacturing facilities in the region, increasing adoption of EVs, and decreasing battery prices. Furthermore, the increasing investments in alternative battery technology are expected to generate growth opportunities for the stakeholders in this market.

Key players operating in the North America EV battery market are NOHMs Technologies, Inc. (U.S.), QuantumScape Corporation (U.S.), American Battery Solutions, Inc. (U.S.), Clarios (U.S.), Romeo Power, Inc. (U.S.), and Electrovaya Inc. (Canada).

The U.S. is expected to record a higher CAGR during the forecast period.

Published Date: Sep-2024

Published Date: Apr-2022

Published Date: Apr-2022

Published Date: Apr-2024

Published Date: Aug-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates