Resources

About Us

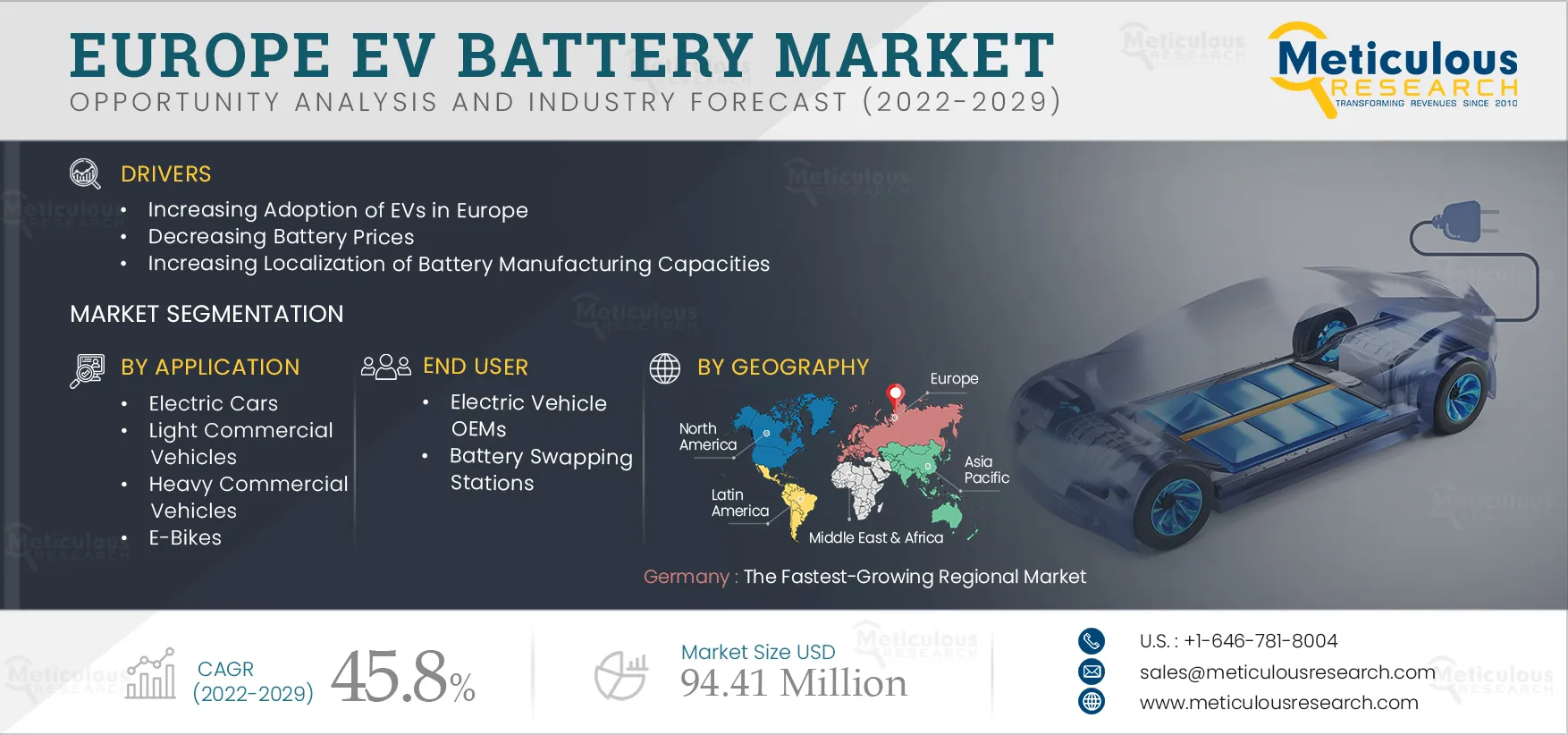

Europe EV Battery Market by Type (Li-ion, Ni-MH, SLA, Ultracapacitors, Solid-state Batteries), Capacity (<50 kWh, 51-100 kWh, 101-300 kWh, >300 kWh), Bonding Type (Wire, Laser), Form, Application, End User, and Country - Forecast to 2029

Report ID: MRAUTO - 104533 Pages: 242 Apr-2022 Formats*: PDF Category: Automotive and Transportation Delivery: 2 to 4 Hours Download Free Sample ReportThe Europe EV Battery Market is expected to reach a value of $94.41 billion by 2029, at a CAGR of 45.8% during the forecast period 2022–2029. The rising adoption of EVs, decreasing battery prices, and increasing investment by leading automotive OEMs to secure battery supply chains for their future electric vehicles are some of the major factors driving the growth of this market. The growing deployment of battery-as-a-service provides significant growth opportunities for players operating in this market.

Several major battery plants—known as gigafactories—are planned for Europe in the next few years to meet an anticipated surge in demand for electric vehicles in the region. Most are being built by Tesla and Asian firms. However, the European Commission and European countries are also attempting to establish a homegrown battery industry to ensure that thousands of R&D jobs stay in Europe along with the related manufacturing supply chains and profits.

Additionally, the European Union supports its battery sector, establishing a European Battery Alliance in 2017 for manufacturing, charging infrastructure, and electric-car uptake. In January 2021, European Commission announced to spend $3.5 billion to subsidize Tesla, BMW, and other companies to produce more batteries in Europe.

The pandemic severely impacted several sectors, including the automotive sector, with major manufacturers temporarily shutting down their operations or operating with limited capacities in accordance with the directives issued by their respective governments. The energy materials and renewable generation & conversion industry, including battery-powered electric vehicles, grid storage, and personal electronic devices, were no exception to the negative impacts of the COVID-19 outbreak. These factors caused a severe decline in electric vehicle sales, which directly affected the sales of batteries, especially in the electric vehicles segment.

In Europe, during the lockdowns, manufacturing facilities, supply chains, and consumer demands were paralyzed in the first half of 2020. The EV batteries market in Europe was severely affected as production facilities temporarily shut down and the demand for EV batteries decreased. In order to overcome this, various companies started initiatives to boost the sales of the electric vehicles market. For instance, BMW invested $340 million in a Leipzig EV plant and $225 million in a Munich battery plant. Total Energies, a French multinational integrated oil & gas company, announced its plans to develop EV battery manufacturing activities in Europe. These initiatives are attributed to the growth of the electric vehicle batteries market in Europe.

Click here to: Get Free Request Sample Copy of this report

Decreasing Battery Prices to Drive the Growth of the European EV Batteries Market

The rise in production capacities and technological improvements are making batteries production cheaper. The increase in production due to EV sales growth and new battery package designs are the factors attributed to the fall of battery prices. Battery costs are determined by how electric vehicles stack up against internal combustion engines (ICE). The price of lithium-ion batteries decreased by 89%, from $1,100/kWh in 2010 to $137/kWh in 2020. In 2020, the price of electric vehicle batteries was 13% lower than prices in 2019. According to a report by BloombergNEF, the average price per kilowatt-hour for batteries is expected to be approximately $100/kWh by 2023, making it possible for EVs to be priced the same as comparable gasoline-powered vehicles.

Several players in the market started initiatives to reduce their EV battery dependency on the Asian market. For instance, in June 2020, Volkswagen's luxury sports car unit Porsche AG announced a joint venture with Customcells (Germany) to produce high-performance batteries with a significant reduction in charging time. Through these initiatives, European carmakers reduce their dependence on Asia for batteries to meet stricter emissions targets in the European Union. Also, in July 2021, Volkswagen planned to manufacture batteries for electric vehicles in Germany with Guoxuan (China). This plan aimed at industrializing battery cell production.

Additionally, governments across Europe are providing incentives for setting up battery manufacturing plants. For instance, In July 2020, the German government invested $2.4 billion in battery cell research and production. This funding supports a new initiative set up under the European Union's Important Project of Common European Interest (IPCEI) program. Hence, such initiatives are expected to reduce the total manufacturing costs of batteries and drive the market's growth during the forecast period.

The Solid-state Batteries Segment Projected to Grow the Fastest Rate Once Commercialized

Based on type, the solid-state batteries segment is expected to witness the highest growth rate once it gets commercialized. As per Meticulous Research® analysis, the commercialization of solid-state batteries is expected to occur from 2025. A solid-state battery has a higher energy density than a Li-ion battery that uses liquid electrolyte solution. A solid-state battery can effectively increase the energy density per unit area as compared to lithium-ion batteries. Because of these properties, a solid-state battery pack will have a higher capacity than a lithium-ion battery of the same size.

The 101kWh to 300kWh Segment Projected to Grow at the Highest CAGR During Forecast Period

The 101kWh to 300kWh segment is expected to grow at the highest CAGR during the forecast period. This segment is expected to witness a high growth rate during the forecast period mainly because 101kWh to 300kWh power capacity batteries are widely used in medium EVs such as light commercial vehicles and utility vehicles. The adoption of such EVs is increasing due to the rise in fuel prices and government initiatives to lower fleet emissions of logistics and public transportation. Also, the increasing launch of new EVs by automotive OEMs for electrification of logistics and public transport fleets and increasing adoption of electric vehicles by e-commerce companies such as Amazon and UPS are expected to support the market's growth during the forecast period.

The Laser Bonding Segment to Grow at a Significant Pace During Forecast Period

Based on bonding type, the laser bonding segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of this segment during the forecast period is mainly due to its ability to withstand higher currents, offer the advantages of narrow welds, high welding speed, and low level of heat, which is important for battery tab welding because the chemicals within the batteries are heat sensitive. Laser welding is a reliable technology to connect battery cells and achieve fast, automated, precise production of battery pack conductive joints. Lasers offer the advantages of precision and non-contact welding, which can be adapted to fit small areas with low accessibility using a concentrated heat source.

The Pouch Segment to Grow at a Significant Pace During Forecast Period

Based on form, the pouch segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of this segment is attributed to its higher energy density compared with the same weight of prismatic cells, more safety performance, and lower internal resistance. A pouch cell's energy storage capacity is much greater in a given physical space than cylindrical cells. Leading automotive and battery OEMs are investing in pouch cell formats for powering the upcoming EVs. For instance, in April 2020, General Motors and LG Energy Solution announced a joint venture to supply large-format pouch cells for GM's Ultium battery strategy to power the upcoming GMC Hummer EV models and a Chevrolet Silverado EV in 2023.

The Light Commercial Vehicles Segment Projected to Grow at the Highest CAGR During Forecast Period

Based on application, the light commercial vehicles segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of this segment during the forecast period is attributed to the increasing shift of retail MNCs and transport fleet operators to electric light commercial vehicles, growing awareness regarding the role of electric vehicles in reducing emissions, increase in demand for electric vehicles to reduce fleet emissions, and stringent government rules and regulations towards vehicle emissions. The mass production of batteries and the attractive tax incentives offered by governments have further brought down vehicle costs, making electric light commercial vehicles much more cost-effective.

The Battery Swapping Stations Segment Projected to Grow at the Highest CAGR During Forecast Period

Based on end user, the battery swapping stations segment is expected to grow at the highest CAGR during the forecast period. This segment's high growth rate during the forecast period is mainly because battery swapping service helps reduce EV acquisition costs, increase battery lifespan, and increase battery swapping services by various automotive start-up companies. Also, other mobility stakeholders such as oil refining companies are partnering with e-mobility start-ups to set up battery swapping stations, which is expected to further support the market growth of this segment.

Germany to be Fastest-growing Regional Market

Germany is expected to account for the largest share and witness the highest growth rate in the European EV batteries market during the forecast period, followed by France, the U.K., and Italy. The country's high market growth rate is attributed to the numerous gigafactories planned to be commissioned during the forecast period and the high adoption of electric mobility in the region.

Hungary is expected to hold the second position in terms of market growth rate during the forecast period. The country's high market growth rate is attributed to the growing automotive industry and increasing investments by OEMs for the development of EV batteries.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategies adopted by the leading market participants in the European EV batteries market over the last four years. The key players profiled in the European EV batteries market are Northvolt AB (Sweden), Lithium Werks B.V. (Netherlands), Faradion Limited (U.K.), BMZ Group (Germany), DRÄXLMAIER Group (Germany), E4V (France), Britishvolt Limited (U.K.), Ilika plc (U.K.), and Johnson Matthey Plc (U.K.).

Scope of the Report

Europe EV Battery Market, by Type

Europe EV Battery Market, by Capacity

Europe EV Battery Market, by Bonding Type

Europe EV Battery Market, by Form

Europe EV Battery Market, by Application

Europe EV Battery Market, by End User

Europe EV Battery Market, by Country

Key Questions Answered in the Report:

Published Date: Sep-2024

Published Date: Jun-2024

Published Date: Apr-2022

Published Date: Jul-2023

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates