Resources

About Us

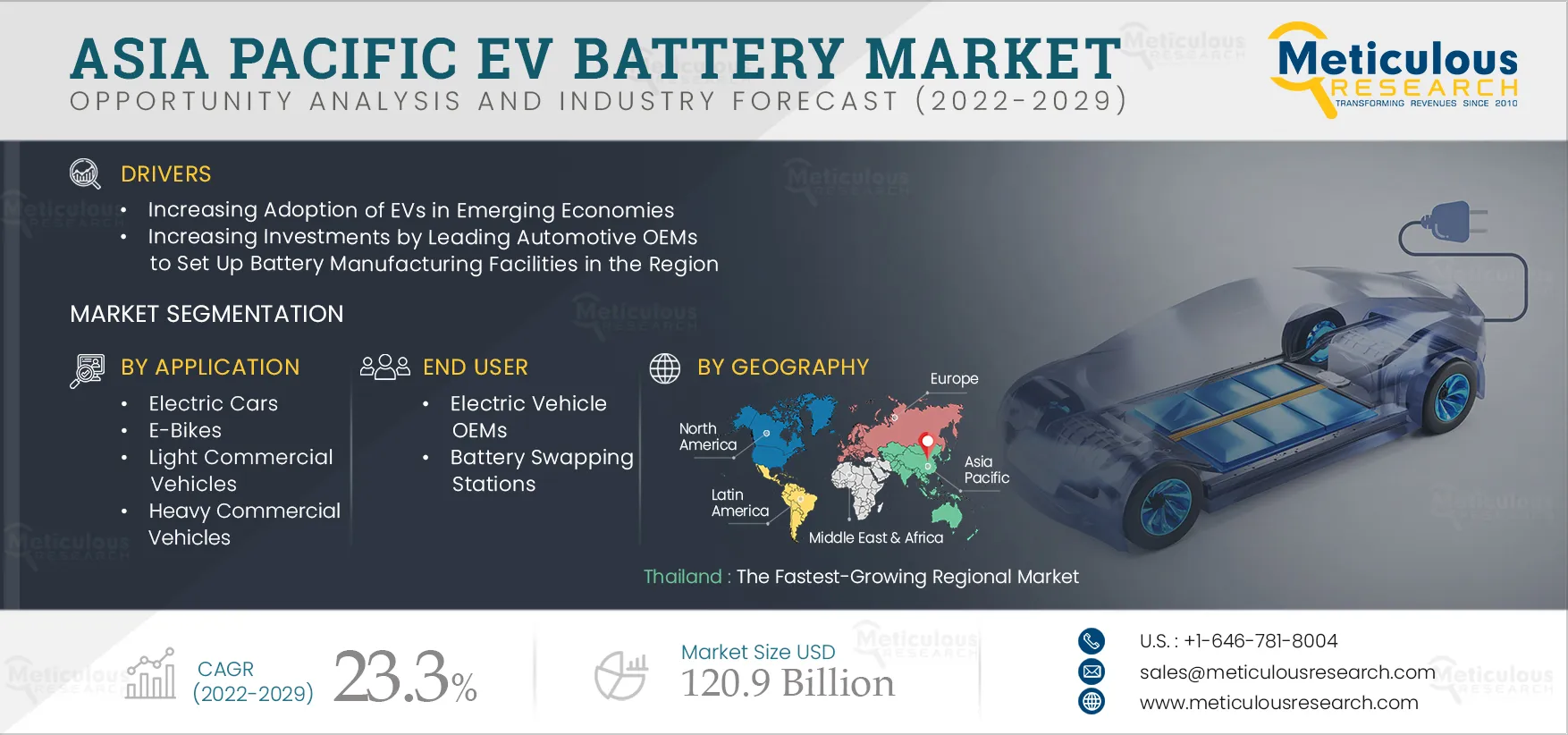

Asia-Pacific EV Battery Market by Type (Li-ion, Ni-MH, SLA, Ultracapacitors, Solid-state Batteries), Capacity (<50 kWh, 51-100 kWh, 101-300 kWh, >300 kWh), Bonding Type (Wire, Laser), Form, Application, End User, and Country - Forecast to 2029

Report ID: MRAUTO - 104529 Pages: 215 Apr-2022 Formats*: PDF Category: Automotive and Transportation Delivery: 2 to 4 Hours Download Free Sample ReportThe Asia-Pacific EV Battery Market is expected to reach a value of $120.9 billion by 2029, at a CAGR of 23.3% during the forecast period 2022–2029. The increasing adoption of EVs in emerging economies, growing investments by leading automotive OEMs to set up battery manufacturing facilities in the region, and rising government initiatives to support EV and EV battery manufacturing in the region are some of the major factors driving the growth of this market. The growing deployment of battery-as-a-service provides significant growth opportunities for players operating in this market.

The COVID-19 pandemic has severely impacted several sectors, including the automotive sector, with major manufacturers temporarily shutting down their operations or operating with limited capacities in accordance with the directives issued by their respective governments. The energy materials and renewable generation and conversion industry are no exception, including battery-powered electric vehicles, grid storage, and personal electronic devices. These factors caused a severe decline in overall electric vehicle sales, which directly affected the sales of EV batteries.

The electric vehicle batteries market in Asia-Pacific was severely affected as developing countries in the Asia-Pacific region witnessed a sharp decline in their economy due to low consumer demands, disrupted supply chain of batteries and other materials, and increased prices for essential commodities. The adoption of EVs also decreased significantly, thereby affecting the EV batteries market.

In addition, various automotive OEMs halted their plans due to the pandemic. For instance, LG Chem halted its lithium-ion battery project in India as the auto sector struggled amidst the ongoing COVID-19 pandemic. Also, in April 2020, Ford Motor Co. and Plymouth-based electric vehicle startup Rivian Automotive LLC canceled their plans to develop a new electric vehicle for the Lincoln luxury brand due to the COVID-19 outbreak.

Click here to: Get Free Request Sample Copy of this report

Increasing Adoption of EVs In Emerging Economies

EVs have witnessed rapid evolution due to the ongoing developments in the automotive sector. The rising consumer preference for shared mobility, growing adoption of mobility-as-a-service (MaaS), declining costs of high-capacity batteries, and significant investments by EV manufacturers are fueling the adoption of electric mobility in emerging economies.

Supportive government incentives in the form of tax reductions and grants for residential and commercial infrastructure are encouraging the adoption of electric mobility. These developments are expected to support the growth of EVs across the globe in the coming years. China’s EV market is growing significantly with extensive government support and expansion in charging infrastructures. In 2020, China recorded sales of 1.3 million EVs, attributing to an increase in the adoption of the Tesla Model 3 and the Hongguang Mini. Increasing government efforts to push EV sales to 25% of the car sales by 2025 has driven this market’s growth considerably in China. To achieve the set target, the government had extended the tax exemptions for purchasing an EV by 2023.

Similarly, South Korea is a growing automobile market and a leading country in Asia-Pacific. The sales of electric and hybrid vehicles in South Korea reached 17,992 units in January 2021, and exports reached 32,053 units. The country's electric and hybrid vehicle exports reached a record-high of 276,000 units in 2020. Moreover, automotive OEMs are increasingly launching new EVs in the market. For instance, Tesla launched the Model–Y and updated Tesla Model 3 in 2021. Additionally, Tesla Korea announced plans to establish supercharger stations in 27 locations across the country and eight maintenance centers nationwide. In 2021, Hyundai launched its Ioniq 5 midsize electric crossover with a maximum driving range of about 480 km (298 miles).

Growing investments by leading investors worldwide in the Indian EV market are anticipated as opportunities for this market's stakeholders. In 2019, India's EV start-ups' investment soared to $406 million from $20 million in 2017. Ola Electric raised around $300 million of that investment leading the company to establish its mark in the Indian EV market. Also, the company has partnered with numerous battery manufacturers and OEMs to work in accordance with the automotive industry and create seamless solutions for EV operations. These developments are expected to support the growth of EVs across the globe in the coming years, which will boost the demand for electric batteries in the market.

The Solid-state Battery Segment Projected to Grow at Fastest Rate Once Commercialized

Based on type, the solid-state battery segment is expected to grow faster once it gets commercialized. As per Meticulous Research Analysis, the commercialization of solid-state batteries is expected to occur from 2025. A solid-state battery has a higher energy density than a Li-ion battery that uses liquid electrolyte solution. The solid electrolyte used in a solid-state battery provides increased safety due to its non-volatile and non-flammable components, in contrast to the liquid electrolytes found in lithium-ion batteries. A solid-state battery also effectively increases the energy density per unit area as compared to lithium-ion batteries. Due to such properties, a solid-state battery pack has a higher capacity than a lithium-ion battery of the same size.

The 101kWh to 300kwh Segment Projected to Grow at Highest CAGR During Forecast Period

The 101kWh to 300kWh segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of this segment is mainly because 101kWh to 300kWh power capacity batteries are widely used in medium EVs such as light commercial vehicles and utility vehicles.

The adoption of EVs is increasing due to the rise in fuel prices and government initiatives to lower fleet emissions of logistics and public transportation. Also, the increasing launch of new EVs by automotive OEMs for electrification of logistics and public transport fleets and increasing adoption of electric vehicles by e-commerce companies such as Amazon and UPS are expected to support the growth of the market during the forecast period.

The Laser Bonding Segment to Grow at Significant Pace During Forecast Period

Based on bonding type, the laser bonding segment is expected to grow at the highest CAGR during the forecast period. The high market growth of this segment is mainly attributed to the numerous advantages of laser-welded bonds, such as its ability to withstand higher currents, offer narrow welds, high welding speed, and low heat level, which is important for battery tab welding since the chemicals within the batteries are heat-sensitive. Laser welding is a reliable technology to connect battery cells and achieve fast, automated, precise production of battery pack conductive joints. Lasers also offer the advantages of precision and non-contact welding, which can be adapted to fit small areas with low accessibility using a concentrated heat source.

The Pouch Segment to Grow at Significant Pace During Forecast Period

Based on form, the pouch segment is expected to grow at the highest CAGR during the forecast period. The high market growth of this segment is attributed to its higher energy density compared to the same weight of prismatic cells, more safety performance, and lower internal resistance. A pouch cell’s energy storage capacity is much greater in a given physical space than cylindrical cells. Leading automotive and battery OEMs are investing in pouch cell formats for powering their upcoming EVs. For instance, in April 2020, General Motors and LG Energy Solution announced a joint venture to supply large-format pouch cells for GM’s Ultium battery strategy to power the upcoming GMC Hummer EV models and a Chevrolet Silverado EV in 2023.

Light Commercial Vehicle Segment Projected to Grow at Highest CAGR During Forecast Period

Based on application, the light commercial vehicle segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of this segment during the forecast period is attributed to the increasing shift of retail MNCs and transport fleet operators to electric light commercial vehicles, growing awareness regarding the role of electric vehicles in reducing emissions, increase in demand for electric vehicles to reduce fleet emissions, and stringent government rules and regulations towards vehicle emissions. The mass production of batteries and the attractive tax incentives offered by governments have further brought down vehicle costs, making electric light commercial vehicles much more cost-effective.

Battery Swapping Stations Segment Projected to Grow at Highest CAGR During Forecast Period

Based on end user, the battery swapping stations segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of this segment is attributed to the benefits offered by battery swapping services, such as reduction of EV acquisition costs and increased battery lifespan. The increase in battery swapping services by various automotive start-up companies also contributes to the market growth of this segment. Also, other mobility stakeholders such as oil refining companies are partnering with e-mobility start-ups to set up battery swapping stations, which is expected to significantly boost the market growth of this segment.

Thailand to Be the Fastest-growing Regional Market

China is expected to account for the largest share of the APAC EV battery market in 2021, followed by Japan, South Korea, and Thailand. However, Thailand is expected to witness the fastest market growth during the forecast period, followed by Indonesia. The major factor attributed to Thailand’s high market growth rate is the growing production of EV batteries through manufacturing plants operated by SAIC, Honda, Toyota, and Mercedes.

Indonesia is also expected to witness significant market growth during the forecast period. The factors attributed to the high market growth in this country are the availability of raw availability needed for EV batteries production and growing company initiatives for the development of EV batteries.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategies adopted by the leading market participants in the APAC electric vehicle battery market over the last four years. The key players profiled in the Asia-Pacific EV batteries market are SK Innovations Co., Ltd. ( South Korea), LG Chem, Ltd (South Korea), Farasis Energy (GanZhou) Co., Ltd. (China), SVOLT Energy Technology Co., Ltd. (China), BYD Company Limited (China), Samsung SDI Co., Ltd. (South Korea), GS Yuasa International Ltd. (Japan), Vehicle Energy Japan Inc. (Japan), Contemporary Amperex Technology Co. Limited (CATL) (China), A123 Systems, LLC (China), Exide Industries Ltd. (India), Primearth EV Energy Co., Ltd. (Japan), and E-One Moli Energy Corp. (Taiwan).

Scope of the Report

Asia-Pacific EV Battery Market, by Type

Asia-Pacific EV Battery Market, by Capacity

Asia-Pacific EV Battery Market, by Bonding Type

Asia-Pacific EV Battery Market, by Form

Asia-Pacific EV Battery Market, by Application

Asia-Pacific EV Battery Market, by End User

Asia-Pacific EV Battery Market, by Country

Key Questions Answered in the Report:

Published Date: Sep-2024

Published Date: Jun-2024

Published Date: May-2022

Published Date: Apr-2022

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates