Resources

About Us

Negative Pressure Wound Therapy (NPWT) Market By Product (Conventional/Traditional, Single-use, Accessories), Wound Type (Diabetic Foot Ulcer [DFU], Venous Leg Ulcer, Surgical, Burn, Skin Grafts), End User (Hospital, Home Care) - Global Forecast to 2032

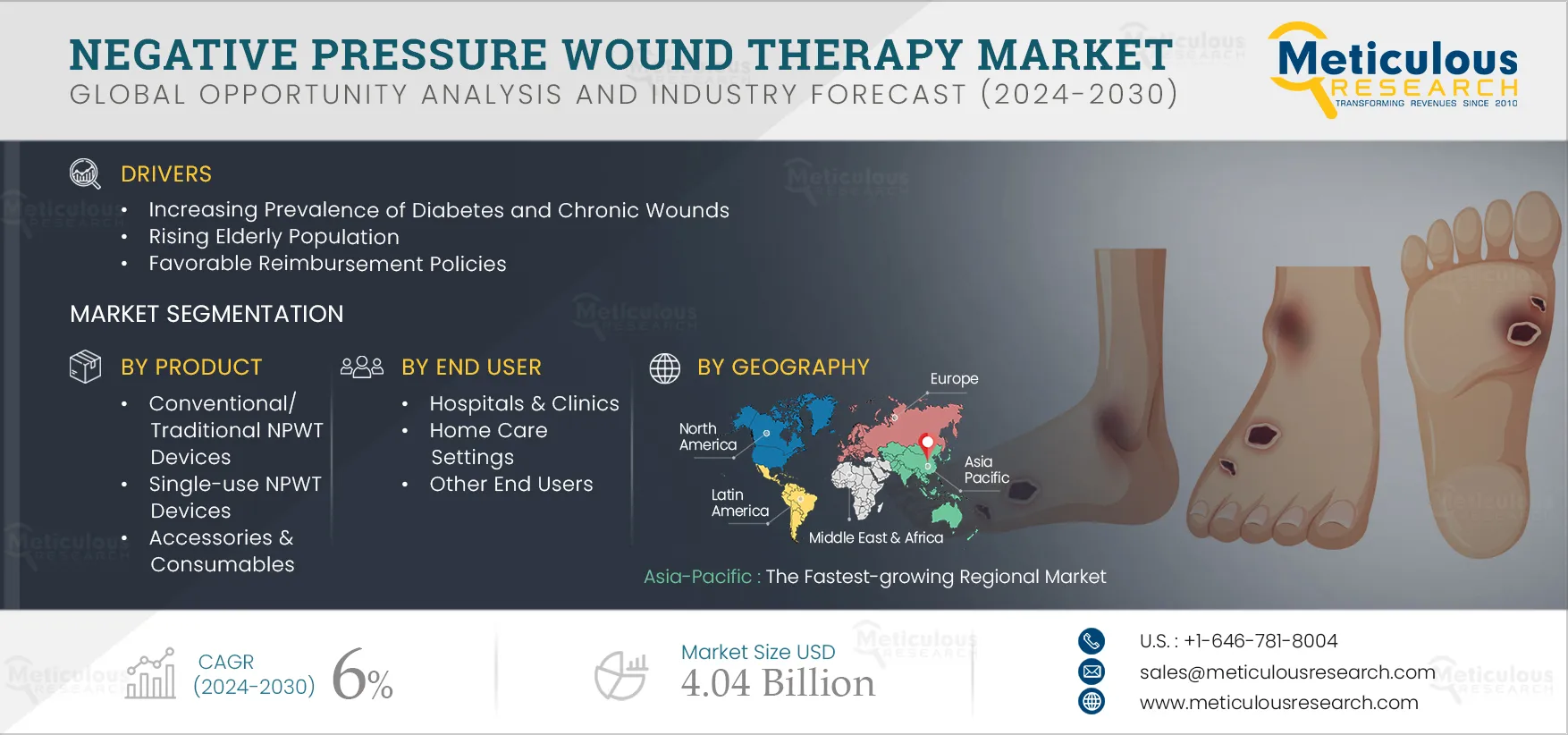

Report ID: MRHC - 104852 Pages: 180 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Negative Pressure Wound Therapy Market is projected to reach $4.04 billion by 2032, at a CAGR of 6% from 2025 to 2032. Negative pressure wound therapy (NPWT), also called vacuum-assisted wound closure, aims to optimize the physiological process of wound healing. It promotes the process of wound healing in acute or chronic wounds. NPWT uses negative pressure or suction to facilitate wound healing. The vacuum is applied to the wound through a specialized dressing or wound vacuum system. Negative pressure wound therapy is used in various types of wounds, such as diabetic foot ulcers, venous or arterial ulcers, surgical wounds, pressure ulcers, and burn wounds. It facilitates the process of wound healing through several pathways, including removal of excess fluid, promotion of blood flow, stimulation of tissue formation, reduction of edema, and wound contraction.

The growth of this market is driven by the increasing prevalence of diabetes and chronic wounds, rising elderly population, favorable reimbursement policies and increasing incidence of obesity and associated comorbidities. In addition, the technological advancements in negative pressure wound therapy devices and emerging economies are expected to provide significant growth opportunities for this market.

However, the high costs of NPWT devices and the potential risk of complications are expected to restrain the growth of this market to a certain extent. In addition, factors such as the limited awareness and training of healthcare professionals and the lack of adherence to the treatment among patients due to discomfort pose major challenges to the market’s growth.

Diabetes is a chronic disease that can lead to several health complications. One of the major health complications it causes is impairment of wound healing. Individuals with diabetes are more prone to developing chronic wounds, such as diabetic foot ulcers. These wounds often occur due to neuropathy and peripheral arterial disease associated with diabetes. The prevalence of diabetes has been steadily increasing globally, primarily due to factors such as sedentary lifestyles, unhealthy dietary habits, and rising elderly population. According to the International Diabetes Federation (IDF), the number of people living with diabetes is estimated to increase from 537 million in 2021 to 643 million by 2032 and 783 million by 2045.

Chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, are a common complication in people with diabetes. Due to diabetic conditions, these wounds often exhibit impaired healing, causing an increased risk of infections and higher amputation rates if not managed properly.

Negative pressure wound therapy has been proven to effectively treat chronic wounds such as diabetic foot ulcers. It promotes wound healing by removing excess fluid, reducing edema, enhancing blood circulation, and stimulating tissue formation. Thus, the rising prevalence of diabetes and chronic wounds drives the growth of the negative pressure wound therapy market.

Click here to: Get a Free Sample Copy of this report

High Costs of NPWT Systems to Hinder the Growth of this Market

The high costs of negative pressure wound therapy systems hinder the widespread adoption and utilization of this market. In addition, the expenses of dressings and disposable supplies can be a significant financial burden for healthcare facilities and patients.

The purchase of NPWT systems requires substantial initial capital investment by healthcare facilities or providers. Additionally, disposable supplies such as foam or gauze dressings, adhesive films, canisters, and tubing are required for this therapy. The costs of these supplies can accumulate over time and add to the overall cost of NPWT. These factors hinder the widespread adoption of negative pressure wound therapy, thereby hindering the growth of this market.

In 2025, the Conventional/ Traditional NPWT Devices Segment is Expected to Dominate the Negative Pressure Wound Therapy Market

Based on product, the negative pressure wound therapy market is segmented into conventional/ traditional NPWT devices, single-use NPWT devices, and accessories & consumables. In 2025, the conventional/ traditional NPWT devices segment is expected to account for the largest share of the negative pressure wound therapy market. Conventional NPWT devices typically consist of a vacuum pump, tubing, and dressing materials, which create negative pressure or suction at the wound site to facilitate healing. Factors such as the widespread use of these devices in hospitals for various wounds, proven clinical outcomes, and the high preference for conventional NPWT devices among healthcare professionals contribute to the large market share of this segment.

In 2025, the Diabetic Foot Ulcers Segment is Expected to Dominate the Negative Pressure Wound Therapy Market

Based on wound type, the negative pressure wound therapy market is segmented into diabetic foot ulcers, venous leg ulcers, surgical wounds, skin grafts, burn wounds, and other wound types. In 2025, the diabetic foot ulcers segment is expected to account for the largest share of the negative pressure wound therapy market. The large market share of this segment is attributed to factors such as the high prevalence of diabetes, increased patient awareness, and clinical evidence showcasing improved patient outcomes with negative pressure wound therapy.

In 2025, the Hospitals & Clinics Segment is Expected to Dominate the Negative Pressure Wound Therapy Market

Based on end user, the negative pressure wound therapy market is segmented into hospitals & clinics, home care settings, and other end users. In 2025, the hospitals & clinics segment is expected to account for the largest share of the negative pressure wound therapy market. The large market share of this segment is attributed to the increasing number of patients visiting hospitals & clinics for inpatient wound care, advanced infrastructure in hospitals for wound care treatments, and the availability of skilled healthcare professionals in hospitals & clinics.

Asia-Pacific: The Fastest-growing Regional Market

Asia-Pacific is slated to record the highest CAGR in the negative pressure wound therapy market during the forecast period. The growth of this regional market is driven by the increasing patient population, the rising prevalence of chronic diseases like diabetes, the ongoing development of healthcare infrastructure in the region, and favorable government initiatives aimed at enhancing wound care and promoting advanced medical technologies.

Key Players

The report includes a competitive landscape based on an extensive assessment of the market based on product, wound type, end user, and geography. The report also provides insights into the geographic presence of major market players and the key growth strategies adopted by them in the last three to four years.

The key players profiled in the negative pressure wound therapy market are Acelity L.P. Inc. (U.S.), Cardinal Health, Inc. (U.S.), Convatec Group plc (U.S.), DeRoyal Industries, Inc. (U.S.), Genadyne Biotechnologies, Inc. (U.S.), Medela AG (Switzerland), Mölnlycke Health Care AB (Sweden), Smith & Nephew plc (U.K.), PAUL HARTMANN AG (Germany), and Talley Group Ltd (U.K.).

Scope of the Report:

Negative Pressure Wound Therapy Market Assessment, by Product

Negative Pressure Wound Therapy Market Assessment, by Wound Type

Negative Pressure Wound Therapy Market Assessment, by End User

Negative Pressure Wound Therapy Market Assessment, by Geography

Key questions answered in the report:

This market study covers the market sizes & forecasts of the negative pressure wound therapy market based on product, wound type, end user, and geography. This market study also provides the value analysis of various segments and subsegments of the negative pressure wound therapy market at the regional and country levels.

The negative pressure wound therapy market is projected to reach $4.04 billion by 2032, at a CAGR of 6% during the forecast period of 2025–2032.

Based on product type, the negative pressure wound therapy market is segmented into conventional/traditional NPWT devices, single-use NPWT devices, and accessories & consumables. In 2025, the conventional/traditional NPWT devices segment is expected to account for the largest share of the negative pressure wound therapy market due to its proven clinical outcomes, the widespread use of conventional NPWT devices in healthcare facilities, and compatibility with a wide range of wound types.

Based on wound type, the negative pressure wound therapy market is segmented into diabetic foot ulcers, venous leg ulcers, surgical wounds, skin grafts, burn wounds, and other wound types. In 2025, the diabetic foot ulcers segment is expected to account for the largest share of the negative pressure wound therapy market due to factors such as the high prevalence of diabetes globally, increased patient awareness about NPWT, and clinical evidence showcasing improved patient outcomes with negative pressure wound therapy.

Based on end user, the negative pressure wound therapy market is segmented into hospitals & clinics, home care settings, and other end users. In 2025, the hospitals & clinics segment is expected to account for the largest share of the negative pressure wound therapy market. The large market share of this segment is attributed to the increasing number of patients visiting hospitals & clinics for inpatient wound care, advanced infrastructure in hospitals for wound care treatments, and the availability of skilled healthcare professionals in hospitals & clinics.

The growth of this market is driven by the increasing prevalence of diabetes and chronic wounds, rising elderly population, favorable reimbursement policies and increasing incidence of obesity and associated comorbidities. In addition, the technological advancements in negative pressure wound therapy devices and emerging economies are expected to provide significant growth opportunities for this market.

The high costs of NPWT devices and the potential risk of complications are expected to restrain the growth of this market to a certain extent. In addition, factors such as the limited awareness and training of healthcare professionals and the lack of adherence to the treatment among patients due to discomfort pose major challenges to the market’s growth.

The key players operating in the negative pressure wound therapy market are Acelity L.P. Inc. (U.S.), Cardinal Health, Inc. (U.S.), Convatec Group plc (U.S.), DeRoyal Industries, Inc. (U.S.), Genadyne Biotechnologies, Inc. (U.S.), Medela AG (Switzerland), Mölnlycke Health Care AB (Sweden), Smith & Nephew plc (U.K.), PAUL HARTMANN AG (Germany), and Talley Group Ltd (U.K.).

Asia-Pacific is slated to register the highest CAGR during the forecast period and offer significant growth opportunities for the players in this market. The growth of this regional market is driven by the increasing patient population, the rising prevalence of chronic diseases like diabetes, the ongoing development of healthcare infrastructure in the region, and favorable government initiatives aimed at enhancing wound care and promoting advanced medical technologies.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.3.3. Market Share Analysis

2.4. Assumptions for this Study

3. Executive Summary

4. Market Insights

4.1. Market Overview

4.2. Drivers

4.2.1. Increasing Prevalence of Diabetes and Chronic Wounds

4.2.2. Rising Elderly Population

4.2.3. Favorable Reimbursement Policies

4.2.4. Increasing Incidence of Obesity and Associated Comorbidities

4.3. Restraints

4.3.1. High Costs of NPWT Devices

4.3.2. Potential Risk of Complications

4.4. Opportunity

4.4.1. Technological Advancements in Negative Pressure Wound Therapy Devices

4.4.2 Emerging Economies

4.5. Challenges

4.5.1. Limited Awareness and Training Among Healthcare Professionals

4.5.2. Lack of Adherence to the Treatment Among Patients Due to Discomfort

4.6. Pricing Analysis

4.7. Regulatory Analysis

4.8. Industry & Technological Trends

5. Negative Pressure Wound Therapy Market Assessment—by Product

5.1. Overview

5.2. Conventional/Traditional NPWT Devices

5.3. Single-use NPWT Devices

5.4. Accessories & Consumables

6. Negative Pressure Wound Therapy Market Assessment—by Wound Type

6.1. Overview

6.2. Diabetic Foot Ulcers

6.3. Venous Leg Ulcers

6.4. Surgical Wounds

6.5. Skin Grafts

6.6. Burn Wounds

6.7. Other Wound Types

7. Negative Pressure Wound Therapy Market Assessment—by End User

7.1. Overview

7.2. Hospitals & Clinics

7.3. Home Care Settings

7.4. Other End Users

8. Negative Pressure Wound Therapy Market Assessment—by Geography

8.1. Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. U.K.

8.3.3. France

8.3.4. Italy

8.3.5. Spain

8.3.6. Rest of Europe

8.4. Asia-Pacific

8.4.1. China

8.4.2. Japan

8.4.3. India

8.4.4. Rest of Asia-Pacific

8.5. Latin America

8.6. Middle East & Africa

9. Competition Analysis

9.1. Overview

9.2. Key Growth Strategies

9.3. Vendor Benchmarking

9.4. Competitive Dashboard

9.4.1. Industry Leaders

9.4.2. Market Differentiators

9.4.3. Vanguards

9.4.4. Emerging Companies

9.5. Market Share Analysis (2022)

10. Company Profiles (Company Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis of Top 5 Companies)

10.1. Acelity L.P. Inc.

10.2. Cardinal Health, Inc.

10.3. Convatec Group plc

10.4. DeRoyal Industries, Inc.

10.5. Genadyne Biotechnologies, Inc.

10.6. Medela AG

10.7. Mölnlycke Health Care AB

10.8. Smith & Nephew plc

10.9. PAUL HARTMANN AG

10.10. Talley Group Ltd

10.11. Other Companies

11. Appendix

11.1. Available Customization

11.2. Related Reports

List of Tables

Table 1 Global Negative Pressure Wound Therapy Market Drivers: Impact Analysis (2025–2032)

Table 2 Global Negative Pressure Wound Therapy Market Restraints: Impact Analysis (2025–2032)

Table 3 Global Negative Pressure Wound Therapy Market Opportunities: Impact Analysis (2025–2032)

Table 4 Global Negative Pressure Wound Therapy Market Challenges: Impact Analysis (2025–2032)

Table 5 Global Negative Pressure Wound Therapy Market, by Product, 2021–2032 (USD Million)

Table 6 Global Conventional/Traditional NPWT Devices Market, by Country/Region, 2021–2032 (USD Million)

Table 7 Global Single-use NPWT Devices Market, by Country/Region, 2021–2032 (USD Million)

Table 8 Global Accessories & Consumables Market, by Country/Region, 2021–2032 (USD Million)

Table 9 Global Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 10 Global Negative Pressure Wound Therapy Market for Diabetic Foot Ulcers, by Country/Region, 2021–2032 (USD Million)

Table 11 Global Negative Pressure Wound Therapy Market for Venous Leg Ulcers, by Country/Region, 2021–2032 (USD Million)

Table 12 Global Negative Pressure Wound Therapy Market for Surgical Wounds, by Country/Region, 2021–2032 (USD Million)

Table 13 Global Negative Pressure Wound Therapy Market for Skin Grafts, by Country/Region, 2021–2032 (USD Million)

Table 14 Global Negative Pressure Wound Therapy Market for Quarantine Services, by Country/Region, 2021–2032 (USD Million)

Table 15 Global Negative Pressure Wound Therapy Market for Burn Wounds, by Country/Region, 2021–2032 (USD Million)

Table 16 Global Negative Pressure Wound Therapy Market for Other Wound Types, by Country/Region, 2021–2032 (USD Million)

Table 17 Global Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 18 Global Negative Pressure Wound Therapy Market for Hospitals & Clinics, by Country/Region, 2021–2032 (USD Million)

Table 19 Global Negative Pressure Wound Therapy Market for Home Care Settings, by Country/Region, 2021–2032 (USD Million)

Table 20 Global Negative Pressure Wound Therapy Market for Other End Users, by Country/Region, 2021–2032 (USD Million)

Table 21 Global Negative Pressure Wound Therapy Market for Other End Users, by Country/Region, 2021–2032 (USD Million)

Table 22 Global Negative Pressure Wound Therapy Market, by Country/Region, 2021–2032 (USD Million)

Table 23 North America: Negative Pressure Wound Therapy Market, by Country, 2021–2032 (USD Million)

Table 24 North America: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 25 North America: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 26 North America: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 27 U.S.: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 28 U.S.: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 29 U.S.: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 30 Canada: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 31 Canada: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 32 Canada: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 33 Europe: Negative Pressure Wound Therapy Market, by Country/Region, 2021–2032 (USD Million)

Table 34 Europe: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 35 Europe: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 36 Europe: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 37 Germany: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 38 Germany: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 39 Germany: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 40 U.K.: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 41 U.K.: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 42 U.K.: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 43 France: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 44 France: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 45 France: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 46 Spain: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 47 Spain: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 48 Spain: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 49 Italy: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 50 Italy: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 51 Italy: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 52 Rest of Europe: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 53 Rest of Europe: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 54 Rest of Europe: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 55 Asia-Pacific: Negative Pressure Wound Therapy Market, by Country/Region, 2021–2032 (USD Million)

Table 56 Asia-Pacific: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 57 Asia-Pacific: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 58 Asia-Pacific: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 59 China: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 60 China: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 61 China: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 62 Japan: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 63 Japan: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 64 Japan: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 65 India: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 66 India: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 67 India: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 68 Rest of Asia-Pacific: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 69 Rest of Asia-Pacific: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 70 Rest of Asia-Pacific: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 71 Latin America: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 72 Latin America: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 73 Latin America: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 74 Middle East & Africa: Negative Pressure Wound Therapy Market, by Product 2021–2032 (USD Million)

Table 75 Middle East & Africa: Negative Pressure Wound Therapy Market, by Wound Type, 2021–2032 (USD Million)

Table 76 Middle East & Africa: Negative Pressure Wound Therapy Market, by End User, 2021–2032 (USD Million)

Table 77 Recent Developments, by Company (2020–2025)

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for this Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 Global Negative Pressure Wound Therapy Market Size, by Product, 2025 Vs. 2032 (USD Million)

Figure 8 Global Negative Pressure Wound Therapy Market Size, by Wound Type, 2025 Vs. 2032 (USD Million)

Figure 9 Global Negative Pressure Wound Therapy Market Size, by End User, 2025 Vs. 2032 (USD Million)

Figure 10 Global Negative Pressure Wound Therapy Market Size, by Geography

Figure 11 Market Dynamics: Negative Pressure Wound Therapy Market

Figure 12 Global Negative Pressure Wound Therapy Market Size, by Product, 2025 Vs. 2032 (USD Million)

Figure 13 Global Negative Pressure Wound Therapy Market Size, by Wound Type, 2025 Vs. 2032 (USD Million)

Figure 14 Global Negative Pressure Wound Therapy Market Size, by End User, 2025 Vs. 2032 (USD Million)

Figure 15 Global Negative Pressure Wound Therapy Market, by Geography, 2025 Vs. 2032 (USD Million)

Figure 16 North America: Negative Pressure Wound Therapy Market Snapshot

Figure 17 Europe: Negative Pressure Wound Therapy Market Snapshot

Figure 18 Asia-Pacific: Negative Pressure Wound Therapy Market Snapshot

Figure 19 Key Growth Strategies Adopted by Leading Players (2020–2025)

Figure 20 Global Negative Pressure Wound Therapy Market: Vendor Benchmarking Based on Product

Figure 21 Global Negative Pressure Wound Therapy Market: Vendor Benchmarking Based on Geography

Figure 22 Global Negative Pressure Wound Therapy Market: Competitive Dashboard

Figure 23 Market Share Analysis: Negative Pressure Wound Therapy Market (2022)

Figure 24 Cardinal Health, Inc.: Financial Overview (2022)

Figure 25 Convatec Group plc: Financial Overview (2022)

Figure 26 Mölnlycke Health Care AB: Financial Overview (2022)

Figure 27 Smith & Nephew plc: Financial Overview (2022)

Figure 28 PAUL HARTMANN AG: Financial Overview (2022)

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jun-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates