Resources

About Us

Machine Control System Market by Type (Global Navigation Satellite Systems (GNSS), Total Stations, Laser Scanners, Sensors), End-use Equipment (Excavators, Dozers, Graders, Scrapers, Loaders, Paving Systems), Vertical (Infrastructure, Mining, Agriculture, Others) – Global Forecast to 2036

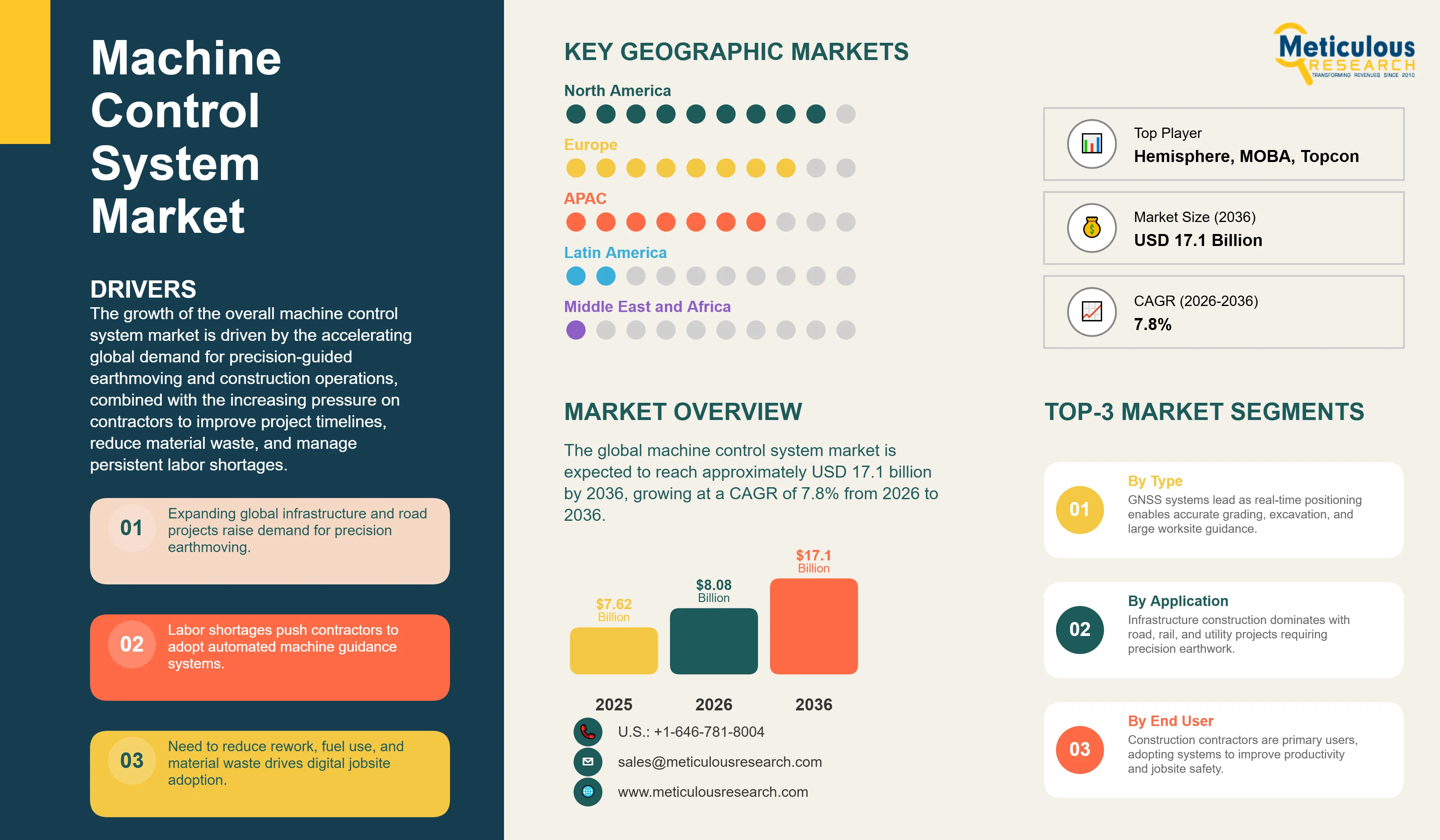

Report ID: MRSE - 1041794 Pages: 276 Feb-2026 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe global machine control system market was valued at USD 7.62 billion in 2025. The market is expected to reach approximately USD 17.1 billion by 2036 from USD 8.08 billion in 2026, growing at a CAGR of 7.8% from 2026 to 2036. The growth of the overall machine control system market is driven by the accelerating global demand for precision-guided earthmoving and construction operations, combined with the increasing pressure on contractors to improve project timelines, reduce material waste, and manage persistent labor shortages. As infrastructure developers and mining operators seek to integrate higher levels of automation and real-time site intelligence into their workflows, machine control systems have emerged as a critical enabler of safer, faster, and more cost-efficient project execution. The rapid expansion of large-scale infrastructure investment programs across North America, Asia-Pacific, and the Middle East, together with the growing adoption of 3D machine guidance and cloud-connected fleet telematics, continues to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Machine control systems are precision-guidance technologies that combine positioning sensors, display interfaces, and control software to automate or assist the operation of heavy earthmoving and construction machinery. These systems use a combination of technologies including GNSS receivers, robotic total stations, laser scanners, and tilt or slope sensors to provide machine operators and project managers with real-time spatial data, enabling accurate grading, excavation, paving, and compaction without the need for conventional staking or manual surveying. The market is defined by a strong shift toward 3D machine guidance, OEM-integrated control modules, and cloud-based project data platforms, which collectively help contractors achieve higher levels of accuracy, reduce costly rework, and lower fuel consumption across complex site operations.

The market spans a wide range of solutions, from simple 2D laser-based grade control systems suited to straightforward leveling applications, to advanced 3D GNSS and total station platforms capable of managing intricate terrain models and real-time as-built verification. These systems are increasingly connected to cloud-hosted project management environments that allow remote design file updates, fleet-level performance tracking, and predictive maintenance alerts, giving site managers full operational visibility from the office to the machine cabin. The ability to reduce dependence on skilled survey personnel, shorten project timelines, and deliver consistent construction quality has made machine control technology the preferred choice for infrastructure developers, mining operators, and large-scale agricultural enterprises worldwide.

The global construction and heavy industry sectors are facing mounting pressure to do more with less — fewer workers, tighter budgets, and stricter environmental compliance standards. This dynamic has accelerated the adoption of machine control systems as a practical and demonstrably cost-effective solution to improve output quality and site productivity. At the same time, the integration of Building Information Modelling (BIM) workflows with on-machine guidance platforms and the rise of autonomous and semi-autonomous equipment are pushing machine control technology into a new phase of maturity, creating significant opportunities for both established manufacturers and innovative new entrants.

Rapid Transition from 2D to 3D Machine Guidance and Digital Terrain Modelling

The machine control system industry is undergoing a fundamental shift away from 2D laser-based grade reference toward fully three-dimensional GNSS and total station-based guidance that leverages digital terrain models for real-time volumetric accuracy. Unlike conventional 2D systems that reference a single horizontal plane, 3D guidance platforms continuously compare the machine's actual position against a pre-loaded digital site design, giving operators live cut-and-fill guidance and eliminating the need for physical survey stakes across the work area. Leading manufacturers such as Trimble Inc. and Hexagon AB (Leica Geosystems) have been at the forefront of this transition, with their Earthworks and iCON platforms offering integrated GNSS, robotic total station, and laser scanner inputs that support the complete range of earthmoving equipment types. Komatsu Ltd.'s Smart Construction 3D Machine Guidance system recorded significant year-over-year growth in adoption in 2024, reflecting the broader industry momentum behind three-dimensional site automation. As contractors increasingly adopt BIM-aligned workflows and digital as-built documentation, the demand for 3D-capable machine control platforms is expected to grow substantially through the forecast period.

Cloud-Connected Telematics and the Emergence of the Fully Integrated Digital Jobsite

Alongside advances in on-machine guidance hardware, the expansion of telematics and cloud-based data connectivity is transforming machine control from a standalone positioning tool into a fully integrated component of a connected jobsite ecosystem. Manufacturers are now designing machine control architectures that support two-way data flow between the field and the project office, enabling project engineers to push updated design files to machines in real time while simultaneously receiving as-built survey data and machine performance metrics without requiring personnel on site. Hexagon AB reported a meaningful increase in recurring software and services revenue in 2024, reflecting the broader industry pivot toward subscription-based cloud platforms for fleet management and project data hosting. Companies such as Topcon Corporation and MOBA Mobile Automation AG are developing integrated control platforms that combine GNSS positioning, sensor-based grade guidance, telematics dashboards, and AI-assisted grading algorithms within a single connected architecture. The growing deployment of 5G connectivity on construction sites and the increasing availability of Real-Time Kinematic (RTK) correction services are further reducing positioning latency and extending the practical range of precision guidance, making connected machine control viable for an increasingly broad range of site types and equipment categories.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 17.1 Billion |

|

Market Size in 2026 |

USD 8.08 Billion |

|

Market Size in 2025 |

USD 7.62 Billion |

|

Market Growth Rate (2026–2036) |

CAGR of 7.8% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Type, End-use Equipment, Vertical, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Rising Demand for Precision Construction and Infrastructure Modernization Programs

A primary driver of the machine control system market is the accelerating global investment in transportation, energy, and urban infrastructure, which is creating strong demand for automated guidance technologies that can deliver higher construction accuracy while managing project costs and labor constraints. Large-scale programs such as the U.S. Infrastructure Investment and Jobs Act, India's PM GatiShakti National Master Plan, and China's ongoing Belt and Road Initiative are channeling significant capital into road construction, rail expansion, port development, and utility projects — all of which are primary use cases for GNSS-based machine guidance and precision earthwork control. Contractors operating under these programs face tight schedules and strict quality standards that make conventional manual survey methods impractical, creating a compelling business case for machine control adoption. The growing chronic shortage of skilled equipment operators in key markets including the U.S., Australia, Japan, and across Western Europe is further accelerating this shift, as machine control systems allow less experienced operators to achieve consistent, design-compliant results that would otherwise require highly trained personnel.

Opportunity: Aftermarket Retrofit Demand and Expansion into Emerging Markets

The growing need to extend the productive life of existing heavy equipment fleets without the capital outlay of new machine purchases presents a significant opportunity for machine control system manufacturers. Aftermarket retrofit solutions that can be installed on conventional excavators, dozers, and graders are gaining rapid commercial traction, particularly among mid-size contractors and operators in emerging economies where new equipment procurement is financially constrained. According to available industry data, aftermarket retrofits now account for a significant and growing proportion of total machine control system installations globally, reflecting strong demand for flexible, equipment-agnostic guidance solutions. At the same time, infrastructure development programs across Southeast Asia, Africa, and Latin America are expanding the addressable market for machine control systems well beyond the traditional core markets of North America, Europe, and Japan. Manufacturers that can offer competitively priced, operationally simple, and locally supported retrofit systems are well-positioned to capture a growing share of this underserved segment as construction mechanization accelerates across developing regions.

Why Does the GNSS Segment Lead the Machine Control System Market?

The Global Navigation Satellite System (GNSS) segment accounts for the largest share of the overall machine control system market in 2026. This is primarily attributed to the broad applicability of GNSS-based positioning across the full range of earthmoving and grading operations, including road construction, dam building, excavation, and large-scale mining, where conventional surveying methods are both time-consuming and operationally inefficient. GNSS receivers provide continuous real-time positioning data that integrates seamlessly with 3D terrain models and digital project files, giving machine operators the precise spatial feedback needed to execute complex earthwork designs without staking or manual grade checking. The technology's scalability across open, large-footprint worksites makes it particularly well-suited to the infrastructure and mining applications that represent the bulk of industry demand. However, the sensors segment is expected to grow at a healthy pace during the forecast period, driven by increasing deployment of tilt, slope, and depth sensors for precise grade and inclination control in confined worksites and urban construction environments where GNSS signal availability can be limited.

How Does the Excavator Segment Maintain Its Dominance?

Based on end-use equipment, the excavators segment holds the largest share of the overall machine control system market in 2026. This dominance stems from the excavator's central role across construction, mining, and infrastructure development workflows, where it is used for the widest variety of precision earthwork tasks, including trenching, foundation excavation, slope grading, and material loading. The intricate and variable nature of excavation work makes it one of the most demanding applications for machine control guidance, and the availability of mature, purpose-built GNSS and sensor systems from manufacturers such as Trimble Inc., Hexagon AB, and Topcon Corporation has made adoption practical and commercially proven across a broad range of job types. The growing integration of automated arm-control and bucket-tip guidance with on-machine GNSS platforms is further extending the value proposition of excavator-focused machine control systems. Meanwhile, the paving systems segment — covering pavers and compactors — is expected to register a notable CAGR during the forecast period, driven by increasing specification of grade and slope control systems in road surfacing and airport pavement projects, where precise layer thickness and surface evenness are critical to long-term infrastructure performance.

Why Does the Infrastructure Segment Lead the Market?

The infrastructure vertical commands the largest share of the global machine control system market in 2026. This dominance is driven by the scale and technical complexity of transportation, utility, and civil engineering projects, which depend on high-precision earthwork operations across large site footprints and often within strict regulatory tolerances for grade accuracy and material placement. Road and highway construction, railway formation earthworks, bridge and tunnel approaches, and large-scale drainage and utility installation collectively represent the highest volume application area for GNSS and total station-based machine guidance. Government-led infrastructure investment programs in North America, Europe, and across Asia-Pacific are sustaining strong and consistent demand within this vertical. The mining segment is expected to grow steadily through 2036, supported by the increasing deployment of machine control systems in open-cut and surface mining operations where GNSS guidance for dozers, graders, and scrapers directly reduces ore loss, improves bench accuracy, and lowers the cost per tonne of material moved.

How is North America Maintaining Dominance in the Global Machine Control System Market?

North America holds the largest share of the global machine control system market in 2026. The region's market leadership is primarily attributed to the high rate of machine control adoption among U.S. construction contractors, the widespread availability of GNSS correction services, and a strong installed base of guidance-ready heavy equipment. The United States alone accounts for the dominant share of regional revenue, supported by long-standing relationships between leading machine control manufacturers such as Trimble Inc. and Hemisphere GNSS and major OEMs, as well as the significant federal investment flowing into transportation infrastructure through the Infrastructure Investment and Jobs Act. Large contractors operating across highway, airport, and utility projects in the U.S. have incorporated 3D machine guidance as a standard operational practice, creating a mature and replacement-driven demand cycle. Canada contributes meaningfully to North American market revenue, particularly through mining and oil sands applications where GNSS-based dozer and grader guidance is well established.

Which Factors Support Asia-Pacific and European Market Growth?

Asia-Pacific is projected to register the fastest growth in the global machine control system market during the forecast period, driven by massive and sustained infrastructure investment across China, India, Japan, South Korea, and key Southeast Asian markets. China's broad network of road, rail, and hydraulic infrastructure projects provides a high-volume demand base for machine control technologies, while India's accelerating highway construction program under PM GatiShakti and the National Infrastructure Pipeline is creating rapidly growing demand for precision earthwork guidance. Japan and South Korea are advancing the integration of machine control with telematics, AI-assisted grading, and autonomous equipment platforms, with Japanese OEMs such as Komatsu Ltd. embedding factory-fitted 3D guidance systems across their core excavator and dozer product lines.

Europe maintains a substantial and technology-driven share of the global market, underpinned by a strong construction automation culture, stringent project quality requirements, and the active push for BIM-aligned digital construction workflows in Germany, the United Kingdom, France, and the Nordic countries. European infrastructure agencies have increasingly mandated digital delivery standards for major public works contracts, which is accelerating the adoption of machine control systems as an integral component of BIM-compliant site workflows. Manufacturers including MOBA Mobile Automation AG play a significant role in serving the European market through purpose-built paving, compaction, and earthmoving guidance solutions.

Companies such as Trimble Inc., Hexagon AB (Leica Geosystems AG), and Topcon Corporation lead the global machine control system market with comprehensive positioning, guidance, and project data management platforms spanning the full range of earthmoving equipment types and site applications. Meanwhile, players including MOBA Mobile Automation AG, Hemisphere GNSS, Inc., and Eos Positioning Systems, Inc. focus on specialized guidance hardware, GNSS receiver technology, and retrofit-oriented solutions targeting mid-tier contractors and regional markets. OEM-integrated manufacturers such as Komatsu Ltd. and Caterpillar Inc. are strengthening the market through factory-fitted machine control offerings that combine precision 3D guidance with proprietary fleet telematics and smart construction platforms. Emerging players including Prolec Ltd. and Carlson Software Inc. are expanding their presence through niche machine safety, excavator guidance, and project data software solutions that complement the broader machine control ecosystem.

The global machine control system market is expected to grow from USD 8.08 billion in 2026 to USD 17.1 billion by 2036.

The global machine control system market is projected to grow at a CAGR of 7.8% from 2026 to 2036.

The GNSS segment is expected to dominate the market in 2026 due to its broad applicability across large-scale earthmoving, road construction, and mining applications. However, the sensors segment is projected to be one of the faster-growing segments, driven by increasing demand for tilt, slope, and depth guidance in confined and urban construction environments where GNSS coverage may be limited.

The transition from 2D laser-based grade control to 3D GNSS and total station guidance is the most significant structural change in the machine control system market, as it enables contractors to manage complex digital terrain models in real time, eliminate physical staking, and achieve as-built verification directly from the machine. This shift is driving higher average system selling prices, increasing software and services revenue, and accelerating OEM integration of guidance systems as standard equipment rather than aftermarket additions.

North America holds the largest share of the global machine control system market in 2026, primarily attributed to the high adoption of automated construction practices among U.S. contractors, significant federal infrastructure funding, and a well-developed GNSS correction infrastructure

The leading companies include Trimble Inc., Hexagon AB (Leica Geosystems AG), Topcon Corporation, MOBA Mobile Automation AG, and Hemisphere GNSS, Inc.

Published Date: Sep-2025

Published Date: Jul-2025

Published Date: Oct-2022

Published Date: Feb-2026

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates