Resources

About Us

3D Weaving Market by Machine Type (Glass Fiber Weaving Machines, Carbon Fiber Weaving Machines, Composite Textile Weaving Machines, Spacer Weaving Machines, Customized 3D Weaving Systems), Application (Structural Components, Protective Materials, Reinforcements, Insulation and Thermal Protection), End-use Industry — Global Forecast to 2036

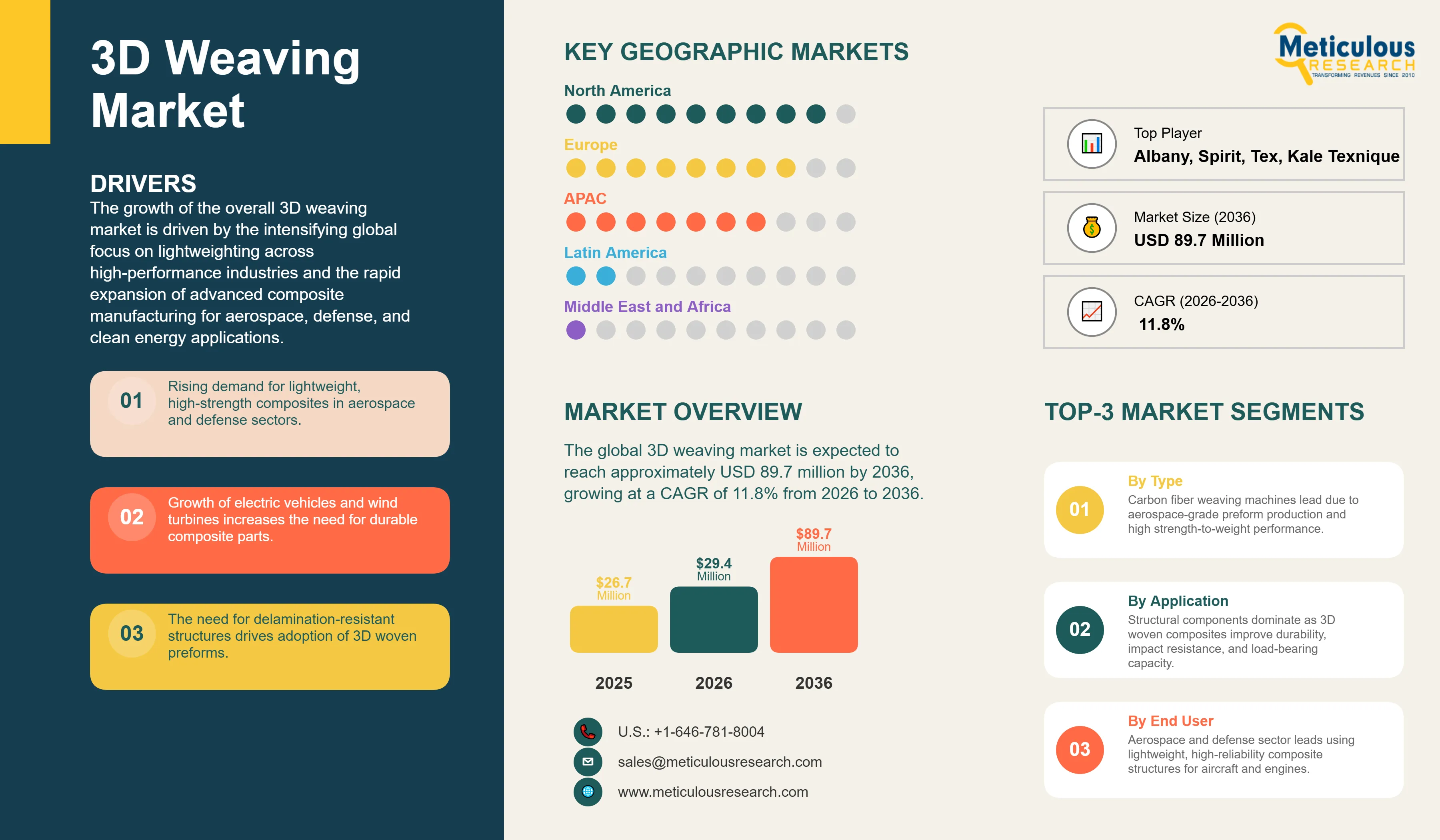

Report ID: MRSE - 1041795 Pages: 282 Feb-2026 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe global 3D weaving market was valued at USD 26.7 million in 2025. The market is expected to reach approximately USD 89.7 million by 2036 from USD 29.4 million in 2026, growing at a CAGR of 11.8% from 2026 to 2036. The growth of the overall 3D weaving market is driven by the intensifying global focus on lightweighting across high-performance industries and the rapid expansion of advanced composite manufacturing for aerospace, defense, and clean energy applications. As manufacturers seek to move beyond conventional laminated composite structures, 3D weaving technology has become essential for producing near-net-shape preforms with superior through-thickness reinforcement, delamination resistance, and structural integrity. The rapid expansion of next-generation aeroengine programs, the accelerating adoption of composite-intensive electric vehicles, and the growing deployment of large-format wind turbine blades continue to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

3D weaving is an advanced textile manufacturing process that interlaces fibers simultaneously in the length, width, and thickness directions to produce fully integrated, multi-layer woven structures. Unlike conventional two-dimensional fabric lay-ups that are prone to interlaminar delamination, 3D woven preforms bind through-thickness fiber reinforcements directly into the fabric architecture, resulting in enhanced damage tolerance, superior impact resistance, and excellent load-bearing capability under dynamic stress conditions. The market is defined by highly specialized weaving machines — including rapier, Jacquard-controlled, and multi-layer systems — that are engineered to process high-performance technical fibers such as carbon, aramid, and glass with exceptional precision and consistency. These machines form the foundation of an advanced manufacturing value chain that spans preform production, resin infusion, and final component integration for safety-critical applications across aerospace, defense, automotive, and energy industries.

The market includes a diverse range of solutions, from entry-level glass fiber weaving systems targeting industrial reinforcement and wind energy applications to fully automated, computer-controlled carbon fiber weaving machines capable of producing complex near-net-shape preforms for turbine blades, fuselage structures, and ballistic armor. These systems are increasingly equipped with IoT-enabled process monitoring, AI-driven weave pattern optimization, and digital twin simulation capabilities that allow manufacturers to minimize material waste, reduce development lead times, and ensure reproducible component quality at scale. Dedicated 3D composite design and simulation software platforms — such as Albany Engineered Composites' proprietary 3D Composite Studio — are becoming indispensable tools for validating fiber architecture and predicting as-manufactured structural performance prior to production.

The global manufacturing sector is under sustained pressure to reduce component weight, lower emissions, and extend service life across its most demanding structural applications. This drive has significantly accelerated the adoption of 3D woven composite solutions, with advanced weaving systems helping to deliver fiber architectures that are unachievable through conventional tape laying or winding processes. At the same time, the growing emphasis on defense supply chain resilience, the expansion of commercial aircraft production, and the scaling of renewable energy infrastructure are intensifying demand for high-reliability, technically advanced 3D weaving equipment capable of supporting both prototype development and high-volume serial production.

Automation and AI-Driven Process Intelligence in 3D Weaving Systems

Manufacturers across the industry are rapidly advancing toward fully automated, digitally intelligent weaving platforms that go well beyond conventional mechanically controlled systems. Lindauer DORNIER's TRITOS® 3D weaving machines now enable the economical series production of three-dimensionally woven fabric structures with thicknesses of up to 100 mm, while the company's P2 Roving rapier platform — featuring the patented SynchroDrive® drive concept — delivers highly consistent carbon fiber fabric production at throughput rates suited to industrial-scale aerospace manufacturing. The real transformation is taking place at the software layer, where AI-powered weave pattern optimization, real-time tension monitoring, and predictive maintenance systems are enabling manufacturers to significantly reduce yarn breakage, scrap rates, and unplanned downtime. A landmark example is the January 2026 collaboration between Astris AI — a Lockheed Martin company — and Albany Engineered Composites, which is deploying AI capabilities directly into AEC's 3D weaving and composite manufacturing operations, establishing a model for technology-driven supply chain modernization within the defense composites sector.

Expansion into Near-Net-Shape Composite Components for Next-Generation Platforms

Growing demand from aerospace original equipment manufacturers and defense prime contractors is pushing 3D weaving technology beyond preform supply and into vertically integrated, near-net-shape composite component production. Albany Engineered Composites' proprietary 3D woven composite fan blades and fan cases — supplied exclusively for the CFM International LEAP aircraft engine, the world's most widely produced commercial aeroengine — represent the clearest demonstration of how 3D weaving technology can enable structural innovation at the highest levels of safety and performance criticality. AEC has further extended the technology's reach by signing a two-year agreement with Airbus to apply 3D reinforced composite technology to next-generation wing substructure applications, and by pursuing 3D woven composite replacements for critical titanium structural elements across multiple commercial and military platforms. Researchers at TU Braunschweig and TU Dresden, recognized with the Peter Dornier Foundation Prize 2025, have also demonstrated the feasibility of 3D woven foldable aircraft wingtips — produced on DORNIER weaving machines — as a path to reducing aerodynamic drag and improving fuel efficiency in commercial aviation.

Sustainable Fiber Architectures and Circular Manufacturing Principles

The growing focus on environmental sustainability within advanced manufacturing is reshaping material selection and production philosophy across the 3D weaving market. Machine manufacturers are developing systems capable of processing a wider range of technically advanced and sustainably sourced fiber inputs, including recycled carbon fiber, natural fiber reinforcements, and thermoplastic matrix-compatible materials that support end-of-life recyclability. Lindauer DORNIER's PROTOS® tape production and weaving system line enables the economical manufacturing of thermoplastic fiber composite semi-finished products from carbon, glass, and aramid rovings — reducing dependence on autoclave processing, cutting energy consumption, and improving production economics for both aerospace and automotive applications. At the same time, growing demand for bio-based and low-embodied-carbon composite reinforcements is opening new avenues for 3D weaving in construction, medical textiles, and consumer applications, broadening the addressable market well beyond traditional high-performance industrial segments.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 89.7 Million |

|

Market Size in 2026 |

USD 29.4 Million |

|

Market Size in 2025 |

USD 26.7 Million |

|

Market Growth Rate (2026–2036) |

CAGR of 11.8% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Machine Type, Application, End-use Industry, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Rising Demand for Lightweight, High-Strength Composites Across High-Performance Industries

A key driver of the 3D weaving market is the sustained and accelerating demand for advanced lightweight composite materials across aerospace, defense, automotive, and clean energy sectors. The need to reduce structural weight while maintaining or improving mechanical strength, thermal stability, and impact resistance is placing conventional composite manufacturing approaches under increasing technical and economic pressure. 3D weaving machines uniquely address this challenge by enabling the production of fully integrated, multilayer woven structures with through-thickness fiber reinforcement that cannot be achieved through traditional tape laying or lamination. Programs such as next-generation aircraft engines, lightweight electric vehicle body structures, and large-format offshore wind turbine blades are all placing growing demand on manufacturers to deliver composite preforms that offer superior delamination resistance, near-net-shape geometry, and reduced material waste relative to competing processes. As defense budgets globally prioritize advanced manufacturing and material science investment, the appetite for technically proven 3D woven composite solutions in ballistic protection, hypersonic thermal shielding, and structural military components is expected to expand substantially through 2036.

Opportunity: Expansion of Electric Mobility and Wind Energy Infrastructure

The rapid global scaling of electric vehicle production and renewable wind energy infrastructure presents a compelling growth opportunity for the 3D weaving market. In the automotive segment, the shift toward battery electric vehicles is creating strong demand for lightweight structural components that can extend driving range, improve crash energy management, and enable new vehicle architectures without compromising safety. 3D woven composites are gaining traction in structural reinforcements, crash protection members, and underbody components, where their ability to absorb impact without delaminating directly supports vehicle safety certification. In the wind energy segment, the continued growth of both onshore and offshore installation programs is driving demand for composite blade materials with superior fatigue resistance, long service life, and the ability to support larger, heavier rotor designs at reduced mass. As global renewable energy capacity continues to expand, with offshore wind in particular entering a major deployment phase across Europe, North America, and Asia-Pacific, the demand for advanced 3D weaving systems capable of producing high-performance structural reinforcements for blade and nacelle applications is expected to rise considerably over the forecast period.

Why Does the Carbon Fiber Weaving Machines Segment Lead the Market?

The carbon fiber weaving machines segment accounts for the largest share of the overall 3D weaving market in 2026. This is primarily attributed to the technology's critical role in producing aerospace-grade preforms for jet engine components, aircraft structural assemblies, defense platforms, and space launch systems, where the superior strength-to-weight ratio and fatigue performance of carbon fiber make it the reinforcement material of choice. Major platforms such as the CFM International LEAP engine — for which Albany Engineered Composites supplies exclusively 3D woven carbon fiber fan blades and fan cases — as well as the F-35 Lightning II fighter jet and a growing range of next-generation aeroengine development programs, have established carbon fiber 3D weaving as a technically irreplaceable manufacturing capability. Lindauer DORNIER's P2 Roving rapier weaving machine, considered a global benchmark for carbon fiber fabric production, enables highly reliable and economical processing of heavy tow and specialty carbon formats for high-end structural applications. However, the composite textile weaving machines segment is expected to register the fastest growth during the forecast period, driven by expanding applications in automotive crash structures, thermally stable aerospace panels, and complex biomedical implants that require the flexibility to work with varied technical fiber types and custom woven architectures.

How Does the Structural Components Application Segment Dominate?

Based on application, the structural components segment holds the largest share of the overall 3D weaving market in 2026. This dominance is primarily driven by the widespread use of 3D woven preforms in load-bearing aerospace structures, engine components, and defense assemblies where delamination resistance and multi-directional reinforcement are non-negotiable performance requirements. Current large-scale aeroengine and airframe programs are increasingly specifying 3D woven composite components to ensure compliance with stringent airworthiness standards and the aggressive weight, durability, and maintainability targets of next-generation platforms.

The protective materials application segment — encompassing ballistic armor panels, helmet shells, blast-resistant structures, and body armor — is expected to witness the fastest growth during the forecast period. The increasing global defense investment environment, growing demand for lightweight personnel protection systems, and the development of advanced 3D woven aramid and hybrid fiber structures capable of providing multi-threat ballistic performance are collectively pushing manufacturers to expand both machine capacity and fiber architecture capability in this high-value application category.

Why Does the Aerospace and Defense Segment Lead the Market?

The aerospace and defense segment commands the largest share of the global 3D weaving market in 2026. This dominance stems from its ability to justify the technology's higher upfront investment through the performance gains, weight savings, and lifecycle cost reductions delivered by 3D woven composite structures in safety-critical applications. Large-scale aerospace programs, military aircraft platforms, hypersonic development efforts, and next-generation propulsion systems are all driving sustained demand, with companies like Albany Engineered Composites, Bally Ribbon Mills, and Tex Tech Industries enabling reliable, high-precision 3D woven component supply for both original equipment and aftermarket programs.

However, the automotive segment is poised for the fastest growth through 2036, fueled by expanding applications in electric vehicle lightweighting, crash protection, and structural component integration. Automakers face mounting pressure to reduce vehicle mass to extend battery range and meet tightening emissions standards, where 3D woven composites provide a compelling alternative to conventional metal and chopped-fiber composite solutions for high-performance structural and safety-related applications.

How is North America Maintaining Dominance in the Global 3D Weaving Market?

North America holds the largest share of the global 3D weaving market in 2026. This regional leadership is primarily attributable to the concentration of world-leading 3D woven composite manufacturers, a deep and well-funded aerospace and defense industrial base, and strong institutional investment in advanced composite materials research. The United States in particular commands a pivotal role, driven by companies such as Albany Engineered Composites and Bally Ribbon Mills, which have spent decades developing proprietary 3D weaving technologies and securing long-term production positions on the most strategically important commercial and military aerospace platforms globally. Government-aligned programs prioritizing domestic defense supply chain resilience — including the integration of AI-driven manufacturing intelligence into 3D woven composite production, as exemplified by Albany Engineered Composites' collaboration with Astris AI in early 2026 — are further reinforcing North America's position as the global center of gravity for advanced 3D weaving technology development and industrialization.

Which Factors Support Europe and Asia-Pacific Market Growth?

Europe accounts for a significant share of the global 3D weaving market, driven by a robust advanced manufacturing ecosystem and a strong tradition of precision engineering in the textile machinery sector. Germany is at the forefront, home to Lindauer DORNIER GmbH, whose TRITOS® 3D weaving machine systems and P2 Roving platform are widely regarded as the global benchmark for composite fabric production. The country's well-established aerospace and automotive industries provide a steady and growing domestic demand base, while DORNIER's global export presence — exceeding 90% of production — amplifies European technology leadership across all major markets. Switzerland's Stäubli International AG further strengthens the European position through its specialized Jacquard machine systems and automation solutions tailored to precision 3D textile production.

Asia-Pacific is expected to register the fastest growth during the forecast period, led by China and India. China's robust industrial foundation, cost-competitive manufacturing environment, and government-backed initiatives to develop domestic advanced composite capabilities are driving rapid expansion of 3D weaving machine adoption in aerospace, automotive, and wind energy sectors. India is also emerging as an important growth market, with companies such as Dashmesh Jacquard and Powerloom Pvt. Ltd., Kale Texnique, and Tantra Composite Technologies Pvt. Ltd. contributing to a growing domestic 3D weaving supply chain that is increasingly targeting export markets across Southeast Asia and the Middle East.

Companies such as Lindauer DORNIER GmbH, Stäubli International AG, Albany Engineered Composites, Inc., and Bally Ribbon Mills lead the global 3D weaving market with a comprehensive range of highly specialized weaving machines, near-net-shape composite preforms, and advanced 3D woven component manufacturing capabilities, particularly for aerospace and defense programs. Meanwhile, players including VÚTS, a.s., Optima 3D Ltd., Tex Tech Industries, Inc., and Spirit AeroSystems, Inc. focus on specialized machine development, niche preform production, and platform-specific composite component supply targeting high-performance industrial and aviation applications. Emerging manufacturers and integrated players such as Unspun, Inc., Dashmesh Jacquard and Powerloom Pvt. Ltd., Hefei Fanyuan Instrument Co., Ltd., Kale Texnique, Sino Textile Machinery Co., Ltd., and Tantra Composite Technologies Pvt. Ltd. are strengthening the market through innovations in automated weaving systems, cost-effective fiber processing, and customized 3D weaving solutions for high-growth regional markets.

The global 3D weaving market is expected to grow from USD 29.4 million in 2026 to USD 89.7 million by 2036.

The global 3D weaving market is projected to grow at a CAGR of 11.8% from 2026 to 2036.

Carbon fiber weaving machines are expected to dominate the market in 2026 due to their critical role in aerospace-grade preform production, next-generation aeroengine programs, and structural defense applications. However, the composite textile weaving machines segment is projected to register the fastest growth, driven by its ability to work with varied technical fiber types and support customized woven architectures for automotive, biomedical, and emerging industrial applications.

Automation and AI are transforming the 3D weaving landscape by enabling higher precision weave pattern control, real-time process monitoring, and predictive maintenance capabilities that significantly reduce scrap rates, development lead times, and unplanned downtime. These technologies are driving the adoption of advanced platforms such as AI-integrated 3D composite design simulation tools and IoT-connected weaving machine management systems, enabling manufacturers to support the complex, high-specification requirements of next-generation aerospace, defense, and automotive composite programs at industrial scale.

North America holds the largest share of the global 3D weaving market in 2026. This position is primarily attributed to the concentration of world-leading 3D woven component manufacturers, a deep aerospace and defense customer base, and strong government-supported investment in advanced composite manufacturing technology.

The leading companies include Lindauer DORNIER GmbH, Stäubli International AG, Albany Engineered Composites, Inc., Bally Ribbon Mills, and VÚTS, a.s.

Published Date: May-2023

Published Date: Sep-2022

Published Date: Jul-2022

Published Date: Nov-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates