What is the LEO Satellite Market Size?

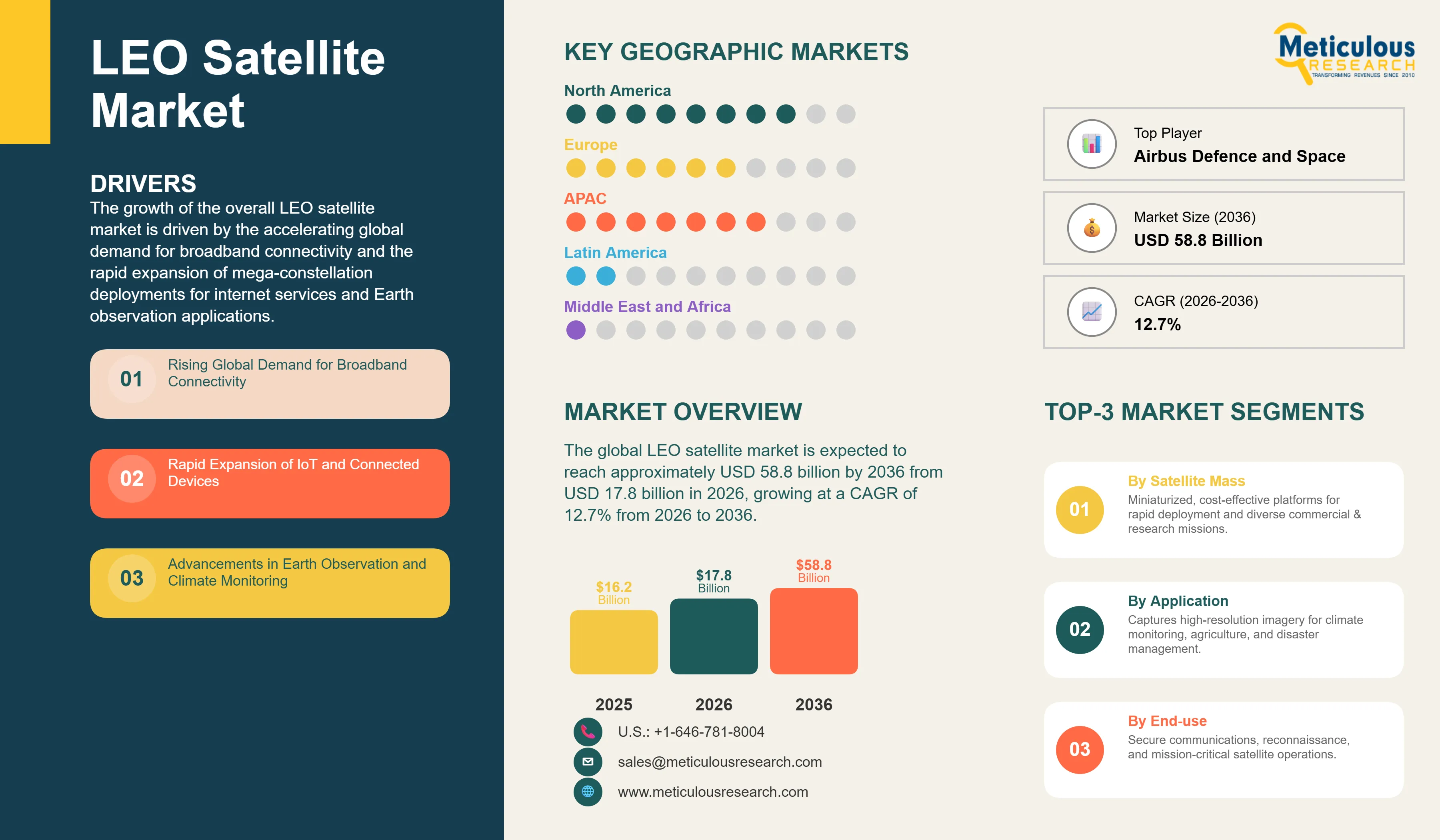

The global LEO satellite market was valued at USD 16.2 billion in 2025. The market is expected to reach approximately USD 58.8 billion by 2036 from USD 17.8 billion in 2026, growing at a CAGR of 12.7% from 2026 to 2036. The growth of the overall LEO satellite market is driven by the accelerating global demand for broadband connectivity and the rapid expansion of mega-constellation deployments for internet services and Earth observation applications. As satellite operators seek to deliver high-speed, low-latency communication services to underserved regions and integrate advanced sensing capabilities into unified space-based platforms, LEO satellite infrastructure has become essential for maintaining competitive operational efficiency and service reliability. The rapid expansion of commercial space initiatives and the increasing need for real-time global monitoring across climate, defense, and logistics sectors continue to fuel significant growth of this market across all major geographic regions.

Market Highlights: Global LEO Satellite Market

- In terms of revenue, the global LEO satellite market is projected to reach USD 58.8 billion by 2036.

- The market is expected to grow at a CAGR of 12.7% from 2026 to 2036.

- North America dominates the global LEO satellite market with the largest market share in 2026, driven by massive investments in satellite constellations and the presence of leading aerospace and technology companies in the U.S. and Canada.

- Asia-Pacific is expected to witness the fastest growth during the forecast period, supported by aggressive space programs and rapidly expanding commercial satellite deployment capabilities in China, India, and Japan.

- By satellite mass, the CubeSats/nanosatellites segment is expected to grow at the fastest CAGR during the forecast period, driven by their cost-effectiveness, rapid deployment cycles, and increasing adoption for Earth observation and IoT connectivity applications.

- By application, the communication segment holds the largest market share in 2026, due to the deployment of mega-constellations for global broadband internet services.

- By end-use, the commercial segment holds the largest share of the overall market in 2026.

Market Overview and Insights

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

LEO satellites are advanced space-based systems that leverage orbital positioning between 300 and 2,000 kilometers above Earth to provide optimized communication services and enhanced Earth monitoring through integrated sensor infrastructure. These systems include satellite buses, advanced payloads, communication subsystems, and propulsion technologies designed to deliver low-latency connectivity and high-resolution data collection across diverse operational environments. The market is defined by cutting-edge technologies such as electric propulsion, miniaturized components, and AI-driven payload processing, which significantly enhance operational precision and resource utilization in demanding commercial and governmental applications. These systems are indispensable for organizations seeking to optimize their space-based operations and meet aggressive connectivity and monitoring targets.

The market includes a diverse range of solutions, ranging from simple CubeSat platforms for educational and research applications to complex mega-constellation systems with thousands of interconnected satellites for global broadband coverage. These systems are increasingly integrated with advanced components such as optical inter-satellite links, on-board processing capabilities, and autonomous collision avoidance to provide services such as real-time Earth imaging, maritime tracking, and atmospheric monitoring. The ability to provide stable, high-frequency coverage while minimizing signal latency has made LEO satellite technology the choice for institutions where communication speed and global reach are paramount.

The global space sector is pushing hard to democratize access to space capabilities, aiming to meet universal broadband targets and data-driven decision-making goals. This drive has increased the adoption of high-performance LEO constellations, with advanced satellite platforms helping to enable seamless connectivity for ultra-high-efficiency communication networks. At the same time, the rapid growth in the Internet of Things and remote sensing markets is increasing the need for high-reliability, scalable space-based solutions.

What are the Key Trends in the LEO Satellite Market?

Deployment of Mega-Constellations and Global Broadband Connectivity

Satellite operators across the industry are rapidly shifting to mega-constellation architectures, moving well beyond traditional single-satellite missions. SpaceX's Starlink platform has deployed thousands of satellites delivering significantly higher global coverage, while Amazon's Project Kuiper installations are accelerating to provide competitive broadband services across underserved regions. The real game-changer comes with interconnected satellite networks featuring optical inter-satellite links that maintain peak operational efficiency even in high-demand communication environments. These advancements make global internet coverage practical and cost-effective for everyone from individual consumers to large-scale enterprise operators chasing excellence in network resilience and lower service costs.

Innovation in Satellite Miniaturization and Advanced Manufacturing

Innovation in miniaturization technologies and automated production is rapidly driving the LEO satellite market, as manufacturing procedures become more efficient and launch operations more streamlined. Equipment suppliers like Airbus and Lockheed Martin are now designing platforms that combine the speed of rapid prototyping with the intelligence of real-time health monitoring in a single system, saving valuable development time and simplifying deployment logistics. These systems often involve advanced lightweight materials like carbon composites and 3D-printed components capable of handling complex orbital environments without compromising mission reliability or structural integrity.

At the same time, growing focus on sustainable space operations is pushing manufacturers to develop satellite solutions tailored to end-of-life disposal and debris mitigation principles. These systems help reduce environmental impact through the use of atmospheric re-entry designs and collision avoidance algorithms. By combining high-density performance with robust space sustainability practices, these new designs support both technological advancement and orbital safety, strengthening the resilience of the broader space infrastructure ecosystem.

Market Summary:

|

Parameter

|

Details

|

|

Market Size by 2036

|

USD 58.8 Billion

|

|

Market Size in 2026

|

USD 17.8 Billion

|

|

Market Size in 2025

|

USD 16.2 Billion

|

|

Market Growth Rate (2026-2036)

|

CAGR of 12.7%

|

|

Dominating Region

|

Asia-Pacific

|

|

Fastest Growing Region

|

Asia-Pacific

|

|

Base Year

|

2025

|

|

Forecast Period

|

2026 to 2036

|

|

Segments Covered

|

Satellite Mass, Application, End-use, Orbit Altitude, Frequency Band, and Region

|

|

Regions Covered

|

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

|

Market Dynamics

Drivers: Rising Demand for Global Broadband Connectivity and IoT Integration

A key driver of the LEO satellite market is the rapid movement of the global telecommunications industry toward universal internet access and connected device models. Global demand for high-speed internet, real-time data transmission, and device-to-device communication has created significant incentives for the deployment of LEO satellite infrastructure. The trend toward distributed connectivity and the integration of satellite systems into unified digital platforms drive operators toward scalable solutions that LEO satellites can uniquely provide. It is estimated that as global adoption of IoT devices rises and connectivity requirements become more decentralized through 2036, the need for robust, low-latency infrastructure increases significantly; therefore, high-performance LEO constellations and modular satellite platforms, with their ability to ensure global coverage and rapid data processing, are considered a crucial enabler of modern communication delivery strategies.

Opportunity: Earth Observation and Climate Monitoring Applications

The rapid growth of the Earth observation market and climate monitoring initiatives provides great opportunities for the LEO satellite market. Indeed, the global surge in environmental awareness and regulatory requirements has created a compelling demand for systems that can deliver frequent revisit rates and provide high-resolution imagery for environmental tracking. These applications require exceptional spatial resolution, temporal coverage, and the ability to handle multi-spectral data collection, all attributes that are met with advanced LEO satellite constellations. The Earth observation market is set to expand significantly through 2036, with LEO satellites poised for an expanding share as governments and enterprises seek to maximize environmental insights and minimize climate-related risks. Furthermore, the increasing demand for precision agriculture, disaster response, and infrastructure monitoring is stimulating demand for modular satellite solutions that provide high-frequency data collection and operational flexibility.

Satellite Mass Insights

Why is the CubeSats/Nanosatellites Segment Expected to Grow Fastest?

The CubeSats/nanosatellites segment is expected to witness the fastest CAGR during the forecast period. This remarkable growth is mainly attributed to the cost-effective nature of these miniaturized platforms and their versatility across diverse mission requirements within modern space operations. These systems offer the most accessible way to enable rapid deployment across experimental, educational, and commercial applications. The technology and research sectors alone drive significant demand for CubeSats/nanosatellites, with major projects in North America and Europe demonstrating the technology's capability to handle sophisticated sensor payloads despite compact form factors. However, the small satellites segment holds a significant market share in 2026, driven by the widespread deployment of constellations for communication and Earth observation, offering a balanced solution between payload capacity and launch economics for comprehensive satellite network architectures.

Application Insights

How Does the Communication Segment Dominate?

Based on application, the communication segment holds the largest share of the overall market in 2026. This is primarily due to the massive deployment of broadband satellite constellations and the rigorous service quality standards required for modern global connectivity. Current large-scale communication systems are increasingly specifying high-capacity platforms to ensure compliance with latency requirements and consumer expectations for reliable internet environments.

The Earth observation & remote sensing segment is expected to witness significant growth during the forecast period. The shift toward data-driven decision-making and the complexity of multi-domain environmental monitoring are pushing the requirement for advanced imaging systems that can handle varied spectral profiles and high-resolution operational data while ensuring absolute reliability for climate-critical applications.

End-use Insights

Why Does the Commercial Segment Lead the Market?

The commercial segment commands the largest share of the global LEO satellite market in 2026. This dominance stems from its superior ability to support satellite internet services, maritime tracking, and logistics optimization applications, making it the end-use of choice for high-performance satellite deployments. Large-scale operations in telecommunications, media broadcasting, and Earth observation services drive demand, with advanced constellations from providers like SpaceX and OneWeb enabling reliable performance in complex connectivity environments.

However, the government & defense segment is poised for steady growth through 2036, fueled by expanding applications in secure communications, reconnaissance, and navigation enhancement. Government agencies face mounting pressure to optimize capabilities for high-security, mission-critical applications, where LEO satellites provide a strategic alternative for resilient space-based infrastructure.

Regional Insights

How is North America Maintaining Dominance in the Global LEO Satellite Market?

North America holds the largest share of the global LEO satellite market in 2026. The largest share of this region is primarily attributed to the massive investments in commercial space ventures and the presence of the world's leading aerospace companies, particularly in the United States. The U.S. alone accounts for a significant portion of global satellite deployments, with its position as a leading innovator in mega-constellation technology and commercial space services driving sustained growth. The presence of leading manufacturers like SpaceX, Lockheed Martin, and Boeing provides a robust market for both standard and advanced satellite solutions.

Which Factors Support Asia-Pacific and Europe Market Growth?

Asia-Pacific is expected to witness the fastest growth rate during the forecast period. The rapid expansion of this market is mainly driven by the aggressive space programs in China, India, and Japan, coupled with increasing commercial satellite deployment capabilities. The demand for advanced satellite systems in Asia-Pacific is mainly due to large-scale infrastructure development projects and the presence of emerging space technology providers.

In Europe, the leadership in aerospace engineering and the push for autonomous space capabilities are driving the adoption of high-reliability satellite solutions. Countries like France, Germany, and the UK are at the forefront, with significant focus on integrating advanced satellite systems into communication workflows and Earth observation programs to ensure the highest levels of performance and technological independence.

Key Players

The companies such as Space Exploration Technologies Corp. (SpaceX), Lockheed Martin Corporation, Airbus Defence and Space, and The Boeing Company lead the global LEO satellite market with a comprehensive range of satellite manufacturing and deployment solutions, particularly for large-scale constellation applications and high-capacity communication systems. Meanwhile, players including Northrop Grumman Corporation, Thales Alenia Space, OneWeb, and Maxar Technologies focus on specialized satellite platforms, Earth observation capabilities, and modular systems targeting the commercial and governmental sectors. Emerging manufacturers and innovative players such as Planet Labs PBC, Spire Global Inc., Surrey Satellite Technology Ltd., GomSpace A/S, Iridium Communications Inc., Kuiper Systems LLC (Amazon), and Mitsubishi Electric Corporation are strengthening the market through innovations in miniaturized satellites and cost-effective constellation deployment platforms.

Key Questions Answered