Resources

About Us

Reusable Launch Vehicle Market by Type (Partially Reusable, Fully Reusable), Orbit Type (LEO, MEO, GTO, BEO), Vehicle Capacity (Small-lift, Medium-lift, Heavy-lift, Super Heavy-lift), Propulsion (Liquid Fuel, Solid Fuel, Hybrid), and Application (Commercial, Defense & Government) – Global Forecast to 2036

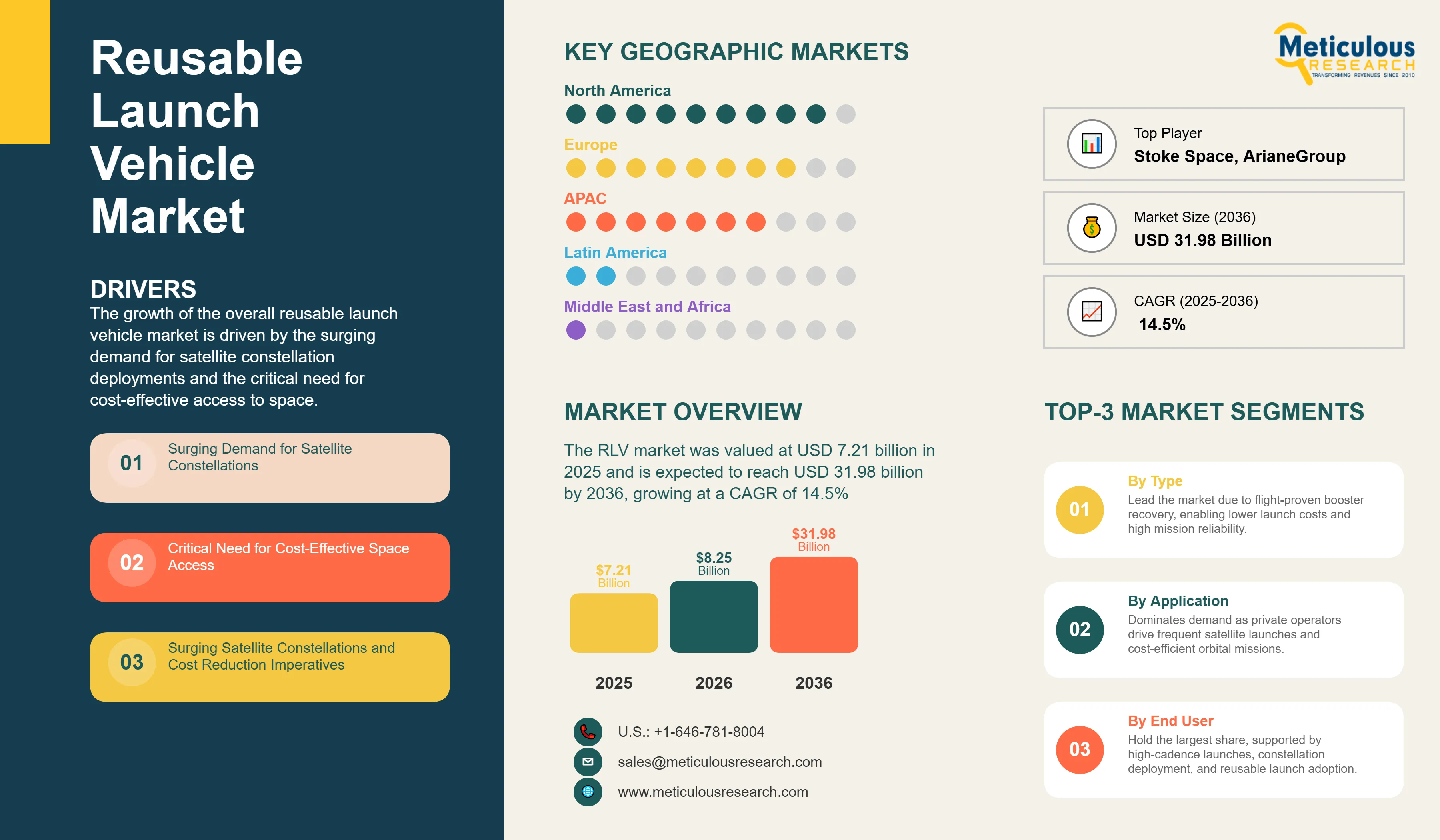

Report ID: MRAD - 1041698 Pages: 288 Feb-2026 Formats*: PDF Category: Aerospace and Defense Delivery: 24 to 72 Hours Download Free Sample ReportThe global reusable launch vehicle (RLV) market was valued at USD 7.21billion in 2025. The market is expected to reach approximately USD 31.98 billion by 2036 from USD 8.25 billion in 2026, growing at a CAGR of 14.5% from 2026 to 2036. The growth of the overall reusable launch vehicle market is driven by the surging demand for satellite constellation deployments and the critical need for cost-effective access to space. As space agencies and private enterprises seek to reduce the cost per kilogram of payload delivered to orbit, RLV technology has become the cornerstone of modern orbital logistics and deep-space exploration. The rapid expansion of the commercial space sector, coupled with the increasing frequency of national security launches and space tourism initiatives, continues to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

A Reusable Launch Vehicle (RLV) is a sophisticated space transportation system designed to be recovered and flown multiple times, significantly reducing the financial burden associated with traditional expendable rockets. These systems utilize advanced vertical takeoff and vertical landing (VTVL) or horizontal landing technologies to return boosters and, increasingly, upper stages to Earth. The market is defined by high-performance propulsion systems and thermal protection materials that enable vehicles to withstand the extreme stresses of atmospheric reentry while maintaining structural integrity for subsequent missions.

The market includes a diverse range of vehicles, from small-lift rockets designed for dedicated nanosatellite missions to super heavy-lift systems capable of supporting lunar and Martian exploration. These vehicles are increasingly integrated with autonomous flight control systems and AI-driven predictive maintenance to ensure rapid turnaround times and high mission reliability. The ability to process advanced propellants, such as liquid methane and liquid oxygen (Methalox), while minimizing the environmental impact of frequent launches has made RLVs the technology of choice for a sustainable and resilient space economy.

The global aerospace sector is pushing hard to modernize launch capabilities, aiming to enhance orbital asset resilience and reduce the barriers to space entry. This drive has increased the adoption of RLVs for diverse missions ranging from Earth observation to point-to-point global cargo delivery. At the same time, the rapid growth in the space exploration and orbital manufacturing markets is increasing the need for high-cadence, low-cost launch services.

Transition to Full Reusability and Next-Generation Propellants

Manufacturers are rapidly shifting from partial reusability toward fully reusable architectures that encompass both the booster and the upper stage. SpaceX’s Starship and Sierra Space’s Dream Chaser represent the leading edge of this transition, aiming to eliminate the loss of expensive hardware in every mission. The real game-changer comes with the adoption of Methalox-based propulsion systems, such as Blue Origin’s BE-4 and SpaceX’s Raptor engines. These systems offer superior performance and cleaner combustion, which reduces the need for extensive engine refurbishment between flights. This shift makes high-frequency space access practical and cost-effective for a broad range of stakeholders, from telecommunications giants to research institutions.

Proliferation of Small and Medium-Lift Reusable Systems

Innovation in the small and medium-lift segments is rapidly driving the RLV market as the demand for flexible, dedicated launches grows. Equipment suppliers and startups are now designing systems specifically for the rapid deployment of small satellite constellations, with a focus on autonomous recovery and modular manufacturing. Rocket Lab’s successful recovery of the Electron booster and the development of the Neutron rocket highlight this trend toward making smaller vehicles reusable. At the same time, growing focus on regional space sovereignty is pushing countries to develop domestic RLV solutions tailored to their specific national security and commercial needs. By combining high-cadence launch capabilities with localized recovery infrastructure, these new designs support both primary satellite deployment and sustainable orbital maintenance.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 31.98 Billion |

|

Market Size in 2026 |

USD 8.25 Billion |

|

Market Size in 2025 |

USD 7.21 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 14.5% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Type, Orbit Type, Vehicle Capacity, Propulsion, Application, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Surging Satellite Constellations and Cost Reduction Imperatives

A key driver of the RLV market is the rapid movement of the global telecommunications industry toward mega-constellations in Low-Earth Orbit. Global requirements for high-speed internet and real-time Earth observation have created significant incentives for the adoption of reusable technologies. The ability to launch hundreds of satellites annually with minimal hardware waste drives manufacturers toward scalable RLV solutions. It is estimated that as the demand for orbital bandwidth rises through 2036, the need for cost-efficient launch services increases significantly; therefore, RLV systems, with their ability to reduce launch costs by up to 50%, are considered a crucial enabler of modern space strategies.

Opportunity: Space Tourism and Point-to-Point Global Transport

The rapid growth of the commercial spaceflight sector provides great opportunities for the RLV market. Indeed, the global surge in space tourism and orbital research initiatives has created a compelling demand for vehicles that can safely transport humans and high-value cargo multiple times. These applications require high reliability, long operational life, and the ability to handle rapid turnaround cycles, all attributes that are met with advanced RLV systems. The suborbital and orbital tourism market is set to expand significantly through 2036, with RLVs poised for an expanding share as operators seek to monetize frequent access to microgravity environments. Furthermore, the increasing demand for ultra-fast global logistics is stimulating demand for RLV systems that provide point-to-point Earth transport capabilities.

Why Do Partially Reusable Systems Dominate the Market?

The partially reusable segment accounts for around 70-75% of the overall RLV market in 2026. This is mainly attributed to the proven operational reliability of first-stage booster recovery, which has become the industry standard for medium and heavy-lift missions. These systems offer the most immediate way to manage launch costs while utilizing existing infrastructure. The commercial satellite and defense sectors alone consume the vast majority of partially reusable launches, with major projects in North America demonstrating the technology’s capability to handle high-cadence mission profiles.

However, the fully reusable segment is expected to grow at the fastest CAGR during the forecast period, driven by the development of next-generation heavy and super heavy-lift vehicles. The ability to recover the entire vehicle stack makes fully reusable systems highly attractive for long-term deep-space exploration and large-scale orbital infrastructure projects.

How Does the LEO Segment Lead the Market?

Based on orbit type, the Low-Earth Orbit (LEO) segment holds the largest share of the overall market in 2026, accounting for around 60-65% of the overall market. From broadband constellation deployment to the servicing of space stations, the use of RLV technology is central to modernizing LEO infrastructure. Current large-scale projects are increasingly specifying RLVs for their ability to deliver payloads with high efficiency and lower costs compared to traditional expendable rockets.

How is North America Maintaining Dominance in the Global RLV Market?

North America holds the largest share of the global RLV market in 2026. The largest share of this region is primarily attributed to the massive investments in space exploration and the presence of the world’s leading private launch providers, particularly in the United States. The U.S. alone accounts for a significant portion of global RLV consumption, with its position as a leading hub for both commercial space innovation and military space dominance driving sustained growth. The presence of leading manufacturers like SpaceX, Blue Origin, and Rocket Lab, along with a well-developed spaceport ecosystem, provides a robust market for both standard and high-capacity RLV solutions.

Which Factors Support Asia-Pacific and Europe Market Growth?

Asia-Pacific is expected to witness the fastest growth, driven by the need for autonomous space access and the expansion of the commercial satellite sectors. Countries like China and India are at the forefront, with significant focus on integrating reusability into their Long March and GSLV rocket families. In Europe, the leadership in aerospace engineering and the push for sustainable space access are driving the adoption of RLV technologies. France, Germany, and the UK are leading the way, with a strong focus on public-private partnerships and the development of next-generation reusable boosters through players like ArianeGroup and various emerging startups.

The companies such as Space Exploration Technologies Corp. (SpaceX), Blue Origin Enterprises, L.P., Rocket Lab USA, Inc., and ArianeGroup lead the global reusable launch vehicle market with a comprehensive range of partially and fully reusable solutions. Meanwhile, players including United Launch Alliance (ULA), The Boeing Company, Lockheed Martin Corporation, and Northrop Grumman Corporation focus on specialized recovery technologies and high-reliability systems targeting the defense and national security sectors. Emerging manufacturers and integrated players such as Relativity Space, Sierra Space, Stoke Space, and CASC (China) are strengthening the market through innovations in fully reusable architectures and advanced propulsion systems.

The global RLV market is projected to reach a valuation of USD 31.98 billion by 2036, expanding from USD 8.25 billion in 2026. This significant growth trajectory is underpinned by a robust CAGR of 14.5% over the forecast period, reflecting the technology’s transition from a disruptive innovation to the industry standard for space access.

The partially reusable segment is anticipated to maintain its dominance in the near term, accounting for the largest market share in 2026. This is primarily due to its established flight heritage and the significant cost savings already realized through first-stage recovery in the medium and heavy-lift sectors.

The Low-Earth Orbit (LEO) segment commands the largest share of the market. The dominance is driven by the critical need for high-cadence deployment and replenishment of large-scale satellite constellations for global broadband and Earth observation.

Asia-Pacific is forecast to exhibit the fastest CAGR during the 2026–2036 period. This accelerated growth is fueled by massive government-led space modernization initiatives in China and India, coupled with a burgeoning ecosystem of private space startups adopting reusable technologies.

The market is being fundamentally reshaped by two major trends: the Transition to Full Reusability, which aims to recover the entire launch stack, and the Proliferation of Small and Medium-Lift RLVs, which provide flexible and dedicated access for the growing small satellite market.

Key market players include SpaceX (Falcon and Starship), Blue Origin (New Shepard and New Glenn), Rocket Lab (Electron and Neutron), and ArianeGroup (MaiaSpace and reusable booster concepts), all of whom are focused on expanding their flight-proven portfolios to address the surging demand for low-cost space transportation.

Published Date: Jan-2026

Published Date: Jan-2026

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates