Resources

About Us

LEO PNT Market by Service Type (Dedicated LEO PNT, Fused Communication and PNT, Signals of Opportunity), Frequency Band (L-Band, C-Band, S-Band), End-use (Defense and Government, Commercial, Telecommunications, Critical Infrastructure) - Global Forecast to 2036

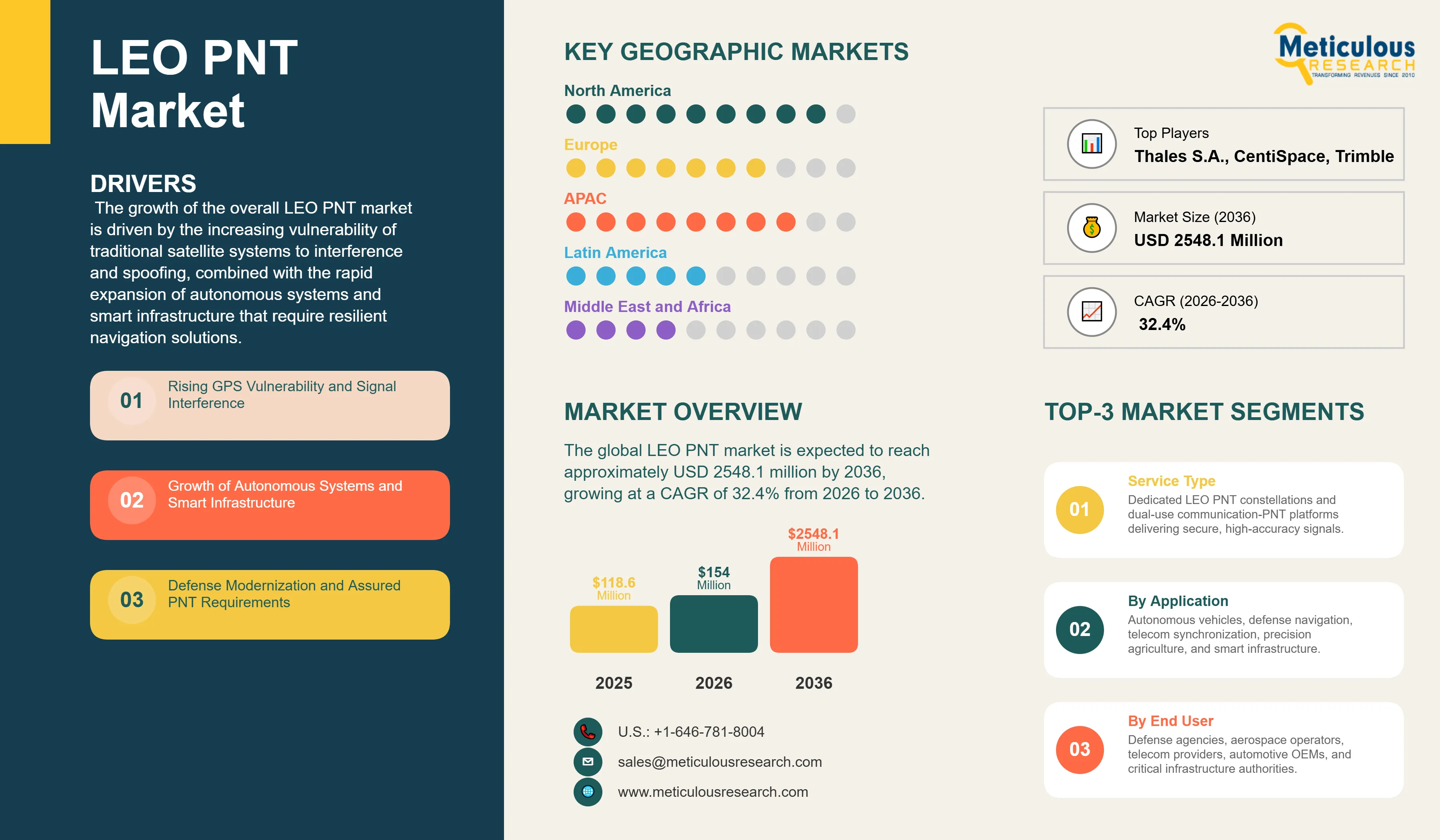

Report ID: MRAD - 1041784 Pages: 287 Feb-2026 Formats*: PDF Category: Aerospace and Defense Delivery: 24 to 72 Hours Download Free Sample ReportThe global LEO PNT market was valued at USD 118.6 million in 2025. The market is expected to reach approximately USD 2548.1 million by 2036 from USD 154.0 million in 2026, growing at a CAGR of 32.4% from 2026 to 2036.The growth of the overall LEO PNT market is driven by the increasing vulnerability of traditional satellite systems to interference and spoofing, combined with the rapid expansion of autonomous systems and smart infrastructure that require resilient navigation solutions. As defense agencies and commercial operators seek to deploy high-precision positioning capabilities that can operate in GPS-denied environments, LEO PNT infrastructure has become essential for maintaining operational continuity and securing critical timing synchronization. The rapid development of commercial constellations and the growing need for anti-jamming protection in aerospace and telecommunications sectors continue to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

LEO PNT represents an advanced positioning architecture that leverages satellite constellations operating in low Earth orbit to deliver navigation signals and precision timing services with substantially improved performance characteristics compared to traditional medium Earth orbit systems. These systems include specialized payloads designed to transmit authenticated ranging signals and encrypted navigation messages that provide resilient location determination across diverse operational environments. The market is defined by breakthrough capabilities such as signal power enhancement through proximity to Earth, sub-meter positioning accuracy, and anti-spoofing protection through cryptographic authentication, which significantly enhance operational reliability in high-stakes defense and commercial applications. These systems are indispensable for mission planners seeking to maintain navigation continuity in contested electromagnetic environments and meet stringent performance requirements for safety-critical operations.

The market includes a diverse range of architectures, ranging from dedicated constellations designed exclusively for PNT delivery to dual-use satellite networks that combine broadband communication services with navigation functionality. These systems are increasingly integrated with advanced capabilities such as inter-satellite links and software-defined signal processing to provide services such as rapid convergence positioning and real-time integrity monitoring of satellite signals. The ability to provide accurate, jam-resistant navigation while minimizing convergence time has made LEO PNT technology the choice for defense organizations where operational autonomy and electromagnetic resilience are paramount.

The global aerospace and defense sectors are pushing hard to diversify navigation infrastructure, aiming to reduce single-point dependencies on government-operated systems and strengthen resilience against emerging threats. This drive has increased the adoption of commercial LEO solutions, with advanced satellite networks helping to stabilize positioning performance for ultra-high-reliability operational environments. At the same time, the rapid growth in the autonomous systems and critical infrastructure markets is increasing the need for secure, high-availability navigation solutions that can operate independently of traditional constellations.

Commercialization of Independent Navigation Constellations and Enhanced Signal Security

Aerospace innovators across the industry are rapidly shifting toward commercial LEO constellations, moving well beyond traditional augmentation approaches. Xona Space Systems' Pulsar platform delivers significantly higher signal strength and sub-meter accuracy, while Iridium's STL service has established proven operational performance in timing synchronization for financial markets and telecommunications infrastructure. The real game-changer comes with proprietary signal designs featuring cryptographic authentication that maintains positioning integrity even in high-threat operational environments. These advancements make precision navigation practical and cost-effective for everyone from defense contractors to autonomous vehicle manufacturers chasing excellence in operational resilience and electromagnetic protection.

Innovation in Multi-Frequency Signal Architecture and Constellation Management

Innovation in hybrid LEO-GNSS integration and automated satellite operations is rapidly driving the LEO PNT market, as navigation procedures become more precise and system reliability more assured. Constellation operators like TrustPoint are now designing networks that combine the accuracy of LEO ranging with the intelligence of real-time anomaly detection in a single platform, saving valuable operational costs and simplifying receiver integration. These systems often involve advanced signal processing techniques and software-defined payloads capable of adapting to dynamic interference environments without compromising navigation performance or timing precision.

At the same time, growing focus on national security is pushing governments to develop sovereign navigation capabilities tailored to defense autonomy and strategic resilience principles. These systems help reduce geopolitical risk through the deployment of independent navigation infrastructure and secure signal encryption. By combining high-precision positioning performance with robust anti-jamming capabilities, these new constellations support both military readiness and civilian infrastructure protection, strengthening the resilience of the broader national security architecture.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 2548.1 Million |

|

Market Size in 2026 |

USD 154.0 Million |

|

Market Size in 2025 |

USD 118.6 Million |

|

Market Growth Rate (2026-2036) |

CAGR of 32.4% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Service Type, Frequency Band, End-use, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: GPS Vulnerability and Rise of Autonomous Systems

A key driver of the LEO PNT market is the growing recognition of vulnerabilities in traditional satellite navigation systems and the proliferation of applications requiring assured positioning capabilities. Global concerns about jamming, spoofing, and signal denial in contested environments have created significant incentives for the deployment of resilient navigation infrastructure. The trend toward autonomous operations in defense and commercial sectors drives organizations toward solutions that LEO PNT can uniquely provide. It is estimated that as military adoption of unmanned systems accelerates and critical infrastructure operators face mounting cybersecurity risks through 2036, the need for robust, independently verifiable navigation increases significantly; therefore, high-performance LEO constellations and encrypted ranging signals, with their ability to ensure operational continuity in GPS-denied environments, are considered a crucial enabler of modern defense strategies and civilian resilience.

Opportunity: Telecommunications Synchronization and Smart Mobility Integration

The rapid expansion of advanced telecommunications networks and autonomous vehicle deployment provides great opportunities for the LEO PNT market. Indeed, the global rollout of next-generation wireless infrastructure has created a compelling demand for systems that can deliver nanosecond-level timing accuracy and provide ultra-reliable synchronization for distributed networks. These applications require high-precision timing, electromagnetic security, and the ability to maintain synchronization during GNSS outages, all attributes that are met with dedicated LEO PNT solutions. The telecommunications market is set to expand significantly through 2036, with LEO PNT poised for an expanding share as operators seek to maximize network reliability and minimize service disruptions. Furthermore, the increasing deployment of autonomous vehicles and smart city infrastructure is stimulating demand for positioning solutions that provide centimeter-level accuracy and real-time integrity monitoring for safety-critical navigation decisions.

Why Does the Dedicated LEO PNT Segment Lead the Market?

The dedicated LEO PNT segment accounts for a significant portion of the overall market in 2026. This is mainly attributed to the superior positioning accuracy and signal authentication capabilities of purpose-built constellation architectures designed specifically for navigation delivery. These systems offer the most comprehensive way to ensure navigation integrity across defense and commercial applications. The defense and aerospace sectors alone consume a large share of dedicated LEO PNT services, with major deployment programs in North America and Europe demonstrating the technology's capability to handle high-security operational requirements. However, the fused communication and PNT segment is expected to grow at a rapid CAGR during the forecast period, driven by the growing need for cost-effective dual-use satellite platforms, spectrum efficiency, and integrated connectivity solutions in commercial Internet of Things and automotive markets.

How Does the L-Band Segment Dominate?

Based on frequency band, the L-band segment holds the largest share of the overall market in 2026. This is primarily due to the extensive installed base of L-band receiver infrastructure and the proven signal propagation characteristics required for reliable navigation services. Current constellation operators are increasingly specifying L-band transmission frequencies to ensure compatibility with established receiver ecosystems and maximize service adoption across existing navigation platforms.

The C-band segment is expected to witness the fastest growth during the forecast period. The shift toward higher signal power and improved multipath mitigation is pushing the requirement for advanced frequency architectures that can deliver enhanced positioning performance in challenging urban environments while maintaining secure communication links for authenticated navigation data.

Why Does the Defense and Government Segment Lead the Market?

The defense and government segment commands the largest share of the global LEO PNT market in 2026. This dominance stems from its critical requirements for assured navigation in contested operational environments, anti-jamming protection for military platforms, and secure timing synchronization for command and control networks, making it the end-use of choice for high-performance LEO PNT services. Large-scale procurement programs in strategic defense modernization, electromagnetic warfare resilience, and aerospace mission planning drive demand, with advanced systems from providers like TrustPoint and Xona Space Systems enabling reliable performance in GPS-denied military operations.

However, the commercial segment is poised for rapid growth through 2036, fueled by expanding applications in autonomous vehicle navigation and precision agriculture. Commercial operators face mounting pressure to achieve positioning accuracy for safety-critical applications, where LEO PNT provides a cost-effective solution for high-reliability navigation in challenging signal environments.

How is North America Maintaining Dominance in the Global LEO PNT Market?

North America holds the largest share of the global LEO PNT market in 2026. The largest share of this region is primarily attributed to the presence of advanced commercial constellation developers and substantial defense investment in alternative PNT capabilities, particularly in the United States. The United States alone accounts for a significant portion of global LEO PNT development, with its position as a leading innovator in satellite technology and defense modernization driving sustained growth. The presence of leading developers like Xona Space Systems and TrustPoint, combined with substantial government funding through Space Force programs, provides a robust market for both dedicated navigation satellites and dual-use commercial platforms.

Which Factors Support Asia-Pacific and Europe Market Growth?

Asia-Pacific and Europe together represent substantial growth potential in the global LEO PNT market. The growth of these markets is mainly driven by strategic national initiatives to establish sovereign navigation capabilities and reduce dependence on foreign satellite systems. The demand for independent LEO PNT systems in Asia-Pacific is mainly due to China's large-scale constellation deployment programs including CentiSpace and Geespace, along with Japan's strategic partnerships in maritime navigation infrastructure.

In Europe, the leadership in space technology and the push for strategic autonomy in critical infrastructure are driving the adoption of resilient positioning solutions. The European Space Agency's FutureNAV program and partnerships with commercial developers are at the forefront, with significant focus on integrating LEO augmentation capabilities into existing navigation workflows and advanced satellite systems to ensure the highest levels of positioning performance and electromagnetic resilience.

The companies such as Xona Space Systems, Iridium Communications Inc., TrustPoint, and Lockheed Martin Corporation lead the global LEO PNT market with a comprehensive range of navigation and timing solutions, particularly for defense applications and high-precision commercial operations. Meanwhile, players including L3Harris Technologies Inc., Northrop Grumman Corporation, Honeywell International Inc., and Raytheon Technologies Corporation focus on specialized receiver systems, signal processing platforms, and integrated defense solutions targeting aerospace operations and critical infrastructure sectors. Emerging constellation operators and technology developers such as CentiSpace, Geespace (Geely), China SatNet, ArkEdge Space, and European Space Agency are strengthening the market through innovations in satellite manufacturing and regional navigation services.

The global LEO PNT market is expected to grow from USD 154.0 Million in 2026 to USD 2548.1 billion by 2036.

The global LEO PNT market is projected to grow at a CAGR of 32.4% from 2026 to 2036.

Dedicated LEO PNT is expected to dominate the market in 2026 due to its superior ability to deliver high-precision navigation and secure timing for defense applications. However, the fused communication and PNT segment is projected to be the fastest-growing segment owing to the increasing need for cost-effective dual-use platforms and integrated connectivity solutions.

Commercial LEO constellations are transforming the navigation landscape by providing independent, high-precision positioning capabilities that reduce dependence on government-operated systems. These technologies drive the adoption of encrypted signals, rapid convergence positioning, and jam-resistant navigation services, enabling defense and commercial operators to maintain operational continuity in contested electromagnetic environments.

North America holds the largest share of the global LEO PNT market in 2026. The largest share of this region is primarily attributed to substantial defense modernization investments and the presence of leading commercial constellation developers.

The leading companies include Xona Space Systems, Iridium Communications Inc., TrustPoint, Lockheed Martin Corporation, and L3Harris Technologies Inc.

1. Introduction

1.1. Market Definition

1.2. Market Scope

1.3. Research Methodology

1.4. Assumptions & Limitations

2. Executive Summary

3. Market Overview

3.1. Introduction

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. Impact of GPS Vulnerabilities on LEO PNT Adoption

3.4. Regulatory Landscape & Spectrum Allocation

3.5. Porter's Five Forces Analysis

4. Global LEO PNT Market, by Service Type

4.1. Introduction

4.2. Dedicated LEO PNT

4.2.1. Purpose-Built Navigation Constellations

4.2.2. Standalone Timing Services

4.3. Fused Communication and PNT

4.3.1. Dual-Use Satellite Platforms

4.3.2. Hosted Payload Services

4.4. Signals of Opportunity (SoOP)

4.4.1. Broadband Constellation Signals

4.4.2. Non-Cooperative Signal Exploitation

5. Global LEO PNT Market, by Frequency Band

5.1. Introduction

5.2. L-Band

5.3. C-Band

5.4. S-Band

5.5. Multi-Band Systems

6. Global LEO PNT Market, by Hardware Component

6.1. Introduction

6.2. Satellite Payload

6.2.1. Navigation Signal Generators

6.2.2. Atomic Clocks & Frequency Standards

6.2.3. Signal Transmission Modules

6.3. Ground Infrastructure

6.3.1. Monitoring Stations

6.3.2. Time Distribution Systems

6.3.3. Uplink Facilities

6.4. User Equipment

6.4.1. Receivers

6.4.2. Antennas

6.4.3. Signal Processors

7. Global LEO PNT Market, by End-use

7.1. Introduction

7.2. Defense and Government

7.2.1. Military Navigation & Timing

7.2.2. Aerospace Operations

7.2.3. Critical Government Infrastructure

7.3. Commercial

7.3.1. Autonomous Vehicles

7.3.2. Maritime Navigation

7.3.3. Precision Agriculture

7.3.4. Surveying & Mapping

7.4. Telecommunications

7.4.1. 5G & 6G Network Synchronization

7.4.2. Telecom Infrastructure Timing

7.5. Critical Infrastructure

7.5.1. Financial Systems

7.5.2. Power Grid Synchronization

7.5.3. Data Centers

7.6. Aviation

7.6.1. Air Traffic Management

7.6.2. Unmanned Aircraft Systems

8. Global LEO PNT Market, by Region

8.1. Introduction

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.3.6. Netherland

8.3.7. Rest of Europe

8.4. Asia-Pacific

8.4.1. China

8.4.2. Japan

8.4.3. India

8.4.4. South Korea

8.4.5. Australia

8.4.6. Southeast Asia

8.4.7. Rest of Asia-Pacific

8.5. Latin America

8.5.1. Brazil

8.5.2. Mexico

8.5.3. Rest of Latin America

8.6. Middle East & Africa

8.6.1. UAE

8.6.2. Saudi Arabia

8.6.3. South Africa

8.6.4. Turkey

8.6.5. Rest of Middle East & Africa

9. Competitive Landscape

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Competitive Dashboard

9.4.1. Industry Leaders

9.4.2. Market Differentiators

9.4.3. Vanguards

9.4.4. Emerging Companies

9.5. Market Ranking / Positioning Analysis of Key Players, 2025

10. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

10.1. Xona Space Systems

10.2. Iridium Communications Inc.

10.3. TrustPoint

10.4. Lockheed Martin Corporation

10.5. L3Harris Technologies Inc.

10.6. Northrop Grumman Corporation

10.7. Honeywell International Inc.

10.8. Raytheon Technologies Corporation

10.9. BAE Systems plc

10.10. Thales S.A.

10.11. CentiSpace

10.12. Geespace (Zhejiang Geely Holding Group)

10.13. China Satellite Network Group (SatNet)

10.14. ArkEdge Space Inc.

10.15. European Space Agency (ESA)

10.16. Trimble Inc.

10.17. Septentrio N.V.

10.18. Microchip Technology Inc.

11. Appendix

11.1. Questionnaire

11.2. Related Reports

Published Date: Feb-2026

Published Date: Feb-2026

Published Date: Feb-2026

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates