Resources

About Us

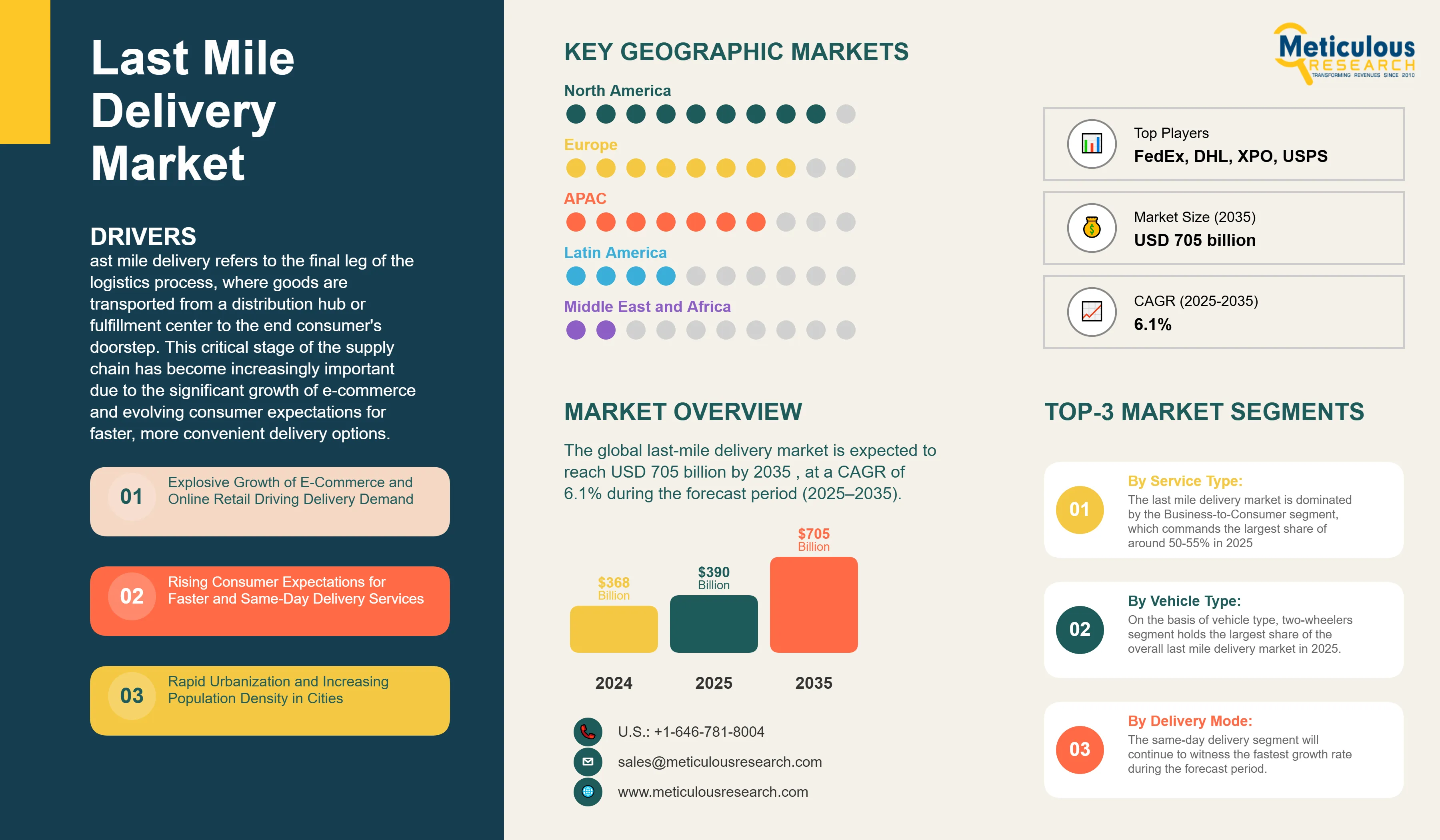

Last Mile Delivery Market by Service Type (B2C, B2B, C2C), Vehicle Type (Two-Wheelers, Vans & Trucks, Drones, Autonomous Vehicles), Delivery Mode (Same-Day, Express, Scheduled), Application (E-Commerce, Food & Grocery, Healthcare) — Global Forecast to 2035

Report ID: MRICT - 1041629 Pages: 245 Dec-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global last-mile delivery market is expected to reach USD 705 billion by 2035 from USD 390 billion in 2025, at a CAGR of 6.1% during the forecast period (2025–2035). Last mile delivery refers to the final leg of the logistics process, where goods are transported from a distribution hub or fulfillment center to the end consumer's doorstep. This critical stage of the supply chain has become increasingly important due to the significant growth of e-commerce and evolving consumer expectations for faster, more convenient delivery options.

Key Market Highlights:

Click here to: Get Free Sample Pages of this Report

Last-mile delivery has been recognized in recent times as an extremely critical differentiator in the highly competitive retail and logistics landscape of e-commerce. This is because the last leg accounts for nearly 53% of the total shipping cost and is the costliest and most complex leg of the supply chain. With consumer expectations continuing to shift to faster, more flexible, and sustainable options, companies are investing heavily in technology and infrastructure to improve their last-mile operation.

The growth of the overall last mile delivery market is driven by factors such as the significant e-commerce growth, rapid urbanization, and technological developments in logistics and delivery systems. The COVID-19 pandemic further accelerated these trends, changing consumer purchasing behaviors and setting new expectations with regard to delivery speed and convenience.

Key Trends Shaping the Market:

The last mile delivery market is shifting towards sustainability and technological integration. Electric vehicles, cargo bikes, and drones are being increasingly deployed to cut carbon emissions and enhance the efficiency of last mile deliveries in urban areas. Companies are investing in micro-fulfillment centers located strategically closer to the end consumer to enable faster delivery times and lower transportation costs.

Artificial Intelligence and Machine Learning continue to transform route optimization, demand forecasting, and scheduling of deliveries. Real-time tracking and visibility solutions have become table stakes, with consumers expecting visibility throughout the process. Integration of IoT sensors and connected devices is further allowing predictive logistics and proactive communication with customers.

The emergence of autonomous delivery solutions, including sidewalk robots and delivery drones, represents a significant growth opportunity. Several companies are conducting pilot programs and expanding commercial operations of autonomous delivery vehicles in urban and suburban areas, particularly for food and grocery delivery applications.

The global last-mile delivery market is expected to reach USD 705.0 billion by 2035 from USD 390.0 billion in 2025, at a CAGR of 6.1% during the forecast period (2025–2035)

Market Scope:

|

Parameter |

Details |

|

Market Size Value in 2025 |

USD 390 Billion |

|

Revenue Forecast in 2035 |

USD 705 Billion |

|

Growth Rate |

CAGR of 6.1% from 2025 to 2035 |

|

Base Year for Estimation |

2024 |

|

Historical Data |

2022–2023 |

|

Forecast Period |

2025–2035 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2035 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape/benchmarking, growth factors, company profiles, and trends |

|

Segments Covered |

Service Type, Vehicle Type, Delivery Mode, Technology, Application, Region |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Countries Covered |

U.S., Canada, Germany, U.K., France, Italy, Spain, China, Japan, India, South Korea, Southeast Asia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

|

Key Companies Profiled |

Amazon Logistics, United Parcel Service of America Inc., FedEx Corporation, DHL International GmbH, XPO Logistics Inc., USPS, DoorDash Inc., Postmates (Uber Technologies Inc.), Instacart, JD Logistics Inc., SF Express Co. Ltd., Yamato Transport Co. Ltd., DPD Group, GLS Group, Kerry Logistics Network Limited, J.B. Hunt Transport Services Inc., Ryder System Inc., Lalamove, Glovo, Grab Holdings Inc. |

Market Dynamics:

Driver: Growth of E-Commerce and Online Retail

Exponential e-commerce growth has completely changed the last mile delivery landscape. Global sales by e-retailers have seen unparalleled growth of late, driven by increasing internet penetration, smartphone adoption, and changing consumer preferences. The convenience of online shopping, along with competitive pricing and product variety, has turned e-commerce into the preferred shopping channel for millions of consumers worldwide. Such a shift has consequently created huge demand for efficient last mile delivery services that can handle volumes while meeting customer expectations in terms of speed and reliability.

Driver: Increasing Consumer Expectations for Speedier Delivery

Consumer expectations of delivery speed have changed dramatically, with same-day and next-day delivery becoming the norm in many parts of the world. The success of Amazon Prime and other subscription services has set a new bar for delivery performance, forcing retailers and logistics providers to invest in faster fulfillment capabilities. This demand is most pressing in urban centers, where consumers expect near-instant gratification for their online purchases.

Opportunity: Autonomous and Drone Delivery Technologies

Significant growth opportunities for the last mile delivery market are perceived with the development and commercialization of autonomous delivery vehicles and drones. These technologies promise to cut labor costs, improve efficiencies in delivery, and extend service coverage to remote areas. A number of major players are conducting extensive pilots and moving toward commercial deployment of autonomous delivery solutions, particularly for applications pertaining to food and grocery delivery.

Opportunity: Sustainability and Green Logistics

Increased environmental awareness among consumers and the considerable regulatory pressure to cut carbon emissions are considered the driving forces toward adopting sustainable delivery solutions. Electric vehicles, cargo bikes, and consolidated delivery models are gaining traction as companies seek to reduce their ecological footprint while enhancing operational efficiency. This paradigm shift toward green logistics opens up a world of opportunities for innovation and competitive differentiation.

Segment Analysis:

By Service Type:

The last mile delivery market is dominated by the Business-to-Consumer segment, which commands the largest share of around 50-55% in 2025. E-commerce platforms and direct-to-consumer sales models spur B2C volumes significantly. Thus, driven by the rising demand for speed, flexibility, and reliability among consumers, logistics providers are increasingly strengthening their B2C capabilities with the same-day and next-day delivery services.

By Vehicle Type:

On the basis of vehicle type, two-wheelers segment holds the largest share of the overall last mile delivery market in 2025. Two-wheelers are also cost-effective means to deliver small parcels. They have better maneuverability in heavy city traffic and find wider acceptance in Asia-Pacific markets. The electric two-wheelers segment is growing rapidly as companies focus on sustainable delivery solutions.

By Delivery Mode:

The same-day delivery segment will continue to witness the fastest growth rate during the forecast period. Higher customer expectations for speed and convenience are driving companies to invest in the infrastructure for same-day delivery, such as micro-fulfillment centers, automated warehouses, and AI-driven route optimization systems.

Regional Insights:

The North America dominates the global last mile delivery market in 2025. The region has an advantage of a well-developed ecosystem for e-commerce, advanced logistics infrastructure, and high demand from consumers for faster options for delivery. Major players like Amazon, UPS, FedEx, and DHL have established wide-reaching delivery networks and continue to invest in technology and infrastructure to maintain their competitive advantage.

However, the Asia-Pacific region is anticipated to record the highest CAGR during the forecast period due to fast e-commerce growth, rapid urbanization, and growing middle-class populations in countries like China, India, and Southeast Asian nations. China dominates the regional market, where key players such as JD Logistics, SF Express, and Alibaba's Cainiao Network have invested heavily in last mile delivery infrastructure.

Key Players:

The major players in the last mile delivery market include Amazon Logistics (U.S.), United Parcel Service of America Inc. (U.S.), FedEx Corporation (U.S.), DHL International GmbH (Germany), XPO Logistics Inc. (U.S.), USPS (U.S.), DoorDash Inc. (U.S.), Postmates (Uber Technologies Inc.) (U.S.), Instacart (U.S.), JD Logistics Inc. (China), SF Express Co. Ltd. (China), Yamato Transport Co. Ltd. (Japan), DPD Group (France), GLS Group (Netherlands), Kerry Logistics Network Limited (Hong Kong), J.B. Hunt Transport Services Inc. (U.S.), Ryder System Inc. (U.S.), Lalamove (Hong Kong), Glovo (Spain), and Grab Holdings Inc. (Singapore), among others.

The last mile delivery market is expected to grow from USD 390 billion in 2025 to USD 705 billion by 2035.

The last mile delivery market is expected to grow at a CAGR of 6.1% from 2025 to 2035.

The major players in the last mile delivery market include Amazon Logistics, United Parcel Service of America Inc., FedEx Corporation, DHL International GmbH, XPO Logistics Inc., USPS, DoorDash Inc., Postmates (Uber Technologies Inc.), Instacart, JD Logistics Inc., SF Express Co. Ltd., Yamato Transport Co. Ltd., DPD Group, GLS Group, Kerry Logistics Network Limited, J.B. Hunt Transport Services Inc., Ryder System Inc., Lalamove, Glovo, and Grab Holdings Inc., among others.

The main factors driving the last mile delivery market include growth of e-commerce and online retail driving delivery volumes, rising consumer expectations for faster same-day and next-day delivery services, rapid urbanization and increasing population density creating demand for efficient urban logistics, technological advancements in route optimization and real-time tracking, growing adoption of sustainable delivery solutions including electric vehicles and cargo bikes, and expansion of quick commerce and instant delivery services for food and grocery applications.

North America region will lead the global last mile delivery market during the forecast period 2025 to 2035.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, by Service Type

3.3. Market Analysis, by Vehicle Type

3.4. Market Analysis, by Delivery Mode

3.5. Market Analysis, by Technology

3.6. Market Analysis, by Application

3.7. Market Analysis, by Geography

3.8. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global Last Mile Delivery Market: Impact Analysis of Market Drivers (2025–2035)

4.2.1. Explosive Growth of E-Commerce and Online Retail Driving Delivery Demand

4.2.2. Rising Consumer Expectations for Faster and Same-Day Delivery Services

4.2.3. Rapid Urbanization and Increasing Population Density in Cities

4.3. Global Last Mile Delivery Market: Impact Analysis of Market Restraints (2025–2035)

4.3.1. High Operational Costs and Thin Profit Margins in Last Mile Operations

4.3.2. Urban Congestion and Infrastructure Challenges Impacting Delivery Efficiency

4.4. Global Last Mile Delivery Market: Impact Analysis of Market Opportunities (2025–2035)

4.4.1. Adoption of Autonomous Delivery Vehicles and Drone Technologies

4.4.2. Expansion of Micro-Fulfillment Centers and Hyperlocal Delivery Networks

4.5. Global Last Mile Delivery Market: Impact Analysis of Market Challenges (2025–2035)

4.5.1. Labor Shortages and Rising Wage Costs in Delivery Operations

4.5.2. Regulatory Complexity and Compliance Requirements Across Regions

4.6. Global Last Mile Delivery Market: Impact Analysis of Market Trends (2025–2035)

4.6.1. Electrification of Delivery Fleets and Sustainable Logistics Adoption

4.6.2. Integration of AI and Machine Learning in Route Optimization

4.7. Porter's Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. The Impact of Technology Advancements on the Global Last Mile Delivery Market

5.1. Introduction to Advanced Technologies in Last Mile Delivery

5.2. Autonomous Delivery Vehicles and Sidewalk Robots

5.3. Drone Delivery Technologies and Aerial Logistics

5.4. Artificial Intelligence and Route Optimization Systems

5.5. Real-Time Tracking and IoT-Enabled Visibility Solutions

5.6. Micro-Fulfillment Centers and Automated Warehousing

5.7. Electric Vehicles and Sustainable Delivery Solutions

5.8. Impact on Market Growth and Technology Adoption

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Share/Ranking by Key Players

7. Global Last Mile Delivery Market, by Service Type

7.1. Introduction

7.2. Business-to-Consumer (B2C)

7.3. Business-to-Business (B2B)

7.4. Consumer-to-Consumer (C2C)

8. Global Last Mile Delivery Market, by Vehicle Type

8.1. Introduction

8.2. Two-Wheelers

8.2.1. Motorcycles

8.2.2. E-Bikes and Cargo Bikes

8.3. Vans and Light Commercial Vehicles

8.4. Trucks and Heavy Commercial Vehicles

8.5. Drones

8.6. Autonomous Delivery Vehicles

8.6.1. Sidewalk Delivery Robots

8.6.2. Autonomous Vans

8.7. Other Vehicle Types

9. Global Last Mile Delivery Market, by Delivery Mode

9.1. Introduction

9.2. Regular Delivery

9.3. Same-Day Delivery

9.4. Express Delivery

9.5. Scheduled Delivery

9.6. Instant Delivery (Quick Commerce)

10. Global Last Mile Delivery Market, by Technology

10.1. Introduction

10.2. Non-Autonomous

10.3. Autonomous

11. Global Last Mile Delivery Market, by Application

11.1. Introduction

11.2. E-Commerce

11.3. Retail and FMCG

11.4. Healthcare and Pharmaceuticals

11.5. Food and Grocery Delivery

11.6. Mails and Packages

11.7. Other Applications

12. Last Mile Delivery Market, by Geography

12.1. Introduction

12.2. North America

12.2.1. U.S.

12.2.2. Canada

12.3. Europe

12.3.1. Germany

12.3.2. U.K.

12.3.3. France

12.3.4. Italy

12.3.5. Spain

12.3.6. Netherlands

12.3.7. Rest of Europe

12.4. Asia-Pacific

12.4.1. China

12.4.2. Japan

12.4.3. India

12.4.4. South Korea

12.4.5. Australia

12.4.6. Southeast Asia

12.4.7. Rest of Asia-Pacific

12.5. Latin America

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Argentina

12.5.4. Rest of Latin America

12.6. Middle East & Africa

12.6.1. Saudi Arabia

12.6.2. UAE

12.6.3. South Africa

12.6.4. Rest of Middle East & Africa

13. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

13.1. Amazon Logistics

13.2. United Parcel Service of America Inc.

13.3. FedEx Corporation

13.4. DHL International GmbH

13.5. XPO Logistics Inc.

13.6. USPS

13.7. DoorDash Inc.

13.8. Postmates (Uber Technologies Inc.)

13.9. Instacart

13.10. JD Logistics Inc.

13.11. SF Express Co. Ltd.

13.12. Yamato Transport Co. Ltd.

13.13. DPD Group

13.14. GLS Group

13.15. Kerry Logistics Network Limited

13.16. J.B. Hunt Transport Services Inc.

13.17. Ryder System Inc.

13.18. Lalamove

13.19. Glovo

13.20. Grab Holdings Inc.

13.21. Others

14. Appendix

14.1. Questionnaire

14.2. Available Customization

Published Date: Aug-2025

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates