Resources

About Us

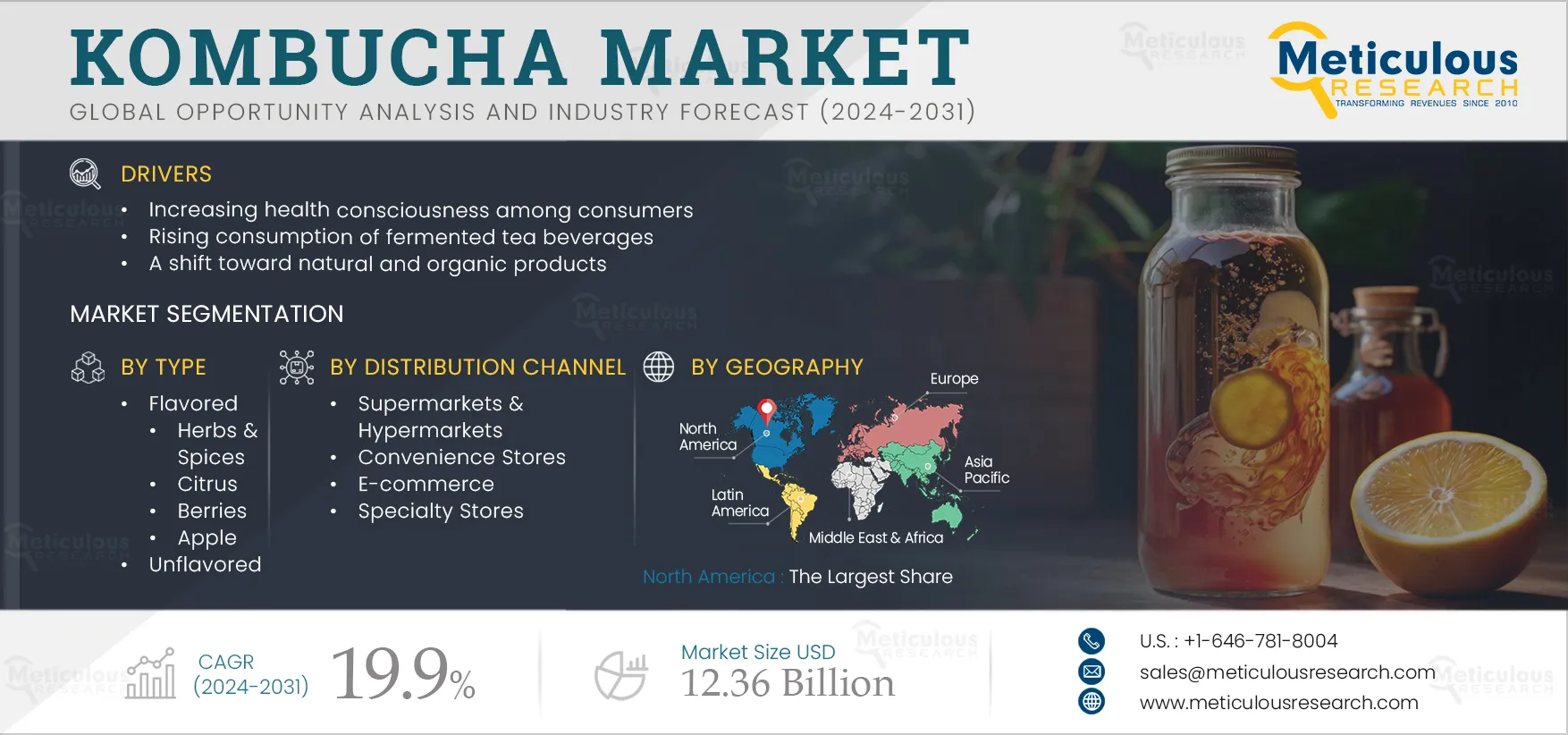

Kombucha Market Size, Share, Forecast, & Trends Analysis by Product Type (Hard, Conventional), Type (Flavored, Unflavored), Nature (Organic, Inorganic), Packaging Type (Bottles, Cans), Distribution Channel—Global Forecast to 2032

Report ID: MRFB - 1041346 Pages: 250 Oct-2024 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThis market's growth is driven by increasing health consciousness among consumers, rising consumption of fermented tea beverages, a shift toward natural and organic products, and an increase in gastrointestinal diseases. However, stringent regulatory requirements and high production costs are expected to restrain market growth.

The emergence of new distribution channels is expected to generate growth opportunities in the market. Conversely, differing taste preferences among consumers pose a significant challenge for players operating in this space. Furthermore, consumers' inclination towards functional beverages and vegan & plant-based diets are prominent trends in the kombucha market.

Click here to: Get Free Sample Pages of this Report

Changing lifestyles driven by growing health awareness are leading consumers to seek functional foods and beverages. Many are increasingly opting for fortified products that are less processed, as these retain more potential health benefits. Fermented drinks, such as kombucha, are recognized for their positive effects in combating cancer, arthritis, digestive issues, and other degenerative diseases. Kombucha is particularly valued for its richness in probiotics, antioxidants, and beneficial compounds that support gut health, boost immunity, improve heart health, reduce inflammation, and aid digestion. As awareness of digestive health and wellness trends rises, consumers are increasingly turning to kombucha as a healthier alternative to sugary soft drinks, further fueling market growth.

Additionally, many consumers are prioritizing beverages that are free from artificial ingredients and preservatives, making kombucha an ideal choice due to its natural fermentation process. The rising interest in plant-based and low-calorie beverages also contributes to demand, as kombucha provides a refreshing and health-conscious option. As a result, these factors are expected to significantly boost the demand for kombucha, driving growth in this market.

The increasing consumption of fermented tea beverages, such as kombucha, is driving market growth by catering to consumers' demand for functional and health-promoting drinks. As consumers increasingly seek beverages with health benefits, fermented teas like kombucha are gaining popularity due to their probiotic content, which supports gut health. Additionally, a 2020 study by the National Center for Biotechnology Information (NCBI) suggests that kombucha consumption may enhance immune system function due to its anti-inflammatory, antioxidant, and cholesterol-lowering properties. The fermentation process also enriches its flavor profile, offering a distinctive tangy taste that increasingly attracts consumers seeking alternatives to traditional soft drinks.

Fermented drinks are linked to various positive health outcomes, such as improved metabolism and detoxification. As consumer awareness of the benefits of fermentation grows, demand for kombucha rises, particularly in markets that prioritize organic, plant-based, and clean-label products. This increasing preference for fermented tea beverages strengthens kombucha's status as a staple in the health drink category, further driving market growth.

Functional beverages are gaining substantial traction in the global market as consumers increasingly seek drinks that provide health benefits beyond basic hydration. Kombucha, recognized for its probiotic content, antioxidants, and digestive health advantages, aligns perfectly with this trend. Demand for functional beverages is primarily driven by health-conscious consumers aiming to improve gut health, boost immunity, and enhance overall well-being. Consequently, kombucha brands are capitalizing on this trend by offering formulations enriched with superfoods, adaptogens, and vitamins to better attract the wellness-focused demographic.

Additionally, according to the National Library of Medicine (2024), irritable bowel syndrome (IBS) affects 5-10% of the global population, with up to one-third of individuals with IBS also experiencing anxiety or depression. By promoting a healthier gut environment, kombucha may alleviate certain IBS symptoms, such as bloating, irregular bowel movements, and abdominal discomfort. Additionally, kombucha contains organic acids and digestive enzymes produced during fermentation, which can enhance digestion and reduce issues like indigestion and gas, potentially providing relief for those suffering from IBS.

Moreover, consumers are increasingly steering clear of artificial ingredients and prefer beverages with natural fermentation processes, such as kombucha, which convey a sense of authenticity and transparency. This trend aligns with the broader wellness movement, where consumers seek products that deliver both taste and functionality without compromising health. The versatility of kombucha, combined with its potential for infusion with various functional ingredients, positions it as a standout option in the expanding functional beverage market.

The emergence of new distribution channels is creating substantial growth opportunities in the kombucha market. E-commerce platforms have transformed how consumers access kombucha, enabling brands to reach a broader audience, including regions where availability in physical stores is limited. This direct-to-consumer (DTC) approach gives brands greater control over pricing, branding, and consumer engagement, fostering customer loyalty and facilitating personalized offerings, such as subscription boxes.

A notable trend is the rise of DTC models, with kombucha brands like Health-Ade, GT’s Living Foods, and Brew Dr. Kombucha selling their products through their own websites or popular online marketplaces like Amazon. Moreover, the growth of specialized online health food stores and wellness-focused platforms offers kombucha brands niche marketing opportunities, making it easier for consumers to discover and purchase these beverages.

Based on product type, the kombucha market is segmented into conventional and hard. In 2025, the conventional segment is expected to account for a larger share of 96.7% of the kombucha market. This segment's large market share is attributed to its affordability, widespread availability, and consumer familiarity. As consumers increasingly prioritize gut health and functional beverages, conventional kombucha, known for its rich probiotic content, has gained traction. Its cost-effectiveness compared to hard kombucha, which often involves additional processes or ingredients, further enhances its market presence.

However, the hard segment is expected to register the highest CAGR of 22.5% during the forecast period. Consumers are increasingly leaning towards hard kombucha, perceiving it as a robust alternative to traditional alcoholic beverages. This shift is driven by its lower sugar and calorie content compared to conventional options, along with a growing variety of flavors and innovative ingredients. Moreover, the enhanced availability of hard kombucha in the market is further fueling consumer preference.

Based on type, the kombucha market is segmented into flavored and unflavored. In 2025, the flavored segment is expected to account for a larger share of the kombucha market. This segment's large market share is primarily driven by the growing consumer interest in new and innovative beverages, along with increasing demand for premium flavored kombucha. Additionally, the rising health and wellness trend has heightened interest in drinks that offer added health benefits, further boosting the demand for flavored kombucha that caters to taste preferences while delivering functional properties.

However, the unflavored segment is slated to register the highest CAGR during the forecast period. This is due to growing awareness regarding the negative impacts of synthetic products on health and the environment. Moreover, consumers are increasingly perceiving unflavored or natural products as healthier and safer to consume than flavored products.

Based on nature, the kombucha market is segmented into organic and inorganic. In 2025, the organic segment is expected to account for a larger share of the kombucha market. This segment's large market share is driven by the growing consumer preference for organic products, fueled by concerns over health, sustainability, and environmental impact.

Moreover, the organic segment is slated to register the highest CAGR during the forecast period. This is due to the rising demand for clean-label products and the increased availability of organic ingredients and farming practices.

Based on packaging type, the kombucha market is segmented into bottles and cans. In 2025, the bottles segment is expected to account for a larger share of the kombucha market. This segment's large market share is primarily attributed to its capability to preserve the beverage's flavor and quality, providing superior protection against light and air. Additionally, its convenient and portable options further enhance consumer appeal.

However, the cans segment is slated to register the highest CAGR during the forecast period. This segment's high growth is driven by its reusability, recyclability, durability, and appearance. Cans provide excellent protection against light and oxygen, which helps preserve the taste, freshness, and quality of food and beverages. Moreover, cans have a long shelf life and are convenient for on-the-go consumption, making them ideal for busy consumers.

Based on distribution channel, the kombucha market is segmented into supermarkets & hypermarkets, convenience stores, E-commerce, specialty stores, and other distribution channels. In 2025, the supermarkets & hypermarkets segment is expected to account for the largest share of the kombucha market. This segment's substantial market share is primarily driven by the increased shelf space allocated to kombucha in established supermarkets and hypermarkets, coupled with the rising number of these retail establishments. The growing consumer preference for shopping at modern grocery stores, which provide enhanced access and availability, further supports this trend. Additionally, supermarkets and hypermarkets effectively stock and distribute kombucha products across regions, leveraging their strong distribution networks and supplier relationships.

However, the E-commerce segment is slated to register the highest CAGR during the forecast period. This segment's robust growth is driven by the increasing demand for personalization, the convenience provided by online channels, the availability of larger discounts compared to traditional retail, and an enhanced product selection experience.

Based on geography, the kombucha market is majorly segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is expected to account for the largest share of 48.6% of the kombucha market, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The North America kombucha market is estimated to be worth USD 1,685.3 million in 2025. North America's large market share is attributed to several key factors, including a well-established food and beverage processing industry, increasing awareness of kombucha's health benefits, and the growing popularity of fermented beverages among consumers. Additionally, the rising obesity rates in the region have prompted a shift in consumer preferences towards non-carbonated and low-calorie options, further driving market growth.

However, Asia-Pacific is expected to record the highest CAGR of 24.7% during the forecast period. This growth can be attributed to rapid urbanization, increasing disposable income, evolving dietary preferences, heightened health awareness, and robust economic growth in China, India, and Southeast Asia. Furthermore, there is a growing interest in functional beverages, alongside the enduring popularity of traditional fermented drinks, which collectively bolster market growth in this region.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the kombucha market are The Coca-Cola Company (U.S.), PepsiCo Inc. (U.S.), Molson Coors Beverage Company (U.S.), The Hain Celestial Group, Inc. (U.S.), Health-Ade LLC (U.S.), Reed's Inc. (U.S.), GT’s Living Foods LLC (U.S.), Brew Dr. Kombucha (U.S.), NessAlla Kombucha (U.S.), Humm Kombucha, LLC (U.S.), Remedy Drinks Pty LTD (Australia), Live Soda, LLC (U.S.), and Unity Vibration Kombucha (U.S.).

|

Particulars |

Details |

|

Number of Pages |

~250 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2025 |

|

CAGR (Value) |

19.9% |

|

Market Size (Value) |

USD 12.36 Billion by 2032 |

|

Segments Covered |

By Product Type

By Type

By Nature

By Packaging Type

By Distribution Channel

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Netherlands, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Thailand, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (Saudi Arabia, South Africa, UAE, and Rest of Middle East & Africa) |

|

Key Companies |

The Coca-Cola Company (U.S.), PepsiCo Inc. (U.S.), Molson Coors Beverage Company (U.S.), The Hain Celestial Group, Inc. (U.S.), Health-Ade LLC (U.S.), Reed's Inc. (U.S.), GT’s Living Foods LLC (U.S.), Brew Dr. Kombucha (U.S.), NessAlla Kombucha (U.S.), Humm Kombucha, LLC (U.S.), Remedy Drinks Pty LTD (Australia), Live Soda, LLC (U.S.), and Unity Vibration Kombucha (U.S.). |

This report covers the kombucha market sizes and forecasts based on product type, type, nature, packaging type, distribution channel, and geography. It also provides the value analysis of various segments of the kombucha market at the regional and country levels.

The kombucha market is projected to reach $12.36 billion by 2032, at a CAGR of 19.9% during the forecast period.

In 2025, the conventional segment is expected to hold a major share of the kombucha market.

The E-commerce segment is expected to register the highest CAGR during the forecast period of 2025–2032.

The growing health consciousness among consumers, increasing consumption of fermented tea beverages, shift towards natural or organic products, and rise in gastrointestinal diseases are the key factors supporting the growth of this market. Moreover, the emergence of new distribution channels creates opportunities for players operating in this market.

The key players operating in the kombucha market are The Coca-Cola Company (U.S.), PepsiCo Inc. (U.S.), Molson Coors Beverage Company (U.S.), The Hain Celestial Group, Inc. (U.S.), Health-Ade LLC (U.S.), Reed's Inc. (U.S.), GT’s Living Foods LLC (U.S.), Brew Dr. Kombucha (U.S.), NessAlla Kombucha (U.S.), Humm Kombucha, LLC (U.S.), Remedy Drinks Pty LTD (Australia), Live Soda, LLC (U.S.), and Unity Vibration Kombucha (U.S.).

Countries in Southeast Asia and Latin America are projected to present significant growth opportunities for market vendors due to several factors: growing consumer awareness about the advantages of kombucha drinks, increasing focus on healthy lifestyles, rising demand for probiotic-rich drinks, and growing consumer interest in trying new beverages.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Kombucha Market Analysis, by Product Type

3.2.2. Kombucha Market Analysis, by Type

3.2.3. Kombucha Market Analysis, by Nature

3.2.4. Kombucha Market Analysis, by Packaging Type

3.2.5. Kombucha Market Analysis, by Distribution Channel

3.3. Regional Analysis

3.4. Key Players

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Growing Health Consciousness Among Consumers

4.2.2. Increasing Consumption of Fermented Tea Beverages

4.2.3. Shift Toward Natural or Organic Products

4.2.4. Rise in Gastrointestinal Diseases

4.2.5. Stringent Regulatory Requirement

4.2.6. High Production Cost

4.2.7. Emergence of New Distribution Channels

4.2.8. Divergence in Taste Preferences

4.2.9. Consumers Inclination Toward Functional Beverages

4.3. Regulatory Analysis

4.3.1. Overview

4.3.2. North America

4.3.3. Europe

4.3.4. Asia-Pacific

4.3.5. Latin America

4.3.6. Middle East & Africa

4.4. Value Chain Analysis

4.5. Porter’s Five Forces Analysis

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Power of Buyers

4.5.3. Threat of Substitutes

4.5.4. Threat of New Entrants

4.5.5. Degree of Competition

5. Kombucha Market Assessment—by Product Type

5.1. Overview

5.2. Hard

5.3. Conventional

6. Kombucha Market Assessment—by Type

6.1. Overview

6.2. Flavored

6.2.1. Herbs & Spices

6.2.2. Citrus

6.2.3. Berries

6.2.4. Apple

6.2.5. Flowers

6.2.6. Other Flavors

6.3. Unflavored

7. Kombucha Market Assessment—by Nature

7.1. Overview

7.2. Organic

7.3. Inorganic

8. Kombucha Market Assessment—by Packaging Type

8.1. Overview

8.2. Bottles

8.3. Cans

9. Kombucha Market Assessment—by Distribution Channel

9.1. Overview

9.2. Supermarkets & Hypermarkets

9.3. Convenience Stores

9.4. E-commerce

9.5. Specialty Stores

9.6. Other Distribution Channels

10. Kombucha Market Assessment—by Geography

10.1. Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. U.K.

10.3.4. Italy

10.3.5. Spain

10.3.6. Netherlands

10.3.7. Rest of Europe (RoE)

10.4. Asia-Pacific

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. South Korea

10.4.5. Australia

10.4.6. Thailand

10.4.7. Rest of Asia-Pacific (RoAPAC)

10.5. Latin America

10.5.1. Brazil

10.5.2. Mexico

10.5.3. Argentina

10.5.4. Rest of Latin America (RoLATAM)

10.6. Middle East & Africa

10.6.1. Saudi Arabia

10.6.2. South Africa

10.6.3. United Arab Emirates (UAE)

10.6.4. Rest of Middle East & Africa (RoMEA)

11. Competitive Landscape

11.1. Overview

11.2. Key Growth Strategies

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Industry Leaders

11.4.2. Market Differentiators

11.4.3. Vanguards

11.4.4. Contemporary Stalwarts

11.5. Market Share/Market Ranking Analysis, by Key Players, 2024

12. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

12.1. The Coca-Cola Company

12.2. PepsiCo Inc.

12.3. Molson Coors Beverage Company

12.4. The Hain Celestial Group, Inc.

12.5. Health-Ade LLC

12.6. Reed's Inc.

12.7. GT’s Living Foods LLC

12.8. Brew Dr. Kombucha

12.9. NessAlla Kombucha

12.10. Humm Kombucha, LLC

12.11. Remedy Drinks Pty LTD

12.12. Live Soda, LLC

12.13. Unity Vibration Kombucha

12.14. Other Companies

(Note: SWOT Analysis* of the Top 5 Companies will be provided)

13. Appendix

13.1. Available Customization

13.2. Related Reports

List of Tables

Table 1 Global Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 2 Global Conventional Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 3 Global Hard Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 4 Global Kombucha Market, by Type, 2022–2032 (USD Million)

Table 5 Global Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 6 Global Flavored Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 7 Global Herbs & Spices Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 8 Global Citrus Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 9 Global Berries Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 10 Global Apple Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 11 Global Flowers Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 12 Global Other Flavors Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 13 Global Unflavored Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 14 Global Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 15 Global Organic Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 16 Global Inorganic Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 17 Global Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 18 Global Bottled Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 19 Global Canned Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 20 Global Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 21 Global Kombucha Market for Supermarkets & Hypermarkets, by Country/Region, 2022–2032 (USD Million)

Table 22 Global Kombucha Market for Convenience Stores, by Country/Region, 2022–2032 (USD Million)

Table 23 Global Kombucha Market for E-commerce, by Country/Region, 2022–2032 (USD Million)

Table 24 Global Kombucha Market for Specialty Stores, by Country/Region, 2022–2032 (USD Million)

Table 25 Global Kombucha Market for Other Distribution Channels, by Country/Region, 2022–2032 (USD Million)

Table 26 Global Kombucha Market, by Region, 2021–2032 (USD Million)

Table 27 North America: Kombucha Market, by Country, 2022–2032 (USD Million)

Table 28 North America: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 29 North America: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 30 North America: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 31 North America: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 32 North America: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 33 North America: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 34 U.S.: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 35 U.S.: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 36 U.S.: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 37 U.S.: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 38 U.S.: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 39 U.S.: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 40 Canada: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 41 Canada: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 42 Canada: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 43 Canada: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 44 Canada: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 45 Canada: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 46 Europe: Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 47 Europe: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 48 Europe: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 49 Europe: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 50 Europe: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 51 Europe: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 52 Europe: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 53 Germany: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 54 Germany: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 55 Germany: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 56 Germany: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 57 Germany: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 58 Germany: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 59 France: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 60 France: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 61 France: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 62 France: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 63 France: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 64 France: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 65 U.K.: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 66 U.K.: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 67 U.K.: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 68 U.K.: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 69 U.K.: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 70 U.K.: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 71 Italy: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 72 Italy: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 73 Italy: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 74 Italy: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 75 Italy: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 76 Italy: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 77 Spain: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 78 Spain: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 79 Spain: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 80 Spain: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 81 Spain: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 82 Spain: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 83 Netherlands: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 84 Netherlands: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 85 Netherlands: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 86 Netherlands: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 87 Netherlands: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 88 Netherlands: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 89 Rest of Europe: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 90 Rest of Europe: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 91 Rest of Europe: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 92 Rest of Europe: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 93 Rest of Europe: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 94 Rest of Europe: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 95 Asia-Pacific: Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 96 Asia-Pacific: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 97 Asia-Pacific: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 98 Asia-Pacific: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 99 Asia-Pacific: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 100 Asia-Pacific: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 101 Asia-Pacific: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 102 China: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 103 China: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 104 China: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 105 China: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 106 China: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 107 China: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 108 Japan: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 109 Japan: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 110 Japan: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 111 Japan: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 112 Japan: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 113 Japan: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 114 India: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 115 India: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 116 India: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 117 India: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 118 India: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 119 India: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 120 South Korea: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 121 South Korea: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 122 South Korea: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 123 South Korea: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 124 South Korea: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 125 South Korea: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 126 Australia: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 127 Australia: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 128 Australia: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 129 Australia: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 130 Australia: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 131 Australia: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 132 Thailand: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 133 Thailand: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 134 Thailand: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 135 Thailand: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 136 Thailand: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 137 Thailand: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 138 Rest of Asia-Pacific: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 139 Rest of Asia-Pacific: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 140 Rest of Asia-Pacific: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 141 Rest of Asia-Pacific: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 142 Rest of Asia-Pacific: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 143 Rest of Asia-Pacific: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 144 Latin America: Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 145 Latin America: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 146 Latin America: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 147 Latin America: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 148 Latin America: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 149 Latin America: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 150 Latin America: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 151 Brazil: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 152 Brazil: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 153 Brazil: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 154 Brazil: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 155 Brazil: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 156 Brazil: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 157 Mexico: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 158 Mexico: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 159 Mexico: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 160 Mexico: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 161 Mexico: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 162 Mexico: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 163 Argentina: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 164 Argentina: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 165 Argentina: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 166 Argentina: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 167 Argentina: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 168 Argentina: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 169 Rest of Latin America: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 170 Rest of Latin America: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 171 Rest of Latin America: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 172 Rest of Latin America: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 173 Rest of Latin America: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 174 Rest of Latin America: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 175 Middle East & Africa: Kombucha Market, by Country/Region, 2022–2032 (USD Million)

Table 176 Middle East & Africa: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 177 Middle East & Africa: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 178 Middle East & Africa: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 179 Middle East & Africa: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 180 Middle East & Africa: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 181 Middle East & Africa: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 182 Saudi Arabia: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 183 Saudi Arabia: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 184 Saudi Arabia: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 185 Saudi Arabia: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 186 Saudi Arabia: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 187 Saudi Arabia: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 188 South Africa: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 189 South Africa: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 190 South Africa: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 191 South Africa: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 192 South Africa: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 193 South Africa: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 194 UAE: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 195 UAE: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 196 UAE: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 197 UAE: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 198 UAE: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 199 UAE: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 200 Rest of Middle East & Africa: Kombucha Market, by Product Type, 2022–2032 (USD Million)

Table 201 Rest of Middle East & Africa: Kombucha Market, by Type, 2022–2032 (USD Million)

Table 202 Rest of Middle East & Africa: Flavored Kombucha Market, by Type, 2022–2032 (USD Million)

Table 203 Rest of Middle East & Africa: Kombucha Market, by Nature, 2022–2032 (USD Million)

Table 204 Rest of Middle East & Africa: Kombucha Market, by Packaging Type, 2022–2032 (USD Million)

Table 205 Rest of Middle East & Africa: Kombucha Market, by Distribution Channel, 2022–2032 (USD Million)

Table 206 Recent Developments, by Company (2021–2025)

Table 207 Recent Developments, by Company (2021–2025)

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for This Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 In 2025, the Conventional Segment to Account for the Largest Share

Figure 8 In 2025, the Flavored Segment to Account for the Largest Share

Figure 9 In 2025, the Organic Segment to Account for the Largest Share

Figure 10 In 2025, the Bottles Segment to Account for the Largest Share

Figure 11 The E-commerce Segment to Register the Highest CAGR During 2025–2032

Figure 12 Asia-Pacific to be the Fastest-growing Regional Market

Figure 13 Impact Analysis of Market Dynamics

Figure 14 Global Kombucha Market Value Chain

Figure 15 Global Kombucha Market: Porter's Five Forces Analysis

Figure 16 Global Kombucha Market, by Product Type, 2025 Vs. 2032 (USD Million)

Figure 17 Global Kombucha Market, by Type, 2025 Vs. 2032 (USD Million)

Figure 18 Global Flavored Kombucha Market, by Type, 2025 Vs. 2032 (USD Million)

Figure 19 Global Kombucha Market, by Nature, 2025 Vs. 2032 (USD Million)

Figure 20 Global Kombucha Market, by Packaging Type, 2025 Vs. 2032 (USD Million)

Figure 21 Global Kombucha Market, by Distribution Channel, 2025 Vs. 2032 (USD Million)

Figure 22 Global Kombucha Market, by Region, 2025 Vs. 2032 (USD Million)

Figure 23 North America: Kombucha Market Snapshot (2025)

Figure 24 Europe: Kombucha Market Snapshot (2025)

Figure 25 Asia-Pacific: Kombucha Market Snapshot (2025)

Figure 26 Latin America: Kombucha Market Snapshot (2025)

Figure 27 Middle East and Africa: Kombucha Market Snapshot (2025)

Figure 28 Key Growth Strategies Adopted by Leading Players (2021–2025)

Figure 29 Competitive Dashboard: Global Kombucha Market

Figure 30 Global Kombucha Market Competitive Benchmarking, by Type

Figure 31 Global Kombucha Market Share, by Key Player, 2024 (%)

Figure 32 The Coca-Cola Company: Financial Overview (2024)

Figure 33 PepsiCo Inc.: Financial Overview (2024)

Figure 34 Molson Coors Beverage Company: Financial Overview (2024)

Figure 35 The Hain Celestial Group, Inc.: Financial Overview (2025)

Published Date: Jun-2023

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates