Resources

About Us

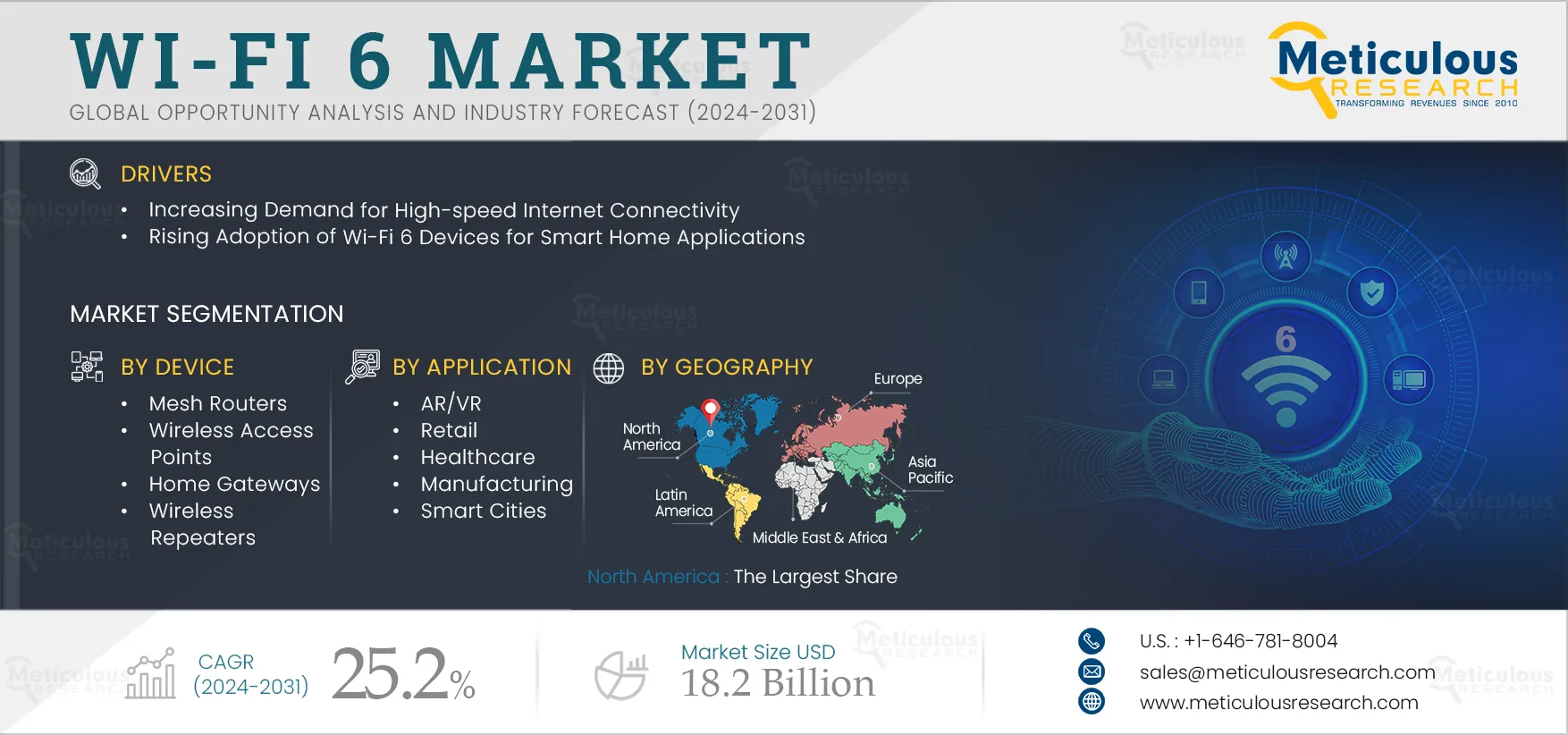

Wi-Fi 6 Market Size, Share, Forecast, & Trends Analysis by Device (Mesh Routers, Wireless Access Points, Home Gateways), Commercial Use (Enterprises, Consumers), Application (Consumer Electronics, AR/VR, Retail, Smart Cities, Healthcare), and Geography - Global Forecast to 2032

Report ID: MRICT - 104551 Pages: 200 Jan-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe Wi-Fi 6 Market is expected to reach $18.2 billion by 2032, at a CAGR of 25.2% from 2025 to 2032. The growth of the Wi-Fi 6 market is driven by the increasing demand for high-speed internet connectivity and the rising adoption of Wi-Fi 6 devices for smart home applications. Furthermore, increasing investments in smart city projects are expected to generate growth opportunities for the players operating in this market.

The proliferation of smartphones, tablets, laptops, smart TVs, gaming consoles, IoT devices, and other connected gadgets has led to a surge in the number of devices requiring internet access. These devices demand high-speed internet connectivity for streaming, video conferencing, online gaming, and accessing cloud services. Additionally, businesses and individuals are increasingly relying on cloud-based services for storage, computing, and software applications. Accessing cloud services requires robust internet connectivity that can upload and download data quickly and utilize cloud-based applications without latency or performance issues. Thus, the increasing need for high-speed internet connectivity is driving the demand for Wi-Fi 6 technology, as it provides faster data transfer speeds, allowing users to download and upload content more quickly, stream high-definition video without buffering, and experience smoother online gaming.

With the increasing demand for high-speed internet connectivity, several companies are launching Wi-Fi6-ready broadband networks. For instance, in October 2024, Nokia Corporation (Finland) signed an agreement with Tata Play Broadband Private Limited (India) to launch a Wi-Fi6-ready broadband network. With Wi-Fi 6, Tata Play Fiber offers differentiated services and delivers a rich indoor user experience for its customers. The deployment provides an intelligent mesh Wi-Fi 6 solution that allows users to enjoy high-speed internet in every corner of their homes. Such developments are supporting the growth of the Wi-Fi 6 market.

Click here to: Get a Free Sample Copy of this report

Click here to: Get a Free Sample Copy of this report

In recent years, smart homes have become more advanced with the addition of IoT devices, smart appliances, and high-definition video streaming. With the increasing bandwidth requirements of these devices, there is a growing need for faster and more reliable internet connectivity. The higher data rates and improved efficiency offered by Wi-Fi 6 solutions meet these demands, ensuring the smooth operation of multiple connected devices simultaneously. Wi-Fi 6 reduces latency and improves overall network performance, which is crucial for real-time smart home applications, such as video doorbells, home security systems, and smart lighting. Thus, the adoption of Wi-Fi 6 technology is expected to continue to grow due to its superior performance and connectivity.

Moreover, the adoption of Wi-Fi 6 solutions for smart home applications is driven by their ability to support multiple connected devices, reduce latency, improve coverage & range, future-proof smart homes, and enhance energy efficiency. Several companies are launching Wi-Fi 6 routers for smart home applications. For instance, in November 2022, Synology, Inc. (Taiwan) launched WRX560, a Wi-Fi 6 router for modern smart homes. WRX560 offers high Wi-Fi speeds with a combined throughput of up to 3,000 Mbps to provide buffer-free streaming and faster downloads. Such developments are increasing the demand for Wi-Fi 6 solutions in smart home applications, driving the growth of this market.

Increasing investments in smart city projects have boosted the demand for Wi-Fi 6 technology globally for the delivery of high-speed & high-bandwidth reliable wireless broadband coverage across high-density environments. Wi-Fi 6 can facilitate better connectivity, efficiency, and performance in various smart city applications through a range of improvements over previous Wi-Fi standards. Hence, smart city projects are increasingly implementing Wi-Fi 6 technology for lower latency, better responsiveness, improved energy efficiency of IoT devices, and enhanced security features.

Additionally, Wi-Fi 6 can accommodate high user density across indoor applications such as stadiums, convention centers, shopping malls, and school campuses. With increasing investments in smart city projects and the growing demand for Wi-Fi 6 technology, market players are collaborating to launch advanced offerings. For instance, in February 2025, LitePoint Corporation (U.S.) collaborated with Morse Micro PTY. LTD. (Australia) and AzureWave Technologies, Inc. (Taiwan) to expand innovative use cases for Wi-Fi HaLow technology namely, IQxel-MW 7G. Wi-Fi HaLow technology is ideal for industrial IoT and large-area smart city infrastructure. It provides low-power, long-range connectivity optimized for IoT applications operating in the sub-GHz frequency band. LitePoint’s IQxel-MW 7G enables a thorough validation of the Wi-Fi HaLow chipset to ensure that it is optimized for peak performance. The platform supports a full range of wireless technologies, including Wi-Fi 6E/7 and Wi-Fi HaLow, Bluetooth, and 2G/3G/4G/5G cellular technologies. Such developments are increasing the adoption of Wi-Fi 6 technology in smart city projects, generating growth opportunities for market players.

Based on device, the Wi-Fi 6 market is segmented into mesh routers, wireless access points, home gateways, and wireless repeaters. In 2025, the wireless access points segment is expected to account for the largest share of over 41.0% of the Wi-Fi 6 market. The segment's large market share is attributed to the increasing adoption of wireless access points to handle more devices simultaneously without sacrificing performance. Wireless access points help improve coverage, providing more reliable connectivity throughout the coverage area. Wi-Fi 6 access points offer significant improvements in speed, capacity, efficiency, security, and support for emerging technologies.

However, the mesh routers segment is expected to register the highest CAGR during the forecast period. The growth of this segment is driven by mesh routers’ capacity to utilize multiple nodes that work together to create a single and seamless Wi-Fi network. Wi-Fi 6 mesh routers provide faster speeds and better overall performance compared to traditional routers and come with built-in support for smart home devices and integrations with popular smart home platforms.

Based on commercial use, the Wi-Fi 6 market is segmented into enterprises and consumers. In 2025, the enterprises segment is expected to account for the larger share of over 65.0% of the Wi-Fi 6 market. The segment's large market share is attributed to the increasing use of Wi-Fi 6 in enterprises to accommodate the growing number of connected devices without sacrificing performance. Wi-Fi 6 offers faster data transfer speeds and reduced latency in applications such as video conferencing, streaming, and large file transfers. It provides enterprises with increased capacity, improved performance, better efficiency, enhanced security, IoT support, better coverage, and reliability.

However, the consumers segment is expected to register the higher CAGR during the forecast period. The growth of this segment is driven by the increasing adoption of Wi-Fi 6 for better data delivery, low latency, improved wireless performance, the growing use of Wi-Fi 6 in commercial applications due to its multi-device connection feature, better battery life, and reduced terminal device power consumption. Also, Wi-Fi 6 offers less bandwidth congestion in commercial use.

Based on application, the Wi-Fi 6 market is segmented into consumer electronics, AR/VR, retail, healthcare, manufacturing, smart cities, and other applications. In 2025, the consumer electronics segment is expected to account for the largest share of over 32.0% of the Wi-Fi 6 market. The segment's large market share is attributed to the increasing use of Wi-Fi 6 technology to improve the performance of consumer electronics products such as smartphones, tablets, laptops, smart TVs, and gaming consoles. Consumer electronics connected to Wi-Fi 6 networks are better protected from unauthorized access and data breaches. Also, Wi-Fi 6 provides consumer electronics with faster speeds, lower latency, improved battery life, and improved performance in crowded environments.

However, the smart cities segment is expected to register the highest CAGR during the forecast period. The growth of this segment is driven by the increasing use of Wi-Fi 6 in smart cities to connect a vast array of devices, sensors, and infrastructure components for real-time communication and data exchange, reduce power consumption, enhance security, provide seamless connectivity, and enable valuable data analytics capabilities. Also, the implementation of Wi-Fi 6 helps city planners and administrators gain valuable insights into traffic patterns, crowd density, and air quality.

In 2025, North America is expected to account for the largest share of over 60.0% of the Wi-Fi 6 market. North America’s significant market share can be attributed to the rising adoption of Wi-Fi-connected devices, the increasing demand for faster internet speeds, and government initiatives to promote the adoption of Wi-Fi 6 technology in the region.

However, Asia-Pacific is expected to register the highest CAGR of over 21.5% during the forecast period. The growth of this regional market is driven by rising consumer demand for high-speed & high-bandwidth internet connectivity, the rising number of connected devices, the high demand for public Wi-Fi6 hotspots, increasing smart city projects, and the increasing use of Wi-Fi 6 among enterprises in the region.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the Wi-Fi 6 market are Cisco Systems, Inc. (U.S.), Cypress Semiconductor Corporation (a part of Infineon Technologies AG) (U.S.), Aruba Networks (a part of Hewlett Packard Enterprise Company) (U.S.), D-Link Corporation (Taiwan), Marvell Technology, Inc. (U.S.), KAONMEDIA Co., Ltd. (Korea), Ruckus Wireless, Inc. (a part of Commscope Holding Company, Inc.) (U.S.), Cambium Networks Corporation (U.S.), Linksys Holdings, Inc. (U.S.), AsusTek Computer Inc. (Taiwan), TP-Link Corporation Limited (China), NETGEAR, Inc. (U.S.), Intel Corporation (U.S.), Huawei Technologies Co., Ltd. (a part OF Huawei Investment & Holding Co., Ltd.) (China), and Juniper Networks, Inc. (U.S.).

In January 2025, D-Link (Australia) launched its new AQUILA PRO AI M30 AX3000 Dual-Band Wi-Fi 6 Mesh Systems. These cutting-edge Mesh Systems, available as both a 2-Pack and 3-Pack, are engineered to address the three most common pain points of Wi-Fi users—coverage, speed, and usability.

In January 2025, Altai Technologies Ltd. (Hong Kong) launched the C260-S Outdoor Dual-Band Wi-Fi 6 Access Point. This cutting-edge access point delivers exceptional performance and reliable wireless connectivity for both indoor and outdoor applications. With its compact design and high-gain directional antenna, the C260-S provides extensive coverage up to 600m and a robust wireless experience, making it the ideal choice for a wide range of environments.

|

Particulars |

Details |

|

Number of Pages |

200 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

25.2% |

|

Market Size (Value) |

$18.2 Billion by 2032 |

|

Segments Covered |

By Device

By Commercial Use

By Application

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, U.K., France, Italy, Netherlands, Spain, Sweden, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Singapore, Australia & New Zealand, Indonesia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (Saudi Arabia, UAE, Israel, and Rest of Middle East & Africa) |

|

Key Companies Profiled |

Cisco Systems, Inc. (U.S.), Cypress Semiconductor Corporation (a part of Infineon Technologies AG) (U.S.), Aruba Networks (a part of Hewlett Packard Enterprise Company) (U.S.), D-Link Corporation (Taiwan), Marvell Technology, Inc. (U.S.), KAONMEDIA Co., Ltd. (Korea), Ruckus Wireless, Inc. (a part of Commscope Holding Company, Inc.) (U.S.), Cambium Networks Corporation (U.S.), Linksys Holdings, Inc. (U.S.), AsusTek Computer Inc. (Taiwan), TP-Link Corporation Limited (China), NETGEAR, Inc. (U.S.), Intel Corporation (U.S.), Huawei Technologies Co., Ltd. (a part OF Huawei Investment & Holding Co., Ltd.) (China), and Juniper Networks, Inc. (U.S.) |

The Wi-Fi 6 market study focuses on market assessment and opportunity analysis based on the sales of Wi-Fi 6 solutions across various regions, countries, and market segments. This study also includes a competitive analysis of the Wi-Fi 6 market based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The Wi-Fi 6 market is projected to reach $18.2 billion by 2032, at a CAGR of 25.2% from 2025 to 2032.

In 2025, the wireless access points segment is expected to account for the largest share of over 41.0% of the Wi-Fi 6 market. The segment's large market share is attributed to the increasing adoption of wireless access points to handle more devices simultaneously without sacrificing performance. Wireless access points help improve coverage, providing more reliable connectivity throughout the coverage area. Wi-Fi 6 access points offer significant improvements in speed, capacity, efficiency, security, and support for emerging technologies.

The smart cities segment is expected to register the highest CAGR during the forecast period. The growth of this segment is driven by the increasing use of Wi-Fi 6 in smart cities to connect a vast array of devices, sensors, and infrastructure components for real-time communication and data exchange, reduce power consumption, enhance security, provide seamless connectivity, and enable valuable data analytics capabilities. Also, the implementation of Wi-Fi 6 helps city planners and administrators gain valuable insights into traffic patterns, crowd density, and air quality.

The growth of the Wi-Fi 6 market is driven by the increasing demand for high-speed internet connectivity and the rising adoption of Wi-Fi 6 devices for smart home applications. Furthermore, increasing investments in smart city projects are expected to generate growth opportunities for the players operating in this market.

The key players operating in the Wi-Fi 6 market are Cisco Systems, Inc. (U.S.), Cypress Semiconductor Corporation (a part of Infineon Technologies AG) (U.S.), Aruba Networks (a part of Hewlett Packard Enterprise Company) (U.S.), D-Link Corporation (Taiwan), Marvell Technology, Inc. (U.S.), KAONMEDIA Co., Ltd. (Korea), Ruckus Wireless, Inc. (a part of Commscope Holding Company, Inc.) (U.S.), Cambium Networks Corporation (U.S.), Linksys Holdings, Inc. (U.S.), AsusTek Computer Inc. (Taiwan), TP-Link Corporation Limited (China), NETGEAR, Inc. (U.S.), Intel Corporation (U.S.), Huawei Technologies Co., Ltd. (a part OF Huawei Investment & Holding Co., Ltd.) (China), and Juniper Networks, Inc. (U.S.).

Asia-Pacific is expected to register the highest CAGR of over 21.5% during the forecast period. The growth of this regional market is driven by rising consumer demand for high-speed & high-bandwidth internet connectivity, the rising number of connected devices, the high demand for public Wi-Fi6 hotspots, increasing smart city projects, and the increasing use of Wi-Fi 6 among enterprises in the region.

Published Date: Sep-2022

Published Date: May-2024

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates