Connected Vehicle Insights and Custom Risk Models Propel the Insurance Telematics Business Expansion

Market Summary

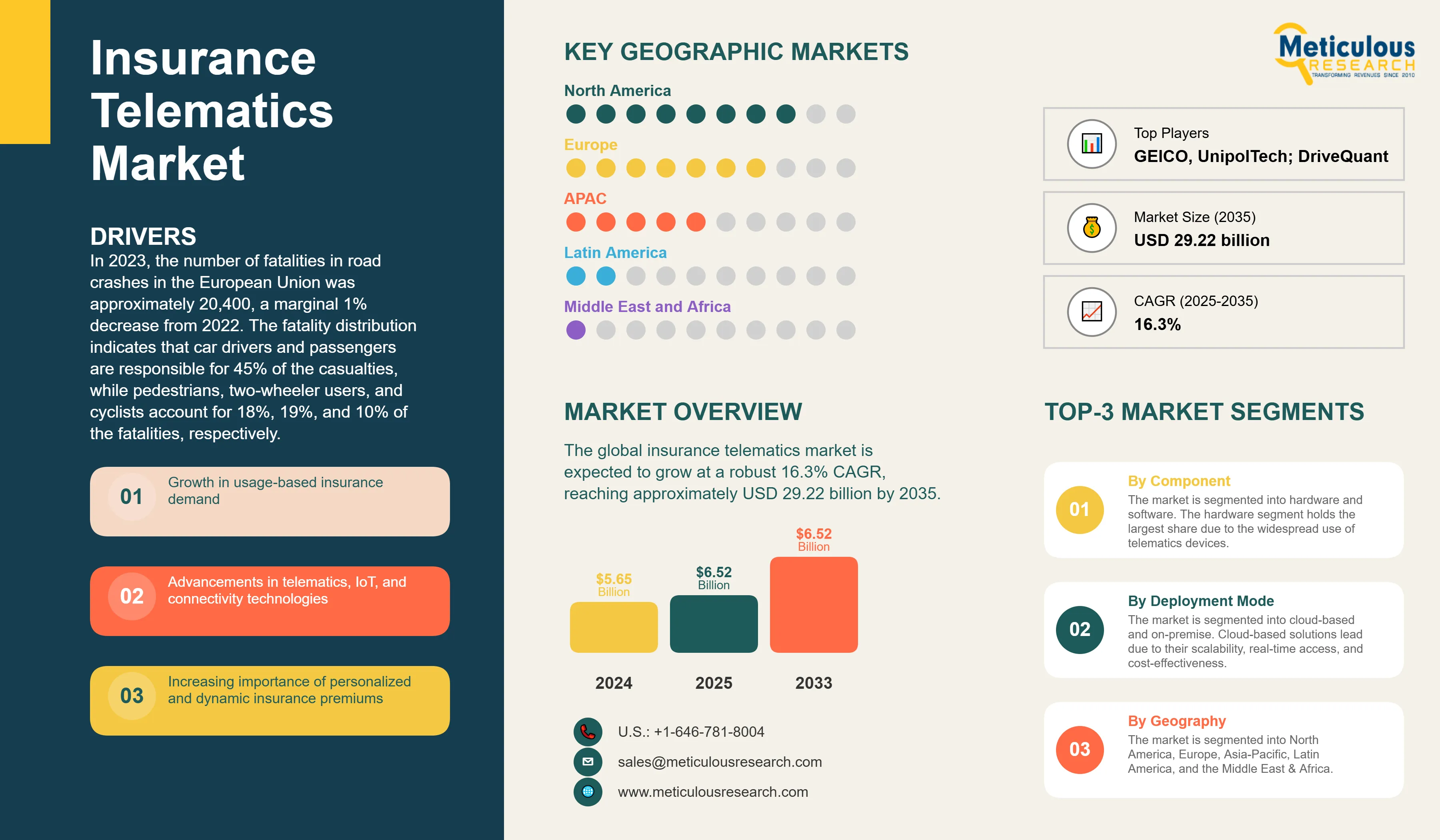

The insurance telematics industry is undergoing a substantial transformation as a result of the changing mobility patterns and evolving road safety concerns. The global insurance telematics market was valued at USD 5.65 billion in 2024. This market is expected to grow at a robust 16.3% CAGR, reaching approximately USD 29.22 billion by 2035 from USD 6.52 billion in 2025.

In 2023, the number of fatalities in road crashes in the European Union was approximately 20,400, a marginal 1% decrease from 2022. The fatality distribution indicates that car drivers and passengers are responsible for 45% of the casualties, while pedestrians, two-wheeler users, and cyclists account for 18%, 19%, and 10% of the fatalities, respectively. The implementation of more sophisticated risk assessment mechanisms through telematics solutions, with a focus on real-time monitoring capabilities and preventive measures, has been prompted by these statistics by insurers. Insurance companies are increasingly transitioning from conventional OBD-II port devices to sophisticated smartphone-based solutions that capitalize on advanced sensors and machine learning algorithms. This technological advancement has resulted in a significant reduction in hardware deployment costs and an enhancement in user accessibility, as well as the development of more precise risk assessment capabilities.

Competitive Scenario and Insights

Click here to: Get Free Sample Pages of this Report

GEICO, AXA SA, Octo Telematics, Cambridge Mobile Telematics, and Allstate Insurance are among the prominent players in the insurance telematics market, which are leading the way in market development and innovation. The development of advanced insurance telematics solutions that are smartphone-based and that utilize artificial intelligence and machine learning capabilities to provide more accurate risk assessments and personalized pricing models is becoming a more prominent focus for companies. The seamless integration of telematics solutions into vehicles has been made possible by the significant trend of strategic partnerships between automotive manufacturers and telematics insurance companies. The technological capabilities of market leaders are being significantly improved through significant investments in research and development, particularly in the areas of real-time monitoring systems, driver behavior analysis, and crash detection.

Recent Developments

Targa Telematics expands in insurance digitization

- In January 2024, Targa Telematics SPA acquired Earnix’s telematics division to bolster insurance digitization. Through this acquisition, Targa gains access to Drive-it, engaged driver behavior analytics through AI and machine learning. This acquisition led to the creation of Targa Drive, the Targa Telematics group’s dedicated business that emphasizes digital transformation of the insurance industry.

Powerfleet and MiX Telematics Announce Transformative Business Combination

- In October 2023, PowerFleet, Inc. and MiX Telematics Limited announced a strategic agreement to combine their businesses and develop a scaled, entity of choice emphasizing helping customers save lives, time, and monetary resources. This combination also aimed to create a comprehensive mobile asset Internet of Things (IoT) Software-as-a-Service (SaaS) providers globally.

Key Market Drivers

- Rising Adoption of Usage-Based Insurance Models: The increasing consumer demand for personalized insurance products is propelling UBI adoption across major economies. Usage-based insurance (UBI) is experiencing unprecedented growth as insurance providers seek to offer more personalized and data-driven coverage options. According to BCG analysis, telematics enables insurers to achieve 15-20 percentage point improvements in combined ratios compared to traditional approaches. Progressive's Snapshot program demonstrates this trend, offering up to 43% discounts for safe drivers while attracting lower-risk customer segments.

- AI-Driven Risk Analytics & Fraud Detection: Fraud continues to be a significant challenge in the insurance sector, resulting in billions of dollars in annual losses for providers. To counter this challenge, insurers are increasingly deploying AI-based technologies particularly machine learning models to detect irregularities and prevent false submissions. According to the Coalition Against Insurance Fraud, insurance fraud costs the industry around USD 80 billion annually. Their fraud detection systems powered by AI, can reduce fraud-related losses by up to 40% and providing a significant ROI.

- Technological Advancements in Connected Vehicle Ecosystems: The convergence of AI, IoT, and 5G technologies is revolutionizing telematics capabilities, enabling real-time data processing and enhanced user experiences. McKinsey research suggests the car data monetization value pool could reach $750 billion by 2030, driven by advanced telematics integration. Connected vehicle penetration is expected to reach nearly 70% of the global vehicle parc by 2035, creating unprecedented data availability for risk assessment.

Key Market Restraints

- Data Privacy and Security Concerns: Concerns around data privacy and security remain a significant restraint in the insurance telematics market. Continuous tracking of driving behavior and vehicle data raises risks of unauthorized access, data breaches, and misuse of personal information. Regulatory compliance with GDPR and similar laws adds complexity and cost, while consumer hesitation over surveillance and data ownership limits broader adoption, particularly in markets with heightened sensitivity to digital privacy.

- High Implementation Costs and Consumer Resistance: Despite long-term benefits, initial deployment costs and consumer reluctance to share driving data create adoption barriers. Studies show that 74% of fleets avoid data sharing because insurers never requested participation, highlighting the need for proactive engagement strategies. Additionally, data also states that 75% of insurers mention getting fleets to share data is their biggest challenge, and as currently only 36% of fleets engage in this practice. Thus, such variables might negatively impact the market expansion.

Table: Key Factors Impacting Global Insurance Telematics Market (2025–2035)

Base CAGR: 16.3%

|

Category

|

Key Factor

|

Short-Term Impact (2025–2028)

|

Long-Term Impact (2029–2035)

|

Estimated CAGR Impact

|

|

Drivers

|

1. Rising Adoption of Usage-Based Insurance Models

|

Improved personalization

|

Widespread adoption

|

▲ +4.0%

|

| |

2. AI-Driven Risk Analytics & Fraud Detection

|

Enhanced fraud detection

|

Integrated AI risk frameworks

|

▲ +3.5%

|

| |

3. Technological Advancements in Connected Vehicle Ecosystems

|

Better data collection

|

Autonomous insurance models

|

▲ +3.3%

|

|

Restraints

|

1. Data Privacy and Security Concerns

|

Consumer hesitation

|

Stricter data protection

|

▼ −2.5%

|

| |

2. High Implementation Costs and Consumer Resistance

|

Slow adoption

|

Cost reductions and education

|

▼ −2.0%

|

|

Opportunities

|

1. Expansion into home, health, and life insurance segments

|

Broadened offerings

|

Integrated insurance ecosystems

|

▲ +2.8%

|

| |

2. Integration with advanced analytics and AI

|

Enhanced risk modelling

|

Predictive and prescriptive solutions

|

▲ +2.5%

|

|

Trends

|

1. Increasing partnerships between insurers and automotive OEMs

|

Faster innovation

|

Unified ecosystems

|

▲ +1.7%

|

|

Challenges

|

1. Regulatory and standardization complexities

|

Compliance burdens

|

Harmonized global standards

|

▼ −1.8%

|

Regional Analysis

Regulatory Leadership and High UBI Penetration Cement North America’s Market Dominance

In 2024, North America maintained its position as the global leader in the telematics insurance market, accounting for approximately 35-40% share of the overall market. The region's dominance is primarily attributed to the widespread adoption of 4G/5G networks, high levels of technology awareness among car buyers, and the substantial presence of automotive OEMs. The U.S., in particular, exhibits substantial market potential pertaining to the consumers' growing preference for usage-based insurance (UBI) snapshot programs over conventional motor insurance policies. The region's expansion is additionally bolstered by the continuous introduction of new products by numerous insurance telematics companies, which have resulted in increased market competition and innovation. The market is being driven by the evolving consumer behavior, stringent government regulations, and the decreasing cost of development and technology.

Government Initiatives and Smartphone Telematics Propel APAC’s Fastest Growth

The Asia-Pacific telematics insurance market is witnessing significant growth, with a projected growth rate of approximately 17.5% from 2025 to 2035. The growth of insurance telematics market in Asia-Pacific region is fuelled by the rapid advancement of technology, strong regulatory support, and the increasing ownership of vehicles. Government safety initiatives and amendments to automotive industry standards have significantly bolstered the connected vehicle ecosystem, particularly in countries such as India. The market is currently experiencing significant advancements in smartphone-centred solutions and mobile telematics, which enable the real-time monitoring and analysis of driving behavior. Governments are enacting supportive policies to encourage the adoption of connected car insurance solutions, while major players in the market are enhancing their presence through strategic partnerships and innovative solution offerings.

Country-level Analysis

Advanced UBI Programs and Regulatory Mandates Drive U.S. Market Leadership

Increasing consumer awareness of the potential for savings and personalized insurance offerings through telematics contributed to the leading share of the U.S. in North American insurance telehealth market. The U.S. market holds around 80-85% share of the North American insurance telematics market in 2024. Furthermore, the development and implementation of telematics-based insurance models have been facilitated by the existence of regulatory frameworks that are supportive in numerous states.

National AI Roadmap and Fintech Synergies Fuel China’s Telematics Surge

Chine leads the Asia-Pacific insurance telematics market and is also anticipated to grow at the fastest CAGR from 2025 to 2035. New opportunities for advanced monitoring systems are emerging as a result of the rapid electrification of the automotive sector, which is reshaping the insurance telematics landscape. In 2023, electric vehicle sales reached unprecedented levels, with China leading the way at 8 million units according to the IEA report. The transition to electric vehicles has required the creation of specialized vehicle telematics solutions that can effectively monitor and evaluate the distinctive risk factors associated with electric powertrains and charging patterns. There has been transformation in the way in which insurers collect and analyze driving data with the integration of IoT technologies and artificial intelligence.

EU Data Regulations and Insurer, OEM Alliances Strengthen Germany’s Telematics Position

The Germany insurance telematics market is distinguished by robust regulatory support, particularly in the European Union, where government mandates necessitate the installation of telematic devices on all new vehicles. The market's growth is fueled by the increasing adoption of advanced driver assistance systems (ADAS) and the ongoing innovation to accommodate consumers' changing needs. The market has been further fortified by the growing emphasis of major automotive manufacturers on connected vehicle technologies. European insurtech companies are actively collaborating to provide customers with new insurance schemes and options, thereby facilitating a more seamless transition from conventional methods of purchasing vehicle insurance to comprehensive telematics alternatives.

Segmental Analysis

Pay-How-You-Drive Insurance Leads Market Growth with AI-Powered Driving Analysis and Dynamic Premium Modelling

The Pay-How-You-Drive (PHYD) segment is dominant segment in the usage-based insurance market. This segment's prominence is a result of its innovative approach, which prioritizes driving skills in the determination of premiums. Insurance providers are increasingly utilizing PHYD insurance models because they provide a more precise risk assessment by monitoring a variety of parameters, including speed, braking patterns, sudden stops, acceleration, and concentration levels, using telematics tracking devices. The integration of advanced technologies such as AI and machine learning for more precise driver behavior analysis further supports the segment's growth.

Passenger Vehicles Dominate Telematics Adoption, Driven by Behavior-Linked Pricing and Connected EV Technology Expansion

The passenger vehicle segment's revenue share in the market is dominant in 2025 and is anticipated to remain consistent throughout the forecast period, growing at 16.8% CAGR through 2035. The demand for insurance telematics in this sector has been driven by the growing appeal of policies that provide premiums based on actual driving behavior and guarantee substantial savings for safe drivers. Furthermore, insurers can enhance their comprehension of risks and modify their pricing models accordingly by incorporating sophisticated analytics features. The use of telematics solutions in this segment is being further facilitated by the substantial advancements in connected car technologies and the increasing popularity of electric vehicles (EVs) among consumers.

Report Specifications:

|

Report Attribute

|

Details

|

|

Market size (2025)

|

USD 6.52 billion

|

|

Revenue forecast in 2035

|

USD 29.22 billion

|

|

CAGR (2025-2035)

|

16.3%

|

|

Base Year

|

2024

|

|

Forecast period

|

2025 – 2035

|

|

Report coverage

|

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints

|

|

Segments covered

|

Usage (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD)), Component, Deployment Mode, Vehicle Type, Geography

|

|

Regional scope

|

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

|

|

Key companies profiled

|

GEICO; AXA SA; Octo Telematics; Cambridge Mobile Telematics; Allstate Insurance; MiX Telematics; UnipolTech; DriveQuant; IMETRIK; Progressive; Liberty Mutual; Nationwide; Targa Telematics; TomTom; Trimble; Sierra Wireless; Agero Inc.; John Hancock; Allianz; Travelers Companies

|

|

Customization

|

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available

|

|

Pricing Details

|

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models

|

Market Segmentation

- By Usage

- Pay-As-You-Drive (PAYD)

- Pay-How-You-Drive (PHYD)

- Manage-How-You-Drive (MHYD)

- By Component

- By Deployment Mode

- By Vehicle Type

- Overview

- Passenger vehicles

- Commercial vehicles

Key Questions Answered in the Report: