Resources

About Us

Injection Molding Market Size, Share, Forecast, & Trends Analysis by Material (Plastic, Metal), Technology, (Structural Foam Molding, Liquid Silicone Injection Molding), Application, Sector (Packaging, Electronics, and Healthcare), and Geography - Global Forecast to 2032

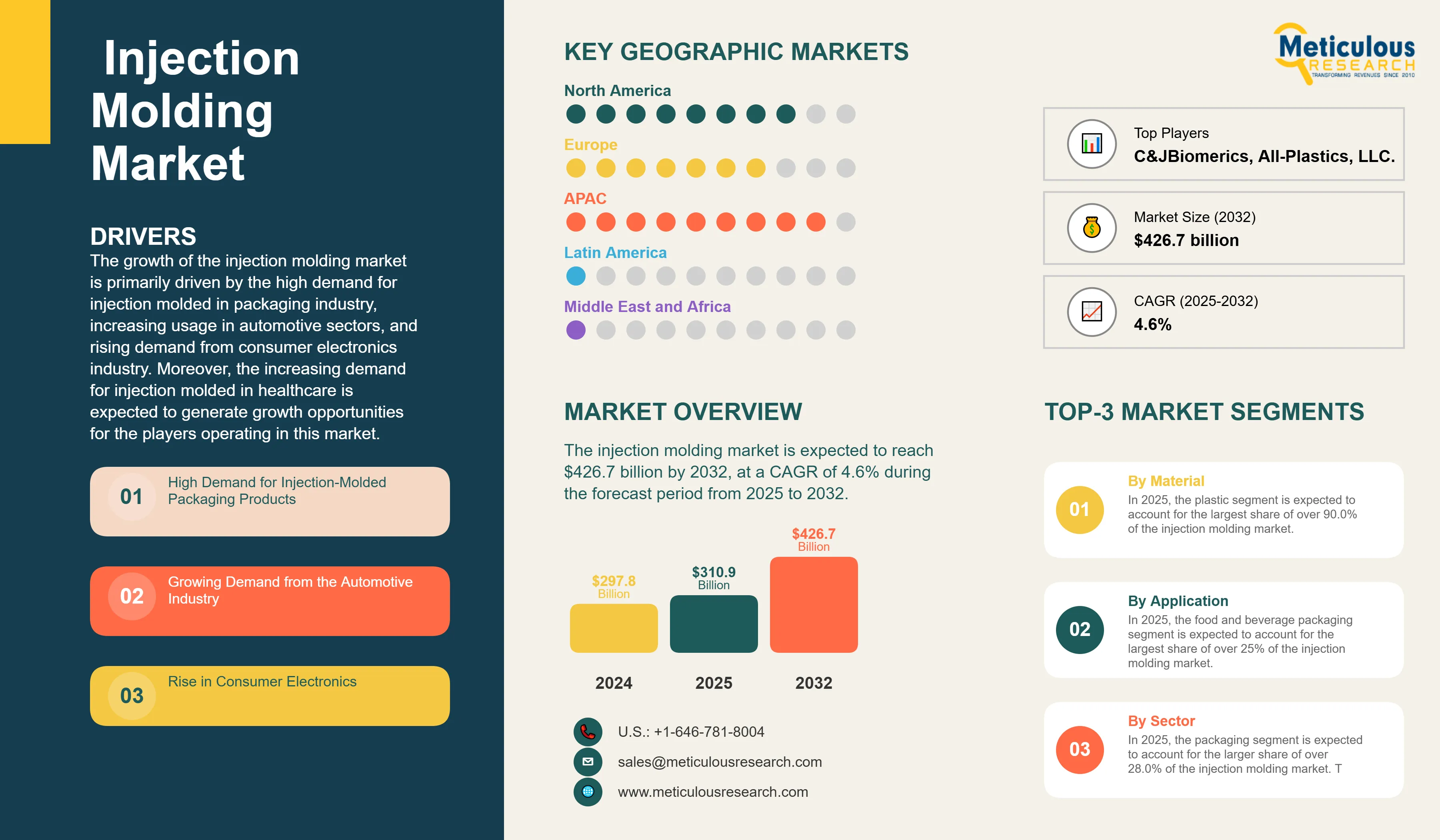

Report ID: MRCHM - 1041298 Pages: 310 Aug-2025 Formats*: PDF Category: Chemicals and Materials Delivery: 2 to 4 Hours Download Free Sample ReportThe injection molding market was valued at $297.8 billion in 2024. This market is expected to reach $426.7 billion by 2032 from an estimated $310.9 billion in 2025, at a CAGR of 4.6% during the forecast period from 2025 to 2032.

The growth of the injection molding market is primarily driven by the high demand for injection molded in packaging industry, increasing usage in automotive sectors, and rising demand from consumer electronics industry. Moreover, the increasing demand for injection molded in healthcare is expected to generate growth opportunities for the players operating in this market.

Click here to: Get Free Sample Pages of this Report

High Demand for Injection Molded in Packaging Industry Driving Market Growth

Injection molding plays a crucial role in the packaging industry due to its ability to produce complex, customized, and cost-effective packaging solutions. Injection molding allows for the creation of highly customized packaging designs. Manufacturers can produce packaging with specific shapes, sizes, textures, and features tailored to the needs of different products. This flexibility is essential for brands looking to differentiate their products on store shelves. Injection molding supports high-volume manufacturing with consistent quality, making it suitable for mass production of packaging items such as bottles, caps, containers, and closures. Also, injection molding supports a wide range of materials, including various types of plastics (e.g., PET, HDPE, PP) and even biodegradable polymers. This versatility allows manufacturers to choose materials that offer specific properties such as durability, flexibility, clarity, or barrier protection, depending on the application.

Also, injection molding enables the incorporation of advanced features into packaging designs, such as tamper resistance, child-proofing mechanisms, easy-open features, and precise dispensing systems. These functionalities enhance product safety, convenience, and user experience. In addition, continuous advancements in injection molding technology, such as multi-cavity molds, hot runners, and real-time monitoring systems, drive innovation in packaging design and manufacturing. These innovations enable faster production cycles, improved design capabilities, and enhanced product performance.

Thus, injection molding is integral to the packaging industry for its ability to produce customized, efficient, and high-quality packaging solutions.

Injection Molding Market Growth Opportunities

Increasing demand for Injection Molded in Healthcare

Injection molding plays a crucial role in the healthcare industry due to its ability to manufacture a wide range of medical devices and components efficiently and with high precision. Injection molding is extensively used to produce components for medical devices such as syringes, IV components, catheters, and respiratory masks. These components often require complex geometry and stringent tolerances, which injection molding achieves consistently. Also, many disposable medical supplies, including tubing, connectors, and surgical instruments, are manufactured using injection molding.

In addition, injection molding is utilized in dental and orthodontic applications for producing items like aligners, trays, and prosthetic components. These applications benefit from the material flexibility and precise molding capabilities offered by injection molding. Thus, the injection molding allows for the production of customized medical devices and components tailored to specific patient needs. This capability supports innovation in healthcare by enabling the development of new, more effective devices.

Consequently, as technology advances and materials improve, injection molding continues to play a pivotal role in advancing healthcare innovation and improving patient care.

Injection Molding Market Analysis: Key Findings

By Material: The Plastic Segment to Dominate the Injection Molding Market in 2024

Based on material, the injection molding market is segmented into plastic, metal, and other materials. In 2025, the plastic segment is expected to account for the largest share of over 90.0% of the injection molding market. The segment’s large share is attributed to the rising shift towards lightweight and durable materials in automotive sector, growing focus on using recycled materials and developing biodegradable plastics, growing emphasis on sustainable practices, and increasing demand for consumer products such as packaging, household items, and toys. In addition, the benefits associated with plastic injection molding, such as high precision and consistency, efficiency in mass production, design flexibility, material versatility, and automation and efficiency, further support the growth of this segment. Moreover, this segment is expected to grow at a higher CAGR during the forecast period.

By Technology: The Structural Foam Molding is Segment to Dominate the Injection Molding Market in 2024

Based on technology, the injection molding market is segmented into the gas-assisted injection molding, thin-wall molding, liquid silicone injection molding, structural foam molding, and metal injection molding. In 2025, the gas-assisted injection molding segment is expected to account for the largest share of the injection molding market. The large share of this technology is mainly due to its ability to produce large, complex, and lightweight parts with superior structural integrity and reduced material consumption. This process involves injecting nitrogen gas into the molten plastic, creating hollow sections that minimize sink marks and warping while enhancing strength-to-weight ratios. Industries such as automotive, consumer goods, and furniture favor GAIM for manufacturing components like handles, panels, and housings that require durability without excess weight. The technology’s cost efficiency—achieved through lower material usage and shorter cycle times—further solidifies its dominance, particularly in high-volume production where precision and consistency are critical.

By Application: The Food and Beverage Packaging is Segment to Dominate the Injection Molding Market in 2024

Based on application, the injection molding market is segmented into the automotive components, food and beverage packaging, stock materials, toys and figurines, mechanical components, electronics hardware and housings, medical device components, and other applications. In 2025, the food and beverage packaging segment is expected to account for the largest share of over 25% of the injection molding market. The segment’s large share is attributed to the increasing consumer demand for convenient, safe, and attractive food packaging, rising demand of precise, tamper-evident, and secure packaging solution, growing use of containers, dairy juice & water packaging, beverage caps & closures, and specialty closures. Moreover, this segment is expected to grow at a higher CAGR during the forecast period.

By Sector: The Packaging is Segment to Dominate the Injection Molding Market in 2024

Based on sector, the injection molding market is segmented into consumables & electronics, automotive, building & constructions, transportation, healthcare, packaging, consumer goods, mechanical engineering, and other sectors. In 2025, the packaging segment is expected to account for the larger share of over 28.0% of the injection molding market. This segment's large market share is attributed to the growing demand for custom and aesthetically pleasing packaging, rising need of specific shapes, sizes, textures, and features tailored to the needs of different products, rising adoption of packaging items such as bottles, caps, containers, and closures. In addition, the benefits associated with packaging sector, such as high efficiency, cost-effectiveness, precision, design flexibility, high-quality, durable, and customizable packaging, further support the growth of this segment. Moreover, this segment is expected to grow at a higher CAGR during the forecast period.

However, the healthcare segment is witnessing rapid growth as medical advancements and increasing health awareness drive demand for precision-engineered, sterile, and disposable plastic components. Injection molding is indispensable in producing medical devices such as syringes, IV components, surgical instruments, and diagnostic equipment housings, where material purity, dimensional accuracy, and biocompatibility are paramount.

Geographic Analysis

Asia-Pacific to Dominate the Injection Molding Market

Based on geography, the injection molding market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Asia-Pacific is expected to account for the largest share of the over 45% of the injection molding market. The presence of prominent injection molding players is expected to contribute to the high revenue share of this region. In addition, the rapid growth in automotive industry, high demand for injection molded in packaging industry, rising demand from consumer electronics industry, and growing emphasis on sustainability drive the demand for injection molding in the region.

Furthermore, the rapid industrialization and governments in the region investing in infrastructure and manufacturing capabilities, are predicted to fuel the injection molding market's expansion Moreover, Asia-Pacific is expected to witness the highest CAGR of 5.4% during the forecast period. Also, the rapid growth of this regional market is attributed to the growth in regional economies and the rapid infrastructure development, especially in Japan, South Korea, and India.

Injection Molding Market: Key Companies

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the injection molding market are Proto Labs (U.S.), The Rodon Group (U.S.), EVCO Plastics (U.S.), HTI Plastics (U.S.), Tessy Plastics (U.S.), C&J Industries, Inc. (U.S.), Biomerics (U.S.), All-Plastics, LLC. (U.S.), Majors Plastics, Inc. (U.S.), Currier Plastics, Inc. (U.S.), H&K Müller GmbH & Co. KG (Germany), Hehnke GmbH & Co KG (Germany), TR PLAST GROUP (Europe), and D&M Plastics, LLC (U.S.).

Injection Molding Industry Overview: Latest Developments from Key Industry Players

|

Particulars |

Details |

|

Number of Pages |

310 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

4.6% |

|

Market Size (2025) |

$310.9 Billion |

|

Market Size (2032) |

$426.7 Billion |

|

Segments Covered |

By Material

By Technology

By Application

By Sector

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, U.K., France, Italy, Spain, Switzerland, Poland, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Singapore, South Korea, Australia & New Zealand, and Rest of Asia-Pacific), Latin America and the Middle East & Africa |

|

Key Companies Profiled |

C&J Industries, Inc. (U.S.), Biomerics (U.S.), All-Plastics, LLC. (U.S.), Majors Plastics Inc. (U.S.), HTI Plastics (U.S.), The Rodon Group (U.S.), EVCO Plastics (U.S.), Tessy Plastics Corporation (U.S.), SCHOTT AG (Germany), ENGEL AUSTRIA GmbH (Austria), Husky Technologies (Canada), and NISSEI PLASTIC INDUSTRIAL CO., LTD. (Japan). |

The injection molding market study focuses on market assessment and opportunity analysis based on the sales of injection molding products across various countries, regions, and market segments. The study includes a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years.

The injection molding market is projected to reach $426.7 billion by 2032, at a CAGR of 4.6% during the forecast period 2025–2032.

In 2025, the packaging segment is expected to account for the larger share of over 25.0% of the injection molding market. This segment's large market share is attributed to the growing demand for custom and aesthetically pleasing packaging, rising need of specific shapes, sizes, textures, and features tailored to the needs of different products, rising adoption of packaging items such as bottles, caps, containers, and closures.

The growth of the injection molding market is primarily driven by the high demand for injection molded in packaging industry, increasing usage in automotive sectors, and rising demand from consumer electronics industry. Moreover, the increasing demand for injections molded in healthcare is expected to generate growth opportunities for the players operating in this market.

The key players operating in the injection molding market are C&J Industries, Inc. (U.S.), Biomerics (U.S.), All-Plastics, LLC. (U.S.), Majors Plastics Inc. (U.S.), HTI Plastics (U.S.), The Rodon Group (U.S.), EVCO Plastics (U.S.), Tessy Plastics Corporation (U.S.), SCHOTT AG (Germany), ENGEL AUSTRIA GmbH (Austria), Husky Technologies (Canada), and NISSEI PLASTIC INDUSTRIAL CO., LTD. (Japan).

At present, Asia-Pacific dominates the injection molding market. Moreover, Japan, China, India, and South Korea are expected to witness strong growth in the demand for injection molding in the coming years.

1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency & Limitations

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Market Analysis by Material

3.2.2. Market Analysis by Technology

3.2.3. Market Analysis by Application

3.2.4. Market Analysis by Sector

3.3. Regional Analysis

3.4. Competitive Analysis

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Market Drivers

4.2.1.1. High Demand for Injection-Molded Packaging Products

4.2.1.2. Growing Demand from the Automotive Industry

4.2.1.3. Rise in Consumer Electronics

4.2.1.4. Advancements in Material Technologies

4.2.1.5. Mass Production Capability

4.2.2. Market Restraints

4.2.2.1. High Initial and Maintenance Cost of Machines

4.2.2.2. Environmental Concerns Regarding Plastic Waste

4.2.2.3. Fluctuation in Raw Material Prices

4.2.3. Market Opportunities

4.2.3.1. Increasing Demand for Injection-Molded Products in Healthcare

4.2.3.2. Emergence of Biodegradable and Sustainable Practices

4.2.3.3. Adoption of Automation and Industry 4.0 Technologies

4.2.3.4. Rising Demand in Emerging Economies

4.2.4. Market Challenges

4.2.4.1. Misconception Regarding Injection Molding

4.2.4.2. Stringent Environmental Regulations

4.2.4.3. Competition from Alternative Manufacturing Technologies

4.3. Vendor Selection Criteria/Factors Influencing Purchase Decisions

4.4. Case Studies

4.4.1. Case Study 1: Injection Molding for Automotive Lightweighting and Part Integration

4.4.2. Case Study 2: Advancing Scalable Manufacturing in Medical Devices

4.4.3. Case Study 3: Innovation in Consumer Electronics Housing Design

5. Injection Molding Market Assessment – by Material

5.1. Overview

5.2. Plastic

5.2.1. Polypropylene

5.2.2. Polyurethane

5.2.3. Acrylonitrile Butadiene Styrene

5.2.4. Polyethylene Terephthalate

5.2.5. Polyethylene

5.2.6. Other Plastic Materials

5.3. Metal

5.3.1. Stainless Steel

5.3.2. Tungsten Carbides

5.3.3. Alloys

5.3.4. Cobalt-Chrome

5.3.5. Titanium

5.3.6. Other Metal Materials

5.4. Other Materials

6. Injection Molding Market Assessment – by Technologies

6.1. Overview

6.2. Gas-Assisted Injection Molding

6.3. Thin-Wall Molding

6.4. Liquid Silicone Injection Molding

6.5. Structural Foam Molding

6.6. Metal Injection Molding

6.7. Other Technologies

7. Injection Molding Market Assessment – by Application

7.1. Overview

7.2. Automotive Components

7.3. Food & Beverage Packaging

7.4. Stock Materials

7.5. Toys & Figurines

7.6. Mechanical Components

7.7. Electronic Hardware and Housings

7.8. Medical Device Components

7.9. Other Applications

8. Injection Molding Market Assessment – by Sector

8.1. Overview

8.2. Electronics

8.3. Automotive

8.4. Building & Construction

8.5. Transportation

8.6. Healthcare

8.7. Packaging

8.8. Consumer Goods

8.9. Mechanical Engineering

8.10. Other Sectors

9. Injection Molding Market Assessment – by Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. U.K.

9.3.2. Germany

9.3.3. France

9.3.4. Spain

9.3.5. Italy

9.3.6. Switzerland

9.3.7. Poland

9.3.8. Rest of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. Singapore

9.4.5. South Korea

9.4.6. Australia and New Zealand

9.4.7. Rest of APAC

9.5. Latin America

9.5.1. Mexico

9.5.2. Brazil

9.5.3. Rest of Latin America

9.6. Middle East & Africa

9.6.1. UAE

9.6.2. Israel

9.6.3. Rest of Middle East & Africa

10. Competitive Landscape

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Share/Position Analysis

11. Company Profiles

11.1. C&J Industries, Inc.

11.2. Biomerics

11.3. All-Plastics, LLC

11.4. Majors Plastics, Inc.

11.5. Hti Plastics

11.6. The Rodon Group

11.7. Evco Plastics

11.8. Proto Labs, Inc.

11.9. Tessy Plastics Corporation

11.10. Currier Plastics, Inc.

11.11. H&K Müller Gmbh & Co. KG

11.12. Hehnke Gmbh & Co. KG

11.13. D&M Plastics, LLC

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables:

Table 1 Global Injection Molding Market, by Country/Region, 2023–2032 (USD Million)

Table 2 Global Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 3 Global Plastic Injection Molding Market, by Country/Region, 2023–2032 (USD Million)

Table 4 Global Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 5 Global Injection Molding Market for Polypropylene, by Country/Region, 2023–2032 (USD Million)

Table 6 Global Injection Molding Market for Polyurethane, by Country/Region, 2023–2032 (USD Million)

Table 7 Global Injection Molding Market for Acrylonitrile Butadiene Styrene, by Country/Region, 2023–2032 (USD Million)

Table 8 Global Injection Molding Market for Polyethylene Terephthalate, by Country/Region, 2023–2032 (USD Million)

Table 9 Global Injection Molding Market for Polyethylene, by Country/Region, 2023–2032 (USD Million)

Table 10 Global Injection Molding Market for Other Plastic Materials, by Country/Region, 2023–2032 (USD Million)

Table 11 Global Metal Injection Molding Market, by Country/Region, 2023–2032 (USD Million)

Table 12 Global Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 13 Global Injection Molding Market for Stainless Steel, by Country/Region, 2023–2032 (USD Million)

Table 14 Global Injection Molding Market for Tungsten Carbides, by Country/Region, 2023–2032 (USD Million)

Table 15 Global Injection Molding Market for Alloys, by Country/Region, 2023–2032 (USD Million)

Table 16 Global Injection Molding Market for Cobalt-chrome, by Country/Region, 2023–2032 (USD Million)

Table 17 Global Injection Molding Market for Titanium, by Country/Region, 2023–2032 (USD Million)

Table 18 Global Injection Molding Market for Other Metal Materials, by Country/Region, 2023–2032 (USD Million)

Table 19 Global Injection Molding Market for Other Materials, by Country/Region, 2023–2032 (USD Million)

Table 20 Global Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 21 Global Gas-Assisted Injection Molding Market, by Country/Region, 2023–2032 (USD Million)

Table 22 Global Thin-Wall Molding Market, by Country/Region, 2023–2032 (USD Million)

Table 23 Global Liquid Silicone Injection Molding Market, by Country/Region, 2023–2032 (USD Million)

Table 24 Global Structural Foam Molding Market, by Country/Region, 2023–2032 (USD Million)

Table 25 Global Metal Injection Molding Market, by Country/Region, 2023–2032 (USD Million)

Table 26 Global Other Injection Molding Technologies Market, by Country/Region, 2023–2032 (USD Million)

Table 27 Global Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 28 Global Injection Molding Market for Automotive Components, by Country/Region, 2023–2032 (USD Million)

Table 29 Global Injection Molding Market for Food and Beverage Packaging, by Country/Region, 2023–2032 (USD Million)

Table 30 Global Injection Molding Market for Stock Materials, by Country/Region, 2023–2032 (USD Million)

Table 31 Global Injection Molding Market for Toys and Figurines, by Country/Region, 2023–2032 (USD Million)

Table 32 Global Injection Molding Market for Mechanical Components, by Country/Region, 2023–2032 (USD Million)

Table 33 Global Injection Molding Market for Electronic Hardware and Housings, by Country/Region, 2023–2032 (USD Million)

Table 34 Global Injection Molding Market for Medical Device Components, by Country/Region, 2023–2032 (USD Million)

Table 35 Global Injection Molding Market for Other Applications, by Country/Region, 2023–2032 (USD Million)

Table 36 Global Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 37 Global Injection Molding Market for Electronics, by Country/Region, 2023–2032 (USD Million)

Table 38 Global Injection Molding Market for Automotive, by Country/Region, 2023–2032 (USD Million)

Table 39 Global Injection Molding Market for Building & Constructions, by Country/Region, 2023–2032 (USD Million)

Table 40 Global Injection Molding Market for Transportation, by Country/Region, 2023–2032 (USD Million)

Table 41 Global Injection Molding Market for Healthcare, by Country/Region, 2023–2032 (USD Million)

Table 42 Global Injection Molding Market for Packaging, by Country/Region, 2023–2032 (USD Million)

Table 43 Global Injection Molding Market for Consumer Goods, by Country/Region, 2023–2032 (USD Million)

Table 44 Global Injection Molding Market for Mechanical Engineering, by Country/Region, 2023–2032 (USD Million)

Table 45 Global Injection Molding Market for Other Sectors, by Country/Region, 2023–2032 (USD Million)

Table 46 Global Injection Molding Market, by Country/Region, 2023–2032 (USD Million)

Table 47 North America: Injection Molding Market, by Country, 2023–2032 (USD Million)

Table 48 North America: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 49 North America: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 50 North America: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 51 North America: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 52 North America: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 53 North America: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 54 U.S.: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 55 U.S.: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 56 U.S.: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 57 U.S.: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 58 U.S.: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 59 U.S.: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 60 Canada: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 61 Canada: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 62 Canada: Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 63 Canada: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 64 Canada: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 65 Canada: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 66 Europe: Injection Molding Market, by Country, 2023–2032 (USD Million)

Table 67 Europe: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 68 Europe: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 69 Europe: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 70 Europe: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 71 Europe: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 72 Europe: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 73 U.K.: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 74 U.K.: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 75 U.K.: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 76 U.K.: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 77 U.K.: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 78 U.K.: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 79 Germany: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 80 Germany: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 81 Germany: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 82 Germany: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 83 Germany: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 84 Germany: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 85 France: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 86 France: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 87 France: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 88 France: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 89 France: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 90 France: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 91 Italy: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 92 Italy: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 93 Italy: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 94 Italy: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 95 Italy: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 96 Italy: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 97 Spain: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 98 Spain: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 99 Spain: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 100 Spain: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 101 Spain: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 102 Spain: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 103 Switzerland: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 104 Switzerland: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 105 Switzerland: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 106 Switzerland: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 107 Switzerland: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 108 Switzerland: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 109 Poland: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 110 Poland: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 111 Poland: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 112 Poland: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 113 Poland: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 114 Poland: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 115 Rest of Europe: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 116 Rest of Europe: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 117 Rest of Europe: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 118 Rest of Europe: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 119 Rest of Europe: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 120 Rest of Europe: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 121 Asia-Pacific: Injection Molding Market, by Country, 2023–2032 (USD Million)

Table 122 Asia-Pacific: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 123 Asia-Pacific: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 124 Asia-Pacific: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 125 Asia-Pacific: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 126 Asia-Pacific: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 127 Asia-Pacific: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 128 China: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 129 China: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 130 China: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 131 China: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 132 China: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 133 China: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 134 Japan: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 135 Japan: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 136 Japan: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 137 Japan: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 138 Japan: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 139 Japan: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 140 India: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 141 India: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 142 India: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 143 India: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 144 India: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 145 India: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 146 South Korea: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 147 South Korea: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 148 South Korea: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 149 South Korea: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 150 South Korea: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 151 South Korea: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 152 Singapore: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 153 Singapore: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 154 Singapore: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 155 Singapore: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 156 Singapore: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 157 Singapore: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 158 Australia & New Zealand: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 159 Australia & New Zealand: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 160 Australia & New Zealand: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 161 Australia & New Zealand: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 162 Australia & New Zealand: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 163 Australia & New Zealand: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 164 Rest of Asia-Pacific: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 165 Rest of Asia-Pacific: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 166 Rest of Asia-Pacific: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 167 Rest of Asia-Pacific: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 168 Rest of Asia-Pacific: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 169 Rest of Asia-Pacific: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 170 Latin America: Injection Molding Market, by Country, 2023–2032 (USD Million)

Table 171 Latin America: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 172 Latin America: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 173 Latin America: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 174 Latin America: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 175 Latin America: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 176 Latin America: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 177 Mexico: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 178 Mexico: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 179 Mexico: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 180 Mexico: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 181 Mexico: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 182 Mexico: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 183 Brazil: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 184 Brazil: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 185 Brazil: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 186 Brazil: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 187 Brazil: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 188 Brazil: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 189 Rest of Latin America: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 190 Rest of Latin America: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 191 Rest of Latin America: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 192 Rest of Latin America: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 193 Rest of Latin America: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 194 Rest of Latin America: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 195 Middle East & Africa: Injection Molding Market, by Country, 2023–2032 (USD Million)

Table 196 Middle East & Africa: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 197 Middle East & Africa: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 198 Middle East & Africa: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 199 Middle East & Africa: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 200 Middle East & Africa: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 201 Middle East & Africa: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 202 UAE: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 203 UAE: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 204 UAE: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 205 UAE: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 206 UAE: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 207 UAE: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 208 Israel: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 209 Israel: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 210 Israel: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 211 Israel: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 212 Israel: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 213 Israel: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 214 Rest of Middle East & Africa: Injection Molding Market, by Material, 2023–2032 (USD Million)

Table 215 Rest of Middle East & Africa: Plastic Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 216 Rest of Middle East & Africa: Metal Injection Molding Market, by Type, 2023–2032 (USD Million)

Table 217 Rest of Middle East & Africa: Injection Molding Market, by Technology, 2023–2032 (USD Million)

Table 218 Rest of Middle East & Africa: Injection Molding Market, by Application, 2023–2032 (USD Million)

Table 219 Rest of Middle East & Africa: Injection Molding Market, by Sector, 2023–2032 (USD Million)

Table 220 Recent Developments from Major Market Players (2022–2025)

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 In 2025, the Plastic Segment Is Expected to Dominate the Injection Molding Market

Figure 8 In 2025, the Gas-Assisted Injection Molding Segment is Expected to Dominate the Injection Molding Market

Figure 9 In 2025, the Food & Beverage Packaging Segment is Expected to Dominate the Injection Molding Market

Figure 10 In 2025, the Packaging Segment is Expected to Dominate the Injection Molding Market

Figure 11 Injection Molding Market, by Region, 2025 Vs. 2032

Figure 12 Impact Analysis of Market Dynamics

Figure 13 Global Injection Molding Market, by Material, 2025 Vs. 2032 (USD Million)

Figure 14 Global Injection Molding Market, by Technology, 2025 Vs. 2032 (USD Million)

Figure 15 Global Injection Molding Market, by Application, 2025 Vs. 2032 (USD Million)

Figure 16 Global Injection Molding Market, by Sector, 2025 Vs. 2032 (USD Million)

Figure 17 Global Injection Molding Market, by Region, 2025 Vs. 2032 (USD Million)

Figure 18 North America: Injection Molding Market Snapshot

Figure 19 Europe: Injection Molding Market Snapshot

Figure 20 Asia-Pacific: Injection Molding Market Snapshot

Figure 21 Latin America: Injection Molding Market Snapshot

Figure 22 Middle East & Africa: Injection Molding Market Snapshot

Figure 23 Key Growth Strategies Adopted by Leading Players, 2022-2025

Figure 24 Injection Molding Market: Competitive Benchmarking, By Region

Figure 25 Competitive Dashboard: Injection Molding Market

Figure 26 Injection Molding Market Position Analysis, 2024

Figure 27 SWOT Analysis - C&J Industries, Inc.

Figure 28 SWOT Analysis - Biomerics

Figure 29 SWOT Analysis - All-Plastics, LLC

Figure 30 SWOT Analysis - Majors Plastics, Inc.

Figure 31 SWOT Analysis - Hti Plastics

Figure 32 SWOT Analysis - The Rodon Group

Figure 33 SWOT Analysis - Evco Plastics

Figure 34 SWOT Analysis - Proto Labs, Inc.

Figure 35 SWOT Analysis - Tessy Plastics Corporation

Figure 36 SWOT Analysis - Currier Plastics, Inc.

Figure 37 SWOT Analysis - H&K Müller Gmbh & Co. KG

Figure 38 SWOT Analysis - Hehnke Gmbh & Co. KG

Figure 39 SWOT Analysis - D&M Plastics, LLC

Published Date: Oct-2025

Published Date: May-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates