Resources

About Us

Inductive Power Transfer System Market by Technology (Magnetic Induction, Magnetic Resonance, RF Power Transfer, Microwave Power Transfer, Laser Power Transmission), Power Range, Application, End-User, and Geography—Global Forecast to 2035

Report ID: MRSE - 1041609 Pages: 230 Oct-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Inductive Power Transfer System Market Size?

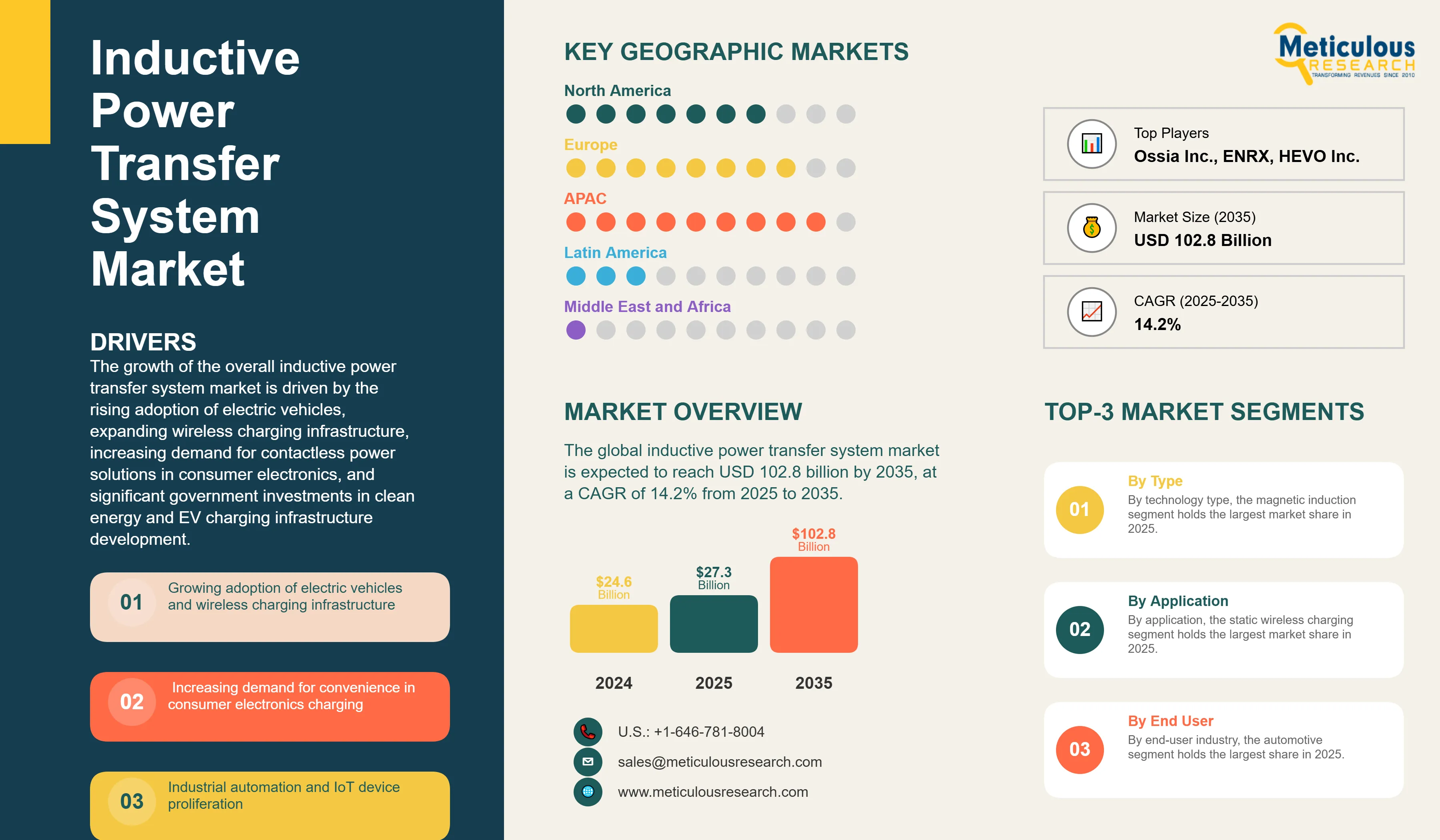

The global inductive power transfer system market was valued at USD 24.6 billion in 2024. This market is expected to reach USD 102.8 billion by 2035 from USD 27.3 billion in 2025, at a CAGR of 14.2% from 2025 to 2035. The growth of the overall inductive power transfer system market is driven by the rising adoption of electric vehicles, expanding wireless charging infrastructure, increasing demand for contactless power solutions in consumer electronics, and significant government investments in clean energy and EV charging infrastructure development.

Market Highlights: Inductive Power Transfer System

Click here to: Get Free Sample Pages of this Report

The inductive power transfer system market focuses on designing, developing, manufacturing, and deploying contactless power transmission technologies. These technologies enable devices to wirelessly transfer energy without physical connections. They use electromagnetic fields to send power from a transmitter coil to a receiver coil through magnetic coupling, which means there are no cables or direct electrical contacts. This technology covers a wide range of power, from milliwatts for small IoT devices to megawatts for charging electric vehicles and industrial applications.

Unlike traditional wired charging methods, inductive power transfer systems offer more convenience, better safety in harsh conditions, less wear and tear, and prevent issues related to connectors. The market is driven by the global shift to electric mobility, growing demand for wireless convenience in consumer electronics, needs in industrial automation, the expansion of IoT ecosystems, and a rising focus on contactless solutions due to hygiene concerns.

The key applications of inductive power transfer systems are automotive wireless charging, consumer electronics, medical implants, industrial automation, and emerging applications like dynamic EV charging and underwater power transmission.

How is AI Transforming the Inductive Power Transfer System Market?

Artificial intelligence allows for smarter power management, improves charging efficiency, and makes the user experience better. AI algorithms look at real-time power demand, environmental conditions, and device features. They adjust power transmission settings to boost efficiency and reduce energy waste.

Machine learning models help with predictive maintenance. They track how the system is performing, find issues, and predict when parts might fail. This lowers downtime and cuts operational costs.

AI-based foreign object detection systems improve safety by spotting metal objects or living things in the charging area. They can automatically adjust or stop power transmission to avoid overheating or injury. Smart charging algorithms improve charging for multiple devices at once. They manage power distribution across several devices while making sure charging speeds stay optimal.

AI tools also speed up the design of new coil shapes, magnetic field patterns, and system layouts through better simulation and modeling. Moreover, AI supports adaptive charging protocols that learn how users behave and their preferences. It can start charging when devices are in the best spots and plan charging during low-energy-cost times.

What are the Key Trends in the Inductive Power Transfer System Market?

Dynamic Wireless Charging Infrastructure: A major trend in the inductive power transfer system market is the creation of dynamic wireless charging solutions. These solutions allow electric vehicles to receive continuous power while in motion. The technology includes embedding charging coils in roadways. This setup enables EVs to charge as they drive, which effectively extends their range indefinitely. Several countries are running pilot projects and commercial deployments. Governments and car manufacturers are investing heavily in this technology. It aims to tackle range anxiety and lessen the need for larger battery sizes.

Multi-Device and High-Power Charging Platforms: Another key trend driving market growth is the shift toward high-power, multi-device charging platforms that can charge multiple devices at the same time, even with different power needs. Manufacturers are creating smart charging surfaces that can recognize and efficiently charge smartphones, tablets, wearables, and other electronics placed anywhere on the surface. This trend also includes automotive applications with wireless charging pads that can charge several devices in vehicles, as well as industrial applications that support different power levels for various types of equipment.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 102.8 Billion |

|

Market Size in 2025 |

USD 27.3 Billion |

|

Market Size in 2024 |

USD 24.6 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 14.2% |

|

Dominating Region |

Asia Pacific |

|

Fastest Growing Region |

Europe |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Technology Type, Power Range, Frequency Range, Application, End-User Industry, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Accelerating Electric Vehicle Adoption and Infrastructure Development

A key factor driving the growth of the inductive power transfer system market is the rapid adoption of electric vehicles along with large investments in wireless charging solutions. Governments around the world are enforcing strict emission regulations and providing significant incentives for EV adoption. Countries such as Norway, China, Germany, and California have set ambitious goals for EV market share, with some aiming for 100% electric vehicle sales by 2030 or 2040. The ease of wireless charging removes worries about range and charging stations, making EVs more attractive to consumers. Major automotive companies like BMW, Mercedes-Benz, Toyota, and General Motors are adding wireless charging features to their electric vehicle models, creating strong demand for inductive power transfer systems.

Restraint

High Implementation Costs and Technical Limitations

Although the market for the inductive power transfer system has a lot of growth potential, it still faces major obstacles such as a high initial implementation cost and technical limitations. A wireless charging system is made up of expensive components such as high-quality magnetic materials, sophisticated power electronics, and precision-manufactured coil assemblies, which result in a cost that is significantly higher than that of traditional wired charging solutions. The efficiency of power transmission is greatly reduced as the distance between the transmitter and receiver coils increases. The range of efficiency for optimal positioning is usually 80-95%, but it drops significantly with misalignment. Moreover, the necessity of specialized installation infrastructure, electromagnetic compatibility issues, and regulations to be followed in different regions are some of the reasons that contribute to the high system costs. Due to these factors, the system is not being used widely in such places that are sensitive to the cost of applications and underdeveloped markets.

Opportunity

Emerging Applications in Healthcare and Industrial Automation

One of the major growth opportunities for the market is the widespread use of the inductive power transfer technology in healthcare devices and industrial automation. The medical/clinical applications for the technology are wireless charging of implantable devices such as pacemakers, neurostimulators, and continuous glucose monitors, which are battery-free and safer, as the risk of infections has been drastically reduced. Whereas, on the industrial side, the main customers for the wireless power solution products are the companies managing automated guided vehicles (AGVs), robots, or IoT sensor networks working in hard environments where conventional charging methods are off-limits or inconvenient.

The rising trend and demand for Industry 4.0, smart manufacturing, and IoT have resulted in a greater need for power solutions that are contactless and reliable, even if they are operating in dusty, wet, or dangerous places. Often, these kinds of uses allow for charging at very high levels because of their seriousness and the large amount of money saved from the reduction of maintenance and reliability improvement, which are significant factors.

Technology Type Insights

Why are Magnetic Induction Systems Dominating the Market?

Within the inductive power transfer system market, the magnetic induction (near-field) segment holds the largest share of the overall inductive power transfer system market in 2025. This is primarily attributed to the technology maturity, proven reliability, and the standardization achieved through protocols like Qi for consumer electronics and SAE J2954 for the automotive industry. Magnetic induction systems operate at relatively low frequencies, usually between 100 and 300 kHz. This results in good efficiency at short distances and minimal electromagnetic interference. The key features of the technology, its low pricing, and the established manufacturing ecosystem have made it the top choice for most commercial applications, such as smartphone wireless charging, electric toothbrushes, and low-end automotive wireless charging systems.

Power Range Insights

How do Medium Power Systems Support Market Growth?

The medium power range of 100W to 10kW dominates inductive power transfer systems in 2025. This power range suits most commercial applications, including automotive Level 1 and Level 2 wireless charging (3.3kW to 11kW), fast charging for consumer electronics, and light industrial equipment. This segment benefits from a good balance of performance, efficiency, and cost, making it suitable for broad commercial use. Most electric vehicle wireless charging setups target this power range because it allows for reasonable charging times during daily commutes while keeping infrastructure costs manageable.

The ultra-high power segment, which exceeds 100kW, is expected to grow at the fastest CAGR throughout the forecast period. This growth is mainly driven by the emerging market for dynamic wireless charging on highways and the creation of megawatt-scale wireless charging systems for commercial vehicles, buses, and marine uses. High-power systems are essential for fast charging commercial fleets and long-haul transport, where shorter charging times lead to higher operational efficiency.

Application Insights

How Static Wireless Charging Applications Drive Market Revenue?

The static wireless charging segment holds the largest market share in 2025. This share depicts how mature stationary charging solutions are in various areas, such as home EV charging, workplace charging stations, consumer electronics charging pads, and industrial equipment charging docks. Static charging systems have established standards, reliable performance, and lower technical complexity compared to dynamic options. This segment includes both built-in charging solutions in vehicles and aftermarket charging pads, catering to the increasing number of wireless charging-capable devices.

On the other hand, the dynamic wireless charging segment is projected to grow at the fastest rate during the forecast period. The innovative possibilities of in-motion charging technology for electric vehicles lead to significant research and development investments from both governments and private companies. Dynamic charging tackles key EV challenges like range anxiety, battery size needs, and charging infrastructure issues, making it a game-changing technology for the future of electric transportation.

End User Insights

Why has the Automotive Sector Found Maximum Application of Inductive Power Transfer Systems?

The automotive segment holds the largest share of the overall inductive power transfer system market in 2025. The major factor driving the shift of the automotive industry to electric vehicles is the demand for charging solutions that are user-friendly and make the plug-in and plug-out process easy. Along with introducing wireless charging technology in their premium electric models, BMW, Mercedes-Benz, Genesis, and Lucid Motors are joined by technology developers like WiTricity, Qualcomm, and Continental. Existing environmental regulations that require zero-emission vehicles fuel the demand for electric vehicles using wireless charging. This segment receives strong support from R&D investors focused on improving efficiency, lowering costs, and standardizing interoperability protocols.

In contrast, the healthcare and medical devices segment is expected to grow at the fastest CAGR from 2025 to 2035. In medical applications, battery replacement can be life-threatening, making wireless charging implants more appealing. Additionally, the ongoing growth of telemedicine and remote health-monitoring systems presents challenges for current medical sensor technology, which wireless charging can solve. Healthcare applications are marked by high prices and rigorous reliability requirements, making this segment very attractive for manufacturers of inductive power transfer systems.

How is the Asia Pacific Inductive Power Transfer System Market Growing Dominantly Across the Globe?

Asia Pacific holds the largest share of the global inductive power transfer system market in 2025. This is because of the strong government support for the adoption of electric vehicles and the development of wireless charging infrastructure in China, Japan, and South Korea. China leads global EV production and has implemented ambitious wireless charging pilot projects, including dynamic charging highways and smart city initiatives.

The technological leadership of Japan in wireless power transfer, demonstrated through companies like Toyota, Panasonic, and TDK, combined with government support for hydrogen and electric mobility, strengthens the position of this region. The aggressive EV adoption targets in South Korea and substantial investments in wireless charging technology by companies like Samsung and LG further contribute to regional growth. The presence of major semiconductor manufacturers and electronics companies provides a robust supply chain for inductive power transfer components.

Which Factors Support the Europe Inductive Power Transfer System Market Growth?

Europe is projected to experience the fastest growth rate in the Europe inductive power transfer system market between 2025 and 2035. This surge is driven primarily by the European Union's Green Deal and stringent upcoming CO2 emission regulations that require automakers to significantly reduce emissions. The EU's 2035 ban on the sale of internal combustion engine vehicles is creating strong demand for comprehensive EV charging infrastructure, including wireless charging solutions.

Horizon Europe, a major funding program, supports the development of new technologies like wireless charging by allocating several billion dollars for clean energy research. Leading luxury car manufacturers in the region, such as BMW, Mercedes-Benz, Audi, and Volvo, are early adopters of high-end wireless charging features, helping to attract consumers.

Europe’s renewed focus on smart cities, commitment to sustainable transportation, and strong consumer acceptance of premium convenience features make it a great market for advancing inductive power transfer systems.

Value Chain Analysis

This stage focuses on advancing wireless power transfer efficiency, developing new magnetic materials, optimizing coil designs, and improving power electronics for higher efficiency and lower electromagnetic interference.

Key Players: WiTricity Corporation, Qualcomm Technologies, Texas Instruments, Samsung Electronics, Toyota Motor Corporation

This stage involves producing critical components, including transmitter and receiver coils, power electronics, magnetic shielding materials, and control systems requiring precision manufacturing and quality control.

Key Players: Murata Manufacturing, TDK Corporation, Panasonic Corporation, NXP Semiconductors, Infineon Technologies

This stage encompasses assembling individual components into complete inductive power transfer systems, including quality testing, efficiency optimization, and integration with vehicle or device platforms.

Recent Developments

May 2024 — WiTricity Corporation established its Japanese subsidiary in Tokyo to promote wireless power transfer projects in Japan and became a founding member of the WEV Alliance.

September 2025 — Porsche introduced advanced inductive charging solutions, representing a premium automotive market entry into wireless charging technology.

January 2025 — Samsung launched the Galaxy S25 series with Qi2 Ready support, marking a pivotal shift in Android wireless charging technology. The Galaxy S25, S25+, and S25 Ultra models support 15W Qi2 wireless charging through compatible magnetic cases, enabling magnetic alignment and improved charging efficiency.

Segments Covered in the Report

By Technology Type

By Power Range

By Frequency Range

By Application

By End-User Industry

By Region

The inductive power transfer system market is expected to increase from USD 27.3 billion in 2025 to USD 102.3 billion by 2035.

The inductive power transfer system market is expected to grow at a CAGR of 14.2% from 2025 to 2035.

The major players in the inductive power transfer system market include WiTricity Corporation, Qualcomm Technologies Inc., Texas Instruments Incorporated, Samsung Electronics Co. Ltd., NXP Semiconductors N.V., Murata Manufacturing Co. Ltd., Panasonic Corporation, TDK Corporation, Infineon Technologies AG, Energous Corporation, Powercast Corporation, Ossia Inc., Renesas Electronics Corporation, ConvenientPower HK Ltd., Powermat Technologies Ltd., Wi-Charge Ltd., Plugless Power Inc., Mojo Mobility Inc., MAHLE GmbH, Wiferion GmbH, InductEV Inc., Momentum Dynamics Corporation, ENRX (Norway), and HEVO Inc., among others.

The main factors driving the inductive power transfer system market include accelerating global adoption of electric vehicles and wireless charging infrastructure, increasing demand for convenience in consumer electronics charging, rapid expansion of IoT devices requiring contactless power solutions, significant government investments in clean energy and EV infrastructure development, and technological advancements improving charging efficiency and reducing costs.

The Asia Pacific region will lead the global inductive power transfer system market during the forecast period 2025 to 2035.

Published Date: Dec-2025

Published Date: May-2024

Published Date: May-2024

Published Date: Sep-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates