Resources

About Us

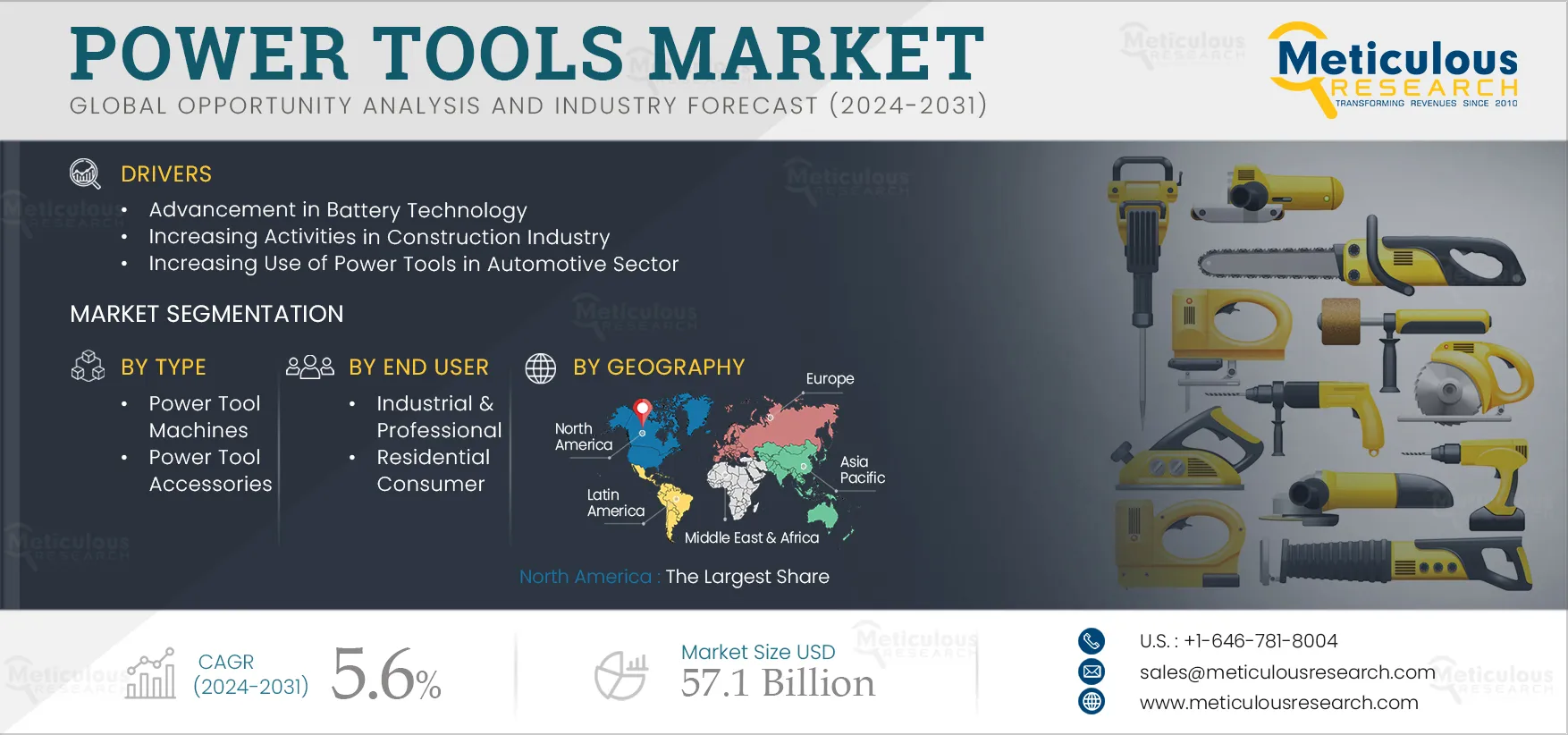

Power Tools Market Size, Share, Forecast, & Trends Analysis by Type (Power Tool Machines (Drills, Saws, Hammers), Power Tool Accessories), Mode of Operation (Electric, Pneumatic), End User (Industrial & Professional, Residential Consumer), and Geography - Global Forecast to 2031

Report ID: MRSE - 1041127 Pages: 250 Sep-2023 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe Power Tools Market is expected to reach $57.1 billion by 2031, at a CAGR of 5.6% from 2024 to 2031. The growth of this market is attributed to the advancement of battery technology, increasing activities in the construction industry, and increasing use of power tools in the automotive sector. Moreover, the increasing integration of IoT and sensor technology to offer smart and connected power tools and the growing demand for power tools for residential use are expected to offer growth opportunities for the players operating in this market.

Emerging technologies such as lithium-ion batteries, solid-state batteries, and graphene batteries offer higher energy density and faster charging times. Long-standing and high-power batteries are needed for power tools to generate instant power. The innovation in battery technology enables the development of more powerful, efficient, and sustainable cordless tools. This helps manufacturers to offer a wider variety of cordless tools, including saws, drills, and impact drivers.

Market players are innovating advanced batteries to provide better energy and improve the performance of power tools. For instance, in November 2023, Robert Bosch GmbH (Germany) launched ProCore 18V+ cordless power tool battery engineered with tabless 21700 Li-ion cells. The new battery delivers more energy than their current 21700-based batteries. Such developments in battery technology support the growth of the power tools market during the forecast period.

The automotive sector utilizes a wide range of power tools such as drills, power grinders, cutters, and impact wrenches for specific tasks. Car manufacturing involves repetitive tasks; thus, power tools are used to reduce worker fatigue and strain. Lighter cordless are preferred to make tasks easier on the worker, promoting better worker health and improving performance. Also, the cordless tools with extended runtime and high power allow for greater flexibility and movability on the assembly line.

The automotive industry is increasingly embracing automation, and automated systems often integrate power tools for specific tasks, further streamlining the production process. Organizations are expanding their businesses to meet the growing demand for power tools in the automotive industry. For instance, in June 2023, Nidec Corporation (Japan) planned to expand its business in India with the construction of a new factory for Nidec India Precision Tools Ltd. (NMTI) to offer produce hob cutters, pinion cutters, and other cutting tools to meet the growing demand for automotive and related components. Such developments drive the growth of the power tools market.

Click here to: Get a Free Sample Copy of this report

The demand for cordless power tools has increased rapidly in recent years, driven by advancements in battery technology and the growing need for portability and flexibility. Cordless tools such as compact drills, grinders, and concrete breakers have become extremely popular in construction, automotive, and aerospace manufacturing. Organizations have been quick to recognize this trend and are consistently delivering cordless power tools to meet the needs of professionals across various industries.

Some of the recent developments in this market space are as follows:

Such developments, due to the increasing demand for cordless tools, support the growth of the power tools market during the forecast period.

The integration of artificial intelligence technologies in power tools has brought a range of improvements and advancements to operating specific tasks. It enhances productivity, improves safety, and personalizes the user experience. AI algorithms provide personalized recommendations for power tool selection and optimize tool usage.

Some of the applications of AI-integrated power tools are as follows:

Power tools have become increasingly popular for residential use due to advancements in technology, affordability, and the growing DIY culture. Homeowners are using power tools to reduce the time and effort required for various tasks around the house. It also saves money needed for hiring professional contractors. Power tools, particularly cordless tools, have become more affordable in recent years, making them accessible to a wider range of homeowners.

Usage of Power Tool for Residential Applications:

Manufacturers are designing lighter and more comfortable cordless tools for ease of use, especially for those without extensive experience. For instance, in March 2021, Lowe's Companies, Inc. (U.S.) and CHERVON (China) Trading Co., Ltd. launched FLEX, a cordless power tool with a lithium-ion battery and brushless motor technologies to improve performance. Such developments are supporting the growth of the power tools market during the forecast period.

Based on type, the global power tools market is segmented into power tool machines and power tool accessories. In 2024, the power tool machines segment is expected to account for the larger share of ~74% of the power tools market. The large market share of this segment can be attributed to the increased demand for tools for building new infrastructure, residential areas, and commercial properties and increasing innovation in power tools to improve safety features. In January 2023, the Bosch India group (India), a subsidiary of Robert Bosch GmbH (Germany), launched GWS 800 Professional, a grinder with high material removal rate powered by an 800W motor and lightweight, ergonomic body for grinding and cutting applications for Indian users. Moreover, this segment is also projected to register the highest CAGR during the forecast period.

Based on mode of operation, the global power tools market is segmented into electric, pneumatic, and hydraulic. In 2024, the electric segment is expected to account for the largest share of ~72% of the power tools market. The large market share can be attributed to the increasing use of electric power tools by residential consumers and the increasing offering of electric tools by market players to offer various features such as cheaper cost, lighter weight, more compact, and easier to handle. In October 2023, Robert Bosch Tool Corporation (U.S.) launched 17 new power tools to offer oscillating multi-tool and grinder tool categories, designed to deliver skilled workers with enhanced efficiency on the job site. Moreover, this segment is also projected to register the highest CAGR during the forecast period.

Based on end user, the global power tools market is segmented into industrial & professional and residential consumer. In 2024, the industrial & professional segment is expected to account for the larger share of ~71% of the power tools market. The large market share of this segment can be attributed to the increasing use of power tools in the industrial sector to improve worker efficiency & safety and increase productivity. In April 2024, Zoho Corporation Pvt. Ltd. (India) launched a new venture, Karuvi, a power tools manufacturing company, to design and manufacture industrial and consumer power tools and other mechanical systems. Moreover, this segment is also projected to register the highest CAGR during the forecast period.

In 2024, North America is expected to account for the largest share of the global power tools market. The market growth in North America is driven by the booming construction sector in the region, increasing demand for cordless power tools due to their convenience, portability, and advancements in battery technology, and increasing integration of IoT and sensor technologies in power tools by US manufacturers. In January 2024, Stanley Black & Decker, Inc. (U.S.) partnered with Eastman Chemical Company (U.S.) to create and offer a new product line of power tools, reviva, by using Eastman's Tritan Renew copolyester.

However, the Asia-Pacific region is projected to record the highest CAGR of ~7% during the forecast period. The high growth of this market is attributed to the increasing demand for power tools in the region's industrial sector, which includes automotive, manufacturing, and aerospace and increasing government initiatives and policies to encourage infrastructure development and industrial growth in the region. In November 2021, Robert Bosch GmbH (Germany) launched X-LOCK, a new innovative system for quick and keyless changing of accessories in India. The system helps to switch angle grinder accessories with just one click to provide greater convenience while ensuring matchless safety and user experience.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the Power Tools market are Stanley Black & Decker, Inc. (U.S.), Techtronic Industries Co. Ltd. (China), Robert Bosch GmbH (Germany), Hilti Corporation (Liechtenstein), Makita Corporation (Japan), Ingersoll Rand (U.S.), Snap-on Incorporated (U.S.), Atlas Copco AB (Sweden), Apex Tool Group (U.S.), Koki Holding Co., Ltd. (Japan), Emerson Electric Co. (U.S.), 3M (U.S.), Honeywell International Inc. (U.S.), Festool GmbH (Germany), and Husqvarna AB (Sweden).

In March 2024, Kanoo Automotive & Industrial Equipment (KAIE) (Bahrain), a part of Ebrahim K. Kanoo B.S.C(C) (Bahrain), partnered with Makita Corporation (Japan) to offer power tools to empower Bahrain's professionals in construction and other industrial fields.

In January 2024, Hilti Inc (North America) launched new cordless tools on the 22V Nuron battery platform to offer precise cutting in wood, fiberboard, drywall, and solid surfaces, including straight and bevel cuts and intricate cut-outs.

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

5.6% |

|

Market Size (Value) |

USD 57.1 Billion by 2031 |

|

Segments Covered |

By Type

By Mode of Operation

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Sweden, Belgium, Rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Australia & New Zealand, Thailand, Rest of Asia-Pacific), Latin America (Mexico, Brazil, Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, Rest of Middle East & Africa) |

|

Key Companies |

Stanley Black & Decker, Inc. (U.S.), Techtronic Industries Co. Ltd. (China), Robert Bosch GmbH (Germany), Hilti Corporation (Liechtenstein), Makita Corporation (Japan), Ingersoll Rand (U.S.), Snap-on Incorporated (U.S.), Atlas Copco AB (Sweden), Apex Tool Group (U.S.), Koki Holding Co., Ltd. (Japan), Emerson Electric Co. (U.S.), 3M (U.S.), Honeywell International Inc. (U.S.), Festool GmbH (Germany), and Husqvarna AB (Sweden). |

The Power Tools Market includes electric, pneumatic, and hydraulic tools used in construction, automotive, and DIY projects, featuring advanced technologies that enhance performance and user experience across various applications.

The Power Tools Market is projected to reach $57.1 billion by 2031, reflecting significant growth driven by technological advancements, increased industrial activities, and rising consumer demand for power tools.

The market is expected to grow at a CAGR of 5.6% from 2024 to 2031. This growth is fueled by innovations in battery technology, increased demand in various sectors, and the growing trend of DIY projects among consumers.

The estimated market size is $57.1 billion by 2031, with robust growth anticipated due to advancements in technology, increased usage in both industrial and residential applications, and a rising DIY culture.

Key players include Stanley Black & Decker, Techtronic Industries, Robert Bosch, Hilti, Makita, Ingersoll Rand, Snap-on, Atlas Copco, Apex Tool Group, and Koki Holding, which drive innovation and market growth.

A prominent trend is the growing demand for cordless power tools, propelled by battery technology advancements and the need for portability. Additionally, AI integration is improving efficiency and safety in power tool operations.

Major drivers include advancements in battery technologies, increasing power tool usage in the automotive sector, growing residential demand, and the integration of IoT and sensor technologies to enhance product functionality.

The market is segmented by type (power tool machines and accessories), mode of operation (electric, pneumatic, hydraulic), and end user (industrial/professional and residential), catering to diverse consumer needs.

The global outlook is strong, with North America expected to dominate due to construction growth. The Asia-Pacific region is anticipated to experience the highest CAGR, driven by industrial demands and infrastructure investments.

The Power Tools Market is witnessing substantial growth, supported by technological innovations, rising consumer demand, and increased usage across various sectors, including automotive, construction, and residential applications.

The market is projected to grow at a CAGR of 5.6% from 2024 to 2031, driven by advancements in technology, expanding applications, and increasing consumer interest in power tools for professional and residential use

North America is expected to hold the highest market share in 2024, driven by demand for innovative cordless tools, advancements in battery technologies, and significant construction and automotive activities in the region.

Published Date: May-2024

Published Date: May-2024

Published Date: Jan-2024

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates