Resources

About Us

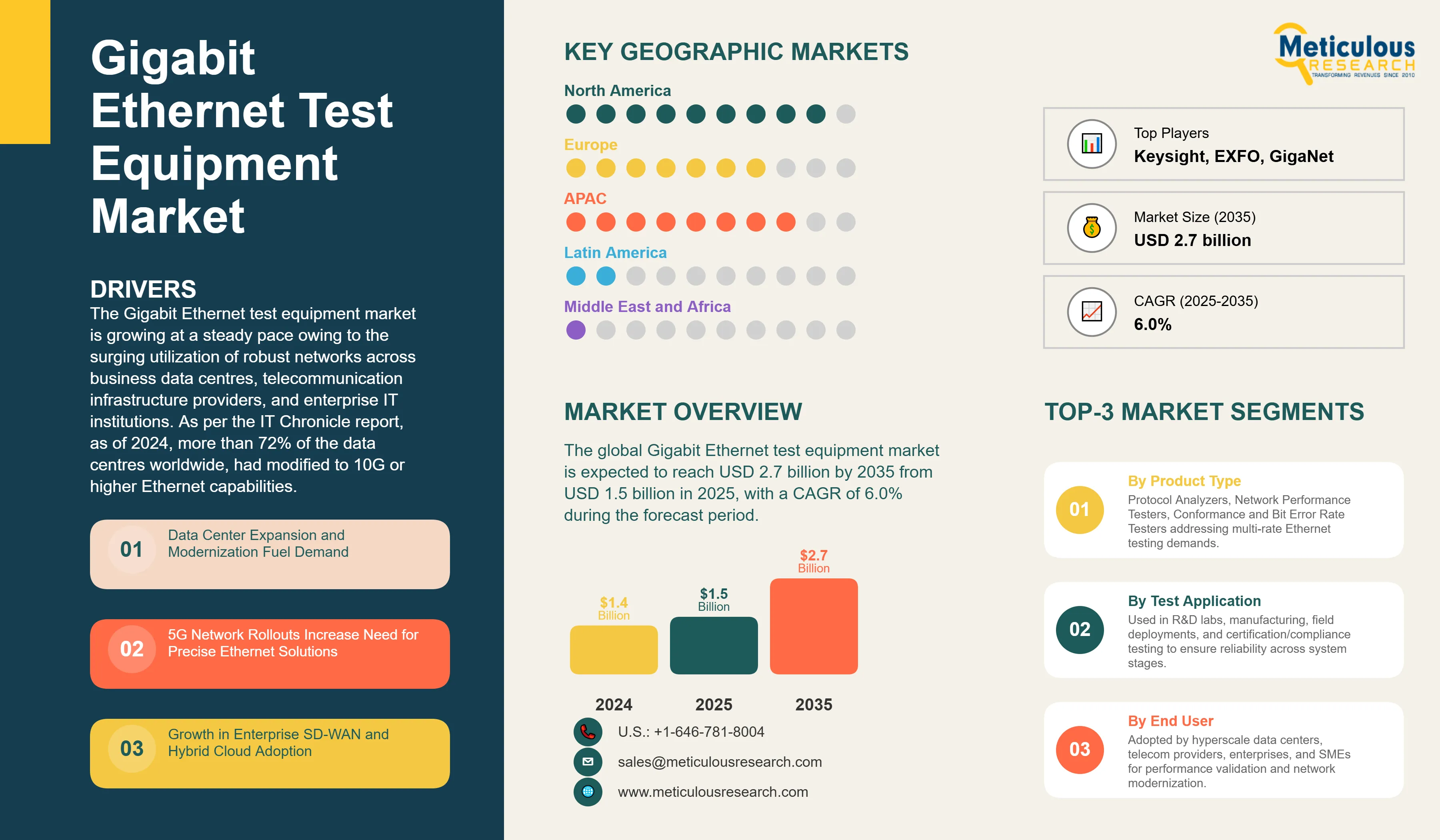

Gigabit Ethernet Test Equipment Market Size, Share, Forecast & Trends by Product (Protocol Analyzers, Network Performance Testers), Test Type, Technology, Application (R&D/Laboratory Testing, Manufacturing/Production Testing, Field Service and Installation, Certification and Compliance Testing) - Global Forecast to 2035

Report ID: MRSE - 1041576 Pages: 205 Aug-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe Gigabit Ethernet test equipment market is growing at a steady pace owing to the surging utilization of robust networks across business data centres, telecommunication infrastructure providers, and enterprise IT institutions. As per the IT Chronicle report, as of 2024, more than 72% of the data centres worldwide, had modified to 10G or higher Ethernet capabilities, driving need for innovative testing solutions that fortify performance, promote reliability, and bolster compliance.

The aggressive uptake of cloud computing solutions, edge information centres, and 5G rollouts has propelled the demand for enhanced accuracy in latency, throughput, and packet loss testing. Enterprises are also employing Ethernet testing solutions to authenticate SD-WAN utilization and hybrid cloud connectivity. Providers are incorporating AI-based testing and mechanization into diagnostic platforms to lower manual interference and enhance fault recognition. The market outlook remains positive, with increasing investments in network modernization and cybersecurity compliance expected to sustain demand.

Competitive Scenario and Insights

Click here to: Get Free Sample Pages of this Report

The competitive landscape is led by companies such as Keysight Technologies, Viavi Solutions, Anritsu, and Spirent Communications. Keysight continues to dominate with its IxNetwork and EtherScope platforms, offering comprehensive protocol testing and automation. Competition is intensifying around AI integration, cloud compatibility, and support for emerging standards like 400G Ethernet.

Recent Developments

Keysight Launches 800G Ethernet Test Platform Targeting Hyperscale Data Centers

In Q1 2025, Keysight Technologies launched its 800G Ethernet test solution targeting hyperscale data centers and telecom operators. The platform supports PAM4 modulation, FEC validation, and real-time error analysis, enabling vendors to validate next-gen transceivers and switches. Early adopters reported a 40% reduction in test cycle time and improved compliance with IEEE 802.3 standards. This launch aligns with the growing demand for ultra-high-speed Ethernet in AI workloads and cloud infrastructure.

Viavi Expands Testing Portfolio Acquires Xena Networks

In late 2024, Viavi Solutions acquired Denmark-based Xena Networks, a specialist in Ethernet traffic generation and performance testing. The acquisition enhances Viavi’s capabilities in high-speed Ethernet testing, particularly in 100G and 400G environments. Xena’s Valkyrie and Chimera platforms will be integrated into Viavi’s OneAdvisor suite, offering expanded protocol coverage and automation features. The move reflects Viavi’s strategy to strengthen its position in the enterprise and telecom testing segments.

Key Market Drivers

Key Market Restraints

Table: Key Factors Impacting the Global Gigabit Ethernet Test Equipment Market (2025–2035)

Base CAGR: 6.0%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Data Center Expansion and Modernization Fuel Demand |

Surge in demand for high-speed, multi-rate |

Standardized use of advanced Ethernet test equipment |

▲ +7.5% |

|

2. 5G Network Rollouts Increase Need for Precise Ethernet Solutions |

Growing deployment of 5G network testing for accurate validation |

Fully matured 5G infrastructure requiring continuous Ethernet |

▲ +7.0% |

|

|

3. Growth in Enterprise SD-WAN and Hybrid Cloud Adoption |

Rising demand for Ethernet testing in SD-WAN setup and hybrid connectivity |

Universal adoption of Ethernet test tools in enterprise environments |

▲ +6.8% |

|

|

4. Rising Emphasis on Network Security and Compliance |

Increased deployment of Ethernet security testing tools |

Holistic, regulatory-driven network testing to prevent vulnerabilities |

▲ +6.5% |

|

|

Restraints |

1. High Cost of Advanced Testing Equipment Limits Adoption |

Limited access and slower adoption in SMEs |

Cost reductions improve accessibility, but challenges remain |

▼ −3.2% |

|

2. Complexity in Multi-Protocol and Multi-Vendor Environments |

Technical difficulties causing errors and deployments |

Development of interoperable and simplified solutions |

▼ −2.8% |

|

|

Opportunities |

1. Emergence of 800G and 1.6T Ethernet Standards |

Early adoption pilots drive next-gen test platform demand |

Broad deployment supporting ultra-speed Ethernet |

▲ +7.3% |

|

2. Industry-Specific Testing Solutions |

Customized test platforms for industrial sectors |

Standardized vertical-specific testing equipment |

▲ +6.9% |

|

|

3. Growth in Virtualized and Cloud-Based Testing Platforms |

Increased use of cloud testing and virtualization tools |

Fully integrated remote and test platforms |

▲ +6.7% |

|

|

Trends |

1. Integration of Artificial Intelligence and Machine Learning |

AI-assisted test automation and anomaly detection pilots |

AI-driven comprehensive test orchestration |

▲ +6.2% |

|

2. Shift Towards Software-Defined Testing Platforms |

Early adoption of flexible, programmable software test tools |

Industry-wide adoption of software-defined testing |

▲ +5.9% |

|

|

Challenges |

1. Ensuring Test Accuracy and Reliability Across Multi-Vendor Environments |

Regulatory and technical complexities affect test reliability |

Harmonized standards |

▼ −1.9% |

|

2. Balancing Comprehensive Testing Coverage |

Trade-offs between test depth and time-to-market pressures |

Optimized testing protocols balancing coverage |

▼ −1.7% |

Regional Analysis

North America Leads Gigabit Ethernet Testing Market with Strong Hyperscale Data Center Growth and Cloud Integration

North America is expected to account for the largest share of around 35% of the global gigabit ethernet test equipment market in 2025, driven by extensive data center infrastructure and early adoption of 400G and 800G technologies. In 2024, over 75% of U.S. hyperscale data centers deployed Ethernet testing platforms to validate AI workloads and cloud connectivity. Telecom operators are using test tools to support 5G backhaul and fiber rollouts, while enterprises are integrating Ethernet diagnostics into SD-WAN and hybrid cloud setups. Moreover, in the U.S., in 2024, over 80% of Fortune 500 companies used Ethernet testing tools to validate SD-WAN, hybrid cloud, and cybersecurity protocols. Hyperscale operators like AWS, Google, and Microsoft are deploying 800G test platforms to support AI workloads and high-throughput applications. The U.S. also benefits from strong regulatory oversight, with FCC and NIST guidelines encouraging performance validation and network audit. Thus, the investment in AI and edge computing is expected to further boost the demand for high-speed Ethernet validation in the region.

Asia-Pacific Experiences Rapid Growth Supported by Telecom Expansion Industrial Automation and Government Digital Initiatives

Asia-Pacific is expected to witness a rapid growth with more than 9.0% CAGR during the forecast period of 2025-2035. The rapid growth of this region is fueled by telecom expansion, industrial automation, and smart city initiatives. 5G base station deployments in India and Southeast Asia rose, with Ethernet backhaul testing becoming a critical requirement. China and South Korea are investing in 400G and 800G infrastructure for AI and cloud services, while Japan is focusing on industrial Ethernet for robotics and manufacturing. The proliferation of internet-connected devices and IoT applications further fuels demand for accurate and reliable Ethernet testing solutions to ensure network integrity and performance. Government initiatives promoting smart cities and digital infrastructure advancements enhance market adoption. Moreover, regional vendors and global players are partnering to offer localized solutions with multilingual interfaces and compliance support. Government-backed digital transformation programs are also driving demand for Ethernet validation in public sector networks.

China Accelerates Investments in Ethernet Testing for 5G Telecom and AI Infrastructure Expansion

China’s Gigabit Ethernet test equipment market is growing rapidly with 6.3% CAGR during the forecast period of 2025-2035, driven by large-scale 5G deployments and AI data center expansion. Leading regional players, supported by government policies aimed at technological self-reliance, are focusing on the development of high-precision, automated Ethernet test instruments. The adoption of 5G and pilot preparations for 6G networks demand robust performance and stress testing to ensure stability and compliance with international standards.

Also, in 2024, China Mobile and China Telecom deployed over 100,000 5G base stations, with Ethernet backhaul testing becoming a standard practice. The country is also investing in 400G and 800G infrastructure to support AI training clusters and cloud services. Domestic vendors like ZTE and Huawei are developing proprietary test platforms, while international firms are partnering for compliance and localization.

Germany Focuses on Industrial Ethernet Testing, Smart Factory Validation and Stringent Compliance Requirements

Germany market is expected to grow at a 5% CAGR during the forecast period. Germany’s market for Gigabit Ethernet test equipment is shaped by its strong industrial base and EU compliance mandates. According to the World Manufacturing Organization, in 2024, over 60% of manufacturing firms adopted Ethernet testing tools to validate robotics, automation, and IoT systems. The rise of Industry 4.0 and smart factories is driving demand for low-latency, high-reliability Ethernet links. German telecom operators are also upgrading to 100G and 400G networks, requiring advanced test platforms. EU regulations on cybersecurity and data integrity are prompting enterprises to invest in audit-ready Ethernet diagnostics. Leading German and European test equipment manufacturers emphasize modular designs, energy efficiency, and advanced signal analysis. Moreover, the presence of prominent industrial R&D centers fosters innovation and adoption of next-generation Ethernet test platforms in both commercial and academic settings.

Segmental Analysis

Ethernet Performance Testing Dominates with Demand for Throughput Latency and Packet Loss Validation

The ethernet performance testing segment is expected to dominate the market in 2025 with a market share of 30-32%. The large share of this segment is mainly due to the need to validate throughput, latency, jitter, and packet loss. As enterprises increasingly adopt high-speed Ethernet standards for mission-critical applications, performance testing is indispensable for validating network infrastructure against quality of service (QoS) benchmarks. Stress testing simulates extreme traffic conditions and fault scenarios to identify vulnerabilities and harden network resilience. Telecom operators and data centers are increasingly adopting performance testing tools to ensure SLA compliance and optimize network configurations. These platforms support multi-rate testing from 1G to 800G, with real-time analytics and automation features. Vendors are integrating AI-based diagnostics and cloud APIs to support remote testing and predictive maintenance. The segment is expected to grow further with the rise of AI workloads and real-time applications.

Protocol Analyzers Gains Importance Amid Increasing Regulatory and Security Mandates

The protocol analyzers segment is expected to hold a second largest share of 25-30% of the global gigabit ethernet test equipment market in 2025. These products are becoming increasingly important as enterprises and service providers face stricter regulatory requirements. Numerous large enterprises are conducting Ethernet protocol audits to meet GDPR, HIPAA, and PCI-DSS standards. These tools validate adherence to IEEE 802.3 and other standards, ensuring interoperability and security. Vendors are offering modular platforms with customizable test scripts, encryption validation, and audit trail generation. The segment is growing rapidly in finance, healthcare, and government sectors, where compliance is critical.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 1.5 billion |

|

Revenue forecast in 2035 |

USD 2.7 billion |

|

CAGR (2025-2035) |

6.0% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers, and restraints |

|

Segments covered |

Product (Protocol Analyzers, Network Performance Testers), Test Type, Technology, Application (R&D/Laboratory Testing, Manufacturing/Production Testing, Field Service and Installation, Certification and Compliance Testing), Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

Keysight Technologies Inc.; Viavi Solutions Inc.; Spirent Communications PLC; Anritsu Corporation; EXFO Inc.; Rohde & Schwarz GmbH; Teledyne LeCroy; NetScout Systems Inc.; Yokogawa Electric Corporation; GL Communications Inc.; VeEX Inc.; Trend Networks; GigaNet Systems; Xinertel Technology; Apposite Technologies; GAO Tek Inc.; Veryx Technologies |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

The Gigabit Ethernet Test Equipment Market size is estimated to be USD 1.5 billion in 2025 and grow at a CAGR of 6.0% to reach USD 2.7 billion by 2035.

In 2024, the Gigabit Ethernet Test Equipment Market size was estimated at USD 1.4 billion, with projections to reach USD 1.5 billion in 2025.

Keysight Technologies Inc., Viavi Solutions Inc., Spirent Communications PLC, Anritsu Corporation, EXFO Inc., Rohde & Schwarz GmbH, Teledyne LeCroy, NetScout Systems Inc., Yokogawa Electric Corporation, GL Communications Inc., VeEX Inc., Trend Networks, and GigaNet among others are the major companies operating in the Gigabit Ethernet Test Equipment Market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035).

Based on test type, the ethernet performance testing segment is expected to dominate the market in 2025.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Gigabit Ethernet Test Equipment Market, by Product

3.2.2. Gigabit Ethernet Test Equipment Market, by Test Type

3.2.3. Gigabit Ethernet Test Equipment Market, by Technology

3.2.4. Gigabit Ethernet Test Equipment Market, by Application

3.2.5. Gigabit Ethernet Test Equipment Market, by Organization Type

3.2.6. Gigabit Ethernet Test Equipment Market, by Region

3.3. Competitive Landscape

3.4. Strategic Recommendations

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Data Center Expansion and Modernization Fuel Demand

4.2.1.2. 5G Network Rollouts Increase Need for Precise Ethernet Solutions

4.2.1.3. Growth in Enterprise SD-WAN and Hybrid Cloud Adoption

4.2.1.4. Rising Emphasis on Network Security and Compliance

4.2.2. Restraints

4.2.2.1. High Cost of Advanced Testing Equipment Limits Adoption

4.2.2.2. Complexity in Multi-Protocol and Multi-Vendor Environments

4.2.2.3. Integration challenges with legacy network infrastructure and existing testing workflows

4.2.3. Opportunities

4.2.3.1. Emergence of 800G and 1.6T Ethernet standards

4.2.3.2. Industry-specific testing solutions

4.2.3.3. Growth in virtualized and cloud-based testing platforms

4.2.4. Trends

4.2.4.1. Integration of artificial intelligence and machine learning

4.2.4.2. Shift towards software-defined testing platforms

4.2.5. Challenges

4.2.5.1. Ensuring test accuracy and reliability across increasingly complex multi-vendor network environments

4.2.5.2. Balancing comprehensive testing coverage

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Technology Impact on Gigabit Ethernet Test Equipment Market

4.4.1. Multi-Speed Ethernet Testing Capabilities

4.4.1.1. Support for 1GbE through 800GbE and beyond with seamless scalability

4.4.1.2. Advanced traffic generation and analysis for complex network scenarios

4.4.1.3. Real-time performance monitoring with sub-microsecond accuracy

4.4.2. AI-Enhanced Test Automation

4.4.2.1. Intelligent test pattern recognition and anomaly detection

4.4.2.2. Automated compliance verification and certification processes

4.4.2.3. Predictive failure analysis and network optimization

5. Impact of Sustainability on Gigabit Ethernet Test Equipment Market

5.1. Enabling energy-efficient network optimization through comprehensive performance testing

5.2. Supporting green data center initiatives with power consumption analysis and optimization

5.3. Reducing physical testing infrastructure through virtualized and cloud-based solutions

5.4. Promoting sustainable network design through lifecycle testing and environmental impact assessment

5.5. Challenges include managing electronic waste from rapid equipment refresh cycles and ensuring energy-efficient test operations

6. Competitive Landscape

6.1. Overview

6.2. Key Growth Strategies

6.3. Competitive Benchmarking

6.4. Competitive Dashboard

6.4.1. Industry Leaders

6.4.2. Market Differentiators

6.4.3. Vanguards

6.4.4. Contemporary Stalwarts

6.5. Market Share/Ranking Analysis, by Key Players, 2024

7. Gigabit Ethernet Test Equipment Market Assessment—By Product

7.1. Overview

7.2. Protocol Analyzers

7.3. Network Performance Testers

7.4. Conformance Testers

7.5. Bit Error Rate Testers

8. Gigabit Ethernet Test Equipment Market Assessment—By Test Type

8.1. Overview

8.2. Functional/Traffic Generation Testing

8.3. Ethernet Performance/Stress Testing

8.4. Compliance/Conformance Testing

8.5. Network Emulation

9. Gigabit Ethernet Test Equipment Market Assessment—By Technology

9.1. Overview

9.2. 1 GbE

9.3. 10 GbE

9.4. 25/50 GbE

9.5. 40/100/200 GbE

9.6. 400 GbE

9.7. 800 GbE and 1.6 TbE

10. Gigabit Ethernet Test Equipment Market Assessment—By Application

10.1. Overview

10.2. R&D/Laboratory Testing

10.3. Manufacturing/Production Testing

10.4. Field Service and Installation

10.5. Certification and Compliance Testing

10.6. Others

11. Gigabit Ethernet Test Equipment Market Assessment—By Organization Size

11.1. Overview

11.2. Large Enterprises

11.3. Small and Medium Enterprises

12. Gigabit Ethernet Test Equipment Market Assessment—By Geography

12.1. Overview

12.2. North America

12.2.1. U.S.

12.2.2. Canada

12.3. Europe

12.3.1. Germany

12.3.2. U.K.

12.3.3. France

12.3.4. Netherlands

12.3.5. Switzerland

12.3.6. Rest of Europe

12.4. Asia-Pacific

12.4.1. China

12.4.2. Japan

12.4.3. South Korea

12.4.4. Taiwan

12.4.5. India

12.4.6. Singapore

12.4.7. Australia

12.4.8. Rest of Asia-Pacific

12.5. Latin America

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Argentina

12.5.4. Rest of Latin America

12.6. Middle East & Africa

12.6.1. UAE

12.6.2. Saudi Arabia

12.6.3. Israel

12.6.4. South Africa

12.6.5. Rest of Middle East & Africa

13. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

13.1. Keysight Technologies Inc.

13.2. Viavi Solutions Inc.

13.3. Spirent Communications PLC

13.4. Anritsu Corporation

13.5. EXFO Inc.

13.6. Rohde & Schwarz GmbH

13.7. Teledyne LeCroy

13.8. NetScout Systems Inc.

13.9. Yokogawa Electric Corporation

13.10. GL Communications Inc.

13.11. VeEX Inc.

13.12. Trend Networks

13.13. GigaNet Systems

13.14. Xinertel Technology

13.15. Apposite Technologies

13.16. GAO Tek Inc.

13.17. Veryx Technologies

13.18. Others

14. Appendix

14.1. Available Customization

14.2. Related Reports

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates