Resources

About Us

AI in Gaming Market by Solution (AI Development Tools, AI Game Engines, AI Infrastructure, AI-Powered Game Services), Application (NPCs & Digital Humans, Procedural Content Generation, Graphics & Rendering, Game Testing), and Platform (PC & Console, Mobile, Cloud Gaming) – Global Forecast to 2036

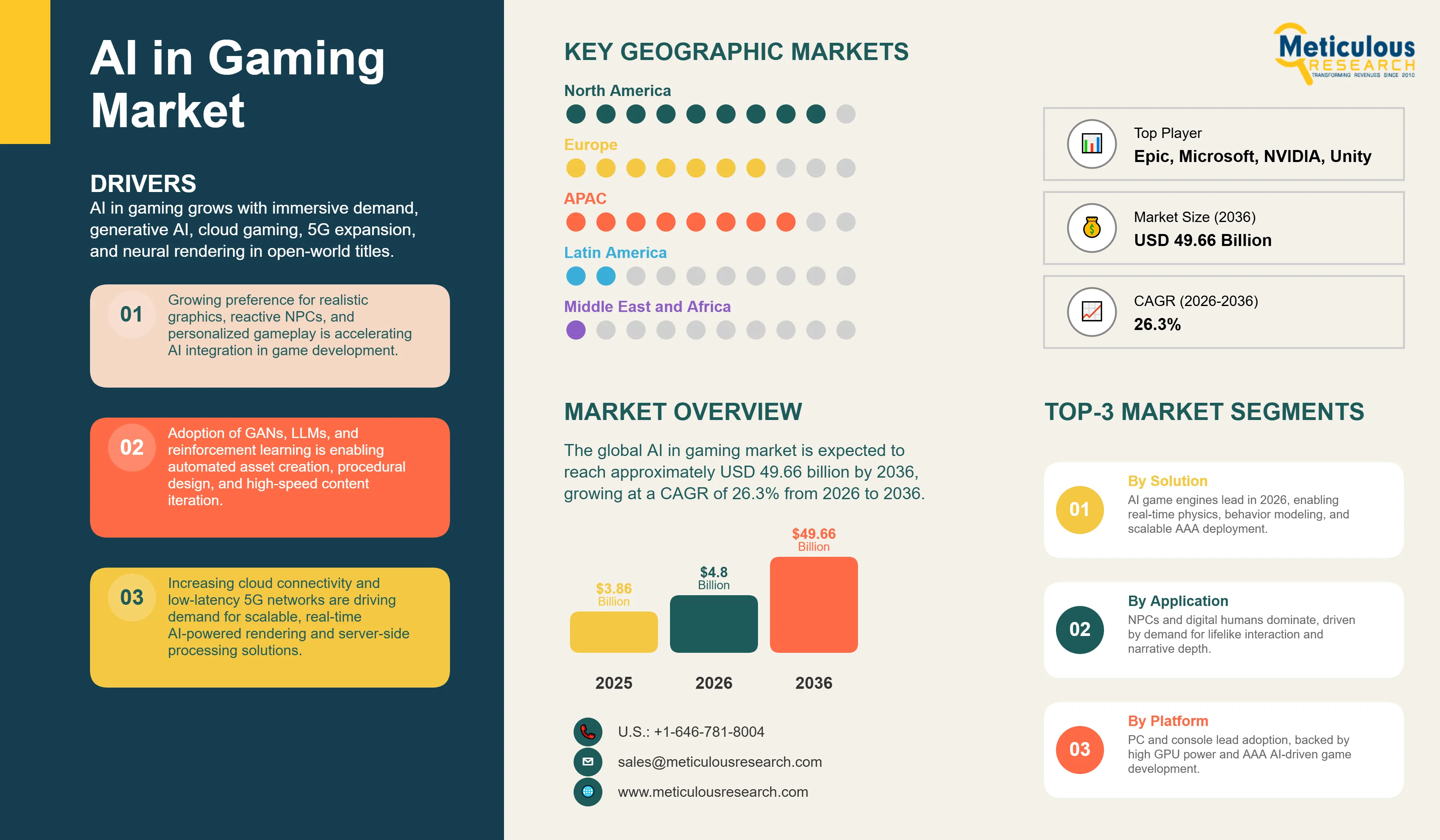

Report ID: MRICT - 1041730 Pages: 185 Feb-2026 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global AI in gaming market was valued at USD 3.86 billion in 2025. The market is expected to reach approximately USD 49.66 billion by 2036 from USD 4.80 billion in 2026, growing at a CAGR of 26.3% from 2026 to 2036. The growth of the overall AI in gaming market is driven by the intensifying global focus on immersive player experiences and the rapid expansion of the generative AI and cloud gaming sectors. As developers seek to integrate more functionality into virtual worlds and reduce production timelines for complex assets, AI-driven systems have become essential for maintaining high-speed content iteration and mechanical durability. The rapid expansion of the 5G infrastructure and the increasing need for high-density neural rendering solutions in open-world games and advanced player-assistance systems continue to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Artificial Intelligence (AI) in gaming refers to critical computational systems used to provide intelligent behavior while allowing for automated content creation and optimized performance throughout the game development and gameplay process. These systems include development tools, runtime engines, and cloud-based services, which are designed to withstand high-frequency data processing and fit into non-linear interactive environments. The market is defined by high-efficiency technologies such as generative adversarial networks (GANs) and large language models (LLMs), which significantly enhance narrative depth and signal performance in high-fidelity applications. These systems are indispensable for developers seeking to optimize their internal production architecture and meet aggressive content delivery targets.

The market includes a diverse range of configurations, ranging from simple behavior trees for basic enemies to complex multilayer neural networks for high-performance digital humans and procedural worlds. These systems are increasingly integrated with advanced components such as edge AI processors and ultra-fast inference engines to provide services such as real-time dialogue generation and improved frame rates through upscaling. The ability to provide stable, high-precision intelligence while minimizing physical development footprint has made advanced AI the technology of choice for industries where creative efficiency and reliability are paramount.

The global gaming sector is pushing hard to modernize production capabilities, aiming to meet AI-driven hardware and cloud connectivity targets. This drive has increased the adoption of high-density AI pipelines, with advanced reinforcement learning techniques helping to stabilize production yields for ultra-fine game balancing. At the same time, the rapid growth in the cloud gaming and metaverse markets is increasing the need for high-reliability, low-latency AI solutions.

Proliferation of Generative AI and High-Speed Content Iteration

Developers across the gaming industry are rapidly shifting to AI-optimized pipelines, moving well beyond traditional manual asset creation toward high-speed, low-loss generative setups. NVIDIA’s latest ACE (Avatar Cloud Engine) delivers significantly higher interaction depth for NPCs, while Unity’s recent Muse installations have slashed asset iteration times in mobile and indie projects. The real game-changer comes with “smart” development environments featuring integrated code assistants and asset generators that maintain peak performance even in complex, multi-app workflows. These advancements make high-precision AI integration practical and cost-effective for everyone from indie startups to global gaming giants chasing narrative excellence and lower system weight.

Innovation in Neural Rendering and Digital Human Systems

Innovation in neural rendering and digital human systems is rapidly driving the AI in gaming market, as virtual worlds become more expansive and multi-functional. Equipment suppliers are now designing units that combine the structural integrity of traditional rendering with the versatility of AI-powered upscaling in a single assembly, saving valuable GPU memory and simplifying rendering logistics. These systems often involve advanced deep learning super sampling (DLSS) and frame generation capable of handling ultra-high resolutions without compromising mechanical strength or electrical reliability.

At the same time, growing focus on inclusive gaming is pushing manufacturers to develop AI solutions tailored to community safety principles. These systems help reduce toxic behavior through real-time voice-to-text analysis and the use of automated moderation substrates. By combining high-density data processing with robust social performance, these new designs support both technological advancement and corporate sustainability, strengthening the resilience of the broader gaming value chain.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 49.66 Billion |

|

Market Size in 2026 |

USD 4.80 Billion |

|

Market Size in 2025 |

USD 3.86 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 26.3% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Solution, Application, Platform, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Demand for Immersive Content and Rise of Generative AI

A key driver of the AI in gaming market is the rapid movement of the global gaming industry toward larger, more detailed, and highly functional virtual worlds. Global player demand for sleek graphics, reactive NPCs, and personalized gameplay has created significant incentives for the adoption of AI technologies. The trend toward “living” worlds and the integration of AI into procedural level design and narrative branching drive developers toward scalable solutions that AI can uniquely provide. It is estimated that as player adoption of cloud-enabled games rises and development tools become more decentralized through 2036, the need for robust, intelligent systems increases significantly; therefore, generative AI and neural rendering, with their ability to ensure high-density content delivery, are considered a crucial enabler of modern game design strategies.

Opportunity: Cloud Gaming Expansion and Metaverse Integration

The rapid growth of the cloud gaming market and metaverse technologies provides great opportunities for the AI in gaming market. Indeed, the global surge in cloud infrastructure has created a compelling demand for systems that can replace heavy local hardware and integrate seamlessly into server-side rendering ecosystems. These applications require high reliability, low latency, and the ability to handle high-concurrency environments, all attributes that are met with advanced AI solutions. The metaverse market is set to expand significantly through 2036, with AI poised for an expanding share as developers seek to maximize user immersion and minimize world-building costs. Furthermore, the increasing demand for AI-powered anti-toxicity and player analytics is stimulating demand for modular digital solutions that provide high-speed data transmission and design flexibility.

Why Do AI Game Engines Lead the Market?

The AI game engines and runtime platforms segment accounts for a significant portion of the overall AI in gaming market in 2026. This is mainly attributed to the versatile use of this technology in supporting real-time behavior modeling and complex physics within extremely tight processing budgets, such as in premium AAA titles and high-performance mobile games. These systems offer the most comprehensive way to ensure gameplay integrity across diverse high-frequency applications. The console and PC sectors alone consume a large share of AI engine production, with major projects in North America and Asia Pacific demonstrating the technology’s capability to handle high-density data requirements. However, the AI development tools segment is expected to grow at a rapid CAGR during the forecast period, driven by the growing need for robust asset generation in indie development, mobile gaming, and metaverse platforms.

How Does the NPCs & Digital Humans Segment Dominate?

Based on application, the NPCs and digital humans segment holds the largest share of the overall market in 2026. This is primarily due to the massive volume of narrative-driven game production and the rigorous performance standards required for modern character interaction. Current large-scale development studios are increasingly specifying high-density AI models to ensure compliance with global performance standards and player expectations for more realistic, reactive characters.

The graphics and rendering optimization segment is expected to witness the fastest growth during the forecast period. The shift toward AI-enhanced visual fidelity and the complexity of neural rendering suites are pushing the requirement for advanced AI systems that can handle varied resolutions and frame rates while ensuring absolute reliability for safety-critical visual systems.

Why Does PC & Console Lead the Market?

The PC and console segment commands the largest share of the global AI in gaming market in 2026. This dominance stems from its superior processing power, hardware stability, and excellent mechanical properties, making it the platform of choice for high-performance AI-driven games. Large-scale operations in AAA development and high-end gaming hardware drive demand, with advanced GPUs from suppliers like NVIDIA and AMD enabling reliable performance in extreme environments.

However, the mobile and tablet segment is poised for steady growth through 2036, fueled by expanding applications in casual gaming and simple AI-powered mechanics. Developers face mounting pressure to optimize costs for high-volume, less demanding applications, where mobile AI provides a cost-effective alternative for basic intelligent connectivity.

How is North America Maintaining Dominance in the Global AI in Gaming Market?

North America holds the largest share of the global AI in gaming market in 2026. The largest share of this region is primarily attributed to the massive industrialization of AI and the presence of the world’s largest technology hubs, particularly in the United States. The U.S. alone accounts for a significant portion of global AI in gaming investment, with its position as a leading exporter of high-end gaming software driving sustained growth. The presence of leading manufacturers like NVIDIA, Microsoft, and Epic Games and a well-developed technology supply chain provides a robust market for both standard and high-density AI solutions.

Which Factors Support Asia-Pacific and Europe Market Growth?

Asia-Pacific and Europe together account for a substantial share of the global AI in gaming market. The growth of these markets is mainly driven by the need for technological modernization in the mobile gaming and indie development sectors. The demand for advanced AI systems in Asia-Pacific is mainly due to its large-scale mobile gaming projects and the presence of innovators like Tencent and NetEase.

In Europe, the leadership in AI research and the push for creative technology innovation are driving the adoption of high-reliability AI solutions. Countries like the UK, France, and Germany are at the forefront, with significant focus on integrating smart AI solutions into narrative design and advanced rendering systems to ensure the highest levels of performance and reliability.

The companies such as NVIDIA Corporation, Unity Software Inc., Microsoft Corporation, and Epic Games, Inc. lead the global AI in gaming market with a comprehensive range of engine and development solutions, particularly for large-scale AAA and high-speed applications. Meanwhile, players including Google LLC, Amazon.com, Inc. (AWS), Tencent Holdings Ltd., and Electronic Arts Inc. focus on specialized cloud infrastructure and R&D targeting the mobile, cloud gaming, and metaverse sectors. Emerging manufacturers and integrated players such as Ubisoft Entertainment, Sony Interactive Entertainment, and IBM Corporation are strengthening the market through innovations in digital human technology and modular AI platforms.

The global AI in gaming market is expected to grow from USD 4.80 billion in 2026 to USD 49.66 billion by 2036.

The global AI in gaming market is projected to grow at a CAGR of 26.3% from 2026 to 2036.

AI game engines and runtime platforms are expected to dominate the market in 2026 due to their superior ability to support real-time behavior and physics. However, AI development tools are projected to be the fastest-growing segment owing to their increasing adoption in asset generation and indie development where production efficiency is required.

Generative AI and Cloud Gaming are transforming the gaming landscape by demanding higher content integrity, lower latency, and improved narrative depth. These technologies drive the adoption of advanced materials like LLMs and neural rendering, enabling developers to support the complex routing and high-frequency requirements of next-generation virtual worlds.

North America holds the largest share of the global AI in gaming market in 2026. The largest share of this region is primarily attributed to the massive industrialization of AI and the presence of the world’s largest technology hubs in the U.S. Asia-Pacific is expected to witness the fastest growth, driven by high-end applications in mobile gaming and metaverse platforms.

The leading companies include NVIDIA Corporation, Unity Software Inc., Microsoft Corporation, Epic Games, Inc., and Google LLC.

Published Date: Aug-2025

Published Date: Apr-2025

Published Date: Jan-2025

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates