Resources

About Us

Food Inspection Device Market by Product (X-ray Systems, Metal Detectors, Checkweighers, Vision Systems), Food Category (Meat, Dairy, Bakery, Fruits & Vegetables, Beverages), Vertical – Global Forecast to 2036

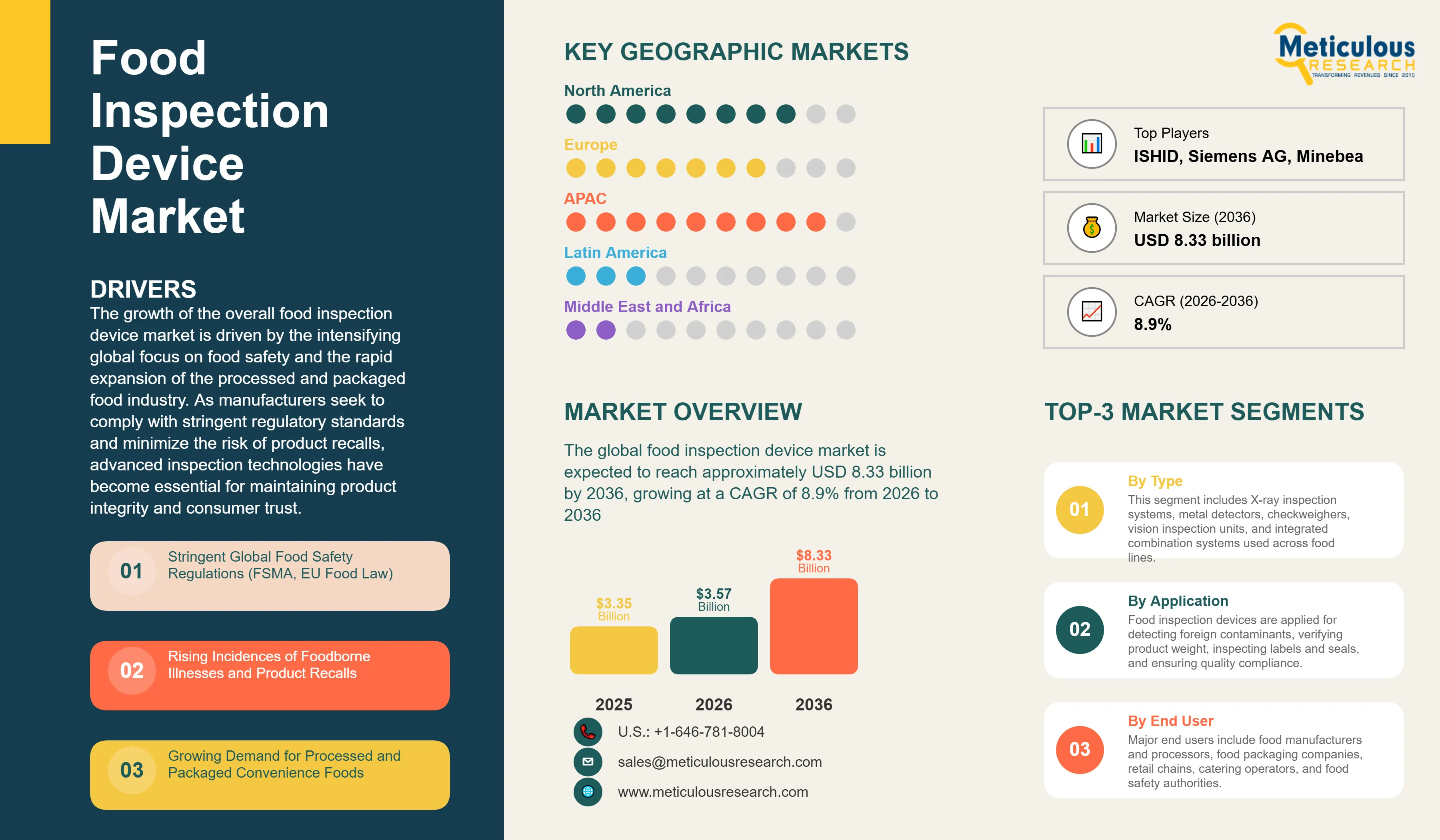

Report ID: MRFB - 1041705 Pages: 278 Feb-2026 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe global food inspection device market was valued at USD 3.35 billion in 2025. The market is expected to reach approximately USD 8.33 billion by 2036 from USD 3.57 billion in 2026, growing at a CAGR of 8.9% from 2026 to 2036. The growth of the overall food inspection device market is driven by the intensifying global focus on food safety and the rapid expansion of the processed and packaged food industry. As manufacturers seek to comply with stringent regulatory standards and minimize the risk of product recalls, advanced inspection technologies have become essential for maintaining product integrity and consumer trust. The rapid expansion of the catering and ready-to-eat sectors, coupled with the increasing need for high-precision contaminant detection and automated quality control solutions, continues to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Food inspection devices are critical quality assurance systems used to detect physical contaminants, verify product weight, and ensure label accuracy throughout the production process. These systems include X-ray units, metal detectors, checkweighers, and vision systems, which are designed to identify foreign objects such as metal, glass, bone, and plastic. The market is defined by high-efficiency technologies such as AI-powered vision systems and hyperspectral imaging, which significantly enhance detection accuracy and reduce false reject rates. These systems are indispensable for manufacturers seeking to optimize their operational efficiency and meet corporate compliance targets.

The market includes a diverse range of configurations, ranging from compact standalone units for small-scale production to massive integrated combination systems for high-speed packaging lines. These systems are increasingly integrated with advanced data analytics and cloud-based monitoring platforms to provide services such as real-time quality tracking and predictive maintenance. The ability to provide stable, high-precision detection while minimizing product waste has made advanced food inspection devices the technology of choice for industries where consumer safety and brand reputation are paramount.

The global food sector is pushing hard to modernize aging production lines, aiming to meet Industry 4.0 and smart factory targets. This drive has increased the adoption of automated inspection systems, with advanced AI-driven units helping to stabilize production yields. At the same time, the rapid growth in the ready-to-eat and convenience food markets is increasing the need for high-speed, multi-functional inspection solutions.

What are the Key Trends in the Food Inspection Device Market?

Proliferation of AI-Powered Inspection and Machine Learning

Manufacturers across the food industry are rapidly shifting to AI-powered inspection systems, moving well beyond traditional rule-based software toward smarter deep learning setups. Mettler-Toledo’s latest AI-driven vision systems deliver significantly higher detection rates for complex defects, while Ishida’s recent installations have slashed false rejects in high-speed snack packaging operations. The real game-changer comes with “smart” inspection systems featuring dynamic learning capabilities that maintain peak performance even when product characteristics or packaging materials change. These advancements make high-precision inspection practical and cost-effective for everyone from small-scale bakers to global beverage giants chasing operational excellence and lower waste.

Innovation in Multi-Technology Combination Systems

Innovation in multi-technology combination systems is rapidly driving the food inspection device market, as production lines become more compact and high-speed. Equipment suppliers are now designing units that combine checkweighing with metal detection or X-ray inspection in a single frame, saving valuable floor space and simplifying data integration. These systems often involve advanced digital signal processing capable of handling high-throughput lines without compromising sensitivity or accuracy.

At the same time, growing focus on end-to-end traceability is pushing manufacturers to develop inspection solutions tailored to digital supply chains. These systems help record and store inspection data for every individual pack, providing a “digital birth certificate” that supports rapid recall management and regulatory compliance. By combining high-sensitivity detection with robust data management, these new designs support both food safety and operational transparency, strengthening the resilience of the broader food value chain.

The global food inspection device market was valued at USD 3.35 billion in 2025. The market is expected to reach approximately USD 8.33 billion by 2036 from USD 3.57 billion in 2026, growing at a CAGR of 8.9% from 2026 to 2036.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 8.33 Billion |

|

Market Size in 2026 |

USD 3.57 Billion |

|

Market Size in 2025 |

USD 3.35 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 8.9% |

|

Dominating Region |

Asia-Pacific |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Product, Food Category, Vertical, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Stringent Food Safety Regulations and Consumer Awareness

A key driver of the food inspection device market is the rapid movement of the global food industry toward stricter safety standards and transparency. Global regulations requiring the prevention of food contamination have created significant incentives for the adoption of inspection technologies. The Food Safety Modernization Act (FSMA) in the U.S., the EU General Food Law, and China’s “Food Safety Law” drive manufacturers toward scalable solutions that automated inspection systems can uniquely provide. It is estimated that as consumer awareness of foodborne illnesses rises and safety audits become more frequent through 2036, the need for robust onsite inspection increases significantly; therefore, X-ray and metal detection systems, with their ability to ensure 100% product inspection, are considered a crucial enabler of modern food production strategies.

Opportunity: Digital Transformation and Industry 4.0 Integration

The rapid growth of digital transformation and Industry 4.0 provides great opportunities for the food inspection device market. Indeed, the global surge in smart manufacturing initiatives has created a compelling demand for systems that can integrate seamlessly into automated production environments. These applications require high reliability, real-time data connectivity, and the ability to handle high-speed processing, all attributes that are met with advanced inspection devices. The smart food factory market is set to expand significantly through 2036, with AI-driven inspection poised for an expanding share as operators seek to maximize yield and minimize downtime. Furthermore, the increasing demand for label accuracy and allergen control is stimulating demand for modular vision systems that provide high-speed verification and brand protection.

Why Do X-ray Inspection Systems Lead the Market?

The X-ray inspection systems segment accounts for a significant portion of the overall food inspection device market in 2026. This is mainly attributed to the versatile use of this technology in detecting a wide range of contaminants, including metal, glass, stone, and high-density plastics, even within metallic packaging. These systems offer the most comprehensive way to ensure product safety across diverse applications. The meat and dairy sectors alone consume a large share of X-ray production, with major projects in Asia Pacific and North America demonstrating the technology’s capability to handle complex, high-volume processing.

However, the vision inspection systems segment is expected to grow at a rapid CAGR during the forecast period, driven by the growing need for label verification, seal integrity checks, and aesthetic quality control. The ability to provide high-speed, non-contact inspection makes vision systems highly attractive for modern food packaging lines.

How Does the Meat, Poultry & Seafood Segment Dominate?

Based on food category, the meat, poultry & seafood segment holds the largest share of the overall market in 2026. This is primarily due to the inherent risks of physical contaminants such as bone fragments and the rigorous hygiene standards required in meat processing. Current large-scale processing plants are increasingly specifying integrated inspection lines to ensure compliance with global export standards and retailer requirements.

The catering & ready-to-eat meals segment is expected to witness the fastest growth during the forecast period. The shift toward convenience foods and the complexity of multi-component meals are pushing the requirement for advanced inspection systems that can handle varied textures and packaging formats while ensuring absolute safety for on-the-go consumers.

Why Do Food Manufacturers & Processors Lead the Market?

The food manufacturers & processors segment commands the largest share of the global food inspection device market in 2026. This dominance stems from their need for continuous, high-throughput inspection to detect contaminants like metals, bones, and foreign objects in raw and processed foods, ensuring compliance with stringent regulations such as FSMA and EU Food Law. Large-scale operations in meat, dairy, and ready-to-eat meal production drive demand, with integrated lines from suppliers like Mettler-Toledo and Thermo Fisher enabling real-time quality control amid rising foodborne illness recalls. However, The retail chains & hypermarkets segment is poised for the highest CAGR through 2036, fueled by expanding private-label production and in-store processing facilities. Retailers face mounting pressure to verify packaging integrity, weight accuracy, and label compliance at the point of sale, especially for fresh and packaged goods. The rise of omnichannel retail and e-commerce demands compact, AI-enhanced systems for end-of-line checks, with notable adoption in Asia-Pacific hypermarkets like those in India and China to minimize recalls and build consumer trust.

How is Asia Pacific Maintaining Dominance in the Global Food Inspection Device Market?

Asia Pacific holds the largest share of the global food inspection device market in 2026. The largest share of this region is primarily attributed to the massive industrialization and the presence of the world’s largest food manufacturing hubs, particularly in China and India. China alone accounts for a significant portion of global inspection device consumption, with its position as a leading exporter of processed foods driving sustained growth. The presence of leading manufacturers and a well-developed food supply chain provides a robust market for both standard and high-efficiency inspection solutions.

Which Factors Support North America and Europe Market Growth?

North America and Europe together account for a substantial share of the global food inspection device market. The growth of these markets is mainly driven by the need for technological modernization and the implementation of stringent food safety mandates. The demand for automated systems in North America is mainly due to its large-scale food automation projects and the presence of innovators like Thermo Fisher Scientific and JBT Corporation.

In Europe, the leadership in food quality standards and the push for sustainable production are driving the adoption of high-efficiency inspection units. Countries like Germany, France, and the UK are at the forefront, with significant focus on integrating smart inspection devices into digital factory environments to ensure the highest levels of consumer protection.

The companies such as Mettler-Toledo International Inc., Thermo Fisher Scientific Inc., ISHIDA CO., LTD., and Anritsu Corporation lead the global food inspection device market with a comprehensive range of detection and weighing solutions, particularly for large-scale industrial and high-speed applications. Meanwhile, players including Loma Systems (ITW), Bizerba SE & Co. KG, Minebea Intec, and JBT Corporation focus on specialized X-ray, metal detection, and vision systems targeting the meat, dairy, and bakery sectors. Emerging manufacturers and integrated players such as Heat and Control, Inc., Mekitec, and Sesotec GmbH are strengthening the market through innovations in AI-driven software and modular inspection platforms.

The global food inspection device market is expected to grow from USD 3.57 billion in 2026 to USD 8.33 billion by 2036.

The global food inspection device market is projected to grow at a CAGR of 8.9% from 2026 to 2036.

X-ray inspection systems are expected to dominate the market in 2026 due to their superior ability to detect physical contaminants, packaging defects, and foreign materials across multiple food formats. However, Vision inspection systems integrated with AI are projected to be the fastest-growing segment owing to their increasing adoption for label verification, defect detection, and quality grading in automated food processing lines.

AI and machine learning are transforming food inspection by enabling real-time defect recognition, predictive quality control, and automated anomaly detection. These technologies significantly reduce false rejects, improve contamination detection accuracy, and allow food manufacturers to optimize production efficiency through data-driven insights and self-learning inspection algorithms.

Asia Pacific holds the largest share of the global food inspection device market in 2026. The largest share of this region is primarily attributed to the massive industrialization and the presence of the world’s largest food manufacturing hubs, particularly in China and India. North America and Europe together account for a substantial share of the global food inspection device market. The growth of these markets is mainly driven by the need for technological modernization and the implementation of stringent food safety mandates.

The leading companies include Mettler-Toledo International Inc., Thermo Fisher Scientific Inc., ISHIDA CO., LTD., Anritsu Corporation, Loma Systems (ITW), Bizerba SE & Co. KG, Minebea Intec, JBT Corporation, Heat and Control, Inc., and Sesotec GmbH. These companies offer a broad portfolio of X-ray systems, metal detectors, checkweighers, vision inspection, and microbial detection solutions.

The key drivers include stringent global food safety regulations (FSMA, EU Food Law), increasing food recalls, rising incidences of foodborne illnesses, growing demand for packaged and convenience foods, and the integration of Industry 4.0 and digital traceability in food manufacturing.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, by Product

3.3. Market Analysis, by Food Category

3.4. Market Analysis, by Vertical

3.5. Market Analysis, by Geography

3.6. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global Food Inspection Device Market: Impact Analysis of Market Drivers (2026–2036)

4.2.1. Stringent Global Food Safety Regulations (FSMA, EU Food Law)

4.2.2. Rising Incidences of Foodborne Illnesses and Product Recalls

4.2.3. Growing Demand for Processed and Packaged Convenience Foods

4.3. Global Food Inspection Device Market: Impact Analysis of Market Restraints (2026–2036)

4.3.1. High Initial Capital Expenditure (CAPEX) for Advanced Systems

4.3.2. Technical Challenges in Inspecting Diverse and Complex Food Matrices

4.4. Global Food Inspection Device Market: Impact Analysis of Market Opportunities (2026–2036)

4.4.1. Integration of AI and Machine Learning for Predictive Quality Control

4.4.2. Expansion of Food Processing Industries in Emerging Economies

4.5. Global Food Inspection Device Market: Impact Analysis of Market Challenges (2026–2036)

4.5.1. Difficulty in Detecting Low-Density Contaminants in Complex Packaging

4.5.2. Shortage of Skilled Personnel to Operate Sophisticated Inspection Units

4.6. Global Food Inspection Device Market: Impact Analysis of Market Trends (2026–2036)

4.6.1. Proliferation of AI-Powered Inspection and Machine Learning

4.6.2. Innovation in Multi-Technology Combination Systems

4.7. Porter’s Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. The Impact of Digital Transformation and Industry 4.0 on the Global Food Inspection Device Market

5.1. Introduction to Smart Food Manufacturing

5.2. Role of Automated Inspection in Reducing Food Waste

5.3. Digital Traceability: From Farm to Fork Inspection Data

5.4. Cloud-Based Analytics and Remote Monitoring of Inspection Lines

5.5. Regulatory Landscape and Digital Compliance Standards

6. Global Food Inspection Device Market, by Product

6.1. Introduction

6.2. X-ray Inspection Systems

6.3. Metal Detectors

6.4. Checkweighers

6.5. Vision Inspection Systems

6.6. Microbial Detection Systems

6.7. Spectroscopy Devices

6.8. Other Devices (Seal Testers, Leak Detectors)

7. Global Food Inspection Device Market, by Food Category

7.1. Introduction

7.2. Meat, Poultry & Seafood

7.3. Dairy Products

7.4. Bakery & Confectionery

7.5. Fruits & Vegetables

7.6. Beverages

7.7. Catering & Ready-to-Eat Meals

7.8. Other Food Categories

8. Global Food Inspection Device Market, by Vertical

8.1. Introduction

8.2. Food Manufacturers & Processors

8.3. Food Packaging Companies

8.4. Retail Chains & Hypermarkets

8.5. Government Agencies & Food Safety Authorities

9. Global Food Inspection Device Market, by Geography

9.1. Introduction

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.3.6. Poland

9.3.7. NORDICS

9.3.8. Rest of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. India

9.4.3. Japan

9.4.4. South Korea

9.4.5. Indonesia

9.4.6. Thailand

9.4.7. Australia

9.4.8. Vietnam

9.4.9. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Argentina

9.5.4. Rest of Latin America

9.6. Middle East & Africa

9.6.1. Saudi Arabia

9.6.2. UAE

9.6.3. South Africa

9.6.4. Rest of Middle East and Africa

10. Competitive Landscape

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Ranking/Positioning Analysis of Key Players, 2024

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments)

11.1. Mettler-Toledo International Inc.

11.2. Thermo Fisher Scientific Inc.

11.3. ISHIDA CO., LTD.

11.4. Anritsu Corporation

11.5. Loma Systems (ITW)

11.6. Bizerba SE & Co. KG

11.7. Minebea Intec

11.8. JBT Corporation

11.9. Heat and Control, Inc.

11.10. Sesotec GmbH

11.11. Fortress Technology Inc.

11.12. Multivac Group

11.13. Eagle Product Inspection

11.14. Siemens AG

11.15. GE Inspection Technologies

12. Appendix

12.1. Questionnaire

12.2. Available Customization

Published Date: Jan-2025

Published Date: Jun-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates