Resources

About Us

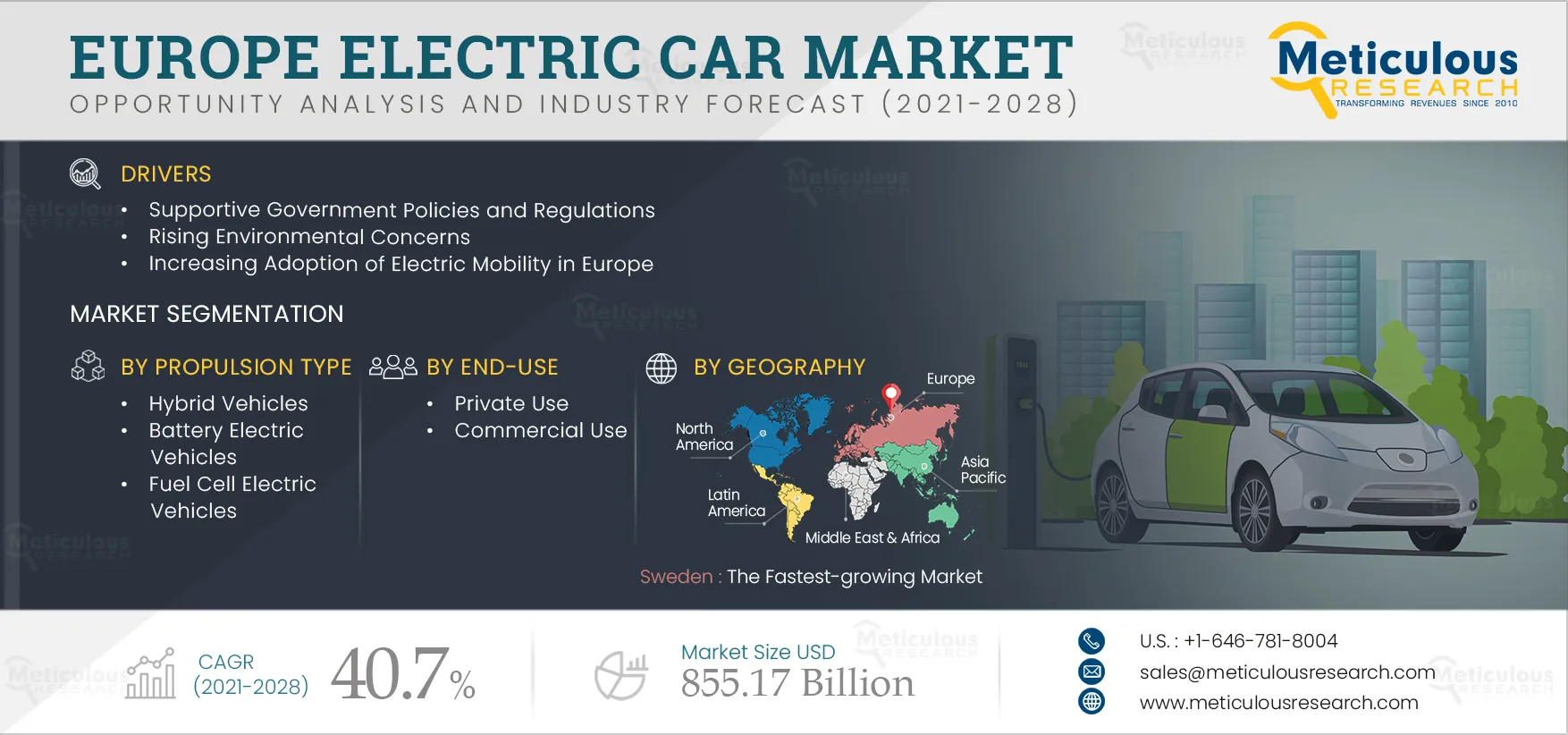

Europe Electric Car Market by Propulsion Type (BEV, FCEV, PHEV, HEV), Power Output (Less Than 100kW, 100 kW to 250 kW), End Use (Private, Commercial), and Geography - Forecast to 2028

Report ID: MRAUTO - 104522 Pages: 134 Dec-2021 Formats*: PDF Category: Automotive and Transportation Delivery: 2 to 4 Hours Download Free Sample ReportSupportive government policies and regulations, rising environmental concerns, and increasing adoption of electric mobility in Europe are the key factors driving the growth of the European electric cars market. The growing adoption of autonomous driving vehicles and the increasing trend of shared mobility provides significant growth opportunities for market players in the coming years.

The outbreak of COVID-19 slowed down vehicle sales in Europe in 2020, including electric cars. The COVID-19 crisis led to disrupted supply chains, limited operations and workforce, and factory closures. This caused a severe decline in vehicle sales in Europe, especially in the electric vehicles segment. Consumer behavior has changed significantly since the pandemic. People have reduced the use of shared mobility services, and the total miles driven have also decreased due to remote working in most industries.

In Europe, during the lockdown, manufacturing facilities, supply chains, and consumer demands were paralyzed in the first half of 2020. However, the European electric cars market is moderately affected due to the strong policy support as 2020 was an important target year for emissions standards. The government supported the automotive industry by regulating policies that benefitted both consumers and manufacturers. Incentives and subsidies were notably increased on purchasing an electric car in Germany, the U.K., and Norway. Besides, the prices for batteries continued to reduce, which helped increase the adoption rate of electric cars in the region. In Europe, around 1,176,000 battery-electric and plug-in hybrid electric cars were sold in 2020. The sale of electric cars doubled in 2020, as compared to the previous year. Developed countries such as Germany, France, the U.K., and Norway commanded most of the stakes in this sale. Thus, the market is anticipated to grow significantly in the forecast period.

Click here to: Get Free Sample Pages of this Report

EVs have witnessed rapid evolution with the ongoing developments in the automotive sector. The rising consumer preference for shared mobility, growing adoption of mobility-as-a-service (MaaS), declining costs of high capacity batteries, and significant investment by EV manufacturers are fueling electric mobility adoption in emerging regions. Several companies are focusing on the development of innovative solutions for electric mobility and charging infrastructure. In 2020, Groupe Renault (U.K.) launched its INCIT-EV project, specifically for electromobility. The company offered innovative wireless charging solutions for EVs across Europe under this 48-month initiative. The project will focus on low-power bidirectional charging and static wireless charging in taxi lanes located at airports and central stations in Zaragoza, Spain.

Government supportive incentives in the form of tax reductions and grants for residential and commercial infrastructure encourage the adoption of electric mobility. For instance, in the Netherlands and Greece, the government offers incentives for purchasing and installing residential charging stations. It provides a deduction of up to 36% and a tax return of up to 75% on costs associated with purchasing and installing charging stations. The Finnish government announced an investment of approximately USD 6.57 million to expand charging infrastructure during 2020 and 2021. These developments are expected to support the growth of EVs in Europe in the coming years.

Based on propulsion type, the hybrid vehicles segment is estimated to account for the largest share of the European electric cars market in 2021. However, the fuel cell electric vehicles segment is projected to grow at the highest CAGR during the forecast period. The rapid growth of this segment is mainly attributed to various advantages of electric cars such as fast refueling, zero tailpipe emissions, lighter and smaller battery pack, rising government initiatives for setting up hydrogen fuel cell charging stations, and increasing investments by leading automotive OEMs in the research and development of hydrogen fuel cell technology.

Based on power output, the less than 100 kW segment is estimated to account for the largest share of the European electric cars market in 2021. However, the 100 kW to 250 kW segment is projected to grow at the highest CAGR during the forecast period. The rapid growth of this segment is mainly attributed to the increasing initiatives by leading automotive OEMs to introduce more powerful electric cars, increasing regulations to reduce tailpipe emissions and rising adoption of electric cars in developed economies

Based on end use, the private use segment is estimated to account for the largest share of the European electric cars market in 2021. However, the commercial use segment is projected to grow at the highest CAGR during the forecast period. The rapid growth of this segment is mainly attributed to the increasing use of electric cars in shared mobility services and corporate taxi fleets, increasing regulations to reduce fleet emissions, and encouragement by global and state-level regulatory bodies to deploy policies promoting the adoption of electric cars for mobility services.

Sweden is expected to witness the fastest growth during the forecast period. The factors attributed to the high growth of this country are growing consumer interests in buying electric cars over conventional diesel-powered cars and growing government support for increasing electric car sales across the country. Sweden is one of the leading European countries to ban diesel-powered vehicles and adopt electric mobility. In 2020, Sweden recorded a sale of 56,559 fully-electric or plug-in hybrids across the country, in which Volkswagen ID.3 remained the highest sold model accounting for the sale of 4,009 units. Plugin hybrid electric cars accounted for 30.1%, followed by battery electric cars (19.2%) of the total car sales in Sweden.

By Volume, Italy is projected to grow at the highest CAGR during the forecast period. Major factors attributed to the high growth of this country are government incentives for adopting electric vehicles, major automotive OEMs heavily investing in developing the electric mobility ecosystem, and stakeholders of electric mobility in Italy increasingly investing in the development of fast charging infrastructure across the country. Italy is actively investing in promoting the rapid adoption of electric mobility. The Government of Italy has planned to have 1 million electric cars on roads by 2022. The cost of transition to electric mobility is estimated at approximately EUR 10 billion, and government incentives for adopting electric vehicles would be around USD 10,000 per car. Moreover, Italy has announced plans to ban diesel vehicles by 2024. These factors support the high adoption of electric cars in Italy.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategies adopted by the leading market participants in the European electric cars market over the last four years. The key players profiled in the European electric cars market are AB Volvo (Sweden), Alcraft Motor Company Ltd.,(U.K.), BMW Group (Germany), BYD Company Ltd. (China), Daimler AG (Germany), Ford Motor Company (U.S.), General Motors Company (U.S.), Honda Motor Co., Ltd. (Japan), Hyundai Motor Company (South Korea), Nissan Motor Co., Ltd. (Japan), Mitsubishi Motors Corporation (Japan), Tesla, Inc. (U.S.), Volkswagen AG (Germany), Toyota Motor Company (Japan), and Groupe Renault (France).

Scope of the Report

European Electric Car Market, by Propulsion Type

European Electric Car Market, by Power Output

European Electric Cars Market, by End-Use

European Electric Car Market, by Geography

Key Questions Answered in the Report:

Published Date: Jun-2024

Published Date: Apr-2024

Published Date: Jul-2023

Published Date: Jan-2022

Published Date: Jun-2021

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates