Resources

About Us

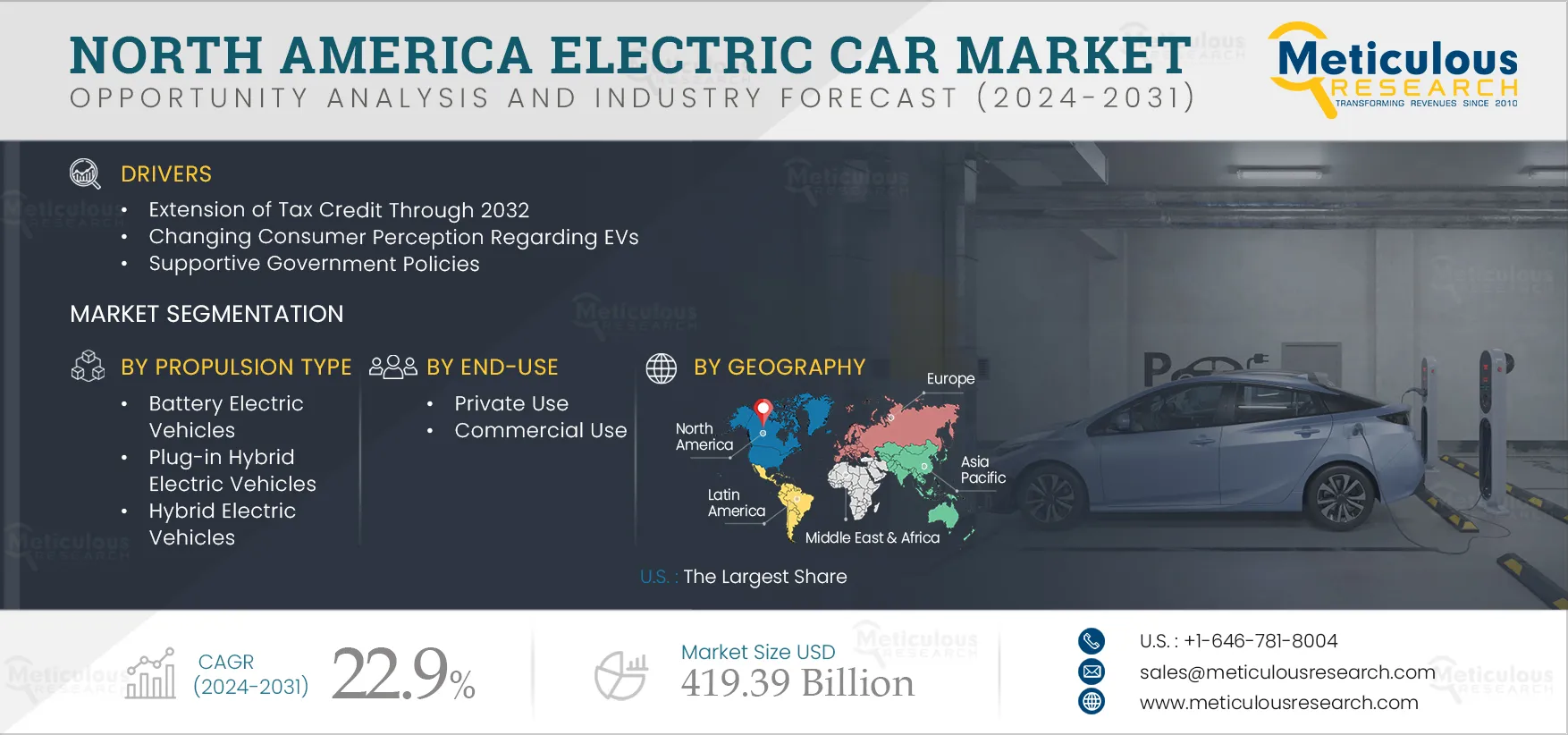

North America Electric Car Market Size, Share, Forecast, & Trends Analysis by Propulsion Type (BEV, PHEV, HEV), Power Output (Less than 100kW, 100 kW to 250 kW, More than 250 kW), End Use (Private, Commercial) - Forecast to 2031

Report ID: MRAUTO - 104525 Pages: 200 Apr-2024 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 48 Hours Download Free Sample ReportThe North America Electric Car Market is expected to reach $419.39 billion by 2031, at a CAGR of 22.9% from 2024 to 2031, while in terms of volume, the market is expected to reach 9.4 million units by 2031, at a CAGR of 20.3% from 2024 to 2031. The growth of this market can be attributed to several factors, such as the extension of the tax credit through 2032 in the U.S., changing consumer perception regarding EVs, and supportive government policies. Moreover, the creation of new occupations and job roles, improvements in battery technology, and range improvements are expected to offer growth opportunities for the players operating in this market.

Consumer demand is a significant factor driving EV growth. As the barriers to adoption are rapidly being removed, eMobility is increasingly becoming a realistic and viable option. Improved battery technology has increased the driving range of EVs while prices have been supported by numerous subsidies and incentives by government.

Utilities are taking proactive steps to support the EV ecosystem and encourage EV adoption. This includes investing in charging infrastructure, offering special rates and incentives for EV owners, and partnering with automakers to promote EVs. Energy providers are also exploring new business models to integrate EVs into the grid and manage their impact on the electricity network.

According to a study conducted by the Consumer Federation of America, the percentage of the U.S. population aware of the benefits of EVs increased from 67% in 2020 to 75% in 2022. People's inclination to purchase EVs is also on the rise. In 2022, approximately 20% of the people in the U.S. are inclined toward purchasing an EV as their next car, up from 16% in 2020.

Consumers are generally optimistic about the future of the EV market. In addition, the increasing investments in charging infrastructure will further enable favorable shifts in consumer preference towards EVs. Such developments will support the market growth of North America Electric Car during the forecast period.

The increasing government regulations to phase out fossil fuel-powered vehicles, government investments for improving public EV charging infrastructure, and initiatives in the form of subsidies & tax rebates for the adoption of electric cars are expected to support this market growth. The US government has set a goal to make 50% of all new vehicles sold in the country by 2030 zero-emissions vehicles. Such policies are creating a sense of urgency and driving the adoption of EVs. Ford, GM, and Stellantis have expressed their support and announced in a joint statement that they are aiming for 40 – 50% electric sales by 2030.

The Bipartisan Infrastructure Law (BIL) represents a historic investment in U.S. infrastructure. It aims to address climate change by building a national network of EV charging points and expanding the domestic EV industry. Under the BIL, the federal government has allocated $7.5 Bn to EV charging, $10 Bn to clean transportation, and $7 Bn to EV component manufacturing. Moreover, the Department of Energy will also allocate $2 Bn to support domestic manufacturing of EVs in the U.S. This funding focuses on cost-shared grants for refurbishing or retooling facilities producing various types of EVs.

On the demand side, the Inflation Reduction Act (IRA) has reinstated a $7,500 consumer tax credit for EV purchases and expanded the umbrella of credit for both new and used EVs. It also supports electrifying heavy-duty vehicles and funds EV charging infrastructure. To qualify, vehicles must meet specific requirements, such as having undergone final assembly in North America. Moreover, several states are implementing policies to enable low-income and disadvantaged communities to access the growing EV market. For example, Virginia recently introduced a rebate program to help low-income customers purchase new or used EVs. This rebate program allows for a $2,500 rebate at the time of purchase for both buyers and leasers, with an additional $2,000 rebate toward either a new EV or $500 toward a used EV for low-income customers. Such policies will support the market growth during the forecast period.

Click here to: Get a Free Sample Copy of this report

Contract manufacturing is becoming an increasingly important strategy for EV manufacturers looking to reduce costs and scalability, improve efficiency, and stay competitive in a rapidly changing market. These companies are primarily in contract manufacturing of various automobile components; however, they are willing to bring in complete EV manufacturing capability. These companies are exploring opportunities to start contract manufacturing of complete electric vehicles.

Benefits of contract manufacturing include a reduction in the production cost of EV OEMs by outsourcing the production of components or entire vehicles to companies with specialized expertise and economies of scale. Contract manufacturing allows EV manufacturers to speed up their time to market by leveraging the expertise and resources of their partners. Contract manufacturing allows EV manufacturers to scale up or down their production as needed without making large investments in manufacturing infrastructure. Scalability can significantly reduce the indirect cost of production.

Contract EV manufacturing is still in its nascent stage, and companies are exploring engagement opportunities with automobile companies. However, it has the potential to rapidly grow and support the ongoing transition in the automobile sector from ICE to EVs. Contract manufacturing can efficiently address prominent issues related to EV manufacturing, such as high R&D costs, scalability, profitability, and sustainability.

The rapid growth of electric vehicles is expected to generate demand for labor in three main areas: the design and development of electric vehicle models, the production of batteries that power them, and the installation and maintenance of charging infrastructure. Some of the occupations that will play pivotal roles in the design and development of electric cars are computer and engineering occupations. Computer occupations create or support computer applications and networks, while engineers design and develop structures or products. Designing an electric car may involve the contributions of several types of engineers. For example, some engineers design the mechanical parts of the car, such as the brakes or motor. Others may develop safety systems, like blind spot and collision alert systems, and the cameras and sensors that enable them. Still, other engineers may specialize in electric battery technologies. Software developers and other computer occupations develop an electric car’s software and computer hardware.

According to the U.S. Bureau of Labor Statistics, employment of software developers, electrical engineers, electronics engineers, chemical engineers, urban and regional planners, and electrical power-line installers and repairers is expected to grow by 26.0%, 1.6%, 6.0%, 13.9%, 3.8%, and 3.2% respectively from 2021 to 2031. Such growth in employment opportunities will support the growth and adoption of electric cars in North America during the forecast period.

In 2024, the battery electric vehicles segment is expected to account for the largest share of approximately 65.0% of the North America electric car market. The growth of this segment is attributed to the increasingly stringent emission standards, rising demand for increased fuel efficiency, growing demand for zero-emission vehicles, and a continuous reduction in battery prices. In addition, increasing initiatives by local government bodies and automotive players for developing BEVs, the proliferation of fast & ultra-fast charging technologies, and increasing acceptance due to reduced noise & vibrations with no emissions drive the BEVs market.

However, the plug-in hybrid electric vehicles segment is projected to witness the highest growth rate of approximately 28.1% during the forecast period of 2024–2031. The growth of this segment is attributed to the supportive government initiatives for promoting the adoption of hybrid vehicles, increasingly stringent emission norms, and the growing need for improved fuel efficiency. PHEVs offer relatively lower lifecycle costs than hydrogen fuel cell cars and internal combustion engine (ICE) cars. Also, these vehicles emit less greenhouse gases, making them more environment-friendly than regular gasoline-powered cars.

In 2024, the less than 100kW segment is expected to account for the largest share of approximately 60.0% of the North America electric car market. This segment's large share is mainly attributed to the increasing usage of light electric cars in the central business districts of major cities, demand for electric cars for shared mobility services in the major cities, and falling battery prices.

In 2024, the private use segment is expected to account for the largest share of approximately 85.3% of the North America electric car market. The segment’s large share is mainly attributed to increasing consumer demand for fuel-efficient and zero tailpipe emission vehicles, major incentive plans by the government, low taxes, reduction in battery costs, and high fuel prices.

However, the commercial use segment is projected to witness the highest growth rate of approximately 28.4% during the forecast period of 2024–2031. The growth of this segment is attributed to the increasing use of electric cars in shared mobility services and corporate taxi fleets, increasing regulations to reduce fleet emissions, growing adoption of mobility-as-a-service (MaaS), and growing demand for energy-efficient commuting, increasing fuel prices, and encouragement by global and state-level regulatory bodies to deploy policies promoting the adoption of electric cars for mobility services.

In 2024, the U.S. is expected to account for the largest share of approximately 88.9% of the North America Electric car market, followed by Canada. The large share of this country is mainly attributed to the greater availability of electric car models, the growing number of mass-premium buyers shifting from gasoline cars to electric cars, the increasing adoption of electric cars, and investment by automotive OEMs. The U.S. has always been at the forefront of innovative technology adoption, including electric cars globally. The state and local governments are supporting the growth of the electric car market with attractive incentives and subsidy schemes. States such as California, Colorado, New Jersey, and Washington State are at the forefront of electric car adoption.

Moreover, the market in Canada is slated to register the highest growth rate of approximately 32.4% during the forecast period. The Canadian government has introduced numerous policies and incentive programs to increase the adoption of electric cars and reduce transportation emissions in the coming years. The authorities have set targets to achieve 100% zero-emission vehicle sales by 2040. Accordingly, the Canadian government has set targets for automotive OEMs to increase the share of electric cars in new vehicle sales to 10% by 2025, 30% by 2030, and 100% by 2040. The Canadian government has also rolled out attractive incentive plans for consumers purchasing EVs in Canada.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the North America Electric car market are Tesla, Inc. (U.S.), General Motors Company (U.S.), Ford Motor Company (U.S.), Rivian, LLC (U.S.), Bollinger Motors Inc. (U.S.), Alcraft Motor Company Ltd., (U.K.), Nissan Motor Co., Ltd. (Japan), NIO Inc. (China), AB Volvo (Sweden), and Groupe Renault (France).

In February 2024, AB Volvo acquired the battery business from Proterra Inc. and Proterra Operating Company Inc. for $210 million. The acquisition includes a development center for battery modules and packs in California and an assembly factory in Greer, South Carolina.

In November 2023, General Motors signed a strategic partnership agreement with Niron Magnetics to co-develop Clean Earth Magnet motor technology that can be used in future GM EVs.

|

Particulars |

Details |

|

Number of Pages |

200 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

22.9% |

|

Market Size (Value) |

USD 419.39 Billion by 2031 |

|

Segments Covered |

By Propulsion Type

By Power Output

By End User

|

|

Countries Covered |

U.S., Canada |

|

Key Companies |

Tesla, Inc. (U.S.), General Motors Company (U.S.), Ford Motor Company (U.S.), Rivian, LLC (U.S.), Bollinger Motors Inc. (U.S.), Alcraft Motor Company Ltd., (U.K.), Nissan Motor Co., Ltd. (Japan), NIO Inc. (China), AB Volvo (Sweden), and Groupe Renault (France). |

The North America Electric Car Market is segmented based on Propulsion type, power output, and end use. Based on propulsion type, the North America Electric car market is segmented into battery electric vehicles, plug-in hybrid electric vehicles, and hybrid electric vehicles. Based on power output, the North America Electric car market is segmented into less than 100kW, 100kW to 250kW, and more than 250kW. Based on end use, the North America Electric car market is segmented into private use and commercial use.

The North America Electric Car Market is projected to reach $419.39 billion by 2031, at a CAGR of 22.9% during the forecast period.

The battery electric vehicle segment is expected to account for the largest share of the North America electric car market.

The less than 100kW segment is expected to account for the largest share, approximately 28% of the North American Electric Car Market.

The growth of the North America Electric Car Market is driven by the extension of the tax credit through 2032 in the U.S., changing consumer perception regarding EVs, and supportive government policies.

Tesla, Inc. (U.S.), General Motors Company (U.S.), Ford Motor Company (U.S.), Rivian, LLC (U.S.), Bollinger Motors Inc. (U.S.), Alcraft Motor Company Ltd., (U.K.), Nissan Motor Co., Ltd. (Japan), NIO Inc. (China), AB Volvo (Sweden), and Groupe Renault (France).

Canada is slated to register the highest growth rate of approximately 32.4% during the forecast period.

Published Date: Jun-2024

Published Date: Aug-2023

Published Date: Dec-2021

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates