Resources

About Us

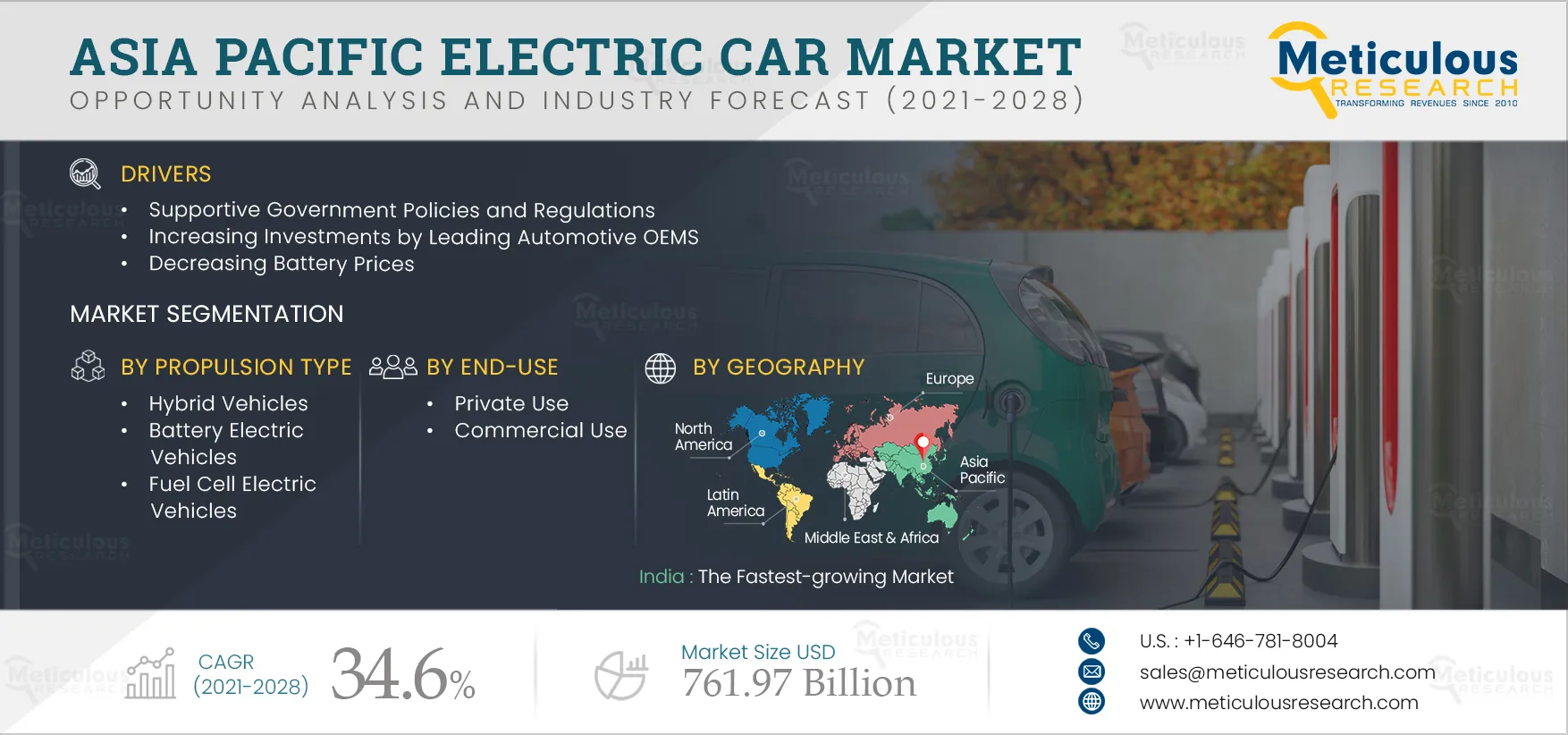

Asia-Pacific Electric Car Market by Propulsion Type (BEV, FCEV, PHEV, HEV), Power Output (Less Than 100kW, 100 kW to 250 kW), End Use (Private, Commercial), and Geography - Forecast to 2028

Report ID: MRAUTO - 104524 Pages: 105 Jan-2022 Formats*: PDF Category: Automotive and Transportation Delivery: 2 to 4 Hours Download Free Sample ReportThe Asia-Pacific Electric Car Market is expected to reach a value of $761.97 billion by 2028, at a CAGR of 34.6 % during the forecast period 2021-2028. By volume, this market is expected to grow at a CAGR of 40.4% from 2021 to reach 53.8 million units by 2028. Supportive government policies and regulations, increasing investments by leading automotive OEMs, and decreasing battery prices are the key factors driving the growth of the Asia-Pacific electric cars market. Increasing adoption of electric mobility in emerging economies and increasing EV and battery manufacturing capabilities in Southeast Asia provides significant growth opportunities for market players in the coming years.

The Impact of COVID-19 on the Asia-Pacific Electric Car Market

The Asia-Pacific electric cars market was moderately affected due to the quick recovery of automotive manufacturing industries in China. The developing countries witnessed a sharp decline in their economy due to low consumer demands and increased prices for essential commodities. The adoption of electric cars has also decreased significantly. The high cost of electric cars also remained a restraining factor for the growth of the electric cars market in these countries. However, stringent government regulations in phasing out ICE vehicles till 2030 are expected to support the market's growth during the forecast period.

In Thailand, the government has introduced an EV roadmap to produce about 250,000 electric cars and establish itself as an Asian EV hub by 2025. Moreover, the tax incentives provided by the government on purchasing electric cars are poised to increase the adoption rate in a couple of years, thus supporting the market growth during the forecast period.

Increasing EV and battery manufacturing capabilities in Southeast Asia to Drive the Growth of this Market in the Coming Years

The supply chain diversification trend is the major driver for the Southeast Asian automotive industry. In this region, Thailand is one of the largest automotive manufacturers due to its well-established automotive manufacturing know-how, policy package, and strategic location that makes a perfect diversification option for the automotive industry, including the strategic EV manufacturing sector. In 2020, the Southeast Asian automotive industry was badly hit by coronavirus pandemic, it aimed to seize the opportunity of the rising EV manufacturing sector, but investments by foreign investors have strengthened the EV market of this region. As of 2020, the Board of Investment of Thailand (BOI) has approved 24 projects by the automotive industry to produce several types of electric vehicles in the country with a capacity of over 500,000 units annually. Further, in 2020, according to the Thai government, the BOI aimed to encourage EV production that will account for 30% of the total Thai automotive production by 2030. Thus, increasing government initiatives are expected to overcome this challenge in the coming years.

Click here to: Get Free Sample Pages of this Report

Key Findings in the Asia-Pacific Electric Car Market Study:

The fuel cell electric vehicles segment is projected to grow at a significant pace during the forecast period

Based on propulsion type, the hybrid vehicles segment is estimated to account for the largest share of the Asia-Pacific electric cars market in 2021. However, the fuel cell electric vehicles segment is projected to grow at the highest CAGR during the forecast period. The rapid growth of this segment is mainly attributed to fast refueling, zero tailpipe emissions, smaller battery pack, various government initiatives for setting up hydrogen fuel cell charging stations, and increasing investments by leading automotive OEMs in the research and development of hydrogen fuel cell technology.

The 100kW to 250 kW segment is projected to grow at a significant pace during the forecast period

Based on power output, the less than 100 kW segment is estimated to account for the largest share of the Asia-Pacific electric cars market in 2021. However, the 100 kW to 250 kW segment is projected to grow at the highest CAGR during the forecast period. The rapid growth of this segment is mainly attributed to the increasing initiatives by leading automotive OEMs to introduce electric cars, increasing regulations and laws to reduce tailpipe emissions and rising adoption of electric cars in developed economies.

The commercial use segment is projected to grow at a significant pace during the forecast period

Based on end use, the private use segment is estimated to account for the largest share of the Asia-Pacific electric cars market in 2021. However, the commercial use segment is projected to grow at the highest CAGR during the forecast period. The rapid growth of this segment is mainly attributed to the increasing use of electric cars in shared mobility services and corporate taxi fleets, increasing regulations to reduce fleet emissions, and encouragement by global and state-level regulatory bodies to deploy policies promoting the adoption of electric cars for mobility services.

India to be the fastest-growing market by value and by volume, Singapore to be the fastest-growing market

However, India is estimated to account for the fastest growth during the forecast period. The factors attributed to the high growth of this country are growing investments by the leading automobile companies in the electric mobility ecosystem, the increasing number of start-ups operating in the electric mobility and associated technologies industry, and the growing need of government to reduce the pollution caused by combustion engine vehicles. India is considered one of the fastest-growing consumer markets in the world. The Indian government has also introduced fiscal incentives such as reduction of customs duty on import of EV components to 10-15%, reduction of GST on EV reduced to 5% from 12%, lowest RTO tax for EVs, and elimination of the requirement of a license to operate EV charging stations. Moreover, leading automotive OEMs are increasingly investing in the development of electric vehicle technology in India. For instance, Mahindra and Mahindra Ltd. has plans to invest USD 400 million (INFR 3,000 Crore) in developing an EV platform over the next three years. Such initiatives are expected to support the growth of the electric cars market in India during the forecast period.

By Volume, Singapore is projected to grow at the highest CAGR during the forecast period. Major factors attributed to the high growth of this country are the investment by major automotive OEMs and various government initiatives to boost the demand for electric cars. Major automotive OEMs worldwide have started investing in Singapore for the manufacturing of electric cars. For instance, in 2020, Hyundai Motor Company invested USD 295 million to construct a research and development center in Singapore to house a small-scale electric vehicle production facility. The facility may produce up to 30,000 electric vehicles (EVs) annually by 2025. These developments are expected to support the growth of the electric cars market in Singapore during the forecast period.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategies adopted by the leading market participants in the Asia-Pacific electric cars market over the last four years. The key players profiled in the Asia-Pacific electric cars market are Hyundai Motor Company (South Korea), Honda Motor Co., Ltd. (Japan), Toyota Motor Corporation (Japan), Tata Motors Limited (India), Mahindra and Mahindra Ltd. (India), NIO Inc. (China), XPeng Inc. (China), Geely Automobile Holdings Limited (China), Nissan Motor Co., Ltd. (Japan), and Mitsubishi Motor Corporation (Japan).

Scope of the Report

APAC Electric Car Market, by Propulsion Type

APAC Electric Car Market, by Power Output

APAC Electric Car Market, by End-Use

APAC Electric Car Market, by Geography

Key Questions Answered in the Report:

Published Date: Jun-2024

Published Date: Jul-2022

Published Date: May-2022

Published Date: Dec-2021

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates