Resources

About Us

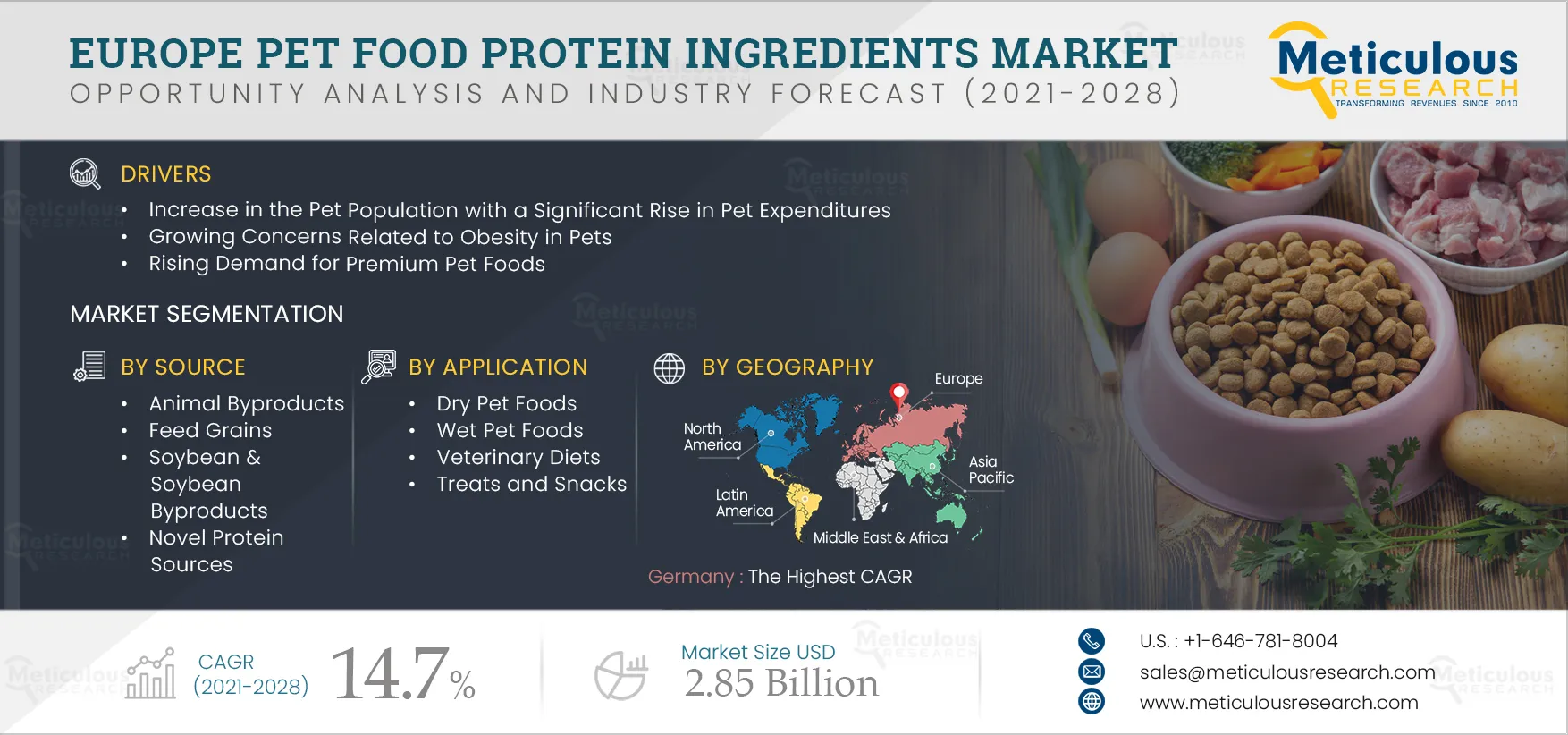

Europe Pet Food Protein Ingredients Market by Source (Animal By Products, Feed Grains, Soybean Byproducts, and Novel Proteins) and Application (Dry Foods, Wet Foods, Veterinary Diets, and Treats and Snacks) - Forecast to 2028

Report ID: MRFB - 104516 Pages: 142 Sep-2021 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportThe Pet Food Protein Ingredients Market in Europe is expected to reach $2.85 billion by 2028, at a CAGR of 14.7% during the forecast period (2021–2028). Major factors driving the growth of this market include increasing awareness regarding the benefits of protein intake for pets, an increase in the pet population with a significant rise in expenditure for pets, and the rising demand for premium pet foods. Additionally, growing consumer interest in novel protein-based nutrition is expected to offer significant growth opportunities for the pet food protein ingredients manufacturers operating in Europe. However, fluctuating raw material prices and a reduction in free trade in Europe are expected to hinder the growth of this market. Also, regulatory structures and interventions, huge capital investments required for pet food production, and the risk of counterfeit pet food products are expected to pose challenges to the growth of the pet food protein ingredients market in Europe.

Consumers’ Growing Focus on Providing Pets with Balanced Protein-rich Diets During the COVID-19 Pandemic Expected to Drive the Growth of the Pet Food Protein Ingredients Market in Europe

The COVID-19 pandemic has been a considerable disruptor for the pet food supply chain in Europe. The pandemic impacted the pet food protein ingredients industry by affecting production and investments and disrupting supply chains. However, increased demand for pet food products was observed among European consumers during the COVID-19 pandemic. According to the European Pet Food Industry Federation, the European pet food market grew by 10.2% between 2019 and 2020. Rising pet ownership, pet humanization, and a consistent increase in spending on pets also contributed to the market’s growth. To address the growing demand, market players have shifted their focus from retail stores to e-commerce, investing in developing their own websites. Some of the online retailers reported strong sales figures in their recent earnings releases. For instance, in 2020, Zooplus (Germany) reported a 21% rise in sales compared to 2019 due to increased demand from existing customers and a stable inflow of new customers. For Nestlé, pet care was the best-performing product category, with a sales growth of 14% between 2019 and 2020, contributing to around half of the group’s organic sales growth. Thus, increasing pet food sales are expected to boost the demand for protein ingredients in the coming years, propelling the growth of the pet food protein ingredients market in Europe.

Click here to: Get Free Sample Pages of this Report

A Growing Interest in Novel Protein-based Nutrition Projected to Drive the Growth of the Pet Food Protein Ingredients Market in Europe

Pet food trends closely follow human food trends, so with the increased focus on sustainable eating, novel protein sources have become popular in pet food applications. Alongside the growing risk profile of livestock production, many well-established animal-based product interests feel threatened by civil society groups and food start-ups that market their novel protein-based products as more ethical and sustainable. There are a variety of novel sources that can be used in pet foods. Pulse-based protein, insect protein, and microbial protein such as spirulina, chlorella, bacteria, yeast, and fungi have emerged as promising and novel protein sources for the future. For instance, algae proteins are gaining prominence as an alternative to plant proteins due to their balanced amino acid profiles. They are complete proteins containing essential amino acids required for metabolic processes like enzyme production. They also contain fatty acids, including omega-3 and omega-6, which play a significant role in energy production. The nutritional value of edible insects is highly variable. Even within the same edible insect species, nutritional values may differ depending on the metamorphic stage, habitat, and diet. Insects are a rich source of protein, vitamins, calcium, iron, and zinc. In countries that struggle with malnutrition, such species could prove to be an invaluable part of the staple diet. The high nutrient content of these novel protein sources supports the uptake of insect and microbial proteins in the European pet food industry.

Many stakeholders in the pet food protein ingredients market are investing in expansions and innovation. Some of the developments are as follows:

Thus, growing venture capital investments that support the growth of the novel proteins industry and aid the leading pet food manufacturers in launching new products with novel protein ingredients drive the growth of the European pet food protein ingredients market.

Regulatory Structures and Intervention to Challenge Market Growth

In most countries, pet foods fortified with protein ingredients are governed by feedstuff regulations. Protein ingredients have become a serious concern in the global regulatory environment for pet food products due to their excessive usage. The regulatory framework for the fortification of pet food through protein ingredients is getting increasingly stringent. For instance, any ingredients sourced from animals that have not passed vet inspections as fit for human consumption at the time of slaughter are not allowed to be incorporated in pet foods. Waste products, roadkill, and diseased meat are also not permitted for use in pet food manufacture. The EU regulatory framework for meat imports has been stringent. For instance, in 2006, a compulsory ban was placed on the use of antibiotics as growth promoters in animals. Such disparities in regulations have adverse effects on global trade, especially between developed and developing economies in the form of standard issues such as product quality, animal welfare, and environmental protection, ultimately impacting the pet food protein ingredients market. Moreover, producers of protein ingredients must follow strict regulations related to regional and national health and safety for product approval in developed nations, which ultimately affects the cost of the final products.

Further, health claims made by pet food producers require authorization under Regulation EC (European Commission) before the products can be labeled and marketed in the EU. As a part of this authorization procedure, the EFSA's (European Food Safety Authority) Panel on Dietetic Products, Nutrition, and Allergies (NDA) needs to verify the scientific substantiation of the health claims. But health claims and labeling patterns vary from country to country. As a result, companies must manufacture products based on country-specific regulations. Thus, the strict and dynamic regulatory frameworks governing protein ingredient-fortified pet products impact the easy availability of innovative products and the demand for protein ingredients, thereby restricting the growth of the pet food protein ingredients market in Europe.

Key Findings in the Europe Pet Food Protein Ingredients Market Study:

The Animal Byproducts Segment Estimated to Account for the Largest Share of the Europe Pet Food Protein Ingredients Market in 2021

Based on source, the pet food protein ingredients market in Europe is segmented into animal byproducts, feed grains, soybean & soybean byproducts, and novel protein sources. In 2021, the animal byproducts segment is estimated to account for the largest share of the European pet food protein ingredients market. The segment's large share is mainly attributed to the widespread adoption of animal byproducts in pet food manufacture, considering their high protein content, balanced amino acid profiles, better digestibility, and palatability. However, the novel proteins sources segment is expected to register the highest CAGR during the forecast period 2021–2028. This segment's rapid growth is mainly attributed to the growing demand for environment-friendly protein-rich foods, rising investments in the farming of novel protein sources and the development of innovative & cost-effective processing technologies, and increasing acceptance of insect and single-cell proteins as food.

The animal byproducts-based protein ingredients market is further segmented into meat, poultry, and seafood. In 2021, the poultry segment is estimated to account for the largest share of the European animal byproducts-based protein ingredients market for pet food production. The segment's large share is mainly attributed to the increasing global poultry meat consumption and the high protein and carbohydrate content and low fat in poultry meat.

The novel sources-based protein ingredients market is further segmented into edible insects, microalgae, and others. In 2021, the edible insects segment is estimated to account for the largest share of the European novel sources-based protein ingredients market for pet food production. The segment's large share is mainly attributed to increased concerns over future food sustainability, increased public and private support for new insect protein research projects, and an increased necessity for protein alternatives.

The Veterinary Diets Segment to Record the Highest CAGR During the Forecast Period

Based on application, the pet food protein ingredients market in Europe is segmented into dry pet foods, wet pet foods, veterinary diets, treats and snacks, and others. In 2021, the dry pet foods segment is estimated to account for the largest share of the European pet food protein ingredients market. The segment's large share is mainly attributed to the dry pet foods' long shelf life, cost-effectiveness, ease of storage, and high energy content. However, the veterinary diets segment is expected to register the highest CAGR during the forecast period 2021–2028. This segment's rapid growth is mainly attributed to the increasing need and demand for health-oriented pet food products, specialized pet food products for different breeds, and products specifically formulated for pets of different ages and physiological needs.

Industry Insights

This study also provides industry insights to help understand the competitive dynamics of the European pet food protein ingredients industry based on various parameters, including the value chain of Europe’s pet food industry, adoption of protein ingredients in pet food, early adopters of novel protein ingredients for pet food production, current and potential applications of novel protein ingredients, average selling prices of protein ingredients, and raw material selection criteria of pet food manufacturers.

Germany to Emerge the Fastest-growing Country-level Market in Europe

At the country level, the European pet food protein ingredients market is segmented into France, Germany, the U.K., Poland, the Netherlands, Switzerland, Austria, the Czech Republic, Belgium, Finland, Denmark, Sweden, Norway, Baltic Countries, and the rest of Europe (RoE). In 2021, France is estimated to account for the largest share of the European pet food protein ingredients market. This country’s leading position is primarily attributed to the well-established pet food manufacturing sector, increasing demand for novel proteins, and increased pet food product launches in France. However, Germany is expected to register the highest CAGR during the forecast period. The rapid growth of this country-level market is mainly attributed to the growing adoption of high-protein diets for pets and the increasing demand for functional and vegan pet foods.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments by the leading market participants in Europe’s pet food market and pet food protein ingredients market during 2018–2021. The key players profiled in the European pet food protein ingredients market are Cargill, Incorporated (U.S.), Roquette Frères Le Romarin (France), DuPont de Nemours, Inc. (U.S.), Kerry Group plc (Ireland), Ingredion Incorporated (U.S.), Archer Daniels Midland Company (U.S.), Enterra Feed Corporation (Canada), Protix B.V. (Netherlands), Alltech (U.S.), BHJ A/S (Denmark), Symrise AG (Germany), Omega Protein Corporation (U.S.), SARIA A/S GmbH & Co. KG (Germany), Darling Ingredients Inc. (U.S.), and BENEO GmbH (Germany).

The key players operating in the European pet food market are Mars, Incorporated (U.S.), Nestlé S.A. (Switzerland), Tiernahrung Deuerer GmbH (Germany), Affinity Petcare S.A. (a part of Agrolimen SA) (Spain), Colgate-Palmolive Company (U.S.), The J.M. Smucker Company (U.S.), Monge & C. S.p.A. (Italy), Versele-Laga (Belgium), heristo Aktiengesellschaft (heristo AG) (Germany), United Petfood (Belgium), Partner in Pet Food (a part of Cinven) (Hungary), Farmina Pet Foods Holding B.V. (Netherlands), and Vafo Group a.s. (Czech Republic).

Scope of the Report

Europe Pet Food Protein Ingredients Market, by Source

Europe Pet Food Protein Ingredients Market, by Application

Europe Pet Food Protein Ingredients Market, by Country

Key Questions Answered in the Report:

Published Date: Jan-2025

Published Date: Sep-2024

Published Date: Aug-2024

Published Date: Mar-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates