Resources

About Us

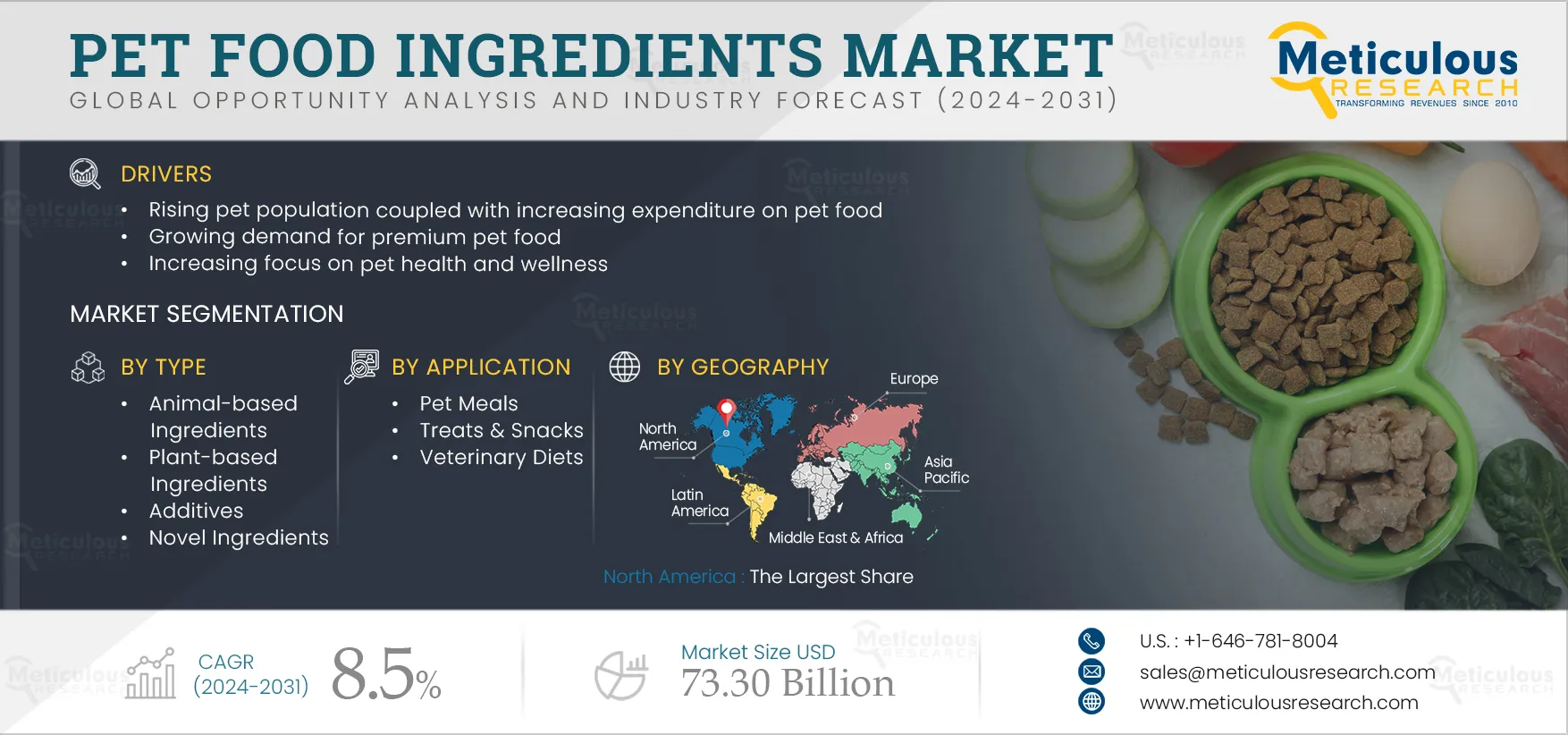

Pet Food Ingredients Market by Type (Meat & Poultry, Fish, Maize, Wheat, Additives, Novel Ingredients), Application (Pet Meals {Dry Meal}, Pet Treats, Pet Snacks, Veterinary Diet), Pet Type (Dog, Cat, Birds, Ornamental Fish) - Global Forecast to 2031

Report ID: MRFB - 1041051 Pages: 347 Mar-2024 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportIn terms of volume, the global pet food ingredients market is projected to reach 63,537.9 thousand tons by 2031, at a CAGR of 8.4% during the forecast period of 2024–2031. The growth of the pet food ingredients market is driven by the rising pet population coupled with increasing expenditure on pet food, the growing demand for premium pet food, and an increasing focus on pet health and wellness. However, the stringent regulatory structures and fluctuating raw material prices restrain the growth of this market.

Furthermore, the increasing availability and growing acceptance of novel pet food ingredients and the proliferation of direct-to-consumer (D2C) brands and start-ups in the pet food category are expected to generate growth opportunities for the stakeholders in this market. However, the risk of counterfeit products is a major challenge impacting the growth of the pet food ingredients market.

Moreover, the rising demand for customized pet food is a prominent trend in the pet food ingredients market.

The report includes a competitive landscape based on an extensive assessment of the key strategic developments of leading market participants during the last 3-4 years. The key players profiled in the pet food ingredients market research report are Cargill, Incorporated (U.S.), Ingredion Incorporated (U.S.), Darling Ingredients Inc. (U.S.), Kemin Industries, Inc. (U.S.), Archer-Daniels-Midland Company (U.S.), Omega Protein Corporation (U.S.), Roquette Frères (France), BASF SE (Germany), Protix B.V. (Netherlands), Duynie Ingredients (Netherlands), Chr. Hansen Holding A/S (Denmark), DSM-Firmenich AG (Switzerland), Symrise AG (Germany), IQI b.v. (Netherlands), and KAGOME Australia Pty Ltd (Australia).

The premiumization trend has significantly influenced the global pet food market in recent years. With a growing focus on pet health among owners, there is a rising demand for specialized products catering to specific age groups, sizes, lifestyles, and breeds. Pet owners seek more control over their pets' diets, emphasizing both the quality and quantity of food consumed. Moreover, there is an increase in the preference for premium pet food with high-quality, nutritious, and natural ingredients.

Pet owners are increasingly becoming aware of the health benefits of incorporating high-quality ingredients into their pets' diets. This trend is projected to continue as the pet food industry adapts to meet the evolving preferences of pet owners who prioritize their pets' welfare. As a result, pet food manufacturers are dedicating resources to research and development to create innovative and high-quality ingredients tailored to the unique dietary requirements of pets. This emphasis on premium ingredients not only enriches the nutritional profile of pet food but also promotes the overall health and well-being of pets.

Premium pet food products typically come at a higher price point as they contain exotic ingredients with enhanced biological availability and digestibility compared to those found in conventional diets. These products do not typically contain animal by-products, artificial colors, preservatives, or meat and bone meal. Furthermore, the 'high protein' trend is also gaining traction in the pet food market as pet owners increasingly seek high-protein and grain-free food products for their pets. Alternative proteins, including plant-based proteins, insect-based proteins, and microbial proteins, offer higher levels of nutrition and are also more environmentally friendly. Pet owners nowadays are becoming increasingly aware of the benefits of incorporating protein into their pets' daily diets, driven by increasing health consciousness. As a result, pet food manufacturers are constantly innovating and developing new formulations to meet the growing demand for high-protein pet food products.

Therefore, the growing demand for premium pet food products increases the demand for higher-quality ingredients, ultimately driving the growth of the pet food ingredients market worldwide.

Click here to: Get Free Sample Pages of this Report

Based on type, the global pet food ingredients market is segmented into animal-based ingredients, plant-based ingredients, additives, and novel ingredients. In 2024, the animal-based ingredients segment is expected to account for the largest share of the global pet food ingredients market. The large market share of this segment is mainly driven by the widespread adoption of animal by-products in pet food manufacturing, considering their high protein content, balanced amino acid profiles, better digestibility, and palatability.

However, the novel ingredients segment is expected to register the highest CAGR during the forecast period of 2024–2031. The high growth of this segment is driven by the growing acceptance of novel ingredients in pet foods, their easy availability, and health benefits. Moreover, the fast growth of this market is further supported by a growing number of novel food ingredient manufacturers, increasing R&D investments from pet food ingredients manufacturers to develop novel ingredients, rising demand for premium pet food products, and growing consumer interest in sustainable pet food sources.

Based on application, the global pet food ingredients market is segmented into pet meals, treats & snacks, veterinary diets, and other applications. In 2024, the pet meals segment is expected to account for the largest share of the global pet food ingredients market. The segment’s large market share is attributed to the increasing demand for convenient and nutritionally balanced pet meals catering to the specific dietary needs of pets. Moreover, the cost-effectiveness, ease of storage, and high energy content of pet meals, the increased spending on premium meals, and the growing demand for customized meals also contribute to the segment’s large market share. Further, the pet meals application is segmented into dry meals and wet meals.

However, the veterinary diets segment is expected to register the highest CAGR during the forecast period of 2024–2031. This segment's high growth is driven by the increasing demand for health-oriented pet food products, specialized pet food products for different breeds, and products specifically formulated for pets of different ages and physiological needs.

Based on pet type, the global pet food ingredients market is segmented into dogs, cats, birds, ornamental fish, and other pet animals. In 2024, the dogs segment is expected to account for the largest share of the global pet food ingredients market. The segment’s large market share can be attributed to the increased number of dog adoptions, the growing demand for high-quality dog food products, and increasing awareness about the nutritional benefits of dog foods. Moreover, continuous innovation in pet food production and increasing investments in dog food ingredients are supporting the growth of this segment.

However, the ornamental fish segment is projected to register the highest CAGR during the forecast period of 2024–2031. This segment's growth is mainly driven by rising disposable incomes and growing consumer interest in aquarium fish, increasing awareness of the therapeutic benefits of keeping fish, the hospitality sector's demand for ornamental fish to enhance aesthetics, and rising adoption and ownership of ornamental fish.

Based on geography, the pet food ingredients market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, North America is expected to account for the largest share of the pet food ingredients market. North America's large market share is attributed to the rising number of millennials as pet owners in the region, the growing focus on the health and diets of pets, and the presence of major pet food manufacturers in the region.

However, Latin America is slated to register the highest CAGR during the forecast period 2024–2031. The high growth of this market is mainly driven by the rising awareness about pet health and nutrition, increasing spending on pet food products, increase in per capita disposable income and rapid urbanization, and rising trend of nuclear families. Moreover, in Latin America, Brazil is slated to register the highest CAGR during the forecast period of 2024–2031.

|

Particulars |

Details |

|

No. of Pages |

347 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2022 |

|

CAGR (Value) |

8.5% |

|

Market Size (Value) |

$73.30 Billion by 2031 |

|

Market Size (Volume) |

63,537.9 Tons by 2031 |

|

Segments Covered |

By Type

By Application

By Pet Type

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Spain, Poland, Italy, Rest of Europe), Asia-Pacific (China, Japan, Australia, India, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, Rest of Latin America), and the Middle East & Africa |

|

Key Companies Profiled |

Cargill, Incorporated (U.S.), Ingredion Incorporated (U.S.), Darling Ingredients Inc. (U.S.), Kemin Industries, Inc. (U.S.), Archer-Daniels-Midland Company (U.S.), Omega Protein Corporation (U.S.), Roquette Frères (France), BASF SE (Germany), Protix B.V. (Netherlands), Duynie Ingredients (Netherlands), Chr. Hansen Holding A/S (Denmark), DSM-Firmenich AG (Switzerland), Symrise AG (Germany), IQI b.v. (Netherlands), and KAGOME Australia Pty Ltd (Australia) |

Pet food ingredients refer to the ingredients used in the formulation of pet food products. This market encompasses a wide range of ingredients, including animal-based, plant-based, additives, and novel ingredients, that are specifically formulated to meet the nutritional needs of companion animals, including dogs, cats, and other pets.

The global pet food ingredients market refers to the revenue of all the ingredients (animal-sourced, plant-sourced, additives, and novel ingredients) used in manufacturing pet food products throughout the globe. The pet food ingredients market study provides valuable insights into the market size and forecast in terms of both value and volume by type and country/region. However, the pet food ingredients market study provides valuable insights and market size and forecast only in terms of value for segmentation based on application and pet type.

The global pet food ingredients market is projected to reach $73.30 billion by 2031, at a CAGR of 8.5% during the forecast period.

Based on application, the veterinary diets segment is expected to witness the fastest growth during the forecast period of 2024–2031.

o Rising Pet Population, Coupled with Increasing Expenditure on Pet Food

o Growing Demand for Premium Pet Food

o Increasing Focus on Pet Health and Wellness

o Stringent Regulatory Structures

o Fluctuating Raw Material Prices

The key players operating in the pet food ingredients market are Cargill, Incorporated (U.S.), Ingredion Incorporated (U.S.), Darling Ingredients Inc. (U.S.), Kemin Industries, Inc. (U.S.), Archer-Daniels-Midland Company (U.S.), Omega Protein Corporation (U.S.), Roquette Frères (France), BASF SE (Germany), Protix B.V. (Netherlands), Duynie Ingredients (Netherlands), Chr. Hansen Holding A/S (Denmark), DSM-Firmenich AG (Switzerland), Symrise AG (Germany), IQI b.v. (Netherlands), and KAGOME Australia Pty Ltd (Australia).

North America is expected to account for the largest market share, mainly due to the rising number of millennials as pet owners in the region, the growing focus on the health and diets of pets, and the presence of major pet food manufacturers in the region. Moreover, in terms of value and volume, in 2024, the U.S. is expected to account for the largest share of the pet food ingredients market in North America.

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Oct-2024

Published Date: Aug-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates