Resources

About Us

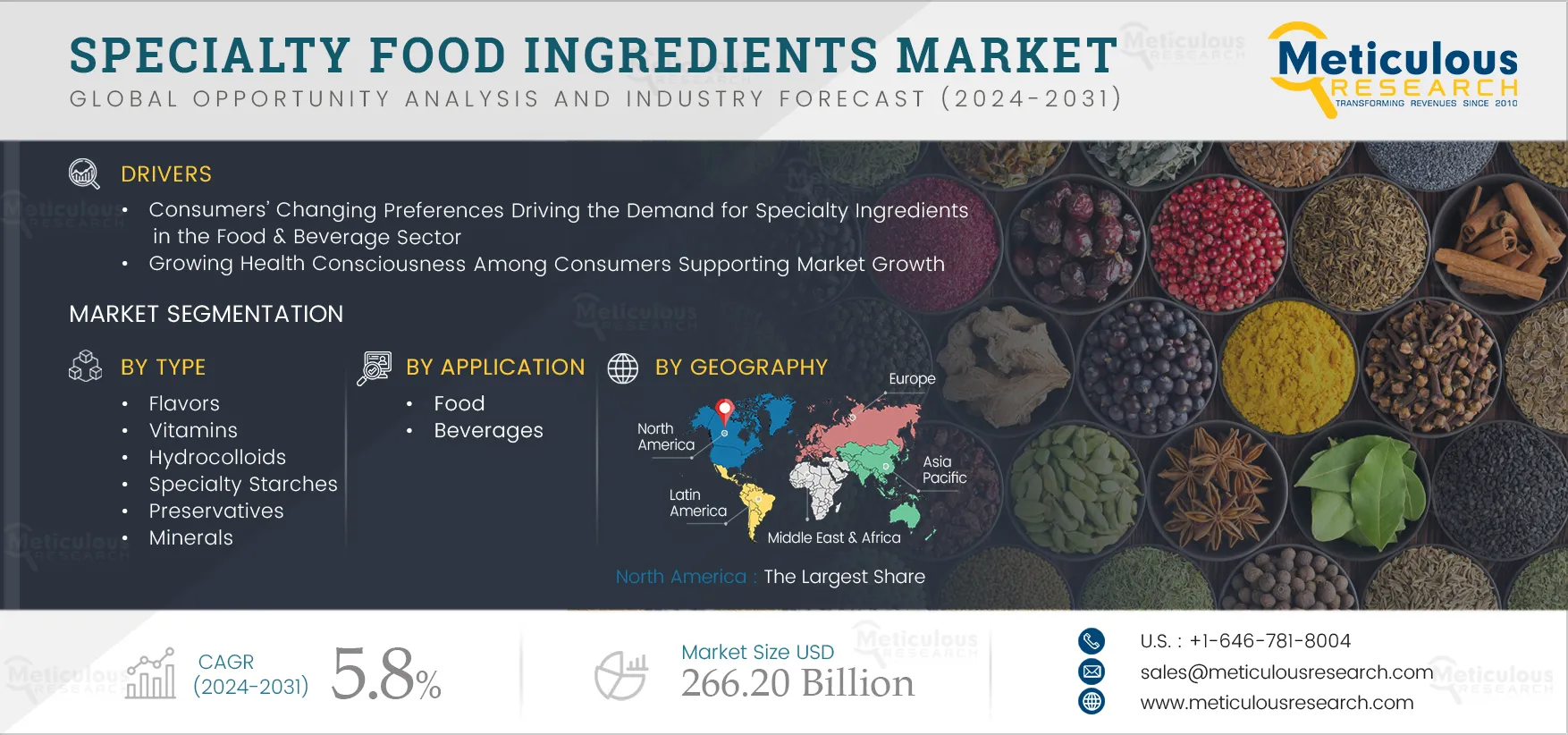

Specialty Food Ingredients Market Size, Share, Forecast, & Trends Analysis by Type (Proteins and Amino Acids, Enzymes, Flavors, Starter Cultures), Source (Natural), Application (Food {Bakery & Confectionery}, Beverages {Alcoholic}) - Global Forecast to 2031

Report ID: MRFB - 104640 Pages: 368 Jan-2024 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportIn terms of volume, the specialty food ingredients market is projected to reach 83,936.1 KT by 2031, at a CAGR of 4.6% during the forecast period of 2024–2031. The growth of this market can be attributed to several factors, including the consumers’ changing preferences driving the demand for specialty ingredients in the food & beverage sector, growing health consciousness among consumers, the growing adoption of convenience foods, and increasing partnerships and distribution agreements among specialty food ingredients manufacturers. New product launches and technological innovations in the specialty food ingredients space are expected to provide market growth opportunities for the stakeholders operating in this market. Moreover, the growing demand for natural, organic, and clean-label ingredients is a prominent trend in the specialty food ingredients market.

However, the specialty food ingredients’ short shelf life and low stability hamper the growth of this market to some extent.

Specialty food ingredients are used to impart color and texture to food & beverage products. They are also used to mix and preserve food products. These ingredients improve the nutritional properties of processed foods. Specialty ingredients are an important component in food & beverage processing and manufacturing. Specialty food ingredients manufacturers are focused on providing all-natural specialty ingredients that increase the shelf life of food products and enable food product manufacturers to label their products as ‘100% natural’ to address the demand for clean-label food products.

Specialty food ingredients are also used in non-alcoholic beverages. Consumers’ growing interest in products such as flavored water and infused water has led to the development of more natural and less sweetened beverages containing natural ingredients. Also, specialty food ingredients add sensory value to plant-based meat and dairy alternatives and provide transparency in their labeling.

Click here to: Get Free Sample Pages of this Report

Factors such as the growing demand for authentic-tasting drink options beyond soft drinks, increasing health awareness among consumers, and the growing application of specialty food ingredients in sports drinks are further expected to drive the growth of this market. Moreover, the development of specialty food ingredients for use in low-alcohol and no-alcohol beverages is further expected to support the growth of this market. In June 2020, Koninklijke DSM N.V. (Netherlands) launched the Delvo Plant range of enzymes for optimizing the taste, texture, and sweetness of plant-based drinks.

Furthermore, the rising health consciousness among consumers leads to a higher demand for food products that offer specific health benefits. Hence, food manufacturers are incorporating functional ingredients such as probiotics, prebiotics, omega-3 fatty acids, vitamins, and minerals into their products to meet this growing demand. Additionally, the rise in disposable income and the growing trend of convenience food are also contributing to the increased demand for specialty food ingredients. Consumers are willing to pay a premium price for food products that offer convenience, taste, and health benefits. Therefore, the shift in consumer preference towards healthier and more functional food options is expected to support the growth of the specialty food ingredients market.

Well-being is becoming a global movement as consumers seek to ensure healthy lives for as long as possible, particularly as the average human lifespan continues to rise. Industrialization, urbanization, economic development, and globalization have led to rapid changes in diets and lifestyles during the last decade. These factors significantly impact people’s health and nutritional status, particularly in developing countries.

The global population is growing rapidly. According to the Population Reference Bureau (PRB), the world population is expected to reach 9.8 billion by 2050, an increase of 22% from around 8.0 billion in 2022. Furthermore, consumers are becoming more health-conscious and recognizing that proper nutrition and hydration are vital for the human body. Consuming healthier foods is also a preventive measure to avoid future healthcare costs.

Specialty food ingredients play a significant role in meeting this growing demand for healthy and functional foods. Specialty food ingredients enhance the texture, flavor, and nutrition of food products to suit consumer preferences.

Therefore, growing health consciousness among consumers is driving the utilization of specialty food ingredients in the manufacture of healthy and functional foods, supporting the growth of this market.

Consumers are becoming increasingly conscious about their health and dietary intake. Most consumers look into ingredient lists before purchasing products, encouraging food & beverage manufacturers to use natural, organic, and clean-label ingredients. The growing consumption of natural and healthy foods and rising consumer awareness regarding natural ingredients are driving the demand for clean-label ingredients. Thus, natural and organic specialty food ingredients are gaining traction in the food & beverage industry as healthier alternatives.

Health is the main consideration for consumers seeking natural and clean ingredients. According to Ingredion Incorporated, a prominent U.S.-based specialty food ingredient company, more than half of global customers preferred foods with natural and clean-label ingredients in 2022. Moreover, as per a survey conducted by the International Food Information Council in 2021, approximately 64% of U.S. adults showed interest in purchasing foods prepared using clean-label ingredients.

Furthermore, consumer preference for natural, organic, and clean-label ingredients has encouraged manufacturers to focus on developing new products. In March 2020, Tate & Lyle plc (U.K.) launched CLARIA EVERLAST, a clean-label starch with freeze-thaw stability. Thus, the growing demand for natural, organic, and clean-label ingredients is expected to boost the growth of the specialty food ingredients market during the forecast period.

The rise of plant-based alternatives is the latest trend in the specialty food ingredients industry. Consumers are increasingly seeking out plant-based ingredients as they become more health-conscious and environmentally aware. This trend has led to a surge in demand for ingredients such as plant-based proteins, dairy alternatives, and meat substitutes. As more companies innovate and expand their plant-based product offerings, the specialty food ingredients industry is poised for significant growth in this area.

Moreover, the increase in awareness of the effects of the livestock industry on the environment is the major driver of this trend. Consumers are also becoming more educated about the health benefits of plant-based diets, leading them to seek out products that align with their values and dietary preferences. In response to this demand, several food manufacturers are investing in R&D to create innovative plant-based ingredients that mimic the taste and texture of traditional animal-based products. Additionally, the rise of social media and influencer marketing has helped to popularize plant-based eating, further fueling the growth of this trend in the specialty food ingredients industry.

The specialty food ingredients market is expected to grow significantly during the forecast period as new product launches and technological innovations continue to drive the demand for specialty food ingredients. The development of new and innovative specialty food ingredients supports food manufacturers in creating unique and innovative food products to cater to consumers’ changing preferences and dietary needs.

In the last four years, i.e., 2020–2024, many players have been focused on developing new specialty food ingredients. For instance, in July 2023, Tate & Lyle PLC (U.K.) launched the TASTEVA SOL Stevia Sweetener for food & beverage applications to meet the growing consumer demand for healthier and tastier low-sugar/calorie products. Also, in June 2023, Kerry Group plc (Ireland) launched Biobake EgR egg reduction enzyme for baking applications.

Additionally, technological advancements are making the production of specialty food ingredients more sustainable. Thus, consumers’ increasing health consciousness and demand for products with added nutritional benefits and specialty food ingredients manufacturers’ strategic focus on developing new products are creating market growth opportunities.

Based on type, the specialty food ingredients market is segmented into proteins & amino acids, flavors, hydrocolloids, specialty starches, vitamins, minerals, prebiotics, probiotics, enzymes, emulsifiers, colorants, acidulants, sweeteners, starter cultures, essential oils, omega-3 fatty acids, carotenoids, preservatives, and other food ingredients. In 2024, the proteins & amino acids segment is expected to account for the largest share of 19.3% of the global specialty food ingredients market. The large market share of this segment is attributed to the growing demand for a protein-rich diet, growing health and wellness, and the rising demand for plant-based protein from the growing vegan population. Further, proteins and amino acids are crucial for the proper functioning and structure of the body. A varied and balanced diet with adequate protein sources can help ensure the body receives the amino acids necessary to support its physiological processes.

However, the probiotics segment is slated to register the highest CAGR of 8.7% during the forecast period of 2024–2031. The growth of this segment is driven by the growing consumer awareness about the health benefits of probiotics, the increasing use of probiotics as an alternative to antibiotics, and the growing research on probiotics.

Based on source, the specialty food ingredients market is segmented into natural specialty food ingredients and artificial specialty food ingredients. In 2024, the natural specialty food ingredients segment is expected to account for the larger share of 71.2% of the specialty food ingredients market. The large market share of this segment is attributed to the increasing demand for organic food products, the growing popularity of clean-label products, and rising awareness about the health hazards associated with synthetic food ingredients. Moreover, this segment is further projected to register a higher CAGR during the forecast period of 2024–2031 due to the increasing awareness about sustainable sourcing and advancements in food technology.

Based on application, the global specialty food ingredients market is segmented into food and beverages. In 2024, the food segment is expected to account for a larger share of 73.3% of the global specialty food ingredients market. The large market share of this segment is attributed to changing consumer lifestyles and the rising preference for convenience food. Additionally, the increasing health awareness among consumers is steadily causing a shift towards safer and healthier foods, which is further expected to boost the demand for specialty food ingredients. The nutrition & health benefits, sustainability, taste, and convenience of the ingredient benefits are expected to cater to the rising health-conscious and environmentally aware consumers. This segment is sub-segmented into bakery and confectionery; dairy products; breakfast cereals; snacks; meat, poultry, and seafood; infant food; sauces, dressings, and condiments; and other foods. In 2024, the bakery and confectionery segment is expected to account for the largest share of the global specialty food ingredients market. The growth of this segment is driven by factors such as rising health consciousness, increasing innovations in confectionery applications, and the rising demand for convenience foods due to busy schedules and high disposable incomes.

However, the beverages segment is expected to register a higher CAGR of 6.6% during the forecast period of 2024–2031. The growth of this segment is mainly attributed to the growing demand for authentic-tasting drink options beyond soft drinks, the increasing health awareness among consumers, causing a shift towards more healthy beverages, and the growing application of specialty food ingredients in sports drinks.

Based on geography, the specialty food ingredients market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, North America is expected to account for the largest share of 30.0% of the specialty food ingredients market, followed by Asia-Pacific, Europe, Latin America, and the Middle East & Africa. North America specialty food ingredients market is estimated to be worth USD 53.8 billion in 2024. The large share of this market is primarily attributed to growing health concerns, the well-established food and beverage industry, growing consumer demand for natural and clean-label foods, increasing demand for functional food ingredients, and increasing consumption of convenience foods.

However, the market in Asia-Pacific is slated to register the highest CAGR of 6.5% during the forecast period of 2024–2031. The growth of this regional market is driven by the rising demand for packaged food, rapid urbanization, the emerging trend of healthy food, rising awareness about the health benefits of products containing natural ingredients, and a growing diabetic and obese population in the region.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the global specialty food ingredients market are Archer-Daniels-Midland Company (U.S.), Ashland Inc. (U.S.), Associated British Foods plc (U.K.), BASF SE (Germany), Cargill, Incorporated (U.S.), Chr. Hansen Holding A/S (Denmark), Givaudan SA (Switzerland), Ingredion Incorporated (U.S.), Kerry Group plc (Ireland), Koninklijke DSM N.V. (Netherlands), and Tate & Lyle PLC (U.K.).

In July 2023, Tate & Lyle PLC (U.K.) launched the TASTEVA SOL Stevia Sweetener for food & beverage applications to meet the growing consumer demand for healthier and tastier low sugar/calorie products.

In June 2023, Kerry Group plc (Ireland) launched Biobake EgR egg reduction enzyme for baking applications.

|

Particulars |

Details |

|

Number of Pages |

368 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

5.8% |

|

Market Size (Value) |

USD 266.20 Billion by 2031 |

|

Market Size (Volume) |

83,936.1 KT by 2031 |

|

Segments Covered |

By Type

By Source

By Application

|

|

Countries Covered |

North America (U.S., Canada), Asia-Pacific (China, Japan, India, Australia, and Rest of Asia-Pacific), Europe (Germany, France, U.K., Italy, Spain, and Rest of Europe), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa |

|

Key Companies |

Archer-Daniels-Midland Company (U.S.), Ashland Inc. (U.S.), Associated British Foods plc (U.K.), BASF SE (Germany), Cargill, Incorporated (U.S.), Chr. Hansen Holding A/S (Denmark), Givaudan SA (Switzerland), Ingredion Incorporated (U.S.), Kerry Group plc (Ireland), Koninklijke DSM N.V. (Netherlands), and Tate & Lyle PLC (U.K.). |

No formal regulatory definition exists for specialty food ingredients globally. There are mainly two types of food ingredients: major/mainstream food ingredients and specialty food ingredients. Major food ingredients are usually core components or primary ingredients that form the base of a food product, while specialty food ingredients are selected and added to enhance specific qualities or characteristics of the product. These specialty food ingredients are used in smaller quantities compared to major ingredients and are selected for their specialized functions.

These specialty food ingredients are usually used to enhance the taste, texture, appearance, shelf life, and nutritional value of food products. These ingredients are primarily obtained from various natural and synthetic sources to provide specific flavors, colors, textures, and health benefits to foods that are not commonly found in major food ingredients. Moreover, these specialty food ingredients offer functional benefits essential in providing today’s consumers with a wide range of tasty, safe, healthy, qualitative, and sustainably produced food.

The specialty food ingredients market study provides valuable insights into the market size and forecast in terms of both value and volume by ingredient type and country/region. However, the specialty food ingredients market study provides valuable insights and market size and forecast only in terms of value for segmentation based on source and application.

The specialty food ingredients market is projected to reach $266.20 billion by 2031, at a CAGR of 5.8% during the forecast period 2024–2031.

Based on type, the protein & amino acids segment is expected to hold the major share of the market in 2024.

Based on application, the beverages segment is projected to record a higher growth rate during the forecast period 2024–2031.

The key players operating in the global specialty food ingredients market are Archer-Daniels-Midland Company (U.S.), Ashland Inc. (U.S.), Associated British Foods plc (U.K.), BASF SE (Germany), Cargill, Incorporated (U.S.), Chr. Hansen Holding A/S (Denmark), Givaudan SA (Switzerland), Ingredion Incorporated (U.S.), Kerry Group plc (Ireland), Koninklijke DSM N.V. (Netherlands), and Tate & Lyle PLC (U.K.).

The Asia-Pacific region is projected to register the highest CAGR during the forecast period. The fast growth of this region is mainly attributed to the rising demand for packaged food, rapid urbanization, the emerging trend of healthy food, rising awareness about the health benefits of products containing natural ingredients, and a growing diabetic and obese population in the region.

Published Date: Jan-2025

Published Date: Oct-2024

Published Date: Oct-2024

Published Date: Aug-2024

Published Date: Mar-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates