Resources

About Us

Europe Food Waste Recycling Market Size, Share, Forecast & Trends by Byproduct Type (Organic Fertilizers, Animal Feed, Biofuels, Bioplastics) Feedstock Source (Household, Food Processing, Retail) Recycling Method - Forecast to 2035

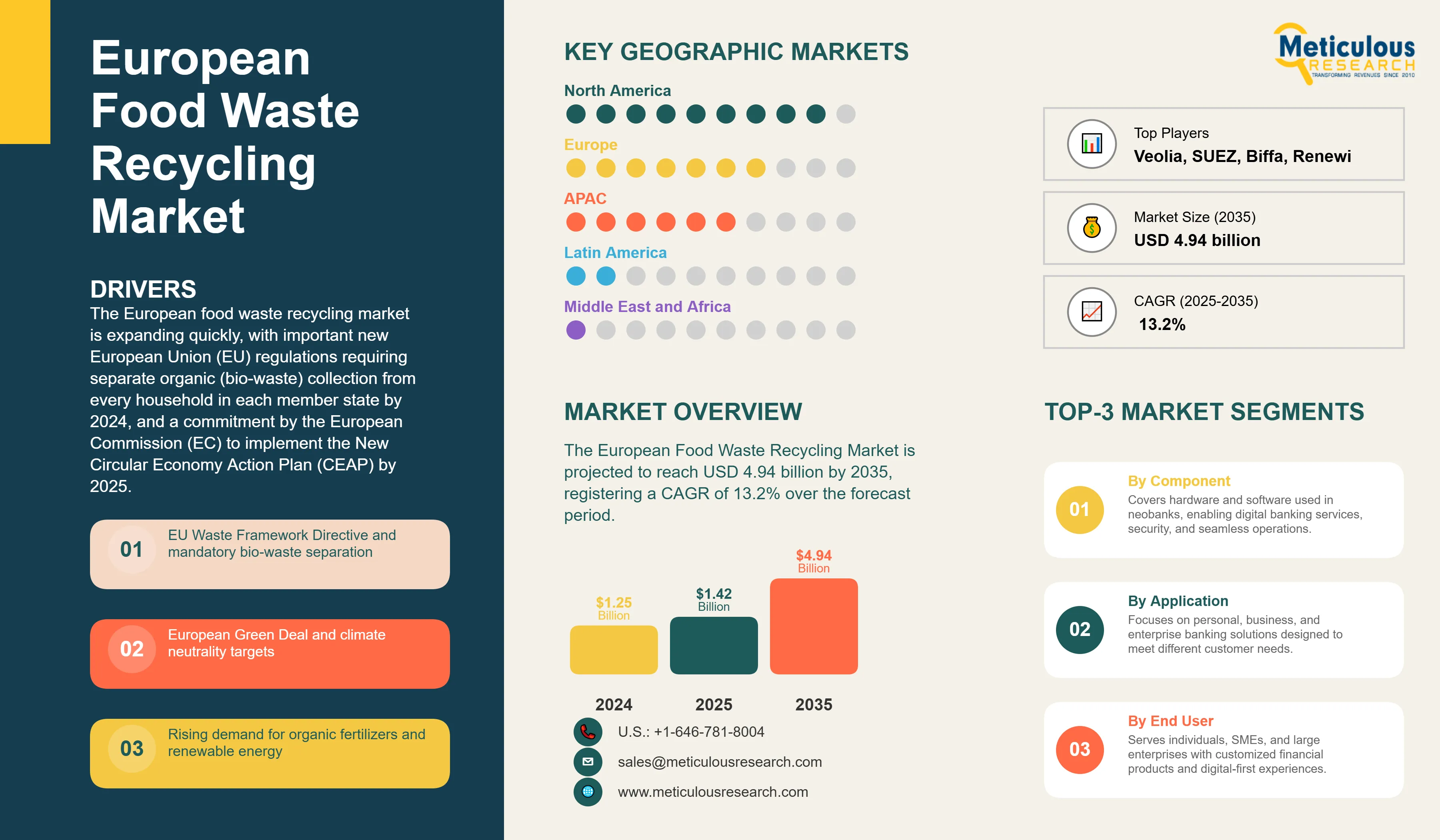

Report ID: MRAGR - 1041566 Pages: 165 Aug-2025 Formats*: PDF Category: Agriculture Delivery: 24 to 72 Hours Download Free Sample ReportThe Europe Food Waste Recycling Market was worth USD 1.25 billion in 2024. The market is estimated to be valued at USD 1.42 billion in 2025 and is projected to reach USD 4.94 billion by 2035, registering a CAGR of 13.2% over the forecast period.

Europe Food Waste Recycling Market - Key Highlights

|

Metric |

Value |

|

Market Value (2025) |

USD 1.42 billion |

|

Market Value (2035) |

USD 4.94 billion |

|

CAGR (2025-2035) |

13.2% |

|

Largest Byproduct Type |

Organic Fertilizers (30-35% share) |

|

Fastest Growing Byproduct |

Bioplastics (14.1% CAGR) |

|

Leading Feedstock Source |

Food Processing Industry (40-45% share) |

|

Dominant Recycling Method |

Anaerobic Digestion (30-40% share) |

|

Top Country by Market Size |

Germany |

|

Fastest Growth Country |

Poland (14.4% CAGR) |

|

Annual Food Waste Generated |

88 million tonnes |

|

Recycling Rate Target (2030) |

65% of municipal waste |

Europe Food Waste Recycling Market Overview

Click here to: Get Free Sample Pages of this Report

Why the Europe Food Waste Recycling Market is Growing?

The European food waste recycling market is expanding quickly, with important new European Union (EU) regulations requiring separate organic (bio-waste) collection from every household in each member state by 2024, and a commitment by the European Commission (EC) to implement the New Circular Economy Action Plan (CEAP) by 2025. In addition, the EU Waste Framework Directive requires each of the 27 EU member states to reduce food waste in the food supply chain by 30% on average by 2025, and by 50% on average by 2030. The result has been the demand for recycling infrastructure and recycling technologies.

The continued growth of the recovered organic waste recycling market is also driven by the European Green Deal's commitment to achieve climate neutrality in the EU by 2050. Food waste recycling and diversion will play a key role in reducing waste organics that create methane emissions in landfills–3% of the EU’s greenhouse gas emissions. The launch in 2022 of mandatory organic waste separation and collection in countries such as Germany, France, and Italy has increased feedstock for food waste recycling by 40%. There is available funding of about EUR 10 billion from the EU's Recovery and Resilience Facility for waste management infrastructure.

Technology improvements in anaerobic digestion, which creates renewable energy and digestate fertilizers, can generate an economic return of EUR 150-200 per tonne of food waste processed, making food waste recycling economically viable on its own without subsidies. There is also a powerful market pull for food waste derived articles associated with food waste generation into organic fertilizers, especially given that the Farm to Fork Strategy includes a target of 25% of farmland to be organic farming by 2030. Ongoing developments in biorefinery technologies to convert food waste into high-value chemicals and materials, coupled with additional extended producer responsibility schemes, will sustain the market because Europe is moving towards a zero waste circular economy.

European Food Waste Recycling Market Size and Forecast

|

Metric |

Value |

|

European Food Waste Recycling Market Value (2025) |

USD 1.42 billion |

|

European Food Waste Recycling Market Forecast Value (2035 F) |

USD 4.94 billion |

|

Forecast CAGR (2025 to 2035) |

13.2% |

Market Segmentation

The European food waste recycling market is segmented by byproduct type, feedstock source, recycling method, end-use application, and country. The market is divided by byproduct type into Organic Fertilizers, Animal Feed, Biofuels, Bioplastics, and Other Biochemicals. By feedstock source, the market includes Household Food Waste, Food Processing Industry, Food Service and Hospitality, Retail and Supermarkets, and Agricultural Residues. By recycling method, the market encompasses Anaerobic Digestion, Composting, Pelletization, Fermentation, and Other Technologies.

Organic Fertilizers Lead European Market with 30-35% Share Driven by Organic Farming Expansion

European food waste recycling byproducts market is dominated by organic fertilizers at about a 30-35% market share in 2025. This is primarily attributed to the continent's strong goal towards sustainable agriculture and reduced reliance on chemical fertilizers. The EU Farm to Fork Strategy aims for 25% organic farmland by 2030, increased from 9.1% in 2024, generating a previously unseen base of demand for organic soil amendments with food waste compost and digestate providing nutrient-rich alternatives with 2-3% nitrogen, 1-2% phosphorus and 2-3% potassium.

Thermophilic composting and digestate refinement are growing practices that produce safe, high-quality organic fertilizers that are also free of detrimental pathogens. These processes are meeting important organic certification requirements, enabling these products to be sold into the lucrative gardening and farming markets. As the demand for carbon farming grows, with carbon-intensive practices being paid EUR 100 - 200 to store carbon in the soil, fertilizers that repurpose food waste, or combine biochar and stable organic material would command more value in the not too distant future. These products will allow income to be gained from replacing chemical nutrients, earning carbon credits, and improving the soil health.

Anaerobic Digestion Dominates Recycling Methods with 30-40% Market Share

Within recycling methods, anaerobic digestion holds the largest share of the European food waste recycling market with 30-40% share in 2025, driven by its dual benefit of producing renewable energy and nutrient-rich digestate. European anaerobic digestion facilities process 35 million tonnes of food waste annually, generating 17 TWh of biogas energy equivalent to powering 4 million homes while producing 28 million tonnes of digestate fertilizer, creating circular economy value exceeding EUR 2.1 billion.

Support from governments with feed in tariffs, green gas certificates (EUR 50-100/MWh), and biomethane injection bonuses further speed up adoption. There will be over 1,000 new plants planned by 2030 and an expected investment influx of EUR 15 billion. Advanced technologies, with dry fermentation, two-stage digestion, and improved co-digestion optimization has increased methane yield by 25-30% while lowering retention times. Therefore, not only are the project economics improved, but we can develop smaller scale distributed facilities that serve local communities, making anaerobic digestion the primary technology for the European valorization of food waste.

What are the Drivers, Restraints, and Key Trends of the European Food Waste Recycling Market?

The European food waste recycling market is expanding due to stringent EU regulations, circular economy policies, rising organic farming demand, and renewable energy targets. Additionally, technological innovations, extended producer responsibility schemes, and consumer awareness enhance market competitiveness.

Impact of Key Growth Drivers and Restraints on European Food Waste Recycling Market

Base CAGR: 13.2%

|

Driver |

CAGR Impact |

Key Factors |

|

Regulatory Compliance |

+3.1% |

|

|

Circular Economy Push |

+2.3% |

|

|

Economic Incentives |

+1.8% |

|

|

Technology Advancement |

+1.4% |

|

Market Restraints

|

Restraint |

CAGR Impact |

Mitigation Trends |

|

Infrastructure Investment |

-1.2% |

|

|

Feedstock Contamination |

-0.8% |

|

|

Market Fragmentation |

-0.6% |

|

EU Regulatory Framework and Circular Economy Policies Drive Market Transformation

The European food waste recycling market is largely defined by EU legislation that outlines mandatory requirements and provides economic incentives to divert waste from landfills. In particular, the Waste Framework Directive has targets which require member states to recycle 65% municipal waste by 2030 and reduce landfilling to a maximum of 10% by 2035. With fines of EUR 1 million per day for non-compliance, member states are under pressure to develop their organic waste processing infrastructure immediately. The requirement for the mandatory separation of bio-waste by December 2023, impacts 150 million households in the EU, which will increase source-separated food waste collection by 60%. This will also provide recycling facilities with a consistent contamination-free feedstock.

The Renewable Energy Directive (RED III) mandates a minimum target of 42.5% renewable energy in the EU by 2030 and specifies food waste-derived biogas and biomethane as important sources. Biogas and biomethane derived from food waste achieves between 80-90% greenhouse gas savings over natural gas and provides a highly sustainable source of energy. Various regulatory frameworks, converging on biogas and biomethane derived from food waste are emerging around Europe. France’s anti-waste law prohibits food waste from being destroyed, while Italy provides biowaste collection for around 7.1 million tonnes of organic waste each year, and Germany’s cascade utilisation preference encourages full material recovery and utilisation. Under the EU Taxonomy Regulations, recycling food waste is considered a sustainable economic activity, allowing for green financing and capital raising with extralow interest rates, in many cases 1-2% lower. There is anticipation that these combined voting and regulatory frameworks could attract around EUR 20 billion in private sector investment on food waste recycling and food waste related activities by 2030.

Rising Demand for Sustainable Products Creates Market Pull for Food Waste Derivatives

The growing consumer awareness and commitment to corporate sustainability has begun to drive vast demand for food waste products, including fertilizers, biobased surfactants, Biolubricants and biobased plastics and so on, taking food processing waste processors and turning them into sustainable materials & chemicals suppliers. The public would pay 20-30% more for food waste-derived organic fertilizers than conventional fertilizers. Various retailers, including Carrefour, Tesco and REWE have committed to NO food waste sent to landfill (in total they invested EUR 2 billion in recycling infrastructure), providing guaranteed feedstocks through long-term contracts.

The European bioplastics market is expected to reach between 1.5 and 2 million tonnes by 2030, fueling demand for food waste-based bioplastics such as PHA and PLA. Leading global brands like Nestlé and Unilever are actively reducing waste, committing to 100% recyclable or bio-based packaging, and securing offtake agreements worth hundreds of millions of euros annually, including around EUR 500 million per year.

Competitive Landscape

The competitive scenario in the European food waste recycling market is varied, with traditional waste management companies, technology providers and start-ups competing on value based, technological differentiation, geographical reach and vertical integration. The market leaders, such as Veolia, SUEZ, and Biffa, are differentiated based on their extensive collection network and processing facilities: they offer turnkey solutions consisting of waste collection, processing, and marketing of end-product. These services result in the processing of over 20 million tonnes of organic waste each year in Europe.

Strategic consolidation in the European food waste recycling market is accelerating with 40+ acquisitions in 2023-2024 as companies build their technological capabilities, while partnerships between waste collectors, technology providers, and end-product users create integrated value chains.

The initiatives like the European Circular Bioeconomy Fund's investment programme of EUR 300 million with the backing of countries and corporate venture funds from Danone, Nestlé, and Unilever have made significant innovations and company market development partnerships to build out a sizeable ecosystem that has strong established infrastructure on which balanced disruptive technology will continue to harness.

European Food Waste Recycling Market Growth, By Key Countries

|

Country |

CAGR |

|

Poland |

14.4% |

|

Spain |

14.1% |

|

Italy |

11.7% |

|

Netherlands |

11.2% |

|

France |

10.6% |

|

Germany |

10.3% |

|

United Kingdom |

9.8% |

|

Nordic Countries |

11.5% |

Country-Specific Growth Analysis

Germany Leads European Food Waste Recycling Market

Germany leads the European food waste recycling market in 2025 and is expected to grow at a CAGR of 10.3% from 2025-2035, leveraging its 10,000 biogas plants and world-leading technology to optimize value extraction from 11 million tonnes annual food waste.

Italy's Circular Economy Excellence Drivers its Food Waste Recycling Market at a CAGR of 11.7% through 2035

Italy processes around 7.1 million tonnes of organic waste every year through approximately 340 composting and 65 anaerobic digestion plants. Each year Italy produces around 2.1 million tonnes of compost valued at around EUR 350 million for agriculture. Milan is attracting attention for its innovative food waste collection system, which collects organic waste twice a week from a resident population of 1.4 million sourced from organic bins placed in the streets, and which achieves a 95% purity rate.

The food waste generates biogas, which powers around 25,000 dwellings, and the compost generated is used on some 3,500 hectares of farmland. The regions of Southern Italy are building their organic waste treatment systems often with support from EUR 2.2 billion Euros of funding from the National Recovery Plan and aim to build 1.5 million tonnes of organic waste processing capacity by 2030. Similarly, management models like the Italian Composting Consortium (CIC) are collectively providing a means for producers to uphold quality standards for the treatment of their organic waste, and to develop the potential markets since the Compost Quality Mark certification can command a sale price premium of around 30%.

France's Regulatory Push and Innovation Drive Market Expansion

The food waste recycling market in France is currently characterized by rapid growth and is projected to have a CAGR of 10.6% between 2025 and 2035, supported by significant regulatory and industry action. France's robust legislation to combat waste includes a comprehensive anti-waste bill which requires sorting out food waste by any producer which annually generates more than 5 tonnes of food waste. It is estimated that nearly 40,000 establishments could be impacted by this policy.

At present, France has around 160 anaerobic digestion sites processing food waste, and to be consistent with its 2030 target, should increase to about 300 anaerobic digestion facilities. The net result should produce about 8 TWh of biomethane to be injected into the grid to help achieve energy independence. For example, in urban areas, new innovative projects in the urban circular economy space such as Les Alchimistes micro-composter facilities in Paris and Lyon, process around 50 tonnes of food waste per day under the city limits and avoids 60% of transport emission. France's national food waste pact has more than 500 businesses committed to target a 50% reduction in food waste by 2030 and embraces the alternative of on-site processing and valorization technologies. France has also witnessed new start-ups such as Phenix, and Too Good To Go emerging with ambitions to focus on food waste prevention and redistribution, and they each have supporting ecosystem effects to build awareness and underlying infrastructure investment. The rapid development of precision farmland technologies has also received venture capital and angel funding of more than EUR 100 million for technology development.

Key Players in Europe Food Waste Recycling Market Expand Through Technology and Integration

Leading waste management companies and technology providers are developing strategies that combine geographic expansion, technological advancement, and vertical integration to seize increasing opportunities in the market for food waste recycling bioproducts. For example, Veolia is presently operating 85 anaerobic digestion plants throughout Europe, treating 5 million tonnes of organic waste per year, and has invested EUR 2 billion on circular economy infrastructure, including advanced biorefineries, producing bio-based chemicals and materials. SUEZ has leveraged digital platforms to improve collection and post-collection processing, with capacity across 300 SUEZ operations, and has developed its own technologies for the recovery of nutrients and the purification of biomethane to a biomethane quality of 99.5% methane.

Biffa and Renewi are focused on their integrated business models in the UK and Benelux regions respectively, such that both companies are leveraging a large collection infrastructure to support a processing infrastructure, which means that they can control the food waste value chain to high-value bioproducts. Technology leaders BTS Biogas and WELTEC BIOPOWER are the keys to demonstrating German engineering capacity and excellence by exporting plants located throughout Europe: approximately 500 plants are in operation and have been deployed with remote monitoring and optimization services. Anaergia provides a complete solution from pre-treatment to biogas upgrading, and developed their own technologies, which have shown to increase methane yields by up to 30%.

Recent Developments in the European Food Waste Recycling Market

October 2024: Veolia commissioned Europe's largest food waste biorefinery in Netherlands, processing 300,000 tonnes annually into biomethane, organic fertilizers, and bio-based chemicals, representing EUR 150 million investment.

September 2024: European Investment Bank announced EUR 500 million green bond program specifically for food waste recycling infrastructure, offering 2% interest rates for qualifying projects across member states.

August 2024: Germany launched national biomethane strategy targeting 10% of gas grid supplied by food waste and agricultural residues by 2030, including EUR 3 billion subsidy program for upgrading facilities.

|

Item |

Value |

|

Market Size (2025) |

USD 1.42 Billion |

|

Byproduct Type |

Organic Fertilizers, Animal Feed, Biofuels, Bioplastics, Biochemicals |

|

Feedstock Source |

Household, Food Processing Industry, Food Service, Retail, Agricultural |

|

Recycling Method |

Anaerobic Digestion, Composting, Pelletization, Fermentation, Others |

|

Countries Covered |

|

|

Key Companies Profiled |

Veolia, SUEZ, Biffa, Renewi, BTS Biogas, Anaergia, WELTEC BIOPOWER, PreZero, FCC Environment |

|

Additional Attributes |

EU regulatory analysis, circular economy metrics, technology benchmarking, carbon footprint assessment, feedstock analysis, end-product market dynamics, investment landscape |

The European food waste recycling market is estimated to be valued at USD 1.42 billion in 2025.

The market size for European food waste recycling is projected to reach USD 4.94 billion by 2035.

The European food waste recycling market is expected to grow at a 13.2% CAGR between 2025 and 2035.

Organic fertilizers command 30-35% market share driven by EU organic farming targets and circular economy principles.

Anaerobic digestion represents 30-40% of recycling methods, offering dual benefits of renewable energy and nutrient recovery.

Published Date: Jan-2026

Published Date: Jan-2026

Published Date: Jan-2026

Published Date: Dec-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates