Resources

About Us

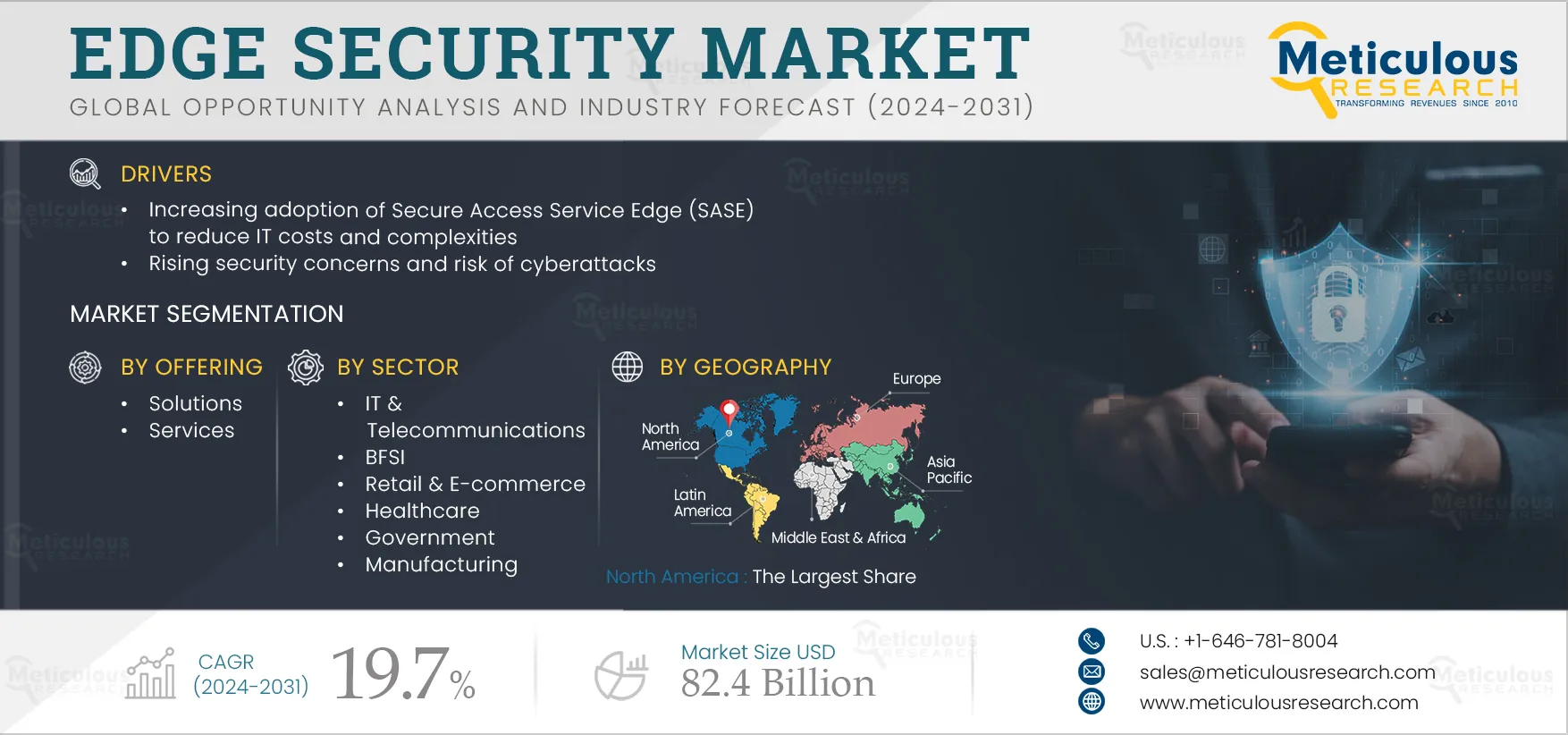

Edge Security Market by Offering (Solution, Services), Deployment Mode, Organization Size, Sector (IT & Telecommunications, Healthcare, Retail & E-Commerce, BFSI, Government, Energy & Utilities), and Geography - Global Forecast to 2031.

Report ID: MRICT - 1041052 Pages: 207 Jan-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 2 to 4 Hours Download Free Sample ReportThe Edge Security Market is expected to reach $82.4 billion by 2031, at a CAGR of 19.7% from 2024 to 2031. The growth of this market can be attributed to several factors, increasing adoption of secure access service edge (SASE) to reduce IT costs and complexities and rising security concerns and risk of cyberattacks. Moreover, the increasing use of 5G technology to enhance communications infrastructure and the rising adoption of cloud-based services among SMEs are expected to offer growth opportunities for the players operating in this market.

Secure Access Service Edge (SASE) is a network architecture that combines VPN and SD-WAN capabilities with cloud-native security functions such as secure web gateways, cloud access security brokers, firewalls, and zero-trust network access. With the digital transformation of businesses, security is moving to the cloud, which is driving the need for converged services to reduce complexity, improve speed and agility, enable multi-cloud networking, and secure the new SD-WAN-enabled architecture.

The adoption of Secure Access Service Edge (SASE) has been on the rise due to its potential to reduce IT costs and complexity. SASE combines network and security functions into a cloud-based service, providing a more streamlined and cost-effective approach to managing IT infrastructure. This approach reduces the need for on-premises hardware, simplifies network management, and enhances security, making it an attractive option for organizations looking to optimize their IT resources. Several businesses are implementing SASE solutions in their network to reduce complexity and improve visibility across IT networks. Market players are focused on collaborations for developing advanced solutions. For instance, in April 2023, Accenture plc (Ireland) collaborated with Palo Alto Networks, Inc. (U.S.) to deliver a joint Secure Access Service Edge (SASE) solution powered by Palo Alto Networks. The solution—AI-powered Prisma SASE enables organizations to improve their cyber resilience and accelerate business transformation efforts. This solution reduces complexity and improves visibility across IT networks. Such developments are also expected to support the growth of this market during the forecast period.

Click here to: Get Free Sample Pages of this Report

Growing digitalization and the rising use of advanced technologies such as IoT and cloud computing are increasing security concerns and the risk of cyberattacks across industries. In recent years, businesses have increased their reliance on SaaS platforms to support a variety of working environments across different geographic locations. With SaaS platforms, organizations can implement remote work, digital collaborations, or multiple field offices. However, cybersecurity is an ongoing concern for organizations, especially with the increasing frequency and sophistication of cyberattacks and organizations’ heavy reliance on software for business functions.

To overcome such risks, several organizations are implementing edge security solutions that protect the network perimeter and endpoints at the edge of a network. Edge security solutions protect organizations against cyber threats by fortifying the network perimeter and safeguarding the devices and data at the edge of the network. Thus, growing security concerns and the risk of cyberattacks are increasing the demand for edge security solutions across industries.

Artificial Intelligence (AI) helps organizations operating across various industries to automate routine tasks, streamline processes, and reduce human error. Artificial intelligence technology helps enterprises drive innovation, cut costs, and gain a competitive advantage. AI is used across various sectors, such as healthcare, finance, and manufacturing. In the finance sector, AI is used for fraud detection, algorithmic trading, and risk management. Several financial businesses are implementing AI technology in their operations to enhance financial services. For instance, in December 2022, Deutsche Bank AG (Germany) partnered with Nvidia Corporation (U.S.) to embed AI into financial services. The company improved risk management, boosted efficiency, and enhanced its customer service using NVIDIA’s AI Enterprise software. Thus, the growing adoption of AI technologies is expected to increase the demand for edge security solutions across industries in the coming years.

The adoption of cloud-based services is rising among Small & Medium-sized Enterprises (SMEs) as these services allow them to store and access data, applications, and resources over the Internet rather than depending on physical servers or computers. Cloud services offer cost-effective solutions, scalability, and flexibility for SMEs. Cloud-based services provide access to advanced technologies, such as data analytics and AI. These benefits provide SMEs with a competitive edge and improve operational efficiency. Additionally, cloud technologies offer remote accessibility, which is becoming increasingly important for today's globalized and remote work environments. However, SMEs need to consider data security and compliance when adopting cloud solutions and services to ensure that their sensitive information remains protected. Thus, the increasing adoption of cloud-based services among SMEs is expected to generate growth opportunities for market stakeholders.

In 2024, the solutions segment is expected to account for the largest share of 50.3% of the global edge security market. The segment’s large share is attributed to the increasing adoption of edge security solutions to monitor network activity for suspicious behavior, prevent cyberattacks, and deliver applications to users with greater security and the growing need to secure data in transit and prevent unauthorized access.

However, the services segment is expected to grow at the highest CAGR during the forecast period of 2024–2031. The growth of this segment is driven by the rising demand for comprehensive security across enterprise systems, the growing adoption of managed security services among small & medium-sized enterprises, and the increasing demand for security auditing, network security assessment, and firewall assessment services.

In 2024, the cloud-based deployments segment is expected to account for the larger share of 64.4% of the global edge security market. Th segment’s large market share is attributed to the increasing adoption of cloud-based solutions among small & medium-sized enterprises and the growing utilization of edge security services to safeguard edge networks against cyberattacks. Also, this segment is expected to register a higher CAGR of during the forecast period of 2024–2031.

In 2024, the IT & telecommunications segment is expected to account for the largest share of 26.7% of the global edge security market. The segment’s large market share is attributed to IT & telecom companies’ increasing need to protect networks, data, and devices at the edge, the growing utilization of 5G networks, and the rising need to reduce complexities and improve visibility across IT networks.

However, the healthcare segment is expected to grow at the highest CAGR during the forecast period of 2024–2031. The growth of this segment is driven by healthcare organizations’ growing need to protect patient data, maintain regulatory compliance, and secure IoT devices and the increasing adoption of telehealth services.

In 2024, North America is expected to account for the largest share of 33.3% of the global edge security market. North America edge security market is estimated to be worth USD 8.02 billion in 2024. North America’s large market share is attributed to the presence of prominent players offering advanced edge security solutions. Furthermore, the increasing investment in edge data centers, the growing adoption of edge security solutions to improve the security of data stored in the cloud, and the rising adoption of advanced technologies such as cloud computing, AI, and IoT are supporting the market growth.

However, the Asia-Pacific region is expected to register the highest CAGR during the forecast period due to the surging demand for edge security solutions due to the increasing number of connected devices in the region, the growing need to deploy edge security solutions to ensure data, network, and device security, and government initiatives to ensure the highest level of edge security for the region’s industrial sector.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the edge security market are Cisco Systems, Inc. (U.S.), Broadcom Inc. (U.S.), Check Point Software Technologies Ltd. (Israel), Palo Alto Networks, Inc. (U.S.), Fortinet, Inc. (U.S.), Juniper Networks, Inc. (U.S.), Zscaler, Inc. (U.S.), Cloudflare, Inc. (U.S.), F5, Inc. (U.S.), Akamai Technologies, Inc. (U.S.), Barracuda Networks, Inc. (U.S.), Forcepoint LLC (U.S.), Versa Networks, Inc. (U.S.), Cato Networks Ltd. (Israel), and Skyhigh Security (U.S.).

In August 2023, Check Point Software Technologies Ltd. (Israel) signed an agreement to acquire Perimeter 81 Ltd. (Israel), a Security Service Edge (SSE) company. With this acquisition, Check Point will help organizations accelerate the adoption of secure access across remote users, sites, cloud, data centers, and the internet to deliver the most secure and fastest SSE solution in the market.

In June 2023, Palo Alto Networks, Inc. (U.S.) partnered with Accenture plc (Ireland) to deliver joint secure access service edge (SASE) solutions that enable organizations to improve their cybersecurity posture and accelerate business transformation initiatives.

|

Particulars |

Details |

|

Number of Pages |

207 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

19.7% |

|

Market Size (Value) |

USD 82.4 Million by 2031 |

|

Segments Covered |

By Offering

By Deployment Mode

By Organization Size

By Sector

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Singapore, and Rest of Asia-Pacific), Latin America, and the Middle East & Africa |

|

Key Companies |

Cisco Systems, Inc. (U.S.), Broadcom Inc. (U.S.), Check Point Software Technologies Ltd. (Israel), Palo Alto Networks, Inc. (U.S.), Fortinet, Inc. (U.S.), Juniper Networks, Inc. (U.S.), Zscaler, Inc. (U.S.), Cloudflare, Inc. (U.S.), F5, Inc. (U.S.), Akamai Technologies, Inc. (U.S.), Barracuda Networks, Inc. (U.S.), Forcepoint LLC (U.S.), Versa Networks, Inc. (U.S.), Cato Networks Ltd. (Israel), and Skyhigh Security (U.S.) |

The edge security market study focuses on the market assessment and opportunity analysis through the sales of edge security across different region, and countries across different market segmentation, this study is also focused on competitive analysis for edge security based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The edge security market is projected to reach $82.4 billion by 2031, at a CAGR of 19.7% during the forecast period.

in 2024, the large enterprises segment is expected to account for the larger share of 50.8% of the global edge security market. The large market share of this segment is attributed to the increasing adoption of edge security services to reduce cyberattacks on their edge networks.

The growth of this market can be attributed to several factors, increasing adoption of secure access service edge (SASE) to reduce IT costs and complexities and rising security concerns and risk of cyberattacks. Moreover, the increasing use of 5G technology to enhance communications infrastructure and the rising adoption of cloud-based services among SMEs are expected to offer growth opportunities for the players operating in this market.

The key players operating in the global edge security market are Cisco Systems, Inc. (U.S.), Broadcom Inc. (U.S.), Check Point Software Technologies Ltd. (Israel), Palo Alto Networks, Inc. (U.S.), Fortinet, Inc. (U.S.), Juniper Networks, Inc. (U.S.), Zscaler, Inc. (U.S.), Cloudflare, Inc. (U.S.), F5, Inc. (U.S.), Akamai Technologies, Inc. (U.S.), Barracuda Networks, Inc. (U.S.), Forcepoint LLC (U.S.), Versa Networks, Inc. (U.S.), Cato Networks Ltd. (Israel), and Skyhigh Security (U.S.).

At present, North America dominates the edge security market. However, Japan, China, India, and South Korea, are expected to witness strong growth in demand for edge security in the coming years.

1. Introduction

1.1. Market Definition & Scope

1.2. Currency & Limitations

1.2.1. Currency

1.2.2. Limitations

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research /Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, by Offering

3.3. Market Analysis, by Organization Size

3.4. Market Analysis, By Deployment Mode

3.5. Market Analysis, By Sector

3.6. Market Analysis, By Geography

3.7. Competitive Analysis

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Increasing Adoption of Secure Access Service Edge (SASE) to Reduce IT Costs and Complexities Accelerating Market Growth

4.2.2. Rising Security Concerns and Risk of Cyberattacks Driving the Need for Edge Security Solutions

4.2.3. Complex and Fragmented Nature of Edge Environments Hampering the Implementation of Edge Security Solutions

4.2.4. Increasing Use of 5G Technology to Enhance Communications Infrastructure Expected to Create Market Growth Opportunities

4.2.5. Rising Adoption of Cloud-based Services Among SMEs Expected to Generate Opportunities for Market Stakeholders

4.2.6. Misconceptions and Lack of Knowledge Regarding Edge Security Expected to Remain Major Challenges for Market Players

4.3. Trends

4.3.1. Surging Adoption of Artificial Intelligence (AI) Across Industries

4.4. Case Studies

4.4.1. Case Study A

4.4.2. Case Study B

4.4.3. Case Study C

4.5. Vendor Selection Criteria/Factors Influencing Purchase Decisions

5. Edge Security Market Assessment—By Offering.

5.1. Overview

5.2. Solutions

5.2.1 Software-defined Wide Area Network Solutions

5.2.2 Secure Web Gateway Solutions

5.2.3 Firewall-as-a-Service Solutions

5.2.4 Cloud Access Security Broker Solutions

5.2.5 Zero Trust Network Access Solutions

5.2.6 Other Edge Security Solutions

5.3. Services

5.3.1 Professional Services

5.3.1.1 Integration Services

5.3.1.2 Training, Consulting, and Advisory Services

5.3.1.3 Support & Maintenance Services

5.3.2 Managed Services

6. Edge Security Market Assessment—By Organization Size

6.1. Overview

6.2. Large Enterprises

6.3. Small & Medium-sized Enterprises

7. Edge Security Market Assessment—By Deployment Mode

7.1. Overview

7.2. Cloud-based Deployments

7.3. On-premise Deployments

8. Edge Security Market Assessment—By Sector

8.1. Overview

8.2. IT & Telecommunications

8.3. BFSI

8.4. Retail & E-commerce

8.5. Healthcare

8.6. Government

8.7. Manufacturing

8.8. Energy & Utilities

8.9. Education

8.10. Other Sectors

9. Edge Security Market Assessment—By Geography

9.1. Overview

9.2. North America

9.2.1 U.S.

9.2.2 Canada

9.3. Asia-Pacific

9.3.1 China

9.3.2 Japan

9.3.3 South Korea

9.3.4 India

9.3.5 Singapore

9.3.6 Rest of Asia-Pacific

9.4. Europe

9.4.1 U.K.

9.4.2 Germany

9.4.3 France

9.4.4 Spain

9.4.5 Italy

9.4.6 Rest of Europe

9.5 Latin America

9.6 Middle East & Africa

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Ranking, By Key Player

11. Company Profiles (Company Overview, Financial Overview, Product Portfolio, and Strategic Developments)

11.1. Cisco Systems, Inc.

11.2. Broadcom Inc.

11.3. Check Point Software Technologies Ltd.

11.4. Palo Alto Networks, Inc.

11.5. Fortinet, Inc.

11.6. Juniper Networks, Inc.

11.7. Zscaler, Inc.

11.8. Cloudflare, Inc.

11.9. F5, Inc.

11.10. Akamai Technologies, Inc.

11.11. Barracuda Networks, Inc.

11.12. Forcepoint LLC

11.13. Versa Networks, Inc.

11.14. Cato Networks Ltd.

11.15. Skyhigh Security

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

12. Appendix

12.1. Available Customization

List of Tables

Table 1 Currency Conversion Rate, 2018–2022

Table 2 Global Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 3 Global Edge Security Solutions Market, By Type, 2022–2031 (USD Million)

Table 4 Global Edge Security Market, By Country/Region, 2022–2031 (USD Million)

Table 5 Global Software-defined Wide Area Network Solutions Market, By Country/Region, 2022–2031 (USD Million)

Table 6 Global Secure Web Gateway Solutions Market, By Country/Region, 2022–2031 (USD Million)

Table 7 Global Firewall-as-a-Service Solutions Market, By Country/Region, 2022–2031 (USD Million)

Table 8 Global Cloud Access Security Broker Solutions Market, By Country/Region, 2022–2031 (USD Million)

Table 9 Global Zero Trust Network Access Solutions Market, By Country/Region, 2022–2031 (USD Million)

Table 10 Global Other Edge Security Solutions Market, By Country/Region, 2022–2031 (USD Million)

Table 11 Global Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 12 Global Edge Security Services Market, By Country/Region, 2022–2031 (USD Million)

Table 13 Global Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 14 Global Edge Security Professional Services Market, By Country/Region, 2022–2031 (USD Million)

Table 15 Global Edge Security Integration Services Market, By Country/Region, 2022–2031 (USD Million)

Table 16 Global Edge Security Training, Consulting, and Advisory Market, By Country/Region, 2022–2031 (USD Million)

Table 17 Global Edge Security Support & Maintenance Services Market, By Country/Region, 2022–2031 (USD Million)

Table 18 Global Edge Security Managed Services Market, By Country/Region, 2022–2031 (USD Million)

Table 19 Global Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 20 Global Edge Security Market for Large Enterprises, By Country/Region, 2022–2031 (USD Million)

Table 21 Global Edge Security Market for Small & Medium-sized Enterprises, By Country/Region, 2022–2031 (USD Million)

Table 22 Global Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 23 Global Edge Security Market for Cloud-based Deployments, By Country/Region, 2022–2031 (USD Million)

Table 24 Global Edge Security Market for On-premise Deployments, By Country/Region, 2022–2031 (USD Million)

Table 25 Global Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 26 Global Edge Security Market for IT & Telecommunications, By Country/Region, 2022–2031 (USD Million)

Table 27 Global Edge Security Market for BFSI, By Country/Region, 2022–2031 (USD Million)

Table 28 Global Edge Security Market for Retail & E-commerce, By Country/Region, 2022–2031 (USD Million)

Table 29 Global Edge Security Market for Healthcare, By Country/Region, 2022–2031 (USD Million)

Table 30 Global Edge Security Market for Government, By Country/Region, 2022–2031 (USD Million)

Table 31 Global Edge Security Market for Manufacturing, By Country/Region, 2022–2031 (USD Million)

Table 32 Global Edge Security Market for Energy & Utilities, By Country/Region, 2022–2031 (USD Million)

Table 33 Global Edge Security Market for Education, By Country/Region, 2022–2031 (USD Million)

Table 34 Global Edge Security Market for Other Sectors, By Country/Region, 2022–2031 (USD Million)

Table 35 Global Edge Security Market, By Country/Region, 2022–2031 (USD Million)

Table 36 North America: Edge Security Market, By Country, 2022–2031 (USD Million)

Table 37 North America: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 38 North America: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 39 North America: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 40 North America: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 41 North America: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 42 North America: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 43 North America: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 44 U.S.: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 45 U.S.: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 46 U.S.: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 47 U.S.: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 48 U.S.: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 49 U.S.: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 50 U.S.: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 51 Canada: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 52 Canada: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 53 Canada: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 54 Canada: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 55 Canada: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 56 Canada: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 57 Canada: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 58 Asia-Pacific: Edge Security Market, By Country/Region, 2022–2031 (USD Million)

Table 59 Asia-Pacific: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 60 Asia-Pacific: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 61 Asia-Pacific: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 62 Asia-Pacific: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 63 Asia-Pacific: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 64 Asia-Pacific: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 65 Asia-Pacific: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 66 China: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 67 China: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 68 China: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 69 China: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 70 China: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 71 China: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 72 China: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 73 Japan: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 74 Japan: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 75 Japan: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 76 Japan: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 77 Japan: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 78 Japan: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 79 Japan: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 80 South Korea: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 81 South Korea: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 82 South Korea: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 83 South Korea: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 84 South Korea: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 85 South Korea: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 86 South Korea: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 87 India: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 88 India: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 89 India: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 90 India: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 91 India: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 92 India: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 93 India: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 94 Singapore: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 95 Singapore: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 96 Singapore: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 97 Singapore: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 98 Singapore: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 99 Singapore: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 100 Singapore: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 101 Rest of Asia-Pacific: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 102 Rest of Asia-Pacific: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 103 Rest of Asia-Pacific: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 104 Rest of Asia-Pacific: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 105 Rest of Asia-Pacific: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 106 Rest of Asia-Pacific: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 107 Rest of Asia-Pacific: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 108 Europe: Edge Security Market, By Country/Region, 2022–2031 (USD Million)

Table 109 Europe: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 110 Europe: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 111 Europe: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 112 Europe: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 113 Europe: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 114 Europe: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 115 Europe: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 116 U.K.: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 117 U.K.: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 118 U.K.: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 119 U.K.: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 120 U.K.: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 121 U.K.: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 122 U.K.: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 123 Germany: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 124 Germany: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 125 Germany: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 126 Germany: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 127 Germany: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 128 Germany: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 129 Germany: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 130 France: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 131 France: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 132 France: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 133 France: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 134 France: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 135 France: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 136 France: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 137 Italy: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 138 Spain: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 139 Spain: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 140 Spain: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 141 Spain: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 142 Spain: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 143 Spain: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 144 Italy: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 145 Italy: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 146 Italy: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 147 Italy: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 148 Italy: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 149 Italy: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 150 Italy: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 151 Rest of Europe: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 152 Rest of Europe: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 153 Rest of Europe: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 154 Rest of Europe: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 155 Rest of Europe: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 156 Rest of Europe: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 157 Rest of Europe: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 158 Latin America: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 159 Latin America: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 160 Latin America: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 161 Latin America: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 162 Latin America: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 163 Latin America: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 164 Latin America: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 165 Middle East & Africa: Edge Security Market, By Offering, 2022–2031 (USD Million)

Table 166 Middle East & Africa: Edge Security Solution Market, By Type, 2022–2031 (USD Million)

Table 167 Middle East & Africa: Edge Security Services Market, By Type, 2022–2031 (USD Million)

Table 168 Middle East & Africa: Edge Security Professional Services Market, By Type, 2022–2031 (USD Million)

Table 169 Middle East & Africa: Edge Security Market, By Deployment Mode, 2022–2031 (USD Million)

Table 170 Middle East & Africa: Edge Security Market, By Organization Size, 2022–2031 (USD Million)

Table 171 Middle East & Africa: Edge Security Market, By Sector, 2022–2031 (USD Million)

Table 172 Market Ranking, By Key Player

List of Figures

Figure 1 Market Ecosystem

Figure 2 Key Stakeholders

Figure 3 Research Process

Figure 4 Key Secondary Resources

Figure 5 Primary Research Techniques

Figure 6 Key Executives Interviewed

Figure 7 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 8 Market Sizing and Growth Forecast Approach

Figure 9 Key Insights

Figure 10 In 2024, The Solution Segment Is Expected to Dominate the Edge Security Market

Figure 11 In 2024, The On-premise Deployments Segment Is Expected to Dominate the Edge Security Market

Figure 12 In 2024, The Large Enterprises Segment Is Expected to Dominate the Edge Security Market

Figure 13 In 2024, The IT & Telecommunication Segment Is Expected to Dominate the Edge Security Market

Figure 14 Global Edge Security Market, By Country/Region (2024 Vs. 2031)

Figure 15 Impact Analysis of Market Dynamics

Figure 16 Vendor Selection Criteria/Factors Influencing Purchase Decisions

Figure 17 Global Edge Security Market, By Offering, 2024 Vs. 2031 (USD Million)

Figure 18 Global Edge Security Market, By Deployment Mode, 2024 Vs. 2031 (USD Million)

Figure 19 Global Edge Security Market, By Organization Size, 2024 Vs. 2031 (USD Million)

Figure 20 Global Edge Security Market, By Sector, 2024 Vs. 2031 (USD Million)

Figure 21 Global Edge Security Market, By Country/Region, 2024 Vs. 2031 (USD Million)

Figure 22 North America: Global Edge Security Market Snapshot

Figure 23 Asia-Pacific: Global Edge Security Market Snapshot

Figure 24 Europe: Global Edge Security Market Snapshot

Figure 25 Growth Strategies Adopted by Leading Market Players (2021–2024)

Figure 26 Vendor Market Positioning Analysis (2021–2024)

Figure 27 Competitive Dashboard: Global Edge Security Market

Figure 28 Cisco Systems, Inc.: Financial Overview (2023)

Figure 29 Cisco Systems, Inc.: Swot Analysis

Figure 30 Broadcom Inc.: Financial Overview (2023)

Figure 31 Broadcom Inc.: Swot Analysis

Figure 32 Check Point Software Technologies Ltd.: Financial Overview (2023)

Figure 33 Check Point Software Technologies Ltd.: Swot Analysis

Figure 34 Palo Alto Networks, Inc.: Financial Overview (2023)

Figure 35 Palo Alto Networks, Inc.: Swot Analysis

Figure 36 Fortinet, Inc.: Financial Overview (2023)

Figure 37 Fortinet, Inc.: Swot Analysis

Figure 38 Juniper Networks, Inc.: Financial Overview (2023)

Figure 39 Zscaler, Inc.: Financial Overview (2023)

Figure 40 Cloudflare, Inc.: Financial Overview (2023)

Figure 41 F5, Inc.: Financial Overview (2023)

Figure 42 Akamai Technologies, Inc.: Financial Overview (2023)

Figure 43 KKR & Co. Inc.: Financial Overview (2023)

Published Date: Oct-2025

Published Date: Jul-2024

Published Date: Jul-2024

Published Date: Jul-2024

Published Date: Apr-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates