Resources

About Us

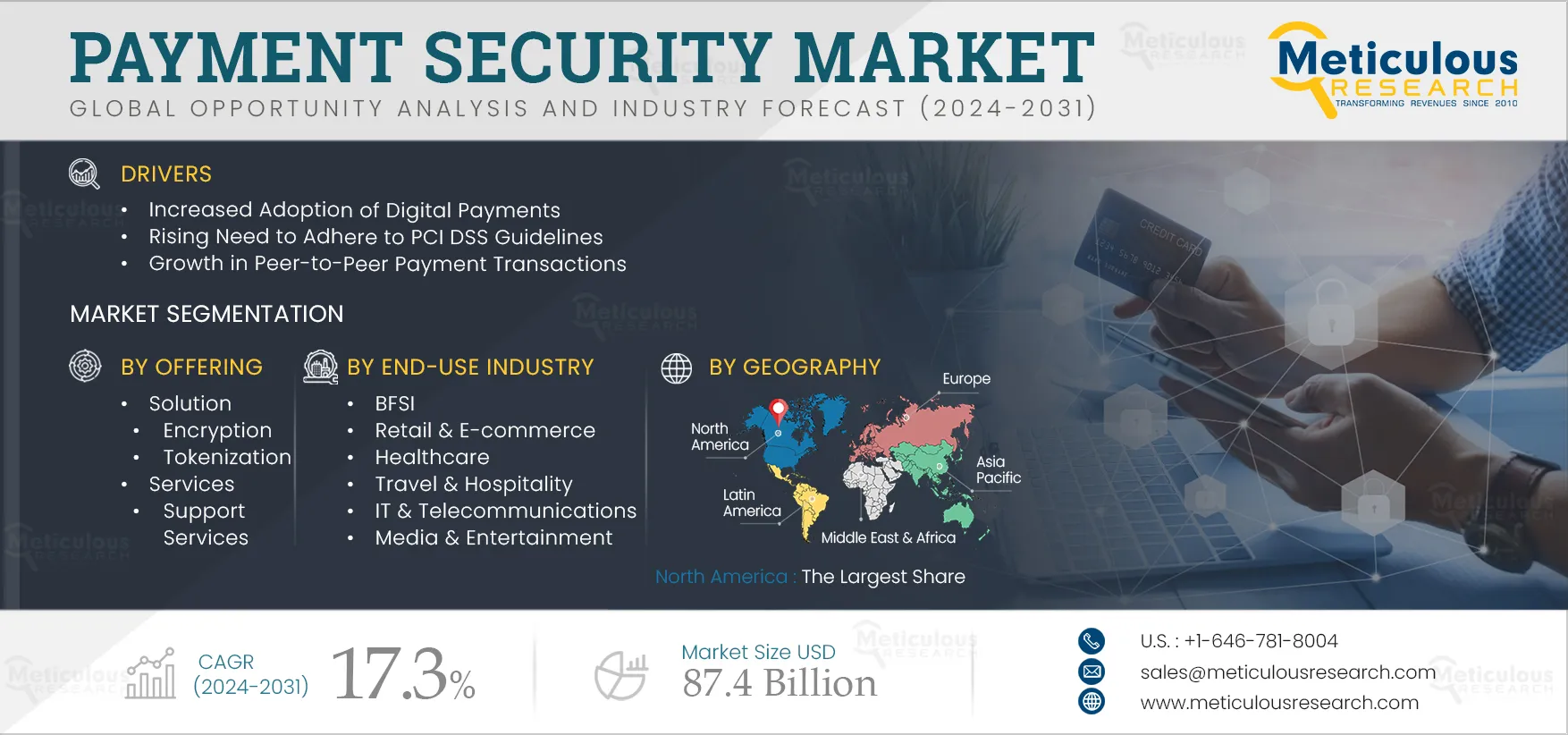

Payment Security Market Size, Share, Forecast, & Trends Analysis By Offering (Solutions, Services), Payment Mode (Banking Cards, Internet Banking, PoS, Digital Wallets, Others), Organization Size, End User (BFSI, Retail & E-commerce, Healthcare, Others) & Geography - Global Forecast to 2031

Report ID: MRICT - 104550 Pages: 250 Jul-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 48 Hours Download Free Sample ReportThe Payment Security Market is expected to reach $87.4 billion by 2031, at a CAGR of 17.3% from 2024 to 2031. The growth of the payment security market is driven by the increased adoption of digital payments, the rising need to adhere to PCI DSS guidelines and the growth in peer-to-peer payment transactions. However, the lack of trust in online banking is a factor restraining the growth of this market.

Furthermore, the rise in payment fraud and the growing use of mobile wallets and contactless payment systems are expected to generate growth opportunities for the stakeholders in this market. However, the low awareness of digital payments in rural areas is a major challenge impacting market growth. Additionally, biometric authentication and the increasing use of AI and blockchain in payment security are prominent trends in the payment security market.

In the past few years, major technological advancements, massive shifts in consumer buying behavior, government policies and regulations, sharp e-commerce growth, the proliferation of smartphones, and the global proliferation of connected devices have driven significant changes in digital payments. The adoption of digital payment modes, such as Internet banking, mobile payments, and card payments, has rapidly increased in recent years and has become a cornerstone for financial inclusion initiatives in various countries. The rising adoption of different payment modes has accelerated the demand for payment security solutions. Secured payment processing facilitates the smooth transfer of online payments, client data safety, and other sensitive information and protects against fraud and other security issues.

Payment processing refers to the complete system of handling financial transactions, including recording, verifying, and approving payments between a buyer and a seller. There are several key payment processing regulations that businesses must comply with, including the Payment Card Industry Data Security Standard (PCI DSS), the Second Payment Services Directive (PSD2), and the General Data Protection Regulation (GDPR). Each of these regulations has specific requirements that businesses must adhere to. Maintaining payment security is crucial; hence, it becomes mandatory that every linked entity closely follows these guidelines. If a data breach occurs and the business does not adhere to guidelines, it will be required to pay penalties and fines. Thus, the stringent guidelines for payment processing are expected to drive the growth of the payment security market.

Click here to: Get a Free Sample Copy of this report

Click here to: Get a Free Sample Copy of this report

The development of digital wallets and contactless payment systems as a result of technological advancements has transformed the way to pay for goods and services. These new payment options provide ease, security, and efficiency while altering the old payment landscape. The proliferation of digital wallets and contactless payment systems has resulted in various advantages for both consumers and companies. However, these methods are gaining the attention of cybercriminals and becoming a prime target. As the use of digital wallets continues to grow, cybercriminals will likely become even more emboldened in their efforts to target both customers and service providers. This is expected to create opportunities for market players to implement payment security strategies to secure mobile wallets and contactless payment transactions.

Financial institutes are now leveraging artificial intelligence and blockchain to ensure secure payments and improve customer experience. AI and blockchain ensure that all transactions are transparent and accountable, which is vital for regulatory compliance and bolstering customer confidence in financial systems. AI’s advanced algorithms enable financial institutions to identify and mitigate fraud effectively. Through machine learning and predictive analytics, these AI systems scrutinize extensive datasets to pinpoint fraud in real time, adapting to new fraudulent patterns over time. Blockchain facilitates fast, secure, low-cost international payment processing services through the use of encrypted distributed ledgers that provide trusted real-time verification of transactions without the need for intermediaries such as correspondent banks and clearinghouses. Such increasing use of AI & blockchain technology in payment systems can enhance payment security and reduce the possibilities of cyberattacks.

Based on offering, the global payment security market is segmented into solutions and services. In 2024, the solutions segment is expected to account for a larger share of over 74.0% of the global payment security market. The segment’s large market share is mainly attributed to the increased adoption of digital payments across retail & e-commerce, hospitality, and healthcare industries, increasing investment of business in cybersecurity, growing use of AI for fraud detection in the banking sector, and increased business focus and priority on payment security.

Moreover, the solutions segment is expected to record the highest CAGR during the forecast period. The growth of this segment is mainly driven by an increase in PoS payments across healthcare, retail, and hospitality industries, the growing integration of payment processing APIs to facilitate secured payments, stringent regulatory compliance for payment security, and the surge in contactless payments.

Based on payment mode, the global payment security market is segmented into banking cards, digital wallets, internet banking, point-of-sales, and other payment modes. In 2024, the banking cards segment is expected to account for the largest share of over 32.0% of the global payment security market. The segment’s large market share is mainly attributed to the growing focus of businesses on enhancing the in-store experience, increased adoption of point-of-sale systems, increased card transactions, the growing e-commerce sector, and the crucial need for businesses to comply with PCI DSS guidelines.

However, the digital wallets segment is expected to record the highest CAGR during the forecast period. The growth of this segment is mainly driven by the growing adoption of multi-factor authentication in digital wallets, the growing adoption of mobile wallets, and the increasing adoption of QR code-based payment methods.

Based on organization size, the global payment security market is segmented into large enterprises, and small and medium-sized enterprises. In 2024, the large enterprises segment is expected to account for a larger share of over 70.0% of the global payment security market. The segment’s large market share is mainly attributed to the crucial need for large-sized businesses to protect customer data due to their higher transaction volume and large customer base. Moreover, the large enterprises segment is expected to record the highest CAGR during the forecast period.

Based on end-use industry, the global payment security market is segmented into BFSI, retail & e-commerce, healthcare, travel & hospitality, IT & telecom, media & entertainment, and other end-use industries. In 2024, the BFSI is expected to account for the largest share of over 29.0% of the global payment security market. The segment’s large market share is mainly attributed to increasing data breaches in the BFSI industry and the increasing efforts to curb them, the rising adoption of payment security solutions to prevent fraud, stringent requirements for data security and privacy, and a large number of financial transactions in the industry.

However, the retail & e-commerce segment is expected to record the highest CAGR during the forecast period. The growth of this segment is mainly driven by increasing smartphone usage for payments, increasing spending on e-commerce, growing focus of businesses on omnichannel presence, rise in point-of-sale data breaches, and growth in contactless payment modes.

In 2024, North America is expected to account for the largest share of over 36.0% of the global payment security market. The large share of this regional market is attributed to factors such as increased adoption of digital payment, growing spending of businesses on cybersecurity measures, growth in uses of card payment methods, growing adoption of PoS terminals across malls and retail stores, and growth in payment frauds across the region.

However, the Asia-Pacific region is projected to register the highest CAGR of 18.9% during the forecast period. The growth of this region is mainly driven by the growing adoption of advanced payment technologies, growth in e-commerce sales, rise in digitalization across several industries, and increased growth in mobile payments across the region.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the payment security market are Bluefin Payment Systems LLC (U.S.), Braintree (U.S.), Elavon Inc. (U.S.), TokenEx, Inc. (U.S.), Shift4 Payments, Inc. (U.S.), Cybersource (U.S.), Ingenico (France), Broadcom Inc. (U.S.), Signifyd, Inc. (U.S.), TNS Inc. (U.S.), Stripe, Inc. (U.S.), Mastercard Incorporated (U.S.), VeriFone, Inc. (U.S.), Utimaco Management Services GmbH (Germany), and SISA Information Security Pvt. Ltd. (India).

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

17.3% |

|

Market Size (Value) |

$87.4 Billion by 2031 |

|

Segments Covered |

By Offering

By Payment Mode

By Organization Size

By End-use Industry

|

|

Countries Covered |

Europe (U.K., Germany, France, Italy, Spain, Sweden, Switzerland, Netherlands, Norway, Austria, Denmark, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Singapore, Australia, Malaysia, Taiwan, Rest of Asia-Pacific), North America (U.S., Canada), Latin America (Brazil, Mexico, Rest of Latin America), and the Middle East & Africa (Israel, UAE, Rest of Middle East & Africa) |

|

Key Companies |

Bluefin Payment Systems LLC (U.S.), Braintree (U.S.), Elavon Inc. (U.S.), TokenEx, Inc. (U.S.), Shift4 Payments, Inc. (U.S.), Cybersource (U.S.), Ingenico (France), Broadcom Inc. (U.S.), Signifyd, Inc. (U.S.), TNS Inc. (U.S.), Stripe, Inc. (U.S.), Mastercard Incorporated (U.S.), VeriFone, Inc. (U.S.), Utimaco Management Services GmbH (Germany), and SISA Information Security Pvt. Ltd. (India) |

The payment security market study focuses on market assessment and opportunity analysis through the sales of payment security solutions and services across different regions and countries. This study also focuses on competitive analysis for payment security based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The Payment Security Market is expected to reach $87.4 billion by 2031, at a CAGR of 17.3% from 2024 to 2031.

In 2024, the solutions segment is expected to hold the largest share of the payment security market.

The retail & e-commerce segment is expected to register the highest CAGR during the forecast period.

The growth of the payment security market is driven by the increased adoption of digital payments, the rising need to adhere to PCI DSS guidelines, and the growth in peer-to-peer payment transactions. Furthermore, the rise in payment fraud and the growing use of mobile wallets and contactless payment systems are expected to generate growth opportunities for the stakeholders in this market.

Key players operating in the payment security market are Bluefin Payment Systems LLC (U.S.), Braintree (U.S.), Elavon Inc. (U.S.), TokenEx, Inc. (U.S.), Shift4 Payments, Inc. (U.S.), Cybersource (U.S.), Ingenico (France), Broadcom Inc. (U.S.), Signifyd, Inc. (U.S.), TNS Inc. (U.S.), Stripe, Inc. (U.S.), Mastercard Incorporated (U.S.), VeriFone, Inc. (U.S.), Utimaco Management Services GmbH (Germany), and SISA Information Security Pvt. Ltd. (India).

Asia-Pacific is expected to record the highest CAGR during the forecast period.

Published Date: Aug-2024

Published Date: Apr-2024

Published Date: Jan-2024

Published Date: Nov-2022

Published Date: Aug-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates