Resources

About Us

Digital Fashion Market Size, Share, Forecast & Trends by Type (Apparel/Clothing, Accessories, Footwear) Application (Men, Women, Children) - Global Forecast to 2035

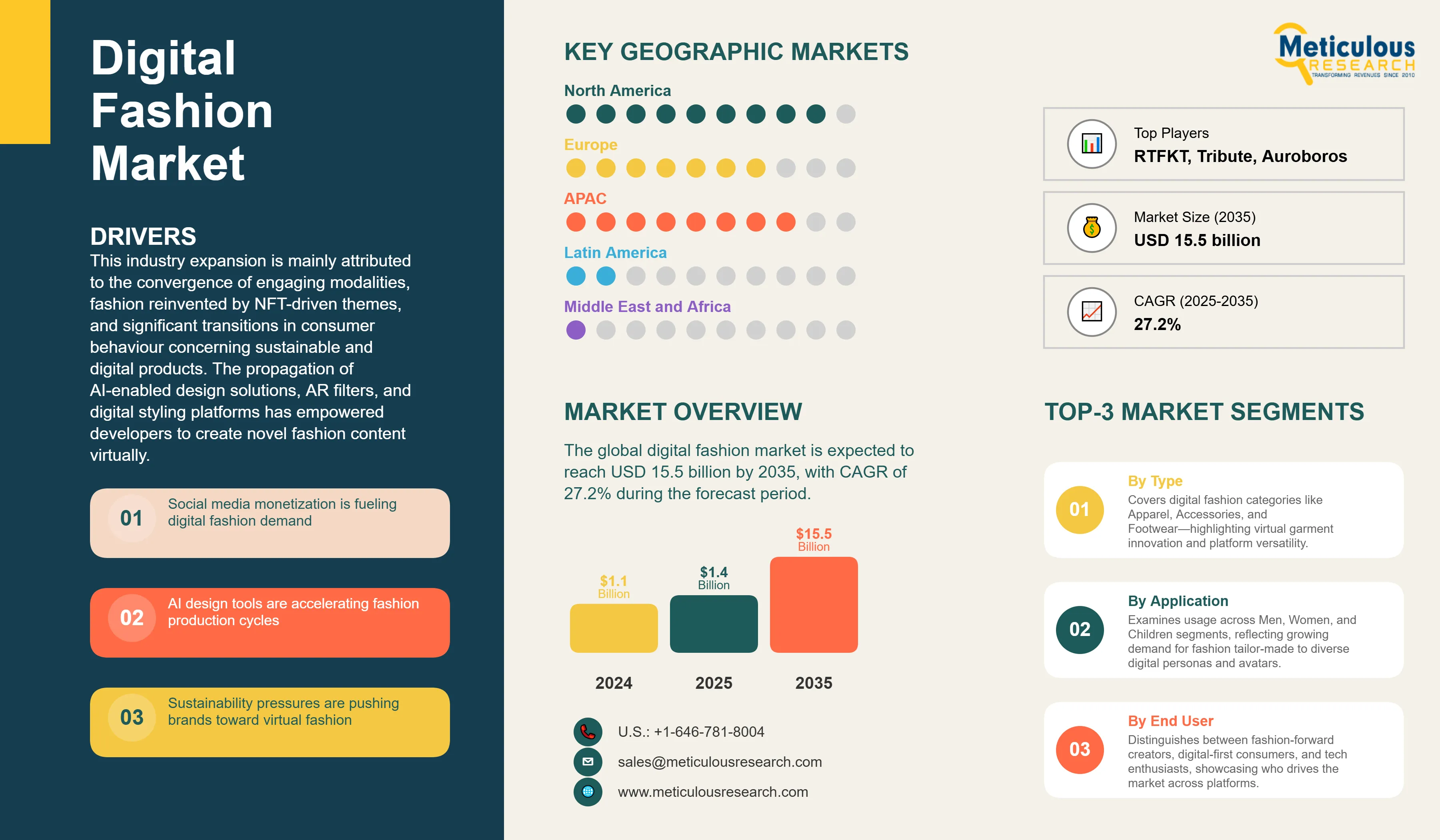

Report ID: MRICT - 1041584 Pages: 192 Sep-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global digital fashion market was valued at USD 1.1 billion in 2024 and is estimated to reach USD 1.4 billion in 2025, growing at a CAGR of 27.2% to hit USD 15.5 billion by 2035.

This industry expansion is mainly attributed to the convergence of engaging modalities, fashion reinvented by NFT-driven themes, and significant transitions in consumer behaviour concerning sustainable and digital products. The propagation of AI-enabled design solutions, AR filters, and digital styling platforms has empowered developers to create novel fashion content virtually. Gen Z consumers are buying virtual fashion assets for social media use, and this trend is expected to surge as digital content renumeration becomes more conventional.

A lifecycle assessment by DressX, highlighted that developing a virtual garment releases 97% less CO₂ and consumes 3,300 liters less water in comparison with the conventional counterpart. The fashion business’s pivot towards sustainable products is also promoting the virtual adoption, with renowned brands utilizing digital try-ons to limit product returns and drive sales. As virtual fashion becomes an inseparable element of influencer marketing, digital retail, and e-commerce, it is projected to significantly drive monetization and consumption within the fashion industry.

Competitive Scenario of the Digital Fashion Market and Insights

Click here to: Get Free Sample Pages of this Report

Major players in the digital fashion space are increasingly tech-driven, with startups and legacy brands competing on innovation. Companies like Finesse, DressX, and The Fabricant are leading with AI-powered design platforms and virtual styling tools. Finesse, for example, uses machine learning to predict fashion trends and generate digital garments, while DressX has partnered with Meta and Snapchat to integrate digital fashion into AR environments. Traditional brands such as H&M and Tommy Hilfiger are also entering the space, launching digital-only collections for marketing and e-commerce. The competitive landscape is defined by speed, personalization, and platform integration.

Recent Developments in the Global Digital Fashion Market

RTFKT x Nike AR Hoodie Launch

In January 2024, Nike unveiled a ground-breaking strategy for its .SWOOSH virtual lab, introducing in-game wearables that users can equip their avatars with in popular video games. These virtual items can be used to unlock corresponding physical apparel or footwear, seamlessly connecting the virtual and physical worlds. Nike has also added a "off-ramp" feature that allows users to transfer virtual items into personal wallets, enabling trading on NFT marketplaces.

Balenciaga and Fortnite Expand Partnership

In March 2023, DRESSX collaborated with fashion house DUNDAS to bring ten real-world runway looks to the Metaverse for Metaverse Fashion Week. Digital twins of the garments were made wearable instantly, combining physical and digital fashion.

Key Market Drivers

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Social media monetization is fueling digital fashion demand |

Rapid adoption of AR try-ons, VR fashion shows, and NFT-enabled ownership |

Widespread interoperability across platforms |

▲ +3.0% |

|

2. AI design tools are accelerating fashion production cycles |

Strong uptake from ESG-driven brands in Europe and Asia |

Becomes a core sustainability metric |

▲ +2.6% |

|

|

Restraints |

1. Limited interoperability across platforms is slowing adoption |

Lack of interoperability limits garment usability |

Partial resolution with adoption of open metaverse standards |

▼ −1.7% |

|

2. Consumer Skepticism Outside Core Demographics |

Low adoption from Gen X and Baby Boomers |

Gradual improvement with hybrid phygital products |

▼ −1.3% |

|

|

Opportunities |

1. Expansion of Digital-Only Fashion Houses |

Significant VC investment and brand partnerships |

Emergence of globally recognized digital-first luxury brands |

▲ +2.3% |

|

2. Metaverse Platforms as Fashion Marketplaces |

Growth of platforms like Roblox, Zepeto, and Decentraland as commerce hubs |

Integration of full retail ecosystems within virtual spaces |

▲ +2.0% |

|

|

Trends |

1.Integration of Digital Fashion in Social and Gaming Ecosystems |

Increasing crossover between fashion brands and gaming studios |

Digital fashion becomes integral to social identity in virtual environments |

▲ +1.7% |

|

Challenges |

1. IP Protection and Digital Asset Security |

Increasing crossover between fashion brands and gaming studios |

Digital fashion becomes integral to social identity |

▼ −1.1% |

Regional Analysis

North America is Leading in Creator-Driven Digital Fashion Adoption

North America is emerging as the leader in creator-driven digital fashion adoption, with the U.S. leading the way due to its robust digital ecosystem and thriving creator economy. The region's high smartphone penetration and widespread use of social media platforms such as TikTok, Instagram, and Snapchat create a fertile environment for virtual fashion adoption.

A growing number of influencers and creators are incorporating digital outfits, augmented reality (AR) filters, and virtual try-ons into their content, opening up new opportunities for consumer engagement. For example, U.S.-based startups such as DRESSX and Finesse are pioneering digital-only clothing and AR-based styling tools, with significant venture capital funding. Furthermore, fashion brands are increasingly working with creators to launch virtual collections, with engagement rates in North America outpacing those in other regions. This convergence of technology, creator influence, and consumer demand establishes North America as the global leader in digital fashion innovation.

Asia-Pacific Is Emerging as a High-Growth Market for Virtual Fashion

The Asia-Pacific region is projected to record the fastest growth in the global digital fashion market, with an estimated CAGR of around 31% between 2025 and 2035. Rapid growth in digital fashion is being observed in the Asia-Pacific region, which is being driven by mobile-first consumers and robust social media engagement. According to Tencent, more than 70% of Gen Z users in China interact with virtual fashion content on a weekly basis.

In addition to 5G infrastructure and AR innovation, South Korea and Japan are also investing in avatar-based fashion ecosystems. In order to appeal to tech-savvy audiences and reduce costs, the region's fashion brands are increasingly launching digital-only campaigns. Also, government initiatives promoting digital economy development and sustainability consciousness among millennials and Gen Z consumers accelerate adoption of virtual garments as eco-friendly alternatives to fast fashion. Major fashion brands leverage Instagram's AR technology and Facebook's gaming partnerships to engage younger demographics through gamified shopping experiences. Asia-Pacific is further anticipated to serve as a significant growth engine until 2035 with the increasing penetration of smartphones and the cultural acceptance of virtual aesthetics.

Traditional Craftsmanship Meets Technological Innovation in Digital Fashion Evolution in Japan

Japan's digital fashion market is growing rapidly, with a projected CAGR of about 20% from 2025 to 2035. This growth comes from the blend of traditional Japanese craftsmanship and new technology, as well as strong consumer interest in unique, customizable fashion experiences.

Japanese products are starting to include smart textiles and wearable technology. Consumers want high-quality, customizable items, supported by digital textile printing that allows for detailed, small-batch production.

The market benefits from Japan's strong digital infrastructure, high e-commerce use, and a fashion-savvy consumer base looking for personalized and sustainable choices. Leading educational programs are also important. Institutions like Bunka Fashion College are at the forefront of digital fashion education, with innovations like Japan's first Roblox-supported digital fashion curriculum launched by Dentsu in 2024.

Augmented reality, virtual try-on technologies, and 3D design tools are commonly used in retail spaces, boosting consumer engagement and helping the market grow.

Advanced E-Commerce Infrastructure and Innovation in the UK is Driving the Demand for Digital Fashion

The digital fashion market in the U.K. is experiencing steady growth, which confirms its leading role in Europe. This growth is fueled by advancements in fashion technology and widespread digital changes. Several factors, such as strong digital infrastructure and high consumer acceptance of online fashion shopping, drive this growth and create significant demand. U.K. consumers are comfortable making fashion purchases online. This comfort is supported by effective retail strategies and the latest AR/VR technologies.

Fashion brands in the U.K. use social media platforms like Instagram, TikTok, and YouTube for influencer marketing targeted at millennials and Gen Z. There is a strong focus on sustainability and ethical fashion in the market. This focus is increasing interest in digital clothing collections and virtual apparel that helps reduce environmental impact. Despite ongoing challenges, such as data privacy laws and managing intellectual property in digital spaces, the U.K.’s developed retail market and openness to new technology position it well for continued growth in the coming years.

Segmental Analysis

Apparel leads the digital fashion product landscape

In 2025, apparel section is expected to dominate the overall digital fashion market, accounting for the majority revenue share across metaverse platforms, gaming environments, and social media integrations. Digital apparel dominates due to its versatility in self-expression, the ability to mirror or exaggerate real-world fashion trends, and compatibility with a wide range of platforms from Roblox to Decentraland.

Major fashion brands including Gucci, Louis Vuitton, and Nike have launched exclusive digital clothing lines, often priced comparably to physical counterparts, demonstrating the premium value consumers place on virtual fashion ownership. The segment benefits from advanced 3D modelling technologies, photorealistic rendering capabilities, and blockchain-based authentication systems that ensure digital ownership and scarcity. Moreover, luxury fashion houses and digital-native brands alike are investing heavily in this segment, releasing exclusive collections and limited-edition drops to create scarcity-driven demand.

Women’s segment dominates while men’s segment leads in growth of Digital Fashion Market

By application, the women’s category accounts for the highest revenue share in 2025, fuelled by fashion-driven consumers actively interacting with metaverse platforms, social media AR filters, and digital runway events.

Women's digital fashion encompasses diverse categories including formal wear, casual clothing, accessories, and exclusive luxury items, often featuring intricate details and premium materials that showcase advanced 3D modelling capabilities.

Additionally, virtual collections witness higher transaction volumes, specifically in association with luxury and quick-fashion brands that resonate their physical product lines. Female consumers demonstrate significantly greater willingness to purchase digital clothing for social media expression, with studies indicating women are 2.3 times more likely than men to buy virtual garments for avatar customization and online content creation.

Contrastingly, the men’s segment is projected to grow at the fastest CAGR of about 27% from 2025 to 2035. This growth is largely propelled by male engagement in gaming platforms, virtual sports environments, and NFT sneaker culture.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 1.4 billion |

|

Revenue forecast in 2035 |

USD 15.5 billion |

|

CAGR (2025-2035) |

27.2% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

By Type (Apparel/Clothing, Accessories, Footwear), Application (Men, Women, Children) Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

RTFKT, Tribute, Auroboros, The Fabricant, Digitalax, Carlings, XR Couture, The Dematerialised, DressX |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

Market Segmentation

The digital fashion market is estimated to be USD 1.4 billion in 2025 and grow at a CAGR of 27.2% to reach USD 15.5 billion by 2035.

In 2024, the digital fashion market was estimated at USD 1.1 billion, with projections to reach USD 1.4 billion in 2025.

RTFKT Studios (Nike), The Fabricant, DressX, Auroboros, Republiqe are the major companies operating in the Digital Fashion Market.

The Asia Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035), driven by government-backed metaverse initiatives, strong gaming culture, and high mobile-first consumer adoption.

The apparel/clothing segment holds the largest share in the Digital Fashion Market.

1. Market Definition & Scope

1.1 Market Definition

1.2 Market Ecosystem

1.3 Currency

1.4 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Process of Data Collection and Validation

2.2.1 Secondary Research

2.2.2 Primary Research / Interviews with Key Opinion Leaders from the Industry

2.3 Market Sizing and Forecast

2.3.1 Market Size Estimation Approach

2.3.1.1 Bottom-up Approach

2.3.1.2 Top-down Approach

2.3.2 Growth Forecast Approach

2.3.3 Assumptions for the Study

3. Executive Summary

3.1 Overview

3.2 Segmental Analysis

3.2.1 Digital Fashion Market, by Type

3.2.2 Digital Fashion Market, by Application

3.2.3 Digital Fashion Market, by Region

3.3 Competitive Landscape

3.4 Strategic Recommendations

4. Market Insights

4.1 Overview

4.2 Factors Affecting Market Growth

4.2.1 Drivers

4.2.1.1 Social media monetization is fueling digital fashion demand

4.2.1.2 AI design tools are accelerating fashion production cycles

4.2.1.3 Sustainability pressures are pushing brands toward virtual fashion

4.2.1.4 Mobile penetration and 5G adoption are expanding digital fashion reach

4.2.2 Restraints

4.2.2.1 Limited interoperability across platforms is slowing adoption

4.2.2.2 Consumer Skepticism Outside Core Demographics

4.2.3 Opportunities

4.2.3.1 Expansion of Digital-Only Fashion Houses

4.2.3.2 Metaverse Platforms as Fashion Marketplaces

4.2.4 Trends

4.2.4.1 Integration of Digital Fashion in Social and Gaming Ecosystems

4.2.4.2 Growth of Phygital Fashion (Hybrid Digital-Physical Collections)

4.2.5 Challenges

4.2.5.1 IP Protection and Digital Asset Security

4.2.5.2 High Development Costs for 3D Assets and AR/VR Integration

4.3 Porter’s Five Forces Analysis

4.3.1 Bargaining Power of Suppliers

4.3.2 Bargaining Power of Buyers

4.3.3 Threat of Substitutes

4.3.4 Threat of New Entrants

4.3.5 Degree of Competition

4.4 Technology Impact on the Digital Fashion Market

4.4.1 Advanced 3D Design & Rendering Technologies

4.4.1.1 Real-time, high-fidelity 3D garment rendering engines for photorealistic visuals

4.4.1.2 AI-assisted design tools enabling automated pattern creation and style adaptation

4.4.2 Immersive AR/VR & Metaverse Integration

4.4.2.1 AR try-on solutions with real-time body tracking for e-commerce and social media

4.4.2.2 VR-based virtual showrooms and metaverse-compatible fashion experiences

4.4.3 Blockchain and Digital Asset Authentication

4.4.3.1 NFT-based ownership certificates ensuring creator rights and originality

4.4.3.2 Smart contract-enabled resale royalties and secondary market traceability

5. Impact of Sustainability on Digital Fashion Market

5.1 Reduction of Textile Waste Through Fully Digital Garments

5.2 Lower Carbon Footprint from Virtual Production Processes

5.3 Blockchain-Based Provenance and Ethical Sourcing Verification

5.4 Circular Digital Asset Ecosystems

5.5 ESG-Driven Investment in Sustainable Virtual Platforms

5.6 Energy and Resource Efficiency in Rendering and Storage

5.7 Integration of Digital Fashion in Sustainable Brand Campaigns

6. Competitive Landscape

6.1 Overview

6.2 Key Growth Strategies

6.3 Competitive Benchmarking

6.4 Competitive Dashboard

6.4.1 Industry Leaders

6.4.2 Market Differentiators

6.4.3 Vanguards

6.4.4 Contemporary Stalwarts

6.5 Market Share/Ranking Analysis, by Key Players, 2024

7. Digital Fashion Market Assessment – By Solution Type

7.1 Overview

7.2 Digital Apparel/Clothing Design Platforms

7.3 Virtual Try-On and AR/VR Solutions

7.4 NFT Marketplaces and Digital Asset Platforms

7.5 Blockchain-Based Authentication and Royalties Solutions

7.6 Metaverse Integration and Virtual Showrooms

7.7 Phygital Fashion Solutions (Hybrid Physical-Digital)

8. Digital Fashion Market Assessment—By Type

8.1 Overview

8.2 Apparel/Clothing

8.3 Accessories

8.4 Footwear

9. Digital Fashion Market Assessment—By Application

9.1 Overview

9.2 Men

9.3 Women

9.4 Children

10. Digital Fashion Market Assessment—By Geography

10.1 Overview

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 U.K.

10.3.3 France

10.3.4 Netherlands

10.3.5 Switzerland

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 Taiwan

10.4.5 India

10.4.6 Singapore

10.4.7 Australia

10.4.8 Rest of Asia-Pacific

10.5 Latin America

10.5.1 Brazil

10.5.2 Mexico

10.5.3 Argentina

10.5.4 Rest of Latin America

10.6 Middle East & Africa

10.6.1 UAE

10.6.2 Saudi Arabia

10.6.3 Israel

10.6.4 South Africa

10.6.5 Rest of Middle East & Africa

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

11.1 RTFKT

11.2 Tribute

11.3 Auroboros

11.4 The Fabricant

11.5 Digitalax

11.6 Carlings

11.7 XR Couture

11.8 The Dematerialised

11.9 DressX

11.10 Others

12. Appendix

12.1 Available Customization

12.2 Related Reports

Published Date: Aug-2025

Published Date: Aug-2025

Published Date: Jan-2025

Published Date: Apr-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates