Resources

About Us

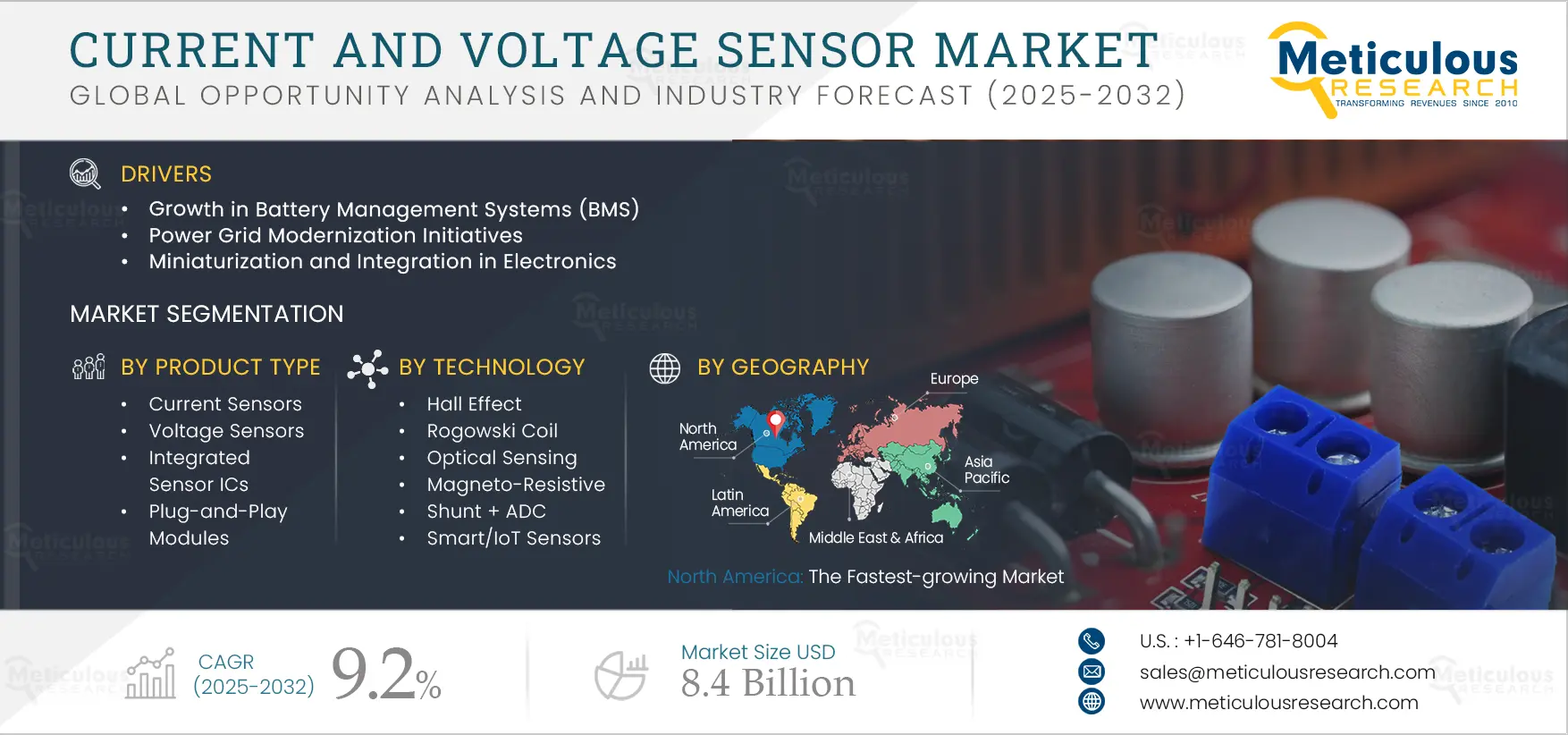

Current and Voltage Sensor Market by Product Type (Current Sensors, Voltage Sensors, Integrated Sensor ICs, Plug-and-Play Modules), Technology, End User, and Geography - Global Forecast to 2032

Report ID: MRSE - 1041480 Pages: 275 Apr-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportReport Overview

This comprehensive market research report analyzes the dynamic current and voltage sensor market, evaluating how advanced sensing technologies are revolutionizing power management, energy efficiency, and operational intelligence across automotive, industrial, renewable energy, and consumer electronics sectors. The report provides strategic analysis of market dynamics, growth projections till 2032, and competitive positioning across global and regional/country-level markets.

Market Dynamics Overview

Key Market Drivers & Trends

The current and voltage sensor market is witnessing strong growth, driven by rising demand for battery management systems in electric vehicles and consumer electronics, alongside accelerated efforts to modernize power grids and enhance energy efficiency across industries. This growth is further supported by the global expansion of renewable energy infrastructure. As power monitoring applications demand greater precision and reliability, traditional sensor designs are evolving. Meanwhile, the adoption of miniaturized components and advanced technologies such as Hall effect and Rogowski coil sensors is gaining traction. The market is also benefiting from the increasing need for contactless measurement solutions and the rise of smart and IoT enabled sensors that integrate seamlessly with digital systems, particularly in industrial automation, automotive, and energy management sectors.

Key Challenges

Despite the strong growth trajectory of the current and voltage sensor market, several key challenges are hindering broader adoption. The high precision-to-cost ratio remains a major barrier, particularly in cost-sensitive segments. Electromagnetic interference continues to pose performance risks, especially in compact electronic systems, while the need for temperature drift compensation adds design and calibration complexity. Global supply chain disruptions have further highlighted vulnerabilities, particularly in the sourcing of raw materials, impacting both production timelines and cost stability. Additionally, the increasing demand for accuracy across varying environmental conditions is complicating product deployment. In high-frequency applications, limitations in bandwidth and response time are constraining scalability and adoption in next-generation power electronics.

Click here to: Get Free Sample Pages of this Report

Growth Opportunities

Significant growth opportunities lie ahead for the current and voltage sensor market, underpinned by advancements in wide bandgap semiconductor integration, which are substantially boosting performance in power electronics. The rise of energy harvesting technologies is also driving demand for highly accurate power monitoring solutions. Furthermore, the growing need for bidirectional power flow monitoring in grid-connected systems is creating strong demand for advanced sensors, positioning them as essential enablers in smart grid evolution and renewable energy integration. The market is also benefiting from increased interest in edged computing, where sensors with embedded processing capabilities are becoming highly desirable. Lastly, the transition to non-contact sensing technologies is opening new avenues by addressing safety and reliability concerns in high voltage applications, thereby expanding the potential for innovation and market growth.

Market Segmentation Highlights

By Product Type

Current sensors are projected to command the largest share of the current and voltage sensor market in 2025, primarily driven by their widespread use in motor control, power monitoring, and battery management systems. Their adaptability spanning Hall effect, shunt-based, and Rogowski coil technologies—supports deployment across key industries such as automotive, industrial automation, renewable energy, and consumer electronics.

On other hand, integrated sensor ICs are expected to be the fastest-growing segment through 2032, as demand surges for compact, multifunctional solutions that consolidate sensing, signal processing, and communication into a single chip. This growth is supported by advancements in semiconductor design and a market shift toward space-efficient, low-complexity architectures, particularly in automotive electronics, industrial IoT, and smart grid applications.

By Technology

Hall effect technology is expected to hold the largest share of the global current and voltage sensor market in 2025, owing to its non-invasive sensing capabilities, robust performance in challenging environments, and wide operational range. These characteristics make Hall effect sensors the preferred choice in applications demanding electrical isolation and durability, such as automotive systems, industrial power monitoring, and consumer devices.

Meanwhile, smart/IoT sensors are poised for the highest growth rate over the forecast period, driven by accelerating digital transformation, the proliferation of Industrial IoT ecosystems, and rising demand for real-time, remote-enabled power monitoring. With built-in communication and processing functions, these sensors are increasingly integral to predictive maintenance, energy efficiency, and intelligent grid management.

By End User

The Automotive & Transportation sector is expected to account for the largest share of the global current and voltage sensor market in 2025, mainly driven by the rapid shift toward vehicle electrification, rising electronic integration in traditional vehicles, and increasingly stringent battery management requirements. These sensors are critical to electric vehicle powertrains, battery monitoring systems, and advanced driver assistance systems (ADAS), underpinning consistent demand within the segment.

On the other hand, the Energy & Power Utilities segment is expected to witness the highest growth rate through 2032. This acceleration is fueled by large scale grid modernization efforts, the growing penetration of renewable energy, and heightened focus on power quality and energy efficiency. Current and voltage sensors are instrumental in enabling reliable power distribution, supporting smart grid rollouts, and managing bidirectional power flow making them a cornerstone of next-generation, sustainable utility infrastructure.

By Geography

North America is is expected to hold the largest share of the global current and voltage sensor market in 2025, followed closely by Europe. This leadership is underpinned by the region’s advanced manufacturing ecosystem, substantial investments in grid modernization, accelerating electric vehicle adoption, and the strong presence of key industry players. These factors collectively position North America as a pivotal hub for technological innovation in sensing solutions across power electronics, renewable energy, and automotive sectors.

However, the Asia-Pacific region, particularly China, South Korea, and India, is expected to experience the highest growth rate over the forecast period. This momentum is mainly driven by large-scale investments in renewable energy infrastructure, the rapid expansion of EV production, widespread industrial automation, and the region's global leadership in consumer electronics manufacturing.

Meanwhile, the Middle East & Africa is emerging as a high-potential market, supported by increasing focus on grid reliability, electrification efforts, and smart city development, all of which are creating new demand for advanced sensing technologies.

Competitive Landscape

The global current and voltage sensor market is marked by intense competition and continuous innovation, driven by a mix of established semiconductor and electronics giants, niche sensor technology specialists, and emerging players targeting application-specific demands.

Market dynamics are increasingly influenced by key trends such as the digitalization of analog sensor platforms, advancements in high-precision sensing, and the adoption of cutting-edge materials and manufacturing processes. Leading companies are prioritizing improvements in temperature stability across broad operating conditions and enhancing electromagnetic compatibility to align with the performance requirements of increasingly sensitive and complex electronic systems.

Key players in the global current and voltage sensor market include LEM International, Allegro Microsystems, Texas Instruments, TDK Corporation, ABB Ltd., Infineon Technologies, Honeywell International, Tamura Corporation, STMicroelectronics, Analog Devices, Eaton Corporation, Siemens AG, Sensitec GmbH, VACUUMSCHMELZE, CR Magnetics, Kohshin Electric Corporation, Melexis Technologies NV, and Pulse Electronics Corporation, among others.

|

Particulars |

Details |

|

Number of Pages |

275 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

9.2% |

|

Market Size (Value)in 2025 |

USD 5.1 Billion |

|

Market Size (Value) in 2032 |

USD 8.4 Billion |

|

Segments Covered |

By Product Type

By Technology

By End User

|

|

Countries Covered |

North America (U.S., Canada) |

|

Key Companies |

LEM International, Allegro Microsystems, Texas Instruments, TDK Corporation, ABB Ltd., Infineon Technologies, Honeywell International, Tamura Corporation, STMicroelectronics, Analog Devices, Eaton Corporation, Siemens AG, Sensitec GmbH, VACUUMSCHMELZE, CR Magnetics, Kohshin Electric Corporation, Melexis Technologies NV, and Pulse Electronics Corporation |

The global current and voltage sensor market was valued at $4.6 billion in 2024. This market is expected to reach $8.4 billion by 2032 from an estimated $5.1 billion in 2025, at a CAGR of 9.2% during the forecast period of 2025–2032.

The global current and voltage sensor market is expected to grow at a CAGR of 9.2% during the forecast period of 2025–2032.

The global current and voltage sensor market is expected to reach $8.4 billion by 2032 from an estimated $5.1 billion in 2025, at a CAGR of 9.2% during the forecast period of 2025–2032.

The key companies operating in this market include LEM International, Allegro Microsystems, Texas Instruments, TDK Corporation, ABB Ltd., Infineon Technologies, Honeywell International, Tamura Corporation, STMicroelectronics, Analog Devices, Eaton Corporation, Siemens AG, Sensitec GmbH, VACUUMSCHMELZE, CR Magnetics, Kohshin Electric Corporation, Melexis Technologies NV, and Pulse Electronics Corporation.

Major trends shaping the market include adoption of contactless current measurement, growing implementation of non-contact sensing technologies, integration of digital features in analog sensors, increasing miniaturization while maintaining accuracy, and rising demand for sensors with wider bandwidth and faster response times.

In 2025, the current sensors segment is expected to account for the largest share of the current and voltage sensor market; based on technology, hall effect technology is expected to hold the largest share of the overall market in 2025; and the electric vehicles (EV) & charging infrastructure segment is expected to account for the largest market share in 2025.

North America leads the global market followed by Europe due to advanced manufacturing capabilities, grid modernization investments, and early technology adoption. Asia-Pacific is witnessing the highest growth rate driven by massive renewable energy investments, expanding EV production, and rapid industrial automation implementation, particularly in China, India, and South Korea.

The growth of this market is driven by increasing demand in battery management systems, accelerating power grid modernization initiatives, growing emphasis on miniaturization and integration in electronics, expanding HVAC and industrial motor control applications, and the emergence of smart grid and IoT technologies requiring precise power monitoring solutions.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Current and Voltage Sensor Market, by Product Type

3.2.2. Current and Voltage Sensor Market, by Technology

3.2.3. Current and Voltage Sensor Market, by End User

3.2.4. Current and Voltage Sensor Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Growth in Battery Management Systems (BMS)

4.2.1.2. Power Grid Modernization Initiatives

4.2.1.3. Miniaturization and Integration in Electronics

4.2.1.4. Expansion of HVAC and Industrial Motor Control

4.2.2. Restraints

4.2.2.1. High Precision-to-Cost Ratio Challenges

4.2.2.2. Sensitivity to Electromagnetic Interference

4.2.2.3. Temperature Drift Compensation Requirements

4.2.2.4. Supply Chain Dependency on Raw Materials

4.2.3. Opportunities

4.2.3.1. Wide Bandgap Semiconductor Integration

4.2.3.2. Energy Harvesting Applications

4.2.3.3. Bidirectional Power Flow Monitoring

4.2.3.4. Edge Computing Integration

4.2.4. Trends

4.2.4.1. Adoption of Contactless Current Measurement

4.2.4.2. Growing Adoption of Non-Contact Sensing Technologies

4.2.4.3. Integration of Digital Features in Analog Sensors

4.2.5. Challenges

4.2.5.1. Accuracy Under Varying Environmental Conditions

4.2.5.2. Bandwidth and Response Time Improvements

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Sustainability Impact on Current and Voltage Sensor Market

4.4.1. Environmental Sustainability Factors

4.4.1.1. Materials and Manufacturing

4.4.1.2. Product Lifecycle

4.4.2. Market Response to Sustainability Demands

4.4.2.1. Regulatory Compliance Drivers

4.4.2.2. Industry Initiatives

4.4.3. Market Opportunities Created by Sustainability Focus

4.4.4. Challenges to Sustainable Implementation

4.4.5. Future Sustainability Trends

5. Current and Voltage Sensor Market Assessment—by Product Type

5.1. Overview

5.2. Current Sensors

5.2.1. Open Loop Hall Effect

5.2.2. Closed Loop Hall Effect

5.2.3. Rogowski Coil

5.2.4. Shunt-Based

5.2.5. Fluxgate

5.2.6. Digital IC-based

5.3. Voltage Sensors

5.3.1. Capacitive

5.3.2. Resistive Divider

5.3.3. Optical

5.3.4. Hall-Based

5.3.5. IC-based

5.4. Integrated Sensor ICs

5.5. Plug-and-Play Modules

6. Current and Voltage Sensor Market Assessment—by Technology

6.1. Overview

6.2. Hall Effect

6.3. Rogowski Coil

6.4. Optical Sensing

6.5. Magneto-Resistive

6.6. Shunt + ADC

6.7. Smart/IoT Sensors

7. Current and Voltage Sensor Market Assessment—by End User

7.1. Overview

7.2. Automotive & Transportation

7.3. Industrial Manufacturing

7.4. Energy & Power Utilities

7.5. Consumer Electronics

7.6. Telecommunications

7.7. Healthcare

7.8. Aerospace & Defense

7.9. Building Automation

7.10. Others

8. Current and Voltage Sensor Market Assessment—by Geography

8.1. Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.3.6. Rest of Europe (RoE)

8.4. Asia-Pacific

8.4.1. China

8.4.2. Japan

8.4.3. India

8.4.4. South Korea

8.4.5. Australia

8.4.6. Rest of Asia-Pacific (RoAPAC)

8.5. Latin America

8.5.1. Brazil

8.5.2. Mexico

8.5.3. Rest of Latin America (RoLATAM)

8.6. Middle East & Africa

8.6.1. Saudi Arabia

8.6.2. United Arab Emirates (UAE)

8.6.3. Rest of Middle East & Africa (RoMEA)

9. Competitive Landscape

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Competitive Dashboard

9.4.1. Industry Leaders

9.4.2. Market Differentiators

9.4.3. Vanguards

9.4.4. Contemporary Stalwarts

9.5. Market Share/Ranking Analysis, by the Key Players, 2024

10. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis*)

10.1. LEM International

10.2. Allegro Microsystems

10.3. Texas Instruments

10.4. TDK Corporation

10.5. ABB Ltd.

10.6. Infineon Technologies

10.7. Honeywell International

10.8. Tamura Corporation

10.9. STMicroelectronics

10.10. Analog Devices

10.11. Eaton Corporation

10.12. Siemens AG

10.13. Sensitec GmbH

10.14. VACUUMSCHMELZE

10.15. CR Magnetics

10.16. Kohshin Electric Corporation

10.17. Melexis Technologies NV

10.18. Pulse Electronics Corporation

11. Appendix

11.1. Available Customization

11.2. Related Reports

List of Tables

Table 1. Global Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 2. Global Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 3. Global Open Loop Hall Effect Sensor Market, by Country/Region, 2023–2032 (USD Million)

Table 4. Global Closed Loop Hall Effect Sensor Market, by Country/Region, 2023–2032 (USD Million)

Table 5. Global Rogowski Coil Sensor Market, by Country/Region, 2023–2032 (USD Million)

Table 6. Global Shunt-Based Sensor Market, by Country/Region, 2023–2032 (USD Million)

Table 7. Global Fluxgate Sensor Market, by Country/Region, 2023–2032 (USD Million)

Table 8. Global Digital IC-based Sensor Market, by Country/Region, 2023–2032 (USD Million)

Table 9. Global Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 10. Global Capacitive Sensor Market, by Country/Region, 2023–2032 (USD Million)

Table 11. Global Resistive Divider Sensor Market, by Country/Region, 2023–2032 (USD Million)

Table 12. Global Optical Sensor Market, by Country/Region, 2023–2032 (USD Million)

Table 13. Global Hall-Based Sensor Market, by Country/Region, 2023–2032 (USD Million)

Table 14. Global IC-based Sensor Market, by Country/Region, 2023–2032 (USD Million)

Table 15. Global Integrated Sensor ICs Sensor Market, by Country/Region, 2023–2032 (USD Million)

Table 16. Global Plug-and-Play Modules Sensor Market, by Country/Region, 2023–2032 (USD Million)

Table 17. Global Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 18. Global Hall Effect Technology Market, by Country/Region, 2023–2032 (USD Million)

Table 19. Global Rogowski Coil Technology Market, by Country/Region, 2023–2032 (USD Million)

Table 20. Global Optical Sensing Technology Market, by Country/Region, 2023–2032 (USD Million)

Table 21. Global Magneto-Resistive Technology Market, by Country/Region, 2023–2032 (USD Million)

Table 22. Global Shunt + ADC Technology Market, by Country/Region, 2023–2032 (USD Million)

Table 23. Global Smart/IoT Sensors Technology Market, by Country/Region, 2023–2032 (USD Million)

Table 24. Global Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 25. Global Current and Voltage Sensor Market for Automotive & Transportation, by End User, 2023–2032 (USD Million)

Table 26. Global Current and Voltage Sensor Market for Industrial Manufacturing, by End User, 2023–2032 (USD Million)

Table 27. Global Current and Voltage Sensor Market for Energy & Power Utilities, by End User, 2023–2032 (USD Million)

Table 28. Global Current and Voltage Sensor Market for Consumer Electronics, by End User, 2023–2032 (USD Million)

Table 29. Global Current and Voltage Sensor Market for Telecommunications, by End User, 2023–2032 (USD Million)

Table 30. Global Current and Voltage Sensor Market for Healthcare, by End User, 2023–2032 (USD Million)

Table 31. Global Current and Voltage Sensor Market for Aerospace & Defense, by End User, 2023–2032 (USD Million)

Table 32. Global Current and Voltage Sensor Market for Building Automation, by End User, 2023–2032 (USD Million)

Table 33. Global Current and Voltage Sensor Market for Other Industry Verticals, by End User, 2023–2032 (USD Million)

Table 34. North America: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 35. North America: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 36. North America: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 37. North America: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 38. North America: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 39. U.S.: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 40. U.S.: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 41. U.S.: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 42. U.S.: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 43. U.S.: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 44. Canada: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 45. Canada: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 46. Canada: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 47. Canada: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 48. Canada: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 49. Europe: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 50. Europe: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 51. Europe: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 52. Europe: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 53. Europe: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 54. Germany: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 55. Germany: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 56. Germany: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 57. Germany: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 58. Germany: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 59. France: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 60. France: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 61. France: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 62. France: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 63. France: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 64. U.K.: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 65. U.K.: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 66. U.K.: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 67. U.K.: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 68. U.K.: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 69. Italy: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 70. Italy: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 71. Italy: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 72. Italy: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 73. Italy: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 74. Spain: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 75. Spain: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 76. Spain: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 77. Spain: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 78. Spain: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 79. Rest of Europe: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 80. Rest of Europe: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 81. Rest of Europe: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 82. Rest of Europe: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 83. Rest of Europe: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 84. Asia-Pacific: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 85. Asia-Pacific: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 86. Asia-Pacific: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 87. Asia-Pacific: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 88. Asia-Pacific: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 89. Japan: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 90. Japan: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 91. Japan: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 92. Japan: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 93. Japan: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 94. China: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 95. China: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 96. China: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 97. China: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 98. China: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 99. South Korea: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 100. South Korea: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 101. South Korea: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 102. South Korea: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 103. South Korea: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 104. India: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 105. India: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 106. India: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 107. India: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 108. India: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 109. Australia: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 110. Australia: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 111. Australia: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 112. Australia: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 113. Australia: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 114. Rest of Asia-Pacific: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 115. Rest of Asia-Pacific: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 116. Rest of Asia-Pacific: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 117. Rest of Asia-Pacific: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 118. Rest of Asia-Pacific: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 119. Latin America: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 120. Latin America: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 121. Latin America: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 122. Latin America: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 123. Latin America: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 124. Brazil: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 125. Brazil: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 126. Brazil: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 127. Brazil: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 128. Brazil: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 129. Mexico: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 130. Mexico: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 131. Mexico: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 132. Mexico: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 133. Mexico: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 134. Rest of Latin America: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 135. Rest of Latin America: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 136. Rest of Latin America: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 137. Rest of Latin America: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 138. Rest of Latin America: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 139. Middle East and Africa: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 140. Middle East and Africa: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 141. Middle East and Africa: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 142. Middle East and Africa: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 143. Middle East and Africa: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 144. Saudi Arabia: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 145. Saudi Arabia: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 146. Saudi Arabia: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 147. Saudi Arabia: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 148. Saudi Arabia: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 149. United Arab Emirates: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 150. United Arab Emirates: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 151. United Arab Emirates: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 152. United Arab Emirates: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 153. United Arab Emirates: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

Table 154. Rest of Middle East and Africa: Current and Voltage Sensor Market, by Product Type, 2023–2032 (USD Million)

Table 155. Rest of Middle East and Africa: Current Sensor Market, by Type, 2023–2032 (USD Million)

Table 156. Rest of Middle East and Africa: Voltage Sensor Market, by Type, 2023–2032 (USD Million)

Table 157. Rest of Middle East and Africa: Current and Voltage Sensor Market, by Technology, 2023–2032 (USD Million)

Table 158. Rest of Middle East and Africa: Current and Voltage Sensor Market, by End User, 2023–2032 (USD Million)

List of Figures

Figure 1. Research Process

Figure 2. Secondary Components Referenced for This Study

Figure 3. Primary Research Techniques

Figure 4. Key Executives Interviewed

Figure 5. Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6. Market Sizing and Growth Forecast Approach

Figure 7. In 2025, the current sensor segment to Account for the Largest Share

Figure 8. In 2025, the hall effect technology to Account for the Largest Share

Figure 9. In 2025, the Current and Voltage Sensor Market for Automotive & Transportation sector to Account for the Largest Share

Figure 10. Asia-Pacific to be the Fastest-growing Regional Market

Figure 11. Impact Analysis of Market Dynamics

Figure 12. Global Current and Voltage Sensor Market: Porter's Five Forces Analysis

Figure 13. Global Current and Voltage Sensor Market, by Product Type, 2025 Vs. 2032 (USD Million)

Figure 14. Global Current and Voltage Sensor Market, by Technology, 2025 Vs. 2032 (USD Million)

Figure 15. Global Current and Voltage Sensor Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 16. Global Current and Voltage Sensor Market, by Region, 2025 Vs. 2032 (USD Million)

Figure 17. North America: Current and Voltage Sensor Market Snapshot (2025)

Figure 18. Europe: Current and Voltage Sensor Market Snapshot (2025)

Figure 19. Asia-Pacific: Current and Voltage Sensor Market Snapshot (2025)

Figure 20. Latin America: Current and Voltage Sensor Market Snapshot (2025)

Figure 21. Middle East and Africa: Current and Voltage Sensor Market Snapshot (2025)

Figure 22. Key Growth Strategies Adopted by Leading Players (2022–2025)

Figure 23. Global Current and Voltage Sensor Market Competitive Benchmarking, by Product Type

Figure 24. Competitive Dashboard: Global Current and Voltage Sensor Market

Figure 25. Global Current and Voltage Sensor Market Share/Ranking, by Key Player, 2024 (%)

Figure 26. ABB Ltd.: Financial Overview (2024)

Figure 27. Infineon Technologies AG.: Financial Overview (2024)

Figure 28. Analog Devices, Inc..: Financial Overview (2024)

Figure 29. TE Connectivity Ltd.: Financial Overview (2024)

Figure 30. Allegro MicroSystems, Inc.: Financial Overview (2024)

Published Date: Dec-2025

Published Date: Jan-2025

Published Date: Jul-2024

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates