Resources

About Us

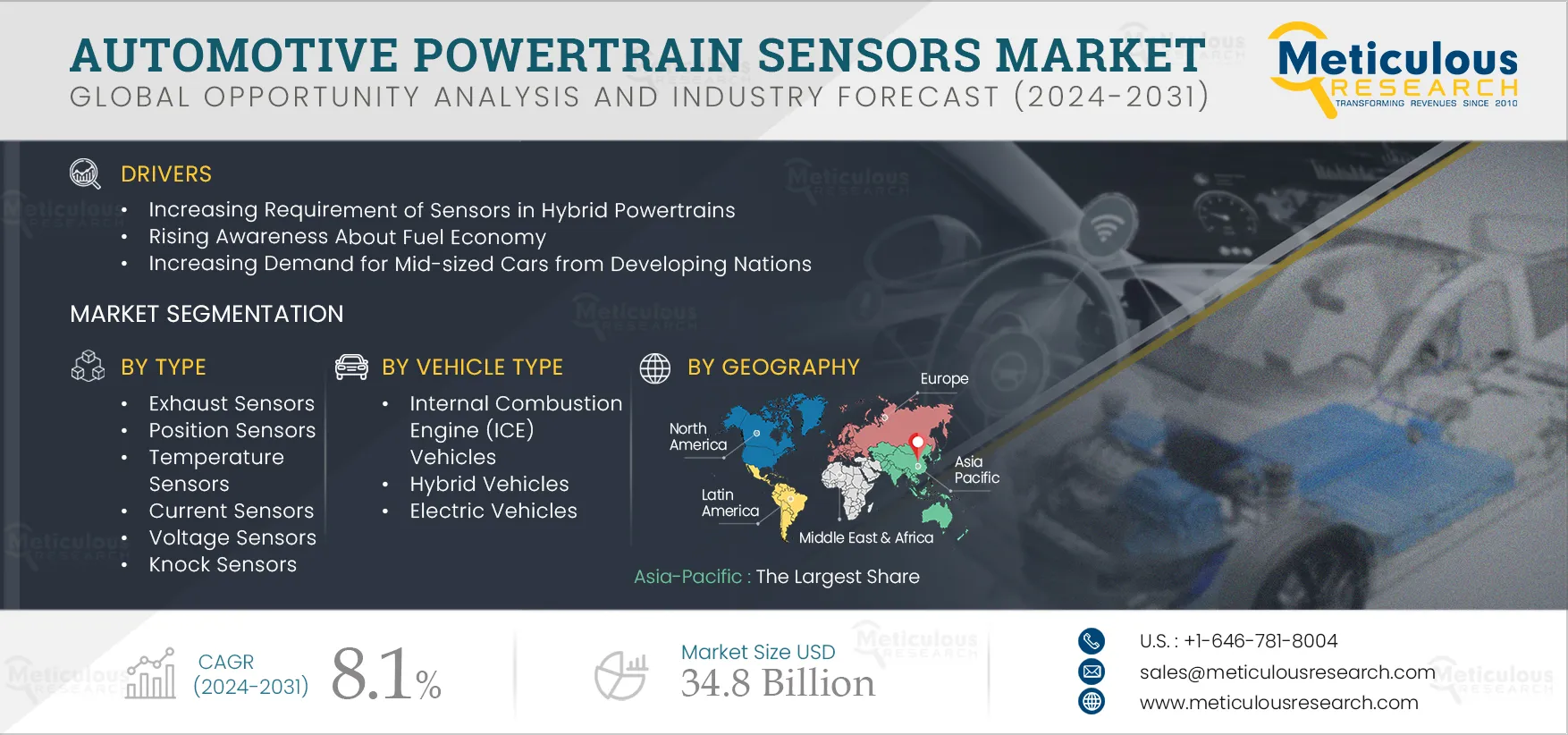

Automotive Powertrain Sensors Market by Type (Temperature, Position, Exhaust, Pressure, Speed, Knock), Powertrain Subsystems (Engine Management, Transmission Management, Power Steering), and Vehicle Type (ICE, HV, EV) - Global Forecast to 2031

Report ID: MRSE - 104459 Pages: 400 Jul-2024 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 48 Hours Download Free Sample ReportThe Automotive Powertrain Sensors Market is projected to reach $34.8 billion by 2031, at a CAGR of 8.1% from 2024 to 2031. In terms of volume, the automotive powertrain sensors market is projected to reach 7.5 billion units by 2031, at a CAGR of 7.8% during the forecast period. The growth of this market is driven by the high requirement for sensors in hybrid powertrains, growing awareness about fuel economy, and increasing demand for mid-sized cars from developing nations. Furthermore, the rising concerns about the carbon footprint of vehicles and stringent emission regulations are expected to create market growth opportunities during the forecast period.

Whether to improve the efficiency of a combustion engine or design electric vehicles (EVs) or hybrid electric vehicles (HEVs), a powertrain system comprises several modules. Each module operates individually, with different sensors and feedback control mechanisms. A vehicle’s efficiency mainly depends on the accuracy, precision, and response time of powertrain sensors and actuators. Stringent emission regulation and fuel economy standards make hybrid powertrain systems a potential solution to clean and efficient personal mobility.

Major automotive manufacturers worldwide are either developing or launching their hybrid vehicle platforms. Hybrid electric vehicles are designed to optimize the performance of combustion engines. Nowadays, new hybrid vehicles have start-stop combustion engines where the motor shuts off for a few seconds at a red light and then does a cold start. Powertrain sensors monitor the movement of the engine as it comes to a stop. When the engine starts, sensors calculate the position of the crankshaft and the cylinder to be fired. The plug-in hybrid can smoothly transition between the all-electric mode and combustion engine mode by quickly driving a few kilometers in all-electric mode and smoothly kicking in the combustion engine when the battery runs low, thereby increasing the fuel economy and efficiency of the vehicle. These functions require extensive use of sensors in the powertrain as the car should adjust to an angle of the crankshaft at all times for smooth and efficient functioning of the powertrain. Such factors help drive the growth of the market during the forecast period.

Click here to: Get Free Sample Pages of this Report

Fuel economy is a key factor in worldwide energy consumption. Better fuel economy can be achieved by increasing the efficiency of the powertrain by accurately identifying the driving conditions. The powertrain system is composed of the engine and transmission, which control the vehicle's drive/braking power. The core components that are used for identifying driving conditions and optimizing fuel economy are the engine control module (ECM), transmission control unit (TCU), and brake control unit (BCU). Fuel economy can be increased by improving the efficiency of powertrains by optimizing the use of engine and battery power. Demand for better real-world fuel economy has created a huge demand for powertrain sensors that monitor and control the engine and transmission in response to driving conditions and optimize the engine performance to increase the fuel economy. The higher fuel economy will help in reducing the consumption of fossil fuels and thus help in reducing vehicular emissions and achieving carbon reduction targets.

Governments across the world are also emphasizing increasing the fuel economy and reducing vehicle emissions. For instance, in the U.S., the regulations require carmakers to meet a corporate average fuel economy (CAFE) target of 54.5 miles per gallon by 2025. To achieve this target, automotive manufacturers are required to achieve an average increase in fuel economy of five percent for cars and three and a half percent for light trucks per year through 2021, with a five percent increase for all vehicles. These factors are expected to drive the market for powertrain sensors during the forecast period.

Automobiles are the largest source of CO2 emissions. Automotive emissions have increased by 25% in the European Union since 1990. To meet the 2050 Paris climate commitments, the automotive sector needs to reduce its carbon footprint. The reduction of real driving emissions and fuel consumption in long-haul traffic is one of the main challenges that need to be addressed to reduce the carbon footprint of vehicles. The powertrain sensors play an important role in reducing ICE vehicle emissions and increasing performance efficiency.

For instance, the energy management system uses information about the road ahead and from other traffic participants to suggest a driving strategy and a control strategy for the powertrain and its components, such as the combustion engine, electric motor, battery, transmission, or transmission auxiliaries. The velocity optimizer ensures the best use of kinetic energy and optimizes fuel consumption by increasing the vehicle’s kinetic energy and reducing braking force. The predictive gearshift module (PGS) provides gear shift suggestions based on road profile and optimized vehicle speed from the velocity optimizer. The major objective of predictive gearshift is to avoid a drop in vehicle velocity that leads to high fuel consumption. The control systems such as energy management system, velocity optimizer, predictive gearshift, and predictive engine & exhaust after-treatment control enable further improvement in the combustion system to optimize fuel consumption and reduce the carbon footprint of vehicles. Such factors are expected to boost their adoption across multiple markets, generating growth opportunities for market players.

The number of sensors in powertrain monitoring and diagnosis applications is increasing due to increasingly stringent fuel economy and emission regulations and the rising adoption of hybrid powertrains. However, there is a huge drawback in their adoption and integration with other components due to the lack of standards among different sensor manufacturers. Additionally, sensors generate tons of data, and the processing power of on-board computers in automotive is very limited.

Automotive manufacturers face integration problems with sensors sourced from different manufacturers. Moreover, sensors must be strategically positioned to provide feedback information on the vehicle’s powertrain performance. If not chosen correctly, the wrong working conditions and data loss can severely damage the sensor’s performance, leading to reduced sensitivity, less accuracy, or wrong position readings. Additionally, power consumption in the sensor is a key challenge. All the powertrain and driver assistance sensors can consume up to 100 W to 200 W and generate 4 g of CO2. These factors are increasingly challenging for the growth of powertrain sensors during the forecast period.

Based on type, the global automotive powertrain sensors market is segmented into temperature sensors, position sensors, exhaust sensors, pressure sensors, fluid concentration sensors, knock sensors, speed sensors, torque sensors, current sensors, voltage sensors, and other sensors. In 2024, the exhaust sensors segment is expected to account for the largest share of over 39.0% of the automotive powertrain sensors market. The large market share of this segment is mainly attributed to increasingly stringent government regulations mandating higher fuel efficiency, fewer exhaust emissions, and the use of exhaust gas regeneration technology. These sensors are critical for closely monitoring real-traffic emissions and the impact of after-treatment systems. Also, due to new emission norms, exhaust sensors are increasingly deployed in all ICE vehicles and hybrid electric vehicles. Conventionally, these sensors are chemical-based, having two electrodes and sensing based on electrode potential principles. These types of chemical-based sensors can have higher maintenance and response times.

Additionally, the exhaust sensors segment is projected to register the highest CAGR during the forecast period.

Based on powertrain subsystems, the global automotive powertrain sensors market is segmented into engine management sensors, power steering sensors, and transmission management sensors. In 2024, the engine management sensors segment is expected to account for the largest share of over 66.0% of the automotive powertrain sensors market. This segment’s large market share is attributed to stringent emission regulations to reduce gas emissions, the rising requirement for fuel economy, improved combustion cycle, and improved engine control for a better driving experience. In engine management, powertrain sensors optimize the combustion process based on the feedback provided by the sensors to the electronic control unit. The sensors' major applications in engine management are optimizing air-fuel mixture for achieving lower emissions; controlling variable valve timing for increasing peak power, low-speed torque, and exhaust gas recirculation; and cylinder activation and deactivation during the idle time for increasing fuel efficiency.

However, the transmission management sensors segment is projected to register the highest CAGR during the forecast period. The growth of this segment is driven by factors such as the increased adoption of hybrid electric vehicles and plug-in hybrid electric vehicles requiring multiple sensors to measure torque, the position of gears, and power delivery. Moreover, the implementation of technologies, such as continuously variable transmission, multi-gear automatic transmission, dual-clutch transmission, and regenerative braking, have led to powertrain designs that involve higher internal pressures, greater instantaneous forces, increased electronic signatures, and more complex designs and mechanical operation which support the high growth of this segment.

Based on vehicle type, the global automotive powertrain sensors market is segmented into internal combustion engine vehicles, hybrid vehicles, electric vehicles, and other vehicles. In 2024, the internal combustion engine vehicles segment is expected to account for the largest share of over 77.0% of the automotive powertrain sensors market. This segment’s large market share is attributed to the rising requirement for fuel economy in ICE vehicles, stringent emission norms to reduce greenhouse gas emissions, and dominance of ICE powertrains in developing economies such as India, Southeast Asia, Latin America, and a major part of the Middle East & Africa. Internal combustion engine powertrain, both diesel and gasoline, is the dominant powertrain technology until the next decade. Powertrain sensors have major applications in internal combustion engine vehicles. These sensors monitor and collect data such as temperature, pressure, position, and fluid concentration from various parts of the powertrain and send them to an electric control unit of the vehicle for dynamically adjusting the combustion process, gear shift timing, air-fuel mixture, vehicle steering, and engine on/off.

However, the electric vehicles segment is projected to register the highest CAGR during the forecast period. The growth of this segment is driven by the rapid adoption of hybrid electric powertrains for optimizing the use of combustion engines for low-speed cruising, stringent emission norms in Europe and the U.S., and innovations in battery technology production. Powertrain sensors in electric vehicles are majorly used to monitor and control the power transmission from battery to wheels, control the electric power steering, and optimize battery performance to increase the travel range of electric vehicles. Major sensors used in electric vehicles are torque, current, voltage, temperature, and position sensors.

In 2024, Asia-Pacific is expected to account for the largest share of over 52.0% of the automotive powertrain sensors market, followed by Europe, North America, Latin America, and the Middle East & Africa. The large share of this regional market is mainly attributed to the high production level of automobiles in the region driven by huge demand from China, India, and Japan, the upgradation of powertrain systems due to rising consumer awareness regarding the environmental effects of automotive emissions, and increasing infrastructural developments in the region. Moreover, due to the presence of some of the fastest-growing economies of the world, such as India, China, Indonesia, and Thailand, consumers in the region are witnessing a rise in disposable incomes. This is boosting the purchasing power and propelling the demand for automobiles. Also, China is expected to lead global automotive production during the forecast period, which is expected to drive a large share of this region during the forecast period.

However, Latin America is slated to register the highest CAGR of 7.5% during the forecast period. The high growth of automotive powertrain sensors in Latin America is majorly attributed to the presence of fast-growing economies, such as Brazil and Argentina, and the growing adoption of torque sensors in electric power steering systems. The growing emphasis on emission standards and stringent fuel economy regulations are the major factors influencing the powertrain sensors market in Latin America. Brazil and Chile are the leading countries to implement fuel efficiency policies. Brazil has set a fuel economy target of 123g CO2/km for 2022-2023. As a result of stricter emission regulations, the powertrain sensors market is expected to grow during the forecast period since petrol-based ICEs, including ethanol ‘flex-fuel’ vehicles in Brazil, will account for more than 50% of these powertrains by 2030. Moreover, governments in Latin America are supporting the adoption of fuel-efficient powertrain sensors, which is expected to drive the growth of this regional market.

The report offers a competitive analysis based on an extensive assessment of the product portfolios and geographic presence of leading market players and the key growth strategies adopted by them over the past three to four years. The key players operating in the automotive powertrain sensors market include Texas Instruments (U.S.), Denso Corporation (Japan), Robert Bosch GmbH (Germany), Mitsubishi Electric Corporation (Japan), Infineon Technologies (Germany), NXP Semiconductor (Netherlands), HELLA GmbH & Co. (Germany), Valeo (France), CTS Corporation (U.S.), Renesas Electronics Corporation (Japan), ZF Friedrichshafen AG (Germany), Delphi Technologies (U.K.), PCB Piezotronics Inc. (U.S.)., STMicroelectronics N.V. (Switzerland), and TE Connectivity (Switzerland).

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

8.1% |

|

CAGR (Volume) |

7.8% |

|

Market Size |

$34.8 Billion by 2031 |

|

Market Size (Volume) |

7.5 billion units by 2031 |

|

Segments Covered |

By Type

By Powertrain Subsystem

By Vehicle Type

|

|

Countries Covered |

Europe (Germany, U.K., France, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), North America (U.S. and Canada), Latin America, and Middle East & Africa |

|

Key Companies Profiles |

Texas Instruments (U.S.), Denso Corporation (Japan), Robert Bosch GmbH (Germany), Mitsubishi Electric Corporation (Japan), Infineon Technologies (Germany), NXP Semiconductor (Netherlands), HELLA GmbH & Co. (Germany), Valeo (France), CTS Corporation (U.S.), Renesas Electronics Corporation (Japan), ZF Friedrichshafen AG (Germany), Delphi Technologies (U.K.), PCB Piezotronics Inc. (U.S.)., STMicroelectronics N.V. (Switzerland), and TE Connectivity (Switzerland) |

The automotive powertrain sensors market is expected to reach $34.8 billion by 2031, at a CAGR of 8.1% from 2024 to 2031.

The automotive powertrain sensors market study focuses on market assessment and opportunity analysis based on the sales of automotive powertrain sensors products across different regions, countries, and market segments. This study also includes a competitive analysis of the automotive powertrain sensors market based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years.

Based on type, in 2024, the exhaust sensors segment is expected to account for the largest share of over 39.0% of the automotive powertrain sensors market. The large market share of this segment is mainly attributed to increasingly stringent government regulations mandating higher fuel efficiency, fewer exhaust emissions, and the use of exhaust gas regeneration technology. These sensors are critical for closely monitoring real-traffic emissions and the impact of after-treatment systems.

Based on vehicle type, the electric vehicles segment is projected to register the highest CAGR during the forecast period. The growth of this segment is driven by the rapid adoption of hybrid electric powertrains to optimize combustion engines for low-speed cruising, stringent emission norms in Europe and the U.S., and innovations in battery technology production.

The growth of this market is driven by the increasing requirement for sensors in hybrid powertrains, rising awareness about fuel economy, and increasing demand for mid-sized cars from developing nations. Furthermore, the rising awareness about the carbon footprint of vehicles and stringent emission regulations are expected to create market growth opportunities during the forecast period.

The key players operating in the automotive powertrain sensors market include Texas Instruments (U.S.), Denso Corporation (Japan), Robert Bosch GmbH (Germany), Mitsubishi Electric Corporation (Japan), Infineon Technologies (Germany), NXP Semiconductor (Netherlands), HELLA GmbH & Co. (Germany), Valeo (France), CTS Corporation (U.S.), Renesas Electronics Corporation (Japan), ZF Friedrichshafen AG (Germany), Delphi Technologies (U.K.), PCB Piezotronics Inc. (U.S.)., STMicroelectronics N.V. (Switzerland), and TE Connectivity (Switzerland).

Latin America is slated to register the highest CAGR of 7.5% during the forecast period. The high growth of automotive powertrain sensors in Latin America is majorly attributed to the presence of fast-growing economies, such as Brazil and Argentina, and the growing adoption of torque sensors in electric power steering systems. Moreover, government support for adopting fuel-efficient powertrain sensors is further driving the growth of this regional market.

Published Date: Jan-2025

Published Date: Oct-2024

Published Date: Jan-2024

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates