Resources

About Us

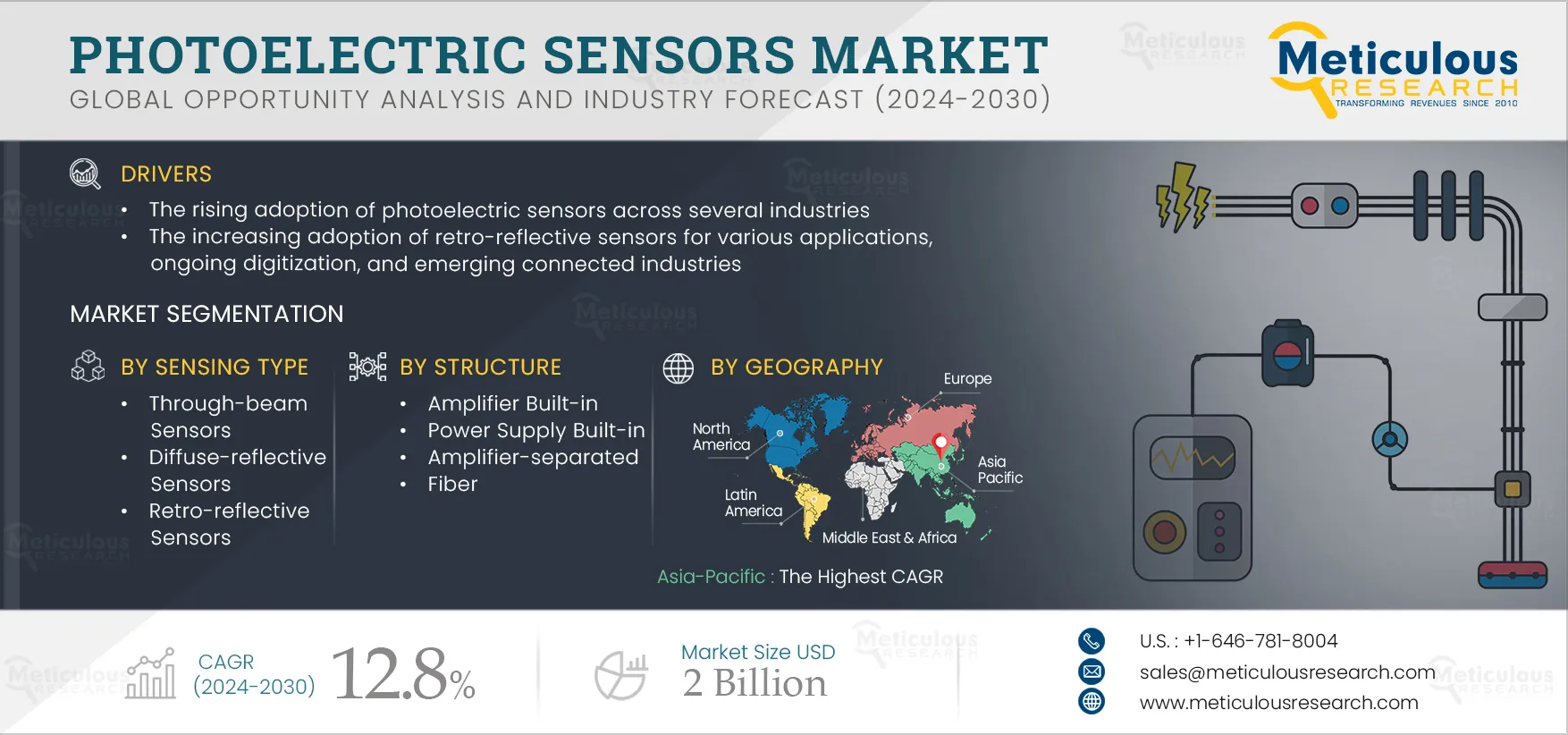

Photoelectric Sensors Market by Sensing Type (Diffuse-reflective Sensors, Retro-reflective Sensors), Sensing Distance, Structure (Amplifier Built-in, Power Supply Built-in), Beam Source, Output, End Use, and Geography - Global Forecast to 2032

Report ID: MRSE - 104831 Pages: 250 Jan-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe Photoelectric Sensors Market is projected to reach $2 billion by 2032, at a CAGR of 12.8% from 2025 to 2032. The growth of this market is driven by the rising adoption of photoelectric sensors across industries, the increasing adoption of retro-reflective sensors for various applications, ongoing digitization, and emerging connected industries. However, the availability of alternatives restrains market growth. The rising adoption of industrial robots and the growing demand for packaged foods are expected to generate significant market growth opportunities. However, the scarcity of raw materials and the high maintenance costs of photoelectric sensors are challenges for market growth.

The photoelectric sensors market is segmented by sensing type, sensing distance, structure, beam source, output, end use, and geography. The study also evaluates industry competitors and analyzes the market at the regional and country levels.

Click here to: Get a Free Sample Copy of this report

Rising Adoption of Photoelectric Sensors Across Industries

In recent years, the adoption of photoelectric sensors has increased across multiple industries, such as automotive, food, transportation, and material handling. They are utilized for counting, object orientation on production lines, and operation of automatic doors, among other applications.

In manufacturing lines, stable detection using conventional sensors is challenging due to users’ need to adjust or accommodate uneven shapes, patterns, or colors. To address such challenges, key market players are launching sensing technologies that allow reliable detection amid changing production needs. For instance, in October 2020, OMRON Corporation (Japan) launched the E3AS-HL Series of CMOS (complementary metal oxide semiconductor) photoelectric sensors. This product range was designed to enable the stable detection of objects and ensure low maintenance and enhanced flexibility. This launch was also aimed at aiding manufacturers seeking to address sensing challenges on flexible manufacturing lines and widening the applications of photoelectric sensors.

Furthermore, as the demand for photoelectric sensors has risen significantly due to their increasing industrial applications, technology companies have been focused on releasing new and advanced photoelectric sensors to deliver improved performance. For instance, in August 2022, Rockwell Automation Inc. (U.S.) unveiled Allen-Bradley 42JA VisiSight M20A and 42EA RightSight S18, its economical and easy-to-apply photoelectric sensing solutions. The sensors were developed to offer a range of sensing modes, options, and features, making them optimal for global operations. These new lines were also designed for packaging, material handling, and assembly applications to address the needs of pharmaceutical, life sciences, and food & beverage, among other industries. The development of such economical and high-performance products is expected to contribute to the expansion of the photoelectric sensors industry globally.

The Through-beam Sensors Segment to Register the Highest CAGR During the Forecast Period

Based on sensing type, the through-beam sensors segment is projected to register the highest CAGR during the forecast period. The growth of this segment is driven by through-beam sensors’ ability to provide reliable and precise detection over longer distances compared to other sensor types. This ability makes them suitable for industries such as manufacturing, logistics, automotive, and pharmaceuticals, which require long sensing ranges. Through-beam sensors are deployed in applications such as object detection, position sensing, part counting, and presence detection. Additionally, advancements in energy efficiency and power management have extended the operational life and reduced the energy costs of through-beam sensors, making them more efficient and sustainable for industrial use.

The 300 mm to 1000 mm Segment to Register the Fastest Growth During the Forecast Period

Based on sensing distance, the 300 mm to 1000 mm segment is projected to record the fastest growth during the forecast period, mainly due to the short-range and long-range object detection capabilities and compact sizes of 300 mm to 1000 mm sensors. These sensors are widely utilized by logistics and packaging companies due to their benefits. The utilization of these sensors in packaging and handling operations has increased businesses’ profitability.

The Fiber Segment to Register the Highest CAGR During the Forecast Period

Based on structure, the fiber segment is projected to register the highest CAGR during the forecast period. The growth of this segment is driven by fiber photoelectric sensors’ ability to detect small differences in the height of objects. The use of fiber photoelectric sensors is limited to narrow-space applications.

The Red Beam Segment to Record the Fastest Growth During the Forecast Period

Based on beam source, the red beam segment is projected to register the highest CAGR during the forecast period. The growth of this segment is driven by the visibility, contrast, human eye sensitivity, cost-effectiveness, and power efficiency of photoelectric sensors with red beam sources. Their reliability and compatibility with various environments and detection requirements contribute to their widespread use in industrial automation, object detection, and position-sensing applications.

The Digital Segment to Record the Higher CAGR During the Forecast Period

Based on output, the digital segment is projected to register the higher CAGR during the forecast period. The growth of this segment is driven by the rising adoption of digital photoelectric sensors for object detection. Photoelectric sensors with digital output offer both design and operational advantages over photoelectric sensors with analog output. They offer enhanced technical performance, improved safety margins, and reduced maintenance costs.

The Food & Beverage Segment to Register the Highest CAGR During the Forecast Period

Based on end use, the food & beverage segment is projected to register the highest CAGR during the forecast period. The food & beverage industry’s growing focus on technologies and mechanical manipulation of raw foods to create high-value-added food products is fueling the demand for photoelectric sensors in F&B applications. Moreover, automation brings standardization to all packaged food & beverage products. Photoelectric sensors minimize human interference, eliminating the chances of food contamination and ensuring that all health standards are met.

Asia-Pacific to Register the Highest CAGR During the Forecast Period

Based on geography, the photoelectric sensors market is segmented into Asia-Pacific, North America, Europe, Latin America, and the Middle East & Africa. Asia-Pacific is projected to register the highest CAGR during the forecast period. The region includes major country-level markets such as China, Japan, South Korea, India, and Taiwan, which are known for their strong industrial base and manufacturing capabilities. These countries have well-established automotive, electronics, consumer goods, and machinery industries which utilize photoelectric sensors. The high demand for photoelectric sensors in these industries, coupled with the region's growing industrialization, drives the growth of this regional market.

The rapid expansion of industries, including consumer electronics, automobile, and textiles in Asia-Pacific, is contributing to the growth of the photoelectric sensors market as these sensors themselves are used to improve the productivity of manufacturing setups as the data gathered by the sensors can be collated and acted upon immediately. Other benefits of photoelectric sensors driving market growth are reduced downtime, lower costs, adaptability for self-calibration and compensation, fewer interconnections between multiple sensors and control systems, lower weight, and higher reliability. The increasing adoption of nanotechnology has also created growth opportunities for the players operating in the photoelectric sensors market in Asia-Pacific. Additionally, the key players in this market are focused on launching new and advanced sensors to cater to the increasing demand across industries. For instance, in December 2022, SICK unveiled its new Roller Sensor Bar (RSB) to expand its extensive portfolio of photoelectric sensors. This sensor is a reliable solution for the logistics and production industries to accommodate the ever-increasing variety of packaging shapes and sizes. The product also offers quick and easy installation.

Key Players:

The key players profiled in the photoelectric sensors market study are OMRON Corporation (Japan), KEYENCE CORPORATION (Japan), SICK AG (Germany), Schneider Electric SE (France), Rockwell Automation Inc. (U.S.), ifm electronic gmbh (Germany), Pepperl+Fuchs SE (Germany), Balluff GmbH (Germany), Banner Engineering Corp. (U.S.), Panasonic Corporation (Japan), EATON CORPORATION plc (Ireland), HTM Sensors Inc (U.S.), wenglor sensoric GmbH (Germany), Fargo Controls Inc. (U.S.), and Carlo Gavazzi (Switzerland).

Report Summary:

|

Particulars |

Details |

|

Number of Pages |

300 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2022 |

|

CAGR |

12.8% |

|

Estimated Market Size |

$2 Billion by 2032 |

|

Segments Covered |

By Sensing Type

By Sensing Distance

By Structure

By Beam Source

By Output

By End Use

By Geography

|

Key questions answered in the report:

The photoelectric sensors market is segmented by sensing type, sensing distance, structure, beam source, output, end use, and geography. The study also evaluates industry competitors and analyzes the market at the regional and country levels.

The photoelectric sensors market is projected to reach $2 billion by 2032, at a CAGR of 12.8% from 2025 to 2032.

In 2025, the retro-reflective sensors segment is expected to account for the largest share of the photoelectric sensors market.

Based on end use, in 2025, the automotive & transportation segment is expected to account for the largest share of the photoelectric sensors market.

The growth of this market is driven by the rising adoption of photoelectric sensors across several industries, the increasing adoption of retro-reflective sensors for various applications, ongoing digitization, and emerging connected industries. Moreover, the rising adoption of industrial robots and the growing demand for packaged food are expected to create significant market growth opportunities.

The key players profiled in the photoelectric sensors market study are OMRON Corporation (Japan), KEYENCE CORPORATION (Japan), SICK AG (Germany), Schneider Electric SE (France), Rockwell Automation Inc. (U.S.), ifm electronic gmbh (Germany), Pepperl+Fuchs SE (Germany), Balluff GmbH (Germany), Banner Engineering Corp. (U.S.), Panasonic Corporation (Japan), EATON CORPORATION plc (Ireland), HTM Sensors Inc (U.S.), wenglor sensoric GmbH (Germany), Fargo Controls Inc. (U.S.), and Carlo Gavazzi (Switzerland).

Asia-Pacific is projected to register the highest CAGR during the forecast period. The region includes countries such as China, Japan, South Korea, India, and Taiwan, which are known for their strong industrial base and manufacturing capabilities. These countries have well-established automotive, electronics, consumer goods, and machinery industries that utilize photoelectric sensors. The high demand for photoelectric sensors in these industries, coupled with the region's increasing industrialization, drives the growth of this regional market.

Published Date: Dec-2025

Published Date: Oct-2024

Published Date: Jul-2024

Published Date: Jan-2024

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates